A complete guide to customer satisfaction research

Last updated

10 August 2024

Reviewed by

Miroslav Damyanov

If you’re not in business to create happy customers, you won’t be in business for very long.

Customer satisfaction research is the best way to determine how happy your customers are with your product or service. It also enables you to ensure their happiness becomes long-term satisfaction. When you understand customer feedback, you can improve your products and services, increase customer loyalty, and drive long-term success.

In this article, we’ll take a detailed look at what this type of research is and how you can conduct it.

- What is customer satisfaction research?

Happy customers are repeat customers. They are likely to tell their friends and colleagues about the products and services they enjoy, potentially sending new customers your way.

Unsatisfied customers are the opposite. They won’t return, and they will possibly warn their friends, family members, and colleagues to stay away too. It stands to reason that building a successful brand means creating far more happy customers than unhappy ones.

Customer satisfaction research is the process of collecting and analyzing feedback from customers to understand how well you are meeting their expectations and needs. This vital research can help your business improve its products and services, ensuring happier and more loyal customers.

Through customer satisfaction research, you can learn which steps your company should take to create more happy customers.

- Why do customer satisfaction research?

Getting more happy customers and fewer unhappy customers is important as a general aim, but it’s quite broad. Customer satisfaction research has several concrete goals that it provides insights into. Some companies begin their journey into customer satisfaction research specifically because they have one or more of these goals in mind:

Improving product/service quality

Enhancing customer loyalty and retention

Gaining a competitive advantage

Identifying areas for improvement

Measuring the impact of business initiatives

- What are the objectives of customer satisfaction research?

To provide you with actionable insights, customer satisfaction research needs to be comprehensive. It isn’t enough to know whether a customer is happy with your brand or not; you need to understand the specifics of what makes them happy or unhappy.

Here are some objectives:

Measure overall customer satisfaction levels

Understand the drivers of satisfaction

Identify strengths and weaknesses

Track changes in satisfaction over time

Benchmark against industry standards

Gather feedback for product/service development

Understanding how your company measures up in these areas will enable you to determine whether you have a problem with customer satisfaction. It will also provide an important guide for how to address those issues and improve how customers view your brand.

When you know the true reasons your satisfied customers keep coming back, you can incorporate that into your value proposition. This will make your marketing efforts more effective, helping you retain customers who might not have considered that positive aspect of your offering before.

This information also tells you which of your features are worth developing further, which need work to live up to your expectations of them, and which you can abandon entirely.

- Examples of customer satisfaction research topics

All the questions above can be applied to a number of customer satisfaction questions. Trying to answer them all at once will result in unfocused and possibly unhelpful research. Instead, it’s best to focus your research on one or two areas. Some common areas for customer satisfaction research are listed below:

Product/service quality

Customer support and service

Pricing and value perception

Ease of doing business

Brand reputation and loyalty

Post-purchase experience

Comparison to competitor offerings

You might not know which of these you should start with. By gathering some initial customer feedback, you can narrow down which of these topics are strengths and which are weaknesses, allowing you to drill down deeper in your next round of research.

- Levels of customer satisfaction research

We can also take a different view of granularity when doing customer satisfaction research. Customers interact with your brand on several levels. Their opinions of the brand at each of these levels may vary.

Transactional (single interaction)

This level of customer satisfaction deals with a single interaction. While a customer could generally be very happy with your brand, an individual transaction could annoy them in some way. Eliminating these sources of annoyance could be the tipping point that pushes less satisfied customers toward brand loyalty and away from dissatisfaction.

Here are some examples of transactional customer satisfaction research:

Post-purchase surveys

Service desk satisfaction surveys

Website/app feedback surveys

Point-of-sale customer satisfaction ratings

Event feedback forms

Relational (ongoing relationship)

This deals with the customer’s overall perception of your brand independent of any single interaction.

Just as it’s possible for a generally happy customer to have a negative single experience, customers can develop a negative view of your brand even if they have one or two great transactions.

By looking at customer satisfaction from a broader perspective and focusing on the customer’s view of your brand itself, you can unlock deeper insights into what makes customers leave or stay.

Examples of relational customer satisfaction research include the following:

Customer satisfaction and loyalty survey programs

Churn/retention analysis

Net promoter score (NPS) surveys

Long-term, in-depth customer interviews

Quarterly customer surveys

Brand perception studies

Holistic (overall experience)

This level of customer satisfaction research involves combining the previous two. Instead of focusing solely on single interactions or the brand’s overall perception, holistic customer satisfaction research examines the entire picture.

So, why is this helpful? In customer satisfaction, the whole is often more than the sum of its parts. By looking at how everything fits together, you can get a broader sense of which areas need adjustment.

Examples of holistic customer satisfaction research include the following:

Customer journey mapping

Customer lifecycle analysis

Omnichannel experience surveys

Ethnographic studies and observational research

Comprehensive customer feedback programs

- How to carry out customer satisfaction research

Although the specifics will depend on your business and the type of customer research you’re interested in, the seven steps below provide a solid roadmap for successfully carrying out customer satisfaction research.

Step 1: define research objectives

The first step is defining your objectives. Before you can research something, you need to know what you’re researching.

Your research objectives might include, for example, retaining customers, improving marketing and sales efforts, elevating long-term product use, and more.

Next, identify the key performance indicators (KPIs) you’ll be measuring. These can include retention rate, monthly active users, repeat purchase rate, net promoter score, customer satisfaction (CSAT) scores , churn rate, and various customer support metrics, among other things. Include these or any others that are specific to your goals.

As you’re deciding what your objectives are and which KPIs to use, ensure that your choices align with your business objectives.

Step 2: select a research methodology

The next step is to determine which research methodology you’ll use to gather your data. Quantitative methods, such as surveys and rating scales, can provide concrete numbers that are easy to track over time. Qualitative methods, such as interviews and focus groups, can provide more in-depth information about what customers do and don’t like about your product or service.

In practice, you’ll likely want to use a mixture of these two methods. A hybrid approach will provide you with data you can use to compare your results with industry standards or past results from your own research. It will also give you more actionable insights to drive those numbers in the direction you want.

Step 3: develop customer satisfaction surveys

If surveys will be a part of your methodology, you need to decide what those surveys will entail.

Remember, focus is key. There are many questions you can ask customers, but you should limit yourself to those that directly address the current research topic. This will make the data easier to sort through and help you use your resources more effectively.

When crafting your surveys, consider your customers. If you want to get a sufficient number of well-thought-out responses, you’ll need to make sure the surveys are easy and convenient to complete. Overly lengthy surveys or those that use challenging technologies can limit the number and quality of responses you get.

The customer satisfaction score (CSAT) is the simplest and most straightforward method for measuring customer satisfaction. It typically involves asking customers to rate their satisfaction with a specific interaction or transaction on a scale, such as 1–5.

Step 4: choose a sampling strategy

Next, decide who you’ll be conducting research on. Do you have a specific customer segment that you’d like to better understand? If your company makes heavy use of customer personas, it can be helpful to survey each of them independently to better understand how to appeal to them.

Here are some sampling methods you can consider:

Random sampling: randomly pick participants from your full customer base to ensure each customer has an equal chance of being included.

Stratified sampling: divide your customer base into distinct subgroups and sample equally from each to ensure complete representation across key segments.

Systematic sampling: choose every nth customer from a list to ensure an even spread of participants.

Convenience sampling: select participants who are easiest to reach or most readily available, which is quicker but may not be as representative.

Step 5: data collection and analysis

Now we come to the meat and potatoes of customer satisfaction research—the collection and analysis of the data. If you’re conducting surveys, this could mean online forms, phone calls, or in-person questioning. Whatever your method, collect all the data and store it in a convenient place.

Tools like Dovetail make it easy to do the following:

Collect disparate data types and create a single source of truth around customer insights

Sort through the data and glean actionable insights from what you have collected

Analyze both quantitative and qualitative results, identify trends and patterns, and determine what the next steps should be

Step 6: implement changes

Once you have analyzed the data, it’s time to put what you have learned into action.

First, identify all the areas that need improvement and prioritize them. The insights provided by customers can provide a great metric for prioritization, but be sure to also factor in the resources available to you and your business goals.

Once you have decided which areas to work on, develop an action plan to make the necessary changes. To stay organized, assign responsibility for overseeing these changes to someone who is capable and reliable. You might have several people handle larger changes, each with their own specific area of the plan.

Step 7: implement a feedback loop

Customer satisfaction research isn’t a one-and-done thing. You’ll want to revisit the research regularly to ensure that changing customer preferences and market dynamics haven’t altered how your customers view you. Quantitative measurements that can be tracked over time can be a big help.

If you’re making improvements but the rate of improvement is leveling off compared to previous results, it could indicate that a change is underway, shifting customer desires. It could also mean that you’re nearing peak customer satisfaction. The best way to know for sure is to set up more customer satisfaction research to understand your numbers.

The important thing is that you don’t let your customer satisfaction efforts become stagnant. Customer needs and preferences change all the time, and if you’re not making an effort to meet those evolving needs, a competitor will happily step in and do it for you.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 3 April 2024

Last updated: 30 April 2024

Last updated: 13 May 2024

Last updated: 22 July 2023

Last updated: 26 July 2024

Last updated: 22 August 2024

Last updated: 10 August 2024

Latest articles

Related topics, .css-je19u9{-webkit-align-items:flex-end;-webkit-box-align:flex-end;-ms-flex-align:flex-end;align-items:flex-end;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-flex-direction:row;-ms-flex-direction:row;flex-direction:row;-webkit-box-flex-wrap:wrap;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;row-gap:0;text-align:center;max-width:671px;}@media (max-width: 1079px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}}@media (max-width: 799px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}} decide what to .css-1kiodld{max-height:56px;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;}@media (max-width: 1079px){.css-1kiodld{display:none;}} build next, decide what to build next, log in or sign up.

Get started for free

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Customer Satisfaction Research: What it is + How to do it?

Customer satisfaction research is essential for businesses looking to build long-term customer relationships. It provides organizations with essential insights into their customers’ thinking and tastes.

Customers who are satisfied with the quality of service are more likely to become loyal customers. In this blog, we will explore customer satisfaction research and how to do it for customer-centric success.

What is customer satisfaction research?

Customer satisfaction research is a systematic process of collecting, analyzing, and interpreting data that allows companies to measure the satisfaction level of customers when purchasing a product or service from their brand.

This research is useful to identify satisfied customers who are loyal defenders of your brand and who are dissatisfied to follow up on their demands.

There are many reasons to measure customer satisfaction. Customer satisfaction research offers great insights, so your team can focus on meeting customer expectations or flagging potential issues that may affect your business growth.

Importance of conducting a satisfaction study

Customer satisfaction research allows business managers and owners to discover that keeping current customers costs less than getting new ones.

One way to collect information about customer satisfaction is by conducting online surveys, which will help you make the necessary changes to improve your business and maintain customer loyalty.

Responding to customer complaints and concerns don’t always mean knowing their needs. Satisfaction surveys allow companies to understand what is working, what needs to be improved, and why.

To provide better customer service, it’s important to understand how they feel and allow them to explain why they feel that way. Only then can you adapt your services and offer an experience that makes you stand out from the competition.

Companies carry out satisfaction studies for different objectives. Among the most important uses of this mechanism are:

- Know what are the areas that need to be improved in the business.

- Know the opinion of customers about your brand.

- Find out what the true needs of customers are.

- Create better customer retention strategies.

- Know if the market strategies that are carried out are working.

- Meet customer expectations.

How to carry out customer satisfaction research?

Customer satisfaction research takes several steps to get a thorough and accurate insight into your customer experiences and perspectives. Here’s a step-by-step method you can follow for carrying out customer satisfaction research:

Step 1: Define Research Objectives

Defining precise and well-structured research objectives is an essential first step in every customer satisfaction research project. These objectives will guide you through the whole research process and ensure that the research remains focused, relevant, and connected with your business goals.

To define research objectives, follow the steps outlined below:

- Identify the Objectives: Start by identifying the overall objectives of your customer satisfaction research.

- Break Down Objectives: Divide the purpose into specific objectives. Each objective should be specific and address a different component of customer satisfaction.

- SMART Criteria: Make sure your objectives are SMART—specific, measurable, attainable, relevant, and time-bound.

- Prioritize: If you have several objectives, prioritize them according to relevance and potential impact.

Step 2: Select Research Methodology

Selecting an appropriate research technique is a vital decision that will define your overall research process. Your approach will influence the type of data you gather, the level of insights you get, and the general validity of your findings. Here are some examples of research methodology.

- Surveys: Surveys are a popular and versatile method for collecting data on customer satisfaction. You can gather qualitative and quantitative data through structured questions.

Customer Satisfaction Score (CSAT) is the most straightforward of the customer satisfaction survey methodologies. Surveys are well-suited for measuring customer satisfaction scores, Net Promoter Scores (NPS), and other quantitative metrics.

- Interviews: Interviews will enable you to have in-depth interactions with customers. You can get valuable qualitative insights into customer experiences through phone interviews or in-person chats.

- Focus Groups: In a focus group, a small group of customers shares their experiences, ideas, and impressions in a guided session. This strategy encourages group interactions by allowing participants to respond to each other’s comments.

- Observations: Observational research refers to directly monitoring customers as they interact with your products or services. This strategy will provide you insights into user behavior and reactions in real time.

Step 3: Develop Customer Satisfaction Surveys

Developing well-crafted customer satisfaction surveys is an important stage in customer satisfaction research. It serves as the primary tool for gathering customer data and insights.

A well-crafted customer satisfaction survey will ensure that you get relevant and meaningful data. It will also motivate you to make improvements and increase customer satisfaction. You can develop a robust customer satisfaction survey by following the steps below:

- Define Research Objectives: Before developing survey questions, ensure you understand the research objectives. Determine which aspects of customer satisfaction you want to measure and what insights you want to get.

- Choose Question Types: Remember the research objectives when creating customer satisfaction survey questions. Select appropriate question types that align with your research objectives. It will help you to capture different dimensions of customer satisfaction. To quantify responses, include closed-ended questions with Likert scales, multiple-choice options, and ranking scales. Include open-ended questions. It will encourage your customers to provide thorough comments and insights.

- Order and Flow: Organize the survey questions logically, begin with general questions, and then proceed to more specialized and complicated topics. Keep a balance between qualitative and quantitative questions.

- Avoid Leading Questions: Leading questions will unintentionally influence your respondents and compromise the accuracy of their responses. So, avoid including leading questions and design questions that are neutral and unbiased.

- Incorporate Demographic Questions: Demographic questions (e.g., age, gender, location) will help you to segment responses and analyze satisfaction across different customer segments. So include it.

- Mobile-Friendly Design: Make sure your survey is mobile-friendly and displays properly on different screen sizes.

Step 4: Sampling Strategy

Sampling ensures that the findings are representative of your whole customer base. It will enable you to make correct decisions and judgments. A well-planned sampling method will help you reduce biases and increase your findings’ generalization.

Depending on your research objectives and available resources, you can use a variety of sampling methods . Here are a few common approaches:

- Simple Random Sampling : It ensures that every person in the population has an equal chance of being chosen.

- Stratified Random Sampling : This sampling method divides your population into subgroups based on specified criteria.

- Convenience Sampling : This method selects participants who are easily accessible, such as customers who frequently visit your physical store or online store.

Step 5: Data Collection and Analysis

In this step, you will collect data from your target audience, arrange and evaluate the data systematically, and generate useful insights to make informed decisions.

Use statistical tools to analyze trends, correlations, and distributions for quantitative data. Calculate measures such as averages, percentages, and standard deviations. You can visually represent the findings using graphs, charts, and tables.

Use qualitative analysis tools for qualitative data. Content analysis, thematic analysis, and sentiment analysis are all common methodologies you can use. These strategies will help you identify repeating themes, attitudes, and patterns in open-ended responses.

Step 6: Implement Changes

The implementation phase of customer satisfaction research is where insights and recommendations are implemented. Here, you will turn data-driven findings into real improvements that directly influence the customer experience.

Create a detailed implementation plan for each identified improvement. Implementing changes based on research findings involves careful planning, cooperation, and a dedication to providing greater customer value.

Define specific tasks, time frames, responsible parties, and key performance indicators (KPIs) to measure the effectiveness of each effort. Prioritize the actionable recommendations that are most likely to improve customer satisfaction and retention significantly.

Step 7: Communication and Regular Feedback Loop

Transparency is essential for maintaining trust and credibility with your customers. Share the research’s findings and the responses that were made. Let your customers know that their opinions are taken seriously and have resulted in concrete improvements.

Customer satisfaction will remain a dynamic and changing emphasis of your business strategy if you establish a continual feedback loop. Here are some tips for creating and keeping a consistent feedback loop:

- Scheduled Surveys: Conduct customer satisfaction surveys quarterly, semi-annually, or yearly.

- Incorporate Feedback Mechanisms: Integrate feedback mechanisms into various touchpoints, such as post-purchase follow-up emails, customer service interactions, or feedback forms on your website.

- Feedback Analysis: Analyze the customer feedback you received from each cycle in detail. Identify recurring themes, popular trends, and problem areas.

- Action Planning: Create action plans for additional improvements based on the newly acquired insight.

- Implementation: Implement the suggested modification and changes in every relevant part of your business.

Advantages of carrying out a satisfaction study

Carrying out a satisfaction study has great benefits for your organization:

- Obtain valuable information from customers

Doing customer satisfaction research allows you to obtain information about your customers, determine how happy they are with your company, and correct what is wrong.

- Establish priorities

The satisfaction study results allow you to discover which areas of your business need more attention, such as customer service, the sales closing process, etc.

- Customer retention

If your customers are satisfied with your products, it is possible that they will stay in your business. Maintaining a high level of customer satisfaction is extremely important to the overall success of your organization.

- Maintain your reputation

A satisfaction study allows you to interact with consumers and show them that you care about their needs and opinions. In particular, they offer to improve the customer experience if you make the changes.

- Maintain customer loyalty

If you want to maintain customer loyalty, a satisfaction survey will give you the opportunity to listen to their feedback and improve your brand.

- Get new customers

People feel more confident buying from transparent companies, so post the feedback you get from current customers to show that you allow any kind of feedback and value it.

- An advantage over the competition

There is a lot of competition in the market today, so any advantage you may have needs to be made known. Show current and potential customers the areas in which you excel.

Conducting customer satisfaction research with QuestionPro

One of the best ways to find out the opinion of customers and their needs is through online surveys, which allow you to collect information and perform data analysis to make better business decisions.

With QuestionPro, you can find out how satisfied your customers are by asking a Net Promoter Score question, which will let you know if consumers are promoters or detractors of your brand.

Other types of questions that will help you gather information for your study are:

- Multiple Choice Questions

- Closed questions

- Open text questions

- Order and Ranking Questions

You can track customer satisfaction and measure how happy your existing customers are with your business, brand, and customer initiatives by using QuestionPro’s customer satisfaction survey templates and survey questions. These customer satisfaction survey examples help ensure a higher survey completion and response rate for your market research.

Find out what customers think! Carry out customer satisfaction research and collect the necessary information to improve the consumer experience. Contact us and learn how to measure customer satisfaction using QuestionPro.

LEARN MORE FREE TRIAL

MORE LIKE THIS

Statistical Methods: What It Is, Process, Analyze & Present

Aug 28, 2024

Velodu and QuestionPro: Connecting Data with a Human Touch

Google Forms vs QuestionPro: Which is Best for Your Needs?

Cross-Cultural Research: Methods, Challenges, & Key Findings

Aug 27, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

.webp)

Customer Research Methods: Key Strategies for Market Insights in 2024

- Customer surveys : Survey tools such as Survicate are essential for conducting quantitative and qualitative research across various customer touchpoints and improving digital CX

- Diverse research methods : Employ a mix of customer research methods like different types of surveys , interviews, focus groups, observational studies, and usability testing to gain comprehensive insights into customer behavior and product interaction.

- Importance of continuous feedback : Establishing feedback loop mechanisms is crucial for ongoing improvement, ensuring that products and services evolve in response to customer needs .

- Data analysis : Systematic data collection followed by thorough analysis using appropriate customer research tools is key to identifying trends and making informed decisions.

- Actionable feedback : Prioritize and strategize based on research findings to create actionable insights that drive measurable improvements in customer experience management and business processes.

Cutting through the chatter to hear your customers' true opinions is no small feat.

Tailored for business owners and marketers, this article zeroes in on how to conduct customer research . We'll highlight the strategies that directly connect you to your audience's preferences and pain points. By tapping into these insights, you'll be equipped to make informed, impactful business decisions.

Dive in to transform customer feedback into a clear direction for your brand's growth and success.

What is customer research?

Customer research is an essential practice focused on collecting data about your customers to understand their characteristics, needs, and behaviors.

Why is customer research important?

- Informed Decision-Making: You gain actionable insights into customer preferences and satisfaction, empowering you to make data-driven decisions.

- Enhanced Customer Experience: Understanding what your customers value guides your efforts to improve their experiences with your product or service.

- Strategic Focus: Tailoring your business strategy becomes more focused as you identify key demographics and market segments.

- Product Development: Product features and improvements align better with customer expectations when informed by customer research.

- Competitive Edge: Detailed knowledge about your customers can give you a competitive advantage by identifying opportunities and gaps in the market.

Customer research vs. market research

Customer research and market research serve distinct purposes in understanding buyers and the competitive environment.

Customer research dives deep into your existing or potential customers' behaviors, needs, and preferences . It aims to create a detailed understanding of the customer journey , from awareness to purchase and is often qualitative in nature.

On the other hand, market research takes a broader approach, examining the market as a whole, including industry trends, competitor analysis, and market share.

While customer research is about the 'who' and 'why' behind purchasing decisions, conducting market research addresses the 'what' and 'how' of market conditions and opportunities.

Both types of research are crucial for informed decision-making but focus on different aspects of the business landscape. Customer research is about improving the customer experience and tailoring products or services to consumer needs. Market research is about understanding the market landscape to strategize and position offerings effectively.

Primary research vs. secondary research

In customer research, understanding the distinction between primary research and secondary research is crucial for choosing the right approach to obtain your insights.

Primary research

Primary research involves collecting data firsthand for your specific research goal. This data is original and gathered through methods directly controlled by you. Examples include:

- Surveys and questionnaires : Deploying custom surveys to collect customer feedback on a new product or service.

- Interviews : Conducting one-on-one dialogues to dive deep into customer opinions and experiences.

- Focus groups : Facilitated group discussions to obtain a range of perspectives on a particular topic.

Secondary research

Secondary research methods rely on data previously collected by others. It's an evaluation of existing information that may include:

- Industry Reports : Analyzing market research findings related to your sector.

- Academic Journals : Reviewing studies and papers for trends and outcomes that align with your interests.

- Market Analysis : Assessing competitor data and market summaries to inform your strategies.

Types of customer data

Before diving into specific categories, understand that customer data is essential to personalize your marketing strategies and enhance customer experiences. This data comes in two core types: qualitative and quantitative.

Qualitative data

Qualitative research gathers non-numeric information that captures your customers' opinions, motivations, and attitudes. This data often comes from:

- Interviews , direct conversations that provide in-depth insights.

- Open-ended survey responses allow customers to express their thoughts in their own words.

Quantitative data

Quantitative research collects numerical data and can be measured and analyzed statistically. Key sources include:

- Transaction records : Sales data showing purchasing patterns.

- Website analytics : Metrics like page views and click-through rates representing user behavior.

Best customer research methods

When conducting customer research, you need to select the right methodology to gain valuable insights. Various research methods cater to different needs, from understanding user behavior to gauging customer satisfaction.

Customer surveys and questionnaires

Deploy online surveys and questionnaires to quickly gather quantitative and qualitative data from a large audience. For example, a survey tool such as Survicate offers a variety of different distribution channels:

- surveys embedded in emails

- website pop-up surveys

- mobile app surveys

- link surveys

- in-product surveys

Surveys are a cost-effective way to gather market research insights from the entire customer digital journey . If you use them as a part of a feedback loop, they can help you improve the CX considerably.

widely via email, websites, or social media platforms. Ensure your questions are direct and easy to understand to maximize response rates.

Conduct interviews to collect in-depth qualitative data. One-on-one interviews allow for a deep dive into customer opinions, beliefs, and experiences. Record these sessions, if possible, to ensure that none of the details are lost.

Focus groups

Utilize focus groups to explore customer attitudes and behaviors in a group setting. This method sparks conversation and can uncover insights that might not surface in one-on-one interactions. Be wary of group dynamics such as conformity, which can influence individual responses.

Observational studies

Observational studies involve watching how users interact with your product in their natural environment. This method provides unfiltered, real-world user behavior that can be invaluable in understanding how your product is used.

Usability testing

Usability testing is imperative for evaluating the functionality and design of your product. Recruit participants to complete specific tasks while observers note where they encounter issues or experience confusion.

Field trials

Conduct field trials by providing users a prototype or beta version of your product for a certain period. This hands-on approach yields feedback on your product's performance in real-life scenarios.

Review mining

Lastly, review mining involves analyzing customer feedback found in online reviews and forums. This passive method is particularly useful for identifying common pain points and areas for improvement without the need for direct interaction.

Types of customer research

Customer research encompasses various methodologies aimed at understanding your market and clientele. Tailoring these approaches helps you stay informed and make data-driven decisions.

Competitive research

You analyze your competitors to benchmark your products, services, and customer satisfaction levels against them. This helps in identifying industry standards and areas for improvement.

Customer journey mapping

Journey mapping involves charting the steps your customers take, from discovering your brand to making a purchase and beyond. It's a strategic approach to understanding customer interactions with your brand.

Buyer persona research

You create detailed profiles of your typical customers based on demographic and psychographic data. These personas help in crafting targeted marketing strategies.

Customer experience research

You assess customers' overall experience with your brand, from the usability of your website to customer service interactions, to optimize every touchpoint.

Customer segmentation research

Market segmentation divides your customer base into distinct groups based on common characteristics to provide more personalized products and services.

Customer needs research

You investigate your customers' underlying needs and desires to develop products that solve specific problems or enhance their lives.

Customer satisfaction research

You measure how your products and services meet, exceed, or fall short of customer expectations, often using surveys, feedback forms, and follow-up interviews.

Pricing research

You evaluate customers' responses to pricing changes and their perception of your product's value to establish an optimal pricing strategy.

Brand perception research

You gauge how customers perceive your brand to ensure your messaging aligns with their beliefs and your company values.

Designing a research plan

Precision and structure are pivotal for gathering actionable insights in constructing a customer research plan. These steps will guide you through creating an effective framework for your research efforts.

Set objectives

Identify what you want to achieve with your research. For instance, you may aim to understand customer satisfaction , identify buying patterns, or test product concepts. These objectives should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) to ensure clarity and focus.

Identify target audience

Determine who your customers are by segmenting the market. To accurately represent your overall market, include demographics, psychographics, and behaviors in your segmentation. Knowing your audience can tailor your research to yield more relevant data.

Recruit participants

Once you know who to target, select participants who best represent your customer base. Employ strategies such as customer databases, social media outreach, or third-party panels to gather a varied group that reflects your target audience's diversity.

Choose appropriate methods

Your objectives will dictate the methods you choose. Qualitative approaches like interviews afford depth, while quantitative methods like surveys provide breadth. Select the right blend of methods to gain a multidimensional view of customer sentiments.

Sampling techniques

Employ sampling techniques to generalize your findings. Random sampling ensures everyone has an equal chance of selection, while stratified sampling involves dividing your audience into subgroups and sampling from these categories to ensure all segments are represented.

Build a continuous process with feedback loops

Establish ongoing mechanisms to capture customer feedback regularly. This could involve periodic surveys or real-time feedback systems. Make sure you continuously iterate your product or service based on this input, creating a virtuous cycle of improvement.

Data collection and analysis

Effective customer research hinges on the systematic collection and meticulous analysis of data to decipher patterns, understand behaviors, and make informed decisions.

Gather data systematically and analyze it to uncover patterns and trends. Use analytical tools that can handle your data type and amount. Look for relationships between variables and compare these findings against your goals.

Quantitative data analysis

You'll handle numerical data that can be measured and compared in a straightforward manner. Quantitative analysis often employs statistical tools to interpret data sets and deduce meaningful insights. Common techniques include:

- Descriptive Statistics: Summarize your data through means, medians, and modes.

- Inferential Statistics: Make predictions and infer trends from your sample data.

- Regression Analysis: Determine the relationship between variables.

Qualitative data assessment

With qualitative data, your focus is on interpretative analysis of non-numerical information, such as customer interviews or open-ended survey responses. Key approaches involve:

- Thematic Analysis: Identify patterns or themes within qualitative data.

- Content Analysis: Categorize text to understand the frequency and relationships of words or concepts.

- Narrative Analysis: Explore the structure and content of stories to gain insights into customer perspectives.

Mixing methods

Combining quantitative and qualitative analysis can provide a holistic view of your customer research. Employ a 'mixed methods' strategy to:

- Validate findings across different data types.

- Gain a richer, more nuanced understanding of research questions.

- Balance the depth of qualitative assessment with the generalizability of quantitative analysis.

Interpreting and reporting results

Turn your data into action by using insights to inform business decisions. Whether it is refining product features or adjusting marketing strategies, use the research to create value for your customers and your business.

Drawing conclusions

When you are ready to draw conclusions from your customer research, begin by assessing the data's significance. Look for patterns and trends in the feedback and quantifiable data. Tabulate your findings when possible, as this makes comparisons clearer:

- Quantitative Data : Calculate averages, frequencies, and percentages. A table showing the response distribution for each question can clarify these statistics.

- Qualitative Data : Group feedback into themes. For instance, list common descriptors used by customers when discussing a product feature.

Conclusions should directly relate to the research objectives you set before the study.

Creating actionable insights

After drawing conclusions, it's crucial to translate them into actionable insights:

- Prioritize : Determine which findings substantially impact your objectives or pose the biggest challenge to your CX.

- Strategize : For each priority area, brainstorm potential strategies. This may involve a simple list or a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for complex decisions.

Always ensure that your insights are actionable; they should inform decisions and lead to measurable improvement in consumer experience or business processes. Communicate these insights with clear, straightforward language to the relevant stakeholders in your organization.

Emerging trends in customer research

Conduct market research with ai.

Customer research is adapting to leverage cutting-edge technologies. You'll notice a significant shift towards harnessing data analytics and artificial intelligence (AI) to derive deeper insights into customer behavior.

You can leverage Survciate AI-powered features as well. Try the AI survey creator that will design your customer or market research survey in under a minute after you describe your needs and objectives.

After you collect feedback, you can use the AI Topics feature to speed up getting qualitative insights. It will automatically categorize and summarize answers to your open-ended questions. Worth trying, isn't it?

Social listening

Social listening tools are another trend on the rise. They enable you to monitor your brand's social media presence and gather direct feedback from conversations about your products or services. Mobile ethnography also offers a way to observe customer interactions in a natural setting, providing contextually rich data.

Predicting customer behavior

Lastly, as the emphasis on personalization grows, predictive analytics are being adopted to tailor customer experiences. These techniques analyze past behavior to anticipate future needs, enhancing your ability to meet customer expectations preemptively.

Remember, these methods involve collecting various forms of customer data, so being vigilant about privacy and ethical data use is crucial. Follow regulations and best practices to ethically manage the information you gather.

Survicate for your market and customer research

As we've explored, the key to thriving in the current market is to truly understand your customers. The challenge, however, lies in efficiently gathering and interpreting their feedback to inform your business strategies.

With its user-friendly interface, Survicate allows you to create targeted surveys, collect real-time feedback, and analyze the data with ease, ensuring that every customer voice is heard and accounted for.

Survicate's suite of features simplifies the process of connecting with customers and extracting the insights you need to make data-driven decisions. Whether it's through NPS , customer satisfaction surveys, or user experience research, Survicate provides the clarity and direction required to adapt and excel in a fast-paced market.

For those ready to elevate their customer research, consider giving Survicate a try. Start your journey to clearer insights today with a free 10-day trial of the Business Plan , and experience the full potential of focused customer feedback. Take the step today, and transform the way you connect with your audience.

We’re also there

Customer service satisfaction

Conceptualised service encounter satisfaction model proposed by Walker (1995, pp. 8-9) is divided into three disconfirmation stages:

- Evaluation stage. In that stage the peripheral service is encountered prior to the core service being consumed.

- Core service is more anticipated by the consumer.

- After core service delivery interaction is undertaken in the final stage.

The influence of several complex and multiple factors to the customer tolerance zone is noted by Zeithaml et al (1993, p.2). Eleven factors affecting both desired and adequate service levels are described by Zeitheml et al (1993, pp.3-11) as following:

Desired service influencing factors:

1. Enduring service intensifiers

- Derived expectations

- Personal service philosophies

2. Personal needs

3. Explicit service promises

- Advertising

- Personal selling

- Other communications

4. Implicit service promises:

5. Word of mouth:

- Expert (Consumer reports, publicity, consultants, surrogates)

6. Past experience

Adequate service influencing factors:

7. Transitory service intensifiers

- Emergencies

- Service problems

8. Perceived service alternatives

9. Self-perceived service role

10. Situational factors:

- Bad weather

- Catastrophe

- Random over-demand

11. Predicted service

- Hutchinson, TP, 2009, “The customer experience when using public transport: a review”, Proceedings of the ICE – Municipal Engineer

- Kotler, P & Keller, K, 2006, “Marketing Management”, twelfth edition, Prentice-Hall

- McManus, J & Miles, D, 1993, “An underground journey: Managing Service Quality”, MCB UP Ltd

- Miller, M, 1995, “Improving customer service and satisfaction at London Underground”, Managing Service Quality, Vol.5, Issue:1

- Walker, JL, 1995, “Service Encounter Satisfaction: Conceptualized”, Journal of Service Marketing Issue: 9(1)

- Zeithaml, VA, Berry, LL & Parasuraman, A, 1993, “The Nature and Determinants of Customer Expectations of Service”, Journal of the Academy of Marketing Science , Issue: 21(1)

Researching Customer Satisfaction and Loyalty: How to Find out What People Really Think

Journal of Consumer Marketing

ISSN : 0736-3761

Article publication date: 1 April 2006

- Customer satisfaction

- Customer loyalty

- Market research methods

Goncalves, K.P. (2006), "Researching Customer Satisfaction and Loyalty: How to Find out What People Really Think", Journal of Consumer Marketing , Vol. 23 No. 3, pp. 173-173. https://doi.org/10.1108/07363760610663349

Emerald Group Publishing Limited

Copyright © 2006, Emerald Group Publishing Limited

Paul Szwarc's Researching Customer Satisfaction and Loyalty: How to Find out What People Really Think is a hybrid between the rigor and quantitative orientation of a textbook, and the “lightness” of a trade book. It is easy to read, well‐organized, easy to follow, and contains many helpful hints for practitioners new to commercial consumer research. The case studies throughout the book are likely to be especially interesting to new researchers. Senior researchers are not likely to find great value in this book.

Part I . Introduction and Theory (four chapters; 70 pages).

Part II . Getting Started (four chapters; 72 pages).

Part III . ‘Touching’ the Customer (one chapter; 20 pages).

Part IV . Outputs (two chapters; 45 pages).

Part V . What Lies Ahead? (one chapter; ten pages).

Part I provides useful background for anyone new to consumer satisfaction research. For example, Chapter 1 reminds readers that “customers” are really a wide array of stakeholders ranging from “external customers” to employees, stockholders, and prospective and lost customers. In chapter 2 the author reviews the important differences between strategic and operational research. He also takes the time to describe several well‐known customer service awards, as well as what some familiar terms mean (e.g. ISO 9002; Six Sigma).

“Instant feedback” must be the greatest concern of all moderators. Having just spent a couple of hours running a group, the moderator is asked to produce an instant summary of the “key findings” that emerged from the session. This does not allow any time for the moderator to reflect on all that has happened. Neither does it allow him or her to determine how different this group was from others her or she (or his/her colleagues) has conducted on the subject. Meanwhile, there is a risk that the client has drawn his or her own conclusions, and is keen to see if the moderator has similar “findings” (pp. 45‐6).

Chapter 4, on quantitative research, is where I had difficulty, because the author missed key points that may lead inexperienced researchers astray. For example, in the discussion of disadvantages of face‐to‐face interviewing, there is no mention of interviewer bias! Clearly, interviewer bias is a potential concern any time there is a live interviewer – telephone, in‐person, focus group moderation, etc. – so it should be included. In fact, bias is ignored or downplayed throughout the chapter, and experienced researchers know that bias can discredit any findings.

Aside from my disagreements with some of Chapter 4's content, it is easy to read, even for those who avoid the quantitative world of statistics, reliability levels, and sample size decisions. This alone, would make the chapter worth reading for new researchers, because it might help them overcome “numbers phobia”.

Part II addresses the research design process from when the research sponsor first develops its research objectives, until the formal research instrument is pre‐tested and ready for fieldwork. Chapters 5 and 6 provide both the “client” and “researcher” organizational perspectives – illuminating for those new to the field. These chapters also provide details such as who completes various tasks, how to handle budgets, and what to do when there are conflicts over methodology.

Chapter 7 moves on to sampling – who to reach, how to reach them, issues associated with certain types of samples, how many people to include, response rates, and other practical aspects of sampling that are hard to grasp until one has had to construct a sample. The author even includes a section on longitudinal research and how the samples, questionnaires, and research processes differ for one‐off projects versus those designed to be continuous or repeated at intervals.

Chapter 8 is a good overview of the questionnaire design process, from what to ask, to the role of order bias and how to handle sensitive questions. Szwarc's comments and advice are sound, and to a large degree, reflect what I have seen in my own practice. The sub‐headings he uses and some of the content are not exactly “purist” from an academic perspective, but they are very useful when designing commercial surveys.

What to do when you learn something confidential and time‐sensitive from a respondent, which should be shared with the client, but which is difficult (or impossible) to share given standard confidentiality rules.

Addressing misperceptions on the part of clients who have listened to or observed a small portion of the fieldwork, and then feel that anything which does not agree with their “knowledge” must be wrong.

Part IV (Chapters 10 and 11) are written in the same format as earlier sections but feel more like “checklists”, because they cover data cleaning, coding, entry, analysis and reporting. This is where many researchers seem to get lost, and these two chapters could easily be used to guide the data analysis and reporting process in an objective, logical fashion.

Part V, Chapter 12 shares the author's view of major global environmental shifts from demographics (the “aging” of the population in several countries) to technological change (internet, consumer electronics) to psychographics (consumer attitudes toward work, leisure and to the process of change itself). He also addresses how these shifts are affecting the market research process and industry. As he notes, everything is changing so rapidly, it is hard to keep up, and this chapter is a good example. No matter how recently the book was written, readers will find parts of this chapter sound dated – evidence that Szwarc is right!

Overall, this book is worthwhile for anyone new to market research. Junior staffers at research firms, as well as those who work for the companies that sponsor commercial research can benefit, and they may find that this becomes a reference work. It is easier to read than their marketing research textbook, and when in doubt about anything the author says, they can always refer to their textbook for a “purer”, more academic view of the world.

Related articles

All feedback is valuable.

Please share your general feedback

Report an issue or find answers to frequently asked questions

Contact Customer Support

Customer satisfaction and firm performance: insights from over a quarter century of empirical research

- Review Paper

- Published: 31 May 2019

- Volume 48 , pages 543–564, ( 2020 )

Cite this article

- Ashley S. Otto ORCID: orcid.org/0000-0003-3670-730X 1 ,

- David M. Szymanski 2 &

- Rajan Varadarajan 3

13k Accesses

135 Citations

12 Altmetric

Explore all metrics

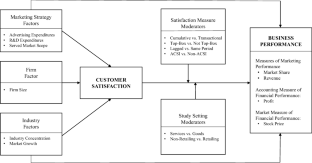

Emphasizing customer satisfaction as a strategic lever for enhancing business performance is a widespread business practice. However, just over 25 years of empirical studies by academic researchers has produced evidence that is sometimes contradictory. Hence, greater academic clarity and improved managerial understanding could result from a meta-analysis of the customer satisfaction-business performance relationship. To that end, the authors analyzed 251 correlations from 96 studies published between 1991 and 2017. While the satisfaction-performance relationship is positive and statistically significant on average ( r = .101), more meaningful insights emerge from the explication of moderating and mediating relationships. Illustrative of these insights is the finding that satisfaction is more appropriately depicted as mediating the effects of selected marketing strategy variables on firm performance outcomes. Moreover, when satisfaction is viewed in the right setting using the right satisfaction and performance measures, a most favorable contingencies (MFC) perspective, the estimated correlation is reasonably strong ( r = .349).

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Customer satisfaction, loyalty behaviors, and firm financial performance: what 40 years of research tells us

Customer satisfaction and international business: A multidisciplinary review and avenues for research

Defining Customer Satisfaction: A Strategic Company Asset?

Explore related subjects.

- Artificial Intelligence

Another market measure of financial performance that has been the focus of investigation in the satisfaction-performance literature is Tobin’s q. However, concerns have been raised recently by Bendle and Butt ( 2018 ) regarding the use and misuse of Tobin’s q in marketing (see Bendle and Butt 2018 ). Because of these concerns (brought to our attention by a reviewer for which we are grateful, and a reviewer’s related suggestion), the analysis of Tobin’s q is presented in the Supplemental Material.

A breakout of the mean satisfaction-performance correlation by time period (i.e., year of study publication) similarly fails to illuminate a meaningful pattern of ever increasing or decreasing effect sizes. Specifically, for studies published (i) before 1997, M = −.110 (95% CI of −.224 to .007, n = 15), (ii) during the period 1998–2002, M = .092 (95% CI of .046 to .138, n = 42), (iii) during the period 2003–2007, M = .097 (95% CI of .064 to .131, n = 66), (iv) during the period 2008–2012, M = .140 (95% CI of .089 to .191, n = 90), and (v) during the period 2013–2017, M = .112 (95% CI of .044 to .180, n = 38). Thus, while the respective means for the last four time periods are each significantly stronger than the mean estimate for the time period “before 1997” (note, the mean for “before 1997” is not statistically significant), it should be noted that the respective means for each of the four, more recent time periods are not significantly different from one another.

Prior to estimating the final PM models, a full mediating (FM) model (i.e., marketing strategy, firm, and industry factors only directly impacting satisfaction and satisfaction then directly impacting performance) was estimated to determine whether fit would be superior. The MASEM findings indicate that the FM model is a poor fitting model across the performance measure while the respective partial-mediating versions of those models can be considered to fit the data well. Regarding the FM pooled performance model, the χ 2 (6) of 67.34 is significant ( p < .05), the CFI of .57 and TFI of .04 are below the critical threshold of .95 suggestive of a good fit, the SRMR of .05 is reasonable, but values of zero represent perfect fit, and the RMSEA of .11 and its 90% CI having an upper bound that exceeds .10 (CI = .087 to .133) are further indicants of poor fit. Similarly, the FM model is a poor fit for market share . The Δχ 2 (5) of 921.56 is significant ( p < .05), the CFI is .06 and TFI is −1.06 (which is a non-normed value), the SRMR is .16, and the RMSEA of .48 with a 90% CI of .455 to .508 are also indicants of poor fit. Likewise, the FM model is a poor fit to the data when profit is the performance measure. The χ 2 (6) of 36.83 is significant ( p < .05), the CFI of .72 and TFI of .40 are below the threshold of .95, the SRMR of .04 is reasonable, but the RMSEA of .08 and its 90% CI having an upper bound that exceeds .10 (CI = .055 to .104) are indicative of poor model fit. The resulting modification indices (in the case of each of these three FM models) pointed to estimating a partial mediating model instead, with one or more of the exogenous factors further exerting a direct effect on the respective performance metric.

Adjei, M. T., Griffith, D. A., & Noble, S. M. (2009). When do relationships pay off for small retailers? Exploring targets and contexts to understand the value of relationship marketing. Journal of Retailing, 85 (4), 493–501.

Article Google Scholar

Ailawadi, K. L., Dant, R. P., & Grewal, D. (2004). The difference between perceptual and objective performance measures: an empirical analysis . Cambridge: Marketing Science Institute.

Google Scholar

Aksoy, L., Cooil, B., Groening, C., Keiningham, T., & Yalcin, A. (2008). The long-term stock market valuation of customer satisfaction. Journal of Marketing, 72 (4), 105–122.

Anderson, E. W., Fornell, C., & Lehmann, D. R. (1994). Customer satisfaction, market share and profitability: findings from Sweden. Journal of Marketing, 58 (3), 53–66.

Anderson, E. W., Fornell, C., & Mazvancheryl, S. (2004). Customer satisfaction and shareholder value. Journal of Marketing, 68 (4), 172–185.

Barger, P. B., & Grandey, A. A. (2006). Service with a smile and encounter satisfaction: emotional contagion and appraisal mechanisms. Academy of Management Journal, 49 (6), 1229–1238.

Becker, B. J. (2009). Model-based meta-analysis. In H. Cooper, L. Hedges, & J. Valentine (Eds.), The handbook of research synthesis and meta-analysis (pp. 377–395). New York: Russell Sage Foundation.

Beckers, S. F., van Doorn, J., & Verhoef, P. C. (2017). Good, better, engaged? The effect of company-initiated customer engagement behavior on shareholder value. Journal of the Academy of Marketing Science, 45 (3), 1–18.

Bendle, N. T., & Butt, M. N. (2018). The misuse of accounting-based approximations of Tobin’s q in a world of market-based assets. Marketing Science, 37 (3), 484–504.

Bergkvist, L., & Rossiter, J. R. (2007). The predictive validity of multiple-item versus single-item measures of the same constructs. Journal of Marketing Research, 44 (2), 175–184.

Bharadwaj, S. G., & Mitra, D. (2016). Satisfaction (Mis)pricing revisited: real? Really big? Journal of Marketing, 80 (5), 116–121.

Bharadwaj, S. G., & Varadarajan, R. (2004). Toward an integrated model of business performance. In N. K. Malhotra (Ed.), Review of marketing research (pp. 207–243). Armonk: M. E. Sharpe.

Blundell, R., Griffith, R., & Van Reenen, J. (1999). Market share, market value and innovation in a panel of British manufacturing firms. The Review of Economic Studies, 66 (3), 529–554.

Bolton, R. N. (1998). A dynamic model of the duration of the customer’s relationship with a continuous service provider: the role of satisfaction. Marketing Science, 17 (1), 45–65.

Borenstein, S. (1991). Selling costs and switching costs: explaining retail gasoline margins. RAND Journal of Economics, 22 (3), 354–369.

Borenstein, M., Hedges, L. V., Higgins, J. P. T., & Rothstein, H. R. (2009). Introduction to meta-analysis . Chichester: Wiley.

Book Google Scholar

Bradburd, R. M., & Caves, R. E. (1982). A closer look at the effect of market growth on industries' profits. The Review of Economics and Statistics, 64 (4), 635–645.

Brown, S., & Lam, S. (2008). A meta-analysis of relationships linking employee satisfaction to customer responses. Journal of Retailing, 84 (3), 243–255.

Buzzell, R. D., & Wiersema, F. D. (1981). Modelling changes in market share: a cross-sectional analysis. Strategic Management Journal, 2 (1), 27–42.

Cai, G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86 (1), 22–36.

Camisón, C., & Forés, B. (2010). Knowledge absorptive capacity: new insights for its conceptualization and measurement. Journal of Business Research, 63 (7), 707–715.

Churchill, G. A., & Surprenant, C. (1982). An investigation into the determinants of customer satisfaction. Journal of Marketing Research, 19 (4), 491–504.

Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Hillsdale: Erlbaum.

Cotterill, R. W., & Putsis, W. P. (2000). Market share and price setting behavior for private labels and national brands. Review of Industrial Organization, 17 (1), 17–39.

De Haan, E., Verhoef, P. C., & Wiesel, T. (2015). The predictive ability of different customer feedback metrics for retention. International Journal of Research in Marketing, 32 (2), 195–206.

Doorley, T. L., & Donovan, J. M. (1999). Value-creating growth: how to lift your company to the next level of performance . San Francisco: Jossey-Bass.

Dunlap, W. P. (1999). A program to compute McGraw and Wong’s common language effect size indicator. Behavior Research Methods, Instruments, & Computers, 31 (4), 706–709.

Edvardsson, B., Jognson, M. D., Gustafsson, A., & Strandvik, T. (2000). The effects of satisfaction and loyalty on profits and growth: products versus services. Total Quality Management, 11 (7), 917–927.

Eisend, M. (2015). Have we progressed marketing knowledge? A meta-meta-analysis of effect sizes in marketing research. Journal of Marketing, 79 (3), 23–40.

Falk, T., Hammerschmidt, M., & Schepers, J. J. L. (2010). The service quality-satisfaction link revisited: exploring asymmetries and dynamics. Journal of the Academy of Marketing Science, 38 (3), 288–302.

Fornell, C. (1992). A national customer satisfaction barometer: the Swedish experience. Journal of Marketing, 55 (1), 1–21.

Fornell, C., Mithas, S., Morgenson, F. V., III, & Krishan, M. S. (2006). Customer satisfaction and stock prices: high returns, low risk. Journal of Marketing, 70 (1), 1–14.

Fornell, C., Morgeson, F. V., III, & Hult, G. T. M. (2016a). An abnormally abnormal intangible: stock returns on customer satisfaction. Journal of Marketing, 80 (5), 122–125.

Fornell, C., Morgeson, F. V., III, & Hult, G. T. M. (2016b). Stock returns on customer satisfaction do beat the market: gauging the effect of a marketing intangible. Journal of Marketing, 80 (5), 92–107.

Gatignon, H., & Hanssens, D. M. (1987). Modeling marketing interactions with application to salesforce effectiveness. Journal of Marketing Research, 24 (3), 247–257.

Geyskens, I., Stenkamp, J., & Kumar, N. (1999). A meta-analysis of satisfaction in marketing channel relationships. Journal of Marketing Research, 36 (2), 223–238.

Grewal, R., Chandrashekaran, M., & Citrin, A. (2010). Customer satisfaction heterogeneity and shareholder value. Journal of Marketing, 47 (4), 612–626.

Grewal, D., Puccinelli, N., & Monroe, K. B. (2018). Meta-analysis: integrating accumulated knowledge. Journal of the Academy of Marketing Science, 46 (1), 1–22.

Gruca, T., & Rego, L. (2005). Customer satisfaction, cash flow, and shareholder value. Journal of Marketing, 69 (3), 115–130.

Harbord, R. M., & Higgins, J. P. (2008). Meta-regression in Stata. Meta, 8 (4), 493–519.

Hartung, J., Knapp, G., & Sinha, B. K. (2011). Statistical meta-analysis with applications (Vol. 738). Hoboken: Wiley.

Higgins, J. P. T., Thompson, S. G., Deeks, J. J., & Altman, D. G. (2003). Measuring inconsistency in meta-analyses. BMJ [British Medical Journal], 327 (7414), 557–560.

Homburg, C., Koschate, N., & Hoyer, W. D. (2005). Do satisfied customers really pay more? A study of the relationship between customer satisfaction and willingness to pay. Journal of Marketing, 69 (2), 84–96.

Homburg, C., Allmann, J., & Klarmann, M. (2014). Internal and external price search in industrial buying: the moderating role of customer satisfaction. Journal of Business Research, 67 (8), 1581–1588.

Hurley, R. F., & Estelami, H. (1998). Alternative indexes for monitoring customer perceptions for services quality: a comparative evaluation in retailing. Journal of the Academy of Marketing Science, 26 (3), 209–221.

Jacobson, R., & Mizik, N. (2009). Rejoinder—customer satisfaction-based mispricing: issues and misconceptions. Marketing Science, 28 (5), 836–845.

Jak, S. (2015). Meta-analytic structural equation modelling . New York City: Springer.

Johnson, M. S., Garbarino, E., & Sivadas, E. (2006). Influences of customer differences of loyalty, perceived risk and category experience on customer satisfaction ratings. International Journal of Market Research, 48 (5), 601–622.

Jones, M. A., & Suh, J. (2000). Transaction-specific satisfaction and overall satisfaction: an empirical analysis. Journal of Services Marketing, 14 (2), 147–159.

Keiningham, T. L., Aksoy, L., Cooil, B., Andreassen, T. W., & Williams, L. (2008). A holistic examination of net promoter. Journal of Database Marketing & Customer Strategy Management, 15 (2), 79–90.

Koschat, M. A. (2008). Store inventory can affect demand: empirical evidence from magazine retailing. Journal of Retailing, 84 (2), 165–179.

Kumar, V. (2016). Introduction: is customer satisfaction (ir) relevant as a metric? Journal of Marketing, 80 (5), 108–109.

Lehmann, D. R., & Reibstein, D. J. (2006). Marketing metrics and financial performance . Cambridge: Marketing Science Institute.

Loo, R. (2002). A caveat on using single-item versus multiple-item scales. Journal of Managerial Psychology, 17 (1), 68–75.

Luo, X., & Homburg, C. (2007). Neglected outcomes of customer satisfaction. Journal of Marketing, 71 (2), 133–149.

Luo, X., & Homburg, C. (2008). Satisfaction, complaint, and the stock market gap. Journal of Marketing, 72 (4), 29–43.

Luo, X., Homburg, C., & Wieseke, J. (2010). Customer satisfaction, analyst stock recommendations, and firm value. Journal of Marketing Research, 47 (6), 1041–1058.

Luo, X., Wieseke, J., & Homburg, C. (2012). Incentivizing CEOs to build customer-and employee-firm relations for higher customer satisfaction and firm value. Journal of the Academy of Marketing Science, 40 (6), 745–758.

Maiga, A. S., Nilsson, A., & Jacobs, F. A. (2013). Extent of managerial IT use, learning routines, and firm performance: a structural equation modeling of their relationship. International Journal of Accounting Information Systems, 14 (4), 297–320.

McGraw, K. O., & Wong, S. P. (1992). A common language effect size statistic. Psychological Bulletin, 111 (2), 361–365.

Mittal, V., & Kamakura, W. A. (2001). Satisfaction, repurchase intent, and repurchase behavior: investigating the moderating effect of customer characteristics. Journal of Marketing Research, 38 (1), 131–142.

Mittal, V., Kamakura, W. A., & Govind, R. (2004). Geographic patterns in customer service and satisfaction: an empirical investigation. Journal of Marketing, 68 (3), 48–62.

Morgan, N. A., & Rego, L. L. (2006). The value of different customer and loyalty metrics in predicting business performance. Marketing Science, 25 (5), 426–439.

Oliver, R. L. (2010). Satisfaction: A behavioral perspective on the consumer (2nd ed.). London: ME Sharp Incorporated.

Palmatier, R. W., Dant, R. P., Grewal, D., & Evans, K. R. (2006). Factors influencing the effectiveness of relationship marketing: a meta-analysis. Journal of Marketing, 70 (4), 136–153.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49 (4), 41–50.

Rego, L. L., Morgan, N. A., & Fornell, C. (2013). Reexamining the market share–customer satisfaction relationship. Journal of Marketing, 77 (5), 1–20.

Reichheld, F. F., & Sasser, W. E., Jr. (1990). Zero defections: quality comes to services. Harvard Business Review, 68 (5), 105–111.

Robinson, W. T. (1988). Sources of market pioneer advantages: the case of industrial goods industries. Journal of Marketing Research, 25 (1), 87–94.

Romano, J. L., & Kromrey, J. D. (2009). What are the consequences if the assumption of independent observations is violated in reliability generalization meta-analysis studies? Educational and Psychological Measurement, 69 (3), 404–428.

Rothstein, H. R., & Hopewell, S. (2009). Grey literature. In H. Cooper, L. Hedges, & J. Valentine (Eds.), The handbook of research synthesis and meta-analysis (pp. 103–125). New York: Russell Sage Foundation.

Röver, C., Knapp, G., & Friede, T. (2015). Hartung-Knapp-Sidik-Jonkman approach and its modification for random-effects meta-analysis with few studies. BMC Medical Research Methodology, 15 (1), 99–105.

Rubera, G., & Kirca, A. H. (2017). You gotta serve somebody: the effects of firm innovation on customer satisfaction and firm value. Journal of the Academy of Marketing Science, 45 (5), 741–761.

Ruef, M., & Scott, W. R. (1998). A multidimensional model of organizational legitimacy: hospital survival in changing institutional environments. Administrative Science Quarterly, 43 (4), 877–904.

Rust, R. T., & Zahorik, A. J. (1993). Customer satisfaction, customer retention and market share. Journal of Retailing, 69 (2), 193–215.

Schmidt, F. L., & Hunter, J. E. (2015). Methods of meta-analysis: correcting error and bias in research findings (3rd ed.). Los Angeles: Sage Publications.

Shackman, G. (2001). Sample size and design effect. Albany Chapter of American Statistical Association , http://faculty.smu.edu/slstokes/stat6380/deff%20doc.pdf . Accessed August 2017.

Singh, J., & Sirdeshmukh, D. (2000). Agency and trust mechanisms in consumer satisfaction and loyalty judgments. Journal of the Academy of Marketing Science, 28 (1), 150–167.

Slater, S. F., & Narver, J. C. (1994). Does competitive environment moderate the market orientation-performance relationship? The Journal of Marketing, 58 (1), 46–55.

Song, R., Jang, S., & Cai, G. G. (2016). Does advertising indicate product quality? Evidence from prelaunch and postlaunch advertising in the movie industry. Marketing Letters, 27 (4), 791–804.

Sorescu, A., & Sorescu, S. M. (2016). Customer satisfaction and long-term stock returns. Journal of Marketing, 80 (5), 110–115.

Sridhar, S., Narayanan, S., & Srinivasan, R. (2014). Dynamic relationships among R&D, advertising, inventory and firm performance. Journal of the Academy of Marketing Science, 42 (3), 277–290.

Swaminathan, V., Groening, C., Mittal, V., & Thomaz, F. (2014). How achieving the dual goal of customer satisfaction and efficiency in mergers affects a firm’s long-term financial performance. Journal of Service Research, 17 (2), 182–194.

Szymanski, D. M., & Henard, D. H. (2001). Customer satisfaction: a meta-analysis of the empirical evidence. Journal of the Academy of Marketing Science, 29 (1), 16–35.

Szymanski, D. M., Bharadwaj, S. G., & Varadarajan, R. (1993). An analysis of the market share-profitability relationship. Journal of Marketing, 57 (3), 1–18.

Szymanski, D. M., Kroff, M., & Troy, L. C. (2007). Innovativeness and new product success: insights from the cumulative evidence. Journal of the Academy of Marketing Science, 35 (1), 35–52.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18 (7), 509–533.

Tellis, G. J. (1988). The price elasticity of selective demand: a meta-analysis of econometric models of sales. Journal of Marketing Research, 25 (4), 331–341.

Terpstra, M., & Verbeeten, F. H. (2014). Customer satisfaction: cost driver or value driver? Empirical evidence from the financial services industry. European Management Journal, 32 (3), 499–508.

Thursyanthy, V., & Tharanikaran, V. (2017). Antecedents and outcomes of customer satisfaction: a comprehensive review. International Journal of Business and Management, 12 (4), 144–156.

Van Doorn, J., & Verhoef, P. (2008). Critical incidents and the impact of satisfaction on customer share. Journal of Marketing, 72 (4), 123–142.

Verhoef, P. C., Kannan, P. K., & Inman, J. J. (2015). From multi-channel retailing to omni-channel retailing: introduction to the special issue on multi-channel retailing. Journal of Retailing, 91 (2), 174–181.