Peloton Changed the Exercise Game. Can the Company Push Through the Pain?

Few companies create an entirely new consumer market and reach icon status—and then set out to reinvent themselves. But that’s the hill the at-home, interactive-exercise firm Peloton is now climbing.

Peloton was one of the freewheeling successes of the first year of the COVID-19 pandemic. When the world went into lockdown, droves of people who couldn’t go to a health club turned their homes into one with Peloton’s pricey bikes and treadmills. Exercise enthusiasts used them with a devotion that earned them the nickname “Pelo-people.”

But the company struggled to keep up with the intense demand, which led to shipment delays, followed by pricing confusion and a series of public relations bungles—just as the pandemic eased and people began returning to gyms. Peloton scrambled by recalling items and dropping prices, amid an onslaught of competition from copycats.

“You’ve got a nice, clean product line. Everybody can understand it,” says Harvard Business School Professor Robert J. Dolan. “Then it got incredibly complicated.”

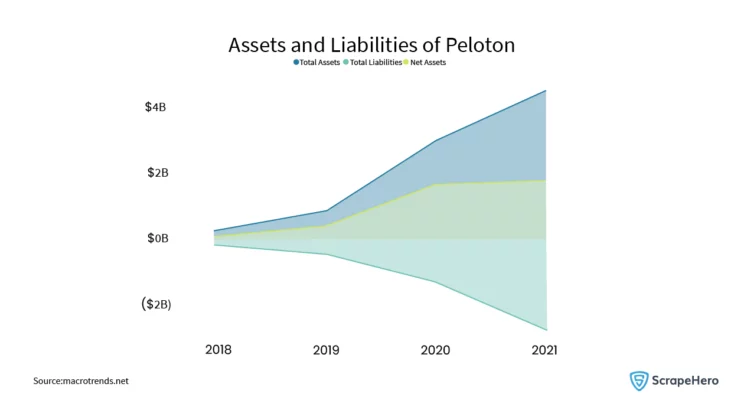

In May, Peloton reported its biggest quarterly loss since its 2019 initial public offering and said it borrowed $750 million to help its cash flow.

Dolan, HBS’s Baker Foundation Professor, examines what business leaders can learn from Peloton’s journey in his case study, Peloton Interactive, Inc.: Creating the Immersive Connected-Fitness Category . The main takeaway: The company could have avoided some of its problems had it kept things simple.

‘Things were going through the roof’

John Foley founded Peloton in 2012 partly to solve a challenge in his own life. He and his wife fed on the energy of high-end boutique fitness classes, but they had demanding jobs and young children, so fitting in workouts when and where they were offered wasn’t working.

“These classes left us energized, refreshed, stronger, and ready to take on anything,” Foley explained in Peloton’s 2019 registration filing with the Securities and Exchange Commission. But “we were often left without time, without options, and without the feeling of ‘being our better selves’ that we sought.”

“I figured there must be a way to make these workouts more convenient, more affordable, and more accessible. And my hunch was that if I could make it possible, others would want it as well,” he said at the time.

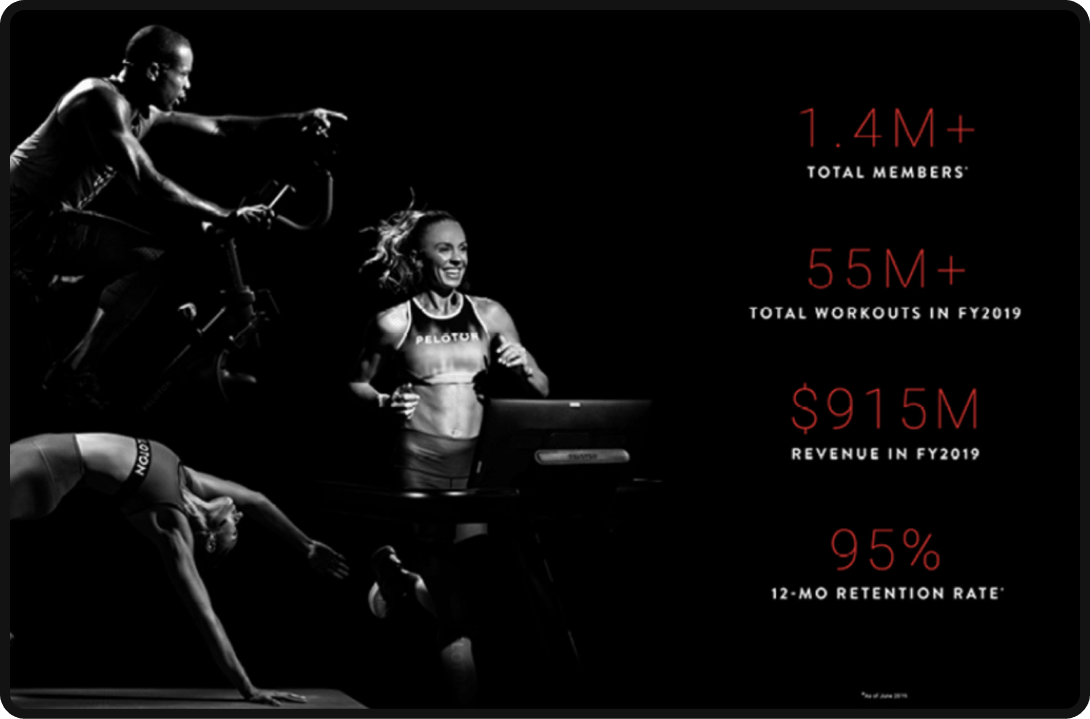

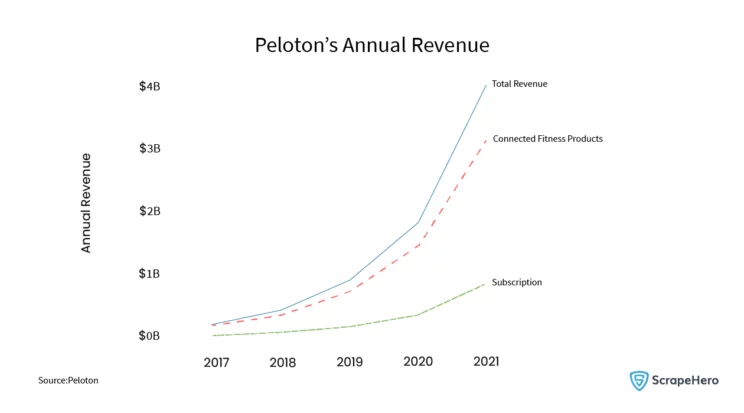

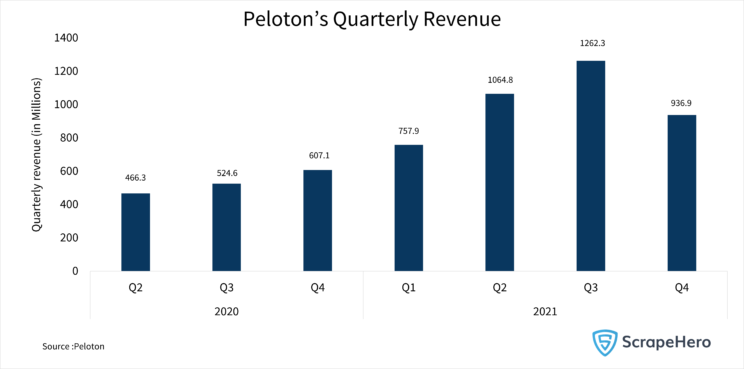

Foley’s hunch paid off: Customers flocked to his $2,245 stationary bikes and $4,295 treadmills, both of which had touchscreens for Peloton-produced digital workout videos featuring glamorous trainers with loyal followings. Growth was brisk: Revenue in 2019 was some $915 million, doubling that of 2018.

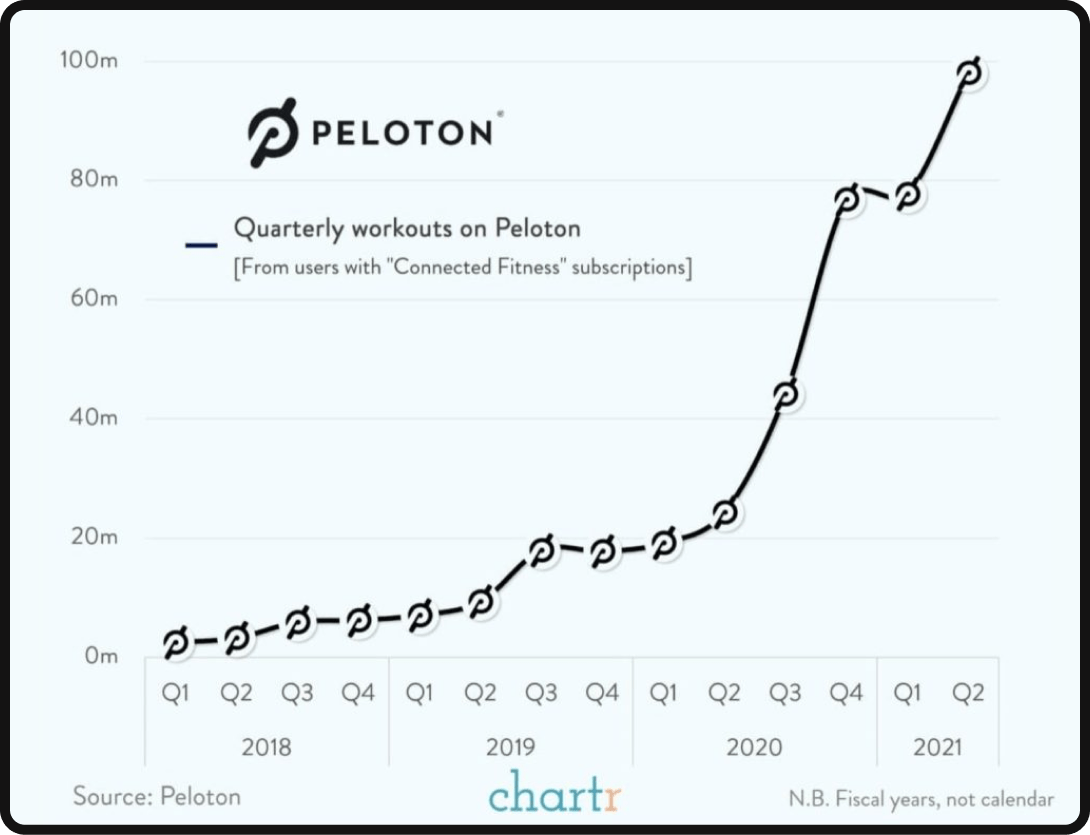

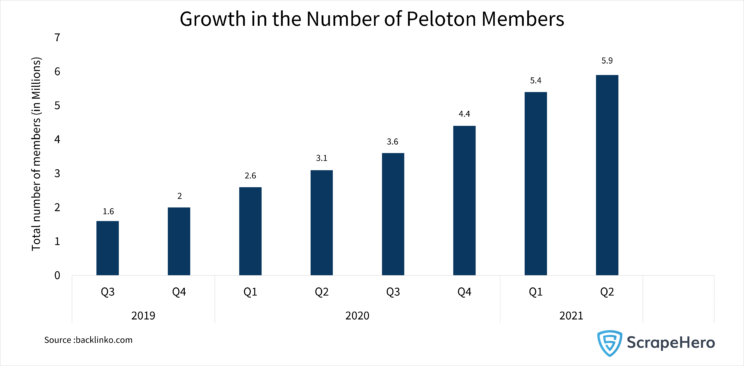

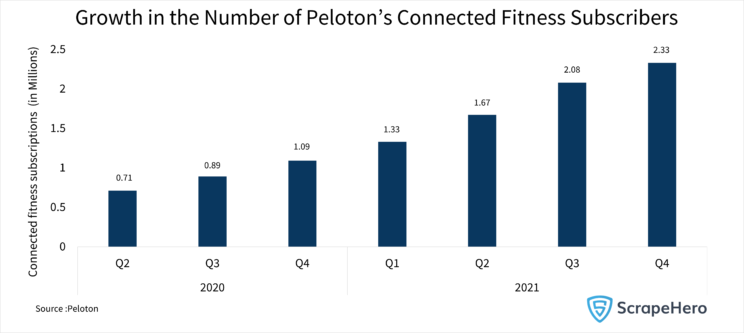

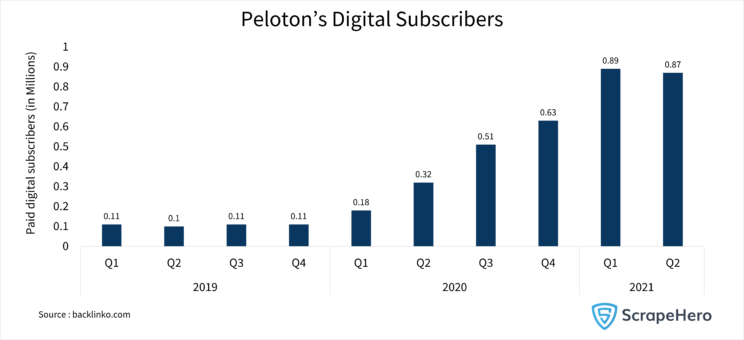

The pandemic provided the perfect setting for expansion, as holdouts who remained committed to in-person classes could no longer head to gyms and fitness studios. At the end of June 2020, Peloton had 1.09 million subscribers, 113 percent over the previous year, with people paying $39 a month for the videos they could watch on their bike and treadmill screens.

“Things were going through the roof,” Dolan says. “Then they hit a lot of bumps.”

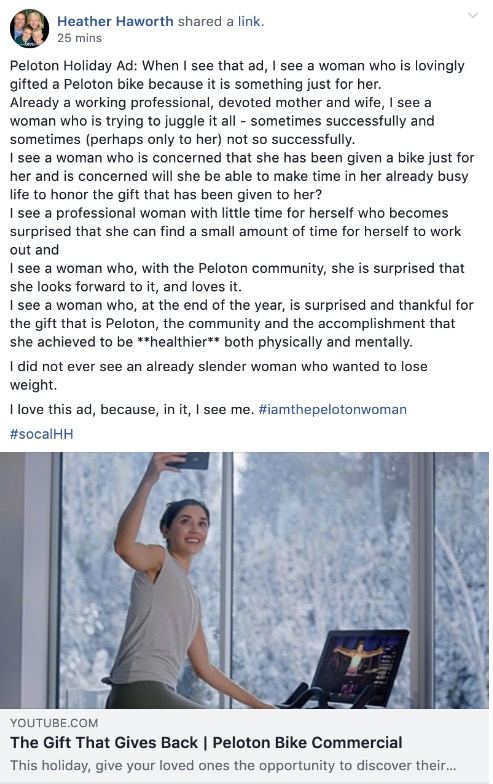

Backlash from a holiday 2019 ad foreshadowed problems to come. In the ad, a fictional husband gifts his wife a Peloton, and the wife documents her yearlong use of the bike, leading some to suggest that she craved her husband’s approval. Critics in a New York Times article called the ad “sexist and dystopian,” and T he Atlantic published a piece with the headline: “Peloton Doesn’t Understand the People Who Love It Most.”

‘A pretty hard fall’

By early 2021, equipment shipments were delayed, as Peloton’s manufacturer struggled to keep pace with demand. A child died in a treadmill accident, and dozens of other people were injured. That prompted a product recall.

The company was in the midst of a complicated product line expansion to offer two bikes and treadmills at different prices in an attempt to reach people who were turned off by the original products’ cost. In August 2021, the company dropped the original bike’s price to $1,495; the treadmill that was still on the market cost $2,495, with a similar name but not the higher price of its recalled sister product. Longtime users and potential new customers alike were confused.

Then, a main character in HBO’s Sex and the City reboot died in an episode that showed him working out on a Peloton bike. The plot twist seemed like a metaphor for the brand’s troubles.

“They did this very complicated product line extension,” Dolan says. “Foley pioneered the interactive-exercise market, and [people] give him credit for that. Innovation is great, but if you haven’t figured out a renovation strategy [for the long term], you can drive yourself into a ditch.”

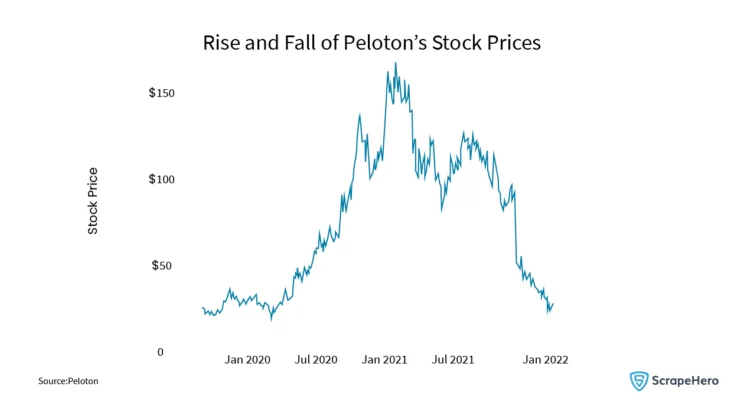

Peloton’s valuation and stock price reflected the depth of that hole: The company was worth $3.3 billion as of June 21, a fraction of its almost $50 billion market cap in January 2021. Its shares now trade for less than $10 a share, down from an intraday high of $170 in December 2020. “That’s obviously a pretty hard fall,” Dolan says.

Meanwhile, Peloton attracted a flock of competitors: NordicTrack and Bowflex, established home equipment providers, along with SoulCycle and Exxentric’s Flywheel, began marketing their own interactive workouts.

Dolan says Peloton also hurt itself by offering its whole archive of videos to non-Peloton customers for $13 a month. Bowflex encouraged people to pair its bike with Peloton videos—creating a Peloton-like experience at a much lower cost, “so Peloton created a gateway [for a rival],” says Dolan.

Still a viable business

Even so, Dolan says Peloton retains a number of advantages. “They still have an incredible user base,” he says, with 3 million subscribers—four times the number in 2019, despite the problems of 2021.

The monthly customer churn rate of lost customers is less than 1 percent, and the videos the company produces are more popular than ever: They now generate 33 percent of Peloton’s total revenue, up from 20 percent in 2020. And Peloton still has 75 stores in the US and two studios for video production.

“The large subscriber base and devotion of many make it a viable business, but with significant management challenges,” Dolan says.

The next year or two may be telling. Amid questions about whether Foley might sell to Amazon or another mega-company, in February Peloton brought in Barry McCarthy, former CFO at Netflix and Spotify, to serve as CEO to revive the company’s pre-pandemic focus. Foley is staying on as executive chairman and retains 80 percent of the voting power.

The company has cut 20 percent of its workforce and will raise the subscription for Peloton users to $44 a month, the first increase since Peloton launched. The non-Peloton price for access to videos will remain at $13.

“They’re trying to get their costs down, trying to build their base,” Dolan says. “I don’t know if they’ve figured out where they want to make their money, from hardware or software. Given McCarthy’s experience with Spotify and Netflix, McCarthy appears to be saying, ‘We’re a subscription company.’”

Will inflation change the game?

But Dolan says that can be “an enormous risk.” As US inflation remains high, “everybody is thinking, are there discretionary expenses we can get rid of? Can I trade down my Peloton subscription?”

Since the subscription increase began June 1, “Three million subscribers are wondering, what is he [McCarthy] going to do?” Dolan says. “I’m not sure he’s got a lot of levers to pull.”

Despite the risk, Dolan believes Peloton does appear to have a future.

“It’s not like they’re a high-tech company, wondering if a drug will get FDA approval,” Dolan says. “No surprises are coming down the pike. The game is pretty well staked out. So we’ll see.”

You Might Also Like:

- Free Isn’t Always Better: How Slack Holds Its Own Against Microsoft Teams

- Apple vs. Feds: Is iPhone Privacy a Basic Human Right?

- Cruising in Crisis: How Carnival Is Riding Out the COVID-19 Storm

Related reading from the Working Knowledge Archives

Winners and Losers at the Olympics

Feedback or ideas to share? Email the Working Knowledge team at [email protected] .

Image: iStockphoto/hapabapa

- 25 Jun 2024

- Research & Ideas

Rapport: The Hidden Advantage That Women Managers Bring to Teams

- 11 Jun 2024

- In Practice

The Harvard Business School Faculty Summer Reader 2024

How transparency sped innovation in a $13 billion wireless sector.

- 24 Jan 2024

Why Boeing’s Problems with the 737 MAX Began More Than 25 Years Ago

- 27 Jun 2016

These Management Practices, Like Certain Technologies, Boost Company Performance

- Product Positioning

- Media and Broadcasting

Sign up for our weekly newsletter

The rise and fall of Peloton, from pandemic-era success story to its stock hitting a record low

- Peloton was a Wall Street darling during the pandemic, with a market cap of around $50 billion.

- Now, its CEO is out after two years, it announced more layoffs, and its stock hit a record low.

- Here is the history of Peloton's impressive rise and fall in recent years.

At the height of the pandemic, Peloton was on top of the world.

Its stock pushed $171 per share and its market cap hovered around $50 billion.

On Thursday, the company announced its CEO was out and its stock was trading below $3 — a record low.

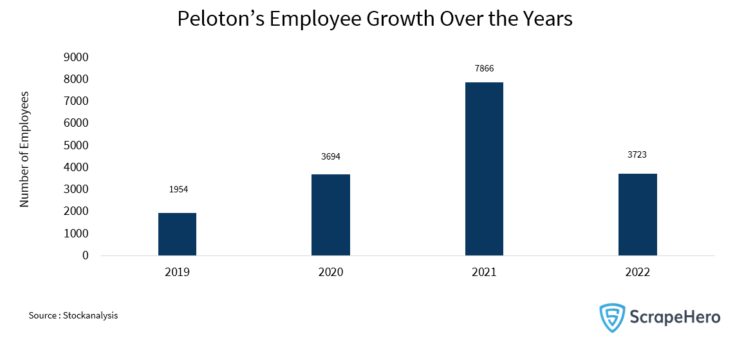

The company has struggled since the pandemic boom and falling demand for its products. In 2022, the company laid off more than 5,000 staff members, saw four top executives depart, and reportedly considered a potential sale to the likes of Amazon, Apple, or Nike. The company has also seen mass layoffs and recalled millions of bikes .

It's a stunning reversal for a company once at the top of the connected-fitness food chain, and it's the result of a culmination of factors, including the fading popularity of at-home fitness and a mishandled logistics operation.

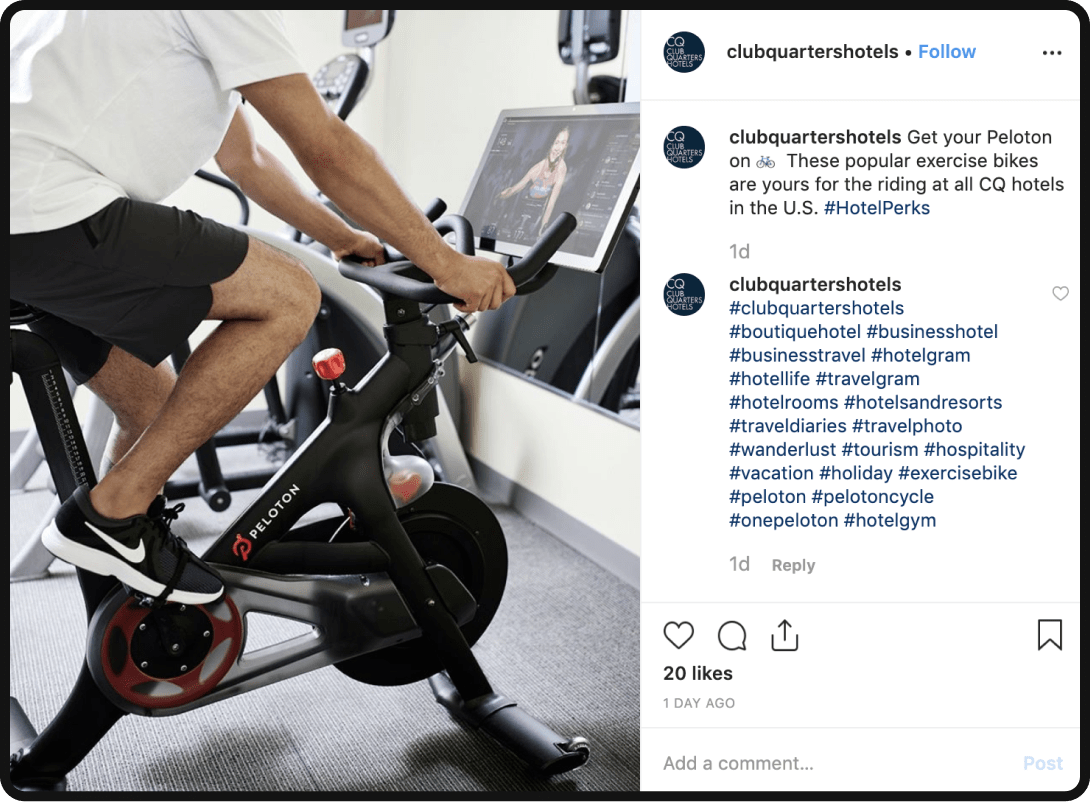

Now, to re-energize its business, the company is focused on pushing beyond the at-home fitness market. It is incentivizing businesses to offer Peloton as a workplace benefit and adding Peloton equipment to local gyms, apartments, and hotels, Bloomberg reported.

Here's how Peloton got its start and became a fitness world darling, and just as quickly saw its decline.

Peloton was founded in 2012 by a group of ex-IAC employees

John Foley, Hisao Kushi, Tom Cortese, and Graham Stanton — four of Peloton's five cofounders — met working at media and internet company IAC. The fifth cofounder, Yony Feng, met the group through his roommate who worked at IAC.

Foley has said that the vision for the company was his, but that his four cofounders "took it, ran with it, and built it while I was gone" raising money, he told Fortune in 2021.

Prior to founding Peloton, Foley was president at Barnes & Noble, overseeing its e-commerce business.

The early version of its bike was 'janky,' and it struggled to find investors

Foley is a self-professed "boutique fitness addict," as well as an avid cyclist. But the early versions of the Peloton bike didn't look like something you'd find in a high-end fitness studio, the company's first instructor, Jenn Sherman, told Fortune.

"They had this little tiny corner of the office that was sectioned off by black velvet curtains. There was a camera on a tripod sticking through a circle people literally cut out of the curtain. There was a janky, broken bike in there — the instructor bike was like this rusted piece of crap. It was ridiculous," she said.

Still, Sherman signed on. Meanwhile, Foley was on the road for the first three years, pitching what he told Business Insider in 2018 was as many as 400 investors.

"I got 400 'nos,'" he said at the time. "The worst part is that we're not talking about 400 individual pitches. A lot of people would want me to come back four or five times and have me meet more partners and pitch again. I would say that I've been turned down maybe five or six thousand times."

Still, the company scraped together funding from more than 200 angel investors and put its first bike on Kickstarter in 2013 for an "early bird" price of $1,500.

Peloton quickly developed a cult following

Peloton began shipping bikes in 2014 , with Foley and the other cofounders showing off how they worked at pop-up stores inside shopping centers.

But it didn't take long for the company to develop a cult following, thanks in large part to its roster of high-wattage instructors. When the company opened its own studio in New York City, owners of the company's $2,000 bike would make a pilgrimage to Manhattan in order to take a live class with their favorite instructor.

Eventually, big-name investors came calling. "I would say that it took about five years for the really smart money to start getting involved," Foley told BI in 2018. "When Mary Meeker is calling you to say, 'Hey, I want to invest' — that's pretty cool."

That year, Peloton raised $550 million in venture capital funding at a valuation of $4.1 billion, according to Pitchbook.

Peloton expanded its offerings as spinning faded in popularity

Peloton introduced its second product, a $4,000 treadmill called the Peloton Tread, in 2018, and added new types of classes, like high-intensity interval training and yoga, to keep users engaged or get new customers to sign onto a digital subscription, no equipment required.

By 2019, the company had sold 577,000 bikes and treadmills .

In August of that year, Peloton filed for an initial public offering , revealing it had over 500,000 paying subscribers, but also spiraling losses from major investments in marketing and licensing music for its classes.

Related stories

Peloton went public on September 26, 2019 in what was at the time the third-worst trading debut for a major IPO since the financial crisis.

Peloton's stock plummeted following its 2019 holiday ad

Ahead of the holidays in 2019, Peloton made what was seen as a major public misstep with its infamous "Peloton wife" ad.

The ad, featuring a woman whose husband gifts her a Peloton bike for Christmas, was viewed as being sexist and playing into outdated standards of beauty . Public outrage over the ad sent Peloton's stock plunging 9% , wiping out $942 million in market value in a single day.

But Peloton stood by the commercial, issuing a statement saying it was "disappointed" by how people had "misinterpreted" the ad.

The pandemic became a major boon for Peloton's business

Then, in early 2020, the pandemic hit. Suddenly stuck inside, people turned to at-home fitness and found connection in Peloton's streamed workout classes. The company's share price took off.

By May 2020, Peloton reported a 66% increase in sales and a 94% increase in subscribers. In September of that year, Peloton said that it had had its first profitable quarter , with sales spiking 172% since the same quarter the year prior and revenue rising to $607 million.

But the unexpected uptick in demand showed the cracks in Peloton's logistics operation. Delivery times for new equipment became longer and longer, and Peloton's typically diehard fans began expressing their frustration online .

Then, some customers began experiencing issues with their bikes where pedals snapped off mid-ride . The company took weeks or months to make repairs, further frustrating users. After 120 reports of bikes breaking and 16 reports of customers getting injured, the company issued a recall affecting 30,000 bikes .

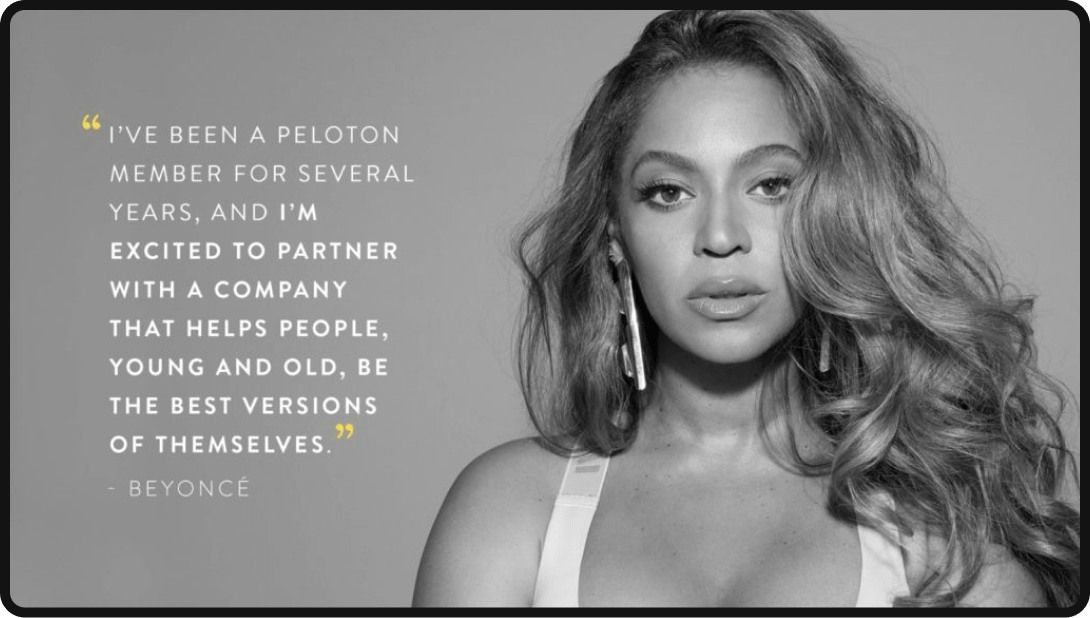

Still, 2020 was all around a stellar year for Peloton that included debuting new, higher-end versions of the bike and treadmill and inking a multi-year deal with Beyoncé. A year after the "Peloton wife" ad, the company's market value had hit $34 billion .

In early 2021, Peloton reported its first-ever billion-dollar quarter , driven by holiday sales and sustained demand for at-home fitness as the pandemic raged on. Foley pledged to manufacture "tens of millions" of treadmills and bikes to keep up with surging sales and spend $100 million to speed up deliveries hampered by port congestion.

Peloton had to issue a treadmill recall following a child's death

But in March 2021, tragedy struck when a child was fatally injured in an accident with a Peloton treadmill. Shares dipped 4% following the news and regulators urged a recall .

Foley initially pushed back, calling the warnings "inaccurate and misleading," but by that May, the company announced a recall of the higher-end Tread+.

In an effort to make the treadmill safer, Peloton also made a change that resulted in it becoming unusable unless users paid $39 per month. Following customer outrage, the company said it would work on a fix.

As the pandemic began to recede, so did Peloton's popularity

As the nation continued to move toward reopening — and returning to the gym and fitness studios — Peloton's business took a punch. The company's stock dropped 34% following its fiscal first-quarter earnings in November, which included a dismal outlook for the months ahead.

"It is clear that we underestimated the reopening impact on our company and the overall industry," Foley said in a call with shareholders.

Peloton was also being chased by rivals like Echelon and iFit Health, which offer similar, cheaper products. Peloton filed a lawsuit against them in November 2021, accusing them of patent infringement.

In the meantime, Peloton had been taking reputational hits. A hiring freeze set in, and Black employees voiced concerns over their pay compared with the industry standard. A character in the "Sex and the City" reboot died after using his bike, and then the same thing happened to a "Billions"character soon after. And in December, Foley threw a lavish holiday party as the company's stock tanked.

By January 2022, the company was discussing layoffs , reportedly pausing production of new equipment, and halting plans to open a new $400 million factory . Employees told BI the company's warehouses were filled with excess bikes .

Peloton began laying off employees, replaced Foley, and eyed a potential acquisition

In February 2022, The Wall Street Journal reported that Amazon was eyeing Peloton as a potential acquisition — soon after, the Financial Times reported that Nike was considering the same. Wall Street analysts posited that Apple would be another natural fit as the new owner of Peloton.

Days later, Foley announced that he would step down as Peloton's CEO and that the company was slashing 2,800 jobs, about 20% of its workforce. The company said that the fired employees would receive a free year's subscription to the platform, along with a "meaningful cash severance allotment" and other benefits. Its roster of instructors would not be impacted by the layoffs.

During a conference call following the company's second-quarter earnings, Foley said he took responsibility for what happened at Peloton.

"We've made missteps along the way. To meet market demand, we scaled our operations too rapidly. And we overinvested in certain areas of our business," he said.

"We own this. I own this. And we're holding ourselves accountable," he added.

Experts told BI that the company fell prey to the "bullwhip effect," spending big on logistics while expecting that demand would remain high — when demand cooled, Peloton was left with costly supply chain operations that now require a major overhaul.

Barry McCarthy , the former chief financial officer of Spotify and Netflix, replaced Foley as CEO. In a leaked memo to employees , McCarthy called the layoffs "a bitter pill" but said that the company needed to accept "the world as it is, not as we want it to be if we're going to be successful."

"Now that the reset button has been pushed, the challenge ahead of us is this…… do we squander the opportunity in front of us or do we engineer the great comeback story of the post-Covid era?" he wrote. "I'm here for the comeback story."

Foley severed his remaining ties to the company

July 2022 brought news of 570 additional job cuts , and that August, the company announced yet another round of layoffs , slashing roughly 800 customer-service and distribution team members — and raising prices on some equipment.

In September of that year, Foley stepped down as executive chairman. Cofounder and Chief Legal Officer Hisao Kushi and Chief Commercial Officer Kevin Cornils also left the company.

In a statement, Foley said: "Now it is time for me to start a new professional chapter. I have passion for building companies and creating great teams, and I am excited to do that again in a new space. I am leaving the company in good hands." Lead independent director Karen Boone took over as chair.

Then came the departure of another top executive: The New York Times' DealBook newsletter reported that Chief Marketing Officer Dara Treseder would exit the company that October. Treseder was instrumental in helping Peloton double its membership, which numbered more than 6.9 million at the time, a company spokesperson told DealBook.

Peloton made another round of cuts in October 2022, but McCarthy said he's 'optimistic about our future'

McCarthy told The Wall Street Journal in October 2022 that the company would cut an additional 500 employees , many of whom work on the marketing team, in an effort to cut costs.

The report revealed that Peloton had eliminated more jobs than was previously known. About 600 additional employees had left the company since June through factors like retail store closings and attrition. That brought Peloton's total cuts for the year to over 5,200.

The Journal also reported that McCarthy said the company had only six months to turn things around, which McCarthy later denied in a memo to employees published by Bloomberg. McCarthy said his comments were taken out of context and that he's never felt more optimistic about the company's future.

"There is no ticking clock on our performance and even if there was, the business is performing well and making steady progress toward our year-end goal of break-even cash flow," he said.

Peloton has indeed made several changes since last summer that could help re-energize sales: it launched its long-awaited rowing machine , started selling its gear on Amazon , and inked new deals with Dick's Sporting Goods and Hilton in hopes of attracting new customers.

But 2023 was rough for the company

Peloton's 2023 wasn't a great cause for optimism so far, though.

That May, Peloton reported a wider-than-expected loss of 79 cents per share for the most recent quarter, and it projected its first-ever decline in subscribers.

And in a shareholder letter, McCarthy said the upcoming quarter "will be among our most challenging from a growth perspective."

And things got worse as the company had to issue a massive recall

The New York-based company announced in May 2023 that, in cooperation with the US Consumer Product Safety Commission, it was doing a voluntary recall of the Peloton original Bike sold from January 2018 to May 2023 in the US for about $1,400 . Per the company, "the seat post can break unexpectedly during use, creating a potential fall and injury risk." Peloton said that as of April 30, 2023, it had identified 35 reports of seat posts breaking, out of more than 2.1 million units sold.

According to the US Consumer Product and Safety Commission, there were more than a dozen reports of injuries – including a fractured wrist, lacerations, and bruises – caused by seat posts suddenly breaking.

The recall does not impact Peloton Bike+ members nor Peloton original Bike owners in the UK, Germany, and Australia, according to the company.

Peloton now wants to be a workplace benefit for employees

Peloton is working to expand its reach beyond the at-home fitness market. The company is focused on building partnerships with businesses, including hotels, apartments, gyms, as well as education and healthcare facilities, to offer its services and equipment, Bloomberg reported.

Employees at participating businesses will receive discounts on Peloton equipment and free use of the Peloton app, which typically costs customers $24 per month and doesn't need to be used with Peloton equipment.

Peloton's next hurdle is another CEO departure and more layoffs

Peloton announced in May 2024 that CEO Barry McCarthy would be stepping down and that it's laying off around 400 workers, or roughly 15% of its total workforce.

The layoffs are part of restructuring efforts to reduce yearly expenses by more than $200 million by the end of the 2025 fiscal year, the company said. As part of these efforts, the company will also be reducing its retail showroom footprint and rethinking its international approach.

Karen Boone, the chair of Peloton's board, and Chris Bruzzo, one of its directors, will serve as interim co-CEOs. The board has already begun looking for its next CEO, the company says.

Peloton's stock was trading below $3 — a record low — following the news.

Watch: What happens when Elon Musk moves markets with a tweet

- Main content

The Peloton Breakdown: Causes, Consequences, and Bailouts

The interactive fitness company Peloton has been recently caught in the midst of turmoil amid investors’ accusations of gross mismanagement. The claims being made focus on poor decision-making by top executives, along with the lack of a clear long-term strategy for the company’s growth and abysmal returns for Peloton’s shareholders. Peloton, on its side, tried to discard allegations of mismanagement and attributed the dissatisfying financial performance to a seasonal downturn caused by an inversion of trend following the spike in sales driven by “stay-at-home” orders (issued worldwide during the earlier phases of the COVID-19 pandemic).

Despite Peloton’s efforts to ease pressures on its top executive, a hard-hearted presentation prepared by the privately held investment firm Blackwell Capital caused the ex-CEO John Foley – who is still keeping his hold on Peloton thanks to ownership of super-voting shares – to step down and be appointed as executive chair of the company. The issues raised by Blackwell followed worrisome data from the last quarterly reports indicating a declining financial performance (Peloton’s one-year stock price was down 85% since February 2021), coupled with a loss in “active users” among Peloton’s subscriber base. Consequently, Blackwell is currently pushing towards a strategic sale of the company to a potential new acquirer to solve its existing financial and managerial problems.

In the context of its presentation, Blackwell suggested several potential acquirers for Peloton, among which companies like Apple, Amazon, and Nike. None of such companies has approached Peloton for a potential acquisition, even though Amazon and Nike started exploring the possible scenarios involving a takeover. The Financial Times also reported considerations of people informed on the matter, deeming the decision to acquire Peloton as seemingly “opportunistic” due to the recent steep decline in the company’s market value. Indeed, interest in the company appears to be driven by Peloton stocks being currently undervalued. With that in mind, a Peloton deal could provide Nike and Amazon with appealing opportunities to strengthen their revenues and acquire a strategic workforce. Similarly, a Peloton takeover would prove to be for Amazon an effort to increase its business presence in the e-fitness industry.

Despite all the hype around a potential takeover, some practical obstacles remain. First, Peloton’s valuation is far from generating consensus. Blackwell evaluates Peloton’s share price at a minimum of $65 – a figure that does not correspond to the sentiment of the rest of the market. Second, former CEO Foley appears resistant to any sale, which may pose a significant threat to the possibility of getting a deal done (Foley remains executive chair of the company and owns super-voting shares which allow him to exercise control on the company).

However, let us not rush to conclusions. Peloton announced on February 8 a series of steps as part of a comprehensive program aiming to decrease costs and result in “long-term growth, profitability, and free cash flow,” suggesting that the company intends to recover on its own before considering an acquisition. The first step in this ultimate effort to avoid selling the company to the best offeror consisted of a major internal reorganization, initiated with the appointment of ex-Spotify-and-Netflix CFO Barry McCarthy as new CEO. “Peloton is at an important juncture, and we are taking decisive steps… This restructuring program is the result of diligent planning to address key areas of the business and realign our operations so that we can execute against our growth opportunity with efficiency and discipline,” said John Foley.

Amongst the restructuring measures announced, Peloton will suspend its plans to build its own manufacturing facilities in Ohio, which should result in $60 million in restructuring capital expenditures. The construction of Peloton Output Park was indeed expected to start in summer 2021 and had initially been scheduled to open in 2023 . This project would have cost an estimated $400 million. Instead, Peloton intends to minimize expenditures on in-house warehouses and delivery centers to rely mostly on third-party logistic providers. The other significant measure announced to place Peloton for sustainable growth will be job cuts of approximately 2,800 positions, the equivalent of 20% of the company’s workforce. The company said this will impact “ almost all operations across almost all levels “. When implemented, these restructuring initiatives are estimated to yield around $800 million in annual run-rate cost savings in 2022, along with a decrease in capital expenditures by approximately $150 million. If Peloton implements these changes correctly, it may be enough to keep the wheels spinning.

Peloton Marketing Strategy: Uncovering Key Lessons For Rapid Growth

- Growth Marketing

What does it mean to achieve exponential growth as a direct-to-consumer company? With the constantly rising cost of acquisition (CAC) and an ever-changing landscape for paid media, it’s becoming increasingly...

- Icon Facebook

- Icon Linkedin

What does it mean to achieve exponential growth as a direct-to-consumer company? With the constantly rising cost of acquisition (CAC) and an ever-changing landscape for paid media, it’s becoming increasingly difficult for brands to grow rapidly . Companies often think they can throw a few dollars into their Google Ads or Facebook account and then watch their sales skyrocket. While this may have been true a few years ago, it is no longer true. Proven growth tactics like the Peloton Marketing Strategy highlight the importance of staying informed about the latest marketing trends.

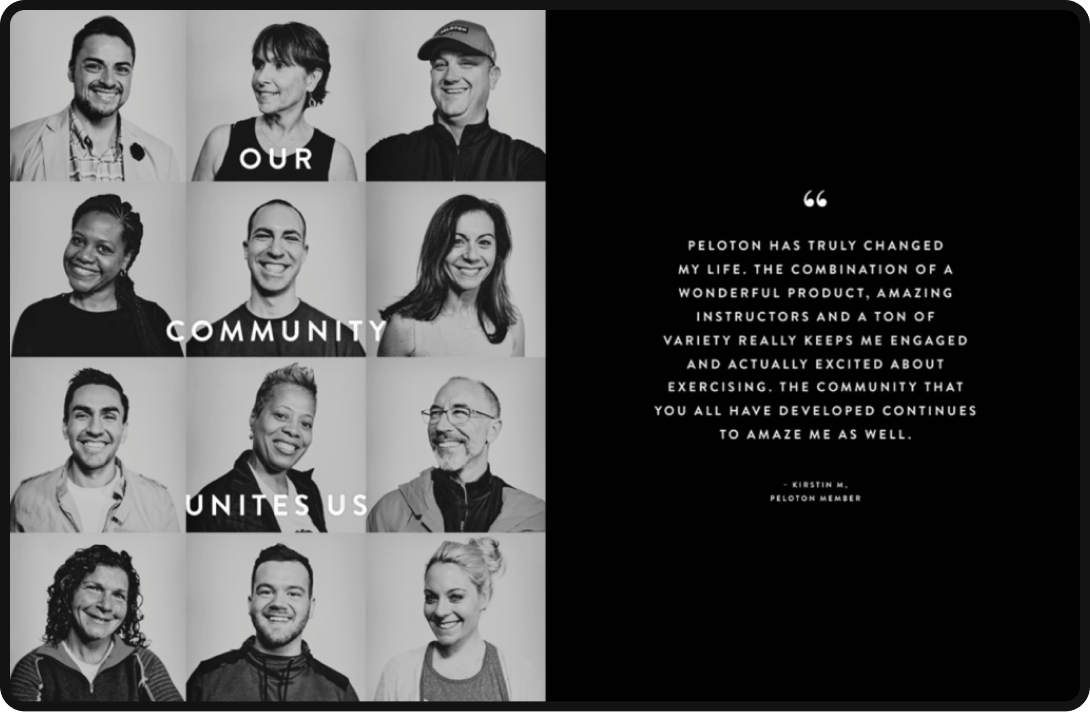

New and interesting tactics are becoming increasingly important to retain and engage potential customers, and that’s exactly how Peloton went from launch to a $3.9 billion valuation in less than 10 years and now boasts over half a million users. The Peloton Marketing Strategy puts community and content first, selling much more than just a bike. “Peloton sells happiness,” says co-founder and CEO John Foley.

And merriness sells at a luxury price point.

Peloton Marketing Strategy: Be Quick To Adapt

Focusing on the paradigm shift as the worlds of branding and performance marketing overlap , the Peloton Marketing Strategy understood how to ignite emotional responses among its user base. While FlyWheel and SoulCycle were busy luring customers to $34 classes at location-specific studios, Peloton saw the potential of the boutique fitness trend in New York and developed a new model. With the in-home bike, subscribers can achieve their fitness goals and become members of an engaged community without going anywhere. And their bikes are never soaked in other people’s sweat.

Hardware-plus-subscription business models have delivered some spectacular failures in recent years, Juicero being a prime example. So why has Peloton been successful? After a failed Kickstarter campaign caused them to rethink their actual offering, they quickly adapted to launch an entirely new category. The Peloton Marketing Strategy prioritized leveraging personalization, content, product development, and exceptional service to achieve an almost unheard-of 95% retention rate, which they call Connected Fitness Subscribers, while maintaining a monthly churn rate of 0.65%. To put that number in perspective: Netflix , a company we all know and love, has a retention rate of 93%, while Blue Apron, which showed early promise, now has a rate of just 13%.

Boost Retention With Community

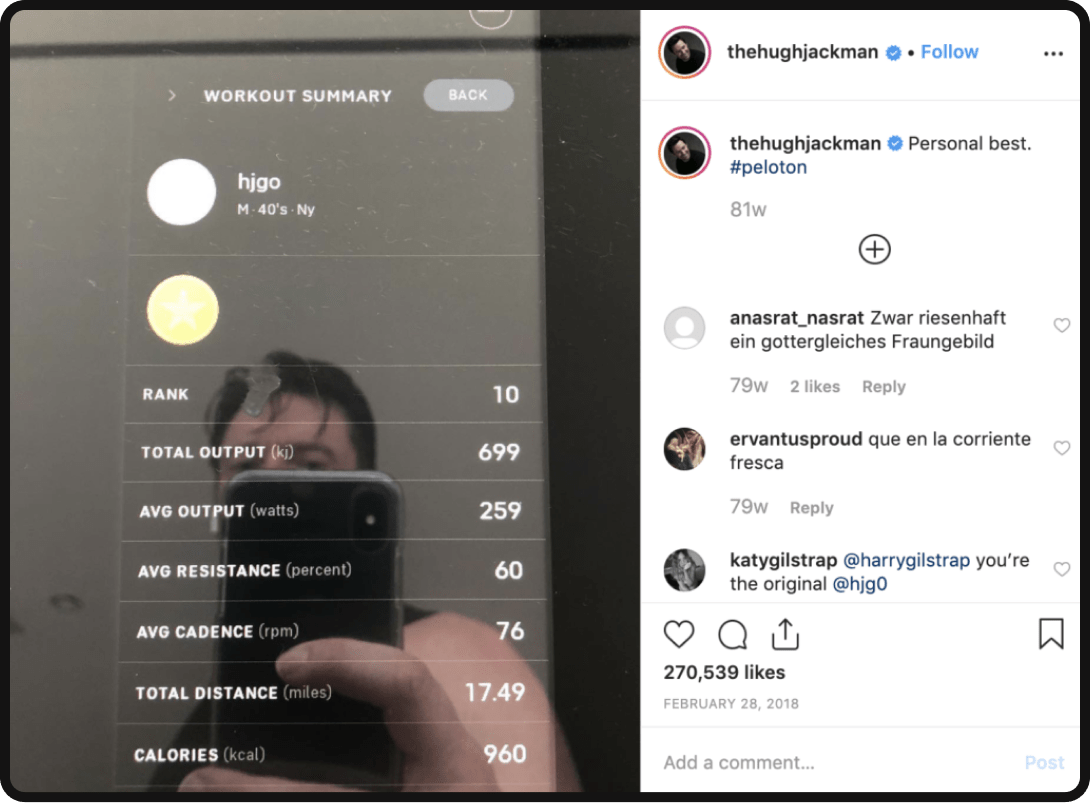

At-home cycling has been around forever (since 1796, to be exact), but Peloton has turned an activity you normally do in solitude into a community experience. Joining the community feels like a ritual. Users are asked to enter their complete bio: height, weight, gender, age, etc., and are invited to create a unique screen name (Hugh Jackman accidentally revealed his on Instagram recently).

During classes, instructors use the data to give riders “shoutouts” for milestone rides and birthdays during live classes triggering an emotional, rewarding response. The bikes track the riders’ performance and remember their preferences.

Peloton encourages engagement as users are invited to race against each other and track their progress live. There’s nothing more motivating than realizing you’re lagging behind 200 of your closest friends and neighbors. The ability to send high-fives is another example of the Peloton Marketing Strategy aiming to meet users’ expectations and surprise and delight them. By gamifying the exercise experience, Peloton has tapped into what keeps its users returning for more.

If playing the Peloton game isn’t for you, you can opt-out . Turn off the leaderboard, and it’s just you and the instructor. The Peloton Marketing Strategy understands the ability to choose is as important as the feature itself. Celebrities are fans in part because they can get a quality workout without the selfie requests they would get at a regular gym.

The more personal the service is, the more involved users get entrenched in the community, and the more involved they feel, the more they use the service. As we know, Peloton stands behind the statement that “increased usage equals increased loyalty,” backing the customer stickiness of the Peloton Marketing Strategy.

Peloton listens to its user base. After completing a workout, members are asked for an immediate review of the workout, and targeted recommendations are made to encourage the user to try additional classes. For example, after a 30-minute ride, recommendations are made for classes outside of cycling, such as yoga and meditation. The product feedback and interaction loops allow Peloton to make changes quickly and adapt to user suggestions in real-time while keeping users engaged.

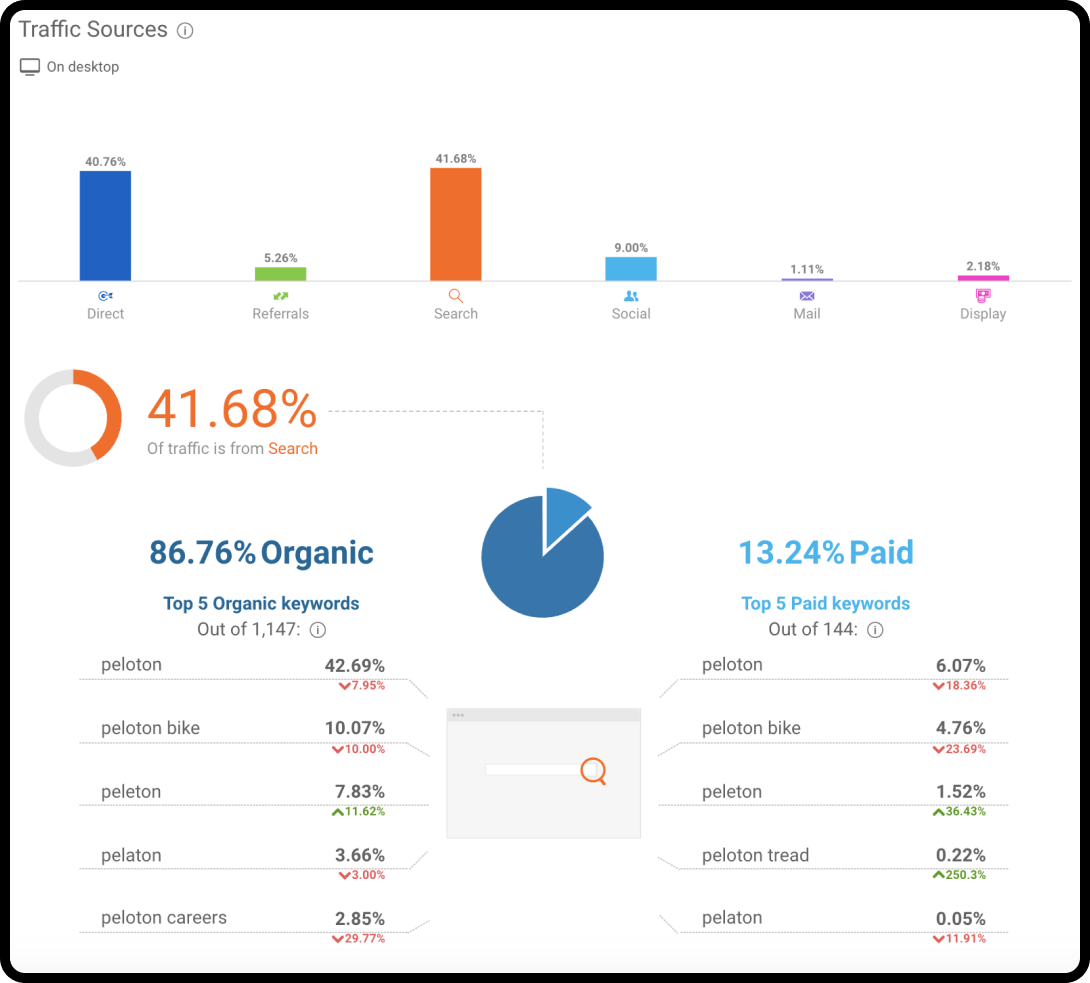

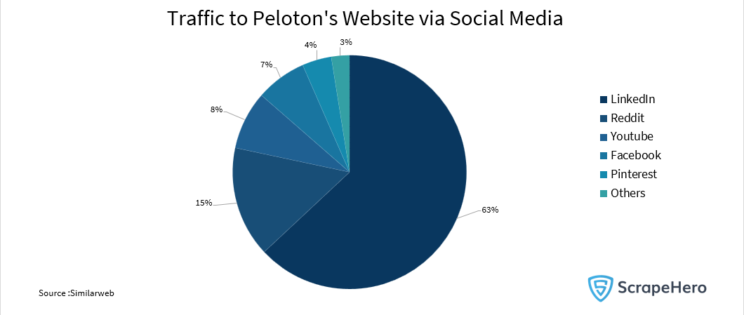

The loyalty created by the service is evident in the way the brand is discovered online. According to data from Sim ilarweb, 55.71% of traffic is direct, while 38.36% comes from search. Even more impressive is that 91.01% of that search traffic is organic. The tribe of raving fans shares the brand with friends, and word-of-mouth referral is one of the most lucrative ways the Peloton Marketing Strategy drives new users.

Content: But Keep It Legal

While Peloton is not without its faults, a group of music publishers sued Peloton in 2019, alleging it used more than 1,000 songs from Lady Gaga, Drake, Gwen Stefani, Justin Timberlake, and others without permission — content is at the heart of what has driven Peloton to such success. The most successful companies know to leverage content in many different formants .

With celebrity instructors (some of whom make more than 6 figures and have their own cult following) leading at least 12 new live classes daily, Peloton is a content machine. Some of their notable instructors are favorites like Cody Rigsby (683K followers) and Ally Love (641K followers). They also acquired Neurotic Media in 2018, a B2B music aggregation and streaming service, giving them a new edge in content generation.

“We’re trying to be creative with new forms of media that fall somewhere between earned media and more traditional marketing,” Foley said.

The Peloton Marketing Strategy includes a film studio, which pumps out about 950 original programs a month, is no joke. It may have started with 4 bikes in the back room of their office with rented lights, but it certainly isn’t anymore. The New York-based studio is staffed with top producers, some of whom have won Emmys for production excellence, and is a state-of-the-art film studio.

Content is so critical to Peloton that their website title and meta-description don’t mention the equipment. Instead, they highlight what Peloton considers the most valuable part of their business: the service.

Delivering Exceptional Product Experience

Product development at Peloton hasn’t stopped at a sexy spin bike design and celebrity-led classes.

They have been able to achieve tremendous growth in their subscription revenue by accepting that, for some riders, expensive gear just wasn’t an option. To serve this additional market, Peloton began selling digital memberships (no equipment purchase required) in 2018. The cost is just $39.00/month, and now, in 2024, there are about 2.33 million digital-only subscribers, with an annual retention rate of over 92%.

Peloton is constantly pushing for the latest and greatest, which keeps users signing up and staying. Looking for a workout away from the bike, like yoga, stretching, or even sleep meditation? There’s that, too, via the app. Prefer to run instead of riding a bike? Their newest product, Tread, is a treadmill that offers the same in-home workout experience as the bike.

And it’s not just equipment and app innovation that has kept them at the forefront. The Peloton Marketing Strategy continues to evolve. Traveling? Stay at one of the more than 300 hotels offering private Peloton rooms where you get your own private bike and access to their network of classes. Waiting for a sale? Don’t hold your breath. Peloton rarely has sales and leans heavily on its referral program as the main source of discounts.

Other media investments include Facebook ads, retargeting, search engine marketing, email marketing, TV, and print. The company spent over $100 million on paid media in the last year, advertising on over 250 different media properties across multiple media formats.

Ready to meet your audience where they are?

Peloton’s pricing strategy has also had marketers talking. Peloton partnered with Affirm to offer frictionless product financing, enabling customers to pay off equipment purchases for as little as $50 per month over time. By eliminating this upfront cost, Peloton was able to remove many consumers’ hesitation and bring the price below that of a boutique fitness club membership, significantly strengthening their core value proposition (especially because multiple people can use the bike for the same subscription price). This financing also “locks in” users for 3+ years, which adds to the case for their low churn and high retention rate.

Peloton SVP of Global Marketing Carolyn Tisch Blodgett says, “While it’s nice to see headlines that say ‘the Peloton of rowing’ or the Peloton of something else, we’re not really focused on what our competitors are doing. We’re focused on solving needs for our core consumer through innovation.”

1.4 Million Users Who Expect the Best

Users are willing to pay a premium for exceptional service — and when the price point is high, so are their expectations. With members exceeding 1.4 million in 2019, the pressure is on the Peloton Marketing Strategy to continue to provide exceptional service. From the white-glove delivery to the consistent evolution of classes offered, this is a prime example of a data-driven approach allowing a company to leverage customer insights to provide best-in-class service.

Blodgett said , “Traditional fitness classes are 45 minutes, but our 30-minute classes outperformed, so we produced more. Many people like on-demand classes, so we’ve added features that make the on-demand classes feel like a live class.” Peloton uses customer data like demographics, location, etc., to target new users and drive acquisition, determining that their fastest-growing market is users under 35 with a household income of under $75,000.

As mentioned in their registration documents, “We use performance data to understand our Members’ workout habits to evolve and optimize our programming around class type, length, music, and other considerations.”

By going above and beyond to delight members, they have seen nothing but growth in year-over-year subscriber rates. When you make something exciting and worthwhile, people want to be part of it.

Peloton Marketing Strategy: Addictive Fitness

Achieving optimal user retention means creating a product that feels like a need more than a want. The Peloton Marketing strategy does just that. The $39/month Peloton subscription is mandatory when you buy the equipment and gives users access to the community and thousands of live and on-demand classes while generating consistent revenue and data for the company to use to improve its offerings. We’ve seen other subscription companies try to do what Peloton has done, but most with average success. The goal is to make the at-home fitness experience “as physically rewarding and addictive as attending a live, in-studio class,” according to the registration filing.

The keyword here is addictive. With retention rates through the roof, it seems it might be. On average, its subscribers complete 19.9 workouts per month, and subscriber engagement with Peloton workouts has grown 2.65x over the last four fiscal years (June 2017 – June 2021). And they do it all with very little churn. As they mention in the S-1, “Usage drives value and loyalty.” Peloton’s customer reviews average 4.8 out of five across more than 1,000 reviewers, according to Wirecutter .

Peloton Marketing Strategy: What’s Next?

“Arguably, the Peloton bike has been the most disruptive product in the fitness industry,” says William Lynch, the company’s president. “But that’s a really narrow view of what we’re doing.”

The impact Peloton has had on the fitness industry is huge, and there’s no doubt that it would be hard to return to the way things were before. With Peloton’s constant thirst for innovation, there seems to be no reason that Peloton won’t continue to thrive and push the boundaries of what consumers can expect from a hardware-plus-subscription business.

Countless competitors and imitators have popped up in recent years, including Mirror, an at-home device that touts itself as “the nearly invisible interactive home gym,” which was recently acquired by Lululemon, and SoulCycle or FlyWheel, which have now launched their own connected home bikes. Startups like Tonal have taken a different approach, focusing more on full-body workout functionality, incorporating magnetically powered weights for added resistance. Strava and Whoop, on the other hand, have established themselves as a way for athletes to track and measure their progress (and split times) with people in the real world.

Partner with us for cutting-edge growth marketing services that propel businesses forward.

What’s the takeaway here? The Peloton Marketing Strategy and the companies unwavering commitment to building community, creating a tribe of avid fans, generating quality content, and providing exceptional service, is a backed-by-science recipe to turn a failed Kickstarter into billionaire-dollar company.

Understanding Peloton’s Breakout Year

Unlike many retail businesses, the Peloton Marketing Strategy benefited from the pandemic, becoming a top choice for home workouts as people were forced to move indoors and rethink their exercise routine. The demand for Peloton equipment has become so high that the company is struggling to keep up , prompting Peloton to raise its sales outlook for the full year. The company said heightened demand for its bikes has continued to grow as those who were not considering buying one before the Covid-19 crisis began to warm towards the idea.

Peloton Marketing Strategy: Power Of Influencer Marketing

As themed workouts became popular within the Peloton community, the company partnered with celebrity influencers. On November 10, 2020, Peloton announced its multi-year partnership with Beyonce Knowles to produce some of these themed workouts for their members. The announcement saw immediate success, with Peloton’s stock soaring 8.6% on the day of the announcement.

Customers were equally excited, with one follower on Peloton’s Instagram commenting, “This is so powerful. My personal trainer […] is a Howard student and he taught me how to use Peloton. This campaign makes me feel seen and valued as a current Howard student and Peloton user. Thank you.” Another wrote, “You market to ME, you get me! Peloton purchased.”

The Peloton Marketing Strategy and Beyonce collaboration was a win on all fronts. According to Peloton, Beyonce was the most requested artist among its 3.6 million members worldwide. That’s not surprising, given that millions already have Beyonce’s music on their workout playlists, but it’s not just her music that makes this partnership perfect. Beyonce is a global superstar, businesswoman, and activist with a massive fanbase (172 million followers on Instagram at the time of this article update).

Beyonce is a master of social media who truly understands how to connect with her fans, ignite conversations about everything, and sell ( take a look at her first Ivy Park collection with Adidas, which sold out in one weekend). According to social media analytics firm D’Marie Analytics, one post from Beyonce is worth over $1 million in advertising.

Furthermore, the logic behind this partnership goes one step further: Beyonce is a performer known for her fitness and stamina, who often talks about the importance of prioritizing her health to achieve her goals and be the best version of herself. She embodies hard work and excellence — everything Peloton and its followers strive to be.

By partnering with Beyonce, a Black female artist, and building relationships with HBCUs, Peloton is taking steps to make the health and wellness industry more inclusive. Consumers in 2024 are becoming more aware and have higher expectations for companies to be inclusive and mindful in their business practices. By building partnerships like this, Peloton is sure to attract new subscribers who may not have previously seen Peloton as something they could use before.

The partnership has been a huge success and in a single quarter, 1 million people completed workouts featuring music by Beyoncé.

Peloton Launches DFB Partnership

Peloton’s path to further advance their role in fitness innovation includes the companies recent partnership with DFB Academy (German Football Academy). Through this partnership, the Peloton community can “train with” and and compete in “DFP” branded workouts. Not only did Peloton give its users another tangible benefit of being a member of the community, this marketing move positioned Peloton in front of a brand new segment of consumers. With its business partnerships and sales trajectory, there’s no doubt the Peloton Marketing Strategy is one to watch despite the tough competition in the space and we can’t wait to see what they dream up next.

Don’t feel like reading? We summarized our Peloton growth marketing guide into a short video. Take a look:

Keep up with the latest & greatest in growth marketing, stephanie farrell, ayushi gupta.

This is really an in-depth article on Peloton’s rise. Really helpful!

Great read! I completely agree with the importance of creating a strong brand identity and leveraging customer testimonials in Peloton’s marketing strategy. Their focus on creating an immersive experience for their customers has been a key factor in their rapid growth. The use of social media influencers and partnerships with popular brands has also been a smart move to reach a wider audience. Looking forward to seeing how they continue to innovate and push the boundaries of their marketing strategy.

Leave a comment

Cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Read more from our in-house growth marketing experts. 🧠

Protecting Your Brand from Ad Hijacking: 4 Things to Know

Utilize these actionable steps to protect your brand from ad hijacking and lower CPCs.

6 Best Advertising Agencies NYC 2024

Explore NYC's leading advertising agencies, known for their creativity, innovation, and impact in the ad world.

The 7 Best B2B Marketing Campaigns & What to Learn from Them

Dive into the world's best B2B marketing campaigns. Gain insights and inspiration to create your own standout strategy.

- Work & Careers

- Life & Arts

Inside Peloton’s epic run of bungled calls and bad luck

To read this article for free, register now.

Once registered, you can: • Read free articles • Get our Editor's Digest and other newsletters • Follow topics and set up personalised events • Access Alphaville: our popular markets and finance blog

Explore more offers.

Then $75 per month. Complete digital access to quality FT journalism. Cancel anytime during your trial.

FT Digital Edition

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- Global news & analysis

- Expert opinion

Standard Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- FT App on Android & iOS

- FT Edit app

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

More From Forbes

Peloton and the ‘four laws of holes’ when managing a crisis.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Close-up of logo for Peloton on exercise bicycle, San Francisco, California, June 14, 2021. (Photo ... [+] by Smith Collection/Gado/Getty Images)

Peloton appears to be following the first of what I call the Four Laws Of Holes for managing a crisis.

The First Law Of Holes

The first law should be common sense for all business leaders: When you find yourself in a hole, stop digging.

According to Business Insider yesterday the exercise equipment manufacturer laid off almost 3,000 employees. “Peloton's job cuts amount to some 20% of its 14,000-strong corporate workforce. The cuts are expected to contribute to savings of at least $800 million a year, the company said in its news release. It's also winding down the building of a $400 million factory in Ohio where it had planned to produce bikes and treadmills.”

The Second Law Of Holes

But Peloton is not yet following the Second Law Of Holes: Don’t do anything that will make the crisis worse.

Business Insider noted that the salaries of company instructors will remain the same.

“Peloton's instructors— recruited by talent agents—are full-time employees with a fixed salary and incentive compensation... Senior instructors are paid more than $500,000 a year, Bloomberg reported, citing people familiar with the company. That's about 12 times more than the $40,510 annual median salary for fitness trainers and instructors, according to the Bureau of Labor Statistics .”

Best Travel Insurance Companies

Best covid-19 travel insurance plans, the third law of holes.

The third law is to climb out of the hole as soon as possible.

The AP reported that, “John Foley [who] first pitched the idea for Peloton in 2011...will give up the CEO position and become executive chair at Peloton Interactive Inc. Barry McCarthy, who served as CFO at Spotify as well as at Netflix, will take over as CEO, the company said Tuesday”

“’The problem for Peloton isn’t that it has a bad product. Nor is it that there is no demand for what it sells,” said Neil Saunders, managing director of Global Data Retail in a note published Tuesday. ‘The central problem is one of hubris and bad judgment. Peloton incorrectly assumed that the demand created by the pandemic would continue to curve upward.’”

“In a conference call with analysts on Tuesday, Foley acknowledged that the company expanded its operations too quickly and over-invested in certain areas of the business.

“We own it. I own it, and we are holding ourselves accountable,” said Foley, noting he will be working closely with the new CEO. “That starts today.”

Maximize Assets

Stacy Rosenberg is an associate teaching professor at Carnegie Mellon University's Heinz College. She noted that Peloton’s most visible assets “are their highly popular instructors. Maximizing the social media influence these instructors have on perceptions about the strength of the company would be a strategic way to reenergize the Peloton brand.”

Problems Tied To Market Demand And Values

Robert C. Bird is a professor of business law at the University of Connecticut's School of Business. He said that, “Peloton’s problems are tied to market demand, but they are also tied to values. Any company no matter how popular or how rapidly it grows, must not lose touch with its core ethical values. Such values cannot be generated overnight, but must permeate through the organization via a culture of integrity. That way when a crises appears suddenly, a company like Peloton can respond organically and with authenticity.

“Peloton didn’t do that when the Consumer Product Safety Commission (CPSC) reported a number of serious accidents with its treadmill. It’s first instinct was to dispute the information and respond defensively. That does not reassure consumers or investors. Instead of resisting public accusations, it should have offered to make amends immediately. Peloton didn’t have the culture of integrity to do that, and now it is paying a heavy price,” Bird commented.

The Fourth Law Of Holes

My Fourth Law Of Holes is simple: After you have climbed out of the hole, don’t fall back in or dig yourself a new hole.

It is too early to tell, of course, if Peloton will be able to climb out of their hole—or avoid falling back in it.

‘Peloton’s Future Is At Risk’

Ahren Tiller is the founder and supervising attorney at the Bankruptcy Law Center . He said that “Yesterday’s announcement is clearly an indicator that Peloton’s future is at risk. Peloton is one of those [companies who saw] glory during the pandemic. But because of some miscalculations and wrong decisions, their triumph is now being replaced with an uncertain future. But if their new chief executive, Barry McCarthy, will play his cards right, he might still save the company from uncertainty.”

Advice For Business Leaders

Take ownership.

Tiller observed that, “For me, there’s only one crisis management lesson that business leaders must learn from these developments— that when something went wrong, taking ownership and responsibility will always be the right thing to do.”

Positioning

Carnegie Mellon’s Rosenberg pointed out that, “Restructuring is a normal part of business. Peloton, and other companies deciding to reduce their workforce, should position the news of layoffs as a step toward more efficient operations. Ultimately, as long as the customer experience does not suffer and their bottom-line improves, then they can present a restructuring as an opportunity not a shortfall.

“When announcing a change in leadership, the board should focus more on the potential success of the incoming C-suite talent than on the failings of the outgoing executive. Shareholders and consumers do not want the company to dwell on past mismanagement. It is more productive to highlight the company’s strengths,” she advised.

Avoid Traps

Margaret Hopkins is a professor of management at The University of Toledo’s Neff College of Business and Innovation, which is located near where Peloton was going to build their first U.S. production facility.

She noted that there are three traps that leaders can fall into during crisis situations.

- “The first trap is to return to the leader’s operational comfort zone and focus on managing the present as opposed to anticipating and taking a longer-term view.”

- “A second trap is that leaders try to control all decisions and centralize the responses to the crisis.”

- “The third trap is forgetting the human factors and focusing on the numbers of costs, revenues, and share prices. Crises affect people, and the numerical outcomes are the result of the coordinated work of people.”

- Editorial Standards

- Reprints & Permissions

Analysing Peloton’s Breakthrough Marketing Strategy: A Case Study

By Aditya Shastri

Quick Read The marketing strategy of Peloton focuses on leveraging digital marketing, celebrity endorsements, and a strong community presence. This case study explores Peloton’s marketing strategies, advertising campaigns, and recent developments, providing insights into how the brand maintains its leadership in the fitness industry.

Learn From Asia’s #1 Digital Marketing Institute

AI-Based Curriculum

Dive in to the future with the latest AI tools

Placement at top brands and agencies

Talk to counsellor

Peloton isn’t your average gym equipment company. Founded in 2012, this American company has become a household name for revolutionising the home fitness industry. They launched in 2013 with a bang, thanks to a successful Kickstarter campaign, and quickly established themselves as a leader in both, exercise equipment and fitness media.

This case study dives deep into the marketing strategy of Peloton’s secret sauce, exploring their marketing strategy, strengths and weaknesses (SWOT analysis), how they’ve crafted successful campaigns, and how they leverage social media to stay connected with their passionate user base.

For those looking to understand such comprehensive marketing approaches for companies like Peloton, pursuing a post-graduation in digital marketing can provide valuable insights. So, buckle up and get ready to learn how Peloton went from a Kickstarter hopeful to a fitness phenomenon.

About Peloton

Source: Google

Peloton’s mission is clear: create an engaging and effective home workout experience that fosters a global fitness community. Peloton’s marketing strategy has achieved this by combining cutting-edge technology with a variety of motivating content. Their innovative bikes, with personalised features, disrupted the home fitness market when they were first introduced.

While creating Peloton’s advertising strategy, the company understands the desire to skip the gym and exercise at home. They’ve made this easier than ever by offering a unique approach: gamified workouts. This makes exercising at home not just convenient, but also fun and competitive.

Want to know how companies like Peloton build successful marketing strategies? Digital marketing classes can teach you the secrets behind their success.

The company has expanded beyond bikes, now offering treadmills, accessories, and apparel. They also have their own app with a library of classes, catering to a wide range of fitness goals.

Peloton Case Study – What’s New With the Brand?

- Revenue: Peloton reported revenue of $4.02 billion for the fiscal year 2023 [Source: Peloton Annual Report 2023].

- Subscribers: Peloton has over 6.9 million members across its digital and connected fitness platforms [Source: Peloton Q4 Earnings Report 2023].

- Market Share: Peloton holds a significant share in the home fitness market, commanding approximately 25% [Source: Market Research Report 2023].

For those who want to understand the impact of how the latest trends and news can impact the marketing strategy of companies like Peloton, pursuing a digital marketing course online can provide valuable insights and skills.

Business News

Peloton announced a strategic partnership with major hotel chains to provide Peloton bikes in hotel gyms and rooms, enhancing its brand presence in the hospitality industry [Source: Business Insider, June 2024].

Product Launch

Peloton launched a new rowing machine, expanding its range of connected fitness equipment and offering a new modality for its users [Source: Peloton Press Release, April 2024].

Marketing News

Peloton’s inspiring ‘Find Your Strength’ campaign, showcased in Marketing Week in May 2024, has sparked interest in crafting similar impactful campaigns. To learn the strategies behind such successful initiatives, check out courses on digital marketing online, which offer valuable insights and tools for creating effective campaigns for your product or service.

Celebrity News

Tennis star Serena Williams joined Peloton as a brand ambassador, promoting the brand’s commitment to empowering individuals through fitness [Source: Times of India, March 2024].

🚨 FREE MASTERCLASS

Building a Profitable Instagram Strategy

Worked with:

Register For Free

IG Content Creater With 10+ million views

Peloton Target Market – Buyer Persona

A buyer persona provides a detailed profile of Peloton’s ideal customer. Peloton’s marketing strategy is based on its audience’s motivations, preferences, challenges, and online activities.

Buyer’s Persona

Profession:

Interior Designer

- Seeking high-quality and convenient workout solutions

- Desire for a strong community and engaging fitness content

Interest & Hobbies

- Fitness, wellness, technology, and group activities

Pain Points

- High cost of equipment and subscription fees

- Need for motivation and accountability in-home workouts

Social Media Presence

- Active on Instagram, Facebook, and Twitter, engaging with users through motivational content, workout tips, and community stories

After studying this detailed breakdown, it is obvious that Peloton’s advertising strategy can leverage the use of social media platforms like Instagram and Facebook to execute their campaigns. Here, it features fitness and wellness that resonate with its target audience.

Additionally, many AI tools like ChatGPT can help in refining the implementation of a marketing strategy. How? You can find out by enrolling for this free ChatGPT course .

SWOT Analysis – The Factors That are Important in Formulating Peloton’s Marketing Strategy

Every company has its strengths which make it different from its competitors. But along with that, they also possess certain weaknesses that need to be worked upon to continue on a forward path. Following is a SWOT analysis of this fitness leader which will help in crafting Pelton’s advertising strategy.

Peloton’s Strengths

Peloton’s bicycles are high-tech and are designed by professional bicyclists. Plus the production takes place only in America so there is no compromise in the quality of the products. The product itself is thus, Peloton’s core strength. And showcasing the uniqueness of this product is a major part of Pelton’s advertising strategy.

The company uses advanced technology not only in the designing process but also during the production and testing of its products. Peloton products are very effective and are produced by studying the body movements of a person. They have meshed the physical and digital worlds and have created an immersive experience for their members. They made access to high-quality boutique fitness available to everyone in the comfort of their house. Leveraging these strengths helps in creating the marketing strategy of Peloton.

For those looking to use their strengths like Peloton does and enhance their marketing skills, obtaining a free digital marketing certification can be highly beneficial, providing valuable insights and techniques that can be applied to develop effective strategies for companies like Peloton.

Peloton’s Weaknesses

Peloton has hit some bumps in the road lately. Peloton’s marketing strategy hasn’t always landed well, with some ads coming across as strange or even offensive (more on that in the blog). Let’s face it, when people dislike your company’s message, it doesn’t exactly inspire trust. This has led to some negative publicity and a bit of a tarnished image for Peloton.

Things aren’t much smoother internally either. Peloton has acknowledged weaknesses in its accounting department, and there have been reports of leaks in various areas. This suggests that there are some organisational and management challenges that need to be addressed. It will be interesting to see how the new Pelton advertising strategy positions the company as one that has overcome battles and experienced victory.

Peloton’s Opportunities

Peloton has ample growth opportunities across diverse markets and industries. This includes the world market, expansion in the product line, and growth in the hospitality industry. Peloton’s marketing strategy currently sees a potentially huge market in Canada, this is a big opportunity for the company to maximise its profits. The company has thus entered the Canadian market and is trying to expand its reach.

Are you finding this blog insightful? Check out our digital marketing blogs to explore a wealth of knowledge now!

Peloton’s Threats

One of the biggest threats for Peloton is their competitor i.e. SoulCycle. SoulCycle operates in the fitness industry as well and is a big competitor to Peloton. It is launching similar products into the market and has the potential to take away significant market share from Peloton. Peloton’s limited control over its partners, manufacturers, and suppliers poses risks that could impact both, the quality and quantity of its products.

The SWOT analysis thus sums up the various areas the company can capitalise on while working to eradicate the threats and weaknesses when creating the marketing strategy of Pelton.

Peloton Marketing Strategy

Peloton’s marketing strategy has been a successful journey of adaptation. They started by focusing on the product itself, highlighting the features and benefits of their bikes and their at-home fitness concept. This resonated with people looking for a boutique fitness experience without leaving their homes.

However, Peloton’s marketing cleverly evolved to emphasise the sense of community they were building. Working out can be isolating, but Peloton connected users with like-minded people, transforming a solitary activity into a shared journey with support and encouragement.

To keep users engaged, Peloton’s marketing strategy prioritises continuous updates and new features based on user needs. This not only keeps their offerings fresh but also fosters loyalty among their customer base. Ideally, this loyal base will become Peloton’s biggest advocates through word-of-mouth marketing, reducing long-term marketing costs.

The COVID-19 pandemic presented a unique opportunity for Peloton. With the rise of at-home workouts, user recommendations fueled a surge in sales. Peloton’s advertising strategy also uses incentives like merchandise and exclusive plans to further entice customers to join their membership program.

The company maintains a strong digital presence through social media campaigns and videos. Here, Peloton’s advertising strategy focuses on showcasing real people using their Peloton bikes, treadmills, and other fitness equipment, making their offerings relatable and aspirational to potential customers.

All of these strategies have helped the company in achieving an almost unheard-of 95% retention rate.

If you find yourself interested in more about the marketing strategy of other renowned brands, then you should check out our digital marketing case studies .

Peloton’s Marketing Strategy That Helps in Creating Its Marketing and Advertising Campaigns

Peloton’s marketing strategy isn’t just about selling exercise bikes; it’s about crafting a lifestyle. Their campaigns don’t just promote a product; they create a community. By understanding their target audience’s desires and aspirations, Peloton has managed to position itself as more than just a fitness brand. They’ve become a symbol of health, motivation, and achievement.

1) ‘We All Have Our Reasons’

This Peloton marketing campaign was the first one since the pandemic began. In this campaign, Peloton has chosen 9 of its members to convey their Peloton experience and how Peloton keeps them motivated to work out. The company also wrote a blog featuring some of its member’s stories. They stated that every member in their community has their reasons to work out and use Peloton. Peloton also then asked their members to post their stories on social media using the hashtag #mypelotonreason. They chose a few of these to post on their social media.

This was Peloton’s first campaign that didn’t feature actors but instead starred real riders. The campaign featured a military veteran, a public defender, a nurse, a baker, a grandpa, an NFL agent, and a school teacher and they all described their riding stories.

This Peloton’s marketing campaign was focused on showcasing how people fit in at-home workouts with their everyday lives. They aimed at showing the diversity across race, gender, age, and language, portraying the differences in everyone’s everyday lives through the ad. While simultaneously, indirectly also showing their similarities in wanting to stay fit. The campaign appeared across various platforms including televisions and top social media platforms.

Peloton’s successful marketing strategy has inspired many Mumbai residents to explore digital marketing courses in Mumbai , eager to learn the creative genius behind such campaigns.

2) ‘The Gift That Gives Back’

Peloton’s advertising strategy launched a Christmas advertisement in November titled ‘The Gift That Gives Back.’ In this advertisement, the company showed a woman receiving Peloton’s bike as her Christmas gift from her partner and it inspired her to record her fitness journey using Peloton’s bike for 6 months.

Here, the Pelton marketing campaign turned out to be a big fail as the critics stated that the woman shown was already slim and the partner gifting her a fitness bike implies that he wants her to lose weight.

This campaign was termed sexist and dystopian. Even though it received 2m+ views on YouTube, the video has around 5 dislikes for 1 like. Peloton chose to turn off their comments section on YouTube due to the amount of criticism they received.

Peloton lost around $1.5bn in value due to this ad campaign.

Clearly, the company has had some hits and misses about Pelton’s marketing campaigns. The company needs to be extra careful in the future to avoid any more mishaps.

The campaign ‘The Gift That Gives Back’ has inspired residents of South Delhi to avoid such pitfalls while formulating their strategy. This has encouraged them to pursue digital marketing courses in South Delhi and learn the right way to market a product.

Understanding the Digital Marketing Strategy of Pelton

Here is a detailed breakdown of components that the company employs while formulating its Pelton’s marketing strategy:

SEO Strategy: Peloton optimises its website and content for search engines (a platform used to find information), targeting keywords (words used by users while look for information) related to fitness equipment, home workouts, and connected fitness to ensure high visibility.

SMM Strategy: Peloton actively engages its audience on social media platforms, sharing user-generated content, success stories, and promotional offers, fostering a strong online community.

E-commerce Strategy: Peloton’s online store offers a seamless shopping experience, with features like detailed product descriptions, financing options, and secure payment gateways, enhancing customer satisfaction.

Mobile App: The Peloton mobile app provides users with access to a vast library of live and on-demand classes, workout tracking, and community features, improving engagement and loyalty.

Influence Marketing Strategy: Peloton collaborates with fitness influencers, celebrities, and brand ambassadors to promote its products and classes, reaching a broader audience and enhancing its brand image.

Side Note: With digital marketing booming in Meerut, understanding its components is crucial. This has resulted in a rise in demand for digital marketing courses in Meerut .

Peloton’s Social Media Presence

A digitally-focused company like Peloton needs to have a social media presence that is interactive and appealing to its audience. Following is the analysis of Peloton’s social media:

- Peloton has 1.5M followers on Instagram, 148.5K on Twitter and 788K likes on Facebook.

- The company is very active on its social media and posts regularly. Which is at least a couple of times a week.

- True to its brand of being a fitness solutions company, it posts a lot of tips and guidance from its instructors. This definitely adds value to their content.

- Peloton is effectively using Instagram’s latest and most popular feature- reels. They post a lot of motivational content on reels that are aimed at making people realise their ideal fitness goals.

- The company also engages with its audience by posting memes. Meme marketing is very effective in today’s times.

- Their Instagram page posts their member’s experiences periodically. This shows potential customers the advantages of availing of Peloton’s services, while also encouraging existing members by featuring them.

- Their Twitter mostly posts informative content about new products and offerings that are in the works.

- On all social media, their recurring content is introducing their instructors and their upcoming classes.

All in all, the company’s social media presence is certainly effective and well-rounded.

Marketing Strategy of Pelton That Failed

The holiday advertisement showcased a woman receiving a Peloton bike as a gift from her husband, documenting her fitness journey throughout the year. The campaign intended to highlight the joy and transformative power of fitness.

Issue: Peloton faced backlash for a holiday ad that was perceived as tone-deaf and promoting unrealistic body standards.

Backlash: Here, the Pelton marketing campaign led to significant negative feedback on social media, with consumers criticising the ad for its portrayal of fitness and wellness.

Response: Peloton issued a statement clarifying the intent behind the ad and took steps to ensure future campaigns were more inclusive and sensitive to consumer perceptions.

Top Competitors That Influence the Marketing Strategy of Pelton

Pelton is not the only fitness company operating in this industry. Many players can affect the impact of Pelton’s advertising strategy, some of which are:

- NordicTrack: Known for its innovative fitness equipment and interactive workout content.

- Mirror: Offers a sleek, interactive home gym that provides live and on-demand fitness classes.

- Echelon: Provides a range of connected fitness equipment and classes at competitive prices.

- Tonal: Features a digital strength training system with personalised workouts.

- Hydrow: Specialises in connected rowing machines with immersive workout experiences.

Peloton’s marketing strategy focuses on connecting with its users and providing them with value. They keep customer satisfaction as their main objective. They have thoroughly changed the entire home workout scenario for their customers. Even though Peloton’s main services are pretty expensive, they have come up with many new programmes and features that are quite affordable and accessible to a large number of people.

Their marketing is consistent in communicating their objectives and is very up-to-date. Although they do need to be more mindful of their campaigns’ social tones in the future. Overall, Peloton is a great mixture of high-end technology, innovation, and an amazing social experience.

We hope you found this blog on the marketing strategy of Peloton informative and that it added value to your time. If you did enjoy it, comment down below and let us know!

Learning From Other Brands

In comparison to other companies, the marketing mix of Adidas focuses on leveraging high-profile athlete endorsements, innovative product designs, and global brand campaigns to engage with a diverse audience, which has helped the brand maintain a strong presence in the sportswear market and foster a deep connection with fitness enthusiasts.

Similarly, the marketing mix of Hindustan Unilever emphasises creating a unique customer experience through a broad range of products, strategic pricing, extensive distribution networks, and impactful advertising, showcasing how a customer-centric approach and consistent brand experience can drive customer loyalty and market leadership.

Additionally, the marketing strategy of Tata Group highlights the company’s focus on diversification, quality, and ethical business practices, along with strategic acquisitions to expand its market reach and customer base. The group also emphasises opportunities for growth through digital transformation and robust customer engagement. These examples illustrate how effective branding and targeted marketing initiatives can foster brand loyalty and industry leadership across various sectors.

FAQs About the Marketing Strategy of Pelton

Peloton’s marketing strategy focuses on leveraging digital marketing, celebrity endorsements, and strong community engagement.

The marketing strategy of Peloton uses SEO, social media engagement, e-commerce strategies, and a mobile app to reach and engage customers.