How to Conduct an Industry Analysis? Steps, Template, Examples

Appinio Research · 16.11.2023 · 41min read

Are you ready to unlock the secrets of Industry Analysis, equipping yourself with the knowledge to navigate markets and make informed strategic decisions? Dive into this guide, where we unravel the significance, objectives, and methods of Industry Analysis.

Whether you're an entrepreneur seeking growth opportunities or a seasoned executive navigating industry shifts, this guide will be your compass in understanding the ever-evolving business terrain.

What is Industry Analysis?

Industry analysis is the process of examining and evaluating the dynamics, trends, and competitive forces within a specific industry or market sector. It involves a comprehensive assessment of the factors that impact the performance and prospects of businesses operating within that industry. Industry analysis serves as a vital tool for businesses and decision-makers to gain a deep understanding of the environment in which they operate.

Key components of industry analysis include:

- Market Size and Growth: Determining the overall size of the market, including factors such as revenue, sales volume, and customer base. Analyzing historical and projected growth rates provides insights into market trends and opportunities.

- Competitive Landscape: Identifying and analyzing competitors within the industry. This includes assessing their market share , strengths, weaknesses, and strategies. Understanding the competitive landscape helps businesses position themselves effectively.

- Customer Behavior and Preferences: Examining consumer behavior , preferences, and purchasing patterns within the industry. This information aids in tailoring products or services to meet customer needs.

- Regulatory and Legal Environment: Assessing the impact of government regulations, policies, and legal requirements on industry operations. Compliance and adaptation to these factors are crucial for business success.

- Technological Trends: Exploring technological advancements and innovations that affect the industry. Staying up-to-date with technology trends can be essential for competitiveness and growth.

- Economic Factors: Considering economic conditions, such as inflation rates, interest rates, and economic cycles, that influence the industry's performance.

- Social and Cultural Trends: Examining societal and cultural shifts, including changing consumer values and lifestyle trends that can impact demand and preferences.

- Environmental and Sustainability Factors: Evaluating environmental concerns and sustainability issues that affect the industry. Industries are increasingly required to address environmental responsibility.

- Supplier and Distribution Networks: Analyzing the availability of suppliers, distribution channels, and supply chain complexities within the industry.

- Risk Factors: Identifying potential risks and uncertainties that could affect industry stability and profitability.

Objectives of Industry Analysis

Industry analysis serves several critical objectives for businesses and decision-makers:

- Understanding Market Dynamics: The primary objective is to gain a comprehensive understanding of the industry's dynamics, including its size, growth prospects, and competitive landscape. This knowledge forms the basis for strategic planning.

- Identifying Growth Opportunities: Industry analysis helps identify growth opportunities within the market. This includes recognizing emerging trends, niche markets, and underserved customer segments.

- Assessing Competitor Strategies: By examining competitors' strengths, weaknesses, and strategies, businesses can formulate effective competitive strategies. This involves positioning the company to capitalize on its strengths and exploit competitors' weaknesses.

- Risk Assessment and Mitigation: Identifying potential risks and vulnerabilities specific to the industry allows businesses to develop risk mitigation strategies and contingency plans. This proactive approach minimizes the impact of adverse events.

- Strategic Decision-Making: Industry analysis provides the data and insights necessary for informed strategic decision-making. It guides decisions related to market entry, product development, pricing strategies, and resource allocation.

- Resource Allocation: By understanding industry dynamics, businesses can allocate resources efficiently. This includes optimizing marketing budgets, supply chain investments, and talent recruitment efforts.

- Innovation and Adaptation: Staying updated on technological trends and shifts in customer preferences enables businesses to innovate and adapt their offerings effectively.

Importance of Industry Analysis in Business

Industry analysis holds immense importance in the business world for several reasons:

- Strategic Planning: It forms the foundation for strategic planning by providing a comprehensive view of the industry's landscape. Businesses can align their goals, objectives, and strategies with industry trends and opportunities.

- Risk Management: Identifying and assessing industry-specific risks allows businesses to manage and mitigate potential threats proactively. This reduces the likelihood of unexpected disruptions.

- Competitive Advantage: In-depth industry analysis helps businesses identify opportunities for gaining a competitive advantage. This could involve product differentiation, cost leadership, or niche market targeting .

- Resource Optimization: Efficient allocation of resources, both financial and human, is possible when businesses have a clear understanding of industry dynamics. It prevents wastage and enhances resource utilization.

- Informed Investment: Industry analysis assists investors in making informed decisions about allocating capital. It provides insights into the growth potential and risk profiles of specific industry sectors.

- Adaptation to Change: As industries evolve, businesses must adapt to changing market conditions. Industry analysis facilitates timely adaptation to new technologies, market shifts, and consumer preferences .

- Market Entry and Expansion: For businesses looking to enter new markets or expand existing operations, industry analysis guides decision-making by evaluating the feasibility and opportunities in target markets.

- Regulatory Compliance: Understanding the regulatory environment is critical for compliance and risk avoidance. Industry analysis helps businesses stay compliant with relevant laws and regulations.

In summary, industry analysis is a fundamental process that empowers businesses to make informed decisions, stay competitive, and navigate the complexities of their respective markets. It is an invaluable tool for strategic planning and long-term success.

How to Prepare for Industry Analysis?

Let's start by going through the crucial preparatory steps for conducting a comprehensive industry analysis.

1. Data Collection and Research

- Primary Research: When embarking on an industry analysis, consider conducting primary research . This involves gathering data directly from industry sources, stakeholders, and potential customers. Methods may include surveys , interviews, focus groups , and observations. Primary research provides firsthand insights and can help validate secondary research findings.

- Secondary Research: Secondary research involves analyzing existing literature, reports, and publications related to your industry. Sources may include academic journals, industry-specific magazines, government publications, and market research reports. Secondary research provides a foundation of knowledge and can help identify gaps in information that require further investigation.

- Data Sources: Explore various data sources to collect valuable industry information. These sources may include industry-specific associations, government agencies, trade publications, and reputable market research firms. Make sure to cross-reference data from multiple sources to ensure accuracy and reliability.

2. Identifying Relevant Industry Metrics

Understanding and identifying the right industry metrics is essential for meaningful analysis. Here, we'll discuss key metrics that can provide valuable insights:

- Market Size: Determining the market's size, whether in terms of revenue, units sold, or customer base, is a fundamental metric. It offers a snapshot of the industry's scale and potential.

- Market Growth Rate: Assessing historical and projected growth rates is crucial for identifying trends and opportunities. Understanding how the market has evolved over time can guide strategic decisions.

- Market Share Analysis: Analyzing market share among industry players can help you identify dominant competitors and their respective positions. This metric also assists in gauging your own company's market presence.

- Market Segmentation : Segmenting the market based on demographics, geography, behavior, or other criteria can provide deeper insights. Understanding the specific needs and preferences of various market segments can inform targeted strategies.

3. Gathering Competitive Intelligence

Competitive intelligence is the cornerstone of effective industry analysis. To gather and utilize information about your competitors:

- Competitor Identification: Begin by creating a comprehensive list of your primary and potential competitors. Consider businesses that offer similar products or services within your target market. It's essential to cast a wide net to capture all relevant competitors.

- SWOT Analysis : Conduct a thorough SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for each competitor. This analysis helps you identify their internal strengths and weaknesses, as well as external opportunities and threats they face.

- Market Share Analysis: Determine the market share held by each competitor and how it has evolved over time. Analyzing changes in market share can reveal shifts in competitive dynamics.

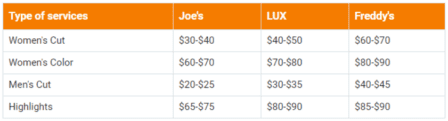

- Product and Pricing Analysis: Evaluate your competitors' product offerings and pricing strategies . Identify any unique features or innovations they offer and consider how your own products or services compare.

- Marketing and Branding Strategies: Examine the marketing and branding strategies employed by competitors. This includes their messaging, advertising channels, and customer engagement tactics. Assess how your marketing efforts stack up.

Industry Analysis Frameworks and Models

Now, let's explore essential frameworks and models commonly used in industry analysis, providing you with practical insights and examples to help you effectively apply these tools.

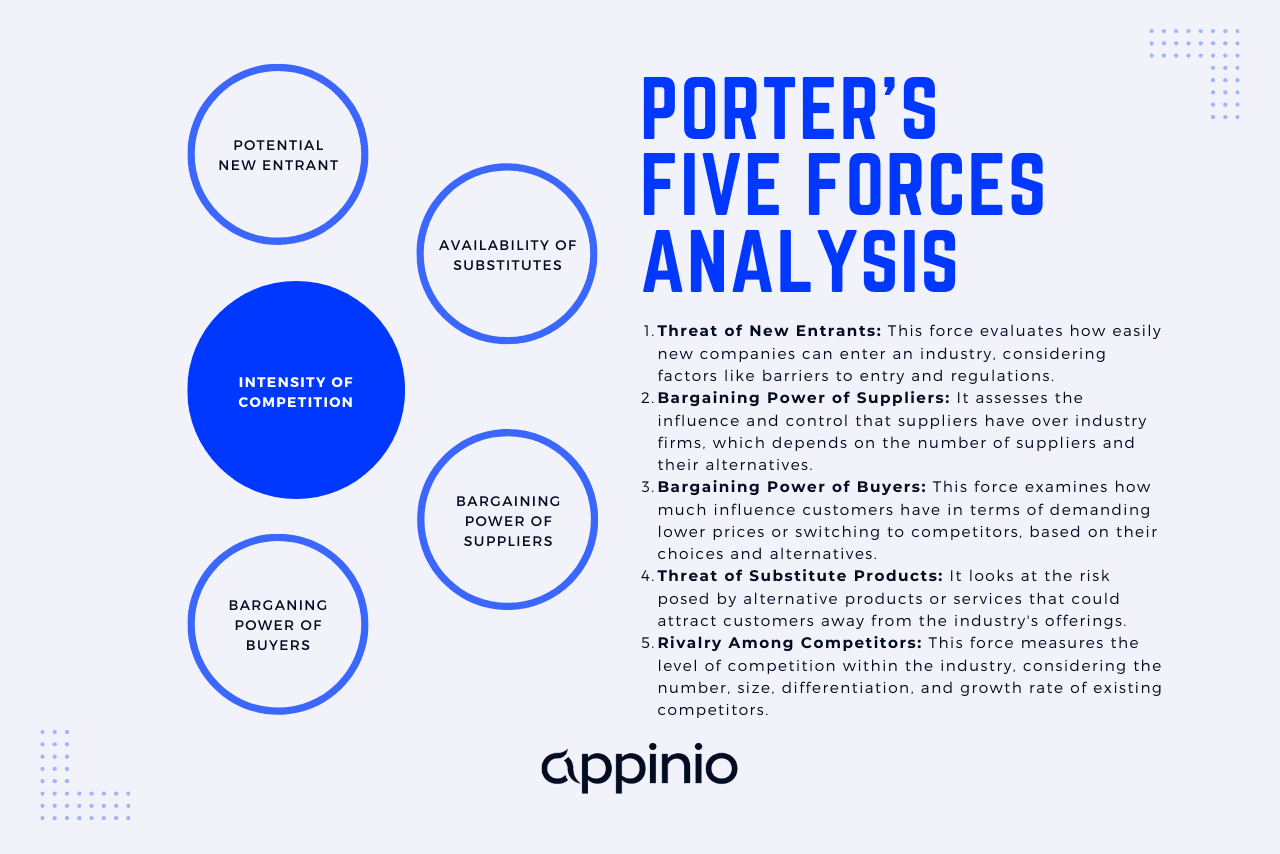

Porter's Five Forces Model

Porter's Five Forces is a powerful framework developed by Michael Porter to assess the competitive forces within an industry. This model helps you understand the industry's attractiveness and competitive dynamics.

It consists of five key forces:

- Threat of New Entrants: This force evaluates how easy or difficult it is for new companies to enter the industry. Factors that increase barriers to entry include high capital requirements, strong brand loyalty among existing players, and complex regulatory hurdles. For example, the airline industry has significant barriers to entry due to the need for large capital investments in aircraft, airport facilities, and regulatory approvals.

- Bargaining Power of Suppliers: This force examines the influence suppliers have on the industry's profitability. Powerful suppliers can demand higher prices or impose unfavorable terms. For instance, in the automotive industry, suppliers of critical components like microchips can wield significant bargaining power if they are few in number or if their products are highly specialized.

- Bargaining Power of Buyers: The bargaining power of buyers assesses how much influence customers have in negotiating prices and terms. In industries where buyers have many alternatives, such as the smartphone market, they can demand lower prices and better features, putting pressure on manufacturers to innovate and compete.

- Threat of Substitutes: This force considers the availability of substitute products or services that could potentially replace what the industry offers. For example, the rise of electric vehicles represents a significant threat to the traditional gasoline-powered automotive industry as consumers seek eco-friendly alternatives.

- Competitive Rivalry: Competitive rivalry assesses the intensity of competition among existing firms in the industry. A highly competitive industry, such as the smartphone market, often leads to price wars and aggressive marketing strategies as companies vie for market share.

Example: Let's consider the coffee shop industry . New entrants face relatively low barriers, as they can set up a small shop with limited capital. However, the bargaining power of suppliers, such as coffee bean producers, can vary depending on the region and the coffee's rarity. Bargaining power with buyers is moderate, as customers often have several coffee shops to choose from. Threats of substitutes may include energy drinks or homemade coffee, while competitive rivalry is high, with numerous coffee chains and independent cafes competing for customers.

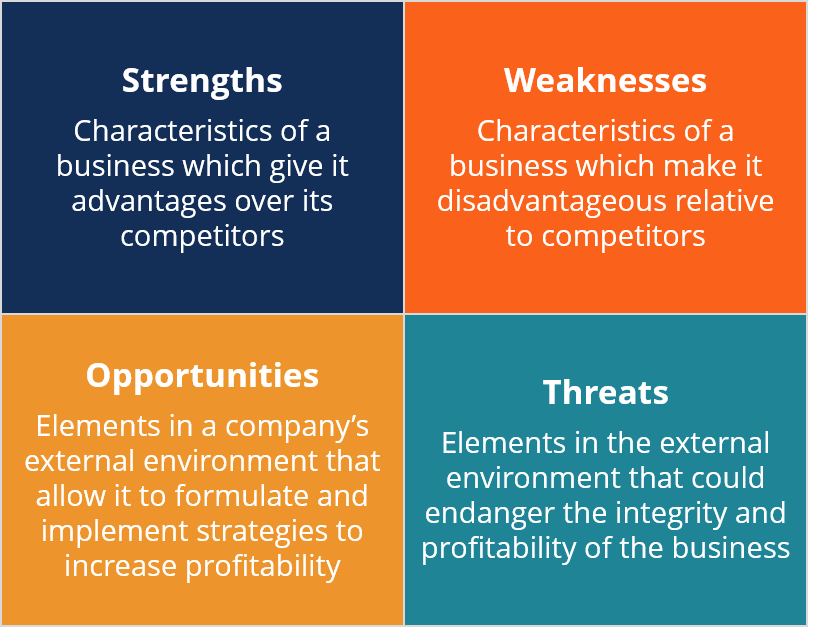

SWOT Analysis

SWOT Analysis is a versatile tool used to assess an organization's internal strengths and weaknesses, as well as external opportunities and threats. By conducting a SWOT analysis, you can gain a comprehensive understanding of your industry and formulate effective strategies.

- Strengths: These are the internal attributes and capabilities that give your business a competitive advantage. For instance, if you're a tech company, having a talented and innovative team can be considered a strength.

- Weaknesses: Weaknesses are internal factors that hinder your business's performance. For example, a lack of financial resources or outdated technology can be weaknesses that need to be addressed.

- Opportunities: Opportunities are external factors that your business can capitalize on. This could be a growing market segment, emerging technologies, or changing consumer trends.

- Threats: Threats are external factors that can potentially harm your business. Examples of threats might include aggressive competition, economic downturns, or regulatory changes.

Example: Let's say you're analyzing the fast-food industry. Strengths could include a well-established brand, a wide menu variety, and efficient supply chain management. Weaknesses may involve a limited focus on healthy options and potential labor issues. Opportunities could include the growing trend toward healthier eating, while threats might encompass health-conscious consumer preferences and increased competition from delivery apps.

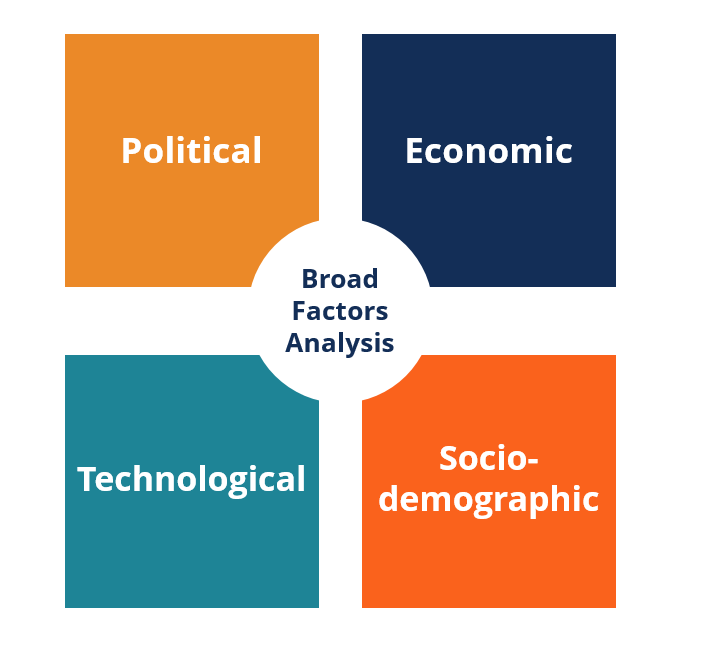

PESTEL Analysis

PESTEL Analysis examines the external macro-environmental factors that can impact your industry. The acronym stands for:

- Political: Political factors encompass government policies, stability, and regulations. For example, changes in tax laws or trade agreements can affect industries like international manufacturing.

- Economic: Economic factors include economic growth, inflation rates, and exchange rates. A fluctuating currency exchange rate can influence export-oriented industries like tourism.

- Social: Social factors encompass demographics, cultural trends, and social attitudes. An aging population can lead to increased demand for healthcare services and products.

- Technological: Technological factors involve advancements and innovations. Industries like telecommunications are highly influenced by technological developments, such as the rollout of 5G networks.

- Environmental: Environmental factors cover sustainability, climate change, and ecological concerns. Industries such as renewable energy are directly impacted by environmental regulations and consumer preferences.

- Legal: Legal factors encompass laws, regulations, and compliance requirements. The pharmaceutical industry, for instance, faces stringent regulatory oversight and patent protection laws.

Example: Consider the automobile manufacturing industry. Political factors may include government incentives for electric vehicles. Economic factors can involve fluctuations in fuel prices affecting consumer preferences for fuel-efficient cars. Social factors might encompass the growing interest in eco-friendly transportation options. Technological factors could relate to advancements in autonomous driving technology. Environmental factors may involve emissions regulations, while legal factors could pertain to safety standards and recalls.

Industry Life Cycle Analysis

Industry Life Cycle Analysis categorizes industries into various stages based on their growth and maturity. Understanding where your industry stands in its life cycle can help shape your strategies.

- Introduction: In the introduction stage, the industry is characterized by slow growth, limited competition, and a focus on product development. New players enter the market, and consumers become aware of the product or service. For instance, electric scooters were introduced as a new mode of transportation in recent years.

- Growth: The growth stage is marked by rapid market expansion, increased competition, and rising demand. Companies focus on gaining market share, and innovation is vital. The ride-sharing industry, exemplified by companies like Uber and Lyft, experienced significant growth in this stage.

- Maturity: In the maturity stage, the market stabilizes, and competition intensifies. Companies strive to maintain market share and differentiate themselves through branding and customer loyalty programs. The smartphone industry reached maturity with multiple established players.

- Decline: In the decline stage, the market saturates, and demand decreases. Companies must adapt or diversify to survive. The decline of traditional print media is a well-known example.

Example: Let's analyze the video streaming industry . The introduction stage saw the emergence of streaming services like Netflix. In the growth stage, more players entered the market, and the industry saw rapid expansion. The industry is currently in the maturity stage, with established platforms like Netflix, Amazon Prime, and Disney+ competing for market share. However, with continued innovation and changing consumer preferences, the decline stage may eventually follow.

Value Chain Analysis

Value Chain Analysis dissects a company's activities into primary and support activities to identify areas of competitive advantage. Primary activities directly contribute to creating and delivering a product or service, while support activities facilitate primary activities.

- Primary Activities: These activities include inbound logistics (receiving and storing materials), operations (manufacturing or service delivery), outbound logistics (distribution), marketing and sales, and customer service.

- Support Activities: Support activities include procurement (acquiring materials and resources), technology development (R&D and innovation), human resource management (recruitment and training), and infrastructure (administrative and support functions).

Example: Let's take the example of a smartphone manufacturer. Inbound logistics involve sourcing components, such as processors and displays. Operations include assembly and quality control. Outbound logistics cover shipping and distribution. Marketing and sales involve advertising and retail partnerships. Customer service handles warranty and support.

Procurement ensures a stable supply chain for components. Technology development focuses on research and development of new features. Human resource management includes hiring and training skilled engineers. Infrastructure supports the company's administrative functions.

By applying these frameworks and models effectively, you can better understand your industry, identify strategic opportunities and threats, and develop a solid foundation for informed decision-making.

Data Interpretation and Analysis

Once you have your data, it's time to start interpreting and analyzing the data you've collected during your industry analysis.

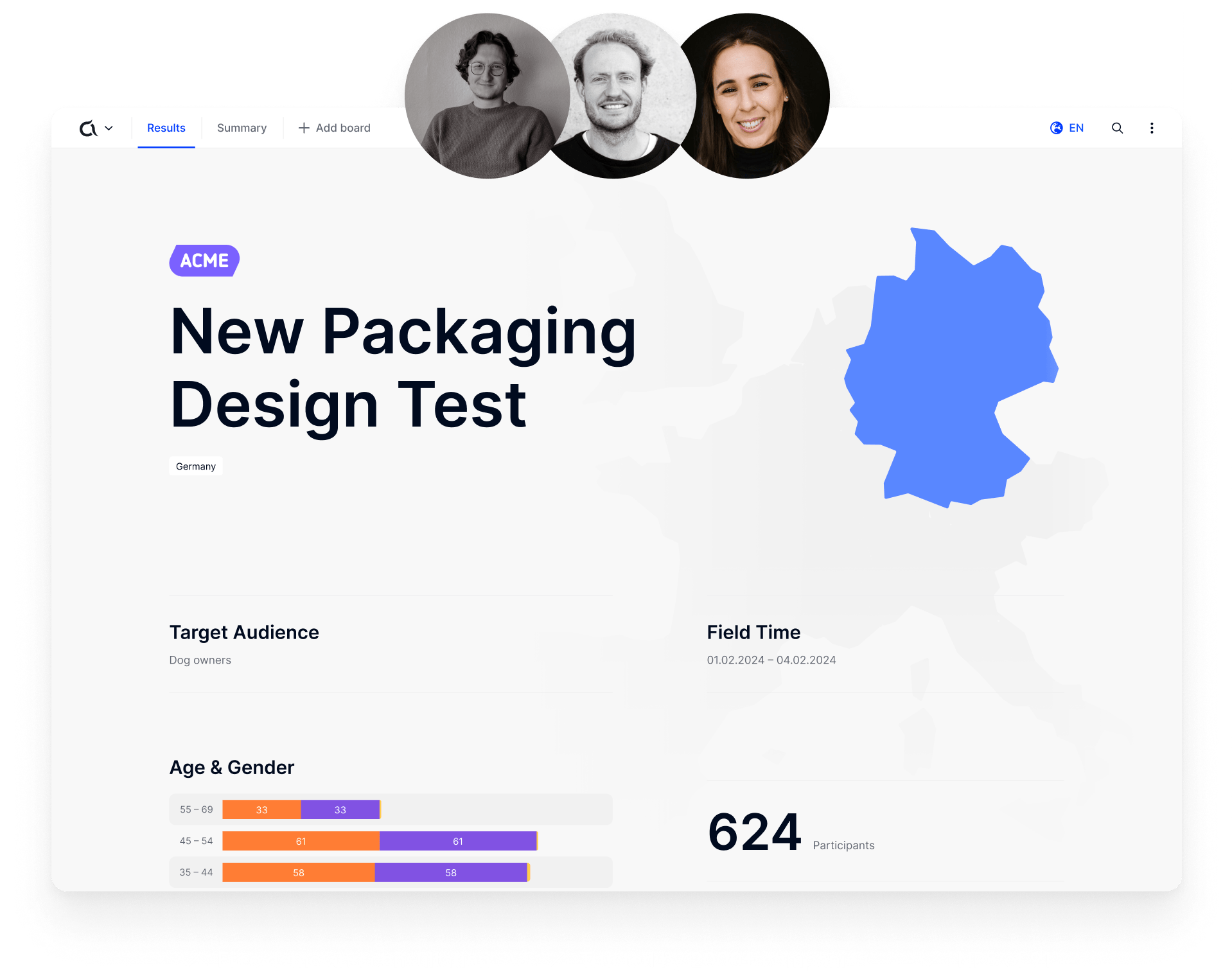

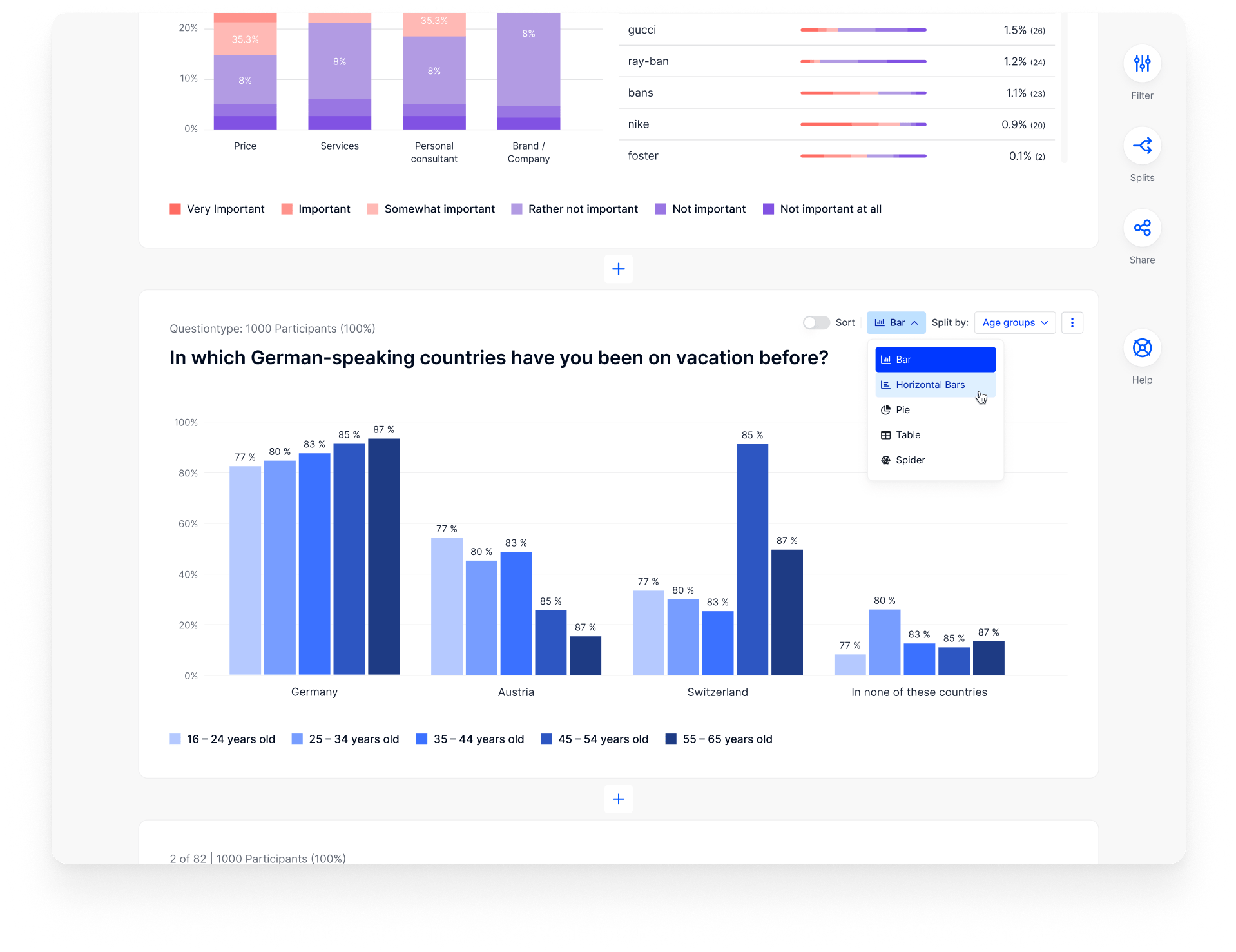

You can unlock the full potential of your data with Appinio 's comprehensive research platform. Beyond aiding in data collection, Appinio simplifies the intricate process of data interpretation and analysis. Our intuitive tools empower you to effortlessly transform raw data into actionable insights, giving you a competitive edge in understanding your industry.

Whether it's assessing market trends, evaluating the competitive landscape, or understanding customer behavior, Appinio offers a holistic solution to uncover valuable findings. With our platform, you can make informed decisions, strategize effectively, and stay ahead of industry shifts.

Experience the ease of data collection and interpretation with Appinio – book a demo today!

Get a free demo and see the Appinio platform in action!

1. Analyze Market Size and Growth

Analyzing the market's size and growth is essential for understanding its dynamics and potential. Here's how to conduct a robust analysis:

- Market Size Calculation: Determine the total market size in terms of revenue, units sold, or the number of customers. This figure serves as a baseline for evaluating the industry's scale.

- Historical Growth Analysis: Examine historical data to identify growth trends. This includes looking at past year-over-year growth rates and understanding the factors that influenced them.

- Projected Growth Assessment: Explore industry forecasts and projections to gain insights into the expected future growth of the market. Consider factors such as emerging technologies, changing consumer preferences, and economic conditions.

- Segmentation Analysis: If applicable, analyze market segmentation data to identify growth opportunities in specific market segments. Understand which segments are experiencing the most significant growth and why.

2. Assess Market Trends

Stay ahead of the curve by closely monitoring and assessing market trends. Here's how to effectively evaluate trends within your industry.

- Consumer Behavior Analysis: Dive into consumer behavior data to uncover shifts in preferences, buying patterns, and shopping habits. Understand how technological advancements and cultural changes influence consumer choices.

- Technological Advancements: Keep a keen eye on technological developments that impact your industry. Assess how innovations such as AI, IoT, blockchain, or automation are changing the competitive landscape.

- Regulatory Changes: Stay informed about regulatory shifts and their potential consequences for your industry. Regulations can significantly affect product development, manufacturing processes, and market entry strategies.

- Sustainability and Environmental Trends: Consider the growing importance of sustainability and environmental concerns. Evaluate how your industry is adapting to eco-friendly practices and how these trends affect consumer choices.

3. Evaluate Competitive Landscape

Understanding the competitive landscape is critical for positioning your business effectively. To perform a comprehensive evaluation:

- Competitive Positioning: Determine where your company stands in comparison to competitors. Identify your unique selling propositions and areas where you excel.

- Market Share Analysis: Continuously monitor market share among industry players. Identify trends in market share shifts and assess the strategies that lead to such changes.

- Competitive Advantages and Weaknesses: Analyze your competitors' strengths and weaknesses. Identify areas where you can capitalize on their weaknesses and where you need to fortify your own strengths.

4. Identify Key Success Factors

Recognizing and prioritizing key success factors is crucial for developing effective strategies. To identify and leverage these factors:

- Customer Satisfaction: Prioritize customer satisfaction as a critical success factor. Satisfied customers are more likely to become loyal advocates and contribute to long-term success.

- Quality and Innovation: Focus on product or service quality and continuous innovation. Meeting and exceeding customer expectations can set your business apart from competitors.

- Cost Efficiency: Strive for cost efficiency in your operations. Identifying cost-saving opportunities can lead to improved profitability.

- Marketing and Branding Excellence: Invest in effective marketing and branding strategies to create a strong market presence. Building a recognizable brand can drive customer loyalty and growth.

5. Analyze Customer Behavior and Preferences

Understanding your target audience is central to success. Here's how to analyze customer behavior and preferences:

- Market Segmentation: Use market segmentation to categorize customers based on demographics, psychographics , and behavior. This allows for more personalized marketing and product/service offerings.

- Customer Surveys and Feedback: Gather customer feedback through surveys and feedback mechanisms. Understand their pain points, preferences, and expectations to tailor your offerings.

- Consumer Journey Mapping: Map the customer journey to identify touchpoints where you can improve engagement and satisfaction. Optimize the customer experience to build brand loyalty.

By delving deep into data interpretation and analysis, you can gain valuable insights into your industry, uncover growth opportunities, and refine your strategic approach.

How to Conduct Competitor Analysis?

Competitor analysis is a critical component of industry analysis as it provides valuable insights into your rivals, helping you identify opportunities, threats, and areas for improvement.

1. Identify Competitors

Identifying your competitors is the first step in conducting a thorough competitor analysis. Competitors can be classified into several categories:

- Direct Competitors: These are companies that offer similar products or services to the same target audience. They are your most immediate competitors and often compete directly with you for market share.

- Indirect Competitors: Indirect competitors offer products or services that are related but not identical to yours. They may target a slightly different customer segment or provide an alternative solution to the same problem.

- Potential Competitors: These companies could enter your market in the future. Identifying potential competitors early allows you to anticipate and prepare for new entrants.

- Substitute Products or Services: While not traditional competitors, substitute products or services can fulfill the same customer needs or desires. Understanding these alternatives is crucial to your competitive strategy.

2. Analyze Competitor Strengths and Weaknesses

Once you've identified your competitors, you need to analyze their strengths and weaknesses. This analysis helps you understand how to position your business effectively and identify areas where you can gain a competitive edge.

- Strengths: Consider what your competitors excel at. This could include factors such as brand recognition, innovative products, a large customer base, efficient operations, or strong financial resources.

- Weaknesses: Identify areas where your competitors may be lacking. Weaknesses could involve limited product offerings, poor customer service, outdated technology, or financial instability.

3. Competitive Positioning

Competitive positioning involves defining how you want your business to be perceived relative to your competitors. It's about finding a unique position in the market that sets you apart. Consider the following strategies:

- Cost Leadership: Strive to be the low-cost provider in your industry. This positioning appeals to price-conscious consumers.

- Differentiation: Focus on offering unique features or attributes that make your products or services stand out. This can justify premium pricing.

- Niche Market: Target a specific niche or segment of the market that may be underserved by larger competitors. Tailor your offerings to meet their unique needs.

- Innovation and Technology: Emphasize innovation and technology to position your business as a leader in product or service quality.

- Customer-Centric: Prioritize exceptional customer service and customer experience to build loyalty and a positive reputation.

4. Benchmarking and Gap Analysis

Benchmarking involves comparing your business's performance and practices with those of your competitors or industry leaders. Gap analysis helps identify areas where your business falls short and where improvements are needed.

- Performance Benchmarking: Compare key performance metrics, such as revenue, profitability, market share, and customer satisfaction, with those of your competitors. Identify areas where your performance lags behind or exceeds industry standards.

- Operational Benchmarking: Analyze your operational processes, supply chain, and cost structures compared to your competitors. Look for opportunities to streamline operations and reduce costs.

- Product or Service Benchmarking: Evaluate the features, quality, and pricing of your products or services relative to competitors. Identify gaps and areas for improvement.

- Marketing and Sales Benchmarking: Assess your marketing strategies, customer acquisition costs, and sales effectiveness compared to competitors. Determine whether your marketing efforts are performing at a competitive level.

Market Entry and Expansion Strategies

Market entry and expansion strategies are crucial for businesses looking to enter new markets or expand their presence within existing ones. These strategies can help you effectively target and penetrate your chosen markets.

Market Segmentation and Targeting

- Market Segmentation: Begin by segmenting your target market into distinct groups based on demographics , psychographics, behavior, or other relevant criteria. This helps you understand the diverse needs and preferences of different customer segments.

- Targeting: Once you've segmented the market, select specific target segments that align with your business goals and capabilities. Tailor your marketing and product/service offerings to appeal to these chosen segments.

Market Entry Modes

Selecting the proper market entry mode is crucial for a successful expansion strategy. Entry modes include:

- Exporting: Sell your products or services in international markets through exporting. This is a low-risk approach, but it may limit your market reach.

- Licensing and Franchising: License your brand, technology, or intellectual property to local partners or franchisees. This allows for rapid expansion while sharing the risk and control.

- Joint Ventures and Alliances: Partner with local companies through joint ventures or strategic alliances. This approach leverages local expertise and resources.

- Direct Investment: Establish a physical presence in the target market through subsidiaries, branches, or wholly-owned operations. This offers full control but comes with higher risk and investment.

Competitive Strategy Formulation

Your competitive strategy defines how you will compete effectively in the target market.

- Cost Leadership: Strive to offer products or services at lower prices than competitors while maintaining quality. This strategy appeals to price-sensitive consumers.

- Product Differentiation: Focus on offering unique and innovative products or services that stand out in the market. This strategy justifies premium pricing.

- Market Niche: Target a specific niche or segment within the market that is underserved or has particular needs. Tailor your offerings to meet the unique demands of this niche.

- Market Expansion : Expand your product or service offerings to capture a broader share of the market. This strategy involves diversifying your offerings to appeal to a broader audience.

- Global Expansion: Consider expanding internationally to tap into new markets and diversify your customer base. This strategy involves thorough market research and adaptation to local cultures and regulations.

International Expansion Considerations

If your expansion strategy involves international markets, there are several additional considerations to keep in mind.

- Market Research: Conduct in-depth market research to understand the target country's cultural, economic, and legal differences.

- Regulatory Compliance: Ensure compliance with international trade regulations, customs, and import/export laws.

- Cultural Sensitivity: Adapt your marketing and business practices to align with the cultural norms and preferences of the target market.

- Localization: Consider adapting your products, services, and marketing materials to cater to local tastes and languages.

- Risk Assessment: Evaluate the political, economic, and legal risks associated with operating in the target country. Develop risk mitigation strategies.

By carefully analyzing your competitors and crafting effective market entry and expansion strategies, you can position your business for success in both domestic and international markets.

Risk Assessment and Mitigation

Risk assessment and mitigation are crucial aspects of industry analysis and strategic planning. Identifying potential risks, assessing vulnerabilities, and implementing effective risk management strategies are essential for business continuity and success.

1. Identify Industry Risks

- Market Risks: These risks pertain to factors such as changes in market demand, economic downturns, shifts in consumer preferences, and fluctuations in market prices. For example, the hospitality industry faced significant market risks during the COVID-19 pandemic, resulting in decreased travel and tourism .

- Regulatory and Compliance Risks: Regulatory changes, compliance requirements, and government policies can pose risks to businesses. Industries like healthcare are particularly susceptible to regulatory changes that impact operations and reimbursement.

- Technological Risks: Rapid technological advancements can disrupt industries and render existing products or services obsolete. Companies that fail to adapt to technological shifts may face obsolescence.

- Operational Risks: These risks encompass internal factors that can disrupt operations, such as supply chain disruptions, equipment failures, or cybersecurity breaches.

- Financial Risks: Financial risks include factors like liquidity issues, credit risk , and market volatility. Industries with high capital requirements, such as real estate development, are particularly vulnerable to financial risks.

- Competitive Risks: Intense competition and market saturation can pose challenges to businesses. Failing to respond to competitive threats can result in loss of market share.

- Global Risks: Industries with a worldwide presence face geopolitical risks, currency fluctuations, and international trade uncertainties. For instance, the automotive industry is susceptible to trade disputes affecting the supply chain.

2. Assess Business Vulnerabilities

- SWOT Analysis: Revisit your SWOT analysis to identify internal weaknesses and threats. Assess how these weaknesses may exacerbate industry risks.

- Financial Health: Evaluate your company's financial stability, debt levels, and cash flow. Identify vulnerabilities related to financial health that could hinder your ability to withstand industry-specific challenges.

- Operational Resilience: Assess the robustness of your operational processes and supply chain. Identify areas where disruptions could occur and develop mitigation strategies.

- Market Positioning: Analyze your competitive positioning and market share. Recognize vulnerabilities in your market position that could be exploited by competitors.

- Compliance and Regulatory Adherence: Ensure that your business complies with relevant regulations and standards. Identify vulnerabilities related to non-compliance or regulatory changes.

3. Risk Management Strategies

- Risk Avoidance: In some cases, the best strategy is to avoid high-risk ventures or markets altogether. This may involve refraining from entering certain markets or discontinuing products or services with excessive risk.

- Risk Reduction: Implement measures to reduce identified risks. For example, diversifying your product offerings or customer base can reduce dependence on a single revenue source.

- Risk Transfer: Transfer some risks through methods such as insurance or outsourcing. For instance, businesses can mitigate cybersecurity risks by purchasing cyber insurance.

- Risk Acceptance: In cases where risks cannot be entirely mitigated, it may be necessary to accept a certain level of risk and have contingency plans in place to address potential issues.

- Continuous Monitoring: Establish a system for continuous risk monitoring. Regularly assess the changing landscape and adjust risk management strategies accordingly.

4. Contingency Planning

Contingency planning involves developing strategies and action plans to respond effectively to unforeseen events or crises. It ensures that your business can maintain operations and minimize disruptions in the face of adverse circumstances. Key elements of contingency planning include:

- Risk Scenarios: Identify potential risk scenarios specific to your industry and business. These scenarios should encompass a range of possibilities, from minor disruptions to major crises.

- Response Teams: Establish response teams with clearly defined roles and responsibilities. Ensure that team members are trained and ready to act in the event of a crisis.

- Communication Plans: Develop communication plans that outline how you will communicate with employees, customers, suppliers, and other stakeholders during a crisis. Transparency and timely communication are critical.

- Resource Allocation: Determine how resources, including personnel, finances, and equipment, will be allocated in response to various scenarios.

- Testing and Simulation: Regularly conduct tests and simulations of your contingency plans to identify weaknesses and areas for improvement. Ensure your response teams are well-practiced and ready to execute the plans effectively.

- Documentation and Record Keeping: Maintain comprehensive documentation of contingency plans, response procedures, and communication protocols. This documentation should be easily accessible to relevant personnel.

- Review and Update: Continuously review and update your contingency plans to reflect changing industry dynamics and evolving risks. Regularly seek feedback from response teams to make improvements.

By identifying industry risks, assessing vulnerabilities, implementing risk management strategies, and developing robust contingency plans, your business can navigate the complexities of the industry landscape with greater resilience and preparedness.

Industry Analysis Template

When embarking on the journey of Industry Analysis, having a well-structured template is akin to having a reliable map for your exploration. It provides a systematic framework to ensure you cover all essential aspects of the analysis. Here's a breakdown of an industry analysis template with insights into each section.

Industry Overview

- Objective: Provide a broad perspective of the industry.

- Market Definition: Define the scope and boundaries of the industry, including its products, services, and target audience.

- Market Size and Growth: Present current market size, historical growth trends, and future projections.

- Key Players: Identify major competitors and their market share.

- Market Trends: Highlight significant trends impacting the industry.

Competitive Analysis

- Objective: Understand the competitive landscape within the industry.

- Competitor Identification: List direct and indirect competitors.

- Competitor Profiles: Provide detailed profiles of major competitors, including their strengths, weaknesses, strategies, and market positioning.

- SWOT Analysis: Conduct a SWOT analysis for each major competitor.

- Market Share Analysis: Analyze market share distribution among competitors.

Market Analysis

- Objective: Explore the characteristics and dynamics of the market.

- Customer Segmentation: Define customer segments and their demographics, behavior, and preferences.

- Demand Analysis: Examine factors driving demand and customer buying behavior.

- Supply Chain Analysis: Map out the supply chain, identifying key suppliers and distribution channels.

- Regulatory Environment: Discuss relevant regulations, policies, and compliance requirements.

Technological Analysis

- Objective: Evaluate the technological landscape impacting the industry.

- Technological Trends: Identify emerging technologies and innovations relevant to the industry.

- Digital Transformation: Assess the level of digitalization within the industry and its impact on operations and customer engagement.

- Innovation Opportunities: Explore opportunities for leveraging technology to gain a competitive edge.

Financial Analysis

- Objective: Analyze the financial health of the industry and key players.

- Revenue and Profitability: Review industry-wide revenue trends and profitability ratios.

- Financial Stability: Assess financial stability by examining debt levels and cash flow.

- Investment Patterns: Analyze capital expenditure and investment trends within the industry.

Consumer Insights

- Objective: Understand consumer behavior and preferences.

- Consumer Surveys: Conduct surveys or gather data on consumer preferences, buying habits , and satisfaction levels.

- Market Perception: Gauge consumer perception of brands and products in the industry.

- Consumer Feedback: Collect and analyze customer feedback and reviews.

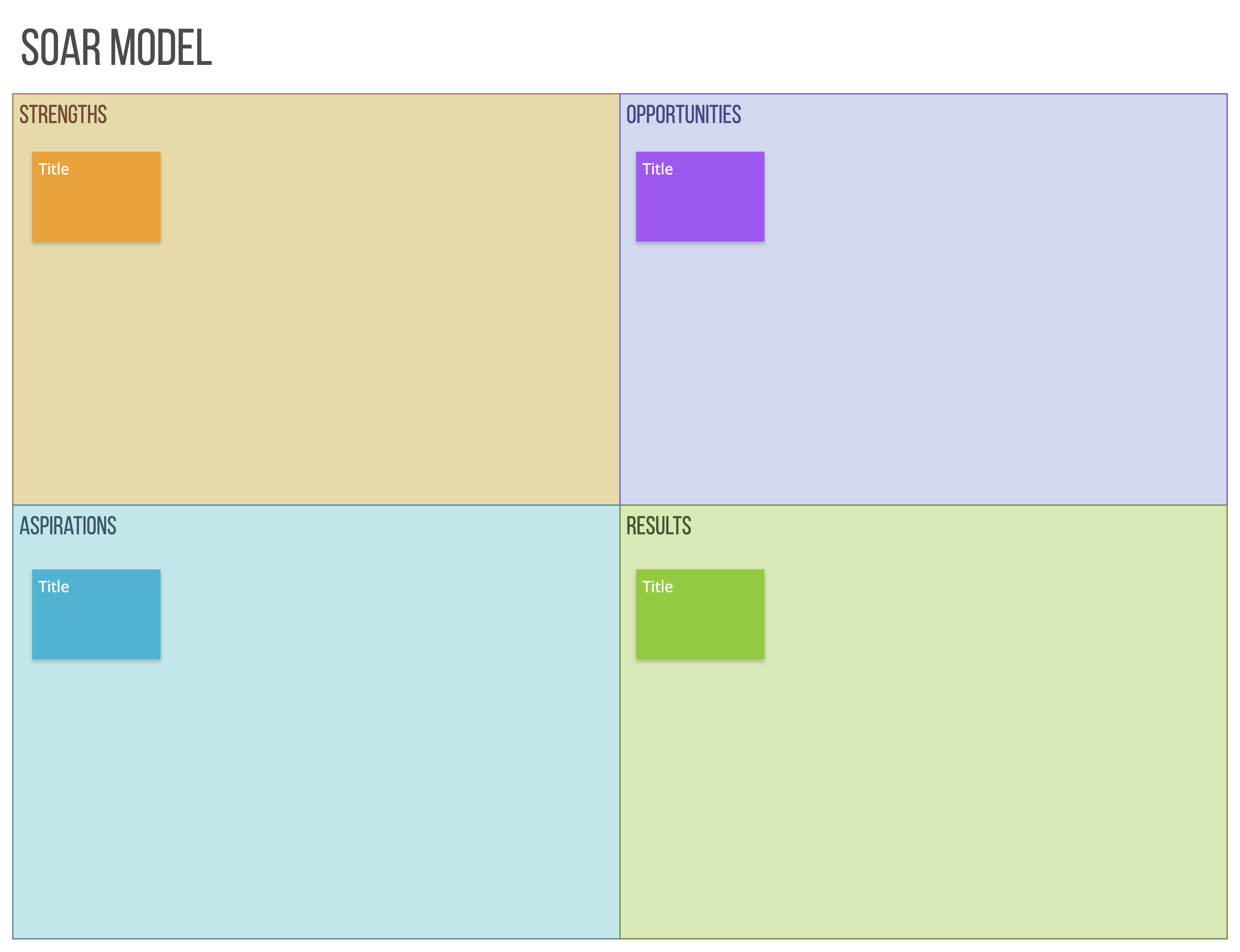

SWOT Analysis for Your Business

- Objective: Assess your own business within the industry context.

- Strengths: Identify internal strengths that give your business a competitive advantage.

- Weaknesses: Recognize internal weaknesses that may hinder your performance.

- Opportunities: Explore external opportunities that your business can capitalize on.

- Threats: Recognize external threats that may impact your business.

Conclusion and Recommendations

- Objective: Summarize key findings and provide actionable recommendations.

- Summary: Recap the most critical insights from the analysis.

- Recommendations: Offer strategic recommendations for your business based on the analysis.

- Future Outlook: Discuss potential future developments in the industry.

While this template provides a structured approach, adapt it to the specific needs and objectives of your Industry Analysis. It serves as your guide, helping you navigate through the complex landscape of your chosen industry, uncovering opportunities, and mitigating risks along the way.

Remember that the depth and complexity of your industry analysis may vary depending on your specific goals and the industry you are assessing. You can adapt this template to focus on the most relevant aspects and conduct thorough research to gather accurate data and insights. Additionally, consider using industry-specific data sources, reports, and expert opinions to enhance the quality of your analysis.

Industry Analysis Examples

To grasp the practical application of industry analysis, let's delve into a few diverse examples across different sectors. These real-world scenarios demonstrate how industry analysis can guide strategic decision-making.

Tech Industry - Smartphone Segment

Scenario: Imagine you are a product manager at a tech company planning to enter the smartphone market. Industry analysis reveals that the market is highly competitive, dominated by established players like Apple and Samsung.

Use of Industry Analysis:

- Competitive Landscape: Analyze the strengths and weaknesses of competitors, identifying areas where they excel (e.g., Apple's brand loyalty ) and where they might have vulnerabilities (e.g., consumer demand for more affordable options).

- Market Trends: Identify trends like the growing demand for sustainable technology and 5G connectivity, guiding product development and marketing strategies.

- Regulatory Factors: Consider regulatory factors related to intellectual property rights, patents, and international trade agreements that can impact market entry and operations.

- Outcome: Armed with insights from industry analysis, you decide to focus on innovation, emphasizing features like eco-friendliness and affordability. This niche approach helps your company gain a foothold in the competitive market.

Healthcare Industry - Telehealth Services

Scenario: You are a healthcare entrepreneur exploring opportunities in the telehealth sector, especially in the wake of the COVID-19 pandemic. Industry analysis is critical due to rapid market changes.

- Market Size and Growth: Evaluate the growing demand for telehealth services, driven by the need for remote healthcare during the pandemic and convenience factors.

- Regulatory Environment: Understand the evolving regulatory landscape, including changes in telemedicine reimbursement policies and licensing requirements.

- Technological Trends: Explore emerging technologies such as AI-powered diagnosis and remote monitoring that can enhance service offerings.

- Outcome: Industry analysis underscores the potential for telehealth growth. You adapt your business model to align with regulatory changes, invest in cutting-edge technology, and focus on patient-centric care, positioning your telehealth service for success.

Food Industry - Plant-Based Foods

Scenario: As a food industry entrepreneur , you are considering entering the plant-based foods market, driven by increasing consumer interest in health and sustainability.

- Market Trends: Analyze the trend toward plant-based diets and sustainability, reflecting changing consumer preferences.

- Competitive Landscape: Assess the competitive landscape, understanding that established companies and startups are vying for market share.

- Consumer Behavior: Study consumer behavior, recognizing that health-conscious consumers seek plant-based alternatives.

- Outcome: Informed by industry analysis, you launch a line of plant-based products emphasizing both health benefits and sustainability. Effective marketing and product quality gain traction among health-conscious consumers, making your brand a success in the plant-based food industry.

These examples illustrate how industry analysis can guide strategic decisions, whether entering competitive tech markets, navigating dynamic healthcare regulations, or capitalizing on shifting consumer preferences in the food industry. By applying industry analysis effectively, businesses can adapt, innovate, and thrive in their respective sectors.

Conclusion for Industry Analysis

Industry Analysis is the compass that helps businesses chart their course in the vast sea of markets. By understanding the industry's dynamics, risks, and opportunities, you gain a strategic advantage that can steer your business towards success. From identifying competitors to mitigating risks and formulating competitive strategies, this guide has equipped you with the tools and knowledge needed to navigate the complexities of the business world.

Remember, Industry Analysis is not a one-time task; it's an ongoing journey. Keep monitoring market trends, adapting to changes, and staying ahead of the curve. With a solid foundation in industry analysis, you're well-prepared to tackle challenges, seize opportunities, and make well-informed decisions that drive your business toward prosperity. So, set sail with confidence and let industry analysis be your guiding star on the path to success.

How to Conduct Industry Analysis in Minutes?

Introducing Appinio , the real-time market research platform that transforms how you conduct Industry Analysis. Imagine getting real-time consumer insights in minutes, putting the power of data-driven decision-making at your fingertips. With Appinio, you can:

- Gain insights swiftly: Say goodbye to lengthy research processes. Appinio delivers answers fast, ensuring you stay ahead in the competitive landscape.

- No research degree required: Our intuitive platform is designed for everyone. You don't need a PhD in research to harness its capabilities.

- Global reach, local insights: Define your target group precisely from over 1200 characteristics and access consumer data in over 90 countries.

Get free access to the platform!

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

03.09.2024 | 3min read

Get your brand Holiday Ready: 4 Essential Steps to Smash your Q4

03.09.2024 | 8min read

Beyond Demographics: Psychographics power in target group identification

29.08.2024 | 32min read

What is Convenience Sampling? Definition, Method, Examples

How to Conduct an Industry Analysis

- March 21, 2024

- Business Plan , How to Write

An industry analysis is a fundamental component of any business plan, offering insights into the market dynamics, competitive landscape , and future market trends . This analysis helps businesses understand their industry’s environment, make informed strategic decisions, and identify potential opportunities and threats.

This guide will walk you through the steps of conducting a thorough industry analysis, using examples to illustrate key points.

Identify Your Industry

Before diving into the analysis, it’s crucial to clearly identify and define your industry. This involves outlining the scope in terms of products, services, and geographic reach.

Understanding the industry’s value chain and how your business fits within this ecosystem is essential. Consider the broader market forces at play, the typical customer base, and the regulatory landscape that shapes your industry’s boundaries.

- Example for a Hair Salon : If you’re opening a hair salon, your industry encompasses beauty and personal care services focused on hair treatment and styling.

Gather Information

The foundation of a solid industry analysis is robust data collection.

Utilize a variety of sources to gather information about your industry, including industry reports online, government publications, academic journals, and news articles. Attend industry conferences or trade shows and engage with other professionals on social media or industry forums to gain firsthand insights.

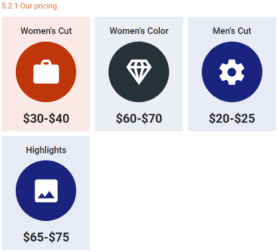

- Example for a Hair Salon : For a hair salon, look into beauty industry trends, salon service pricing strategies , and consumer spending habits in personal care services.

Analyze Market Trends

Identifying and understanding current market trends that affect your industry is vital.

Look for patterns in technological advancements, consumer behavior changes, regulatory developments, and economic factors. Projecting these trends into the future can help predict shifts in the industry landscape, allowing your business to adapt and innovate proactively.

- Example for a Hair Salon : An increasing preference for organic and eco-friendly hair care products is a significant trend in the hair salon industry.

Assess the Competitive Landscape

Analyze who your direct and indirect competitors are, what strategies they employ, their strengths and weaknesses, and their market positioning.

Tools like SWOT analyses analysis can help assess the competitive intensity and the profitability potential within the industry. This analysis also identifies potential barriers to entry and the threat of substitute products or services.

- Example for a Hair Salon : Examine other salons in your area, noting services offered, pricing levels, customer reviews, and marketing tactics.

Determine Market Entry Barriers

Barriers to entry can vary significantly across industries and affect your strategy for market entry and growth.

[link to Market Entry Barriers]

High capital requirements, strict regulatory standards, established brand loyalty, and access to distribution channels are common barriers. Identifying these early on helps in formulating strategies to overcome them, whether through innovation, strategic partnerships, or niche targeting.

- Example for a Hair Salon : For a hair salon, barriers might include the cost of acquiring a prime location, compliance with health and safety regulations, and establishing a brand in a competitive market.

Predict Future Industry Changes

Leveraging the information gathered, anticipate potential changes in the industry. This could involve innovations that disrupt traditional business models, regulatory changes, or shifts in consumer preferences. Understanding these potential changes allows businesses to be agile and adapt their strategies accordingly.

- Example for a Hair Salon : Anticipate how the growing use of online booking platforms and social media marketing could transform customer engagement strategies in the hair salon industry.

Identify Opportunities and Threats

Synthesize your findings to pinpoint opportunities for your business to exploit and threats you may need to mitigate. This SWOT analysis will be crucial for your strategic planning.

[link to SWOT]

- Example for a Hair Salon : Opportunities might include a gap in the market for salons specializing in sustainable practices. A threat could be the rising cost of eco-friendly products.

Related Posts

Pro One Janitorial Franchise Costs $9K – $76K (2024 Fees & Profits)

- July 5, 2024

Dance Studio Business Plan Template & PDF Example

- August 28, 2024

- Business Plan

Carpet and Upholstery Cleaning Business Plan Template & PDF Example

- August 29, 2024

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Industry Analysis In A Business Plan

Industry Analysis In A Business Plan –

Some decisions require a lot of thinking. You cannot just adopt “Rocks, Scissors, and Paper” to decide in such cases. Many reviews, analyses, and debates are behind such vital decisions. The same is the situation of Luke and his wife, Daisy. They have made this big decision to buy a new home. They have analyzed various areas and bungalows and buildings, and flats. Finally, they have shortlisted a small house and are about to do the paperwork. Luke has analyzed all the positives of that area and nearby amenities. Daisy, on the other hand, is having a hard time. Since it is the most significant decision for her after her marriage, she has been going nuts. She is having nightmares of all the possible things that can go wrong with the house and the new place.

Start Your Free Personal Development Course

Effective resume making, job hunting, campus recruitment training & others

But nothing went wrong in their case, and they lived happily in the new home. As an intelligent person, Luke had done some proper analysis and predictions. He made calculations of the possibilities and prospects of that area and came up with a positive outlook. Impressive right? But do you want to know a little secret?

Luke has some fantastic analytical skills . So the question is, from where did he get such skills? Is it hereditary? Or has he developed it over time?

How do you think Luke was able to buy such a magnificent new home? The answer is that Luke is a big fan of Warren Buffet. He has been investing in the stock market for a long time and doing well. Before investing in any company, Luke analyzed that sector and industry well. He came up with his industry analysis report and decided whether to invest in that sector or the company. So let’s use Luke’s analytical skills and get insights into what industry analysis is in a business plan and how to perform the same. So let’s learn the basics of Industry analysis.

What is Industry Analysis In A Business Plan?

Before starting with the actual meaning of the industry analysis in a business plan, first, let’s understand what an Industry is.

The industry is a collection of Competitors producing a similar product or offering similar services to their customers.

So the next question is, why are we studying that industry?

To ensure it is the best or worst industry to enter or invest in.

Industry analysis in a business plan is a tool that enables a company to understand its position relative to other companies that produce similar products or services like it. While considering the strategic planning process, a company must understand the overall industry’s forces. Thus, industry analysis techniques in a business plan enable businesses to identify threats and opportunities. It helps them focus their resources on developing unique capabilities to gain a competitive advantage .

Understanding the industry and forecasting its trends and directions, they need to react and control their portion in the industry.

Major elements

1. Understanding the underlying forces at work

- Competition intensifying

- Changing customers’ needs and taste

- Technological innovation

- Globalization

- Entry of major competitors

- Sudden regulation or deregulation

2. Understanding the attractiveness of the industry

- Whether it is feasible to enter or invest in that industry.

3. Understanding the critical industry analysis factors that determine success within the industry.

Importance

- It is an important element of any investment that one wants to make.

- To succeed, business owners need to analyze that industry.

- Important for positioning the company in the niche market

- It aids the companies in identifying potential opportunities.

- It helps in analyzing the threats.

- Assists in analyzing the fit between internal management preferences and the business environment.

- Facilitates mitigating the risk of entering an extremely competitive business.

Ways to perform

- One way to perform the industry analysis in a business plan is to do the ratio analysis and comparisons. Ratios are ascertained by dividing one business variable by another. By comparing the company ratio with that of the industry, a business owner can understand where his business stands concerning the industry average.

Michael E. Porter developed another model for analyzing the industry in his classic book Competitive Strategy: Techniques for Analyzing Industries and Competitors (1980). His model shows that rivalry among the firms in an industry depends upon the following five forces:

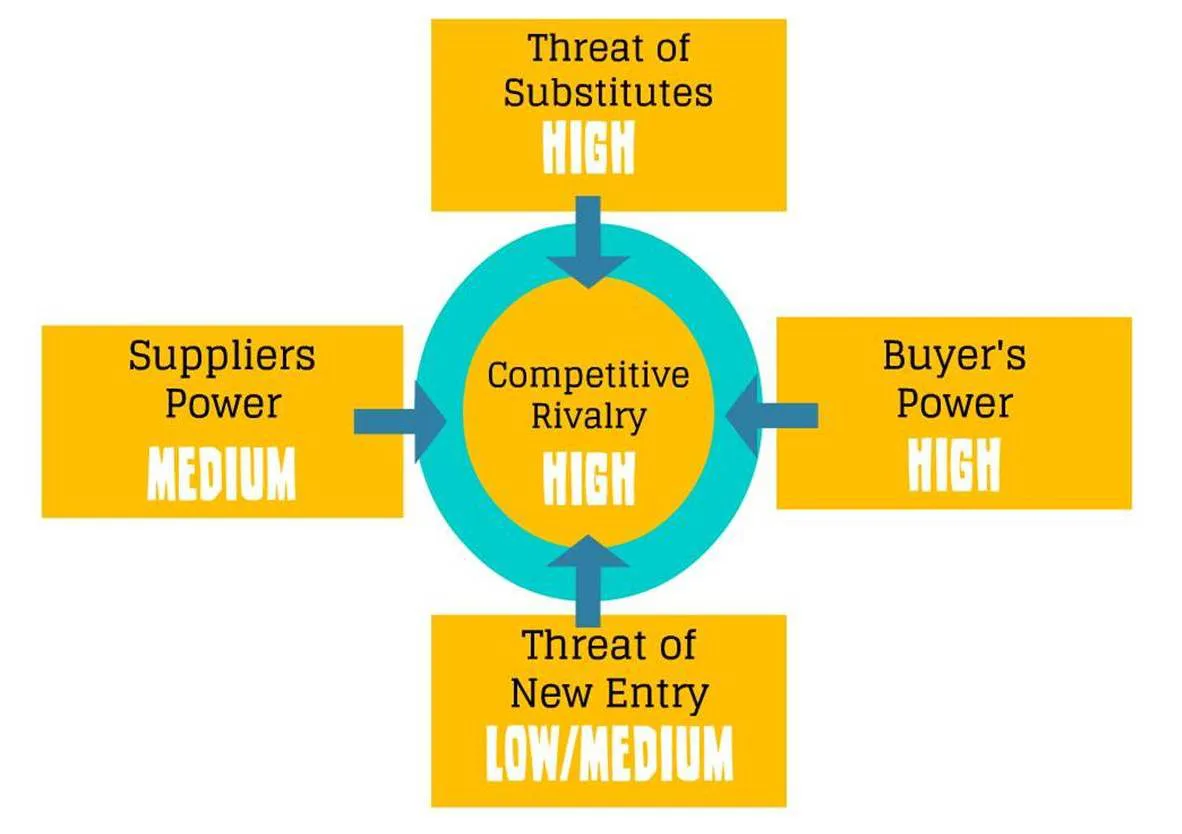

The Threat of New Entry

The threat of new entrants refers to the entry of new competitors in the industry. Naturally, a profitable industry will attract more competitors looking to achieve profits. If the entry barriers in the industry are low, it may pose a significant threat to the firms already competing in that market.

Bargaining power of the Supplier

Supplier power refers to the pressure suppliers can exert on businesses by raising prices, lowering quality, or reducing product availability to intimidate buyers. All of these things directly cost the buyer.

Bargaining power of the Buyer

It refers to the pressure the buyers can exert on businesses to ensure higher quality products, better customer service, and lower prices. Strong buyers can make the industry more competitive, thus decreasing the profit for the seller.

Competitive Rivalry

It is the extent to which the competitive firms within an industry can bully each other, thus decreasing profits. Fierce competition may lead to stealing profits and market share amongst competitors.

Threat of Substitution

It is the availability of a substitute product that the buyers can find instead of a core selling product.

Industry Analysis 3 Steps

# Gathering the Data

- The Scope of the Research

Define the industry where you would like to perform industry analysis research activities. It can be a broad industry or a niche industry.

- Research your industry

Information sources that will help you conduct your industry analysis in a business plan are different for every business. For example, you might need local information, which you can get from your local chamber of commerce. Or you can find your industry analysis information on government websites. You can also find out government statistics or other commercial statistics. You may have to conduct some internet searches to track down the information.

If the information is difficult to obtain at one particular site, you’ll have to extrapolate information from different sources to get the information you’re seeking. Start finding the data from the government or other websites where accurate data is available. Check academic databases for any published information on your area of interest.

- Compile relevant data using the sources above.

Make notes of annual revenues, the number of companies involved, and workforce statistics of the desired industry. Find statistics about the size of the customer base and buying trends.

- Description of the Industry

Start your industry analysis report with a general description of the industry. Include one or two paragraphs about the industry’s size, products, and geographic concentration.

- Describe the company

Include information about the company that you may want to research. Fill in all the general and relevant information about the company.

- Competitor Analysis

Understand the competitors and mention relevant statistical information about their revenues, profit, etc. Describe their product range if possible. Mention their strategies and forth-coming products.

GDP and Inflation effects

Mention how much the sector has been contributing to the GDP and how it has been affected by the rising inflation. Give an outlook on the same.

Try to understand the answers to the following industry analysis questions.

What are the industry’s foremost economic characteristics?

To answer this question, you can acquire data about the industry from governmental census data or sites such as Yahoo.com or other data-intensive web locations.

What kinds of competitive forces are industry members facing?

Understand the interrelationships among companies in the industry and their suppliers and buyers. Also, understand the ease of entry and exit from the industry.

What is the Change driving factors and their impacts?

Understand the industry analysis characteristics of the industry, unlike changing social trends, demographics, regulatory issues, etc.

What do market positions rivals occupy?

Analyze whether a firm is smartly positioned or not. Many industry analysis websites list the company’s key competitors and information about them.

Finally, you should get a positive response to the following question.

Points to Stress in Industry Analysis in a Business Plan

1. Industry attractiveness and industry success factors

- Industry attractiveness is the presence or absence of threats exhibited by industry forces. Thus a more significant threat posed by any of the industry forces lessens the attractiveness of the industry.

- Success factors are the elements that play a significant role in determining whether a company will succeed or fail in a given industry. Some industry analysis examples of success factors are- quick response to market changes, product line, reasonable and fair prices, product quality, sales support, a good record for deliveries, financial position and a management team.

2. Analyzing the future

- One of the crucial factors in industry analysis in a business plan is analyzing the sector’s future. Here one can see how the industry has performed historically. Explore how the sector will perform by looking at historical trends.

- However, the sector’s future is also affected by the significant changes or regulations related to that industry. Hence it is necessary to analyze these factors for the same.

3. Demand and Supply Analysis

Demand and Supply Analysis also plays a major role here. The following factors of demand and supply may affect the industry-

- If demand increases and supply remains unchanged, it leads to a shortage of goods, and the prices increase.

- If demand decreases and supply remains intact, it leads to surplus goods and a decrease in the price.

4. Effect of Inflation on the Industry

- Inflation has affected some major economies of the world over the past years. Hence analyzing the effect of inflation on a particular sector becomes extremely important in the industry analysis of a business plan process.

- Savings, as well as investments, are affected by the high rate of inflation . Hence most companies are affected adversely due to lesser demand for their products and services.

5. Other important factors that can be considered for Industry Analysis in a business plan are

- Size of the industry

- What sectors does it include?

- Major players in this industry

- Markets and customers

- Estimated sales for the industry (This year? Last year? The year before?)

- National/economic trends affecting the industry?

- National/economic trends that might affect it in the future

- Long-term outlook

- Competitor analysis

- The competitive advantage of the business

- Target Market analysis

- Market growth rate

- Market profitability

- Industry cost structure

- Distribution channels

- Success factors

- Success Details

Considerations for Industry Analysis in a business plan

- While carrying out an industry analysis in a business plan, one should consider which forces pose the greatest threat to the business.

- Companies may then undertake careful strategic planning to mitigate these threats.

- Managers should also consider their own preferences and internal capabilities before undertaking a strategy developed from an industry analysis.

Business Cycle Analysis

Try to classify the industries according to their growth cycle.

- Growth industries

The earnings in such industries are significantly above the average of all sectors. Growth stocks suffer less during a recession.

- Defensive industries

Such industries are least affected by recessions and economic adversity.

- Cyclical industries

Such industries are most affected by recessions and economic adversity.

Benefits of Industry Analysis in a Business Plan

- The benefits of completing an industry analysis in a business plan help company managers to gain a better understanding of their business in the industry.

- Allows companies to position themselves carefully in their industry.

- It helps companies to respond better to any changes in the industry.

Example of Industry Analysis In A Business Plan (FMCG Sector)

So having known the importance and ways to carry out an industry analysis in a business plan, let us now analyze the Indian FMCG sector.

Industry Overview

- Currently, the FMCG sector is the fourth largest sector in India, with a market size of USD 12000 Billion.

- It is to grow to a USD 18000 Billion industry by 2031.

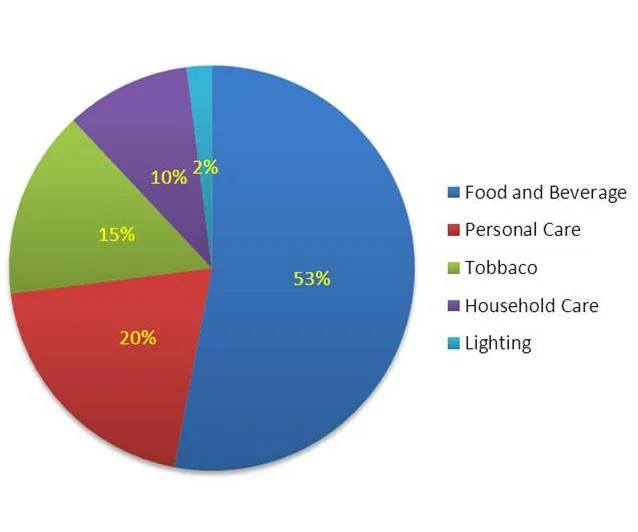

Major Segments in the FMCG Sector

Major Players

SWOT Analysis of the FMCG Sector

1. Low operational costs 2. Established distribution networks in both urban and rural areas 3. Presence of well-known brands in the FMCG sector

1. Lower scope of investing in technology and achieving economies of scale, especially in small sectors 2. Low exports levels 3. Copy products narrow the scope of FMCG products in the rural and semi-urban markets.

Opportunities

1. Rural market is mostly untapped 2. The increased purchasing power of consumers 3. Large domestic market- population of over one billion. 4. Export potential

1. Removal of import restrictions resulting in replacing of domestic brands 2. Tax and regulatory structure.

Porters five forces model for FMCG Sector

Key Challenges

- Consolidation

- Product innovation

- Lifestyle products

- Backward integration

- Third-party manufacturing

- Increased hiring from Tier 1 & 2 cities

- Reducing carbon footprint

- The government approved an investment of up to 100 % foreign equity for NRI & overseas corporate bodies.

- India has allowed 51 % FDI in multi-brand retail

- Relaxation of license rules

The above industry analysis of the Indian FMCG sector is brief to give a gist of what industry analysis in a business plan should include. The actual industry analysis report may be exhaustive detailing all the essential factors.

Hope that the above article has added some value to your learning. Share this with your friends who might find this article interesting.

Related Articles:-

Here are some articles that will help you get more details about Industry Analysis in a business plan.

- Database Management System

- Big Data Analytics Techniques

- Stock vs Options

- Growth Stock vs Value Stock

Industry Analysis In a Business Plan Infographics

Learn the juice of this article in a minute through Industry Analysis Infographics

*Please provide your correct email id. Login details for this Free course will be emailed to you

By signing up, you agree to our Terms of Use and Privacy Policy .

Forgot Password?

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy

Explore 1000+ varieties of Mock tests View more

Submit Next Question

Early-Bird Offer: ENROLL NOW

Analyze your market like a pro with this step-by-step guide + insider tips

Don’t fall into the trap of assuming that you already know enough about your market.

No matter how fantastic your product or service is, your business cannot succeed without sufficient market demand .

You need a clear understanding of who will buy your product or service and why .

You want to know if there is a clear market gap and a market large enough to support the survival and growth of your business.

Industry research and market analysis will help make sure that you are on the right track .

It takes time , but it is time well spent . Thank me later.

WHAT is Market Analysis?

The Market Analysis section of a business plan is also sometimes called:

- Market Demand, Market Trends, Target Market, The Market

- Industry Analysis & Trends, Industry & Market Analysis, Industry and Market Research

WHY Should You Do Market Analysis?

First and foremost, you need to demonstrate beyond any reasonable doubt that there is real need and sufficient demand for your product or service in the market, now and going forward.

- What makes you think that people will buy your products or services?

- Can you prove it?

Your due diligence on the market opportunity and validating the problem and solution described in the Product and Service section of your business plan are crucial for the success of your venture.

Also, no company operates in a vacuum. Every business is part of a larger overall industry, the forces that affect your industry as a whole will inevitably affect your business as well.

Evaluating your industry and market increases your own knowledge of the factors that contribute to your company’s success and shows the readers of your business plan that you understand the external business conditions.

External Support

In fact, if you are seeking outside financing, potential backers will most definitely be interested in industry and market conditions and trends.

You will make a positive impression and have a better chance of getting their support if you show market analysis that strengthens your business case, combining relevant and reliable data with sound judgement.

Let’s break down how to do exactly that, step by step:

HOW To Do Market Analysis: Step-by-Step

So, let’s break up how market analysis is done into three steps:

- Industry: the total market

- Target Market: specific segments of the industry that you will target

- Target Customer: characteristics of the customers that you will focus on

Step 1: Industry Analysis

How do you define an industry.

For example, the fashion industry includes fabric suppliers, designers, companies making finished clothing, distributors, sales representatives, trade publications, retail outlets online and on the high street.

How Do You Analyze an Industry?

Briefly describe your industry, including the following considerations:

1.1. Economic Conditions

Outline the current and projected economic conditions that influence the industry your business operates in, such as:

- Official economic indicators like GDP or inflation

- Labour market statistics

- Foreign trade (e.g., import and export statistics)

1.2. Industry Description

Highlight the distinct characteristic of your industry, including:

- Market leaders , major customer groups and customer loyalty

- Supply chain and distribution channels

- Profitability (e.g., pricing, cost structure, margins), financials

- Key success factors

- Barriers to entry preventing new companies from competing in the industry

1.3. Industry Size and Growth

Estimate the size of your industry and analyze how industry growth affects your company’s prospects:

- Current size (e.g., revenues, units sold, employment)

- Historic and projected industry growth rate (low/medium/high)

- Life-cycle stage /maturity (emerging/expanding/ mature/declining)

1.4. Industry Trends

- Industry Trends: Describe the key industry trends and evaluate the potential impact of PESTEL (political / economic / social / technological / environmental / legal) changes on the industry, including the level of sensitivity to:

- Seasonality

- Economic cycles