Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Brand Experience

Market Segmentation

- Target Market

Try Qualtrics for free

Target market: definition, purpose, examples, & best practices.

11 min read Aiming for your target market with a highly focused marketing strategy is now easier than ever with the support of insights from data and machine learning. Read our in-depth guide to learn how to successfully reach your target market.

What is a target market?

A target market is a subset of the audience you’re aiming to reach (your market). It is made up of a group of customers that have one or more commonalities between them and are most likely to be interested in your products.

These commonalities might be:

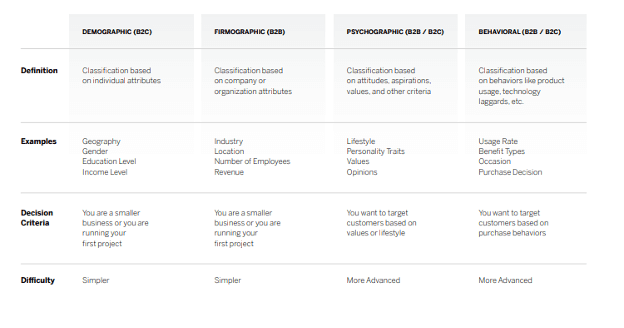

- Demographic targeting : They all have common features, such as age, income level, family status, level of disposable income, and marital status

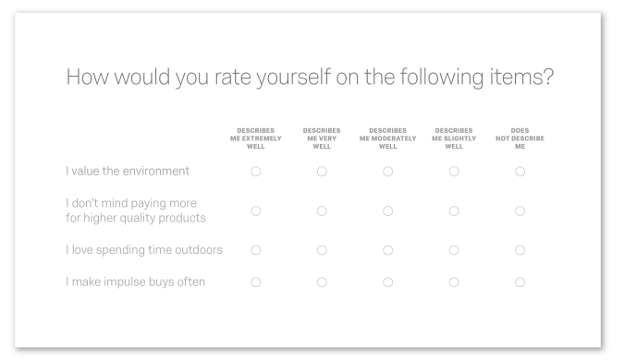

- Psychographic segmentation : They all hold common interests, values, wants, goals, political leanings or lifestyle choices

- Behavioral patterns: They all have common behaviors, such as when they purchase a product or how often they buy

- Geographic segmentation : They are all located in the same region or local area

There are other factors that might group your target market’s members together, and, more often than not, there might be a blend of multiple factors. Keep in mind that there’s also a slight variation if you are looking for B2B customers, as this might include:

- Firmographics: The details about the businesses you’re targeting, such as industry, company size, global or regional spread

- Buying style: The businesses’ buying policies, budgets or stakeholder involvement

- Company behavior: How much they purchase and when, their appetite for risk

Free eBook: 2024 global market research trends report

What is target marketing?

Target marketing is the process of reaching out to particular market segments of your potential customers or your existing audience. This target market is defined by their commonality as mentioned above, usually within a range, such as consumers aged 25-45 or those working in the hospitality industry.

Your marketing strategy will be tailored to that particular niche market, and will encompass all the channels that the target audience might use. Your marketing should be based on market research and take into account the needs and wants of that specific group. Ideally, this means that you have data-led insights about your target market to allow you to create digital marketing or offline marketing strategies that work effectively.

What is consumer targeting?

Where your target market is the broader group of individuals that have a feature in common, your target consumers are the individuals you believe are most likely to purchase your product or service. Your marketing efforts for consumer targeting will be aimed at a more specific audience, such as 35-year-olds or hotel managers.

Consumer targeting vs market segmentation

Consumer targeting is the process of marketing to the specific audience you think will potentially buy your products, based on data-led insights on prior sales data and more.

Market segmentation is a broader process, being the general division of your entire potential audience into target markets, based on the features they share or the products and services they’d be interested in.

Both are necessary processes to narrow down the focus of your marketing efforts for the best results.

Why should you create a target marketing strategy?

Creating a marketing strategy for a specific target market has several advantages over a more general approach.

- You’re more likely to reach an audience interested in your products or services. Having a clear idea of who would be most interested in your offering means you don’t waste time marketing to those who are less likely to buy.

- You can create a more appealing and effective marketing strategy. Knowing your target audiences’ distinct features means you can create a marketing approach that will be more appealing to them.

- You’ll stand out from the competition. By honing in on your target customers and adapting your strategy accordingly, you’ll be ahead of the 76% of marketing executives that don’t use behavioral data to target their marketing efforts .

- You’re able to target and retarget your audience for better outcomes. Comscore found that retargeting customers led to a 1046% uplift in searches for the advertised brand.

- You can discover which customers are more likely to pay a premium for your product. Increase profitability and revenue by targeting the target audience with the highest ROI.

How to target market segments

Step 1: finding your target markets.

Whether you’re planning on exploring target markets for a new or an established business, market research will be vital to discover the most fertile areas for growth. Here are a few ideas on how to define your target market:

Study your current customers

Your current customers have a wealth of information that can help you create a marketing plan for your ideal target market. By gathering data, either through customer feedback channels such as surveys or focus groups, or by examining operations data such as customer purchase patterns, you can develop a persona that describes your ideal customer. What common characteristics do your biggest spenders have? Start by sending a survey with open-ended questions to a small representative sample of customers, perhaps 300 or more, to understand their values in their own words.

Examine the competition

Your competitors are likely targeting the same audiences as you. Analyze how they promote their product or service, and see how their ideal customer responds. What are they providing that you don’t, and what can you give customers that isn’t currently on the market?

Understand the motivations for purchase

Your customers are often telling you in their own words how they feel about your offering and why they have chosen your brand—you just need to listen. Use sophisticated listening tools, such as conversation analytics, to understand things such as customer intent, emotion, effort, and motivation. This will help you build a more solid picture of what your ideal target market looks like, and what challenges your offering solves for them.

Identify groups of customers

Your target markets will be made up of groups of ideal customers. What key characteristics link them together? Build a list of target markets, all defined by distinct features that you can target with your marketing efforts.

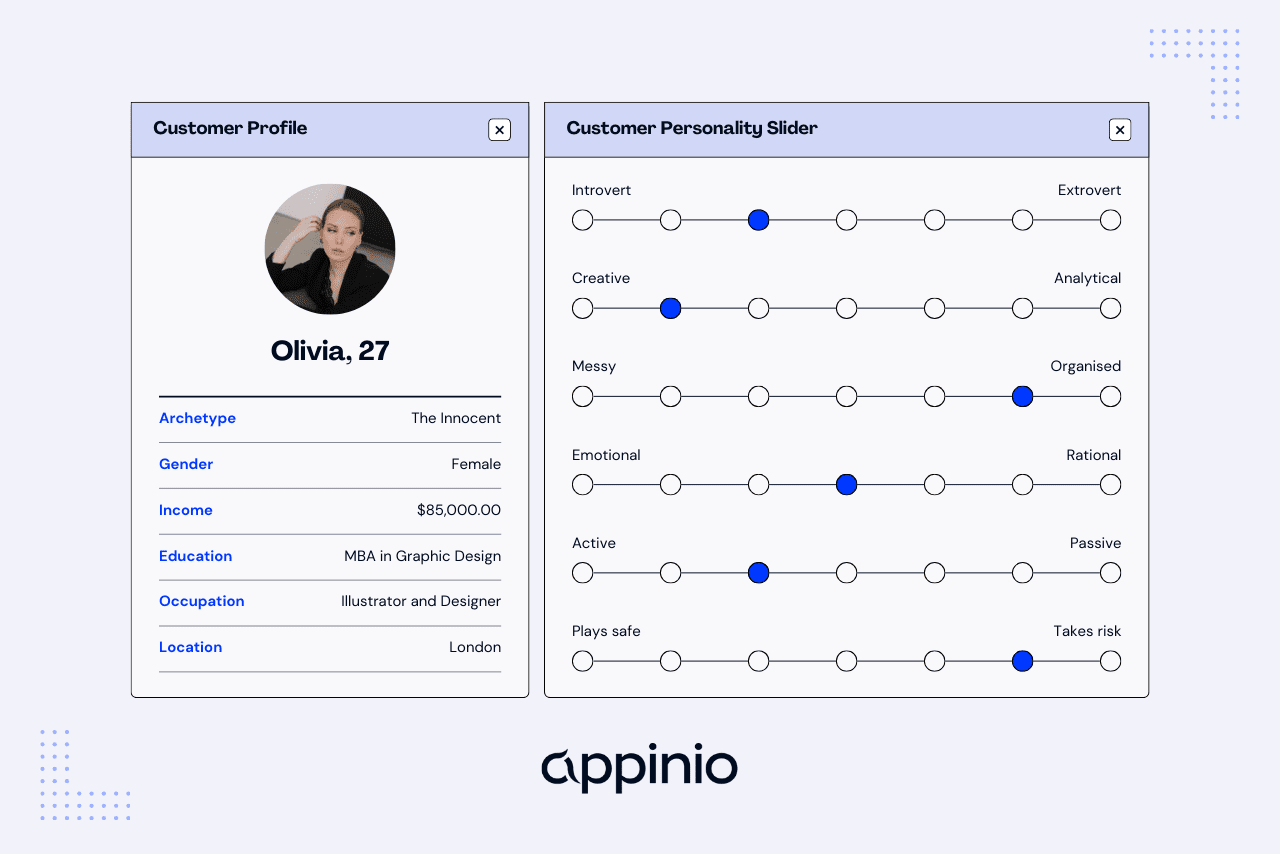

Create personas

Developing a persona, or a fictional character that embodies the type of customer you’d like to pinpoint, means you can better reach your target audience. Identify their roles, goals, and pain points and understand how they like to communicate. By helping them reach goals, fulfill role requirements and solving their pain points, you can better hone your marketing efforts.

Judge near-term vs longer-term opportunities

Not all your target markets will be worth targeting in the near term, perhaps because of the time of year, their growth projections and other factors. It’s a good idea to consider which target market is right for immediate targeting, and which segments are better kept for the longer term.

Evaluate product-market fit and positioning

Where will your value proposition have the most impact? Your product market fit will not be the same for every target market you identify, and sometimes you can position your product more effectively for one market than another. Evaluate which target markets will provide the greatest ROI and focus efforts there first.

Understand how to reach your target audience

Your target market will have preferences for how they want to engage with your brand. Learning how they interact with you by examining internal data and analyzing customer behavior will help you to speak to your target market on the platforms they prefer.

Step 2: Create an effective targeting strategy

There is the option of engaging in mass marketing, creating marketing campaigns designed to reach as many people as possible. However, for an effective strategy, you should forgo the entire market and target only the markets and customers you believe will be responsive.

Consider which marketing strategy will be most effective

Mass marketing is a one-size-fits-all approach that won’t have the same impact as targeting a specific audience. Here are some alternatives:

Differentiated marketing: This marketing strategy develops different marketing campaigns for each target market’s preferences. This helps to demonstrate your value proposition for each target audience, rather than marketing generally about your products and services. This may require more initial budget, as various marketing campaigns will be needed, but is more likely to have a greater impact on each individual target market.

Niche marketing: Through your market research, you may have identified a particular market where a small target audience has needs that are not being met by the offerings of your competitors. Creating a highly targeted marketing campaign for this specific audience can be lucrative if the gap in the market is not being served and if the potential purchases by this audience will be high in value.

Micromarketing: Even more targeted than niche marketing is micro marketing. Taking a small segment of your already-small niche market, you divide the audience into further characteristics that unite them, such as geographic location. Again, focusing on this hyper-specific target market can pay dividends if their potential spend outweighs the cost of serving them such a specific marketing campaign.

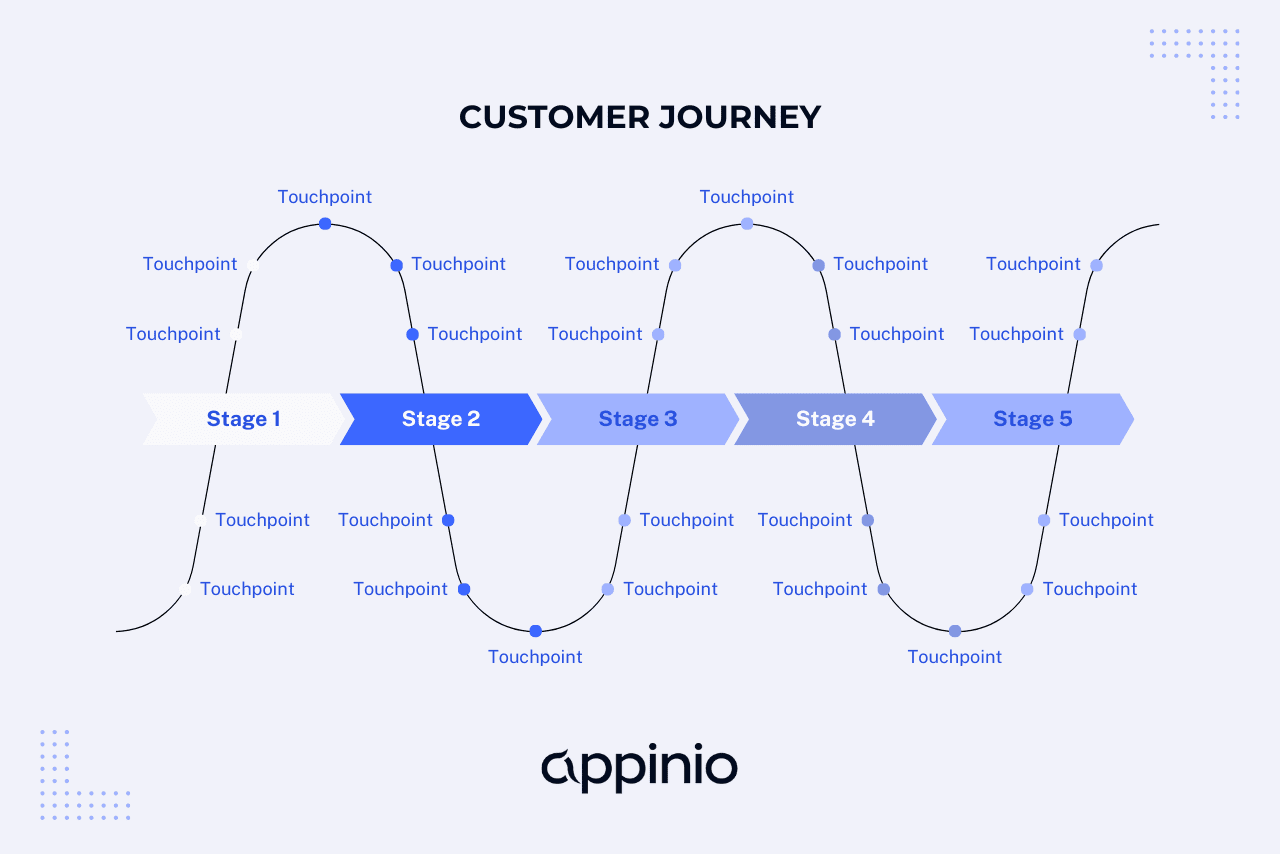

Create an omnichannel strategy with customer preferences in mind

Your market research should have uncovered how your target audience prefers to communicate. Frequently, the purpose of the engagement—to buy a product, resolve a query, find an answer—dictates how customers want to be reached. As a result, it’s best to create an omnichannel marketing strategy that can guide audiences on a personalized customer journey.

Step 4. Implement and learn

Once you’ve established your target market and understand how to reach them, it’s time to test your marketing campaigns and targeted advertising, and then learn from the response. Evaluations to consider include:

- What drives customers to purchase, and what has less of an effect on buying behaviors?

- Which target markets are the most lucrative, and why?

- What new market segments could be targeted with similar strategies?

- How measurable are the results of your strategies?

- How accessible are your strategies to all of your target customers?

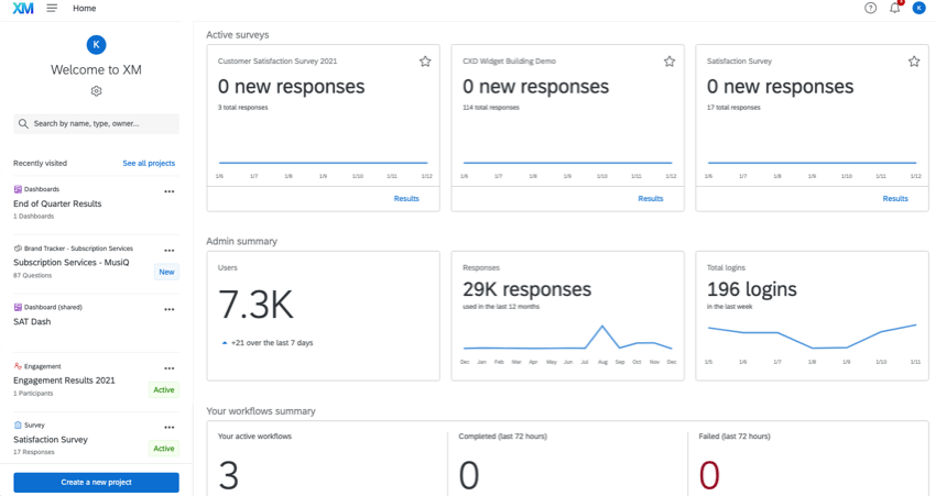

Improve your customer targeting with Qualtrics

Enable more accurate customer targeting with in-depth research supported by Qualtrics’ range of business tools. The CoreXM platform allows you to collect and collate data for unrivaled insights into your target market for highly effective marketing.

Use AI-powered analytics and embedded machine learning to evaluate structured and unstructured data. Best of all, access all your data and insights that make an impact all on one platform.

Related resources

User personas 14 min read, mixed methods research 17 min read.

Analysis & Reporting

Data Saturation In Qualitative Research 8 min read

How to determine sample size 12 min read.

Focus Groups

Focus Groups 15 min read

Market intelligence 10 min read, marketing insights 11 min read, request demo.

Ready to learn more about Qualtrics?

What Is a Target Market (And How to Find Yours)

The better you understand your target market, the more you’ll be able to focus your ads and reach the audience most likely to convert into customers.

Table of Contents

Your target market sets the tone for your entire marketing strategy — from how you develop and name your products or services right through to the marketing channels you use to promote them.

Here’s a hint before we dig in: Your target market is not “everyone” ( unless you’re Google ). Your task in defining your target market is to identify and understand a smaller, relevant niche so you can dominate it. It’s all about narrowing your focus while expanding your reach.

In this guide, we’ll help you learn who’s already interacting with your business and your competitors, then use that information to develop a clear target market as you build your brand .

Bonus: Get the free template to easily craft a detailed profile of your ideal customer and/or target audience.

What is a target market?

A target market is the specific group of people you want to reach with your marketing message . They are the people who are most likely to buy your products or services, and they are united by some common characteristics, like demographics and behaviors.

The more clearly you define your target market, the better you can understand how and where to reach your ideal potential customers. You can start with broad categories like millennials or single dads, but you need to get much more detailed than that to achieve the best possible conversion rates.

Don’t be afraid to get highly specific. This is all about targeting your marketing efforts effectively, not stopping people from buying your product.

People who are not included in your targeted marketing can still buy from you—they’re just not your top focus when crafting your marketing strategy. You can’t target everyone, but you can sell to everyone.

Your target market should be based on research, not a gut feeling . You need to go after the people who really want to buy from you, even if they’re not the customers you originally set out to reach.

What is target market segmentation?

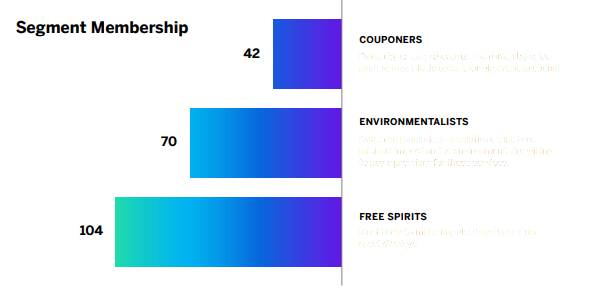

Target market segmentation is the process of dividing your target market into smaller, more specific groups. It allows you to create a more relevant marketing message for each group.

Remember — you can’t be all things to all people. But you can be different things to different groups of people.

For example, as a vegetarian, I’ve eaten plenty of Impossible Burgers. I’m definitely a target customer. But vegetarians are a surprisingly small target market segment for Impossible Foods: only 10% of their customer base.

That’s why Impossible Foods’ first national advertising campaign was definitely not targeted at me:

https://www.facebook.com/ImpossibleFoods/videos/158779836141556

The target market segment for this ad campaign was “meat eaters who haven’t yet tried Impossible products.”

Vegetarians and meat eaters have different reasons for eating plant-based burgers and want different things from the experience. Target market segmentation ensures the company reaches the right audience with the right message.

How to define your target market

Step 1. compile data on your current customers.

A great first step in figuring out who most wants to buy from you is to identify who is already using your products or services. Once you understand the defining characteristics of your existing customer base, you can go after more people like that.

Depending on how someone connects with your business, you might have only a little information about them, or a lot.

This doesn’t mean you should add a lot of questions to your order or opt-in process just for audience research purposes — this can annoy customers and result in abandoned shopping carts.

But do be sure to use the information you naturally acquire to understand trends and averages .

Your CRM is a goldmine here. UTM parameters combined with Google Analytics can also provide useful information about your customers.

Some data points you might want to consider are:

- Age: You don’t need to get too specific here. It won’t likely make a difference whether your average customer is 24 or 27. But knowing which decade of life your customers are in can be very useful.

- Location (and time zone): Where in the world do your existing customers live? In addition to understanding which geographic areas to target, this helps you figure out what hours are most important for your customer service and sales reps to be online, and what time you should schedule your social ads and posts to ensure best visibility.

- Language: Don’t assume your customers speak the same language you do. And don’t assume they speak the dominant language of their (or your) current physical location.

- Spending power and patterns: How much money do your current customers have to spend? How do they approach purchases in your price category?

- Interests: What do your customers like to do, besides using your products or services? What TV shows do they watch? What other businesses do they interact with?

- Challenges: What pain points are your customers facing? Do you understand how your product or service helps them address those challenges?

- Stage of life: Are your customers likely to be college students? New parents? Parents of teens? Retirees?

If you’re selling B2B products, your categories will look a little different. You might want to collect information about the size of businesses that buy from you, and information about the titles of the people who tend to make the buying decisions. Are you marketing to the CEO? The CTO? The social marketing manager?

Step 2. Incorporate social data

Social media analytics can be a great way of filling out the picture of your target market. They help you understand who’s interacting with your social accounts, even if those people are not yet customers.

These people are interested in your brand. Social analytics can provide a lot of information that might help you understand why. You’ll also learn about potential market segments you may not have thought to target before.

You can also use social listening to help identify the people who are talking about you and your product on social media, even if they don’t follow you.

If you want to reach your target market with social ads, lookalike audiences are an easy way to reach more people who share characteristics with your best customers.

Step 3. Check out the competition

Now that you know who’s already interacting with your business and buying your products or services, it’s time to see who’s engaging with the competition.

Knowing what your competitors are up to can help you answer some key questions:

- Are your competitors going after the same target market segments as you are?

- Are they reaching segments you hadn’t thought to consider?

- How are they positioning themselves?

Our guide on how to do competitor research on social media walks you through the best ways to use social tools to gather competitor insights.

You won’t be able to get detailed audience information about the people interacting with your competitors, but you’ll be able to get a general sense of the approach they’re taking and whether it’s allowing them to create engagement online.

This analysis will help you understand which markets competitors are targeting and whether their efforts appear to be effective for those segments.

Step 4. Clarify the value of your product or service

This comes down to the key distinction all marketers must understand between features and benefits. You can list the features of your product all day long, but no one will be convinced to buy from you unless you can explain the benefits .

Features are what your product is or does. The benefits are the results. How does your product make someone’s life easier, or better, or just more interesting?

If you don’t already have a clear list of the benefits of your product, it’s time to start brainstorming now. As you create your benefit statements, you’ll also by default be stating some basic information about your target audience.

For example, if your service helps people find someone to look after their pets while they’re away, you can be pretty confident that your market will have two main segments: (1) pet owners and (2) existing or potential pet-sitters.

If you’re not sure exactly how customers benefit from using your products, why not ask them in a survey, or even a social media poll ?

You might find that people use your products or services for purposes you haven’t even thought of. That might, in turn, change how you perceive your target market for future sales.

Step 5. Create a target market statement

Now it’s time to boil everything you’ve discovered so far into one simple statement that defines your target market. This is actually the first step in creating a brand positioning statement , but that’s a project for another day. For now, let’s stick to creating a statement that clearly defines your target market.

For example, here’s Zipcar’s brand positioning statement, as cited in the classic marketing text Kellogg on Marketing . We’re interested in the first part of the statement, which defines the target market:

“To urban-dwelling, educated, techno-savvy consumers who worry about the environment that future generations will inherit, Zipcar is the car-sharing service that lets you save money and reduce your carbon footprint, making you feel you’ve made a smart, responsible choice that demonstrates your commitment to protecting the environment.”

Zipcar is not targeting all residents of a particular city. They’re not even targeting all the people in a given city who don’t own a car. They’re specifically targeting people who:

- live in an urban area

- have a certain degree of education

- are comfortable with technology

- are concerned about the environment

These are all interests and behaviors that Zipcar can specifically target using social content and social ads .

View this post on Instagram A post shared by Zipcar (@zipcar)

They also help to guide the company’s overall approach to its service, as evidenced by the rest of the positioning statement.

When crafting your target market statement, try to incorporate the most important demographic and behavior characteristics you’ve identified. For example:

Our target market is [gender(s)] aged [age range], who live in [place or type of place], and like to [activity].

Don’t feel like you need to stick to these particular identifiers. Maybe gender is irrelevant for your market, but you have three or four key behaviors to incorporate in your statement.

If you offer multiple products or services, you might need to create a target market statement for each market segment. In this case, it’s useful to define buyer personas .

Target market examples

Nike target market.

Despite its current market domination, Nike actually provides a great example of what can go wrong when you try to target too general of an audience.

Nike started out as a running shoe company. In the 1980s, they tried to expand their target market beyond runners to include anyone who wanted comfortable shoes. They launched a line of casual shoes, and it flopped.

Here’s the thing: Non-runners were already buying Nike shoes to walk to work, or for other casual purposes. Nike spotted this as an opportunity to expand. Instead, they diluted their brand promise, and the company actually started losing money.

The lesson, according to company founder Phil Knight?

“Ultimately, we determined that we wanted Nike to be the world’s best sports and fitness company and the Nike brand to represent sports and fitness activities. Once you say that, you have focus.”

While Nike would certainly not stop casual users from buying its shoes, the company refocused everything from product development to marketing on its target market: athletes of all levels, from pro to beer league.

In fact, understanding the importance of focus led Nike into a highly effective strategy of target market segmentation. The brand has multiple target markets for its various product lines.

On social, that means they use multiple accounts to reach their different target market groups. No one account tries to be all things to all customers.

The post below from Nike’s general Instagram account targets the segment of their audience interested in fashion and lifestyle products.

View this post on Instagram A post shared by Nike Basketball (@nikebasketball)

But the company also has channels dedicated to specific sports. Here’s an example of the content they create for runners:

View this post on Instagram A post shared by Nike Running (@nikerunning)

And that means … the brand has been able to return to marketing its products specifically for casual wear. It just reaches the casual target market through different channels than it uses for its athletic markets. It’s a different target market segment, and a different marketing message

View this post on Instagram A post shared by Nike Sportswear (@nikesportswear)

Like Nike, you might have one target market, or many, depending on the size of your brand. Remember that you can only speak effectively to one target market segment at a time.

Takasa target market

Takasa is a Canadian retail homewares company that specializes in organic, fair trade bedding and bath linens.

Here’s their target market as defined by founders Ruby and Kuljit Rakhra:

“ Our target market is the LOHAS segment, which means Family Lifestyles of Health and Sustainability. This group of people is already living, or striving to live, a green lifestyle … We know our target demo is very conscious about what their families consume, as well as the impact this consumption has on the environment.”

In their social content, they clearly identify the product features most important to their target market: organic materials and fair labor practices.

View this post on Instagram A post shared by Organic + Fairtrade Home Goods (@takasa.co)

The City of Port Alberni’s target market

Why does a city need a target market? In Port Alberni’s case, the city is working to “attract investment, business opportunities and new residents.” To that end, they launched a rebranding and marketing campaign.

And a marketing campaign, of course, needs a target market. Here’s how the city defined it:

“ Our target market is young people and young families 25 to 45 years of age who are entrepreneurial-minded, family oriented, adventurous, enjoy an active lifestyle, desire an opportunity to contribute to growth, well-educated and skilled professionals or tradespeople.”

In their social content, they highlight recreational opportunities aimed at those active and adventurous young families, even using the handle @PlayinPA.

View this post on Instagram A post shared by City of Port Alberni (@playinpa)

White House Black Market target market

White House Black Market is a women’s fashion brand. Here’s how they describe their target customer on their website :

“Our customer … is strong yet subtle, modern yet timeless, hard-working yet easy-going.”

That’s a fine description when talking directly to customers. But the marketing department needs a target market definition with a few more specifics. Here’s the detailed target market as described by the company’s former president:

“ Our target market is women [with a] median age of about 45 … at a stage in her life where she’s very busy, primarily a working woman. She’s probably got one or two kids left at home [or] … her children may be out of the house and on their way to college.”

With their hashtag #WHBMPowerhouse, they focus on this key demographic of women in their 40s with busy home lives and careers.

View this post on Instagram A post shared by White House Black Market (@whbm)

Use Hootsuite to better target your audience on social media. Create, schedule, and publish posts to every network, get demographic data, performance reports, and more. Try it free today.

Start your free 30-day trial

Do it better with Hootsuite , the all-in-one social media tool. Stay on top of things, grow, and beat the competition.

Become a better social marketer.

Get expert social media advice delivered straight to your inbox.

Christina Newberry is an award-winning writer and editor whose greatest passions include food, travel, urban gardening, and the Oxford comma—not necessarily in that order.

Related Articles

How To Create Better Buyer Personas [Free Template]

A well-defined buyer persona—also called a customer persona, audience persona, or marketing persona—will help you target your ideal customer.

How to create a social media marketing strategy in 9 easy steps [free template]

Creating your social media marketing strategy doesn’t need to be painful. Create an effective plan for your business in 9 simple steps.

How to Create a Social Media Report [Free Template Included]

A comprehensive social media report proves the value of your social marketing plan. It shows what you’ve accomplished, backed up by data.

21 of the Best Social Media Analytics Tools for 2024

Are you a social media marketer who wants to better focus your time, effort, and budget? It’s time for some new social media analytics tools!

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

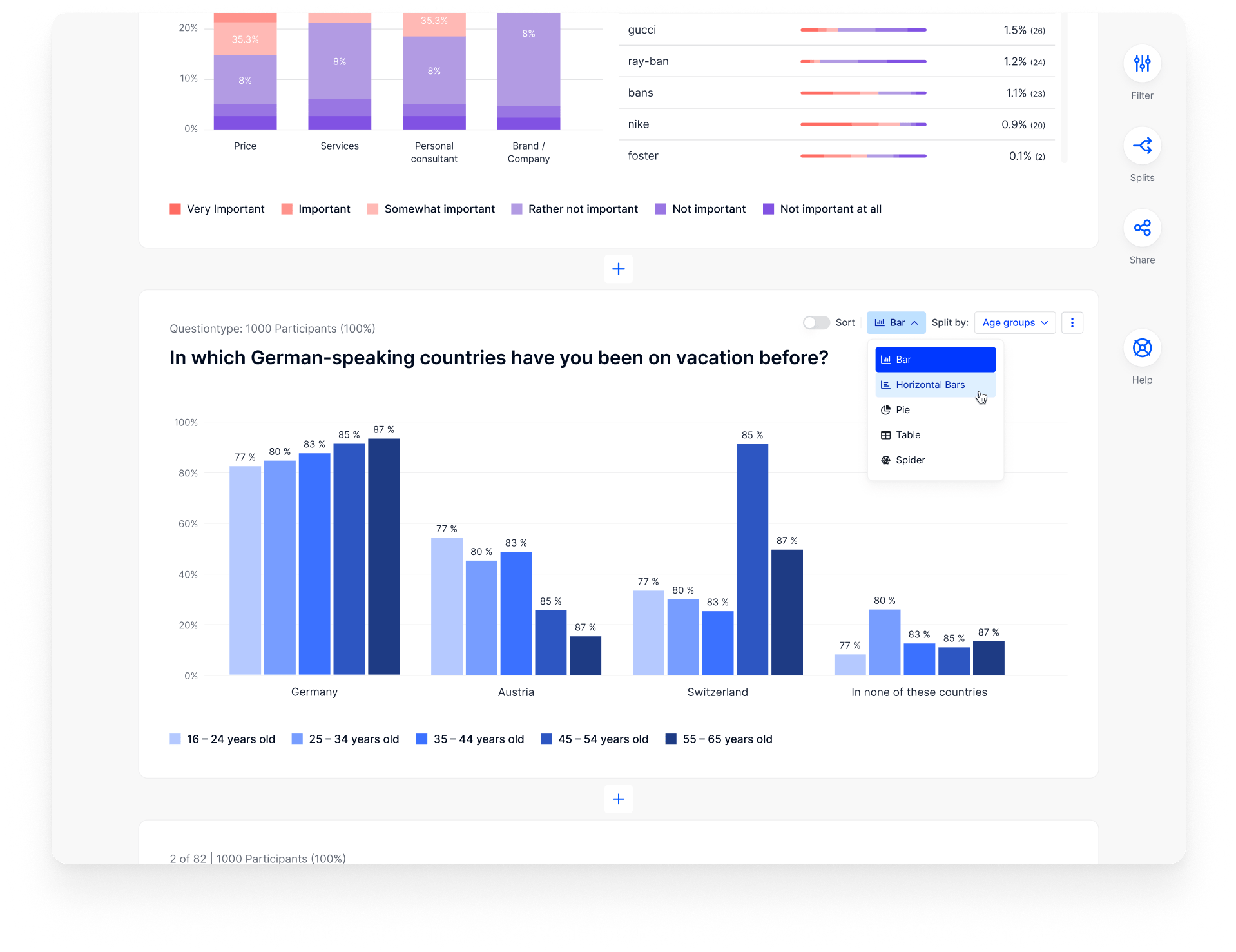

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

What Is a Target Market and How Do You Find Yours? (Examples Included)

Your target market underpins everything your business does, from products to marketing campaigns. Here are the five steps to uncover yours and put that research to use.

Knowing your ideal target market might seem like one of many boxes to check on your “ starting a business ” list, but it’s arguably the most important part of the process.

Your target market underpins everything your business does, from the product you create to the marketing campaigns you build. You can’t sell to anyone and everyone. Limiting the audience you target actually improves your total number of sales, because the marketing messages you’re delivering are highly relevant .

To set up a business right, you need to know who your target market is, which means figuring out not just who they are but how they behave and what they want or need. You’ll then be able to find ways to reach them about what matters most to them while ignoring other potential customers that will never see the relevance in what you’re offering, and vice versa. —Darren Litt, co-founder of Hiya Health

So, how do you define your target market? And more importantly, how do you turn a pretty PDF or slide deck into money for your ecommerce business? This guide shares the answers .

Get your free brand positioning template

Stand out from the competition and make your brand the go-to choice for customers with our brand positioning analysis.

What is a target market?

A target market is the specific group of people most likely to buy your products or services. They’re the people you should be laser focused on attracting—the type of people who return again, recommend you to their friends, and rave about you on social media.

How to define your target market

Many small business owners create products they wish they had. Take footwear brand Allbirds , for example. The brand started after its founder, Tim Brown, struggled to find shoes made with merino wool. Allbirds was created to fill the gap, with Tim being its first customer and target market.

Nevertheless, continuing on the “I am my own customer” path for too long is dangerous. Making assumptions about your target audience based on your own personal thoughts, feelings, and behaviors can kill the target market research process. What your paying customers want can vary dramatically from the product you want to create.

Say you’re anti-Facebook, and deleted your account in protest of its privacy settings. If your target market is just like you, you’d strike Facebook advertising from your marketing campaign ideas. In practice, however, you may be hampering your ability to reach a subset of your potential customers who have most things in common with you.

*You are a sample size of 1* You do not represent your entire target market, intended audience, or customer base. In fact, there's a good chance you behave very differently than your potential customers, so using your own behavior as a heuristic could be disastrous. — Corey Haines 💡 (@coreyhainesco) December 16, 2020

Researching multiple target markets doesn’t have to be complex if you’re just starting out, but it helps to have a minimum viable target market—the bare minimum you need to know about your ideal customer before diving in. Hiya Health co-founder Darren Litt recommends looking for answers to the following questions:

- Who will benefit the most from your product or service?

- Who’s going to be touching this product?

- Why do they need your product or service?

- What difference does this product make compared to its competitors?

Here’s how you can find the answers.

- Host focus groups

Starting your market research from scratch with no existing customer data? The quickest way to get immediate feedback is to host a focus group: a group of eight to 10 people who give honest feedback on your soon-to-launch product .

You *need* to talk to people in your target market that aren't in a sales cycle. So many people rely on Sales for feedback. People don't tell the truth when money is involved. — Andrew Allsop (@AndrewAllsop) August 12, 2021

Advertise that you’re looking for people to take part in a research study. Give people an incentive to participate, such as a free product or $25 gift card. If you’re researching the target market for a new wine brand, for example, host a wine and cheese evening at a local vineyard. The more relaxed and engaged people are at the focus group session, the more likely they are to give honest, free-flowing answers.

Or, host the focus group online via web conferencing tools like Zoom. That way, you can invite people from all over the world without limiting research to opinions from people in a specific area.

When selecting people to join the focus group, go broad with your criteria—especially if it’s your first dip into the market research world. Remember: assumptions on who might buy your product can lead you down the wrong path. There’s always the option to niche down once you’ve excluded a specific group that definitely isn’t your target market.

At the event, ask open-ended questions like:

- What qualities do you look for in brands you purchase from?

- What would need to happen in your life for you to buy this product?

- If you don’t picture yourself buying this, who would you buy the item for as a gift?

Don’t be afraid to dive into rabbit holes. Instead of a one-way survey conversation, you can really pull on the thoughts, feelings, and stories people have to share when you’re communicating face to face (or screen to screen). Ask open-ended questions and pull out interesting parts in their response for further discussion .

After all of these steps, it’s important to evaluate your decision. Ensure that your target audience has enough people in it, that these people will benefit from your product or service, that they can afford it, and that you are able to reach them with your message. This is the final step to finding your target market. —Justin Chan, Growth Manager at June Shine

- Survey existing customers

“Your current customers are a great resource,” says Jean Gregoire, CEO of Lovebox . She’s right: existing customers have handed over their hard-earned cash in exchange for your product. In many cases, following the money leads directly to your target market.

Jean advises, “Figure out why they’re buying from you. Do they have any similar interests? Then, look at your product or service in-depth. What key characteristics does it have? What are its features and benefits? Once you have that information, you can figure out what types of customers would benefit from your product.”

Look at the existing data in your ecommerce back end. For instance, customers will share their postal address for shipping purposes. Assemble that data in one spreadsheet to find your most popular locations.

You could also add a date of birth field to your post-purchase account creation page. Give customers a free gift or discount code on their birthday in exchange for age-related information for your target market research.

Collect more data on autopilot by adding a customer survey in your purchase confirmation emails. Keep the survey short and sweet to encourage new customers to share their feedback. Ask a mixture of demographic and psychographic questions like:

- What is your education level?

- How do you spend your free time?

- Why did you choose to buy our product?

- What was happening in your life around this time?

- Which channels did you use to discover this product?

Apps like POWR Customer Survey , Zigpoll , and Fairing Post Purchase Surveys can also do this for you if you’d prefer your purchase confirmation emails to be clutter free.

Either way, look for common denominators in the answers you get. Thoughts, behaviors, and personality traits you see repeated are those your paying customers have in common—and your target market does too .

By taking a deep look at how your brand can help certain consumers, you’ll be able to pinpoint who those consumers are. —Jean Gregoire, CEO of Lovebox

- Keep tabs on competitors

In a crowded marketplace, knowing your competitors’ target markets can help you narrow your focus, especially if the products you’re selling are largely the same.

Toothpaste brands are a prime example. If you analyze the formulas of popular toothpastes, you’ll notice very little difference. Retailers in the space stand out with strong branding tailored toward a specific target market.

Make a list of competitors in your niche market. Find them by asking this question in your customer feedback surveys: Did you consider any other products before deciding to purchase ours? If so, who were they and what made you choose us?

While it’s highly unlikely for each of these competitors to freely share information about its audience, you can do some detective work by:

- Searching the brand’s name on social media

- Looking at influencers each brand partners with

- Investigating customer reviews and case studies

In marketing my Shopify store, Dead Sea Trading Co., I looked at my biggest competitor and used Alexa.com to determine that their target market was women ages 35 to 65+ who earn more than $100,000 per year. In order to reach this market, I started a free online book club for women in that age group and included ads for Dead Sea Trading Co., where appropriate. The results have been impressive and the traffic to my store has increased threefold since starting the book club. —Mitchell Stern, owner of Side Hustle Tips

While competitive analysis is a good starting point for your own target market research, the goal is to stand out from them. That’s why Justin Chan, growth manager at JuneShine , advises using this data to “find a niche market which they are overlooking.”

Justin says, “It is useful to find your own niche, because it gives you a way to stand out in the crowd. You are able to have a targeted market that looks to you for this product. At JuneShine, we have a super-specific niche of alcoholic kombucha. It mixes the want to be healthy and still enjoy a delicious beverage. ”

- Dive into existing research

Once you’ve got a solid understanding of the types of people in your target market, dig deeper into the thoughts, feelings, and behaviors they share through existing industry research.

The following platforms share consumer behavior trends to lean into:

- McKinsey & Company

- Pew Research Center

McKinsey published a “ State of Grocery in North America ” report, which grocery store owners can use to define their target markets by focusing on those shopping for fresh fruits and vegetables.

“There are many tools to help you do a deep dive on your target audience, but keyword research can reveal more intimate and private pain points that customers or brands may not be open to talking about,” Marquis Matson, VP of Growth at Sozy , adds. “Mental health issues, relationship struggles, body image issues … these are all revealed in keyword research.”

But remember: target market research needs real concrete data, not assumptions. That’s why Marquis adds, “To validate the topics, I talk to the customer support and social media teams to learn about what actual customers are talking about. Listening to what customers are saying and how they’re saying it informs my strategy for all content that goes on the website.

“Once you have buying customers, then you have information about the people most likely to buy your products. That can get you pretty far in your target audience research.”

By platform or sales channel

Ecommerce brands have different target audiences across the platforms and sales channels they sell on. A retailer selling handmade goods , for example, will have different target markets for its:

- Etsy profile

- Ecommerce website

- Brick-and-mortar store

People buying through the brand’s online store will be different from those visiting its Houston brick-and-mortar store. Location is the most obvious difference: selling online opens you up to reach potential customers all over the world. You don’t get that luxury with a physical store (unless you’re in a tourist destination).

Similarly, the platforms you’re marketing your business through have varying target markets. Those who discover products through Instagram likely follow one of the many influencers using the platform to make a living. The target market for Pinterest users, however, may prioritize handmade goods over mass manufactured ones.

To define your target market for a particular platform or sales channel, repeat the steps we’ve covered. Survey existing customers who have found or purchased your products through each. Create Google Analytics segments for each referring source, then use the Ecommerce purchases report to find the most popular products for visitors from each channel :

Or, go directly to the platform itself. Many social media platforms have features for surveying your audience, including Instagram Story polls .

You could even host a giveaway where followers win something—like a free product—in exchange for information about your target market on that channel. “Comment below why you’d like to win” is a simple conversation starter to get your followers talking .

How big should my target market be?

Calculate your target market size by doing some desk research. Lean on free resources, like the ones listed below, to tell you how many people share the same traits you’ve defined.

The US Bureau of Labor Statistics is a great resource to investigate jobs, income levels, and how people spend their free time. Statista also compiles data on how many people buy, watch, stream, or read something .

You could also use Facebook’s audience builder to see estimated sizes based on the interests, genders, and locations of your target market. (Important note: Facebook’s audience builder only includes data from its users, so you may want to avoid this technique if you’re aiming for a target market known not to use the platform.)

A common mistake marketers make when defining their target market is assuming that everyone is a customer. You may try to reach anyone and everyone with the hope they could turn into a customer if you strike your marketing message right. The total opposite occurs in reality.

If you’re unable to form a definition [of who your target market is], your marketing will come across as watered down, therefore essentially wasting money on people who have zero interest in what you’ll have to say. —Ecommerce Entrepreneur Sam Barrante

The same problem occurs if you go too niche. Sure, you can reach a smaller subset of people with uber-specific and personalized marketing messages. But a target market of 100,000 people, assuming the average conversion rate of 2.86%, equals just 2,860 paying customers. If they’re buying $50 products, that results in revenue of $143,000. Repeat customers can bump that figure upward, but it’s still not generating enough revenue to transform a lifestyle business into a larger one.

There is no best practice for how big your target market should be. Certain industries are fundamentally larger than others. There are more people interested in buying groceries than there are people interested in buying Star Wars costumes, for example.

As a rough guideline, assume you’ll achieve the average market penetration rate of 2% to 6% —the percentage of your target market who purchase your product. Multiply your market size by those percentages to see the very top end of achievable revenue.

(For context: Apple claims 51.62% market share for mobile operating systems, hence why you see iOS products everywhere.)

How to segment and reach your target market

You don’t run marketing campaigns to reach your target market. That would be too broad. Segmenting your market to identify target audiences for individual campaigns is what helps you take action on your research. If you use Shopify, then Shopify Segmentation enables you to discover powerful insights about your customers.

So, break your target market down into smaller segments to create target audiences —a smaller subset of your target market who your marketing efforts are tailored to. Within those are buyer personas: fictional representatives for one target audience within your target market.

Take Great Little Trading Company ’s target market for example. Its ideal customers are parents with young children. But other variables, like parents’ geographic location, child’s age, and income level, all come into play. It would be a mistake for the retailer to disregard people who are parents to young children but don’t meet all three checkboxes. They’re still its target market—just a smaller segment of it.

For common characteristics that appear in some potential customers but not others, consider them segments of your target market. Here are three popular ways to use this data for digital marketing.

Demographic segmentation

Demographic target market segmentation is the process of creating personas of people with shared characteristics, such as:

- Ethnicity

- Generations (e.g., Gen X, Gen Z, Millennials, etc.)

- Income level

- Marital status

- Education level