Key Takeaways From JPMorgan’s Investor Day Presentation

The JPMorgan Chase & Co. offices in London.

Here are the key takeaways from JPMorgan Chase & Co. ’s investor day Monday:

To access the full TOPLive blog, click here to read on the Terminal or here online.

- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore blockchain, client service, process payments, manage funds, safeguard information, banking-as-a-service, send payments.

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve

INDUSTRIES WE SERVE

Explore a variety of insights.

Global Research

- Newsletters

Insights by Topic

Explore a variety of insights organized by different topics.

Insights by Type

Explore a variety of insights organized by different types of content and media.

- All Insights

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

- Events and Conferences

Healthcare Conference

| January 8-11, 2024 | San Francisco, California

This is an official site of the J.P. Morgan Healthcare Conference. Please note there are sites offering hotel rates and access to the conference that are not affiliated with J.P. Morgan. This event is by invitation only and invitations are not transferable. Contact your J.P. Morgan representative for more information.

The 42nd Annual Healthcare Conference will take place on January 8-11, 2024 in San Francisco, CA.

This premier conference is the largest and most informative health care investment symposium in the industry which connects global industry leaders, emerging fast-growth companies, innovative technology creators and members of the investment community.

Keynotes and Select Panelists

Chairman and Chief Executive Officer,

Jpmorgan chase & co., jamie dimon.

Jamie Dimon is Chairman of the Board and Chief Executive Officer of JPMorgan Chase & Co., a global financial services firm with assets of $3.2 trillion and operations worldwide. The firm is a leader in investment banking, financial services for consumers, small business, commercial banking, financial transaction processing and asset management. Mr. Dimon became CEO on January 1, 2006 and one year later also became Chairman of the Board. He was named President and Chief Operating Officer upon the company’s merger with Bank One Corporation on July 1, 2004. He joined Bank One as Chairman and CEO in 2000. Mr. Dimon began his career at American Express Company. Next, he served as Chief Financial Officer and then President at Commercial Credit, which made numerous acquisitions and divestitures, including acquiring Primerica Corporation in 1987 and the Travelers Corporation in 1993. He served as President and Chief Operating Officer of Travelers from 1990 through 1998 while concurrently serving as Chief Operating Officer of its Smith Barney Inc. subsidiary before becoming Co-Chairman and Co-CEO of the combined brokerage following the 1997 merger of Smith Barney and Salomon Brothers. In 1998 Mr. Dimon was named President of Citigroup Inc., the global financial services company formed by the combination of Travelers Group and Citicorp. Mr. Dimon earned his bachelor’s degree from Tufts University and holds an MBA from Harvard Business School. He serves on the boards of directors of a number of nonprofit institutions including the Business Roundtable, Bank Policy Institute and Harvard Business School. Additionally, he serves on the executive committee of the Business Council and the Partnership for New York City, and he is a member of the Financial Services Forum and Council on Foreign Relations.

Executive Chairman of the Institute for Global Change and Prime Minister of Great Britain and Northern Ireland (1997–2007)

The rt. hon. tony blair.

Tony Blair served as Prime Minister of Great Britain and Northern Ireland from 1997 to 2007, the only Labour leader in the party’s 100-year history to win three consecutive elections. During his time in Downing Street, Mr. Blair implemented a major domestic reform agenda. Through record investment and reform, the UK’s education and healthcare sectors were transformed. The New Labour Government led by Mr. Blair implemented the largest hospital and school building program since the creation of the UK’s welfare state. Overall crime was reduced by a third, and the first ever national minimum wage was introduced. There was also transformational progress on human rights and equality, all of which took place during a period of record economic growth and levels of employment. As Prime Minister, Mr. Blair was also a central figure on the global stage. He helped bring peace to Northern Ireland, securing the historic Good Friday Agreement in 1998. He was a passionate advocate of an interventionist foreign policy. He created the Department for International Development, tripled the UK’s foreign aid to Africa, and introduced landmark legislation to tackle climate change. Since leaving office Mr. Blair has spent most of his time working on three areas: supporting governments to deliver effectively for their people, working for peace in the Middle East and countering extremism. He established the Tony Blair Institute for Global Change to work on some of the most difficult challenges in the world today, believing that real leadership has never been more necessary or more difficult. Currently, teams from Mr. Blair’s institute are directly supporting leaders across the globe in their fight against COVID-19, delivering analysis and advice to help countries mitigate the economic impact, harness the power of technology and better position themselves for the rebuilding to come.

Ph.D., Deputy Assistant to the President, Cancer Moonshot & Deputy Director,

Health outcomes, white house office of science and technology policy, danielle carnival.

Danielle Carnival contributes to the Biden-Harris Administration’s effort to improve health outcomes for the American people, including leading the effort to achieve the President’s goal of ending cancer as we know it. As CEO of I AM ALS from 2018-2021, Dr. Carnival provided strategic leadership and management for this patient-driven community that is reshaping public understanding of ALS, providing key resources to the community, and creating opportunities for patients to lead the fight against ALS and the drive for cures. Prior, Danielle was Vice President of the Biden Cancer Initiative. From 2010 to 2017, Dr. Carnival worked at White House on issues in the areas of health and biomedical policy, STEM education, and advancing equity in STEM fields, among others. She served as Chief of Staff for the White House Cancer Moonshot and was entrusted with leadership roles for the President and Vice President on some of their signature initiatives and events, including White House Science Fairs, College Opportunity Days of Action, and Computer Science for All and Diversity in STEM initiatives. Danielle earned her Ph.D. in Neuroscience from Georgetown University, and B.S. in Biochemistry from Boston College.

President & CEO,

Institute for clinical and economic review, sarah k. emond.

As ICER’s President & CEO, with nearly 25 years of experience in the business and policy of health care, Sarah leads the strategic operations of the Institute for Clinical and Economic Review – a leading non-profit health policy research organization. Sarah will advance to the role of President and Chief Executive Officer in January 2024. She joined ICER in 2009 as its first Chief Operating Officer and third employee, and has worked to grow the organization’s approach, scope, and impact over those 14 years. Prior to joining ICER, Sarah spent time as a communications consultant, with six years in the corporate communications and investor relations department at a commercial-stage biopharmaceutical company, and several years with a health care communications firm. Sarah began her health care career in clinical research at Beth Israel Deaconess Medical Center in Boston. A graduate of the Heller School for Social Policy and Management at Brandeis University, Sarah holds a Master of Public Policy degree with a concentration in health policy. Sarah also received a bachelor’s degree in biological sciences from Smith College. Sarah speaks frequently at national conferences on the topics of prescription drug pricing policy, comparative effectiveness research, and value-based health care. In her free time, Sarah enjoys skiing and hiking in the White Mountains of New Hampshire.

M.D., Ph.D., FACP, FCCP, Executive Director,

Aamc research and action institute, atul grover.

Atul Grover, MD, PhD, FACP, FCCP is the inaugural Executive Director of the AAMC Research and Action Institute. The Institute brings together experts from the nation’s academic medical centers and other leaders in policy to tackle complex health policy issues, bring nonpartisan analysis to policy, and develop straightforward solutions to improve health. Dr. Grover leads the Institute’s novel approach to helping policy makers and the public understand, navigate, and improve American health care. Dr. Grover is an internal medicine physician, health services researcher, and nationally recognized expert in health policy. Dr. Grover joined the AAMC as associate director for the Center for Workforce Studies in 2005, where he managed research activity and directed externally funded workforce studies. He became a director of government relations and health care affairs in 2007, and served as the association’s chief public policy officer from 2011-2016. From 2016-2020 he served as executive vice president, providing strategic leadership in the areas of medical education, academic affairs, health care affairs, scientific affairs, learning and leadership programming, diversity and inclusion, public policy, and communications. Previously, Dr. Grover held positions in health care finance and applied economics consulting as well as in the U.S. Public Health Service, Health Resources and Service Administration National Center for Health Workforce Analysis. Dr. Grover earned his Doctor of Medicine degree from George Washington University (GWU) School of Medicine and his PhD in health and public policy from Johns Hopkins University Bloomberg School of Public Health. Dr. Grover holds faculty appointments at GWU School of Medicine, and JHU Bloomberg School of Public Health.

M.D., M.P.H., Acting Chief Medical Officer and Acting Director,

Center for clinical standards and quality (ccsq), centers for medicare & medicaid services, dora hughes.

Dora Hughes, M.D., M.P.H., was named the Acting Chief Medical Officer and Acting Director of the Center for Clinical Standards and Quality (CCSQ) for the Centers for Medicare & Medicaid Services (CMS) in July 2023. CCSQ is primarily responsible for executing all national clinical, quality, and safety standards for healthcare facilities and providers, as well as establishing coverage determinations for items and services that improve health outcomes for Medicare beneficiaries. Previously, Dr. Hughes served as Chief Medical Officer at the CMS Innovation Center. She led the Center’s work on health equity, advised on care delivery, payment and data collection strategies for the Center’s models and initiatives, and represented CMS on clinical and cross-agency working groups within HHS. Earlier in her career, Dr. Hughes served as the Counselor for Science & Public Health to Secretary Kathleen Sebelius at the U.S. Department of Health & Human Services. In this role, she helped with passage and early implementation of the Affordable Care Act and provided oversight and guidance on priority issues regarding public health and prevention; workforce and the safety net; food, drug and device regulatory matters; and biomedical research innovation. In addition to federal service, Dr. Hughes was an Associate Research Professor at the Milken Institute School of Public Health at George Washington University (GWU), where her work focused on the intersection of clinical and community health, health equity, healthcare delivery and teaching. She remains on faculty at GWU’s School of Medicine and Health Sciences. Dr. Hughes also has served as Senior Policy Advisor at Sidley Austin, where she advised on regulatory and legislative matters in the life science industry. Dr. Hughes began her career in health policy as Senior Program Officer at the Commonwealth Fund, and subsequently as Deputy Director for the Health, Education, Labor, and Pensions (HELP) Committee under Senator Edward M. Kennedy. She then served as the Health Policy Advisor to former Senator Barack Obama. Dr. Hughes received a B.S. from Washington University, M.D. from Vanderbilt and M.P.H. from Harvard. She completed internal medicine residency at Brigham & Women’s Hospital.

Ph.D., CEO,

American cancer society, karen knudsen.

Karen E. Knudsen, MBA PhD, is the CEO of both the American Cancer Society (ACS) and the American Cancer Society Cancer Action Network (ACS CAN). As an internationally recognized oncology leader, healthcare executive, and advocate, Dr. Knudsen guides both organizations toward the goal of improving the lives of cancer patients and their families. Under Dr. Knudsen, ACS adopted a tripartite strategy to improve lives, resting on the pillars of discovery, advocacy, and patient support. In the discovery (research) pillar, ACS is the largest non-profit funder of cancer research outside the US government, generating breakthroughs in cancer prevention, detection, and treatment that helped to reduce cancer mortality by 33% since 1991. The advocacy arm functions at the state and national level to provide access to these breakthroughs and end cancer disparities through legislation and policy change. Finally, ACS patient support teams work in 5,000 communities across the country to provide patient education, navigation, transportation, and lodging near cancer care. Combined, ACS touches more than 50 million lives each year, and leads the way in ending cancer as we know it, for everyone. Prior to joining ACS, Dr. Knudsen was the EVP of Oncology Services for Jefferson Health and director of the Sidney Kimmel Cancer Center, one of the elite National Cancer Institute’s NCI-Designated Cancer Centers in the US. Dr. Knudsen is well known for her practice-changing discoveries in prostate cancer, contributing to new, effective cancer treatments. In addition to leading ACS, Dr. Knudsen currently holds a number of thought leadership roles across the nation, serving on the board of advisors for the National Cancer Institute, and on 12 external advisory boards for NCI-Designated Cancer Centers. She is an active member of several committees with the American Society for Clinical Oncology (ASCO), in addition to serving on other academic and for-profit advisory boards.

Morgan Health

Dan mendelson.

Dan Mendelson is the Chief Executive Officer of Morgan Health at JPMorgan Chase & Co. Mendelson oversees a business unit at JPMorgan Chase focused on accelerating the delivery of new care models that improve the quality, equity and affordability of employer-sponsored healthcare. Mendelson was previously Founder and CEO of Avalere Health, a healthcare advisory company based in Washington DC. He also served as Operating Partner at Welsh Carson, a private equity firm. Before founding Avalere, Mendelson served as associate director for Health at the Office of Management and Budget in the Clinton White House. Mendelson currently serves on the boards of Vera Whole Health and Champions Oncology (CSBR). He is also an adjunct professor at the Georgetown University McDonough School of Business. He previously served on the boards of Coventry Healthcare, HMS Holdings, Pharmerica, Partners in Primary Care, Centrexion, and Audacious Inquiry. Mendelson holds a Bachelor of Arts (BA) from Oberlin College, and a Master of Public Policy (MPP) from the Kennedy School of Government at Harvard University.

Assistant Professor of Clinical Medicine,

Division of general internal medicine at ucsf (08/2020 - present), diana thiara.

Diana Thiara, MD, is an Assistant Professor of Clinical Medicine within the Division of General Internal Medicine at UCSF (08/2020 - Present). She works in primary care and also is the Medical Director of UCSF's Medical Weight Management Clinic (08/2020 - Present). Her academic interests are focused on developing patient programs for weight management and wellness. She also has created multiple culinary medicine programs within DGIM for patients and is working to expand programming throughout UCSF. Dr. Thiara is board certified in Internal Medicine and is also a Diplomat of the American Board of Obesity Medicine. Dr. Thiara received her bachelor's degree in Political Science from Yale University and her medical degree from Vanderbilt University School of Medicine. She completed Internal Medicine Residency and fellowship at UCSF. Dr. Thiara is an expert in Obesity Medicine. She has been interviewed by several national news agencies, including the Wall Street Journal, Bloomberg, the Washington Post, and Vox, to discuss treatment for obesity, including medications. She has served as a KOL on Obesity Medicine related topics.

Executive Chairman of the Institute for Global Change; Prime Minister of Great Britain and Northern Ireland (1997–2007)

Ph.d., deputy assistant to the president, cancer moonshot & deputy director, white house office of science and technology policy.

She contributes to the Biden-Harris Administration’s effort to improve health outcomes for the American people, including leading the effort to achieve the President’s goal of ending cancer as we know it. As CEO of I AM ALS from 2018-2021, Dr. Carnival provided strategic leadership and management for this patient-driven community that is reshaping public understanding of ALS, providing key resources to the community, and creating opportunities for patients to lead the fight against ALS and the drive for cures. Prior, Danielle was Vice President of the Biden Cancer Initiative. From 2010 to 2017, Dr. Carnival worked at White House on issues in the areas of health and biomedical policy, STEM education, and advancing equity in STEM fields, among others. She served as Chief of Staff for the White House Cancer Moonshot and was entrusted with leadership roles for the President and Vice President on some of their signature initiatives and events, including White House Science Fairs, College Opportunity Days of Action, and Computer Science for All and Diversity in STEM initiatives. Danielle earned her Ph.D. in Neuroscience from Georgetown University, and B.S. in Biochemistry from Boston College.

M.D., Ph.D., FACP, FCCP, Executive Director, AAMC Research and Action Institute,

M.d., m.p.h., acting chief medical officer and acting director, center for clinical standards and quality, center for clinical standards and quality, centers for medicare & medicaid services, ph.d., ceo, american cancer society, university of california, san francisco.

What’s The Deal?

Insights from j.p. morgan’s 42nd healthcare conference.

Mike Gaito, Global Head of Healthcare Investment Banking, shares insights on the latest healthcare developments and the impact of economic factors on this sector.

Major themes shaping health care services in 2024

Lisa Gill Senior Analyst, Healthcare Service, J.P. Morgan Research

From utilization trends to GLP-1s, Lisa Gill, a Senior Analyst covering Health Care Services, tells us what she’s keeping an eye on in 2024.

Lisa: Things to watch for in 2024 when we think about healthcare services specific to managed care and facilities, one, utilization trends. If you think about 2023, we saw an uptick in Medicare advantage utilization trends, we anticipate that those trends will carry forward into the first half of 2024. Second, GLP-1, the impact on both sides. How will this impact the commercial market? How will it impact PBMs? Third, the presidential election.

Lisa: GLP-1 were a big area of topic in 2023. They are currently not covered by Medicare or Medicaid. However, as we move into 2024, We'll need a legislative change for them to be covered.

We recently conducted a survey of 50 of the top 500 companies in the country, a large percentage of them are saying they're not going to cover it for weight loss, so we'll have to wait and see what happens.

Lisa: As we think about the medical costs and pharmacy costs in 24, we're getting back to normalization. Post covid, we had two years where people did not go to the doctor. They did not have surgical procedures done.

We had anticipated coming into 23 that we would see a higher acuity level. what we saw this year is that both cardiac procedures as well as orthopedic procedures, were higher than expected.

As we go into 2024, we expect that trend to continue within Medicare Advantage. On the commercial side, we have generally seen in line, utilization trends across the commercial population.

Lisa: As we think about potential legislative changes for the PBM, pharmacy benefit management business. One of the areas that they're trying to drive is more transparency in the business model. We believe any of the legislation is pretty benign to the current industry as we see it and therefore remain positive on the industry.

Key opportunity spaces for the pharmaceuticals sector in 2024

Chris Schott Senior Analyst, U.S. Diversified Biopharma, J.P. Morgan Research

Chris Schott, a Senior Analyst covering U.S. Diversified Biopharma, underscores what investors should be focusing on this year.

Chris: Heading into 2024, we're seeing a really exciting opportunity to revisit the pharmaceutical sector given some of the underperformance we saw in 2023. We've got investors sentiments actually pretty bearish for the group right now. And we think that's going to be a really nice opportunity for investors to look at a fairly well positioned group at record low valuations.

Chris: We're really excited about the innovation more broadly across the sector. If you just think about 2023, we had the first disease modifying Alzheimer's drug fully approved by the FDA. If you look at oncology market, we had new technologies, things like CAR-T, bispecific antibodies, ADCs, meaningfully improving standard of care in a number of tumor types. These are huge markets where you haven't seen innovation in the last decade or longer.

Chris: The GLP one category. This year has been really an exciting year. We're estimating that this will be over a hundred billion revenue opportunity for the sector by the time we go out to the early 2030s. And that would make the GLP-1s the largest therapeutic market we've ever seen. We're expecting the capacity for the GLP-1s to double in 2024, increase another 50% in 2025, and that should really alleviate the bottlenecks we have from the capacity standpoint.

Chris: As we think about M&A, the themes really remain growth and innovation and that should lead to further consolidation of the small and mid-cap biotech sector, particularly the higher quality names. What we're seeing is a pivot away from larger, more complex transactions that we saw in the past. And instead what the industry seems to be doing is looking at these kind of smaller assets that are easier to integrate.

Chris: As I think about healthcare reform, the big focus for us is going to be on drug price negotiations. This is really coming about because of the inflation reduction act, which is allowing the US government for the first time to directly negotiate drug pricing with the pharmaceutical industry. Many of these are going to make drugs more affordable for seniors, which is great. But for the drug industry specifically, we're got to really watch to see how these negotiations go. It's a big overhang for the sector. One we think is manageable, but obviously we've got to watch exactly how these negotiations play out.

Research Recap

The growing appetite for obesity drugs.

The increase in appetite for obesity drugs

What’s the Deal?

Robbie huffines: dealmaking in the health care sector.

Alex Gorsky: Making big strategic moves in health care

The state of innovation in a volatile market.

How are companies supporting innovation in the health care industry, and what does the future hold?

Healthcare Symposium

Vis Raghavan: A very warm welcome to this, our inaugural innovation symposium in the health care space. It's absolutely fantastic that you can all kind of join us here today.

Dania Chehab: There is quite a lot of innovation coming from health care. And this really permeates across all subsectors, be it cutting edge R&D in biotech, genetic sequencing, and life science tools and diagnostic-- the consumerization of health care, which we have seen accelerate over the last couple of years.

Jeremy Hunt: Life sciences is one that we are particularly proud of, not just because we are home to a third of the European life science startups, but because we can see the impact on ordinary families of what happens when you have a strong life science sector.

Christian Wolfum: We have a growing, but also aging population. There's a strong need for more and more precise medicine. And life science companies help there a lot. The life science industry, it's an industry where you have partners from corporate, academia providers. You can really create an ecosystem of open innovation, bringing new ideas into your company, really seeing what will impact health care and the clinical practice in a couple of years from now.

Rose Nguyen: Over the past 5 to 10 years, there has been tremendous progress in the field in some areas that even exceeded our expectations. We believe that there is a technological revolution going on in health care and life sciences.

Shobi Khan: There's so much innovation going on. And I think to be in that space now, to be able to participate in those discoveries is an extraordinary opportunity.

David Redfern: We feel very optimistic about the level of science. There's a lot of great innovation happening, a lot of great science happening. It is being accelerated by the tech revolution. And the interface of data science with biological and genetic science is hugely exciting.

Juha Anjala: We support innovation in many different ways. We have always been willing to invest early in a relationship with innovators. We are a relationship-based organization that invests in our clients early, consistently, and over time.

David Ke: I'm very excited by a number of the strong innovations that we have coming out of the health care sector. For example, whether it's the latest cutting edge science coming out of biotechnology. It's been unique and remarkable to see just the globalization within the health care industry over the past decade, whether it's European companies that want to list in the U.S., but also attract capital from Asia, or Asia companies thinking about listing in London, but also wanting to attract U.S. investors.

Chris Hollowood: We're incredibly lucky relative to some other industries, where clearly you need to create value for shareholders, but also you create value for so many other stakeholders. At the scientific level translating world-beating science into medicines, then at the medicine level when you see the impact on patients. And the wonderful thing is actually when you serve all three, all three have the greatest success. So there's an alignment there. So if you can't get out of bed in the morning energized by all of that, I don't know what you can.

Highlights from the 41st Annual J.P. Morgan Healthcare Conference

Read our recap of the industry's biggest gathering.

How do I register for the conference?

The J.P. Morgan Healthcare Conference is for clients of the firm, by invitation only. Please reach out to your J.P. Morgan representative to inquire about an invitation.

Can I listen to company presentation if I’m not registered for the conference

Some company presentations will be available on their individual websites.

Where do I get the agenda?

The agenda is made available only to confirmed attendees.

Are media permitted to attend the conference?

Yes. There are a limited number of press passes available for the event.

What is your media policy?

Unless otherwise specified, conference webinars are on-the-record and open to registered members of the press.

Related insights

J.P. Morgan Podcasts

Leaders across J.P. Morgan share their views on the events that are shaping companies, industries and markets around the world.

Sign up for the bi-weekly In Context newsletter, bringing market views and industry news from J.P. Morgan straight to your inbox.

J.P. Morgan’s Research team leverages cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice.

Modal title

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

- Mutual Funds

- SmartRetirement Funds

- 529 Portfolios

- Alternatives

- Separately Managed Accounts

- Money Market Funds

- Commingled Funds

- Featured Funds

Asset Class Capabilities

- Fixed Income

- Multi-Asset Solutions

- Global Liquidity

Investment Approach

- ETF Investing

- Model Portfolios

- Sustainable Investing

- Commingled Pension Trust Funds

Education Savings

- 529 Plan Solutions

- College Planning Essentials

Defined Contribution

- Target Date Strategies

- Retirement Income

- Startup and Micro 401(k) Plan Solutions

- Small to Mid-market 401(k) Plan Solutions

Market Insights

- Market Insights Overview

- Guide to the Markets

- Quarterly Economic & Market Update

- Guide to Alternatives

- Market Updates

- On the Minds of Investors

- Principles for Successful Long-Term Investing

- Weekly Market Recap

Portfolio Insights

- Portfolio Insights Overview

- Asset Class Views

- Long-Term Capital Market Assumptions

- Multi-Asset Solutions Strategy Report

- Strategic Investment Advisory Group

Retirement Insights

- Retirement Insights Overview

- Guide to Retirement

- Principles for a Successful Retirement

- Retirement Hot Topics

Portfolio Construction

- Portfolio Construction Tools Overview

- Portfolio Analysis

- Investment Comparison

- Heatmap Analysis

- Bond Ladder Illustrator

- Retirement Plan Tools & Resources Overview

- Target Date Compass®

- Core Menu Evaluator℠

- Price Smart℠

- Account Service Forms

- News & Fund Announcements

- Insights App

- Continuing Education Opportunities

- Market Response Center

- Artificial Intelligence

- Diversity, Equity, & Inclusion

- Spectrum: Our Investment Platform

- Media Resources

- Our Leadership Team

... Open parent breadcrumb items

- Home | US Financial Professionals

3Q24 Economic and Market Update

This is David Kelly.

I’m Chief Strategist here at J.P. Morgan Asset Management and I head the team that produces the Guide to the Markets. Welcome to the Economic and Market Update for the second quarter of 2024.

Despite facing numerous challenges in 2023, the U.S. economy defied widespread predictions of recession. Growth moderated to a still-strong 3.2% pace in the fourth quarter while inflation continued to fall towards the Fed’s 2% target, although progress has slowed in recent months. This year, moderate job gains and easing inflation should allow the U.S. economy to continue on a soft-landing path. That said, as cyclical tailwinds fade and the U.S. election approaches, there are still plenty of risks to economic stability.

Meanwhile, while the Federal Reserve held rates steady its March meeting, the Fed’s updated dot plot showed only the smallest possible majority of FOMC members expecting as many as three rate cuts in 2024, and they reduced the number of expected rate cuts in 2025 from four to three, underscoring the very gradual nature of projected policy easing. On a more positive note, they did express their intention to begin to reduce quantitative tightening fairly soon.

As investors adjusted to the prospect of fewer rate cuts, long-term interest rates moved higher during the first quarter. Equities, however, appeared unphased by this, setting new all-time highs with the largest stocks still leading the charge. In the year ahead, attractive relative fundamentals outside of the largest stocks should support broader equity market performance, while fixed income should play its traditional role of providing income and diversification. Outside of public assets, alternatives still offer investors to enhance portfolio performance through alpha, diversification and income.

The Guide to the Markets, now in its 20 th year, is constructed to try to illustrate economic fundamentals and investment opportunities and risks. However, it is important to do this concisely. There are over 60 pages in the Guide, but that is far too many for any conversation about the markets.

So, what we do here is boil it down to just 11 slides. In particular, we assess the recent performance of the markets and economy, considering trends in growth, jobs and inflation in the U.S., and how these trends are shaping the outlook for monetary policy. This is followed by comments on growth from around the globe. Finally, we consider the implications of all of this for those investing across asset classes and highlight the importance stepping out of cash and actively engaging with opportunities in alternative assets.

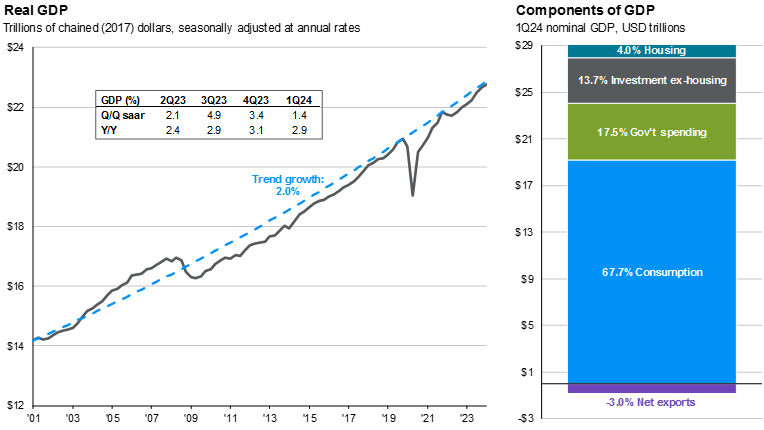

The U.S. economy ended 2023 on a high note, with the fourth quarter marking the sixth consecutive quarter of growth at or above 2%. While the economy may struggle to match last year’s impressive performance, 2024 looks set to be another year of expansion.

Consumers have displayed impressive strength, supported by a tight labor market. That said, some signs of stress are emerging. While revolving credit as a share of disposable income is not flashing any warning signs, auto and credit card loan delinquencies have risen above their pre-pandemic levels, with student loan delinquencies likely to follow. As a still tight labor market and rising real wages offset dwindling excess savings and tighter credit conditions, consumers should continue to spend at a more moderate pace this year.

Business spending has endured tighter lending standards better than expected, supported by increased spending on intellectual property with greater emphasis on developing artificial intelligence capabilities. Tailwinds from AI spending and support from the federal government should continue to partially offset the impact of higher interest rates , while inventories should continue to grow at a steady pace. However, tighter lending standards and weaker corporate profits could still constrain growth in capital expenditures.

The housing market has stabilized at depressed levels, and while a boom in the sector seems unlikely given elevated mortgage rates, tight supply suggests a recovery in activity is more likely than another decline. Trade may be a slight drag on the economy as a still-strong dollar and sluggish global growth weigh on exports. Meanwhile, increased spending on public infrastructure and stronger hiring should continue to support government spending.

Overall, the U.S. economy remains on a soft-landing track, although last year’s momentum looks set to fade. That said, with a U.S. election on the horizon, high policy rates, and elevated geopolitical tension, risks remain that could knock the U.S. economy off its steady path.

While the labor market has normalized from its post-pandemic boom, the U.S. economy still added an impressive 250,000 jobs per month in 2023 and has sustained this pace into early 2024. This has occurred even as the unemployment rate has remained at or below 4% since December 2022 – the longest such streak of low unemployment since the late 1960s. Despite fears of an economic slowdown, strong growth in the U.S. labor supply has allowed employers to steadily hire workers and narrow the gap between supply and demand.

After falling sharply during the pandemic, labor supply in the U.S. staged an impressive recovery over the last two years, largely due to increased immigration. In fact, in fiscal year 2023, Immigration Services approved over 2 million applications for employment authorization, a 70% increase from a record 1.2 million in fiscal 2022. With this surge in migrant workers, employers were able to fill open job openings without applying upwards pressure to wages, helping to explain why strong job creation hasn’t sparked higher inflation. Importantly, a strong recovery in the labor force participation rate has also boosted labor supply. While continued aging of baby boomers into their retirement years has left the overall labor force participation rate below pre-pandemic levels, participation amongst the working age population, or those aged 18-64, has fully recovered its pandemic losses.

Moving forward, still elevated job openings and moderate economic growth point to steady job gains ahead. While this would seem to imply a steady decline in the unemployment rate, the continued influx of migrants should provide a fresh source of workers which could keep the unemployment rate within a narrow range of 3.5% to 4.0%.

While year-over-year CPI inflation remains well below its June 2022 peak of 9.1%, it has stubbornly hovered around 3.2% since October, sparking fears of no further meaningful decline However, we believe that there are still disinflationary forces that should keep inflation on its downward path this year.

Core goods prices trended lower in 2023 as supply chain distortions related to the pandemic and Russia’s invasion of Ukraine continued to fade. Even with recent conflict in the Middle East, supply chains are still in good shape, and goods prices should remain well behaved. On the more volatile components, energy prices have risen in recent months while food prices continue to ease. Moving forward, slow global demand limits the likelihood of a surge in either of these categories. Lastly, shelter inflation, which accounts for over a third of the CPI basket, should follow real-time measures of market rent increases lower.

That leaves us with core services prices excluding housing, a closely watched measure by the Fed given its ties to the labor market. As we show on the right-hand slide of slide 27, progress here has stalled in recent months, largely due to “transportation services,” which remains elevated due to things like auto insurance and repair costs. However, as the rollover in vehicle and auto prices feed through the data, pressures here should ease substantially. This, along with moderating wage growth, should allow services prices to trend lower through the end of the year.

Overall, the disinflationary trend established in 2023 should continue into 2024. While the ride down may take slightly longer than anticipated, the Fed should feel reasonably confident that inflation can fall to close to their 2% target by the end of the year.

With the fourth quarter earnings season in the books, earnings growth finished 2023 flat despite a year of above average economic activity. While these are seemingly lackluster results, they actually surpassed initial expectations for a small earnings contraction. Robust economic activity supported revenues, which were the largest contributor to earnings growth, as consumer strength and pricing power helped boost sales. Margins, however, have detracted from earnings as higher wages, inflation in input costs and geopolitical turmoil offset some of the costs savings of adapting more efficient technological processes. This dynamic was evident in the fourth quarter as margins fell after a third quarter recovery.

While profits could experience healthy growth in 2024, downside risks to analyst expectations for double-digit earnings growth remain. Indeed, gloomy commentary from management teams point to tougher times ahead as growing revenues will become increasingly difficult in an environment of moderating consumer demand and disinflation. However, after the “Magnificent 7” companies drove the lion share of earnings growth in 2023, profit leadership should broaden out this year.

Late last year, the Federal Reserve sparked investor enthusiasm for aggressive policy easing in 2024 after they signaled that rates are at their cycle peak. Since then, mixed economic data has challenged investors’ outlook for rate cuts and left them searching for more guidance.

At its March meeting, the Federal Reserve left rates unchanged at a range of 5.25% to 5.50% and continued to signal three rates cuts in 2024. However, they cut their forecast for rate cuts in 2025 from four cuts to three. In addition, they boosted their projection for the federal funds rate in the long run from 2.5% to 2.6%, in a sign of a slightly more hawkish stance.

In addition, to rate cuts the Fed signaled that they plan to slow the pace of quantitative tightening fairly soon. This should leave the Fed with much larger Treasury holdings that before the pandemic for an extended period of time, helping hold long-term interest rates down. With market expectations and Fed messaging very much in sync, it would likely take a meaningful change in the economic outlook to trigger any sharp movement in long-term interest rates in the months ahead.

The international economy ended 2023 on a rather sluggish note, although there were some exceptions. This dynamic will likely persist into 2024, as some economies could outshine others amidst slowing global momentum.

Depressed sentiment in China continues to challenge both domestic and global growth, and even more economic troubles could lie ahead without meaningful policy support for consumers and manufacturers. Similarly, Europe remains burdened by weaker consumption and business activity, particularly in Germany. However, the prospects of lower energy prices and rising real wages have sparked optimism for improvement ahead. In Japan, the end of negative interest rates should serve as a strong tailwind for activity after the country narrowly avoided a technical recession last year. Other markets, such as Mexico, India and Taiwan have benefited from positive secular trends, including supply chain diversification and semiconductor manufacturing related to AI.

This year could bring better performance for places like Japan and some European markets while others, like China, may continue to struggle. With U.S consumer activity expected to slow, there is still potential for growth differentials to narrow and for other global markets to surprise to the upside.

After hopes for aggressive policy easing fueled an impressive bond market rally late last year, most sectors shown on slide 31 are off to a slower start in 2024 as resilient economic data have forced investors to reign in their expectations for rate cuts. That said, with market and Fed expectations now largely in-line, the worst of bond market volatility is likely behind us, and current yields appear increasingly attractive.

Indeed, with higher yields now offering an attractive “yield cushion,” fixed income offers strong asymmetric returns. Taking the U.S. Aggregate as an example; if yields were to fall by 1%, an investor could expect a return upwards of 11%. However, if rates were to rise by 1%, the coupons from the bonds would help offset some of the price depreciation, and that same investor could expect a loss of only 1.5%.

While rising interest rates led to negative bond returns in 2022, those higher rates today offer investors both positive real income and the portfolio protection provided by the traditional tendency of bonds to rally when stocks falter in the face of economic weakness.

After an impressive 2023, U.S. equities have continued their upward momentum in the early months of 2024. In fact, resilient corporate profits and hopes for policy easing have produced multiple all-time market highs this year. However, market performance remains concentrated as the largest stocks in the index have continued to dominate. While valuations might look stretched, there are still plenty of attractive opportunities outside of this cohort of Mega Cap stocks.

On the left of slide 10, we compare the price-to-earnings ratio of the top 10 stocks in the S&P to that of the broader index. The historically narrow nature of the recent rally has left the top 10 stocks significantly more expensive than the broader index, while the remaining stocks look cheap comparatively and are trading closer to their long-term average.

Indeed, index concentration is not a new phenomenon as the weight of the top 10 stocks in the S&P 500 has been rising since 2016. However, while the top 10 stocks dominated earnings growth last year, their earnings contribution hasn’t kept pace over the long run. With the top 10 stocks now representing a third of the index but only a fourth of the earnings, there appears to be a strong case for investing in the rest of the index.

If economic growth continues at a steady pace in 2024, gains should broaden out beyond the largest names as the market grinds higher. In this environment, an active approach can help identify those companies with high quality earnings and attractive valuations that are being overlooked by the markets.

While many U.S. based investors may feel inclined to focus on opportunities at home, there are attractive fundamental tailwinds emerging outside of the U.S. that can’t be ignored. Slide 46 of the Guide aims to highlight opportunities that investors may be missing.

In terms of earnings growth, the U.S. has been the standout market as of late, although prospects in other countries are improving. In particular, higher inflation in Japan and Europe has allowed companies to raise prices and expand their margins, and the end of negative interest rates in both countries should help boost profits for Financials, a key sector in both markets. While pessimism around China has weighed on Emerging Market earnings estimates, they have stabilized in recent months, suggesting that the worst of this pessimism is already priced in.

With the exception of China, strong equity returns since the beginning of 2023 have pushed valuations higher. Even still, in both absolute terms and relative to their own histories, international markets continue to look attractively priced compared to the U.S. Overall, the potential shift in earnings growth across international markets, combined with discounted valuations, presents an attractive opportunity for U.S. investors looking to diversify abroad.

With equity valuations elevated and bond yields low relative to history, less impressive returns from the 60/40 portfolio moving forward may force investors to look elsewhere for consistent outcomes across alpha, income and diversification. However, investors willing to venture outside of the public markets can leverage a range of different alternative assets to reach their desired outcomes. Indeed, as we show on slide 55 of the Guide, alternative assets can offer low correlations to public markets, diversified income streams and enhanced long-run returns.

Real assets shown towards the left, such as real estate, infrastructure and transport, tend to be less correlated to a traditional 60/40 portfolio while providing robust income. Private equity and venture capital, towards the right, provide much higher total returns but come with higher correlations to public markets and less income generation.

The classic 60/40 stock-bond portfolio still looks attractive, but adding a sleeve of alternatives can help long-term investors achieve strategic goals through higher alpha, better diversification and enhanced income.

Thanks to the Federal Reserve’s rate hiking campaign, cash looks more attractive today than in the last two decades. With yields north of 5% and minimal risk, many investors have decided to allocate more heavily to cash, pushing money market fund assets to a record $6.1 trillion.

However, history shows that staying parked in cash after the peak in interest rates usually leaves money on the table. In the last six rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates, while the S&P 500 and a 60/40 stock-bond portfolio outperformed in 5 of these periods.

This is not to say that investors should abandon cash altogether, as liquidity is an important allocation in any portfolio. However, there is an opportunity cost in holding onto too much cash, and investors should put long-term money in long-term assets. Following a peak in interest rates there has always been a better asset than cash to deploy capital.

This remains the case today, as the U.S. and global economies continue to grow even as inflation wanes and central banks begin to back off from very tight monetary policy. However, with the higher valuations produced by the strong investment returns of 2023 and early 2024, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk as well as provide solid long-term income and capital gains.

For more on the Guide to the Markets, visit our website at am.jpmorgan.com.

There are 65 pages in the Guide to the Markets. However, we believe that the key themes for the first quarter can be highlighted by referencing just 11 slides.

Economic & Market Update: Using the Guide to the Markets to explain the investment environment

Event Details

40th annual j.p. morgan healthcare conference, email alerts.

To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option. After submitting your request, you will receive an activation email to the requested email address. You must click the activation link in order to complete your subscription. You can sign up for additional alert options at any time.

At Pfizer, we promise to treat your data with respect and will not share your information with any third party. You can unsubscribe to any of the investor alerts you are subscribed to by visiting the ‘unsubscribe’ section below. If you experience any issues with this process, please contact us for further assistance.

By providing your email address below, you are providing consent to Pfizer to send you the requested Investor Email Alert updates.

| * |

| * | ||||||

Email Alert Sign Up Confirmation

Forward-Looking Statements of Pfizer Inc.This transcript may contain forward-looking statements about, among other things, our anticipated operating and financial performance, business plans and prospects; expectations for our product pipeline, in-line products and product candidates, including anticipated regulatory submissions, data read-outs, study starts, approvals, post-approval clinical trial results and other developing data that become available, revenue contribution, growth, performance, timing of exclusivity and potential benefits; manufacturing and product supply; our efforts to respond to COVID-19, including our development of a vaccine to help prevent COVID-19 and our investigational protease inhibitor; our expectations regarding the impact of COVID-19 on our business; plans for and prospects of our acquisitions, dispositions and other business-development activities, and our ability to successfully capitalize on these opportunities; and discussions relating to strategic reviews, capital allocation objectives, dividends and share repurchases, among other things, that involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. A description of these risks and uncertainties can be found in Pfizer’s most recent Annual Report on Form 10-K and in its subsequent reports on Form 10-Q, including in the sections thereof captioned “Risk Factors” and “Forward-Looking Information and Factors That May Affect Future Results”, as well as in its subsequent reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission and available at www.sec.gov and www.pfizer.com . The forward-looking statements in the transcript speak only as of the original date of the webcast. Pfizer assumes no obligation to update forward-looking statements contained in the webcast as the result of new information or future events or developments. This webcast may contain forward-looking statements about, among other things, our anticipated operating and financial performance, reorganizations, business plans and prospects; expectations for our product pipeline, in-line products and product candidates, including anticipated regulatory submissions, data read-outs, study starts, approvals, clinical trial results and other developing data that become available, revenue contribution, growth, performance, timing of exclusivity and potential benefits; strategic reviews; capital allocation objectives; dividends and share repurchases; plans for and prospects of our acquisitions, dispositions and other business development activities, and our ability to successfully capitalize on these opportunities; manufacturing and product supply; our efforts to respond to COVID-19, including the Pfizer-BioNTech COVID-19 vaccine and our investigational protease inhibitor; and our expectations regarding the impact of COVID-19 on our business that involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements.

JPMorgan Sets Up Dubai Private Banking Team to Tap Wealth Boom (Bloomberg) -- JPMorgan Chase & Co is establishing a private banking team in Dubai, joining a raft of rivals that have deployed additional resources to the Middle East to capitalize on the thousands of millionaires flocking to the region. The firm has transferred two bankers from Geneva and London to establish the new team, which it plans to grow in coming years, according to a statement. The duo — Sebastian Botana de Beauvau and Carol Mushriqui — will be expected to win business with affluent individuals, family offices, charities and foundations across the region. Lured by the lack of income taxes and a luxury lifestyle, more millionaires are expected to move to the United Arab Emirates this year than any other destination, according to Henley & Partners. About 6,700 ultra-wealthy individuals are expected to move to the country, nearly double the influx expected in the US. In response, some of the world’s largest wealth managers from UBS Group AG to Deutsche Bank AG have earmarked the Middle East as a major growth opportunity. HSBC Holdings Plc added 100 bankers in the region last year and plans to hire “opportunistically” in coming months, while Swiss wealth manager Julius Baer Group Ltd. has hired senior bankers to beef up its business catering to rich Indians in Dubai. JPMorgan’s international private bank is larger than any of its US rivals and the Wall Street giant has been seeking to grow the offering in recent years, according to an investor presentation in May. It has already added 11 city locations in the last decade, the presentation shows. New from Bloomberg: Get the Mideast Money newsletter, a weekly look at the intersection of wealth and power in the region. ©2024 Bloomberg L.P. Top Stories Bank of Canada cuts key interest rate again, signals more cuts ahead CPP Investments and Blackstone buying data centre company Air Trunk Toronto ranks 4th in North American tech talent, driven by demand for AI skills: CBRE Statistics Canada says country posted $684M merchandise trade surplus in July Vancouver home sales fall 17% in August despite interest rate cuts: board Text of the Bank of Canada's decision to cut its key interest rate target Watch LIVE: BNN Bloomberg David Burrows' Market Outlook: North American large caps Fedex earnings are set to growBank of canada cuts its rate to 4.25%.  BoC cuts key interest rate for the third meeting in a row We want to see eonomic growth: Macklem

Entertainment

New on Yahoo

Yahoo FinanceAmicus therapeutics to present at upcoming investor conferences in september 2024. PRINCETON, N.J., Sept. 03, 2024 (GLOBE NEWSWIRE) -- Amicus Therapeutics (Nasdaq: FOLD) today announced that management will participate in upcoming presentations at the following investor conferences in September. Morgan Stanley 22 nd Annual Global Healthcare Conference in New York, NY, on Thursday, September 5, 2024, at 10:00 a.m. ET Cantor Global Healthcare Conference 2024 in New York, NY on Tuesday, September 17, 2024, at 1:55 p.m. ET A live audio webcast of each presentation can also be accessed via the investors section of the Amicus Therapeutics corporate website at https://ir.amicusrx.com/events-and-presentations . Additionally, management will attend the 2024 Wells Fargo Healthcare Conference on Friday, September 6, 2024. About Amicus Therapeutics Amicus Therapeutics (Nasdaq: FOLD) is a global, patient-dedicated biotechnology company focused on discovering, developing and delivering novel high-quality medicines for people living with rare diseases. With extraordinary patient focus, Amicus Therapeutics is committed to advancing and expanding a pipeline of cutting-edge, first- or best-in-class medicines for rare diseases. For more information please visit the company’s website at www.amicusrx.com , and follow on X and LinkedIn . Investors: Amicus Therapeutics Andrew Faughnan Vice President, Investor Relations [email protected] (609) 662-3809 Media: Amicus Therapeutics Diana Moore Head of Global Corporate Affairs and Communications [email protected] (609) 662-5079 How we do businessAwards and recognition.  Chairman and CEO Letter to Shareholders Annual Report 2023 CommitmentsDiversity, equity and inclusion. Latest news  An Ohio-based company is protecting first responders around the world With support from JPMorganChase, Fire-Dex is providing protective equipment to firefighters in 100 countries and all 50 states. Explore all topics How vulnerable are Americans to unexpected expenses? JPMorgan Chase Institute Work with usGrow with us, how we hire, explore opportunities, students and graduates.  Veteran’s Unconventional Path to Landing her Dream Job in Tech U.S. Army Veteran Ashley Wigfall transitioned to a civilian role and charted her path to technologist through mentorship and skills training at the JPMorgan Chase tech hub in Plano, Texas. Investor Relations 2024 Investor Day2024 Investor Day Agenda Senior Management Biographies Forward-looking statements Fixed Income Full Presentation Full Transcript Individual PresentationsConference Opening Opening Remarks Presentation Firm Overview Asset & Wealth Management Consumer & Community Banking Commercial & Investment Bank Closing Remarks and Q&A Related videos Sign up for Investor news and alertsSign up for updates on the ways we are using our expertise, data, resources and scale to open new pathways to economic opportunity and drive inclusive growth in communities around the world. Contact InformationFor help as a customer or client:.

For shareholder and fixed income assistance, including requests for printed materials, please contactInvestor Relations JPMorgan Chase & Co. 277 Park Avenue New York, NY 10172-0003 212-270-2479 [email protected] For ADA-related inquiries, please contact [email protected] with the subject line “ADA inquiry” Stock Trade InformationStock transfer agent:, computershare, by regular mail computershare po box 43006 providence, ri 02940-3006, by overnight delivery: computershare 150 royall street suite 101 canton, ma 02021 800-758-4651 (toll free) 201-680-6862 (international) www.computershare.com, you are now leaving jpmorganchase. JPMorganChase's website terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its website terms, privacy and security policies to see how they apply to you. JPMorganChase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the JPMorganChase name.  |

IMAGES

VIDEO

COMMENTS

For help with J.P. Morgan Securities wealth management accounts. For questions on Asset Management, including Fund details. For general inquiries regarding JPMorgan Chase & Co. or other lines of business or call 212-270-6000.

For help as a customer or client: For help with your Chase account. For Chase customer complaints and feedback. For help with J.P. Morgan Securities wealth management accounts. For questions on Asset Management, including Fund details. For general inquiries regarding JPMorgan Chase & Co. or other lines of business or call 212-270-6000.

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.'s management and are subject to significant risks and uncertainties.

Show Transcript Dr. David Kelly's quarterly presentation using slides from the Guide to the Markets. Need more Guide to the Markets? Access an additional collection of Guide to the Markets slides, updated on a quarterly basis.

January 9, 2024. The world leader in serving science. bor / Non-GAAP MeasuresVarious remarks that we may make in the following presentations about the company's future expectations, plans and prospects constitute forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 ...

This presentation includes the following non-GAAP financial measure: Adjusted EBITDA. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

JPMorgan Chase Investor Day 2022. NEW YORK -- (BUSINESS WIRE)--May 3, 2022-- JPMorgan Chase & Co. (NYSE: JPM) ("JPMorgan Chase" or the "Firm") will host an Investor Day in New York City on Monday, May 23, 2022 at 8:00 a.m. (Eastern). Presentations by members of executive management are expected to conclude at approximately 2:30 p.m ...

The Principles of a successful retirement presentation uses select slides in the award-winning Guide to Retirement to help you simplify the complex for your clients and help them make informed decisions.

This presentation contains statements about the Company's future plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated as a result of various important factors, including ...

World's largest payments franchise1, occupying a unique place in the payments industry. On track to achieve our $15B firmwide revenue target set last year. Continue to invest to deliver scalability, efficiency, and differentiated product offerings, but expect investment spend growth to plateau. going forward.

J.P. Morgan conferences bring together corporate leaders, financial sponsors and institutional investors to explore market and sector trends.

Here are the key takeaways from JPMorgan Chase & Co.'s investor day Monday:

The 42nd Annual Healthcare Conference will take place on January 8-11, 2024 in San Francisco, CA. This premier conference is the largest and most informative health care investment symposium in the industry which connects global industry leaders, emerging fast-growth companies, innovative technology creators and members of the investment community.

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America ("U.S."), with operations worldwide. JPMorgan Chase had $3.9 trillion in assets and $328 billion in stockholders' equity as of December 31, 2023. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial ...

Economic & Market Update: Using the Guide to the Markets to explain the investment environment. Watch J.P. Morgan Asset ManagementChief Global Strategist Dr. David Kelly as he focuses on the most important themes for investors.

40th Annual J.P. Morgan Healthcare Conference 01/10/2022 3:00 PM ET Presentation Transcript

JPMorgan Chase Announces 2023 Investor Day. NEW YORK -- (BUSINESS WIRE)--Oct. 6, 2022-- JPMorgan Chase & Co. (NYSE: JPM) ("JPMorgan Chase" or the "Firm") will hold an Investor Day in New York City on Monday, May 22, 2023 with presentations given by members of executive management. A live audio webcast and presentation slides will be ...

HOW WE DO BUSINESS — THE REPORT JPMORGAN CHASE — WHO WE ARE AT A GLANCE JPMorgan Chase & Co., a financial holding company, is a leading global financial services company and one of the largest banking institutions in the United States.

This presentation includes certain non-Generally Accepted Accounting Principles ("GAAP") financial measures that we use to describe the Company's performance. The non-GAAP financial measures are provided as supplemental information and are presented because management has evaluated the Company's financial results both including and ...

JPMorgan Chase & Co is establishing a private banking team in Dubai, joining a raft of rivals that have deployed additional resources to the Middle East to capitalize on the thousands of millionaires flocking to the region. ... It has already added 11 city locations in the last decade, the presentation shows. New from Bloomberg: Get the Mideast ...

JPMorgan Chase & Co. closed out the most profitable year in US banking history with its seventh consecutive quarter of record net interest income and a surprise forecast that the windfall may ...

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.'s management and are subject to significant risks and uncertainties.

TAMPA, Fla., Sept. 04, 2024 (GLOBE NEWSWIRE) -- Kforce Inc. (NYSE: KFRC), a provider of professional staffing services and solutions, today announced that management will participate in the J.P ...

Asset and Wealth Management. ~45% U.S. PB clients use branch. ~4,000 International UHNW relationships. 94% of You Invest clients are digitally active2. 7,300 hours spent by employees in data science training. > JPMC TV interviews from AWM markets experts. 9mm unique visitors to AWM websites. $1B+ tech spend.

PRINCETON, N.J., Sept. 03, 2024 (GLOBE NEWSWIRE) -- Amicus Therapeutics (Nasdaq: FOLD) today announced that management will participate in upcoming presentations at the following investor ...

Investor Day | JPMorganChase. New JPMorgan Chase HQ Drives Billions in Economic Growth for New York. With about 8,000 jobs created and $2.6 billion added to New York City's economy, JPMorgan Chase is proud to help fuel NYC and sends gratitude to the construction workers who made this possible. An Ohio-based company is protecting first ...