The Ultimate Guide to Writing a Nonprofit Business Plan

A business plan can be an invaluable tool for your nonprofit. Even a short business plan pushes you to do research, crystalize your purpose, and polish your messaging. This blog shares what it is and why you need it, ten steps to help you write one, and the dos and don’ts of creating a nonprofit business plan.

Nonprofit business plans are dead — or are they?

For many nonprofit organizations, business plans represent outdated and cumbersome documents that get created “just for the sake of it” or because donors demand it.

But these plans are vital to organizing your nonprofit and making your dreams a reality! Furthermore, without a nonprofit business plan, you’ll have a harder time obtaining loans and grants , attracting corporate donors, meeting qualified board members, and keeping your nonprofit on track.

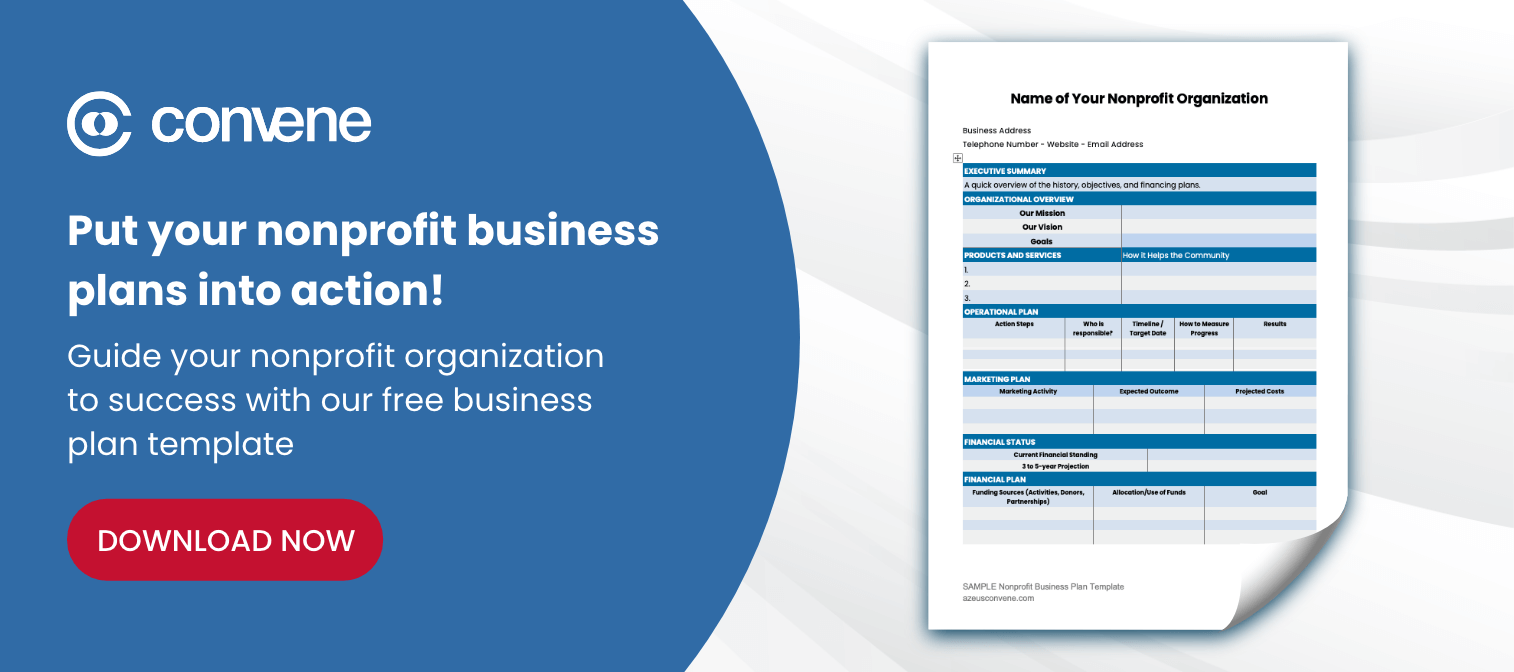

Even excellent ideas can be totally useless if you cannot formulate, execute, and implement a strategic plan to make your idea work. In this article, we share exactly what your plan needs and provide a nonprofit business plan template to help you create one of your own.

What is a Nonprofit Business Plan?

A nonprofit business plan describes your nonprofit as it currently is and sets up a roadmap for the next three to five years. It also lays out your goals and plans for meeting your goals. Your nonprofit business plan is a living document that should be updated frequently to reflect your evolving goals and circumstances.

A business plan is the foundation of your organization — the who, what, when, where, and how you’re going to make a positive impact.

The best nonprofit business plans aren’t unnecessarily long. They include only as much information as necessary. They may be as short as seven pages long, one for each of the essential sections you will read about below and see in our template, or up to 30 pages long if your organization grows.

Why do we need a Nonprofit Business Plan?

Regardless of whether your nonprofit is small and barely making it or if your nonprofit has been successfully running for years, you need a nonprofit business plan. Why?

When you create a nonprofit business plan, you are effectively creating a blueprint for how your nonprofit will be run, who will be responsible for what, and how you plan to achieve your goals.

Your nonprofit organization also needs a business plan if you plan to secure support of any kind, be it monetary, in-kind , or even just support from volunteers. You need a business plan to convey your nonprofit’s purpose and goals.

It sometimes also happens that the board, or the administration under which a nonprofit operates, requires a nonprofit business plan.

To sum it all up, write a nonprofit business plan to:

- Layout your goals and establish milestones.

- Better understand your beneficiaries, partners, and other stakeholders.

- Assess the feasibility of your nonprofit and document your fundraising/financing model.

- Attract investment and prove that you’re serious about your nonprofit.

- Attract a board and volunteers.

- Position your nonprofit and get clear about your message.

- Force you to research and uncover new opportunities.

- Iron out all the kinks in your plan and hold yourself accountable.

Before starting your nonprofit business plan, it is important to consider the following:

- Who is your audience? E.g. If you are interested in fundraising, donors will be your audience. If you are interested in partnerships, potential partners will be your audience.

- What do you want their response to be? Depending on your target audience, you should focus on the key message you want them to receive to get the response that you want.

10-Step Guide on Writing a Business Plan for Nonprofits

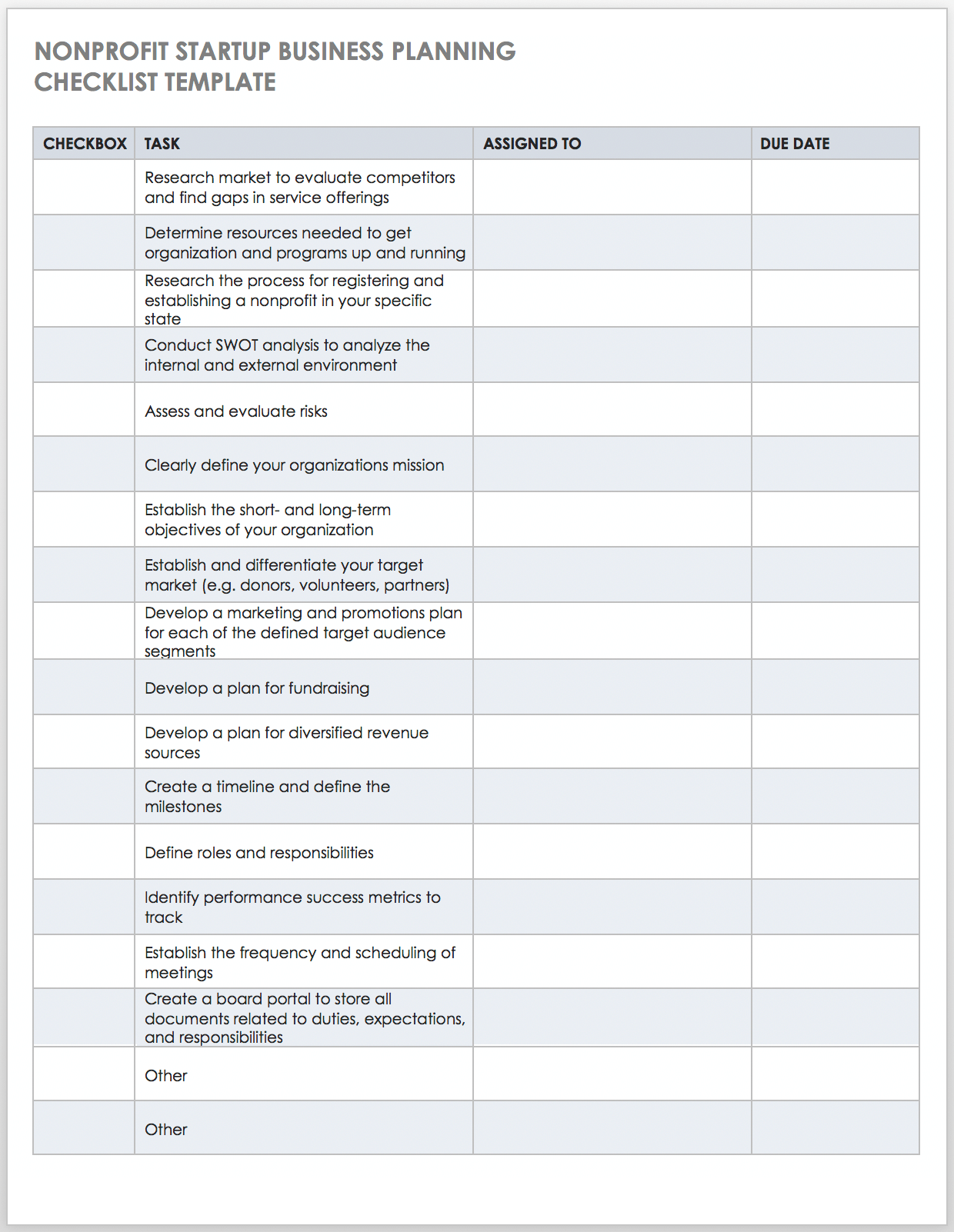

Note: Steps 1, 2, and 3 are in preparation for writing your nonprofit business plan.

Step 1: Data Collection

Before even getting started with the writing, collect financial, operating, and other relevant data. If your nonprofit is already in operation, this should at the very least include financial statements detailing operating expense reports and a spreadsheet that indicates funding sources.

If your nonprofit is new, compile materials related to any secured funding sources and operational funding projections, including anticipated costs.

Step 2: Heart of the Matter

You are a nonprofit after all! Your nonprofit business plan should start with an articulation of the core values and your mission statement . Outline your vision, your guiding philosophy, and any other principles that provide the purpose behind the work. This will help you to refine and communicate your nonprofit message clearly.

Your nonprofit mission statement can also help establish your milestones, the problems your organization seeks to solve, who your organization serves, and its future goals.

Check out these great mission statement examples for some inspiration. For help writing your statement, download our free Mission & Vision Statements Worksheet .

Step 3: Outline

Create an outline of your nonprofit business plan. Write out everything you want your plan to include (e.g. sections such as marketing, fundraising, human resources, and budgets).

An outline helps you focus your attention. It gives you a roadmap from the start, through the middle, and to the end. Outlining actually helps us write more quickly and more effectively.

An outline will help you understand what you need to tell your audience, whether it’s in the right order, and whether the right amount of emphasis is placed on each topic.

Pro tip: Use our Nonprofit Business Plan Outline to help with this step! More on that later.

Step 4: Products, Programs, and Services

In this section, provide more information on exactly what your nonprofit organization does.

- What products, programs, or services do you provide?

- How does your nonprofit benefit the community?

- What need does your nonprofit meet and what are your plans for meeting that need?

E.g. The American Red Cross carries out its mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.

Don’t skimp out on program details, including the functions and beneficiaries. This is generally what most readers will care most about.

However, don’t overload the reader with technical jargon. Try to present some clear examples. Include photographs, brochures, and other promotional materials.

Step 5: Marketing Plan

A marketing plan is essential for a nonprofit to reach its goals. If your nonprofit is already in operation, describe in detail all current marketing activities: any outreach activities, campaigns, and other initiatives. Be specific about outcomes, activities, and costs.

If your nonprofit is new, outline projections based on specific data you gathered about your market.

This will frequently be your most detailed section because it spells out precisely how you intend to carry out your business plan.

- Describe your market. This includes your target audience, competitors, beneficiaries, donors, and potential partners.

- Include any market analyses and tests you’ve done.

- Outline your plan for reaching your beneficiaries.

- Outline your marketing activities, highlighting specific outcomes.

Step 6: Operational Plan

An operational plan describes how your nonprofit plans to deliver activities. In the operational plan, it is important to explain how you plan to maintain your operations and how you will evaluate the impact of your programs.

The operational plan should give an overview of the day-to-day operations of your organization such as the people and organizations you work with (e.g. partners and suppliers), any legal requirements that your organization needs to meet (e.g. if you distribute food, you’ll need appropriate licenses and certifications), any insurance you have or will need, etc.

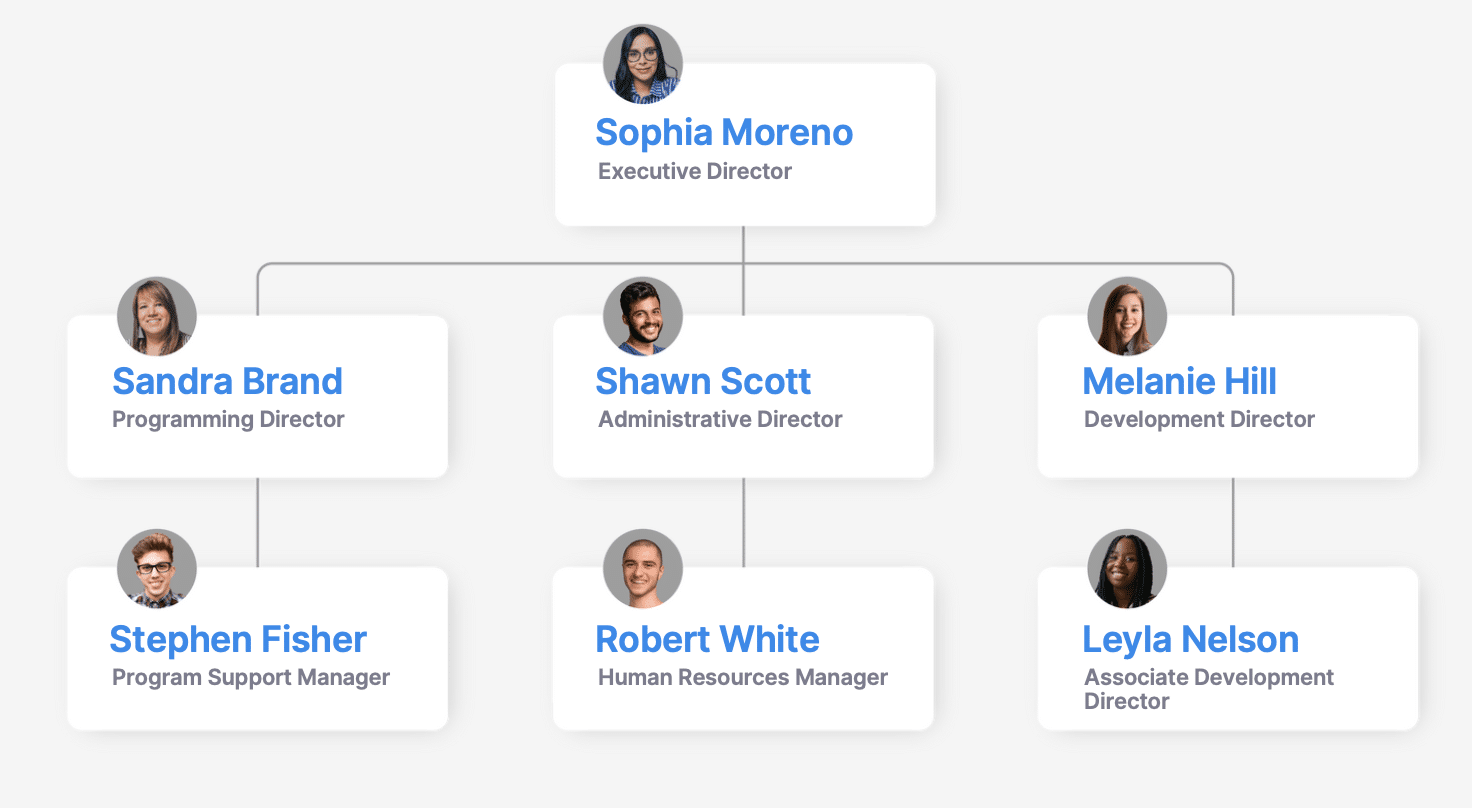

In the operational plan, also include a section on the people or your team. Describe the people who are crucial to your organization and any staff changes you plan as part of your business plan.

Pro tip: If you have an organizational chart, you can include it in the appendix to help illustrate how your organization operates. Learn more about the six types of nonprofit organizational charts and see them in action in this free e-book .

Step 7: Impact Plan

For a nonprofit, an impact plan is as important as a financial plan. A nonprofit seeks to create social change and a social return on investment, not just a financial return on investment.

Your impact plan should be precise about how your nonprofit will achieve this step. It should include details on what change you’re seeking to make, how you’re going to make it, and how you’re going to measure it.

This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives.

These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.

Answer these in the impact plan section of your business plan:

- What goals are most meaningful to the people you serve or the cause you’re fighting for?

- How can you best achieve those goals through a series of specific objectives?

E.g. “Finding jobs for an additional 200 unemployed people in the coming year.”

Step 8: Financial Plan

This is one of the most important parts of your nonprofit business plan. Creating a financial plan will allow you to make sure that your nonprofit has its basic financial needs covered.

Every nonprofit needs a certain level of funding to stay operational, so it’s essential to make sure your organization will meet at least that threshold.

To craft your financial plan:

- Outline your nonprofit’s current and projected financial status.

- Include an income statement, balance sheet , cash flow statement, and financial projections.

- List any grants you’ve received, significant contributions, and in-kind support.

- Include your fundraising plan .

- Identify gaps in your funding, and how you will manage them.

- Plan for what will be done with a potential surplus.

- Include startup costs, if necessary.

If your nonprofit is already operational, use established accounting records to complete this section of the business plan.

Knowing the financial details of your organization is incredibly important in a world where the public demands transparency about where their donations are going.

Pro tip : Leverage startup accelerators dedicated to nonprofits that can help you with funding, sponsorship, networking, and much more.

Step 9: Executive Summary

Normally written last but placed first in your business plan, your nonprofit executive summary provides an introduction to your entire business plan. The first page should describe your non-profit’s mission and purpose, summarize your market analysis that proves an identifiable need, and explain how your non-profit will meet that need.

The Executive Summary is where you sell your nonprofit and its ideas. Here you need to describe your organization clearly and concisely.

Make sure to customize your executive summary depending on your audience (i.e. your executive summary page will look different if your main goal is to win a grant or hire a board member).

Step 10: Appendix

Include extra documents in the section that are pertinent to your nonprofit: organizational chart , current fiscal year budget, a list of the board of directors, your IRS status letter, balance sheets, and so forth.

The appendix contains helpful additional information that might not be suitable for the format of your business plan (i.e. it might unnecessarily make it less readable or more lengthy).

Do’s and Dont’s of Nonprofit Business Plans – Tips

- Write clearly, using simple and easy-to-understand language.

- Get to the point, support it with facts, and then move on.

- Include relevant graphs and program descriptions.

- Include an executive summary.

- Provide sufficient financial information.

- Customize your business plan to different audiences.

- Stay authentic and show enthusiasm.

- Make the business plan too long.

- Use too much technical jargon.

- Overload the plan with text.

- Rush the process of writing, but don’t drag it either.

- Gush about the cause without providing a clear understanding of how you will help the cause through your activities.

- Keep your formatting consistent.

- Use standard 1-inch margins.

- Use a reasonable font size for the body.

- For print, use a serif font like Times New Roman or Courier. For digital, use sans serifs like Verdana or Arial.

- Start a new page before each section.

- Don’t allow your plan to print and leave a single line on an otherwise blank page.

- Have several people read over the plan before it is printed to make sure it’s free of errors.

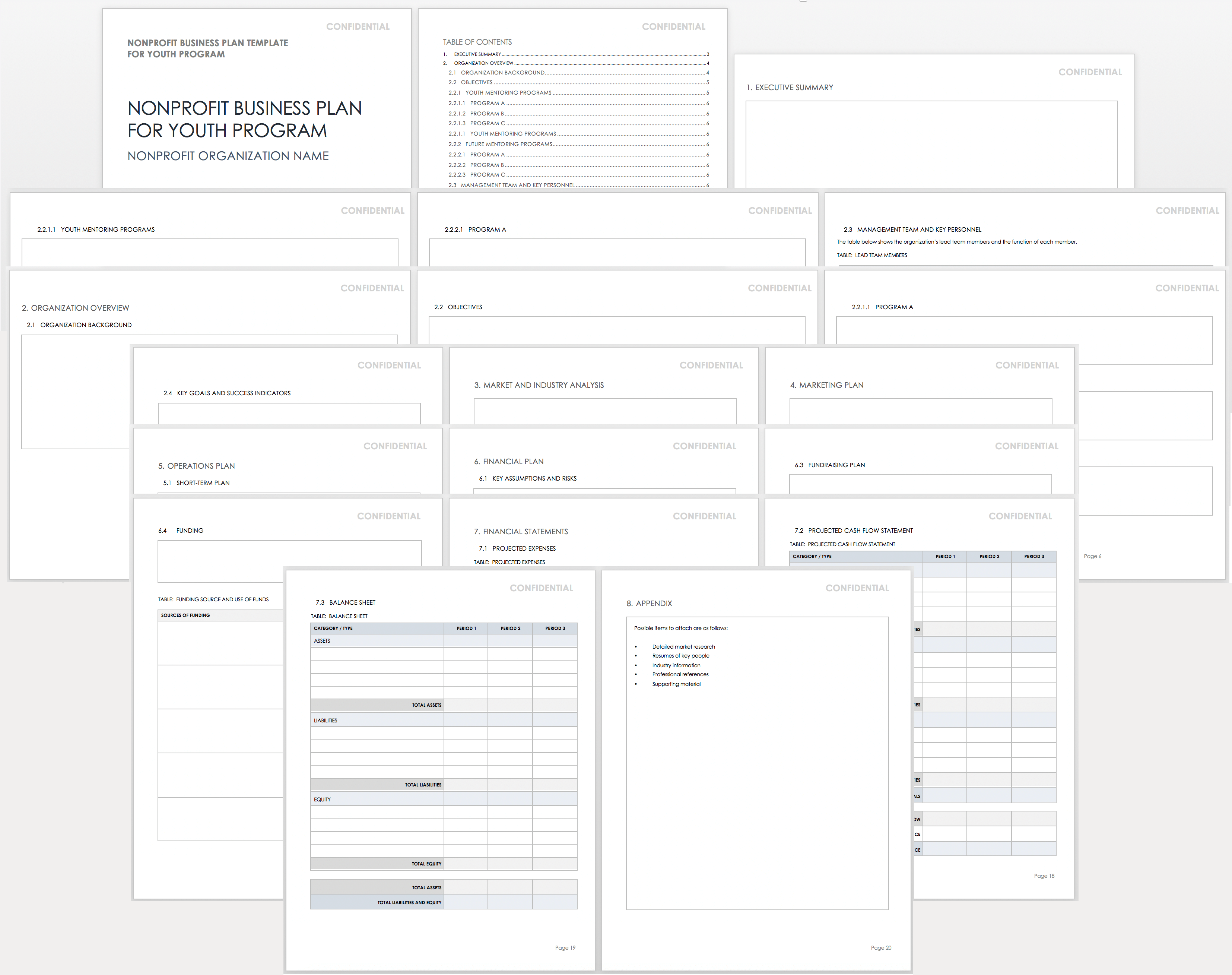

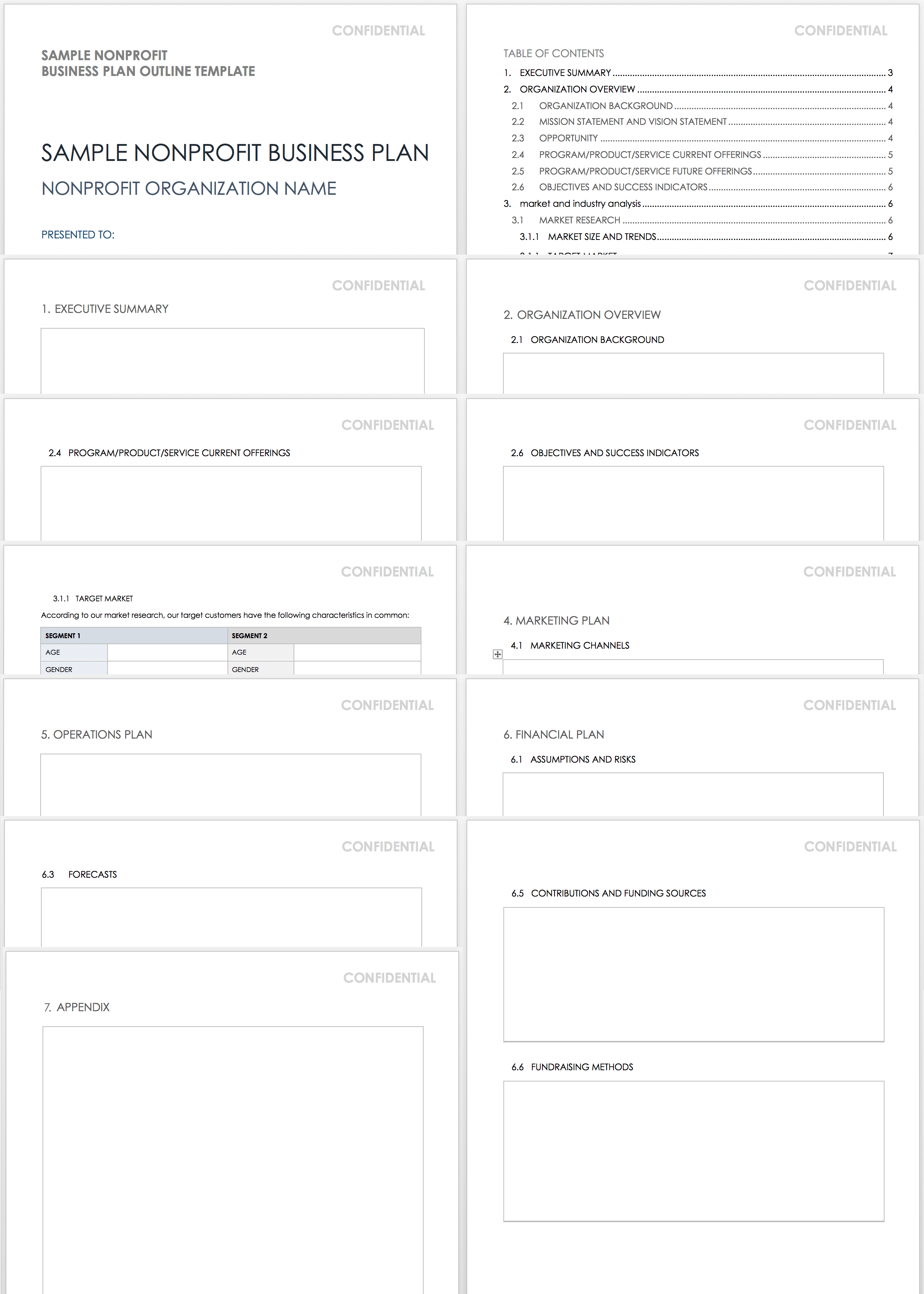

Nonprofit Business Plan Template

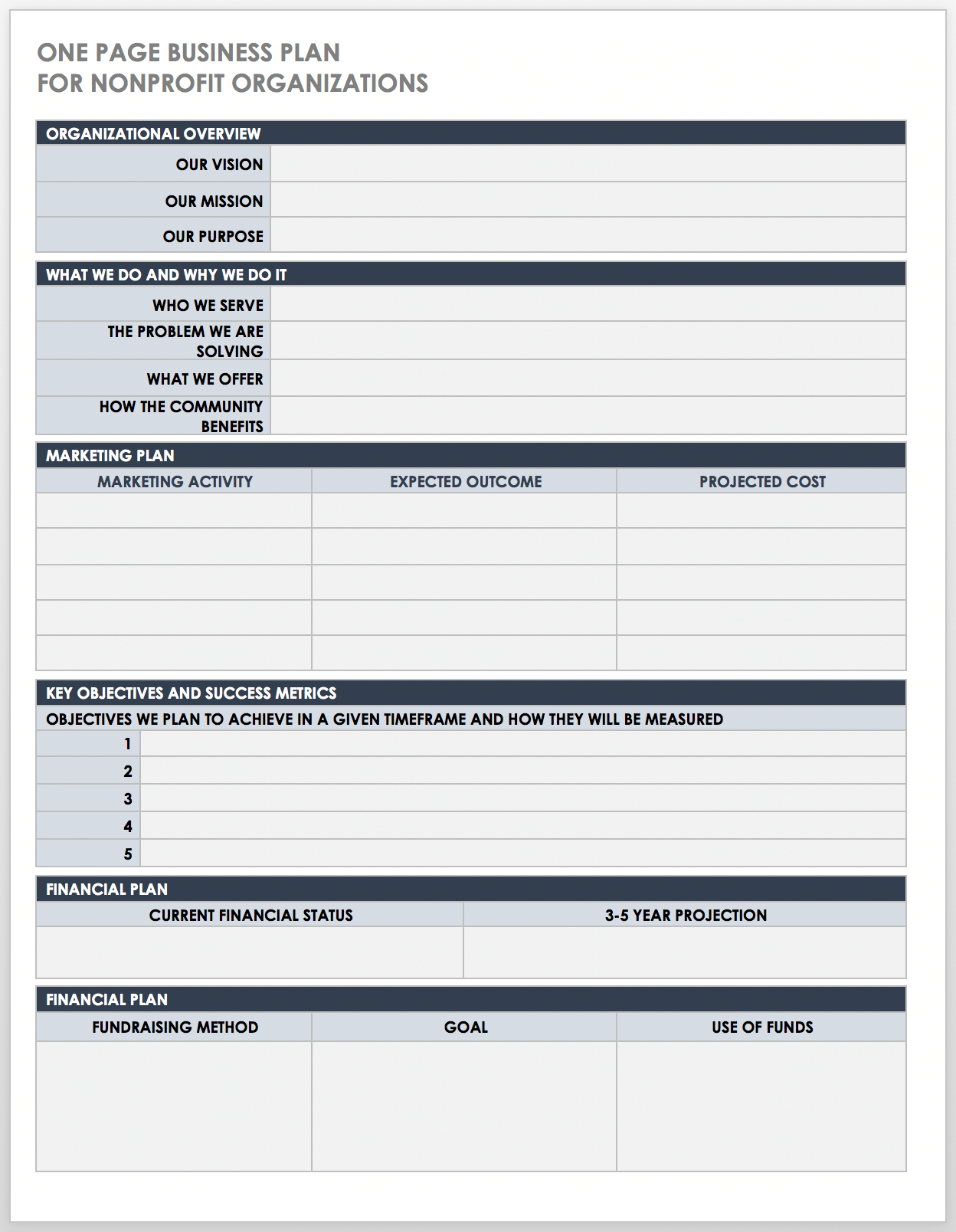

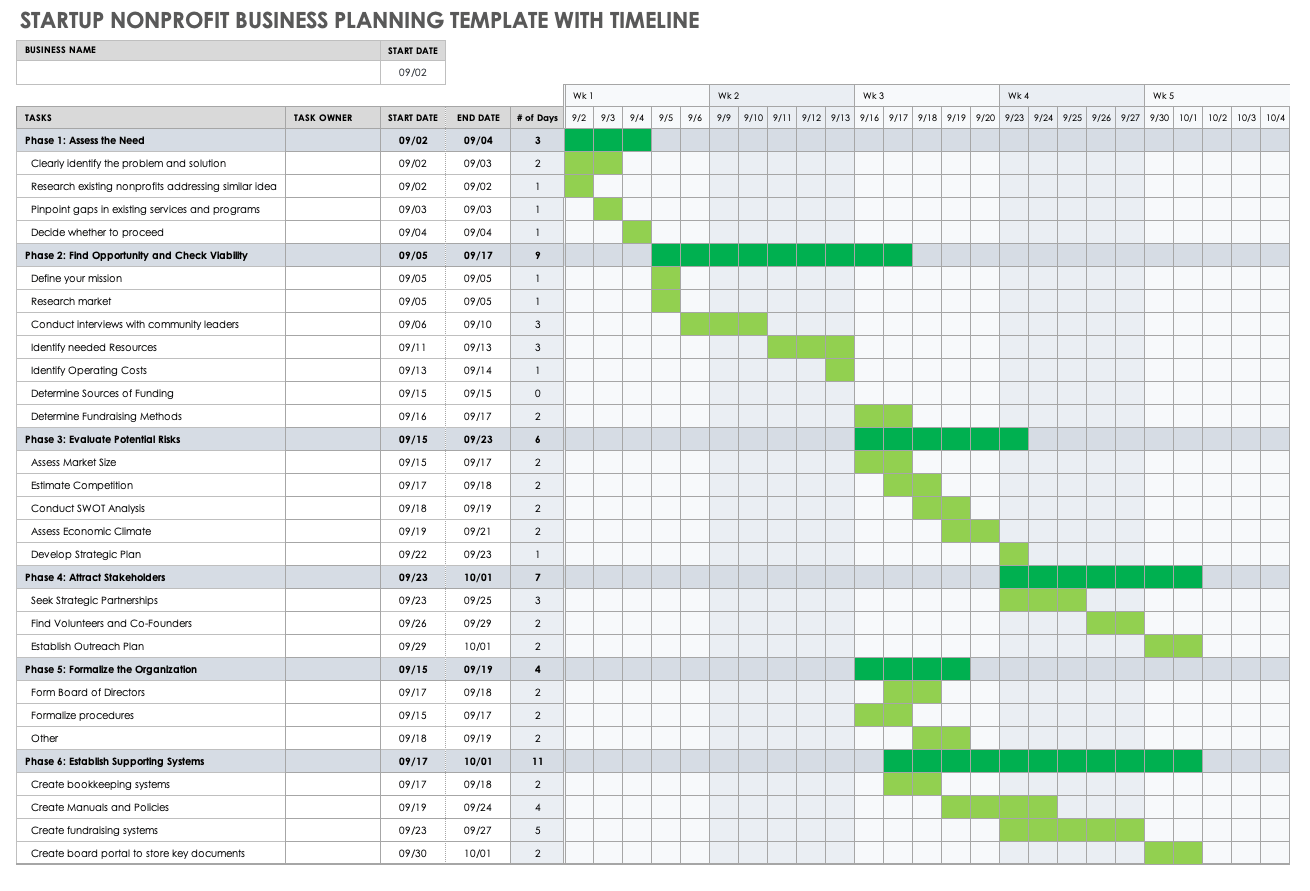

To help you get started we’ve created a nonprofit business plan outline. This business plan outline will work as a framework regardless of your nonprofit’s area of focus. With it, you’ll have a better idea of how to lay out your nonprofit business plan and what to include. We have also provided several questions and examples to help you create a detailed nonprofit business plan.

Download Your Free Outline

At Donorbox, we strive to make your nonprofit experience as productive as possible, whether through our donation software or through our advice and guides on the Nonprofit Blog . Find more free, downloadable resources in our Library .

Many nonprofits start with passion and enthusiasm but without a proper business plan. It’s a common misconception that just because an organization is labeled a “nonprofit,” it does not need to operate in any way like a business.

However, a nonprofit is a type of business, and many of the same rules that apply to a for-profit company also apply to a nonprofit organization.

As outlined above, your nonprofit business plan is a combination of your marketing plan , strategic plan, operational plan, impact plan, and financial plan. Remember, you don’t have to work from scratch. Be sure to use the nonprofit business plan outline we’ve provided to help create one of your own.

It’s important to note that your nonprofit should not be set in stone—it can and should change and evolve. It’s a living organism. While your vision, values, and mission will likely remain the same, your nonprofit business plan may need to be revised from time to time. Keep your audience in mind and adjust your plan as needed.

Finally, don’t let your plan gather dust on a shelf! Print it out, put up posters on your office walls, and read from it during your team meetings. Use all the research, data, and ideas you’ve gathered and put them into action!

If you want more help with nonprofit management tips and fundraising resources, visit our Nonprofit Blog . We also have dedicated articles for starting a nonprofit in different states in the U.S., including Texas , Minnesota , Oregon , Arizona , Illinois , and more.

Learn about our all-in-one online fundraising tool, Donorbox, and its simple-to-use features on the website here .

Raviraj heads the sales and marketing team at Donorbox. His growth-hacking abilities have helped Donorbox boost fundraising efforts for thousands of nonprofit organizations.

Join the fundraising movement!

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a nonprofit business plan.

A nonprofit business plan ensures your organization’s fundraising and activities align with your core mission.

Every nonprofit needs a mission statement that demonstrates how the organization will support a social cause and provide a public benefit. A nonprofit business plan fleshes out this mission statement in greater detail. These plans include many of the same elements as a for-profit business plan, with a focus on fundraising, creating a board of directors, raising awareness, and staying compliant with IRS regulations. A nonprofit business plan can be instrumental in getting your organization off the ground successfully.

Start with your mission statement

The mission statement is foundational for your nonprofit organization. The IRS will review your mission statement in determining whether to grant you tax-exempt status. This statement also helps you recruit volunteers and staff, fundraise, and plan activities for the year.

[Read more: Writing a Mission Statement: A Step-by-Step Guide ]

Therefore, you should start your business plan with a clear mission statement in the executive summary. The executive summary can also cover, at a high level, the goals, vision, and unique strengths of your nonprofit organization. Keep this section brief, since you will be going into greater detail in later sections.

Identify a board of directors

Many business plans include a section identifying the people behind the operation: your key leaders, volunteers, and full-time employees. For nonprofits, it’s also important to identify your board of directors. The board of directors is ultimately responsible for hiring and managing the CEO of your nonprofit.

“Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission,” wrote the Council of Nonprofits.

As such, identify members of your board in your business plan to give potential donors confidence in the management of your nonprofit.

Be as realistic as possible about the impact you can make with the funding you hope to gain.

Describe your organization’s activities

In this section, provide more information about what your nonprofit does on a day-to-day basis. What products, training, education, or other services do you provide? What does your organization do to benefit the constituents identified in your mission statement? Here’s an example from the American Red Cross, courtesy of DonorBox :

“The American Red Cross carries out their mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.”

This section should be detailed and get into the operational weeds of how your business delivers on its mission statement. Explain the strategies your team will take to service clients, including outreach and marketing, inventory and equipment needs, a hiring plan, and other key elements.

Write a fundraising plan

This part is the most important element of your business plan. In addition to providing required financial statements (e.g., the income statement, balance sheet, and cash flow statement), identify potential sources of funding for your nonprofit. These may include individual donors, corporate donors, grants, or in-kind support. If you are planning to host a fundraising event, put together a budget for that event and demonstrate the anticipated impact that event will have on your budget.

Create an impact plan

An impact plan ties everything together. It demonstrates how your fundraising and day-to-day activities will further your mission. For potential donors, it can make a very convincing case for why they should invest in your nonprofit.

“This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives,” wrote DonorBox . “These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.”

Be as realistic as possible about the impact you can make with the funding you hope to gain. Revisit your business plan as your organization grows to make sure the goals you’ve set both align with your mission and continue to be within reach.

[Read more: 8 Signs It's Time to Update Your Business Plan ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Join us on October 8, 2024! Tune in at 12:30 p.m. ET for expert tips from top business leaders and Olympic gold medalist Dominique Dawes. Plus, access our exclusive evening program, where we’ll announce the CO—100 Top Business! - Register Now!

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

RSVP Now for the CO—100 Small Business Forum!

Discover today’s biggest AI and social media marketing trends with top business experts! Get inspired by Dominique Dawes’ entrepreneurial journey and enjoy free access to our exclusive evening program, featuring the CO—100 Top Business reveal. Register now!

For more business strategies

A guide to business certifications for small business owners, how to price your product: a step-by-step calculation, 3 reasons small businesses are optimistic about the year ahead.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

How to Write a Business Plan For a Nonprofit Organization + Template

Creating a business plan is essential for any business, but it can be especially helpful for nonprofits. A nonprofit business plan allows you to set goals and track progress over time. It can also help you secure funding from investors or grant-making organizations.

A well-crafted business plan not only outlines your vision for the organization but also provides a step-by-step process of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article will provide an overview of the key elements that every nonprofit founder should include in their business plan.

Download the Ultimate Nonprofit Business Plan Template

What is a Nonprofit Business Plan?

A nonprofit business plan is a formal written document that describes your organization’s purpose, structure, and operations. It is used to communicate your vision to potential investors or donors and convince them to support your cause.

The business plan should include information about your target market, financial projections, and marketing strategy. It should also outline the organization’s mission statement and goals.

Why Write a Nonprofit Business Plan?

A nonprofit business plan is required if you want to secure funding from grant-making organizations or investors.

A well-crafted business plan will help you:

- Define your organization’s purpose and goals

- Articulate your vision for the future

- Develop a step-by-step plan to achieve your goals

- Secure funding from investors or donors

- Convince potential supporters to invest in your cause

Entrepreneurs can also use this as a roadmap when starting your new nonprofit organization, especially if you are inexperienced in starting a nonprofit.

Writing an Effective Nonprofit Business Plan

The key is to tailor your business plan to the specific needs of your nonprofit. Here’s a quick overview of what to include:

Executive Summary

Organization overview, products, programs, and services, industry analysis, customer analysis, marketing plan, operations plan, management team.

- Financial Plan

The executive summary of a nonprofit business plan is a one-to-two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your nonprofit organization

- Provide a short summary of the key points of each section of your business plan.

- Organize your thoughts in a logical sequence that is easy for the reader to follow.

- Include information about your organization’s management team, industry analysis, competitive analysis, and financial forecast.

This section should include a brief history of your nonprofit organization. Include a short description of how and why you started it and provide a timeline of milestones the organization has achieved.

If you are just starting your nonprofit, you may not have a long history. Instead, you can include information about your professional experience in the industry and how and why you conceived your new nonprofit idea. If you have worked for a similar organization before or have been involved in a nonprofit before starting your own, mention this.

You will also include information about your chosen n onprofit business model and how it is different from other nonprofits in your target market.

This section is all about what your nonprofit organization offers. Include information about your programs, services, and any products you may sell.

Describe the products or services you offer and how they benefit your target market. Examples might include:

- A food bank that provides healthy meals to low-income families

- A job training program that helps unemployed adults find jobs

- An after-school program that helps kids stay out of gangs

- An adult literacy program that helps adults learn to read and write

Include information about your pricing strategy and any discounts or promotions you offer. Examples might include membership benefits, free shipping, or volume discounts.

If you offer more than one product or service, describe each one in detail. Include information about who uses each product or service and how it helps them achieve their goals.

If you offer any programs, describe them in detail. Include information about how often they are offered and the eligibility requirements for participants. For example, if you offer a job training program, you might include information about how often the program is offered, how long it lasts, and what kinds of jobs participants can expect to find after completing the program.

The industry or market analysis is an important component of a nonprofit business plan. Conduct thorough market research to determine industry trends, identify your potential customers, and the potential size of this market.

Questions to answer include:

- What part of the nonprofit industry are you targeting?

- Who are your competitors?

- How big is the market?

- What trends are happening in the industry right now?

You should also include information about your research methodology and sources of information, including company reports and expert opinions.

As an example, if you are starting a food bank, your industry analysis might include information about the number of people in your community who are considered “food insecure” (they don’t have regular access to enough nutritious food). You would also include information about other food banks in your area, how they are funded, and the services they offer.

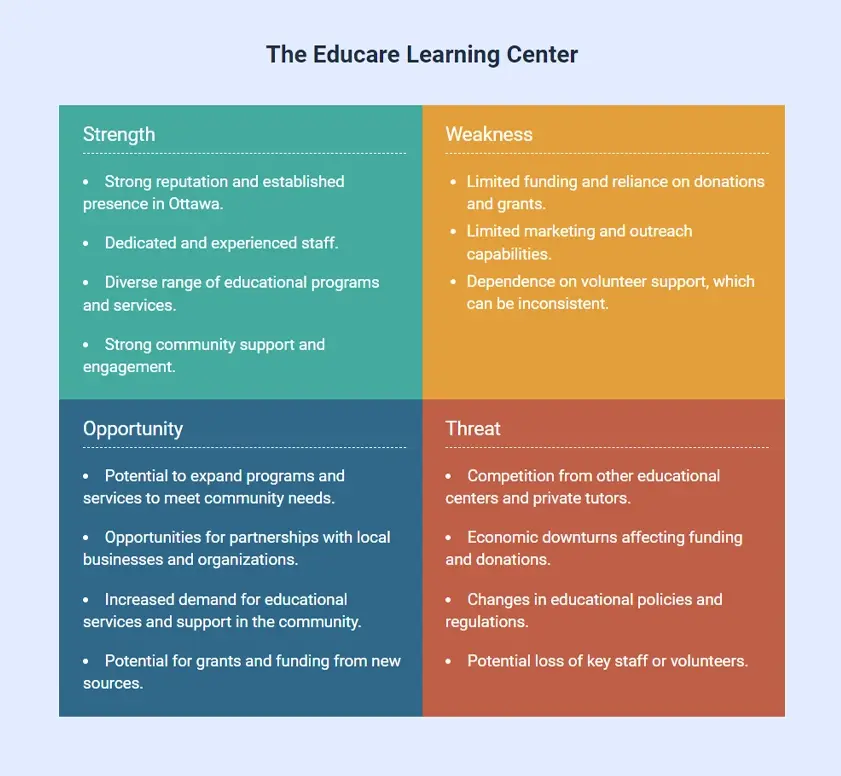

For each of your competitors, you should include a brief description of their organization, their target market, and their competitive advantage. To do this, you should complete a SWOT analysis.

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a helpful tool to assess your nonprofit’s current position and identify areas where you can improve.

Some questions to consider when conducting a SWOT analysis include:

- Strengths : What does your nonprofit do well?

- Weaknesses : What areas could your nonprofit improve?

- Opportunities : What trends or changes in the industry could you take advantage of?

- Threats : What trends or changes in the industry could hurt your nonprofit’s chances of success?

After you have identified your nonprofit’s strengths, weaknesses, opportunities, and threats, you can develop strategies to improve your organization.

For example, if you are starting a food bank, your SWOT analysis might reveal that there is a need for more food banks in your community. You could use this information to develop a marketing strategy to reach potential donors who might be interested in supporting your organization.

If you are starting a job training program, your SWOT analysis might reveal that there is a need for more programs like yours in the community. You could use this information to develop a business plan and marketing strategy to reach potential participants who might be interested in enrolling in your program.

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, if you are starting a job training program for unemployed adults, your target audience might be low-income adults between the ages of 18 and 35. Your customer analysis would include information about their needs (e.g., transportation, childcare, job readiness skills) and wants (e.g., good pay, flexible hours, benefits).

If you have more than one target audience, you will need to provide a separate customer analysis for each one.

You can include information about how your customers make the decision to buy your product or use your service. For example, if you are starting an after-school program, you might include information about how parents research and compare programs before making a decision.

You should also include information about your marketing strategy and how you plan to reach your target market. For example, if you are starting a food bank, you might include information about how you will promote the food bank to the community and how you will get the word out about your services.

Develop a strategy for targeting those customers who are most likely to use your program, as well as those that might be influenced to buy your products or nonprofit services with the right marketing.

This part of the business plan is where you determine how you are going to reach your target market. This section of your nonprofit business plan should include information about your marketing goals, strategies, and tactics.

- What are your marketing goals? Include information about what you hope to achieve with your marketing efforts, as well as when and how you will achieve it.

- What marketing strategies will you use? Include information about public relations, advertising, social media, and other marketing tactics you will use to reach your target market.

- What tactics will you use? Include information about specific actions you will take to execute your marketing strategy. For example, if you are using social media to reach your target market, include information about which platforms you will use and how often you will post.

Your marketing strategy should be clearly laid out, including the following 4 Ps.

- Product/Service : Make sure your product, service, and/or program offering is clearly defined and differentiated from your competitors, including the benefits of using your service.

- Price : How do you determine the price for your product, services, and/or programs? You should also include a pricing strategy that takes into account what your target market will be willing to pay and how much the competition within your market charges.

- Place : Where will your target market find you? What channels of distribution will you use to reach them?

- Promotion : How will you reach your target market? You can use social media or write a blog, create an email marketing campaign, post flyers, pay for advertising, launch a direct mail campaign, etc.

For example, if you are starting a job training program for unemployed adults, your marketing strategy might include partnering with local job centers and adult education programs to reach potential participants. You might also promote the program through local media outlets and community organizations.

Your marketing plan should also include a sales strategy, which includes information about how you will generate leads and convert them into customers.

You should also include information about your paid advertising budget, including an estimate of expenses and sales projections.

This part of your nonprofit business plan should include the following information:

- How will you deliver your products, services and/or programs to your target market? For example, if you are starting a food bank, you will need to develop a system for collecting and storing food donations, as well as distributing them to the community.

- How will your nonprofit be structured? For example, will you have paid staff or volunteers? How many employees will you need? What skills and experience will they need to have?

- What kind of facilities and equipment will you need to operate your nonprofit? For example, if you are starting a job training program, you will need space to hold classes, as well as computers and other office equipment.

- What are the day-to-day operations of your nonprofit? For example, if you are starting a food bank, you will need to develop a system for accepting and sorting food donations, as well as distributing them to the community.

- Who will be responsible for each task? For example, if you are starting a job training program, you will need to identify who will be responsible for recruiting participants, teaching classes, and placing graduates in jobs.

- What are your policies and procedures? You will want to establish policies related to everything from employee conduct to how you will handle donations.

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is the section of the business plan where you elaborate on the day-to-day execution of your nonprofit. This is where you really get into the nitty-gritty of how your organization will function on a day-to-day basis.

This section of your nonprofit business plan should include information about the individuals who will be running your organization.

- Who is on your team? Include biographies of your executive director, board of directors, and key staff members.

- What are their qualifications? Include information about their education, work experience, and skills.

- What are their roles and responsibilities? Include information about what each team member will be responsible for, as well as their decision-making authority.

- What is their experience in the nonprofit sector? Include information about their work with other nonprofits, as well as their volunteer experiences.

This section of your plan is important because it shows that you have a team of qualified individuals who are committed to the success of your nonprofit.

Nonprofit Financial Plan

This section of your nonprofit business plan should include the following information:

- Your budget. Include information about your income and expenses, as well as your fundraising goals.

- Your sources of funding. Include information about your grants, donations, and other sources of income.

- Use of funds. Include information about how you will use your income to support your programs and operations.

This section of your business plan is important because it shows that you have a clear understanding of your organization’s finances. It also shows that you have a plan for raising and managing your funds.

Now, include a complete and detailed financial plan. This is where you will need to break down your expenses and revenue projections for the first 5 years of operation. This includes the following financial statements:

Income Statement

Your income statement should include:

- Revenue : how will you generate revenue?

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, what is the net income or loss?

Sample Income Statement for a Startup Nonprofit Organization

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows what you have in terms of assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Nonprofit Organization

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Income : All of the revenue coming in from clients.

- Expenses : All of your monthly bills and expenses. Include operating, marketing and capital expenditures.

- Net Cash Flow : The difference between income and expenses for each month after they are totaled and deducted from each other. This number is the net cash flow for each month.

Using your total income and expenses, you can project an annual cash flow statement. Below is a sample of a projected cash flow statement for a startup nonprofit.

Sample Cash Flow Statement for a Startup Nonprofit Organization

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

Fundraising Plan

This section of your nonprofit business plan should include information about your fundraising goals, strategies, and tactics.

- What are your fundraising goals? Include information about how much money you hope to raise, as well as when and how you will raise it.

- What fundraising strategies will you use? Include information about special events, direct mail campaigns, online giving, and grant writing.

- What fundraising tactics will you use? Include information about volunteer recruitment, donor cultivation, and stewardship.

Now include specific fundraising goals, strategies, and tactics. These could be annual or multi-year goals. Below are some examples:

Goal : To raise $50,000 in the next 12 months.

Strategy : Direct mail campaign

- Create a mailing list of potential donors

- Develop a direct mail piece

- Mail the direct mail piece to potential donors

Goal : To raise $100,000 in the next 24 months.

Strategy : Special event

- Identify potential special event sponsors

- Recruit volunteers to help with the event

- Plan and execute the special event

Goal : To raise $250,000 in the next 36 months.

Strategy : Grant writing

- Research potential grant opportunities

- Write and submit grant proposals

- Follow up on submitted grants

This section of your business plan is important because it shows that you have a clear understanding of your fundraising goals and how you will achieve them.

You will also want to include an appendix section which may include:

- Your complete financial projections

- A complete list of your nonprofit’s policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- A list of your hard assets and equipment with purchase dates, prices paid and any other relevant information

- A list of your soft assets with purchase dates, prices paid and any other relevant information

- Biographies and/or resumes of the key members of your organization

- Your nonprofit’s bylaws

- Your nonprofit’s articles of incorporation

- Your nonprofit’s most recent IRS Form 990

- Any other relevant information that may be helpful in understanding your organization

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your nonprofit organization. It not only outlines your vision but also provides a step-by-step process of how you are going to accomplish it. Sometimes it may be difficult to get started, but once you get the hang of it, writing a business plan becomes easier and will give you a sense of direction and clarity about your nonprofit organization.

Finish Your Nonprofit Business Plan in 1 Day!

Other helpful articles.

How to Write a Grant Proposal for Your Nonprofit Organization + Template & Examples

How To Create the Articles of Incorporation for Your Nonprofit Organization + Template

How to Develop a Nonprofit Communications Plan + Template

How to Write a Stand-Out Purpose Statement + Examples

How to Write a Nonprofit Business Plan in 12 Steps (+ Free Template!)

The first step in starting a nonprofit is figuring out how to bring your vision into reality. If there’s any tool that can really help you hit the ground running, it’s a nonprofit business plan!

With a plan in place, you not only have a clear direction for growth, but you can also access valuable funding opportunities.

Here, we’ll explore:

- Why a business plan is so important

- The components of a business plan

- How to write a business plan for a nonprofit specifically

We also have a few great examples, as well as a free nonprofit business plan template.

Let’s get planning!

What Is a Nonprofit Business Plan?

A nonprofit business plan is the roadmap to your organization’s future. It lays out where your nonprofit currently stands in terms of organizational structure, finances and programs. Most importantly, it highlights your goals and how you aim to achieve them!

These goals should be reachable within the next 3-5 years—and flexible! Your nonprofit business plan is a living document, and should be regularly updated as priorities shift. The point of your plan is to remind you and your supporters what your organization is all about.

This document can be as short as one page if you’re just starting out, or much longer as your organization grows. As long as you have all the core elements of a business plan (which we’ll get into below!), you’re golden.

Why Your Nonprofit Needs a Business Plan

While some people might argue that a nonprofit business plan isn’t strictly necessary, it’s well worth your time to make!

Here are 5 benefits of writing a business plan:

Secure funding and grants

Did you know that businesses with a plan are far more likely to get funding than those that don’t have a plan? It’s true!

When donors, investors, foundations, granting bodies and volunteers see you have a clear plan, they’re more likely to trust you with their time and money. Plus, as you achieve the goals laid out in your plan, that trust will only grow.

Solidify your mission

In order to sell your mission, you have to know what it is. That might sound simple, but when you have big dreams and ideas, it’s easy to get lost in all of the possibilities!

Writing your business plan pushes you to express your mission in the most straightforward way possible. As the years go on and new opportunities and ideas arise, your business plan will guide you back to your original mission.

From there, you can figure out if you’ve lost the plot—or if it’s time to change the mission itself!

Set goals and milestones

The first step in achieving your goals is knowing exactly what they are. By highlighting your goals for the next 3-5 years—and naming their key milestones!—you can consistently check if you’re on track.

Nonprofit work is tough, and there will be points along the way where you wonder if you’re actually making a difference. With a nonprofit business plan in place, you can actually see how much you’ve achieved over the years.

Attract a board and volunteers

Getting volunteers and filling nonprofit board positions is essential to building out your organization’s team. Like we said before, a business plan builds trust and shows that your organization is legitimate. In fact, some boards of directors actually require a business plan in order for an organization to run!

An unfortunate truth is that many volunteers get taken advantage of . With a business plan in place, you can show that you’re coming from a place of professionalism.

Research and find opportunities

Writing a business plan requires some research!

Along the way, you’ll likely dig into information like:

- Who your ideal donor might be

- Where to find potential partners

- What your competitors are up to

- Which mentorships or grants are available for your organization

- What is the best business model for a nonprofit like yours

With this information in place, not only will you have a better nonprofit business model created—you’ll also have a more stable organization!

Free Nonprofit Business Plan Template

If you’re feeling uncertain about building a business plan from scratch, we’ve got you covered!

Here is a quick and simple free nonprofit business plan template.

Basic Format and Parts of a Business Plan

Now that you know what a business plan can do for your organization, let’s talk about what it actually contains!

Here are some key elements of a business plan:

First of all, you want to make sure your business plan follows best practices for formatting. After all, it’ll be available to your team, donors, board of directors, funding bodies and more!

Your nonprofit business plan should:

- Be consistent formatted

- Have standard margins

- Use a good sized font

- Keep the document to-the-point

- Include a page break after each section

- Be proofread

Curious about what each section of the document should look like?

Here are the essential parts of a business plan:

- Executive Summary: This is your nonprofit’s story—it’ll include your goals, as well as your mission, vision and values.

- Products, programs and services: This is where you show exactly what it is you’re doing. Highlight the programs and services you offer, and how they will benefit your community.

- Operations: This section describes your team, partnerships and all activities and requirements your day-to-day operations will include.

- Marketing : Your marketing plan will cover your market, market analyses and specific plans for how you will carry out your business plan with the public.

- Finances: This section covers an overview of your financial operations. It will include documents like your financial projections, fundraising plan , grants and more

- Appendix: Any additional useful information will be attached here.

We’ll get into these sections in more detail below!

How to Write a Nonprofit Business Plan in 12 Steps

Feeling ready to put your plan into action? Here’s how to write a business plan for a nonprofit in 12 simple steps!

1. Research the market

Take a look at what’s going on in your corner of the nonprofit sector. After all, you’re not the first organization to write a business plan!

- How your competitors’ business plans are structured

- What your beneficiaries are asking for

- Potential partners you’d like to reach

- Your target donors

- What information granting bodies and loan providers require

All of this information will show you what parts of your business plan should be given extra care. Sending out donor surveys, contacting financial institutions and connecting with your beneficiaries are a few tips to get your research going.

If you’re just getting started out, this can help guide you in naming your nonprofit something relevant, eye-catching and unique!

2. Write to your audience

Your business plan will be available for a whole bunch of people, including:

- Granting bodies

- Loan providers

- Prospective and current board members

Each of these audiences will be coming from different backgrounds, and looking at your business plan for different reasons. If you keep your nonprofit business plan accessible (minimal acronyms and industry jargon), you’ll be more likely to reach everyone.

If you’d like, it’s always possible to create a one page business plan AND a more detailed one. Then, you can provide the one that feels most useful to each audience!

3. Write your mission statement

Your mission statement defines how your organization aims to make a difference in the world. In one sentence, lay out why your nonprofit exists.

Here are a few examples of nonprofit mission statements:

- Watts of Love is a global solar lighting nonprofit bringing people the power to raise themselves out of the darkness of poverty.

- CoachArt creates a transformative arts and athletics community for families impacted by childhood chronic illness.

- The Trevor Project fights to end suicide among lesbian, gay, bisexual, transgender, queer, and questioning young people.

In a single sentence, each of these nonprofits defines exactly what it is their organization is doing, and who their work reaches. Offering this information at a glance is how you immediately hook your readers!

4. Describe your nonprofit

Now that your mission is laid out, show a little bit more about who you are and how you aim to carry out your mission. Expanding your mission statement to include your vision and values is a great way to kick this off!

Use this section to highlight:

- Your ideal vision for your community

- The guiding philosophy and values of your organization

- The purpose you were established to achieve

Don’t worry too much about the specifics here—we’ll get into those below! This description is simply meant to demonstrate the heart of your organization.

5. Outline management and organization

When you put together your business plan, you’ll want to describe the structure of your organization in the Operations section.

This will include information like:

- Team members (staff, board of directors , etc.)

- The specific type of nonprofit you’re running

If you’re already established, make a section for how you got started! This includes your origin story, your growth and the impressive nonprofit talent you’ve brought on over the years.

6. Describe programs, products and services

This information will have its own section in your nonprofit business plan—and for good reason!

It gives readers vital information about how you operate, including:

- The specifics of the work you do

- How that work helps your beneficiaries

- The resources that support the work (partnerships, facilities, volunteers, etc!)

- If you have a membership base or a subscription business model

Above all, highlight what needs your nonprofit meets and how it plans to continue meeting those needs. Really get into the details here! Emphasize the work of each and every program, and if you’re already established, note the real impact you’ve made.

Try including pictures and graphic design elements so people can feel your impact even if they’re simply skimming.

7. Create an Executive Summary

Your Executive Summary will sit right at the top of your business plan—in many ways, it’s the shining star of the document! This section serves as a concise and compelling telling of your nonprofit’s story. If it can capture your readers’ attention, they’re more likely to read through the rest of the plan.

Your Executive Summary should include:

- Your mission, vision and values

- Your goals (and their timelines!)

- Your organization’s history

- Your primary programs, products and services

- Your financing plan

- How you intend on using your funding

This section will summarize the basics of everything else in your plan. While it comes first part of your plan, we suggest writing it last! That way, you’ll already have the information on hand.

You can also edit your Executive Summary depending on your audience. For example, if you’re sending your nonprofit business plan to a loan provider, you can really focus on where the money will be going. If you’re trying to recruit a new board member, you might want to highlight goals and impact, instead.

8. Write a marketing plan

Having a nonprofit marketing plan is essential to making sure your mission reaches people—and that’s especially true for your business plan.

If your nonprofit is already up and running, detail the work you’re currently doing, as well as the specific results you’ve seen so far. If you’re new, you’ll mostly be working with projections—so make sure your data is sound!

No matter what, your Marketing Plan section should market research such as:

- Beneficiary information

- Information on your target audience/donor base

- Information on your competitors

- Names of potential partners

Data is your friend here! Make note of market analyses and tests you’ve run. Be sure to also document any outreach and campaigns you’ve previously done, as well as your outcomes.

Finally, be sure to list all past and future marketing strategies you’re planning for. This can include promotion, advertising, online marketing plans and more.

9. Create a logistics and operations plan

The Operations section of your business plan will take the organizational information you’ve gathered so far and expand the details! Highlight what the day-to-day will look like for your nonprofit, and how your funds and resources will make it possible.

Be sure to make note of:

- The titles and responsibilities of your core team

- The partners and suppliers you work with

- Insurance you will need

- Necessary licenses or certifications you’ll maintain

- The cost of services and programs

This is the what and how of your business plan. Lean into those details, and show exactly how you’ll accomplish those goals you’ve been talking about!

10. Write an Impact Plan

Your Impact Plan is a deep dive into your organization’s goals. It grounds your dreams in reality, which brings both idealists and more practically-minded folks into your corner!

Where your Executive Summary lays out your ambitions on a broader level, this plan:

- Clarifies your goals in detail

- Highlights specific objectives and their timelines

- Breaks down how you will achieve them

- Shows how you will measure your success

Your Impact Plan will have quite a few goals in it, so be sure to emphasize which ones are the most impactful on your cause. After all, social impact is just as important as financial impact!

Speaking of…

11. Outline the Financial Plan

One of the main reasons people want to know how to write a nonprofit business plan is because of how essential it is to receiving funding. Loan providers, donors and granting bodies will want to see your numbers—and that’s where your Financial Plan comes in.

This plan should clearly lay out where your money is coming from and where it will go. If you’re just getting started, check out what similar nonprofits are doing in order to get realistic numbers. Even if you’re starting a nonprofit on a tight budget , every bit of financial information counts!

First, map out your projected (or actual) nonprofit revenue streams , such as:

- Expected membership contributions

- Significant donations

- In-kind support

- Fundraising plan

Then, do the same with your expenses:

- Startup costs

- Typical bills

- Web hosting

- Membership management software

- Subscription

- Costs of programs

If your nonprofit is already up and running, include your past accounting information. Otherwise, keep working with those grounded projections!

To make sure you have all of your information set, include documents like:

- Income statement

- Cash flow statement

- Balance sheet

This information comes together to show that your nonprofit can stay above water financially. Highlighting that you can comfortably cover your operational costs is essential. Plus, building this plan might help your team find funding gaps or opportunities!

12. Include an Appendix

Your appendix is for any extra pieces of useful information for your readers.

This could be documents such as:

- Academic papers about your beneficiaries

- Publications on your nonprofit’s previous success

- Board member bios

- Organizational flow chart

- Your IRS status letter

Make sure your additions contribute to your nonprofit’s story!

Examples of Business Plans for Nonprofits

Here are two great examples of nonprofit business plans. Notice how they’re different depending on the size of the organization!

Nonprofit Recording Co-op Business Plan

This sample nonprofit business plan shows what a basic plan could look like for a hobbyists’ co-op. If your nonprofit is on the smaller, more local side, this is a great reference!

What we like:

- Details on running a basic membership model

- Emphasis on what it means to specifically be a sustainable cooperative

- A list of early milestones, such as hitting their 100th member

- Clarification that all recordings will be legal

Nonprofit Youth Services Business Plan

This sample nonprofit business plan is for a much larger organization. Instead of focusing on the details of a membership model, it gets deeper into programs and services provided.

What we like

- The mission is broken down by values

- A detailed look at what each program provides

- A thorough sales plan

- Key assumptions are included for the financial plan

How to Create a Nonprofit Business Plan With Confidence

We hope this sheds some light on how creating a nonprofit business plan can help your organization moving forward! Remember: you know what you want for your organization. A business plan is simply a tool for making those dreams a reality.

Is a membership program part of your business plan? Check out WildApricot ’s award-winning membership management software!

With our 60-day free trial , you’ll have all the time you need to fall in love with what we have to offer.

Related Organizational Management Articles

32 Free Nonprofit Webinars for September 2024

Donor Retention Strategies for Nonprofits

How to Start a Food Pantry

The Membership Growth Report:

Benchmarks & insights for growing revenue and constituents.

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Start A 501(c)(3) Nonprofit

Updated: Feb 13, 2024, 7:53pm

Table of Contents

What is a 501(c)(3) nonprofit, 7 steps to forming a 501(c)(3), bottom line, frequently asked questions.

Starting a 501(c)(3) nonprofit helps organizations by allowing them to solicit tax-exempt funds legally from donors. The steps that go into starting a 501(c)(3) include choosing a name for your nonprofit, writing your purpose statement and bylaws, recruiting and establishing a board of directors, filing your articles of incorporation, applying for federal tax-exempt status as a 501(c)(3) and filing for state recognition of tax exemption.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee + up to $50 Amazon gift card

Varies by State & Package

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

A 501(c)(3) nonprofit is an organization that has applied and been approved for IRS recognition as a tax-exempt organization. Nonprofits rely on their 501(c)(3) status to solicit grants, donations and other funds. Nonprofit status helps organizations raise money because donors may be able to deduct contributions on their own taxes.

Benefits of a 501(c)(3)

The benefits of a 501(c)(3) include protection against liabilities, federal and state tax exemption, discounts and the ability to legally solicit donations from state residents. Here is a closer look at what these advantages mean for your organization:

- Liability protection: The indemnification clause in a 501(c)(3)’s articles of incorporation protects board members of a nonprofit from personal liability around concepts like organizational debt.

- Federal and state tax exemption: Donors who give money to the organization may be able to deduct the donations on their tax returns. In addition, the organization itself is exempt from federal and state taxes.

- Solicitation of donations: Without your 501(c)(3) status, you are allowed to solicit donations legally from individuals, organizations and foundations.

- More funding options: As a 501(c)(3), your organization can apply for government and foundation grants.

- Higher donor attraction: Because your nonprofit undergoes government scrutiny to ensure its legitimacy and purpose, donors are more likely to view your organization as credible and worthy of their funds. In addition, they may get a tax deduction for their donation. Both of these factors contribute to a higher likelihood that donors will donate to your cause.

- Discounts: Nonprofits use many tools for running their daily programs, such as social media marketing and customer relationship management (CRM) software . As a 501(c)(3), you can often receive discounts on such tools.

Drawbacks of a 501(c)(3)

The disadvantages of establishing a 501(c)(3) include the time and expenses involved, limited personal control over the organization’s direction, financial scrutiny by the IRS, a lot of paperwork at startup (and annually thereafter) and regulations and restrictions surrounding the work in which the nonprofit can be involved. Here is a closer look at these disadvantages:

- Expenses: Starting a 501(c)(3) involves startup costs that go to federal and state fees and attorney charges, among other costs. Typically, these start at $2,500. Other costs associated with starting a 501(c)(3) include building an online presence. Then, annual costs to maintain a tax-exempt status add to the expenses on an ongoing basis.

- Time consumption: Time-consuming tasks to start a 501(c)(3) include filling out and submitting an application, setting up recordkeeping systems, recruiting and building a board, filing articles of incorporation and writing your statement of purpose and bylaws.

- Financial scrutiny: The IRS looks at all of your nonprofit’s expenses on a yearly basis to ensure donor dollars are fulfilling their intended purpose. Annual submissions of required financial statements mean this scrutiny is ongoing.

- Regulations and restrictions: As a 501(c)(3), your organization must commit to regulations and restrictions regarding how money can be used and what causes you can support. For example, there are restrictions on the types of political activity in which a 501(c)(3) can participate.

- Loss of control: Your nonprofit must adhere to your bylaws, the fiduciary duty of your board of directors, IRS and state requirements and donor intent. As such, the organization becomes an entity that goes beyond your personal interests.

The steps to starting a 501(c)(3) include writing a purpose statement, naming your organization and appointing your board of directors. At that point, you can file your articles of incorporation and then file for your 501(c)(3) status with the federal government. Finally, to begin soliciting funds, you also must register your nonprofit in your state. Let’s take a closer look at these steps.

1. Write a Purpose Statement.

A nonprofit’s purpose statement tells why an organization exists as a necessary entity. It is included in a nonprofit’s bylaws and is used to qualify the nonprofit for tax-exempt status. It also offers a statement for organizational directors to adhere to when fulfilling their duties as well as a compass for supporters who help to fulfill the organization’s purpose, such as volunteers, donors and partners.

It should have the following specifications and inclusions:

- Length: A purpose statement should be no more than 50 words long.

- Categorization: Offer a classification of the type of services the organization will perform. Examples include humanitarian, religious and educational services.

- Descriptive language: Offer an overview of why the organization exists, its mission, and how it’s different from other organizations. Include descriptive language that adds more context to its categorization like specifics of the types of services offered and the geographical area the organization will serve.

- Context that allows organizational growth: Your statement should be specific enough that it differentiates your organization from other organizations’ purposes while still offering room to grow. For example, if your nonprofit will offer food-insecurity relief, to allow room for growth, specify your service area as a region rather than a specific city.

Start an LLC Online Today With ZenBusiness

Click on the state below to get started.

2. Name Your Organization.

Your nonprofit’s name should embody your purpose statement and be short enough to fit comfortably in domain names and social media handles. To choose an organizational name, use descriptive words that invoke the feeling of your purpose statement. Say your chosen name out loud to ensure it is easy to say. Write it out to ensure it is easy to remember.

Once you have brainstormed a name using the above tips, check to make sure your name isn’t already taken. For legal compliance, begin by checking the U.S. Patent and Trademark Office database to ensure your chosen name is not already trademarked. Then, search to ensure your name is not already being used for an organization in your state. Finally, make sure your name’s domain and social media handles are available to build your nonprofit’s public presence.

To prevent legal liabilities, LegalZoom’s trademark check services are more thorough than online search tools. Your state’s business filing agency can tell you whether your chosen name is in use in your state as many have online tools that allow you to search business names . Check that your name’s domain is available by searching a domain registrar . Finally, search social media for your name’s handle using this format: @domainname.

3. Appoint a Board of Directors.

Your state may only require one director for a nonprofit board, but the IRS prefers that 501(c)(3) organizations have at least three directors. Five is even better. To identify and recruit potential board members, make a list of the skills your nonprofit needs. For example, many nonprofits need people who know about business finance, nonprofit law, fundraising, marketing and the industry in which the nonprofit serves.

Next, make a list of people with the needed skills. Consider people in your personal and social media networks and people in your community who might share your commitment to your nonprofit’s mission.

Your state’s association of nonprofits or United Way often also offers board-matching programs. Finally, Board Source offers board-matching resources by state.

Review your list of candidates. While many or all of them may seem like the perfect fit, it is best to test that fit before finalizing your decision. Do so by first asking potential candidates about their interest in serving. If they answer positively, consider asking them to volunteer in your nonprofit work for a time so both parties can ensure the candidate’s commitment to the organization and its work.

4. Write Your Bylaws.

To write your bylaws, start by finding out what your state includes in its nonprofit corporate act for nonprofit bylaw inclusions. For example, the Florida Not for Profit Corporations Act states that, if a director is not allowed to vote by proxy, this restriction must be stated in the nonprofit’s bylaws.

Most nonprofit bylaws also include some standard provisions. These include provisions stating the nonprofit’s name, purpose statement, governing structure, decision-making process/rules, bylaw amendment rules, a conflict of interest statement and an indemnification act that protects directors against personal liability.

Bylaws govern the operation of your organization, and they’ll also be submitted to the IRS as part of your application for 501(c)(3) status. It’s best to get help from a nonprofit attorney before finalizing your bylaws to make sure they contain all necessary provisions and are written ideally for the best interests of your nonprofit.

5. File Paperwork To Establish a Corporation.

Filing your articles of incorporation for a nonprofit corporation officially establishes your business as a legal entity but not yet a tax-exempt business. Your articles of incorporation must be filed with the business filing agency in the state in which you plan to conduct your nonprofit business. In most states, you’ll file paperwork with the Secretary of State, but in some states you’ll file with a different state agency.

Check with your state filing office to find out how you need to submit your paperwork. Some states, for example, allow you to form a corporation online while requiring you to submit Articles of Incorporation by mail. You can also expect to pay a filing fee.

Be sure to include all information and follow all steps required by your state.

Each state has different requirements for filing your articles of incorporation. For this reason, we advise you to seek a business formation or business incorporation lawyer at the local level for direction on how to correctly file incorporation paperwork.

To conduct the business of your new corporation, you will also need an employer identification number (EIN). You can apply for an EIN online at the IRS website, and you will receive it immediately after your application is submitted. You can also get an EIN by downloading IRS Form SS-4 , filling it out and faxing or mailing it to the IRS at:

Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999

6. Apply for Your 501(c)(3) Status.

Applying for 501(c)(3) status allows the IRS to examine your nonprofit’s structure, purpose and business dealings to determine if it qualifies as a tax-exempt organization. The IRS also seeks to ensure donor dollars will be used for donors’ intended purposes via the absence of any conflicts of interest.

To begin, locate the EIN assigned to your corporation in step five. To file for your 501(c)(3) tax-exempt status, most organizations must use this number to fill out IRS Form 1023 electronically on Pay.gov. This form is called an Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. The submission fee is $600 and must be paid through Pay.gov at the time of filing.

However, if your organization has three years of gross receipts under $50,000 and assets of less than $250,000, you may be able to file the simpler Form 1023-EZ. To file this form, you must first fill out the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023 to determine your eligibility. If your organization is eligible to use Form 1023-EZ, the user fee is $275 and is due at the time of filing on Pay.gov.

Please note that filling out the IRS Form 1023 is a complex process. As such, many nonprofits should and do seek the services of a nonprofit lawyer to guide them in this step.

7. File Paperwork for Your State’s Recognition of Tax Exemption.

Receiving a determination letter stating you are federally tax-exempt does not mean you are ready to solicit donations in your state. For this, you will likely need to register with each state in which you fundraise before receiving donor dollars from residents. All but a handful of states mandate some type of registration.

The forms and requirements to register for soliciting donations vary by state. Contact your state’s government office that handles registrations. You can find their contact information by searching by state on the National Association of State Charity Officials . Forms associated with charitable solicitation registration often must be filled out annually and many states will also request a copy of the IRS Form 990 is attached.

Most states, such as Virginia, grant nonprofit organizations in the state tax exemption status automatically if they are recognized federally as a 501(c)(3). Others require separate applications, including California and Texas. In California, for example, you must fill out a Form 199 or 199N ( for smaller organizations ) annually and submit it to the Franchise Tax Board.

Start A Limited Liability Company Online Today with ZenBusiness

Click to get started.

Starting a 501(c)(3) nonprofit is time-consuming and expensive. However, as an established 501(c)(3) nonprofit organization, you stand to gain more donors and donor types, higher credibility in your space, discounts and a legal avenue for soliciting funds for your cause. For best results, given the complexity of the application and compliance process, it’s best to contact a local nonprofit lawyer to guide your organization in fulfilling the steps in this guide.