Financial Advisor Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Financial Advisor Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Financial Advisor Business Plan

You’ve come to the right place to create your financial advisor business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their financial advisor businesses. Our financial advisor business plan template will help you create your business plan, ensuring that you have all the necessary elements to make your financial advisor business a success.

To write a successful financial advisor business plan, you will first need to decide what type of financial advisor services you will offer. Will you be working with small businesses? Or are your target customers individuals saving for retirement?

You will need to gather information about your business and the financial advisor industry. This type of information includes business goals, customer demographics, market research, and financial statements.

Below are links to each section of a financial advisor business plan example:

Next Section: Executive Summary >

Financial Advisor Business Plan FAQs

What is a financial advisor business plan.

A financial advisor business plan is a plan to start and/or grow your financial advisor business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your financial advisor business plan using our Financial Advisor Business Plan Template here .

What Are the Main Types of Financial Advisor Companies?

There are different types of financial advisor firms . The most common kinds are the investment advisors, broker-dealers and brokers, certified financial planners, financial consultants, wealth advisors, and portfolio, investment, and asset managers. There are also digital platforms that provide automated, algorithm-driven investment services with little to no human supervision called robo-advisors.

What Are the Main Sources of Revenues & Expenses for Financial Advisors?

Financial advisors make money on client fees for financial planning services. These are usually charged on an hourly basis or as a percentage of client assets under management. Another source of income are commissions for certain financial transactions, such as the sale of insurance products or the buying and selling of securities.

The key expenses are salaries and wages, and office space rent.

How to Start a Financial Advisor Business?

Starting a financial advisor business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

- Write A Financial Advisor Business Plan - The first step in starting a business is to create a detailed business plan that outlines all aspects of the venture. This should include market research on the financial industry and potential target market size, information on the services and/or products you will offer, marketing strategies, pricing details, competitive analysis and a solid financial forecast.

- Choose Your Legal Structure - It's important to select an appropriate legal entity for your business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your financial advisor business is in compliance with local laws.

- Register Your Business - Once you have chosen a legal structure, the next step is to register your financial advisor business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

- Identify Financing Options - It’s likely that you’ll need some capital to start your business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

- Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

- Hire Employees - There are several ways to find qualified employees and a top notch management team, including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

- Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your business. Marketing efforts includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising to reach your target audience.

Learn more about how to start a Financial Advisor business:

- How to Start a Financial Advisor Business

How Do You Get Funding for Your Financial Advisor Business Plan?

Financial advisor businesses are typically funded through small business loans, personal savings, credit card financing and angel investors.

A financial advisor's business plan should include a detailed financial plan to secure any type of potential investor. This is true for all types of financial advisor business plans including a financial planner business plan and a wealth management business plan.

Where Can I Get a Financial Advisor Business Plan PDF?

You can download our free financial advisor business plan template PDF here. This is a sample financial advisor business plan template you can use in PDF format.

- Free Newsletter Sign Up

The One-Page Business Plan Template for Financial Advisors

Stephen Boswell , Kevin Nichols | Dec 31, 2018

Ask financial advisors if business planning is important, and most will say, “yes, of course.” Then ask if they have a business plan. If they do, ask whether they refer to it frequently and use it to guide their business development activities. You know the probable answer.

While business planning is undeniably important, it’s too often an exercise in futility. Financial advisors spend days writing yearly business plans. They cram them full of ideas, projects and financial projects that often become a distant memory by February.

In our opinion, your business objectives for the coming year should able to fit on one page. Sure, there are always exceptions. But instead of writing an MBA thesis this year, consider honing your goals down to a one-page document you can share with your team and refer to regularly. There is brilliance in simplicity.

We’ve created a one-page business plan template which you can access here for a limited time. Here’s how to use it:

1. Five-Year Vision: Start by envisioning your personal and professional life five years from today. Contrast where you are now and where you want to be in five years, so the gap between them becomes clear. Don’t be concerned about how you will close the gap between now and five years from now. The principle is this: If you can envision your future, you can achieve it.

2. One-Year Goals: Use this section to list you most important goals for the upcoming year. Most likely, these are financial goals related to assets, revenue and new households. However, feel free to include some personal goals as well.

3. Projects: Whether it’s migrating to a new CRM system, adding more fee-based revenue or finding new financial planning software, there are always projects in the works. Use this section to prioritize projects by quarter.

4. Ideal Client Profile: You inevitably have an idea of the clients with whom you work best. That’s a good start. But you also need a list of criteria that will enable you to quickly identify the right people and qualify them as prospective clients. Your ideal client profile will drive all your marketing efforts.

5. Differentiators: Fifty-six percent of financial advisors claim “outstanding personalized service” as their main differentiator. Doesn’t this seem a bit contradictory? You should be able to articulate and show what sets your practice apart from others.

6. Marketing Strategies: Use this section to list the core marketing strategies you plan to implement in the coming year. In our survey, 524 financial professionals were given a list of marketing activities and asked which actually landed $1 million-plus clients and which did not. The most effective strategies were:

- Unsolicited Referrals

- Proactive Introductions

- Professional Alliances

- Social Prospecting

- Intimate Social Events

- Educational Events

- Social Media, Website and Content Marketing

7. $1,000/Hour Activities: For most financial advisors there are a handful of activities that drive the majority of their business revenue and future growth. We refer to these as “$1,000/hour activities.” High achievers try to spend the majority of their time engaged in these activities. Also, these activities should correspond with the marketing strategies you listed in section 6.

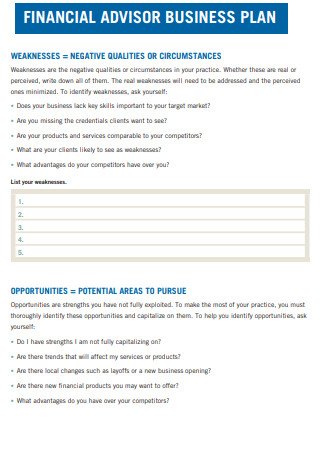

8. SWOT Analysis: No business plan is complete without a SWOT analysis. Make a list of your internal strengths and weaknesses as well as external opportunities and threats. An honest analysis will help you identify what you’re doing well, where you need improvement in the competitive landscape.

How do you plan to get from where you ARE to where you WANT to be in your business? Consider hiring a coach who will guide you through our business planning tools and resources.

@StephenBoswell is President of The Oechsli Institute and co-author of Best Practices of Elite Advisors . @KevinANichols is the Chief Operating Officer of The Oechsli Institute and co-author of The Indispensable LinkedIn Sales Guide for Financial Advisors .

More information about text formats

- Allowed HTML tags: <em> <strong> <blockquote> <br> <p>

- No HTML tags allowed.

- Web page addresses and e-mail addresses turn into links automatically.

- Lines and paragraphs break automatically.

How to Write a Financial Advisor Business Plan (+ Template)

Creating a business plan is essential for any business, but it can be especially helpful for financial advisor businesses that want to improve their strategy and raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every financial advisor business owner should include in their business plan.

Download the Ultimate Financial Advisor Business Plan Template

What is a Financial Advisor Business Plan?

A financial advisor business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Financial Advisor Business Plan?

A financial advisor business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Financial Advisor Business Plan

The following are the key components of a successful financial advisor business plan:

Executive Summary

The executive summary of a financial advisor business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your financial advisor company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company began and provide a timeline of milestones your company has achieved.

If you are just starting your financial advisor business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your financial advisor firm, mention this.

You will also include information about your chosen financial advisor business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of a financial advisor business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the financial advisor industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and, if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, financial advisor business customers may include corporate human resources departments, small business owners, and individual investors.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or financial advisor services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your financial advisor business may have:

- Extensive knowledge and experience in the industry

- Proven track record of success

- Strong relationships with clients

- Offers a unique service that is not currently being offered by competitors

- Highly specialized services that cater to a specific niche

- Low overhead costs

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your financial advisor business via word-of-mouth or referrals.

Operations Plan

This part of your financial advisor business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a financial advisor business include reaching $X in sales. Other examples include acquiring a certain number of clients or partners, launching a new service, opening a new location, and hiring key personnel.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific financial advisor industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities, you plan to hire for in the future.

Financial Plan

Here, you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Financial Advisor Firm

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Financial Advisor Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : Everything you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Financial Advisor Firm

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include cash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup financial advisor business.

Sample Cash Flow Statement for a Startup Financial Advisor Firm

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your financial advisor company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

Following the tips and using the template provided in this article, you can write a financial advisor business plan that will help you succeed.

Finish Your Financial Advisor Business Plan in 1 Day!

Wish there was a faster, easier way to finish your Financial Advisor business plan?

With our Ultimate Financial Advisor Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Articles

Financial Advisor Marketing Plan to Get Clients (+Template)

Establishing Business Goals For Your First Year as a Financial Advisor

Developing Your Financial Advisor Value Proposition

How to Create a Financial Advisor Vision Statement

How to Write a Financial Planner Business Plan (+ Template)

Business Plan Template for Financial Advisors

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

As a financial advisor, having a solid business plan is essential to building a successful practice. It's your roadmap to attract and serve clients, and ultimately achieve long-term success.

ClickUp's Business Plan Template for Financial Advisors is designed to streamline your planning process and help you create a comprehensive strategy that aligns with your goals. With this template, you can:

- Define your business goals and objectives with clarity

- Identify your target market and client profile for effective client acquisition

- Develop marketing plans to promote your services and stand out from the competition

Don't miss out on the opportunity to take your financial advisory business to the next level. Start using ClickUp's Business Plan Template for Financial Advisors today and set yourself up for success!

Business Plan Template for Financial Advisors Benefits

A Business Plan Template for Financial Advisors can provide numerous benefits to help financial advisors achieve long-term success. Here are just a few of them:

- Streamline your business goals and strategies, giving you a clear roadmap to follow

- Define your target market and client profile, allowing you to focus your efforts on the most profitable opportunities

- Develop effective marketing plans to attract and retain clients in a competitive industry

- Provide a comprehensive overview of your business to potential investors or partners

- Set measurable objectives and track your progress towards achieving them

- Identify potential risks and challenges, allowing you to proactively address them

- Enhance your credibility and professionalism in the eyes of clients and industry stakeholders

With a Business Plan Template for Financial Advisors, you can ensure that your business is well-positioned for success in the fast-paced and ever-changing financial advisory industry.

Main Elements of Financial Advisors Business Plan Template

To help financial advisors effectively plan and strategize their business, ClickUp offers a comprehensive Business Plan template with the following key elements:

- Custom Statuses: Track the progress of different sections of your business plan with statuses like Complete, In Progress, Needs Revision, and To Do, ensuring that every aspect of your plan is accounted for and easily manageable.

- Custom Fields: Utilize custom fields such as Reference, Approved, and Section to add specific details and categorize different sections of your business plan, providing a streamlined approach to organizing and accessing vital information.

- Custom Views: Access different perspectives of your business plan with views like Topics, Status, Timeline, Business Plan, and Getting Started Guide, allowing you to focus on specific areas of your plan or get an overview of the entire document effortlessly.

How To Use Business Plan Template for Financial Advisors

If you're a financial advisor looking to create a solid business plan, our Business Plan Template for Financial Advisors can help guide you through the process. Follow these five steps to get started:

1. Define your target market and services

Take the time to identify your target market and the specific services you will offer to them. Are you focusing on retirees, young professionals, or small business owners? Determine who your ideal clients are and what unique value you can provide to them.

Use custom fields in ClickUp to track your target market segments and the services you plan to offer to each segment.

2. Set your business goals and objectives

Establish clear, measurable goals and objectives for your financial advisory business. Do you want to increase your client base by a certain percentage? Are you aiming for a specific revenue target? Setting goals will help you stay focused and motivated as you build your business.

Create Goals in ClickUp to track your business objectives and monitor your progress.

3. Develop a marketing and client acquisition strategy

Outline the strategies and tactics you will use to attract and acquire new clients. This could include digital marketing, referrals, networking events, or partnerships with other professionals. Determine the most effective channels to reach your target market and develop a plan to execute your marketing initiatives.

Use the Board view in ClickUp to create a visual marketing plan and track your progress in acquiring new clients.

4. Create a financial forecast

An essential part of your business plan is a financial forecast. This will help you understand your projected revenue, expenses, and profitability over a specific period. Consider factors such as operating costs, pricing structure, and client retention rates when creating your forecast.

Utilize the Gantt chart in ClickUp to create a timeline for your financial projections and monitor your business's financial health.

5. Monitor, review, and adjust

Once your business plan is in place, it's important to regularly review and monitor your progress. Track key metrics and indicators such as client acquisition rates, revenue growth, and client satisfaction. Analyze the data and make adjustments to your strategies or tactics as needed to ensure you're on track to achieve your business goals.

Use Dashboards in ClickUp to create visual reports and track your business's performance over time.

By following these steps and utilizing our Business Plan Template for Financial Advisors in ClickUp, you'll have a comprehensive plan to guide your financial advisory business towards success.

Get Started with ClickUp’s Business Plan Template for Financial Advisors

Financial advisors can use this Business Plan Template for Financial Advisors to outline their business goals, strategies, target market, target client profile, and marketing plans to achieve long-term success.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a comprehensive business plan:

- Use the Topics View to organize your business plan into different sections such as goals, strategies, target market, and marketing plans

- The Status View will help you track the progress of each section of your business plan, with statuses like Complete, In Progress, Needs Revision, and To Do

- The Timeline View will give you a visual representation of your business plan's timeline, allowing you to set deadlines and milestones

- The Business Plan View will provide a holistic overview of your entire business plan, allowing you to see how all the sections fit together

- The Getting Started Guide View will give you a step-by-step guide on how to use the template effectively and create a successful business plan

- Utilize custom fields like Reference, Approved, and Section to add additional information and categorize different aspects of your business plan

- Update statuses as you progress through each section and task to keep stakeholders informed of progress

- Monitor and analyze your business plan to ensure it aligns with your goals and objectives

- Business Plan Template for Performers

- Business Plan Template for Livestock Managers

- Business Plan Template for Metalworkers

- Business Plan Template for Wendys

- Business Plan Template for Shooting Range Operators

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Sample Financial Advisor Business Plan

Writing a business plan is a crucial step in starting a financial advisor business. Not only does it provide structure and guidance for the future, but it also helps to create funding opportunities and attract potential investors. For aspiring financial advisors, having access to a sample financial advisor business plan can be especially helpful in providing direction and gaining insight into how to draft their own financial advisor business plan.

Download our Ultimate Financial Advisor Business Plan Template

Having a thorough business plan in place is critical for any successful financial advisor venture. It will serve as the foundation for your operations, setting out the goals and objectives that will help guide your decisions and actions. A well-written business plan can give you clarity on realistic financial projections and help you secure financing from lenders or investors. A financial advisor business plan example can be a great resource to draw upon when creating your own plan, making sure that all the key components are included in your document.

The financial advisor business plan sample below will give you an idea of what one should look like. It is not as comprehensive and successful in raising capital for your financial advisor as Growthink’s Ultimate Financial Advisor Business Plan Template , but it can help you write a financial advisor business plan of your own.

Financial Advisor Business Plan Example – WealthWise Planning

Table of contents, executive summary, company overview, industry analysis, customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan.

At WealthWise Planning, we are a new Financial Advisor based in Detroit, MI, dedicated to filling a significant gap in the local market by providing high-quality financial advice and services. Our offerings include Financial Planning, Investment Management, Retirement Planning, Estate Planning, and Tax Advisory, all tailored to meet the unique financial goals and situations of our clients. Our holistic approach ensures comprehensive care for our clients’ financial health, guiding them towards financial security and prosperity. Strategically located in the heart of Detroit, our deep understanding of the local economic environment positions us as the go-to financial advisor in the area.

We are uniquely positioned for success, thanks to the invaluable experience of our founder in running a successful financial advisory business, and our commitment to offering superior financial planning services. Our team’s expertise and dedication to client well-being are at the core of our operations. Since our founding on January 5, 2024, we have achieved significant milestones, including designing our logo, developing our company name, and securing an excellent location for our operations. These accomplishments demonstrate our dedication to becoming the leading financial advisor in Detroit, MI.

The Financial Advisor industry in the United States, with a market size of over $66 billion in 2020 and an average annual growth rate of 5.7% over the past decade, is poised for continued expansion. With a projected market size of over $80 billion by 2025, driven by an aging population, increased financial market complexity, and the rise of digital financial advice platforms, the industry’s future looks promising. WealthWise Planning, serving Detroit, MI, is well-placed to capitalize on these trends by offering tailored financial solutions and personalized advice, aiming to establish itself as a trusted partner for individuals seeking to achieve their financial goals.

WealthWise Planning targets a diverse customer base in Detroit, MI, including young professionals, retirees, small business owners, and families. Our services are designed to address the unique financial needs of these groups, from managing burgeoning finances and preserving wealth to navigating business growth and securing financial futures for families. By providing personalized financial advice and planning strategies, we aim to become a trusted advisor for long-term financial well-being in our community.

WealthWise Planning’s main competitors include Zhang Financial, known for its wealth management and transparent fee structure; Bloom Advisors, which offers personalized financial planning; and Peak Wealth Management, specializing in wealth management and estate planning. Our competitive advantage lies in our personalized approach to financial planning and our commitment to leveraging the latest technology to enhance service delivery and client experience. This, combined with our dedication to client satisfaction, positions WealthWise Planning as a leader in the financial advisory landscape.

WealthWise Planning offers a suite of financial services designed to cater to various needs, with transparent pricing and a client-centric approach. Our comprehensive services include Financial Planning, Investment Management, Retirement Planning, Estate Planning, and Tax Advisory. Our promotional strategy encompasses online marketing, SEO, PPC advertising, social media marketing, email marketing, community outreach, networking, and leveraging client testimonials. By utilizing a multifaceted promotional approach, we aim to stand out in Detroit, MI, and build a solid client base, ensuring we reach potential clients effectively and build lasting relationships.

To ensure WealthWise Planning’s success, our key operational processes include detailed CRM activities, comprehensive financial analysis and planning, market research, compliance and regulatory reporting, professional development, client portfolio management, client meetings and reviews, operational efficiency improvements, risk management, and targeted marketing for client acquisition. Upcoming milestones include launching our business, developing a comprehensive marketing strategy, building a robust client onboarding process, establishing strategic partnerships, hiring additional staff, implementing advanced financial planning tools, and achieving specific revenue targets. These efforts will establish us as a successful, reputable financial advisor in Detroit, MI.

Under the leadership of Aiden Scott, our President, WealthWise Planning boasts a management team with the experience and expertise necessary for success. Scott’s background in financial advisory services, strategic foresight, and leadership skills, along with his deep understanding of the financial industry, are instrumental in guiding our company towards its goals. His expertise ensures that WealthWise Planning remains at the forefront of delivering exceptional financial advisory services.

WealthWise Planning is a new Financial Advisor serving customers in Detroit, MI. As a local financial advisor, we understand the financial landscape and challenges that our community faces. Currently, there are no high-quality local financial advisors in the area, which positions us to fill a significant gap in the market and serve our community with unparalleled financial services.

At WealthWise Planning, our offerings are designed to cater to a broad spectrum of financial needs. Our products and services include Financial Planning, Investment Management, Retirement Planning, Estate Planning, and Tax Advisory. These services are tailored to meet the unique financial goals and situations of our clients in Detroit, MI. Our holistic approach ensures that every aspect of our clients’ financial health is addressed, setting them on a path to financial security and prosperity.

Located in the heart of Detroit, MI, WealthWise Planning is strategically positioned to serve our local community. Our deep understanding of the local economic environment enhances our ability to provide targeted and effective financial advice, making us the go-to financial advisor in Detroit.

WealthWise Planning is uniquely qualified to succeed for several reasons. Our founder brings invaluable experience from previously running a successful financial advisor business. This experience, combined with our commitment to offering better financial planning services than our competition, sets us apart and ensures our success. Our team’s expertise and dedication to our clients’ financial well-being are at the core of everything we do.

Founded on 2024-01-05, WealthWise Planning has quickly made strides in establishing itself as a trusted financial advisor. We are a Limited Liability Company, which reflects our professionalism and commitment to operating with the highest standards of integrity and transparency. To date, our accomplishments include designing our logo, developing our company name, and finding a great location for our operations. These steps mark the beginning of our journey to becoming the leading financial advisor in Detroit, MI, and a testament to our dedication to serving our community.

The Financial Advisor industry in the United States is a booming sector, with a market size of over $66 billion in 2020. This industry has been steadily growing over the past decade, with an average annual growth rate of 5.7%. The increasing demand for financial advice and services, coupled with the growing number of individuals seeking help with their investments, has contributed to the expansion of this market.

Looking ahead, the Financial Advisor industry is expected to continue its growth trajectory, with market analysts projecting a market size of over $80 billion by 2025. This anticipated growth is driven by several factors, including an aging population seeking retirement planning services, increased complexity in financial markets, and the rise of digital platforms offering financial advice. As more individuals recognize the importance of professional financial guidance, the market for Financial Advisors is poised for further expansion.

These trends in the Financial Advisor industry bode well for WealthWise Planning, a new Financial Advisor serving customers in Detroit, MI. With the increasing demand for financial advice and services, WealthWise Planning has a significant opportunity to carve out a niche in this growing market. By providing tailored financial solutions and personalized advice to clients, WealthWise Planning can capitalize on the expanding market and establish itself as a trusted partner for individuals seeking to achieve their financial goals.

Below is a description of our target customers and their core needs.

Target Customers

Local residents will form the primary customer base for WealthWise Planning. This demographic is diverse, encompassing young professionals eager to manage their burgeoning finances and retirees focused on preserving their wealth. WealthWise Planning will tailor its services to meet the unique needs of these local individuals, providing personalized financial advice and planning strategies.

Small business owners in Detroit are another significant segment that WealthWise Planning will target. These entrepreneurs require specialized financial guidance to navigate the complexities of business growth, tax planning, and asset management. WealthWise Planning will offer custom solutions that address the specific challenges faced by these business owners, helping them to achieve financial stability and growth.

In addition to these groups, WealthWise Planning will also cater to families seeking to secure their financial future. These services will include college savings plans, retirement planning, and wealth transfer strategies. By addressing the financial concerns that are most relevant to families in Detroit, WealthWise Planning will establish itself as a trusted advisor for long-term financial well-being.

Customer Needs

WealthWise Planning offers high-quality financial advisory services that cater to the diverse needs of residents seeking to enhance their financial well-being. Customers can expect personalized financial strategies that align with their goals, whether they’re saving for a home, investing for retirement, or managing debt. This level of customization ensures that every financial plan is as unique as the individual’s circumstances, addressing a crucial need for tailored financial guidance.

In addition to personalized financial planning, WealthWise Planning understands the importance of financial education and empowerment. Customers have access to resources and tools that help demystify complex financial concepts and decisions. This empowers them to make informed choices about their financial futures, fostering a sense of confidence and control over their financial destiny.

Furthermore, WealthWise Planning prioritizes accessibility and convenience, recognizing that time is a valuable asset for its customers. By offering flexible consultation schedules and leveraging technology for virtual meetings, clients can easily integrate financial planning into their busy lives. This approach addresses the need for professional financial advice that is both accessible and adaptable to the modern lifestyle of Detroit residents.

WealthWise Planning’s competitors include the following companies.

Zhang Financial

Zhang Financial offers a wide range of services including wealth management, financial planning, and investment advisory services. They cater to high-net-worth individuals and families, providing bespoke solutions tailored to their clients’ unique financial situations. Their price points are typically based on a percentage of assets under management, aligning the firm’s interests with those of their clients.

Zhang Financial is known for its transparent fee structure and has been recognized for its commitment to providing fiduciary advice. The firm operates in multiple locations, with a strong presence in Michigan, which allows them to serve a broad geographic area. They target affluent clients seeking comprehensive financial planning and investment management services.

One of Zhang Financial’s key strengths is their team of highly qualified professionals, including Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs), who bring a depth of expertise to their client engagements. However, their focus on high-net-worth individuals may limit accessibility for potential clients with lower levels of investable assets.

Bloom Advisors

Bloom Advisors offers financial planning, retirement planning, and investment management services. They focus on creating personalized financial plans that address the unique needs of each client, emphasizing long-term relationships. Their pricing model is based on a combination of a flat fee for financial planning and a percentage of assets under management for investment services.

Located in Michigan, Bloom Advisors serves a diverse clientele, including families, professionals, and retirees. They are particularly noted for their comprehensive approach to retirement planning. Their market segment includes individuals and families looking for personalized financial guidance and strategies.

Bloom Advisors’ strength lies in their personalized service and holistic approach to financial planning. However, their weakness may be perceived in terms of scalability, as the highly personalized nature of their services could limit their capacity to grow their client base rapidly.

Peak Wealth Management

Peak Wealth Management specializes in wealth management, financial planning, and estate planning services. They aim to help clients grow and protect their wealth through customized investment strategies and comprehensive financial planning. Pricing at Peak Wealth Management typically involves a fee based on the percentage of assets under management, along with possible flat fees for specific planning services.

With a presence in Michigan, Peak Wealth Management targets a broad range of clients, including individuals, families, and business owners. Their services are designed to cater to a wide spectrum of financial needs, from young professionals to retirees. This allows them to serve a diverse customer base within the region.

The firm’s key strength is its integrated approach to wealth management, combining investment management with financial planning to provide a holistic service offering. A potential weakness could be the challenge of differentiating their services in a crowded market, where many firms offer similar wealth management solutions.

Competitive Advantages

At WealthWise Planning, we pride ourselves on delivering superior financial planning services that set us apart from our competitors. Our team of experienced professionals employs a personalized approach to financial planning, ensuring that each client’s unique needs and goals are meticulously addressed. We understand that financial planning is not a one-size-fits-all service, which is why we tailor our strategies to fit the individual circumstances of our clients. This bespoke service model enables us to provide more accurate, relevant, and effective financial advice, making a significant difference in our clients’ financial well-being and future security.

Furthermore, our competitive advantage extends beyond just the quality of our financial planning services. We are deeply committed to leveraging the latest technology to enhance our service delivery and client experience. From advanced financial modeling tools to seamless digital communication platforms, we ensure that our clients have access to cutting-edge resources. This technological edge not only improves the efficiency and effectiveness of our financial planning solutions but also provides our clients with a level of convenience and accessibility that is rare in the financial advisory sector. Coupled with our unwavering commitment to client satisfaction, WealthWise Planning stands as a beacon of excellence in the financial advisory landscape, ready to guide our clients towards achieving their financial dreams with confidence and clarity.

Our marketing plan, included below, details our products/services, pricing and promotions plan.

Products and Services

Understanding the financial landscape can be daunting for many. This is why WealthWise Planning steps in to offer comprehensive financial services designed to meet a variety of needs. From crafting personalized financial plans to managing investments, WealthWise Planning ensures that its clients are well-prepared for the future, regardless of their current financial situation. Below is a detailed overview of the products and services offered, along with their average selling prices, enabling clients to make informed decisions.

Financial Planning is one of the cornerstone services offered. It encompasses a thorough analysis of the client’s current financial status and the development of strategies to meet future goals. Clients can expect to pay an average of $2,500 for a comprehensive financial plan. This service is tailored to provide a roadmap that covers savings, budgeting, and strategic investment recommendations.

Investment Management is another critical service provided. WealthWise Planning adopts a proactive approach to portfolio management, ensuring that clients’ investments align with their risk tolerance and financial objectives. The cost for this service typically averages 1% of the assets under management (AUM) annually. This fee structure ensures that the firm’s interests are directly aligned with the client’s success.

Retirement Planning is crucial for anyone looking to secure their financial future post-employment. WealthWise Planning helps clients navigate the complex world of retirement savings, pension plans, and Social Security benefits. Clients can expect to pay an average of $1,500 for a retirement plan, which is a small price for the peace of mind and security it brings in one’s golden years.

Estate Planning is also offered, ensuring that clients’ financial affairs are in order, and their legacies are preserved according to their wishes. The service includes guidance on wills, trusts, and estate taxes, among other elements. The average cost for estate planning services is around $3,000, depending on the complexity of the client’s estate and goals.

Tax Advisory services round out WealthWise Planning’s offerings, providing clients with strategies to minimize tax liabilities and ensure compliance with tax laws. This service, priced at an average of $500 annually, is invaluable for both individual and corporate clients looking to optimize their tax situations.

In summary, WealthWise Planning offers a suite of financial services designed to cater to various needs, from financial planning and investment management to retirement, estate planning, and tax advisory. With transparent pricing and a client-centric approach, WealthWise Planning is committed to helping its clients achieve financial well-being and security.

Promotions Plan

Attracting customers in the dynamic financial advisory market requires a multifaceted promotional approach. WealthWise Planning embraces a variety of methods to ensure it stands out in Detroit, MI, and builds a solid client base. Online marketing forms the cornerstone of their promotional strategy, leveraging the power of digital platforms to reach potential clients effectively.

One key aspect of online marketing is search engine optimization (SEO). WealthWise Planning will optimize its website with relevant keywords to ensure it ranks high in search results related to financial advice in Detroit. This strategy will increase visibility and attract organic traffic to their site. Alongside SEO, they will engage in pay-per-click (PPC) advertising, targeting individuals searching for financial planning services. PPC campaigns will allow WealthWise Planning to appear at the top of search results, offering immediate visibility.

Social media marketing is another pillar of their promotional efforts. WealthWise Planning will establish a strong presence on platforms such as LinkedIn, Facebook, and Instagram. By sharing informative content, financial tips, and insights into the financial planning process, they will build a relationship with their audience and establish themselves as thought leaders in the industry. Social media ads, tailored to target demographics in Detroit, will further enhance their visibility and attract potential clients.

Email marketing will also play a crucial role in WealthWise Planning’s promotional strategy. By collecting email addresses through their website and social media channels, they will send out newsletters, financial advice, and updates about their services. This direct form of communication will keep WealthWise Planning top of mind among potential clients and encourage engagement with their services.

Beyond online marketing, WealthWise Planning will engage in community outreach and networking. Hosting financial planning workshops and seminars in Detroit will allow them to demonstrate their expertise and engage directly with potential clients. They will also form partnerships with local businesses and organizations to expand their reach and establish a referral network. These face-to-face interactions will complement their online efforts, creating a comprehensive promotional strategy that builds trust and credibility in the community.

Finally, WealthWise Planning will leverage client testimonials and case studies to showcase their success stories and the value they provide. Sharing these testimonials on their website and social media channels will help build confidence among potential clients, illustrating the positive impact of their financial advisory services.

By integrating online marketing with community engagement and direct communication, WealthWise Planning positions itself to attract a diverse client base in Detroit. Their comprehensive approach ensures they not only reach potential clients but also build lasting relationships that foster trust and credibility in the financial advisory space.

Our Operations Plan details:

- The key day-to-day processes that our business performs to serve our customers

- The key business milestones that our company expects to accomplish as we grow

Key Operational Processes

To ensure the success of WealthWise Planning, there are several key day-to-day operational processes that we will perform.

- Customer Relationship Management (CRM) Activities: We will maintain detailed records of all interactions with clients, including calls, meetings, and emails. This ensures personalized and timely communication, fostering strong relationships.

- Financial Analysis and Planning: We will conduct comprehensive financial analysis for each client, considering their income, expenses, investments, and financial goals. This allows us to provide tailored financial advice and planning services.

- Market Research: We will continuously monitor financial markets and economic indicators to stay informed about trends and opportunities that can impact our clients’ investment strategies.

- Compliance and Regulatory Reporting: We will ensure that all operations comply with financial regulations and laws. This includes preparing and submitting required reports to regulatory bodies in a timely manner.

- Professional Development: We will invest in ongoing education and training for our advisors to keep them abreast of the latest financial planning strategies, tools, and regulatory changes.

- Client Portfolio Management: We will actively manage client portfolios, making adjustments as needed based on market conditions and client objectives. This includes buying and selling assets, rebalancing portfolios, and ensuring diversification.

- Client Meetings and Reviews: We will schedule regular meetings with clients to review their financial plans, discuss any changes in their financial situation, and adjust their investment strategies accordingly.

- Operational Efficiency: We will continuously seek ways to improve operational efficiency, including automating routine tasks, optimizing internal processes, and utilizing technology to enhance service delivery.

- Risk Management: We will implement strategies to identify, assess, and mitigate risks that could impact our clients’ investments or the operation of WealthWise Planning. This includes ensuring cybersecurity measures are in place to protect client information.

- Marketing and Client Acquisition: We will execute targeted marketing campaigns to attract new clients and retain existing ones. This will include digital marketing, community engagement, and networking events.

WealthWise Planning expects to complete the following milestones in the coming months in order to ensure its success:

- Launch our Financial Advisor Business : This initial step involves setting up the legal structure of the business, securing an office space in Detroit, MI, and ensuring all regulatory and compliance measures are met to operate as a financial advisor within the state. This includes obtaining necessary licenses and registrations with state and federal financial regulatory bodies.

- Develop and Implement a Comprehensive Marketing Strategy : Create a multi-channel marketing strategy that includes digital marketing (SEO, social media, email marketing), local advertising, and community engagement to build brand awareness and attract initial clients.

- Build a Robust Client Onboarding Process : Design and implement a streamlined onboarding process that ensures a smooth and professional experience for new clients. This includes client intake forms, assessment of financial goals and risk tolerance, and initial financial planning and advisement sessions.

- Establish Strategic Partnerships with Local Businesses and Communities : Form partnerships with local businesses, community organizations, and professionals (such as accountants and lawyers) to build referral networks and increase client base through trusted sources.

- Hire and Train Additional Financial Advisors and Support Staff : As the client base grows, recruit, hire, and train additional qualified financial advisors and support staff to maintain high service quality and client satisfaction. Focus on team members with strong expertise and excellent client service skills.

- Implement Cutting-Edge Financial Planning Software and Tools : Invest in advanced financial planning software and tools to enhance service delivery, improve client experience, and increase operational efficiency. Ensure staff are trained on these technologies.

- Achieve $5,000/Month in Revenue : This milestone signifies the business’s initial traction and market acceptance. It involves acquiring enough clients and managing enough assets to generate this level of recurring revenue.

- Develop and Launch a Client Retention and Expansion Program : Create programs aimed at retaining existing clients and encouraging referrals, such as regular financial education workshops, personalized financial health reports, and client appreciation events.

- Get to $15,000/Month in Revenue : This critical milestone indicates that WealthWise Planning has successfully scaled its client base and service offerings to a sustainable level. Achieving this target requires consistent marketing efforts, excellent client service, and a focus on expanding services to meet client needs. By systematically achieving these milestones, WealthWise Planning aims to establish itself as a successful and reputable financial advisor in Detroit, MI, positioning itself for long-term growth and success in the financial services industry.

WealthWise Planning management team, which includes the following members, has the experience and expertise to successfully execute on our business plan:

Aiden Scott, President

Aiden Scott brings to WealthWise Planning not only his title of President but also a rich background in financial advisory services. Having successfully led a financial advisory firm in the past, Scott has demonstrated a keen ability to navigate the complex landscape of financial planning and investment management. His track record speaks volumes about his strategic foresight, leadership skills, and his deep understanding of the financial industry. Under his stewardship, WealthWise Planning is poised to benefit from Scott’s experience in creating value for clients and steering the company towards lasting success. His expertise is instrumental in shaping the strategic direction of WealthWise Planning, ensuring that the firm remains at the forefront of delivering exceptional financial advisory services.

To achieve our growth goals, WealthWise Planning requires $182,000 in funding. This funding will be allocated towards capital investments such as location buildout, furniture, equipment, and non-capital investments including working capital, initial rent, staff salaries, marketing, supplies, and insurance. These investments are critical for establishing our operations in Detroit, MI, and positioning WealthWise Planning for long-term success and sustainability in the financial services industry.

Financial Statements

Balance sheet.

[insert balance sheet]

Income Statement

[insert income statement]

Cash Flow Statement

[insert cash flow statement]

Financial Advisor Business Plan Example PDF

Download our Financial Advisor Business Plan PDF here. This is a free financial advisor business plan example to help you get started on your own financial advisor plan.

How to Finish Your Financial Advisor Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your financial advisor business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Financial modeling spreadsheets and templates in Excel & Google Sheets

- Your cart is empty.

Ultimate Guide To Creating A Sample Financial Advisor Business Plan

Crafting the Essential Elements of a Financial Advisor Business Plan

Creating a successful financial advisor business plan involves several essential components that align your vision, identity, and strategy for gr

owth within this competitive industry. As you consider launching your practice, focus on articulating a clear roadmap that resonates with your target market and effectively showcases your value proposition.

Understanding Your Target Audience

Identifying your ideal client is crucial when crafting your business plan. Understanding who you serve allows you to tailor your offerings and marketing strategies. You might consider segmenting your audience based on various factors such as age, income, profession, and financial goals.

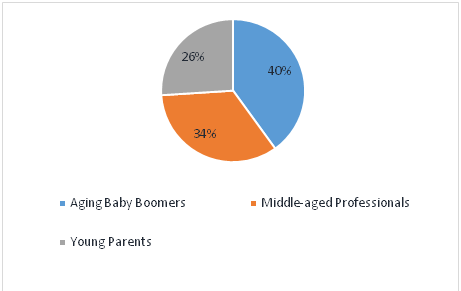

For example, here’s a breakdown of potential target groups:

| Young Professionals | Early career, high potential income | Saving for retirement, buying a home |

| Families | Middle-aged, dual-income households | College savings, life insurance |

| Retirees | 60+, transitioning from career | Estate planning, wealth preservation |

Defining Your Services

Next, clearly outline the services you will offer. This includes comprehensive financial planning, investment management, retirement planning, tax strategies, and estate planning. Each service should be articulated with a brief description to illustrate its significance.

Here’s a list of common services provided by financial advisors:

- Investment Management : Guiding clients in selecting and managing their investment portfolios.

- Financial Planning : Establishing a comprehensive plan to meet long-term financial goals.

- Retirement Planning : Creating strategies for clients to effectively save for and transition into retirement.

- Tax Planning : Advising clients on how to minimize tax liability while maximizing investments.

- Estate Planning : Helping clients prepare for wealth transfer and management after their passing.

Each service should align with the needs of your identified client demographics, enhancing your appeal and relevancy.

Competitive Analysis

Conducting a competitive analysis is vital to differentiate yourself in the marketplace. Research local advisory firms and assess their strengths and weaknesses. Identifying gaps will help you formulate your unique selling proposition (USP).

Here’s a quick framework to assess competition:

- Identify Competitors : Local firms, independent advisors, robo-advisors.

- Services offered

- Pricing structures

- Client engagement methods

- Identify Gaps : Areas where competitors fall short in service delivery or client support.

By pinpointing where you excel—such as personalized service, transparent pricing, or using advanced technology—you establish how your practice will stand out.

Marketing Strategy

Establishing a robust marketing strategy is crucial for client acquisition. Utilize various channels, from social media platforms to email marketing. Consider the following tactics:

- Networking : Attend local business events and engage in community outreach.

- Content Marketing : Establish your expertise through informative blog posts, webinars, or podcasts.

- Referrals : Encourage existing clients to refer friends and family by offering incentives.

- Search Engine Optimization : Optimize your website with relevant keywords to enhance your online visibility.

A multifaceted marketing approach ensures consistent outreach and helps in building a recognizably trustworthy brand.

Financial Projections and Budgeting

Monitor your financial health by creating realistic projections and budgets. Include startup costs such as licenses and certifications, office space, and marketing expenditures. Document projected revenue streams from client fees to understand your financial trajectory.

Here’s a basic outline of anticipated financial aspects:

| Office Rent | $1,500 | $18,000 |

| Marketing | $500 | $6,000 |

| Technology/Software | $200 | $2,400 |

| Professional Fees | $300 | $3,600 |

| Total Expenses | $2,500 | $30,000 |

Leveraging realistic financial projections helps in planning for potential growth and sustainably managing expenses.

Implementation Timeline

Create an actionable timeline for rolling out your business plan. Coffee workshops, client onboarding processes, and technology implementation should all be mapped out with deadlines.

Having a step-by-step approach keeps you on track and accountable, adapting as necessary based on client feedback and market trends.

Remember that a well-crafted financial advisor business plan is a living document. Regularly review and adjust your strategies to ensure continued relevance and effectiveness in serving your clients.

Understanding Your Target Market: Strategies for Financial Advisors

As a financial advisor, understanding your target market is crucial for your success. Tailoring your services to meet the specific needs of your audience not only enhances client satisfaction but also drives business growth. Here are some effective strategies to better understand your target market.

Identify Your Ideal Client Profile

To develop an effective marketing strategy, begin by creating a detailed client persona. Ask yourself questions such as:

- What is their age and gender?

- What is their income range?

- What are their financial goals?

- Which challenges do they face in achieving those goals?

By answering these questions, you can craft a clear picture of whom you want to serve. This profile will guide your marketing tactics, service offerings, and client interactions.

Conduct Market Research

Gather data through surveys and interviews. Utilize online tools to create surveys that can easily be shared with potential clients. Consider asking:

- What financial services do they currently use?

- How do they prefer to receive advice?

- What factors influence their decisions when selecting a financial advisor?

Analyzing this information helps you make informed decisions about market trends and client desires.

Segment Your Audience

You shouldn’t treat your entire client base as a monolith. Segmenting your audience allows for targeted marketing. Here are some examples of how you might segment your clients:

| Segment | Description |

|---|---|

| Age Groups | Different age brackets often have distinctly different financial needs. |

| Income Level | High-income individuals have different investment strategies compared to those with lower incomes. |

| Financial Goals | Some clients might be focused on retirement, while others could be more interested in wealth accumulation. |

By creating targeted campaigns for each segment, your marketing efforts will resonate more effectively with potential clients. You can use personalized messaging that speaks directly to each group’s needs.

Utilize Social Media Platforms

Social media can serve as a treasure trove of insight into your target market’s preferences and behaviors. Here’s how to use these platforms:

- Engage in conversations and discussions on forums and groups related to personal finance.

- Use polls and surveys within your social media channels to gauge interests.

- Analyze comments and feedback to identify common questions or concerns.

Platforms like LinkedIn can be particularly valuable for connecting with professionals who might need your services.

Leverage Analytics Tools

Online analytics tools can provide a wealth of data about your websites and marketing campaigns. Utilize these insights to understand:

- Which demographics visit your website?

- What content they find most engaging?

- The paths they take before they become clients.

With this data, you can refine your marketing strategy to better resonate with potential clients.

Solicit Feedback

Once you begin working with clients, don’t stop gathering data. Regularly solicit feedback on your services. Consider methods like:

- Email surveys post-consultation.

- Periodic one-on-one check-ins to discuss satisfaction.

- Offering incentives for completing feedback forms.

Not only does this give you insight into how you can improve, but it also shows clients that you value their opinions.

Stay Informed on Industry Trends

The financial sector is constantly changing. Stay updated on new regulations, market trends, and technological advances that can impact your clients’ financial situations. Subscribe to industry newsletters, attend webinars, and network with peers. Adjust your service offerings based on what you learn to better meet the evolving needs of your target market.

By utilizing these strategies, you can gain a comprehensive understanding of your target market. This knowledge will empower you to create personalized client experiences and build lasting relationships, ensuring your financial advisory practice thrives in a competitive landscape.

Effective Marketing Techniques to Attract Clients in the Financial Sector

Attracting clients in the financial sector requires a well-thought-out strategy that resonates with your target audience. The competition is fierce, and financial advisors need effective marketing techniques to stand out. Here, we explore some advanced methods to draw in clients while focusing on relationship building and trust. A strong marketing approach can make all the difference.

Knowing your ideal client is the first step in creating a tailored marketing plan. Understanding their goals, dilemmas, and interests helps you market more effectively. Segmentation plays a key role—classify clients based on age, financial goals, and risk tolerance. Here are some questions to identify your target audience:

- Who are my current clients, and what do they have in common?

- What challenges do they face regarding finances?

- What age groups or demographical categories do they belong to?

- What are their investment preferences and financial goals?

Once you understand your audience, you can create content that speaks directly to their needs.

Content Marketing for Authority and Engagement

Content marketing is an invaluable tool in the financial sector. By sharing valuable information, you position yourself as an expert. Engaging articles, insightful blog posts, and informative webinars can help build your brand.

- Blog Posts: Craft informative articles about market trends, investment strategies, or personal finance tips.

- Webinars: Host online seminars to discuss relevant topics, and provide Q&A sessions to engage directly with potential clients.

- Newsletters: Regular updates with financial news, tips, or exclusive content keep your audience informed and engaged.

By consistently delivering valuable content, you not only attract potential clients but also foster loyalty among existing ones.

Leverage Social Media for Client Engagement

Social media platforms are powerful tools for client engagement and outreach. Each platform serves different demographics, so choose the right ones to reach your target audience. Here are some effective techniques:

- Create Useful Content: Regularly post financial tips, client testimonials, and case studies.

- Interact with Followers: Respond promptly to comments and messages to build relationships.

- Run Targeted Ads: Use Facebook and LinkedIn advertising to reach specific demographics and drive traffic to your website.

Social media isn’t just about broadcasting your services; it’s about creating a community around your brand.

Email Marketing: Personalize Your Approach

Email marketing remains one of the most effective channels for client communication. A well-crafted email strategy can help you nurture leads and maintain existing relationships. Consider these points:

- Segment Your List: Tailor content based on different client groups or interests.

- Personalize Your Messages: Use clients’ names and reference their specific situations to make them feel valued.

- Provide Exclusive Content: Share market insights or reports with your subscribers to encourage engagement.

By adding a personal touch, you foster a connection that can lead to lasting client relationships.

Networking and Building Referrals

In the financial sector, referrals can significantly impact your client base. Building a network that includes current clients, fellow professionals, and community leaders can be incredibly beneficial. Here are some strategies:

- Attend Industry Events: Participate in seminars, workshops, and conferences to meet potential clients and share your expertise.

- Join Professional Associations: Becoming a member of associations can help you build credibility and connections.

- Launch a Referral Program: Encourage satisfied clients to refer friends and colleagues by offering incentives.

Referrals add a layer of trust that traditional advertising often cannot achieve.

Utilizing SEO to Enhance Visibility

In today’s digital world, an effective website with strong SEO practices can significantly enhance your visibility. Incorporate relevant keywords related to finance to improve search engine rankings. Focus on: