- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Private Equity Forum PE

Private Equity Case Study: Dell Technologies

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

This PE case study sample is brought to you by Value Add , the leading research journal for the operating side of private equity. Join thousands of buyside professionals who subscribe to Value Add for weekly news and insights about private equity buyouts, turnarounds, and exits.

Private Equity Case Study: Dell Technologies

Introduction

In the early 2010s, Dell Technologies, once a leader in the personal computing industry, was facing numerous challenges. The company was struggling with declining PC sales, intense competition from rivals like Lenovo, Samsung, and Apple, and a rapidly changing technology landscape favoring mobile devices and cloud computing. Dell's stock price was underperforming, reflecting its stagnating growth and poor market positioning.

In 2013, Silver Lake partnered with Michael Dell, the company's founder, to take Dell Technologies private in a $24.9 billion deal. It was one of the largest leveraged buyouts since the financial crisis and marked the beginning of a significant transformation for Dell Technologies. Michael Dell invested $4.2 billion in the deal, while Silver Lake invested $1.4 billion, and the rest of the transaction was financed by debt and cash from Dell Technologies.

Silver Lake, one of the more technology-focused private equity firms, saw an opportunity to work with Dell’s namesake founder and turnaround the company from being a declining PC-maker to a fast-growing IT solutions provider. The value creation plan ultimately proved fruitful, as Silver Lake and Michael Dell earned an estimated $70 billion from the deal by 2023, making it one of the most-successful private equity turnarounds of all-time.

In 2013, the global financial crisis was firmly behind market participants, but Dell Technologies’ stock continued to struggle. $100 invested in Dell’s stock in 2008 would have been worth just $68 in 2013; for comparison, $100 invested in the broader S&P Information Technology index in 2008 would have been worth $138 by 2013. It showed how Dell, once a pioneer of the technology industry, was underperforming relative to its peers.

Dell's stock price underperformed competitors in the years leading up to being taken private by Michael Dell and Silver Lake.

The problem for Dell was that the PC market, its main source of revenue, was falling-out from under the company. “PC sales slump enters sixth quarter with no end in sight. Research firms Gartner and IDC offer gloomy prognostication as consumers stay away,” wrote The Guardian in an October 2013 article. Mobile devices, such as the iPhone, iPad, and Samsung Galaxy, had started to cannibalize the PC market. In fairness to Dell, the company did launch a smartphone in 2010, but much like Microsoft’s early attempts at mobile devices, it failed to gain traction.

It was a horrible turn of events for Dell Technologies. The company was overexposed to the PC market and had little diversification in its business model. In 2013, 77% of Dell’s total revenue came from “product” sales, which included PCs and other devices, and total revenue declined by -8% in just one year.

Michael Dell knew as far back as the early-2000s that the company had to transform itself if it wanted to survive in a post-PC era. “We’re doing a lot of reinventing of the business model and the strategies of the company,” he said in a rare interview in 2010. “Here’s the way I think about it. The IT industry, depending on how you define it, is somewhere in the vicinity of $1.8 trillion. It’s a pretty big industry. Within that are all sorts of opportunities to provide products and services, and all of that goes into what we call the modern world today in terms of how businesses operate and are productive.”

With a radical transformation in mind, Michael Dell partnered with Silver Lake to take the company private. As we’ll learn later, Michael Dell and his chief lieutenants felt that they could operate much more effectively as a private company. “We can go faster on the transformation journey in a private setting,” said Dell’s former-CFO Tom Sweet.

Buyout and Value Creation Plan

In late-2013, Dell Technologies announced that it would be taken private by Michael Dell and Silver Lake for $24.9 billion. The company’s namesake founder would invest $4.2 billion for a 75% stake and Silver Lake would invest $1.4 billion for a 25% stake. The remainder of the deal was financed by Dell Technologies’ own debt and cash, a move that angered many of the company’s existing shareholders.

“This feels like the ultimate insider trade,” remarked Frederick Rowe, a general partner of Greenbrier Partners, at the time of the deal. Carl Icahn said the deal undervalued the company and likened Michael Dell to a “corporate dictator.” Forbes called it the “nastiest tech buyout ever.”

But Michael Dell and Silver Lake survived the criticism and were able to get to work on turning around Dell as a private company. Silver Lake co-CEO Egon Durban, who helped architect the turnaround of Skype between 2009-2011, joined Dell’s Board. The first order of business was solidifying the company’s value creation plan which focused on four key areas:

- Strategic Restructuring and Focus on Higher Margin Businesses. One of the key strategies Michael Dell and Silver Lake employed was the restructuring of Dell's business model. Under its private ownership, Dell shifted from being predominantly a PC manufacturer to focusing on higher-margin segments such as enterprise solutions, software, and services. This pivot was essential in repositioning Dell in the rapidly evolving tech landscape, where traditional hardware was becoming less profitable due to intense competition and thinning margins. By concentrating on areas like data storage, network security, and cloud computing, Dell could offer integrated solutions, enhancing its value proposition to enterprise customers.

- Operational Improvements and Cost Efficiency . Dell began cutting costs associated with its PC business as early as 2012, with the goal of taking $2 billion of expenses out by 2015 and an additional $1 billion out in 2016. These measures ramped-up once the company was taken private. In 2014, more than 2,000 people (2% of Dell’s workforce) were laid off. Dell also streamlined the supply chain for manufacturing PCs by standardizing system configurations, moving operations to more affordable geographic areas, and making the supply chain more efficient. The company also sold-off several low-margin, non-core businesses in 2016, including NTT Data for $3 billion, as well as Quest Software and SonicWALL for a combined $2 billion. These efforts were part of a broader shift in Dell's business strategy to focus on higher-margin services, which helped the company improve gross margin from 21% in 2013 to 25% in 2018.

- Investment in Research and Development. Increasing investment in R&D was a key pillar of Dell’s revitalization as a private company. By increasing the budget allocated to R&D, Dell was able to innovate and develop new products and services, especially in emerging technology areas like cloud infrastructure and cybersecurity. This focus on innovation helped Dell stay ahead in a technology market where continuous evolution is the key to survival – a reality it learned all too well when it was late to diversify away from PCs in the early-2000s. Between 2013 and 2018, Dell increased R&D spending from $1.1 billion to $4.4 billion.

- Expansion through Strategic Acquisitions. Michael Dell and Silver Lake also guided Dell Technologies through a series of strategic acquisitions. These acquisitions were targeted to bolster Dell's presence in its new margin accretive business segments such as enterprise solutions, software, and services. For instance, the acquisition of EMC Corporation in 2016, a massive deal valued at approximately $67 billion, significantly enhanced Dell's capabilities in data storage and cloud computing, making it a powerhouse in the IT infrastructure domain.

To execute the value creation plan, Dell’s Board brought in a slew of new high-ranking executives. In 2014, Tom Sweet was promoted to company CFO and Priceline’s former-CIO Ron Rose was hired as SVP of online operations in 2013. The following year, AMD’s former-CEO Rory Read was named Dell’s COO, and former-Cisco VP Paul Perez was brought in to be CTO of Dell’s new enterprise group.

To continue reading this case study and for more private equity insights, subscribe to Value Add .

You guys should try to get a discount for WSO users

6 month free trial for any of our paying students... goal was to get our students access to some great content (+ value to our courses + programs) in exchange for a lot of exposure for them.

Does that include those who have bought PE course?

Commercial Due Diligence (Dell 2013 LBO)

- Dell (Project Denali) Presentation of The Boston Consulting Group to the Special Committee of the Company, dated December 5, 2012. Via SEC Filing: Dell - SC 13E3/A (Going private transaction) (3.29.2013); (EX-99.(C)(19).

- https://www.sec.gov/Archives/edgar/data/826083/000119312513134621/d5054…

Note - reformatted from original images/slides to fit better in the space provided. Hope this helps add to the OP's post on Dell above

Source: Dell (Project Denali) Presentation of The Boston Consulting Group to the Special Committee of the Company, dated December 5, 2012. Via SEC Filing: Dell - SC 13E3/A (Going private transaction) (3.29.2013); (EX-99.(C)(19). Hyperlink: https://www.sec.gov/Archives/edgar/data/826083/000119312513134621/d5054… https://www.sec.gov/Archives/edgar/data/826083/000119312513134621/d505474dex99c19.htm

Optio rem sint tempora dignissimos id reiciendis. Ut et est id qui. Iste labore perferendis veritatis qui veniam velit voluptas. Ut eum est ea dolore accusantium voluptate officia. Ut eum reprehenderit voluptatem ipsum.

Est et sunt corporis soluta qui cupiditate. Qui provident molestiae neque nisi aut consectetur. Veritatis et occaecati beatae eveniet quo possimus voluptas aspernatur. Explicabo qui cum voluptatem et itaque distinctio. Harum eius impedit non numquam molestiae consectetur. Deleniti veniam quo maxime possimus quam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Want to Vote on this Content?! No WSO Credits?

Already a member? Login

Trending Content - Private Equity Forum

| +83 | Whether its their inability to respond in a timely manner, to misleading you about where you stand relative to other buyers in the process, to providing horrendously inaccurate or incomplete information / data, there are a few banks that come to mind that would cause me to roll my eyes the minute w… ">Worst Bank You've Ever Worked with? Perspectives from the Buy-Side | 38 | 2h |

| +44 | Started at a MF about 1 month after banking and portco assignments just dropped last week Low and behold, I've been staffed on a deal marked at 0.5x after 5 years (significant equity check). Rest of the fund is doing well. Does anyone have advice for dealing with a situation like this?… ">Staffed on underperforming portco - what to do? | 16 | 2d |

| +28 | Hey everyone, Relatively new here, so please forgive me if I'm not familiar with the customs. I'm seeking some advice on how to think about a current job opportunity. I'm at MBB in a US office. My reviews have been fairly good, and I've been rated as ahead of the curve consistentl… ">MBB to PE shop. Worth it? | 15 | 1d |

| +24 | Let’s say someone has 5-6 years of experience in IB and PE and a dozen or so deals under their belt across both. I think such a person could win business from middle market firms looking to do M&A and helping them source and complete M&A. The types of firms that are not sophisticate… ">Starting corp dev firm after PE | 2 | 5d |

| +24 | I have relatively little PE experience and am recently out of college. I'm joining a firm raising a 100m fund as a person #3, as I have a lot of specific industry knowledge. I am currently paid peanuts in a T2 city until the fund closes (6-9 months). I am also very actively involved in creating the… ">Unique situation carry in a 100m fund | 10 | 4d |

| +21 | Basically, I don’t have time to interview, practice, what have you. With at least 1 all nighter a week, spending every night working till 4am+ I don’t see how it is physically possible for me to exit here alive. Doesn’t help when everyone on my junior team is quitting or leaving so they do nothing… ">Bad idea to quit to recruit for PE? | 7 | 3d |

| +21 | Currently in a situation where I'm trying to exit direct PE right around that Sr. Associate/VP level - I know, bad time to get out, market is shit, good luck getting a job, I've heard it all. Bottom line is, I've done well at my job, I can crank, but I'm entering late 20s and don't wanna work this … ">PE > OCIO a good life transition? What does Comp look like? | 3 | 6d |

| +20 | I am looking for advice towards the end of a 2 year associate program. The firm is a small LMM, but they are having difficulty raising a new fund which creates the most uncertainty. There is still hope for the new fund though after some exits hopefully create some fundraising momentum. They have of… ">End of Associate Program Advice | 5 | 9s |

| +17 | I have heard that they are pretty sweaty but how does it compare to banking? How sweaty are they? Is it consistent 2AM nights and weekend work? Or does that only happen every so often? ">How sweaty is Stonepeak? | 8 | 22m |

| +14 | What are your thoughts on the culture, pay, and reputation of BlackRock SLS? They raised a $3b Fund I in 2021 and are looking to raise a $4b Fund II, but without the return info, unsure how to think about them relative to the BXSP, Ardian, Lexington, Ares, Carlyle/AlpInvest, Neuberger Berman, etc o… ">BlackRock Secondaries & Liquidity Solutions - Culture and Reputation | 6 | 5d |

Career Resources

- Financial Modeling Resources

- Excel Resources

- Download Templates Library

- Salaries by Industry

- Investment Banking Interview Prep

- Private Equity Interview Prep

- Hedge Fund Interview Prep

- Consulting Case Interview Prep

- Resume Reviews by Professionals

- Mock Interviews with Pros

- WSO Company Database

WSO Virtual Bootcamps

- Sep 07 Venture Capital Bootcamp 10:00AM EDT

- Sep 14 Financial Modeling & Valuation Bootcamp Sep 14 - 15 10:00AM EDT

- Sep 21 Investment Banking Interview Bootcamp 10:00AM EDT

- Sep 28 Real Estate Modeling Bootcamp 10:00AM EDT

- Oct 05 Private Equity Interview Bootcamp 10:00AM EDT

Career Advancement Opportunities

September 2024 Private Equity

Overall Employee Satisfaction

Professional Growth Opportunities

Total Avg Compensation

“... there’s no excuse to not take advantage of the resources out there available to you. Best value for your $ are the...”

Leaderboard

- Silver Banana

- Banana Points

| 1 | 99.2 | |

| 2 | 99.0 | |

| 3 | 99.0 | |

| 4 | 99.0 | |

| 5 | 98.9 | |

| 6 | 98.9 | |

| 7 | 98.9 | |

| 8 | 98.9 | |

| 9 | 98.9 | |

| 10 | 98.8 |

“... I believe it was the single biggest reason why I ended up with an offer...”

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Dell to go private in landmark $24.4 billion deal

- Medium Text

Additional reporting by Aaron Pressman in Boston; Writing by Ben Berkowitz and Edwin Chan; Editing by Tiffany Wu, Leslie Gevirtz and Cynthia Osterman

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

US judge says X must face class action age bias claims over mass layoff

A federal judge in San Francisco has ruled that roughly 150 older workers who were laid off by social media platform X when Elon Musk acquired the company can sue for age discrimination as a class, exposing the company to millions of dollars in potential damages.

- PGP Business Accounting and Taxation

- Financial Modeling

Training for Corporate

- Corporate Learning Solution

Soft Skills Training

Training for college students.

- Resume Building Training

- Mock Interview Sessions

Job Opportunities

Recent selections, free resources.

- Free Downloads

- Seminars & Webinars

- Classroom Pictures

- Star Performers

- Testimonials

Dell’s Leveraged Buyout: A Real-life Case Study

Acquisitions

Acquisitions or takeovers are a transaction or process wherein one company (commonly called as acquirer) or an investor acquires another company (known as target). Acquisition can be done in a number of ways that can range from one firm merging with another firm to create a new firm or managers of a firm acquiring the firm from its stockholders and creating a private firm.

Briefly the transactions can be classified as follows:

If a firm is acquired by another firm, the various distinctions are:

- Merger: Target firm becomes part of acquiring firm; stockholder approval is needed from both firms

- Consolidation: Target firm and acquiring firm become new firm; stockholder approval needed from both firms

- Tender offer: Target firm continues to exist, as long as there are dissident stockholders holding out. Successful tender offers ultimately become mergers. No shareholder approval is needed

- Acquisition of assets: Target firm remains as a shell company, but its assets are transferred to the acquiring firm. Ultimately, target firm is liquidated.

If the company is acquired by its own manager or/and outside investors

- Buyout: Target firm continues to exist, but as a private business. It is usually accomplished with a tender offer.

Here, we will discuss Buyout only with particular reference to the Leveraged Buyout case of DELL which is in the news nowadays.

Leveraged Buy Out (LBO)

Any type of acquisition aims at creating synergy by acquisitions or takeover of another company. Some companies use these transactions to create strategic synergies wherein the acquirer target the companies in same sector and thus profit by increasing economies of scale and capturing market share and expertise of target company. This type of buyer is a strategic buyer and finances the purchase through company cash, company stock as well as some percentage of debt.

On the other hand LBO is the purchase or the acquisition of the company using significant amount of debt and some amount of sponsor’s equity. Ratio of Debt to Equity is generally 70 to 30 .

LBO is often undertaken by financial buyers or investors who seek to generate high returns on the equity and increase their potential returns by using financial leverage (debt) and implementation of cost cutting strategies in operations of the company.

Acquisition of HCA Inc. in 2006 by Kohlberg Kravis Roberts & Co. (KKR), Bain & Co., and Merrill Lynch is the largest LBO transaction in recent times. The three companies paid around $33 billion for the acquisition.

While looking for a company for a leveraged buyout, an acquirer looks for company which:

- Has very little or no debt on its balance sheet

- Is a non-cyclical and mature company with a well established brand, products, and industry position

- Is Undervalued

- Has a strong management team

- Has non-core assets which can be liquidated to generate cash flows

- Has an operating cash flow which is predictable and strong enough to service the debt raised for LBO

- Has limited Working capital requirements

- Has a viable exit strategy.

It is essential for an acquirer to perform a detailed analysis while determining the Purchase value to be paid for buying out a company.

- Most important parameters in the valuation of a company are EBITDA and Free Cash Flow (FCF). Projections for these two have to be drawn out for the investment horizon (typically 3 to 7 years)

- Exit Multiple: Valuation Multiples such as EV/EBIDTA and EV/FCF are used to determine the value of the company at time of acquisition. An acquirer aims at multiples which are similar or higher at the time of exit then at the time of acquisition

- Key Leverage levels and Capital structure (senior and subordinated debt, mezzanine financing, etc.) which has to be managed for the achievement of required results

- Determining equity returns (IRRs) to the financial sponsor and performing sensitivity analysis of the results across range of leverage and exit multiples, as well as investment horizons

- Reaching a value which can be paid to acquire the company.

For a successful LBO generating positive returns, three factors are most essential:

- De-levering (paying down debt): Company is generating cash flow sufficient to pay off the debt raised to buy it

- Operational improvement (e.g. margin expansion, revenue growth): Cost cutting measures and sale of non-core assets result in lean structure thereby generating higher profits

- Multiple expansions (buying low and selling high): EV/EBIDTA increasing or remaining similar.

Risks in LBOs for Equity and Debt Holders

Along with operating risk, there is risk associated with financial leverage. High Interest costs which are also fixed costs are a huge burden on company. It is a risk for both debt as well as equity holders. Small changes in the enterprise value (EV) of a company can have a significant effect on the equity value since the company is highly levered and the value of the debt remains constant.

Exiting from a LBO

Financial buyers can use many exit strategies to realize the profits made on their investments. A financial buyer typically expects to realize a return on its LBO investment within 3 to 7 years via one of these strategies.

- Outright sale of the company to a strategic buyer or another financial sponsor

- IPO: Initial Public offering , that is, issuing new equity to the public

- Recapitalization: By paying off the debt over the time thereby converting debt into Equity and optimizing capital structure of the company.

LBO of DELL

Let us have a look at the LBO of computer manufacturer DELL Inc. (DELL.O) which was completed in October 2013.

On September 12, 2013, the buyout by founder and CEO Michael DELL and private equity firm Silver Lake Partners of DELL for $25 billion had been approved by DELL stockholders. The merger transaction closed on October 29, 2013, and the delisting from NASDAQ Stock Market commenced. DELL shareholders received $13.75 in cash, in addition to a special dividend of $0.13 per common share.

LBO of DELL faced stiff opposition from minority stake controllers Southeastern Asset Management, second largest shareholder after Mr. DELL and T. Rowe Price, third largest holder. As per an analysis by Southeastern Asset Management, share price of DELL was determined at $23.72 per share.

Go Shop period

It allows DELL to solicit alternative takeover proposals for 45 days. It is an exercise to promote level playing field. Blackstone and Carl Icahn emerged as the two interested parties offering $14.25 per share and $15 per share.

Offer was withdrawn due to DELL’s deteriorating business.

Financing the LBO

A debt of $7.5 billion has been issued which is the second-largest institutional LBO loan this year, behind Heinz’s $9.5 billion institutional issuance for Heinz’s $28 billion buyout by Berkshire Hathaway and 3G Capital.

- DELL has proposed to raise the first-lien secured debt totaling $7.5 billion and the company has proposed $1.25 billion second-lien notes due in 2021.

- Once the deal closes, DELL will have a debt load of about $18 billion, including a $2 billion loan provided by Microsoft Corp. (MSFT), up from $6.8 billion in debt before the LBO, according to data compiled by Bloomberg.

It will take DELL at least three years to repay its debt if it continues to generate cash flow of $2 billi4on to $3 billion a year. Also, reduction of workforce by a number 108,800 is also in the pipeline in order to make DELL more efficient.

- The business of laptops and workstations is decreasing and thus there is an immediate requirement for DELL to grow by acquisitions in upcoming technologies such as Tablets and Pads.

- The company has a strong brand name, broad customer base and good market position.

The deal is expected to close before the end of the second quarter of DELL’s fiscal 2014 year.

Leveraged Buyout has emerged as most preferred way to acquire in recent times. DELL’s CEO and co-founder Michael DELL believes that as a private entity DELL has conquered horizons and will continue to do so. He quotes that:

DELL has made solid progress executing this strategy over the past four years, but we recognize that it will still take more time, investment and patience, and I believe our efforts will be better supported by partnering with Silver Lake in our shared vision. I am committed to this journey and I have put a substantial amount of my own capital at risk together with Silver Lake, a world-class investor with an outstanding reputation. We are committed to delivering an unmatched customer experience and excited to pursue the path ahead

If you have any comments, questions or queries, post them below!

Related links you will like:

Importance of Leveraged Buyouts

What makes a good Leveraged Buyout?

Zomato acquires US based firm Urbanspoon

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

MAKE YOUR CAREER IN

Need more info.

Individual Corporate

—Please choose an option—

- ABOUT FRM COURSE IN INDIA

- ABOUT THE US CPA COURSE

- ACCA CERTIFICATION

- ACCA COURSE

- ACCA COURSE DETAILS

- ACCA COURSE DURATION

- ACCA COURSE ELIGIBILITY CRITERIA

- ACCA COURSE ELIGIBILITY IN INDIA

- ACCA COURSE FEES

- ACCA COURSE FEES IN INDIA

- ACCA COURSE IN INDIA

- ACCA COURSE STRUCTURE

- ACCA COURSE STRUCTURE AND FEES IN INDIA

- ACCA COURSE SYLLABUS

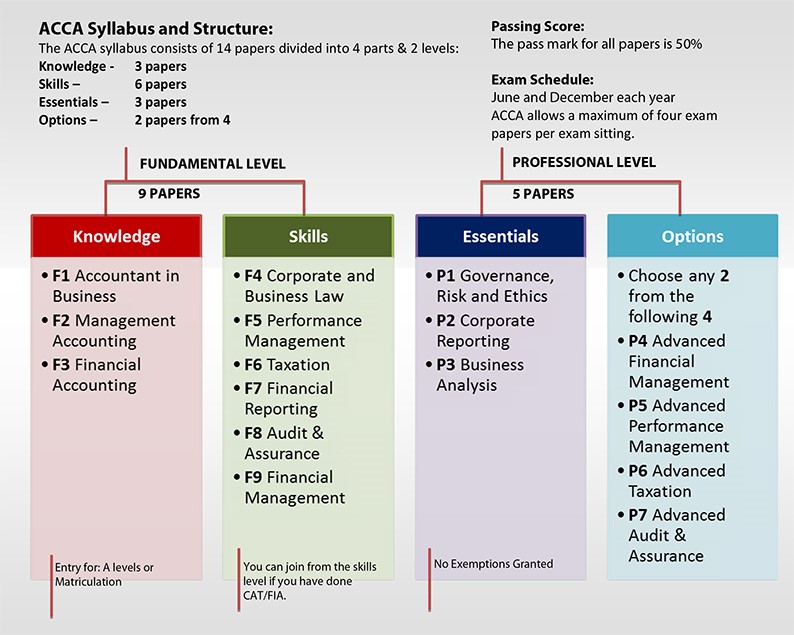

ACCA EXAM STRUCTURE AND PATTERN

- ADMISSION TO CFA

- BEST FINANCIAL MODELING COURSE

- BEST FINANCIAL MODELING COURSE IN INDIA

- BEST ONLINE CFA PREP COURSE

- BEST ONLINE FINANCIAL MODELING COURSE

- CAREER OPPORTUNITIES FOR CPA

- CFA CERTIFICATION

- CFA COURSE CURRICULUM

- CFA COURSE DETAILS

- CFA COURSE DURATION

- CFA COURSE FEES

- CFA COURSE FEES IN INDIA

- CFA COURSE FULL DETAILS

- CFA COURSE IN INDIA

- CFA COURSE IN INDIA CFA COURSE CFA COURSE DETAILS CFA COURSE SUBJECTS

- CFA COURSE SYLLABUS

- CFA COURSE TRAINING

- CFA FOUNDATION COURSE

- CMA COURSE DETAILS

- CMA COURSE DETAILS IN INDIA

- CMA COURSE DURATION.

- CMA COURSE ELIGIBILITY

- CMA COURSE ELIGIBILTY

- CMA COURSE IN INDIA

- CMA COURSE SUBJECTS

- CMA COURSE SYLLABUS

- CPA ACCOUNTANT

- CPA COURSE DETAILS

- CPA COURSE DURATION

- CPA COURSE ELIGIBILITY

- CPA COURSE IN INDIA

- CPA COURSE STRUCTURE

- CPA COURSE SYLLABUS

- FINANCIAL MODELING

- FINANCIAL MODELING AND VALUATION

- FINANCIAL MODELING COURSE

- FINANCIAL MODELING COURSE CURRICULUM

- FINANCIAL MODELING COURSE DETAILS

- FINANCIAL MODELING COURSE FEE

- FINANCIAL MODELING COURSE IN INDIA

- FINANCIAL MODELING COURSE WITH PLACEMENT

- FINANCIAL MODELLING COURSE

- FINANCIAL MODELLING COURSE DURATION

- FINANCIAL MODELLING COURSE FEES

- FINANCIAL MODELLING COURSE ONLINE

- FINANCIAL RISK MANAGER

- FRM COURSE CERTIFICATION

- FRM COURSE CURRICULUM

- FRM COURSE DETAILS

- FRM COURSE DURATION

- FRM COURSE ELIGIBILITY

- FRM COURSE FEES

- FRM COURSE IN INDIA

- FRM COURSE SYLLABUS

- FRM® COURSE SUBJECTS

- FRM® COURSE SYLLABUS & HOW TO APPLY FOR FRM® COURSE

- PG PROGRAM IN BUSINESS ACCOUNTING & TAXATION

- PGP BAT COURSE FEES

- PGP BAT COURSE SALARY IN INDIA

- PGP-BAT COURSE

- PGP-BAT COURSE COURSE IN INDIA

- PGP-BAT COURSE DETAILS

- PGP-BAT COURSE DURATION

- PGP-BAT COURSE ELIGIBILITY

- PGP-BAT COURSE IN INDIA

- PGP-BAT COURSE INSTITUTE IN INDIA

- PGP-BAT COURSE SYLLABUS

- PLACEMENTS TO CFA

- US CMA COURSE

- US CMA COURSE DETAILS

- US CMA PREPARATION

- US CPA COURSE

- US CPA COURSE DETAILS

- US CPA COURSE FEES

- US CPA COURSE FULL FORM

- US CPA COURSE TRAINING

- US CPA EXAMS

- US CPA MEANING

- WHAT IS ACCA COURSE

- WHAT IS CMA COURSE

- WHAT IS CPA COURSE

- WHAT IS FINANCIAL MODELING ALL ABOUT

- WHAT IS FINANCIAL MODELING COURSE

- WHAT IS FRM® COURSE? FRM® COURSE DETAILS

- WHAT IS FRM® COURSE? FRM® COURSE REVIEW

- WHAT IS US CPA COURSE?

- WHAT IS US-CMA COURSE

related blogs

CPA License in India- A Game-Changer for Your Accounting Career

Understanding Payroll and Its Components by EduPristine

Safeguarding Success: Tackling Operational Risk in FRM® Course | EduPristine

US CPA Course: Unlocking Diverse Career Paths | EduPristine

Understanding Market Risk within FRM® Course EduPristine

Financial Modelling Course Opportunities | EduPristine

Is the ACCA Course Suitable for Working Professionals in India

Which Path to Take- US CPA vs. Canada CPA?

Why Should BCom Graduates and Those with 0-2 Years of Experience Pursue the PGP-BAT Course at Edu Pristine

Why the ACCA Qualification is Gaining Popularity in India by EduPristine

ACA vs ACCA What’s the Difference? A guide by Edupristine

Ethical Decision Making in Financial Management | Edupristine

Understanding the Time Value of Money – TVM

Guide on How to Study for the US CMA Exams | US CMA Course Full Details

CMA Advantages: Benefits of Classroom Training | CMA COURSE | EDUPRISTINE

Guide to choose an Institute for US CMA program | EduPristine

Core Differences: US CMA vs. Indian CMA

The Critical Importance of Soft Skills for CPAs

Essential Soft Skills for CMAs | US CMA COURSE

Guide to Expected Shortfall (ES) by EduPristine

Guide to Choose an Institute for the ACCA Course

BEST INSTITUTE FOR US CPA COURSE IN INDIA | EDUPRISTINE

Guide to Value at Risk (VaR) by EduPristine

How to Choose an Institute for the PGP-BAT Program by EduPristine

US CPA Eligibility Criteria in India by EduPristine

The Cost Involved in Pursuing the ACCA Qualification

Why EduPristine’s Classroom Training Gives PGP-BAT Students a Leading Advantage

Why is the FM course gaining popularity in India | EduPristine

Why EduPristine’s Classroom Training Gives ACCA Students a Leading Advantage?

Why is the CFA® course gaining popularity in India | EduPristine

Public Accounting vs. Corporate Accounting by EduPristine

EduPristine: Empowering Tomorrow’s Finance and Accounting Leaders

Understanding Top Finance Skills Employers Value in 2024 | EduPristine

The Essential Role of Financial Management and Its Purpose | EduPristine

What is Financial Reporting and Why is it Important | EduPristine

Mastering the Foundations of Accounting by EduPristine

All about Credit Risk: A Comprehensive Guide by EduPristine

The Critical Role of Performance Management | EduPristine

A Comprehensive Comparison of Power BI and Excel | EduPristine

CMA vs MBA: Choosing the Right Path for Your Career Growth

Corporate Governance: A Comprehensive Guide by EduPristine

A Guide to Mastering Payroll Management by EduPristine

Data Analytics for Management Accountants – EduPristine

Investment Valuation: A Comprehensive Guide by EduPristine

Mastering MS Excel: Empowering Accountants for Success | EduPristine

Different Payment Methods for Merger & Acquisition | EduPristine

Internal vs External Financial Reporting by EduPristine

Difference Between Equity Funds and Mutual Funds by EduPristine

Navigating the ACCA Career Landscape with EduPristine

Chief Financial Officer (CFO): A Complete Guide | EduPristine

All About Merger and Acquisition by EduPristine

What is Income Tax? Part Two by EduPristine

Understanding the Basics of Direct Taxation with EduPristine

The Crucial Role of Ethics in Management Accounting | EduPristine

What is Income Tax? Part one by EduPristine

Financial Reporting vs. Financial Accounting by EduPristine

How Do Firms Manage Financial Risk | EduPristine

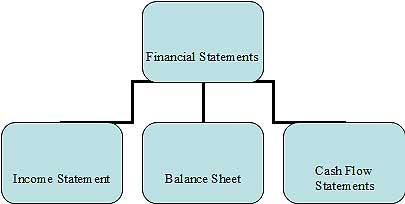

Financial Accounting and Types of Financial Statements | EduPristine

Managerial Accounting- Its Meaning, Process and Types | EduPristine

A Guide on Project Finance by EduPristine

Why do Finance Professionals use Power BI | EduPristine

Macroeconomics: Meaning, Process, and Indicators | EduPristine

Internal Audit- Meaning, Objectives, Types and Importance by EduPristine

A Simple Guide on Quantitative Analysis- EduPristine

Five Basic Principles of Accounting by EduPristine

Internal Controls: Meaning, Types, and Importance by EduPristine

Basics of Accounting – Meaning and Basics Concepts | EduPristine

The Different Business Functions by EduPristine

The Different Types of Business Structures | EduPristine

The Vital Role of Cost Management for US-CMAs | EduPristine

Role of Ethics and Professionalism in the Investment Industry

The Risk Management Process: Essential Steps | EduPristine

ACCA vs CPA: Choosing the Right Path for Your Career | EduPristine

Transforming Aspirations into Achievements: CPA Course Excellence

Comprehensive Guide to ACCA Certification with EduPristine

CPA Course Decoded: Achieve Success with EduPristine Training

US CMA Course: A Step-by-Step Preparation Guide by EduPristine

Key Reasons Why Upskilling is Important

All About Evolving Aviation Industry

How India’s Digital Payment Revolution is Reshaping the Economy

Understand the catastrophic impact of a possible US Debt Default

RBI Bids Farewell to Rs. 2000 Notes

Key Insights from the Economic Survey 2022-2023

What is Digital Marketing? What is the objective?

Why you must consider being a Certified Management Accountant

All About Classroom Training vs Online Training

All About Axis-Citi Acquisition

Can vernacular edtech ever become mainstream?

Indian start-ups need to start taking corporate governance seriously, why?

How to Level up the Overall Digital Marketing Strategy?

Snapchat for Business

What will Digital Marketing Look like in the Next 20 years?

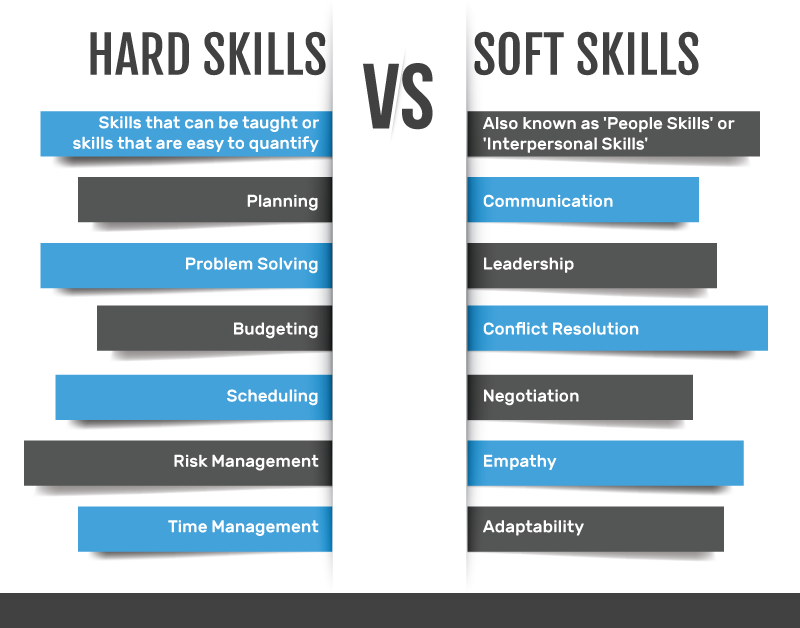

Importance of Soft Skills

Why are Mr. Men and Little Miss characters all over the social media?

How global firms are looking at the Indian investment market

Role of Keywords in Digital Marketing

All About the Social Media Careers and the Skills to be Mastered

All About Leadership in a Multicultural World

All about Metaverse and why is metaverse important for brands?

Why will the Netflix business model need more than just a quick fix?

Financial Models and How to Create them Effectively

Top 5 Digital Marketing Trends to be Followed

Best Practices for Financial Management

How did the crisis in Sri Lanka impact India?

Objectives of Risk Management

Career Options After Qualifying for the US CMA Course

Skills That Make You Proficient in Digital Marketing

What Are The Different Types of Financial Markets?

How Indian Students Can Pursue the US CPA?

Equity Derivatives and Benefits of Equity Derivatives

What are Black Swans in Risk Management?

Will Digital Marketing Replace Traditional Marketing?

Functions of Financial Markets?

How to Calculate GST (Goods and Services Tax)?

Why are Financial Markets Regulated?

Does an Accountant Need an MBA?

Why is ACCA Not Recognized in The USA?

Is the US CMA Course Appropriate for Working Professionals?

What is a Derivative?

What is Derivative Market?

Types of Acquisitions

Types of Mergers

What are Mergers and Acquisition?

Do Indian Companies Hire CFA’s?

What Should I Study, US CMA or Digital Marketing?

Types or Methods of Business Valuation

What is GST? What Are The Career Opportunities in GST (Tax domain)?

How to Manage Risks in a Business?

How to Work On a Digital Marketing Project for Practice?

Is CA the only optimal career option for commerce graduates?

All about the US CPA course

In your opinion, what makes a good Financial Model?

What is Business Valuation?

Does CFA has any scope in India?

Career Advice: Is doing the ACCA over a CA a better option?

Which is a Better Career Option, CFA or FRM?

What is the procedure for enrolment for the CPA program for beginners?

How Do People Judge the Quality of Financial Modeling?

What is the Reality of a Career in Digital Marketing?

Which is Better CMA or CIMA?

Is CFA in India Good for a Career?

I Desire to Get an ACCA Degree, but the Tuition is too Expensive. Why is the ACCA Course Expensive?

Are There Any Job-Oriented Courses After Completing Graduation?

Is Financial Modeling from EduPristine Worth It?

Does Digital Marketing Have a Great Future Ahead?

What are the Benefits of Pursuing FRM Course(GARP)?

What is the Syllabus for CPA Course? Is it the Same as CA or Different?

What are The Top Skills a Commerce Student Must Have?

What are the Benefits of Learning Financial Modeling?

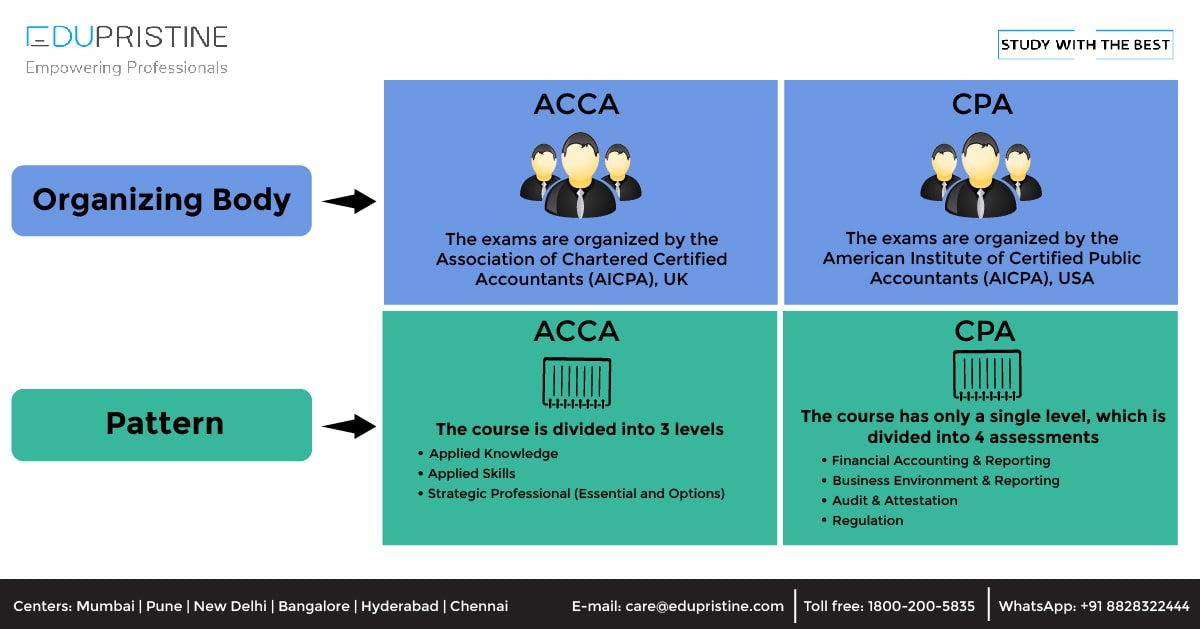

What is the difference between ACCA and CPA?

5 Reasons why you should pursue the CPA course after CA

How Opting for Full-Time Level I CFA Course Gives You an Edge Over Others

A Complete Guide on ACCA Course Eligibility, Duration, Registration, Fees, Etc.

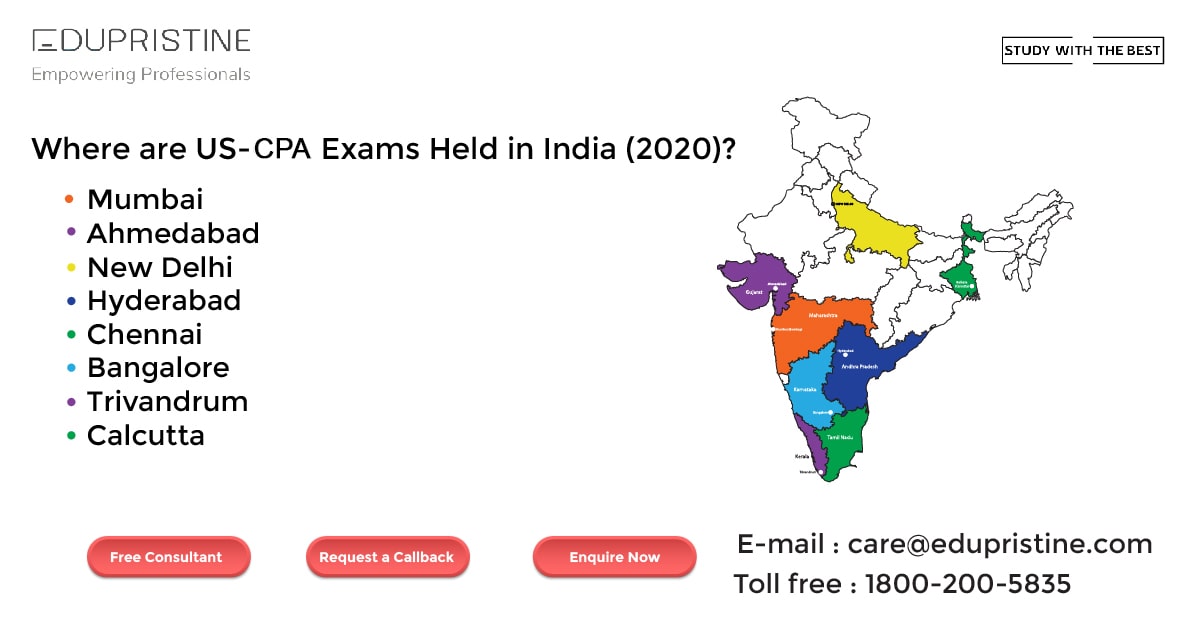

CPA Exam Registrations and Scheduling in India

What is Soft Skill Training ?

What is Finance: Types of Finance and Financial Instruments?

All you want to know about Chartered Accountant (CA)

Soft Skills For The Hard World

What is the Importance Of Relative Valuation

Ratio Analysis – Ratios Formulae

Excel Tricks: Text Functions in Excel

Explore the Top 12 Opportunities Which Will Take Your Career to the Next Levet [2020 – 2021]]

Top 10 Accounting Firms

Everything you want to know about the CMA certification

SAP certification – examination, eligibility and benefits

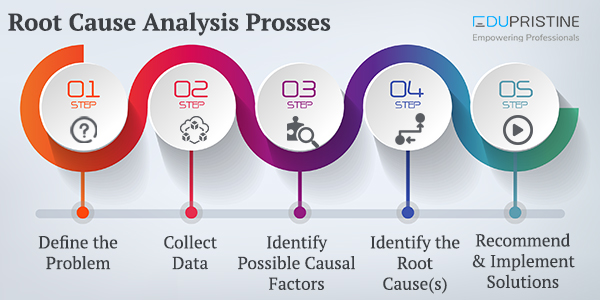

Root Cause Analysis

Principles and Fundamental Concepts of Basic accounting

Know how to understand and interpret cash flow statement

ALL YOU WANT TO KNOW ABOUT SENSITIVITY ANALYSIS

ACCA Full Form

FINDING AND REMOVING DUPLICATES IN EXCEL

Capital Budgeting: Techniques & Importance

Importance of Business Accounting for enterprises

Amalgamation Explained in detail

Working capital management.

STATISTICAL FUNCTIONS IN EXCEL

Venture Capital

Financial Reporting

Cell references in excel.

Costing Methods & Important Cost Terms

Balance sheet explained in detail

Cash Flow Statement

What are the career options after Mcom

WHAT IS STANDARD DEVIATION?

Know how effective is cma course compared to mba in providing a dream job.

Comparison of CPA course with other courses

Advantages and application process of frm.

An insight into OTC Derivatives

CPA Course Syllabus – Topics and Importance

Cfa® study planner.

CPA Course details, application fees and benefits of doing it

All Important About CFA® LEVEL 1 Syllabus

All about Portfolio Management

Cost Management: Meaning, Techniques & Advantages

How to get into Big 4 Accounting Firms?

Frm question bank, top 10 companies that hire cfa® charterholders, income statement in detail.

KPIs for Business Analysts

Annual report.

Capital Budgeting

Mergers and Acquisitions

Detecting multicollinearity.

ANALYSIS OF FINANCIAL STATEMENT OF A COMPANY

8 excel functions that every data analyst must know, duckworth-lewis method, 6 most common excel errors.

RULE PRECEDENCE IN CONDITIONAL FORMATTING

Types of Investment Banking jobs

Frm part 1 syllabus, ratio analysis – introduction, ratio analysis – classification of ratios and liquidity ratio, bootstrapping solution.

CASH FLOW STATEMENT: LEARN TO CREATE CASH FLOW STATEMENT TEMPLATE IN EXCEL

Cfa® program from icfai (india) vs cfa® program from cfai (us).

REGISTER NOW

Have a query our expert will call you and answer it at the earliest, your valued interest. our team will connect with you shortly., request a call back, download syllabus, download broucher, free download, webinars download, your valued interest. hope the content will help you at the best., contact our experts today, enquire now.

How Dell’s strategy transformed it from a doomed player to leading the data revolution

Table of contents, here’s what you’ll learn from dell's strategy study:.

- How to sustain your company’s growth beyond its initial success.

- How a sober bet for the future fuels your conviction to win.

- How to think long-term and not sacrifice your future for short-term benefits.

Dell Technologies is a multinational technology company that designs, develops, and sells a wide range of products and services, including personal computers (PCs), servers, data storage devices, network switches, software, and cloud solutions.

The general public owns 58% of Dell Technologies, while private equity firms and institutions own the rest. Michael Dell is the founder, chairman, and current CEO.

Dell's market share and key statistics:

- Brand value of $26,5 billion

- Net Worth of $28.7 billion as of Jan 13, 2023

- Annual revenue of $105.3 billion for 2022

- Total number of employees: 133.000

- Total assets worldwide: $93 billion in 2022

{{cta('e9abffcd-5522-40c9-be83-0e844633a49a')}}

Humble beginnings: How did Dell start?

The story of every company starts with the story of its founder.

Usually, a great company has a great founder story behind it. And Dell Technologies certainly has one. Michael Dell’s story goes hand in hand with the story of the company he founded. By understanding the story of Michael, we can understand the company’s initial advantages and opportunities it pursued.

And like every great tech company story, Dell’s story starts in a college dorm room.

From stamps to startups: Michael Dell's early years and the birth of Dell

Michael Dell founded the company in college, but his entrepreneurial journey started much earlier.

He had an early interest in technology and business, and by the age of 12, he was already buying and selling stamps and coins to make extra money. As a teenager, he worked summer jobs where he learned by trial and error how demand and supply worked, how to be efficient, how to segment the market, and determine the most profitable persona to sell.

By the time he graduated from high school, he had saved up enough money to buy his own BMW and his first personal computer, an Apple and later an IBM.

But he was curious about the inner workings of these machines and, to his parents' horror, he took them apart, learning about the different components and how they worked together. He soon made a crucial discovery. IBM DIDN’T manufacture its own parts. Instead, it sourced them from other companies. This sparked an idea in Michael's mind - he could build his own PCs using the same components but at a lower cost and higher quality.

That idea didn’t come out of the blue.

Michael Dell was constantly educating himself on computers, how to build them, how they worked, and how to code. He followed all computer magazines at the time and attended every event in his neighborhood to network and learn the latest about the industry. In high school, he was already an expert, modifying his own PC and, once the word spread, customizing the PCs of professionals.

His first customers were friends and acquaintances who were impressed by his knowledge and expertise. Michael quickly realized that there was a demand for customized computers that were not available in the market. He began assembling machines with increased storage capacity and memory at a fraction of the cost of buying from big brands like IBM.

Doctors and lawyers were among his early customers, and word-of-mouth about Michael's high-quality and affordable PCs spread quickly.

He eliminated the middleman by buying components directly and assembling the machines himself, which allowed him to offer lower prices and better performance. By the end of his first year in college, Michael had a vendor's license, he was winning bids against established companies in the industry, and he incorporated his first company, “ Dell Computer Corporation .”

Dell’s direct-to-consumer strategy & how its corporate culture was formed

The company was growing frightfully fast, forcing the team to constantly change and evolve its processes.

Before the company had its second birthday, they had moved to bigger offices three times to accommodate its increased inventory, growing telephone needs, and physical or electronic systems. However, the company was still a high-risk venture and had a small capacity for expensive mistakes.

In those early days, the challenges Dell faced formed its processes and the core traits of its culture that are present to this day:

- Practicality and reduced bureaucracy. They did some things unconventionally, like having salespeople set up their own computers. That way, they gained first-hand knowledge of the technology and the customer’s pain problems (customers and salespeople were uneducated on the technology, so they shared the same problems).

- A “can-do” and “I’ll-pitch-in” attitude. Employees took substantial liberties with their “responsibilities.” Engineers would help with the overloaded manufacturing line, everyone would answer phone calls, salespeople would fulfill orders while taking new ones, etc.

- A sense of making a difference. Money was tight, so Dell employees wouldn’t mind solving secondary “needs” with cheap solutions like using cardboard boxes to throw their trash because they didn’t have trash cans.

- Direct relationships with the customers. Maybe one of the most important aspects of Dell’s culture and strategy. The company was talking at the same time with prospects and current customers on the phone. That way, it got first-hand feedback on what the market was currently asking for and was enjoying or not enjoying. That gave birth to Dell’s “Direct Model.”

The company went to great lengths to build and maintain the direct model because it was one of its most important sources of competitive advantage. Where other companies had to guess what to build next, Dell was already on it because their customers were telling them.

There were clear advantages to the Direct model:

- Closed feedback loop. Dell was talking directly to prospects – no dealer costs – and had no need for inventory. Lower costs = lower prices = more customers. And with every new customer, Dell had another finger on the pulse of the market.

- A single salesforce. Focused solely on the end customer. There was no need to have salespeople to sell to dealers and then additional salespeople to sell to the customer.

- Specialization in sales. Dell sold to large corporations, and smaller customers, like SMBs, educational institutions, and individual consumers. But selling to these two different buyers, large corporations and SMBs, was incomparable. So, the company had different salespeople for different customer segments and thus offering the best customer support and experience.

But the model wasn’t without its disadvantages:

- The model wasn’t irreplicable. Dell was making IBM-compatible PCs and selling them directly to customers. This model wasn’t hard to replicate, and the market’s conditions favored the birth of competitors with the same model.

- Lack of credibility. It’s hard to make a $5,000 sale when the customer has never heard of you and you lack a physical store.

- Incompatibility. Dell’s PC had to be compatible with IBM’s. But they had multiple suppliers for their components and sometimes those components were incompatible. Designing high-quality machines that were outperforming and compatible with IBM’s was a challenge.

But these disadvantages didn’t stop the team. The company doubled down on customer support and service and developed a strong reputation around them. It advertised a 30-day money-back guarantee and educated its suppliers to make components based on Dell designs. They even started their first R&D attempts that gave them a 12-MHz that was faster than IBM’s latest model, cheaper, and got them on the cover of the most prestigious magazine in the industry, the PC Week .

Dell’s strategy was so effective that phone calls started coming in, urging them to accept capital and go public.

Only three years after the company’s birth in a college dorm room, Dell went public, raising $30 million with a market valuation of $85 million.

Key Takeaway #1: Build a coherent strategy beyond your initial differentiator to sustain growth

Most companies enjoy initial success due to an untapped opportunity in the market, from addressing a niche market to exploiting the weaknesses of major players.

But no company succeeds at growing beyond the limits of the initial opportunity if it doesn’t evolve and expand its competitive advantage. So when evaluating your next move, ask yourself:

- What is our current competitive advantage?

- How easily can our competition replicate it?

- How can we make it harder (if we can)?

- How can we expand our capabilities to strengthen our current competitive advantage?

- How can we develop new competitive advantages?

- What are the market trends and how can we adapt/take advantage of them before others?

The occasional bold move doesn’t hurt, either.

Recommended reading: 6 Competitive Analysis Frameworks: How to Leave Your Competition In the Dust

How Dell’s privatization led to a strategic triumph

In the first decade of the new millennium, the PC business was growing rapidly.

Computing power followed Moore’s Law and innovation cycles in hardware were less than 12 months long. At the same time, a new generation of software was spreading and the World Wide Web was expanding globally. Being a part of a growing industry, like the PC business back then, was lucrative. So naturally, many companies did well.

Dell was one of them. In 2000, the company became the world’s largest seller of PCs, having enjoyed a decade of skyrocketing sales.

However, in 2011, things changed. The PC global sales reached their peak and the next year was the first of an 8-year streak of decline that lasted until the pandemic hit.

That decline impacted Dell severely.

Navigating decline: Dell's strategy for a shrinking market

Dell was in deep trouble at the start of the previous decade:

- It had lost its position as a top PC seller in the US to its main competitor, HP.

- It came third in the global PC market share, behind HP and ACER.

Many believed that it was a dying company that would perish like Kodak or Motorola.

The PC market was shrinking and some experts were saying it was the beginning of its end. Dell was expected to be among the first casualties. The truth was that the PC industry wasn’t dying, but it was evolving – it was losing some of its traits and gaining new ones. The difference is subtle but also key. In a competitive arena, every alert player is aware of the market changes: declining sales, emerging trends, and other important facts. But how each player interprets them determines whether they’ll formulate a winning strategy or not.

The more substantial the changes, the more important the interpretation.

In 2012, the fact was that the PC business was declining. Every major player could see it with a single glance at their balance sheet. In Dell's case, the decline was even direr since its PC sales were down by double digits. The company desperately needed to turn things around. And only a bold strategic move could do that.

The company tried to bounce back up with some obvious but desperate moves:

- The introduction of the Streak “phablet.” An embarrassing attempt at creating a new product category between tablets and smartphones. Its design was bulky and its Android software unsuitable for the device, while its purpose was unclear to the consumer.

- Making Windows 8 its default operating system. Dell and Microsoft have been longtime partners, to the benefit of both companies. Unfortunately, their growing interdependence meant that when one failed, it dragged the other one down. Windows 8 failure dragged down Dell and further decreased its PC market share.

- Attempts to enter the tablet and smartphone markets: the “Venue” debacle. Dell was always viewed as a PC company, not a technology company, making it harder to expand to new categories. Its first smartphone, the Venue , ran on Windows Mobile and it never got any traction. As a result, the company abandoned the categories and, even today, it has less than negligible presence in these markets.

But where people saw a vulnerable company, Michael Dell saw an opportunity.

He had an assumption, a vision attached to it, and a plan to make it a reality. But he had no way to execute it with the company’s organizational structure at the time.

The obstacles to implementing Dell's competitive strategy

Dell’s strategy was to go on the offensive. He wanted the company to be highly aggressive by:

- Becoming competitive in the PC business again.

- Expanding its services and software solutions.

- Increasing its sales capacity.

Dell aimed to achieve these goals by investing heavily in R&D, gaining tighter control over its PC and server prices, and expanding its sales workforce. The idea was to fund new business capabilities in the software and services space from Dell's PC segment. That was a bold plan that involved a lot of changes and, thus, a lot of risks.

Dell’s strategy was essentially a business transformation proposal.

And although a lot of public companies have successfully gone through a transformation, none did it in such a short period of time without sacrificing the short-term faith of its shareholders. And that was exactly the problem.

The strategy was inherently risky – like every good strategy is – as it promised capital expenditure and an immediate decrease in profitability due to increased operating expenses. Things shareholders hate. And if shareholders aren’t happy with the company’s near-term returns, they start selling their shares, and the company loses its value and a good portion of its funding capabilities.

Short-term risk = lower share prices = less funding for the company

Thus, the strategy was impossible to execute without the support of the shareholders. So the company had only two options: gain the support of the shareholders or go private.

Dell chose to go private.

Dell's game-changing decision was based on a strategic bet

For a gigantic public company with a market cap of nearly $20 billion, going private is a tough decision and a complicated process.

But it was an unavoidable preliminary for the successful execution of Michael Dell’s plan. And the first step was to convince the board of the necessity of the transformation. After announcing his idea, the board started discussions with experts to evaluate the move, i.e. top consulting agencies and other independent third parties.

JP Morgan , Boston Consulting Group, Evercore, and Debevoise were some of the names involved. And they all shared the same view:

- The PC is dying.

- Funding a business transformation from a declining business is a bad idea (despite such successful attempts from IBM and BMW in the past).

The experts had a lot of facts and strong arguments to support their case. However, all of them were based on a single assumption: tablets and smartphones will replace the dying PC . The growth in those categories would entail a decline in the PC business. They believed the PC was about to be cannibalized.

Dell’s CEO disagreed. What was his assumption?

He believed that tablets and smartphones wouldn’t take away from PCs but rather add to it. He believed that the PC’s central role in productivity and business wasn’t going to be dethroned by the new shiny toys. People would buy and use tablets and smartphones, but PCs would remain their primary productivity tool.

And he would bet Dell’s future on it.

But he had to convince the board of directors first. At the start, conversations were happening in secret and things were moving slowly but steadily. But when the idea was leaked, two new problems presented themselves.

The first was Carl Icahn, who contested for the ownership of Dell. Carl Icahn is a self-proclaimed “activist investor” but others call him a “corporate raider.” The closer the go-private initiative was to happen, the more Carl Icahn fought for it. And he used every improper tool and method he could muster. The battle that followed between Carl and Michael delayed the deal and almost derailed it.

The second was Dell’s customers’ hesitation in doing business with the company. The rumors about the go-private initiative left the customers wondering about the future of Dell and doubted whether any kind of investment in it was worth it. They were suspending purchases and all Dell’s leadership could say was, “We don’t comment on rumors and speculations.”

The press had also concluded that the go-private initiative was a declaration of Michael Dell’s incompetence and a desperate attempt to keep Wall Street’s eyes away from its demise.

History would prove them wrong and crown Michael Dell victorious.

A new chapter: How Dell's go-private move set the stage for future success

The deal happened.

In February 2013, Michael Dell and the investment firm of Silver Lake took Dell private in a leveraged buyout of $24.4 billion, at $13.65 a share.

Despite all the time that passed until Dell could fully execute its strategy, the company didn’t remain idle. It had made several calculated moves to significantly reduce its dependence on the declining PC market before the deal conversations ever happened.

From 2007 to 2012, Dell spent north of $12.40 billion in key acquisitions to increase its enterprise software and hardware solutions, including cloud data storage and management. The acquisitions focused on areas like:

- Data storage

- Systems management

- Data management in healthcare

- Cutting edge software

The company had already started severing the connection between its financial health and its PC market share many years ahead of its privatization.

But after the buyout, it went all in. Speed and agility became its prominent advantages. Dell became, nearly overnight, a hungry, quick, and ready-to-attack-its-prey jackal. Whenever a new opportunity arose and people asked for resources to pursue it, leadership committed double the resources and said, "Go faster!"

For example, SMBs (small and medium businesses) presented a gigantic opportunity. So the company increased its sales workforce, retrained its existing salespeople, and hit endless SMB doors. They would enter a business selling their low-margin PCs and simultaneously become their trusted advisor on all things tech. Then they sold their whole portfolio of solutions.

And the morale of employees was off the charts. Leadership kept their promises on the changes and provided all the support their people needed to execute the plan.

In addition, people started viewing PC and smartphones as complementary, just as Dell expected.

Was Michael Dell’s bet a good one? Well…

45% of Dell’s revenue was generated from PC sales, but 80% or more of its profits were generated by its new solutions. Eight years after the privatization, the value of their equity had increased more than 625% and their enterprise value reached $100 billion.

We’re pretty confident that’s a yes.

Key Takeaway #2: Successful strategic bets require a sober conviction

Markets change and evolve all the time. The difference between players that emerge prosperous and those that struggle to fit in the new order of things isn’t the unique access to data.

No. Every alert player in your competitive zone has more or less the same access to market trends and changes. The difference lies in what you envision the future to be. That’s your bet.

That’s what a winning corporate strategy needs. And because bets are inherently risky, you require two things to place a successful bet:

- Sobriety to envision what the future of your industry will look like.

- Conviction to pursue that vision relentlessly.

Steering towards success: Dell's current strategy and the EMC merger

Michael Dell had foreseen the evolution of the technology industry since the 2000s.

Not the specifics, but the trend of PCs and hardware becoming less relevant – or at least less profitable – and software, the cloud, and back-end taking the front seat. He realized (from very early on) that servers and storage management would become a huge concern for large enterprises building (or upgrading) their IT infrastructure.

Dell anticipated the market’s needs by making a simple observation: the quantity of data in the world expanded exponentially and the traditional way of data management would require server performance that wasn’t physically possible to achieve. But he knew there was a solution underway: virtualization – software that mimics the computer, creating virtual mainframes within the physical mainframe.

That’s why the company had started investing in these technologies since 2001.

Achieving synergy: Dell's competitive strategy and the merger with EMC and VMware

Dell, EMC, and VMware are three major players in the technology industry with distinct but complementary offerings.

EMC had a successful product in networked information storage systems, i.e. a database management system for enterprises.

VMware was pioneering in virtualization, allowing users to run multiple operating systems on the same device.

Dell had an established distribution network and a series of back-end solutions that could expand and fit well with the former technologies.

The relationship between these three companies started in 2001. Dell and EMC entered a strategic alliance to rule a market of $100 billion worth by 2005.

%20(1).jpg)

For EMC, the alliance was a one-stone-three-birds initiative. First, it offered a lucrative distribution channel to customers their competitors were already targeting. Second, it ensured Dell wouldn’t partner with a competitor. And third, it reduced its supply costs for components.

For Dell, it also had a threefold benefit. First, It added high-performing products to a rapidly growing business. Second, it gave it an important customer – EMC was using Dell’s servers. And third, it allowed Dell to infiltrate deeper into enterprise data centers.

A strategic alliance that gave both Dell and EMC a competitive edge.

Then EMC bought VMware. That gave the company massive capabilities around cloud infrastructure services ending up being a very lucrative move. Dell, which had invested in VMware back in 2002, saw a massive opportunity to acquire the new EMC.

So Dell and EMC first began discussions of a potential partnership back in 2008, but the idea was ultimately shelved due to the financial crisis. However, in 2014, Dell revisited the idea as both companies had grown and become leaders in their respective industries.

Dell saw the potential for a merger as the two companies' services would bring significant value to their customers when combined. EMC's CEO, Joe Tucci, agreed with this assessment, but they still had to convince EMC's board. EMC was publicly held while Dell was private, and as soon as the idea was on the table, Dell found itself competing with two other interested parties, Cisco Systems and HP. In fact, HP nearly succeeded in acquiring EMC.

It failed due to a financial disagreement. So Dell jumped on the opportunity.

By then, EMC had grown tremendously and had eliminated any short- to mid-term potential start-up disruptors by acquiring them. EMC’s three businesses were uniquely complementary to Dell’s solutions:

- EMC Information structure , a leader in the data storage system market.

- VMware , the undisputed leader in virtualization.

- Pivotal , a start-up with a platform to develop cloud software.

However, the acquisition was a tough process. EMC had grown to a market cap of over $60 billion. It was impossible for Dell to fund an acquisition. Instead, the two companies merged.

The merger happened through a complex but effective financial plan, and the synergies created by the combined company increased revenue significantly. A year after the merger was initiated, the added revenue was well above expectations. This allowed Dell to pay down a significant portion of its debt and improve its financial standing and investment rating. The success of the merger led the company to simplify its structure and align the interests of the stakeholders of the three companies.

In 2018, Dell went public again as a very different entity than its first IPO, uniquely equipped to lead the 5-S sectors: services, software, storage, servers, and security.

What is Dell’s business strategy’s primary focus today?

Dell aspires to become a leading player in the data era by providing a wide range of solutions, products, and services.

Excluding VMware, Dell is divided into two main business segments supported by its financial subsidiary:

- The Infrastructure Solutions Group ISG helps customers with their digital transformation by providing multi-cloud and big data solutions that are built on modern data center infrastructure. These solutions are designed to work in multi-cloud environments and can handle workloads in public and private clouds as well as on-premise.

- The Client Solutions Group CSG focuses on providing solutions for clients such as laptops, desktops, and other end-user devices.

- Dell Financial Services DFS supports Dell businesses by providing financial options and services to customers according to the company’s flexible consumption models. Through DFS, the company tries to tailor its financial options to each customer’s way of consuming Dell’s solutions.

Dell's core offerings include servers, storage solutions, virtualization software, and networking solutions. The company is constantly investing in research and development, sales and other key areas to improve its products and solutions and to drive long-term growth.

Its primary strategic priorities are:

- Improving and modernizing its current offerings in the markets it operates in.

- Expanding into new growth areas such as Edge computing, telecommunications, data management, and as-a-service consumption models.

And its plan involves several key initiatives :

- Developing its flexible consumption models and as-a-Service options to customers to meet their financial needs and expectations.

- Building momentum in recurring revenue streams through multi-year agreements.

- Investing in R&D to develop scalable technology solutions and incorporating AI and machine-learning technology. Since its Fiscal year 2020, the R&D budget is consistently at least $2.5 billion. Most of it goes towards developing the software that powers its solutions.

- Collaborating with a global network of technology companies for product development and integration of new technologies.

- Investing in early-stage, privately-held companies through Dell Technologies Capital.

Although Dell has a coherent strategy to achieve its objectives, competition isn’t idle nor trivial in the core competitive arenas. The company faces a significant risk that includes:

- Failure to achieve intended benefits regarding the VMware spin-off.

- Competition providing products and services that are cheaper and perform better.

- Delays in products, components, or software deliveries from single-source or limited-source suppliers.

- Inability to effectively execute its business strategy (transitioning sales capabilities, expanding solutions capabilities through acquisitions, etc.) and implement its cost efficiency measures.

The technological advances are rapid, and players are in a constant race to innovate not only on the technologies they provide but on their business models and all of their services and solutions. Emerging players and strategic relationships between competitors could easily shift the competitive landscape before the company finds a way to react.

Key Takeaway #3: When making transformational decisions, prioritize thinking long-term

A major acquisition, or a merger, between industry leaders is a bet on the industry’s future.

If you believe in the bet long-term, don’t sacrifice a good move for short-term returns, as HP did with EMC. Instead, do your due diligence in the consideration phase:

- Consider real alternatives.

- Understand deeply how the capabilities of both companies will be improved.

- Validate your assumptions with current market needs and trends.

- Move faster than the competition.

Why is Dell so successful?

One of the key reasons Dell has been so successful is Michael Dell’s intuition and strategic instinct.

He demonstrated a consistent ability to take an accurate pulse of the market, make a winning bet and chase it relentlessly by performing a business transformation. Additionally, Dell never lost one of its core strategic strengths: building strong relationships with its customers by providing excellent customer support and tailored solutions to meet their unique needs. The company has also been successful in streamlining its operations and supply chain, which has allowed it to offer competitive prices and high-quality products.

Dell puts the customer first and makes strategic pivots with perfect timing.

How Dell’s vision guides its steps

According to Dell’s annual report, its vision is:

“To become the most essential technology company for the data era. We seek to address our customers’ evolving needs and their broader digital

transformation objectives as they embrace today’s hybrid multi-cloud environment.”

And their two strategic priorities, growing core offerings and pursuing new opportunities, are their roadmap to achieving it.

Growth by numbers

|

|

|

|

| Revenue | $14 billion | $101 billion |

| Cost of Goods Sold | $12 billion | $79 billion |

| Earnings Per Share (EPS) | -$4.6 | $7.02 |

| Number of employees | <100.000 | 133.000 |

Don't miss tomorrow's CFO.com industry news

Let CFO's free newsletter keep you informed, straight from your inbox.

What the Dell Decision Teaches Us About Valuation

The May 31 Delaware Court of Chancery decision In Re: Appraisal of Dell, Inc. highlights many of the valuation issues faced not only by the Chancery Court in post-merger disputes, but by many courts in all types of disputes over valuation.

In the Dell matter, the Chancery Court held that the fair value of Dell, Inc. was $17.62 per share in a going-private transaction in September 2013. This opinion of value by the Court was about 30% more than the transaction price of $13.78 per share. At first glance, the Court’s opinion of value was surprising, since it is greater than a transaction price derived through a year-long process involving competing arm’s-length proposals.

The story essentially begins In 2012, when Michael Dell approached Dell’s board about taking the company private through a management buyout (MBO), to be sponsored by one or more private equity firms. Before the eventual transaction, a special committee of Dell’s board retained two investment advisers and a consulting firm to assist in “shopping” the company during a 45-day “go-shop” period as part of the board’s due diligence.

As part of the transaction, Dell obtained two fairness opinions which concluded that the transaction was fair “from a financial point of view.” But certain groups of shareholders dissented from the transaction and asserted their appraisal rights, believing the transaction price to be too low.

During the trial, both parties presented valuation experts, each one of which providing an opinion of the fair value of a share of common equity of Dell as of the transaction date. The petitioner’s expert in the case concluded that the fair value of Dell was $28.61 per share, while the respondent’s valuation expert concluded $12.68 per share. The court noted that “two highly distinguished scholars of valuation science, applying similar valuation principles, thus generated opinions that differed by 126%, or approximately $28 billion. This is a recurring problem.” The Court eventually concluded the fair value of Dell was $17.62 per share.

The Dell decision highlights why two reputable experts may differ about an opinion of value. First, experts must deal with how value is defined by the courts. In the Chancery Courts of Delaware, fair value is defined as: “the fair value of the shares exclusive of any element of value arising from the accomplishment or expectation of the merger or consolidation, together with interest, if any, to be paid upon the amount determined to be the fair value. In determining such fair value, the Court shall take into account all relevant factors.”

Fair value is the value to existing shareholders just prior to the corporate action (in the case of Dell, the management buy-out) and should not include any value enhancement from the transaction itself.

The definition of value in a particular matter often leads the valuation expert to use certain specific assumptions and methodologies in performing the valuation. Two common valuation techniques often used to measure the fair value of an operating entity like Dell are the use of multiples of similar publicly traded companies (“the guideline public company method”) and a discounted cash flow method (DCF).

In a large going-private transaction like the Dell buyout, the share price of similar publicly traded companies may be affected by a competitor’s proposed MBO. As a result, the guideline public company method may include benefits from the proposed transaction which are contrary to the definition of fair value. As such, the DCF often becomes the primary valuation method, but supported by multiples of similar, guideline companies. In Dell, however, the court relied solely upon the DCF method.

The DCF has three basic components: the explicit forecast period of cash flows, cash flow after the forecast period, and the discount rate reflecting the risk of receiving the cash flows. The starting point of the discounted cash flow is typically forecasts prepared by management reflecting their expectation of the future. Courts tend to prefer prospective financial information (PFI) prepared at the same time in the ordinary course of business so that any potential biases in the assumptions are likely mitigated.

Next, the value contributed by cash flows after the first forecast period are often limited by using an assumption to reflect the overall growth in the economy in estimating these longer term returns.

The third component of the DCF is the selection of a discount rate to discount the cash flows to the present to reflect the relative risk of not achieving the forecasts. Academics continue to debate the assumptions which underlie the cost of capital. The cost of capital is typically used as a proxy for the discount rate in a DCF. The assumptions used by valuation specialists in the DCF can cause a wide variation in conclusions.

In the Dell case, the valuation experts assumed different weightings of debt and equity in estimating the appropriate capital structure of the company. Both experts also made different assumptions in the required return on equity, which were incorporated into their respective discount rate. The court, however, ignored certain assumptions used by both experts and computed its own discount rate.

In contemplating the MBO, Dell’s board retained an outside consulting firm to assist in preparing detailed forecasts of expected cash flows of the company. At the trial, both experts used the forecasts as a basis for their DCF. But the respondent’s expert adjusted the forecasts for the declines in market conditions from the time the forecasts were prepared in January 2013 to the transaction date, as well as a “transition period” to normal operations and stock-based compensation.