The Ultimate Guide to Writing a Nonprofit Business Plan

A business plan can be an invaluable tool for your nonprofit. Even a short business plan pushes you to do research, crystalize your purpose, and polish your messaging. This blog shares what it is and why you need it, ten steps to help you write one, and the dos and don’ts of creating a nonprofit business plan.

Nonprofit business plans are dead — or are they?

For many nonprofit organizations, business plans represent outdated and cumbersome documents that get created “just for the sake of it” or because donors demand it.

But these plans are vital to organizing your nonprofit and making your dreams a reality! Furthermore, without a nonprofit business plan, you’ll have a harder time obtaining loans and grants , attracting corporate donors, meeting qualified board members, and keeping your nonprofit on track.

Even excellent ideas can be totally useless if you cannot formulate, execute, and implement a strategic plan to make your idea work. In this article, we share exactly what your plan needs and provide a nonprofit business plan template to help you create one of your own.

What is a Nonprofit Business Plan?

A nonprofit business plan describes your nonprofit as it currently is and sets up a roadmap for the next three to five years. It also lays out your goals and plans for meeting your goals. Your nonprofit business plan is a living document that should be updated frequently to reflect your evolving goals and circumstances.

A business plan is the foundation of your organization — the who, what, when, where, and how you’re going to make a positive impact.

The best nonprofit business plans aren’t unnecessarily long. They include only as much information as necessary. They may be as short as seven pages long, one for each of the essential sections you will read about below and see in our template, or up to 30 pages long if your organization grows.

Why do we need a Nonprofit Business Plan?

Regardless of whether your nonprofit is small and barely making it or if your nonprofit has been successfully running for years, you need a nonprofit business plan. Why?

When you create a nonprofit business plan, you are effectively creating a blueprint for how your nonprofit will be run, who will be responsible for what, and how you plan to achieve your goals.

Your nonprofit organization also needs a business plan if you plan to secure support of any kind, be it monetary, in-kind , or even just support from volunteers. You need a business plan to convey your nonprofit’s purpose and goals.

It sometimes also happens that the board, or the administration under which a nonprofit operates, requires a nonprofit business plan.

To sum it all up, write a nonprofit business plan to:

- Layout your goals and establish milestones.

- Better understand your beneficiaries, partners, and other stakeholders.

- Assess the feasibility of your nonprofit and document your fundraising/financing model.

- Attract investment and prove that you’re serious about your nonprofit.

- Attract a board and volunteers.

- Position your nonprofit and get clear about your message.

- Force you to research and uncover new opportunities.

- Iron out all the kinks in your plan and hold yourself accountable.

Before starting your nonprofit business plan, it is important to consider the following:

- Who is your audience? E.g. If you are interested in fundraising, donors will be your audience. If you are interested in partnerships, potential partners will be your audience.

- What do you want their response to be? Depending on your target audience, you should focus on the key message you want them to receive to get the response that you want.

10-Step Guide on Writing a Business Plan for Nonprofits

Note: Steps 1, 2, and 3 are in preparation for writing your nonprofit business plan.

Step 1: Data Collection

Before even getting started with the writing, collect financial, operating, and other relevant data. If your nonprofit is already in operation, this should at the very least include financial statements detailing operating expense reports and a spreadsheet that indicates funding sources.

If your nonprofit is new, compile materials related to any secured funding sources and operational funding projections, including anticipated costs.

Step 2: Heart of the Matter

You are a nonprofit after all! Your nonprofit business plan should start with an articulation of the core values and your mission statement . Outline your vision, your guiding philosophy, and any other principles that provide the purpose behind the work. This will help you to refine and communicate your nonprofit message clearly.

Your nonprofit mission statement can also help establish your milestones, the problems your organization seeks to solve, who your organization serves, and its future goals.

Check out these great mission statement examples for some inspiration. For help writing your statement, download our free Mission & Vision Statements Worksheet .

Step 3: Outline

Create an outline of your nonprofit business plan. Write out everything you want your plan to include (e.g. sections such as marketing, fundraising, human resources, and budgets).

An outline helps you focus your attention. It gives you a roadmap from the start, through the middle, and to the end. Outlining actually helps us write more quickly and more effectively.

An outline will help you understand what you need to tell your audience, whether it’s in the right order, and whether the right amount of emphasis is placed on each topic.

Pro tip: Use our Nonprofit Business Plan Outline to help with this step! More on that later.

Step 4: Products, Programs, and Services

In this section, provide more information on exactly what your nonprofit organization does.

- What products, programs, or services do you provide?

- How does your nonprofit benefit the community?

- What need does your nonprofit meet and what are your plans for meeting that need?

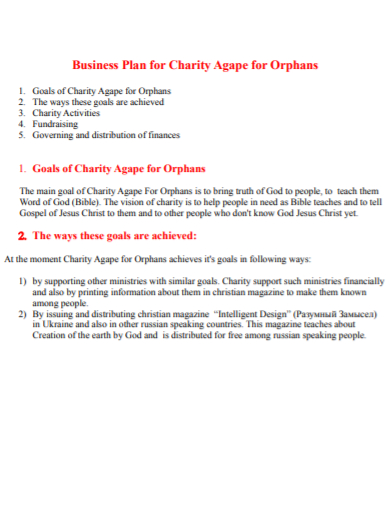

E.g. The American Red Cross carries out its mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.

Don’t skimp out on program details, including the functions and beneficiaries. This is generally what most readers will care most about.

However, don’t overload the reader with technical jargon. Try to present some clear examples. Include photographs, brochures, and other promotional materials.

Step 5: Marketing Plan

A marketing plan is essential for a nonprofit to reach its goals. If your nonprofit is already in operation, describe in detail all current marketing activities: any outreach activities, campaigns, and other initiatives. Be specific about outcomes, activities, and costs.

If your nonprofit is new, outline projections based on specific data you gathered about your market.

This will frequently be your most detailed section because it spells out precisely how you intend to carry out your business plan.

- Describe your market. This includes your target audience, competitors, beneficiaries, donors, and potential partners.

- Include any market analyses and tests you’ve done.

- Outline your plan for reaching your beneficiaries.

- Outline your marketing activities, highlighting specific outcomes.

Step 6: Operational Plan

An operational plan describes how your nonprofit plans to deliver activities. In the operational plan, it is important to explain how you plan to maintain your operations and how you will evaluate the impact of your programs.

The operational plan should give an overview of the day-to-day operations of your organization such as the people and organizations you work with (e.g. partners and suppliers), any legal requirements that your organization needs to meet (e.g. if you distribute food, you’ll need appropriate licenses and certifications), any insurance you have or will need, etc.

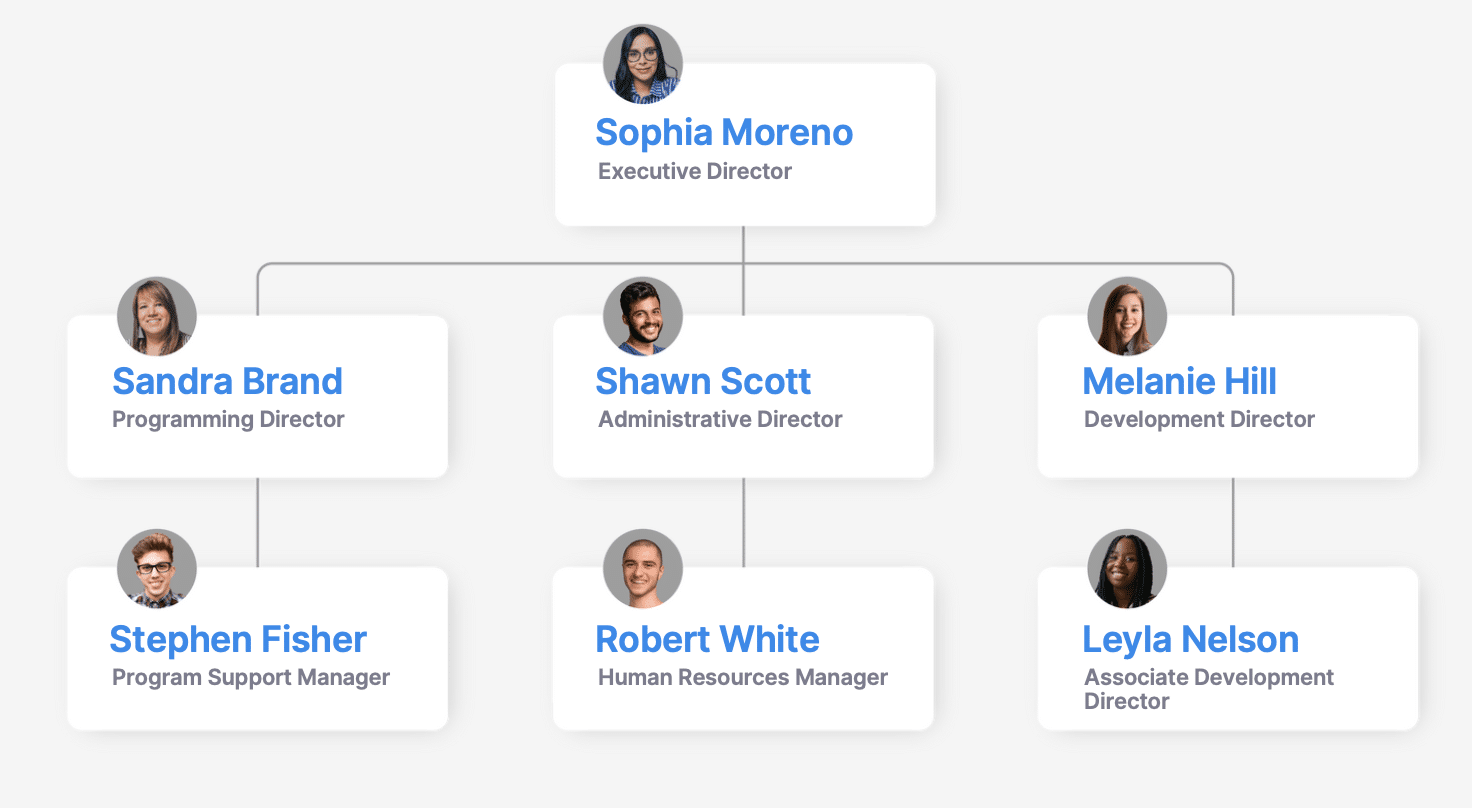

In the operational plan, also include a section on the people or your team. Describe the people who are crucial to your organization and any staff changes you plan as part of your business plan.

Pro tip: If you have an organizational chart, you can include it in the appendix to help illustrate how your organization operates. Learn more about the six types of nonprofit organizational charts and see them in action in this free e-book .

Step 7: Impact Plan

For a nonprofit, an impact plan is as important as a financial plan. A nonprofit seeks to create social change and a social return on investment, not just a financial return on investment.

Your impact plan should be precise about how your nonprofit will achieve this step. It should include details on what change you’re seeking to make, how you’re going to make it, and how you’re going to measure it.

This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives.

These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.

Answer these in the impact plan section of your business plan:

- What goals are most meaningful to the people you serve or the cause you’re fighting for?

- How can you best achieve those goals through a series of specific objectives?

E.g. “Finding jobs for an additional 200 unemployed people in the coming year.”

Step 8: Financial Plan

This is one of the most important parts of your nonprofit business plan. Creating a financial plan will allow you to make sure that your nonprofit has its basic financial needs covered.

Every nonprofit needs a certain level of funding to stay operational, so it’s essential to make sure your organization will meet at least that threshold.

To craft your financial plan:

- Outline your nonprofit’s current and projected financial status.

- Include an income statement, balance sheet , cash flow statement, and financial projections.

- List any grants you’ve received, significant contributions, and in-kind support.

- Include your fundraising plan .

- Identify gaps in your funding, and how you will manage them.

- Plan for what will be done with a potential surplus.

- Include startup costs, if necessary.

If your nonprofit is already operational, use established accounting records to complete this section of the business plan.

Knowing the financial details of your organization is incredibly important in a world where the public demands transparency about where their donations are going.

Pro tip : Leverage startup accelerators dedicated to nonprofits that can help you with funding, sponsorship, networking, and much more.

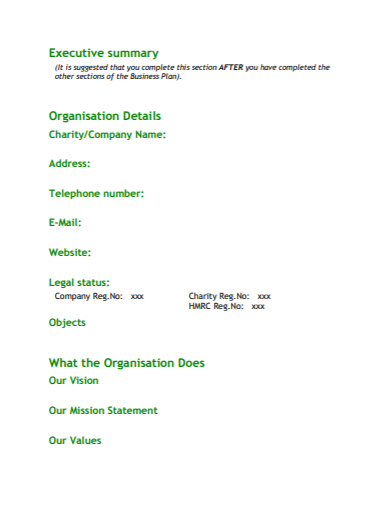

Step 9: Executive Summary

Normally written last but placed first in your business plan, your nonprofit executive summary provides an introduction to your entire business plan. The first page should describe your non-profit’s mission and purpose, summarize your market analysis that proves an identifiable need, and explain how your non-profit will meet that need.

The Executive Summary is where you sell your nonprofit and its ideas. Here you need to describe your organization clearly and concisely.

Make sure to customize your executive summary depending on your audience (i.e. your executive summary page will look different if your main goal is to win a grant or hire a board member).

Step 10: Appendix

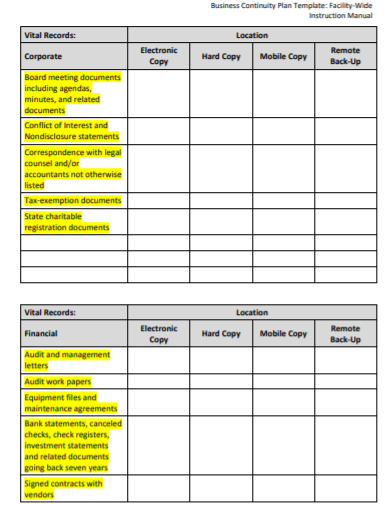

Include extra documents in the section that are pertinent to your nonprofit: organizational chart , current fiscal year budget, a list of the board of directors, your IRS status letter, balance sheets, and so forth.

The appendix contains helpful additional information that might not be suitable for the format of your business plan (i.e. it might unnecessarily make it less readable or more lengthy).

Do’s and Dont’s of Nonprofit Business Plans – Tips

- Write clearly, using simple and easy-to-understand language.

- Get to the point, support it with facts, and then move on.

- Include relevant graphs and program descriptions.

- Include an executive summary.

- Provide sufficient financial information.

- Customize your business plan to different audiences.

- Stay authentic and show enthusiasm.

- Make the business plan too long.

- Use too much technical jargon.

- Overload the plan with text.

- Rush the process of writing, but don’t drag it either.

- Gush about the cause without providing a clear understanding of how you will help the cause through your activities.

- Keep your formatting consistent.

- Use standard 1-inch margins.

- Use a reasonable font size for the body.

- For print, use a serif font like Times New Roman or Courier. For digital, use sans serifs like Verdana or Arial.

- Start a new page before each section.

- Don’t allow your plan to print and leave a single line on an otherwise blank page.

- Have several people read over the plan before it is printed to make sure it’s free of errors.

Nonprofit Business Plan Template

To help you get started we’ve created a nonprofit business plan outline. This business plan outline will work as a framework regardless of your nonprofit’s area of focus. With it, you’ll have a better idea of how to lay out your nonprofit business plan and what to include. We have also provided several questions and examples to help you create a detailed nonprofit business plan.

Download Your Free Outline

At Donorbox, we strive to make your nonprofit experience as productive as possible, whether through our donation software or through our advice and guides on the Nonprofit Blog . Find more free, downloadable resources in our Library .

Many nonprofits start with passion and enthusiasm but without a proper business plan. It’s a common misconception that just because an organization is labeled a “nonprofit,” it does not need to operate in any way like a business.

However, a nonprofit is a type of business, and many of the same rules that apply to a for-profit company also apply to a nonprofit organization.

As outlined above, your nonprofit business plan is a combination of your marketing plan , strategic plan, operational plan, impact plan, and financial plan. Remember, you don’t have to work from scratch. Be sure to use the nonprofit business plan outline we’ve provided to help create one of your own.

It’s important to note that your nonprofit should not be set in stone—it can and should change and evolve. It’s a living organism. While your vision, values, and mission will likely remain the same, your nonprofit business plan may need to be revised from time to time. Keep your audience in mind and adjust your plan as needed.

Finally, don’t let your plan gather dust on a shelf! Print it out, put up posters on your office walls, and read from it during your team meetings. Use all the research, data, and ideas you’ve gathered and put them into action!

If you want more help with nonprofit management tips and fundraising resources, visit our Nonprofit Blog . We also have dedicated articles for starting a nonprofit in different states in the U.S., including Texas , Minnesota , Oregon , Arizona , Illinois , and more.

Learn about our all-in-one online fundraising tool, Donorbox, and its simple-to-use features on the website here .

Raviraj heads the sales and marketing team at Donorbox. His growth-hacking abilities have helped Donorbox boost fundraising efforts for thousands of nonprofit organizations.

Join the fundraising movement!

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.

How to Write a Business Plan For a Nonprofit Organization + Template

Creating a business plan is essential for any business, but it can be especially helpful for nonprofits. A nonprofit business plan allows you to set goals and track progress over time. It can also help you secure funding from investors or grant-making organizations.

A well-crafted business plan not only outlines your vision for the organization but also provides a step-by-step process of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article will provide an overview of the key elements that every nonprofit founder should include in their business plan.

Download the Ultimate Nonprofit Business Plan Template

What is a Nonprofit Business Plan?

A nonprofit business plan is a formal written document that describes your organization’s purpose, structure, and operations. It is used to communicate your vision to potential investors or donors and convince them to support your cause.

The business plan should include information about your target market, financial projections, and marketing strategy. It should also outline the organization’s mission statement and goals.

Why Write a Nonprofit Business Plan?

A nonprofit business plan is required if you want to secure funding from grant-making organizations or investors.

A well-crafted business plan will help you:

- Define your organization’s purpose and goals

- Articulate your vision for the future

- Develop a step-by-step plan to achieve your goals

- Secure funding from investors or donors

- Convince potential supporters to invest in your cause

Entrepreneurs can also use this as a roadmap when starting your new nonprofit organization, especially if you are inexperienced in starting a nonprofit.

Writing an Effective Nonprofit Business Plan

The key is to tailor your business plan to the specific needs of your nonprofit. Here’s a quick overview of what to include:

Executive Summary

Organization overview, products, programs, and services, industry analysis, customer analysis, marketing plan, operations plan, management team.

- Financial Plan

The executive summary of a nonprofit business plan is a one-to-two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your nonprofit organization

- Provide a short summary of the key points of each section of your business plan.

- Organize your thoughts in a logical sequence that is easy for the reader to follow.

- Include information about your organization’s management team, industry analysis, competitive analysis, and financial forecast.

This section should include a brief history of your nonprofit organization. Include a short description of how and why you started it and provide a timeline of milestones the organization has achieved.

If you are just starting your nonprofit, you may not have a long history. Instead, you can include information about your professional experience in the industry and how and why you conceived your new nonprofit idea. If you have worked for a similar organization before or have been involved in a nonprofit before starting your own, mention this.

You will also include information about your chosen n onprofit business model and how it is different from other nonprofits in your target market.

This section is all about what your nonprofit organization offers. Include information about your programs, services, and any products you may sell.

Describe the products or services you offer and how they benefit your target market. Examples might include:

- A food bank that provides healthy meals to low-income families

- A job training program that helps unemployed adults find jobs

- An after-school program that helps kids stay out of gangs

- An adult literacy program that helps adults learn to read and write

Include information about your pricing strategy and any discounts or promotions you offer. Examples might include membership benefits, free shipping, or volume discounts.

If you offer more than one product or service, describe each one in detail. Include information about who uses each product or service and how it helps them achieve their goals.

If you offer any programs, describe them in detail. Include information about how often they are offered and the eligibility requirements for participants. For example, if you offer a job training program, you might include information about how often the program is offered, how long it lasts, and what kinds of jobs participants can expect to find after completing the program.

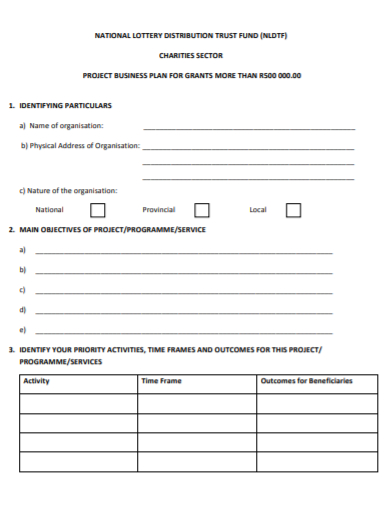

The industry or market analysis is an important component of a nonprofit business plan. Conduct thorough market research to determine industry trends, identify your potential customers, and the potential size of this market.

Questions to answer include:

- What part of the nonprofit industry are you targeting?

- Who are your competitors?

- How big is the market?

- What trends are happening in the industry right now?

You should also include information about your research methodology and sources of information, including company reports and expert opinions.

As an example, if you are starting a food bank, your industry analysis might include information about the number of people in your community who are considered “food insecure” (they don’t have regular access to enough nutritious food). You would also include information about other food banks in your area, how they are funded, and the services they offer.

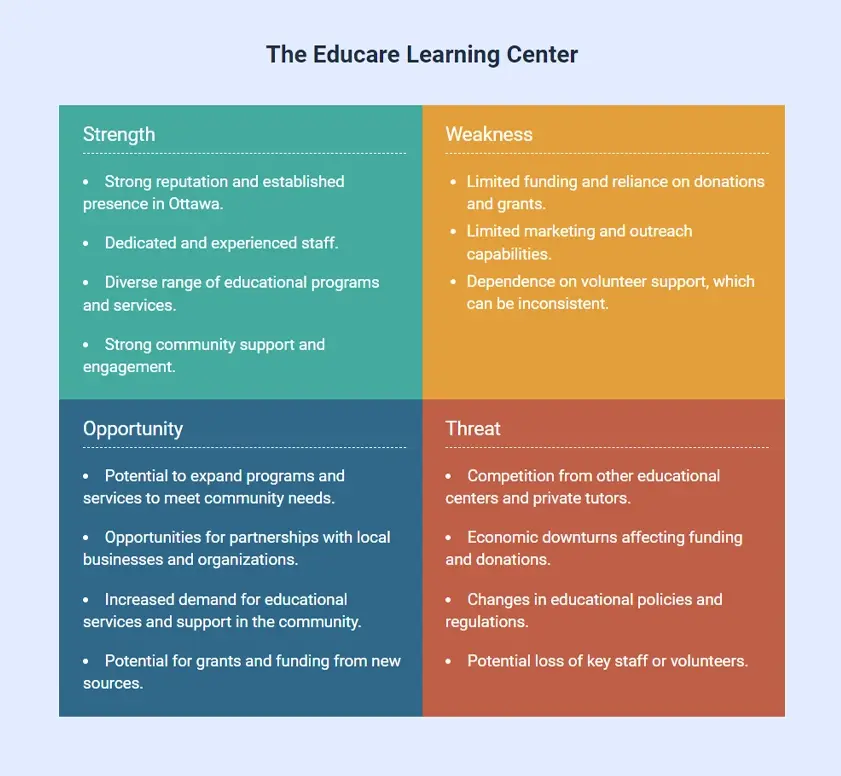

For each of your competitors, you should include a brief description of their organization, their target market, and their competitive advantage. To do this, you should complete a SWOT analysis.

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a helpful tool to assess your nonprofit’s current position and identify areas where you can improve.

Some questions to consider when conducting a SWOT analysis include:

- Strengths : What does your nonprofit do well?

- Weaknesses : What areas could your nonprofit improve?

- Opportunities : What trends or changes in the industry could you take advantage of?

- Threats : What trends or changes in the industry could hurt your nonprofit’s chances of success?

After you have identified your nonprofit’s strengths, weaknesses, opportunities, and threats, you can develop strategies to improve your organization.

For example, if you are starting a food bank, your SWOT analysis might reveal that there is a need for more food banks in your community. You could use this information to develop a marketing strategy to reach potential donors who might be interested in supporting your organization.

If you are starting a job training program, your SWOT analysis might reveal that there is a need for more programs like yours in the community. You could use this information to develop a business plan and marketing strategy to reach potential participants who might be interested in enrolling in your program.

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, if you are starting a job training program for unemployed adults, your target audience might be low-income adults between the ages of 18 and 35. Your customer analysis would include information about their needs (e.g., transportation, childcare, job readiness skills) and wants (e.g., good pay, flexible hours, benefits).

If you have more than one target audience, you will need to provide a separate customer analysis for each one.

You can include information about how your customers make the decision to buy your product or use your service. For example, if you are starting an after-school program, you might include information about how parents research and compare programs before making a decision.

You should also include information about your marketing strategy and how you plan to reach your target market. For example, if you are starting a food bank, you might include information about how you will promote the food bank to the community and how you will get the word out about your services.

Develop a strategy for targeting those customers who are most likely to use your program, as well as those that might be influenced to buy your products or nonprofit services with the right marketing.

This part of the business plan is where you determine how you are going to reach your target market. This section of your nonprofit business plan should include information about your marketing goals, strategies, and tactics.

- What are your marketing goals? Include information about what you hope to achieve with your marketing efforts, as well as when and how you will achieve it.

- What marketing strategies will you use? Include information about public relations, advertising, social media, and other marketing tactics you will use to reach your target market.

- What tactics will you use? Include information about specific actions you will take to execute your marketing strategy. For example, if you are using social media to reach your target market, include information about which platforms you will use and how often you will post.

Your marketing strategy should be clearly laid out, including the following 4 Ps.

- Product/Service : Make sure your product, service, and/or program offering is clearly defined and differentiated from your competitors, including the benefits of using your service.

- Price : How do you determine the price for your product, services, and/or programs? You should also include a pricing strategy that takes into account what your target market will be willing to pay and how much the competition within your market charges.

- Place : Where will your target market find you? What channels of distribution will you use to reach them?

- Promotion : How will you reach your target market? You can use social media or write a blog, create an email marketing campaign, post flyers, pay for advertising, launch a direct mail campaign, etc.

For example, if you are starting a job training program for unemployed adults, your marketing strategy might include partnering with local job centers and adult education programs to reach potential participants. You might also promote the program through local media outlets and community organizations.

Your marketing plan should also include a sales strategy, which includes information about how you will generate leads and convert them into customers.

You should also include information about your paid advertising budget, including an estimate of expenses and sales projections.

This part of your nonprofit business plan should include the following information:

- How will you deliver your products, services and/or programs to your target market? For example, if you are starting a food bank, you will need to develop a system for collecting and storing food donations, as well as distributing them to the community.

- How will your nonprofit be structured? For example, will you have paid staff or volunteers? How many employees will you need? What skills and experience will they need to have?

- What kind of facilities and equipment will you need to operate your nonprofit? For example, if you are starting a job training program, you will need space to hold classes, as well as computers and other office equipment.

- What are the day-to-day operations of your nonprofit? For example, if you are starting a food bank, you will need to develop a system for accepting and sorting food donations, as well as distributing them to the community.

- Who will be responsible for each task? For example, if you are starting a job training program, you will need to identify who will be responsible for recruiting participants, teaching classes, and placing graduates in jobs.

- What are your policies and procedures? You will want to establish policies related to everything from employee conduct to how you will handle donations.

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is the section of the business plan where you elaborate on the day-to-day execution of your nonprofit. This is where you really get into the nitty-gritty of how your organization will function on a day-to-day basis.

This section of your nonprofit business plan should include information about the individuals who will be running your organization.

- Who is on your team? Include biographies of your executive director, board of directors, and key staff members.

- What are their qualifications? Include information about their education, work experience, and skills.

- What are their roles and responsibilities? Include information about what each team member will be responsible for, as well as their decision-making authority.

- What is their experience in the nonprofit sector? Include information about their work with other nonprofits, as well as their volunteer experiences.

This section of your plan is important because it shows that you have a team of qualified individuals who are committed to the success of your nonprofit.

Nonprofit Financial Plan

This section of your nonprofit business plan should include the following information:

- Your budget. Include information about your income and expenses, as well as your fundraising goals.

- Your sources of funding. Include information about your grants, donations, and other sources of income.

- Use of funds. Include information about how you will use your income to support your programs and operations.

This section of your business plan is important because it shows that you have a clear understanding of your organization’s finances. It also shows that you have a plan for raising and managing your funds.

Now, include a complete and detailed financial plan. This is where you will need to break down your expenses and revenue projections for the first 5 years of operation. This includes the following financial statements:

Income Statement

Your income statement should include:

- Revenue : how will you generate revenue?

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, what is the net income or loss?

Sample Income Statement for a Startup Nonprofit Organization

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows what you have in terms of assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Nonprofit Organization

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Income : All of the revenue coming in from clients.

- Expenses : All of your monthly bills and expenses. Include operating, marketing and capital expenditures.

- Net Cash Flow : The difference between income and expenses for each month after they are totaled and deducted from each other. This number is the net cash flow for each month.

Using your total income and expenses, you can project an annual cash flow statement. Below is a sample of a projected cash flow statement for a startup nonprofit.

Sample Cash Flow Statement for a Startup Nonprofit Organization

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

Fundraising Plan

This section of your nonprofit business plan should include information about your fundraising goals, strategies, and tactics.

- What are your fundraising goals? Include information about how much money you hope to raise, as well as when and how you will raise it.

- What fundraising strategies will you use? Include information about special events, direct mail campaigns, online giving, and grant writing.

- What fundraising tactics will you use? Include information about volunteer recruitment, donor cultivation, and stewardship.

Now include specific fundraising goals, strategies, and tactics. These could be annual or multi-year goals. Below are some examples:

Goal : To raise $50,000 in the next 12 months.

Strategy : Direct mail campaign

- Create a mailing list of potential donors

- Develop a direct mail piece

- Mail the direct mail piece to potential donors

Goal : To raise $100,000 in the next 24 months.

Strategy : Special event

- Identify potential special event sponsors

- Recruit volunteers to help with the event

- Plan and execute the special event

Goal : To raise $250,000 in the next 36 months.

Strategy : Grant writing

- Research potential grant opportunities

- Write and submit grant proposals

- Follow up on submitted grants

This section of your business plan is important because it shows that you have a clear understanding of your fundraising goals and how you will achieve them.

You will also want to include an appendix section which may include:

- Your complete financial projections

- A complete list of your nonprofit’s policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- A list of your hard assets and equipment with purchase dates, prices paid and any other relevant information

- A list of your soft assets with purchase dates, prices paid and any other relevant information

- Biographies and/or resumes of the key members of your organization

- Your nonprofit’s bylaws

- Your nonprofit’s articles of incorporation

- Your nonprofit’s most recent IRS Form 990

- Any other relevant information that may be helpful in understanding your organization

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your nonprofit organization. It not only outlines your vision but also provides a step-by-step process of how you are going to accomplish it. Sometimes it may be difficult to get started, but once you get the hang of it, writing a business plan becomes easier and will give you a sense of direction and clarity about your nonprofit organization.

Finish Your Nonprofit Business Plan in 1 Day!

Other helpful articles.

How to Write a Grant Proposal for Your Nonprofit Organization + Template & Examples

How To Create the Articles of Incorporation for Your Nonprofit Organization + Template

How to Develop a Nonprofit Communications Plan + Template

How to Write a Stand-Out Purpose Statement + Examples

Free Nonprofit Business Plan Templates

By Joe Weller | September 18, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up the most useful list of nonprofit business plan templates, all free to download in Word, PDF, and Excel formats.

Included on this page, you’ll find a one-page nonprofit business plan template , a fill-in-the-blank nonprofit business plan template , a startup nonprofit business planning timeline template , and more. Plus, we provide helpful tips for creating your nonprofit business plan .

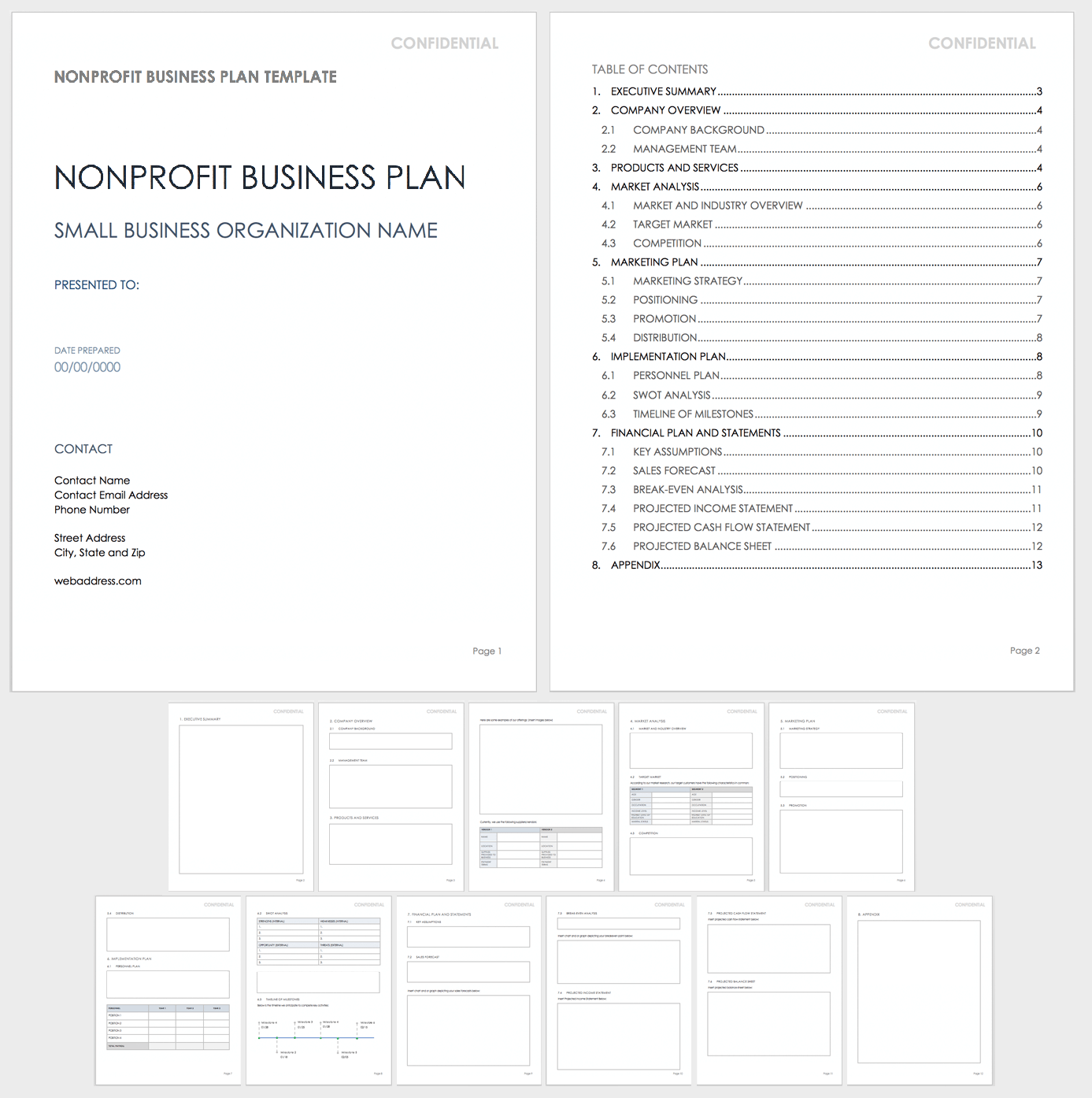

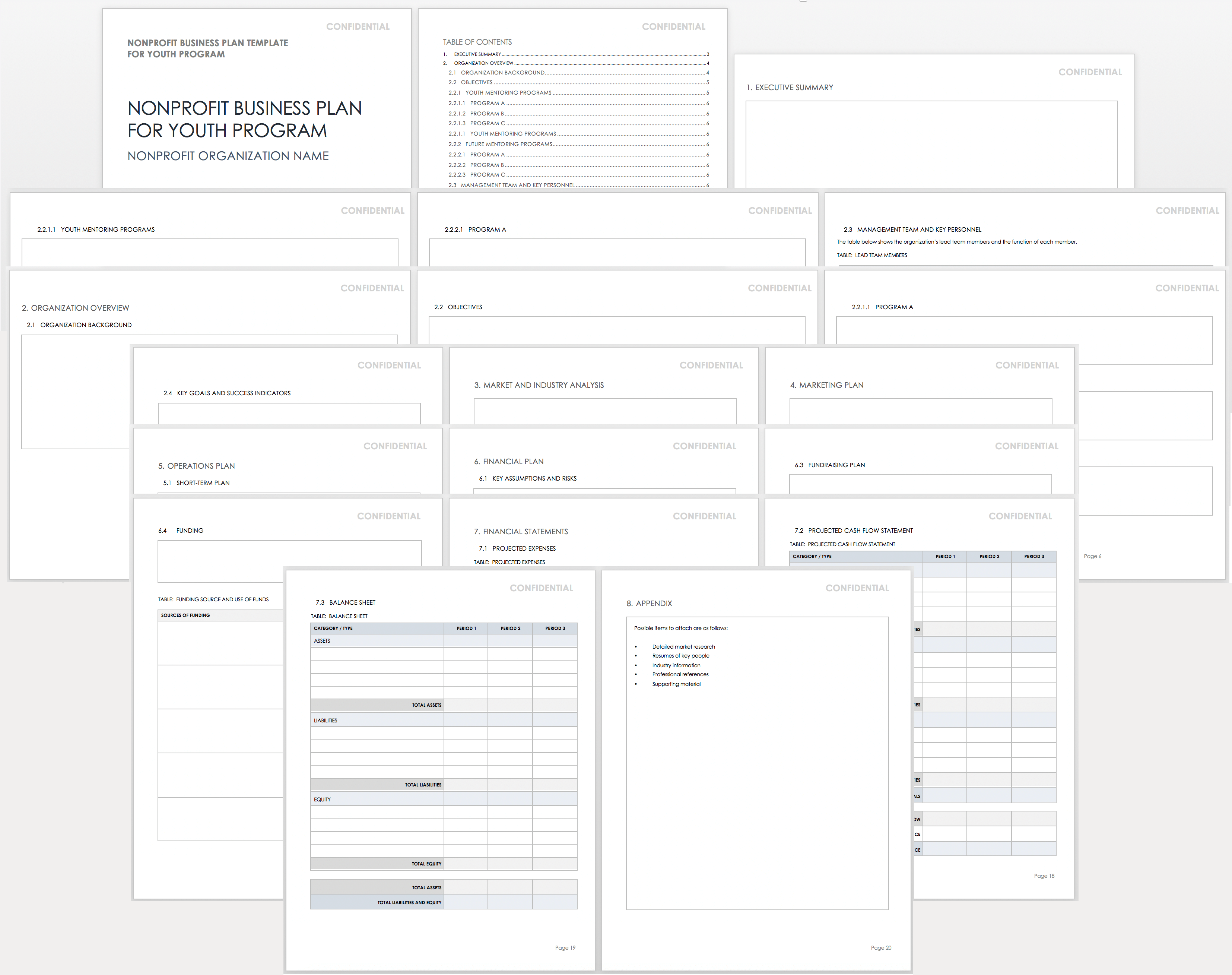

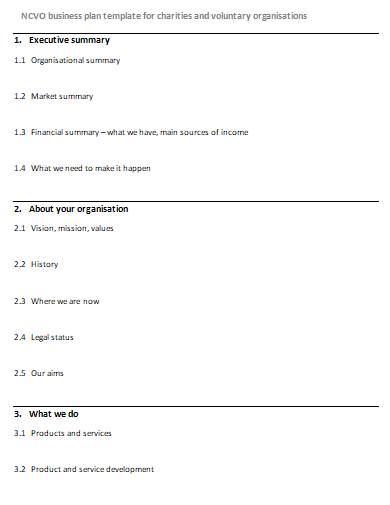

Nonprofit Business Plan Template

Use this customizable nonprofit business plan template to organize your nonprofit organization’s mission and goals and convey them to stakeholders. This template includes space for information about your nonprofit’s background, objectives, management team, program offerings, market analysis, promotional activities, funding sources, fundraising methods, and much more.

Download Nonprofit Business Plan Template

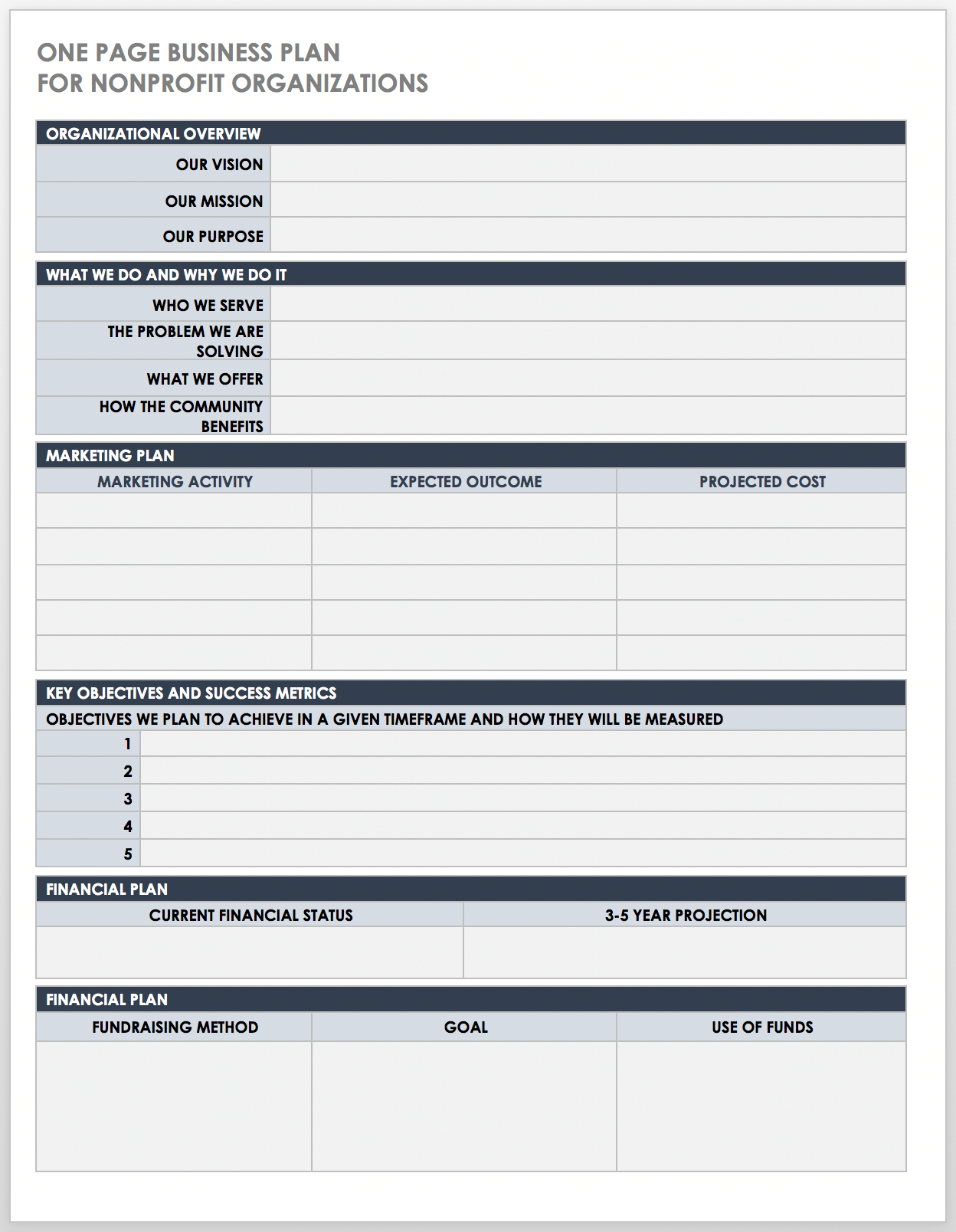

One-Page Business Plan for Nonprofit Template

This one-page nonprofit business plan template has a simple and scannable design to outline the key details of your organization’s strategy. This template includes space to detail your mission, vision, and purpose statements, as well as the problems you aim to solve in your community, the people who benefit from your program offerings, your key marketing activities, your financial goals, and more.

Download One-Page Business Plan for Nonprofit Template

Excel | Word | PDF

For additional resources, including an example of a one-page business plan , visit “ One-Page Business Plan Templates with a Quick How-To Guide .”

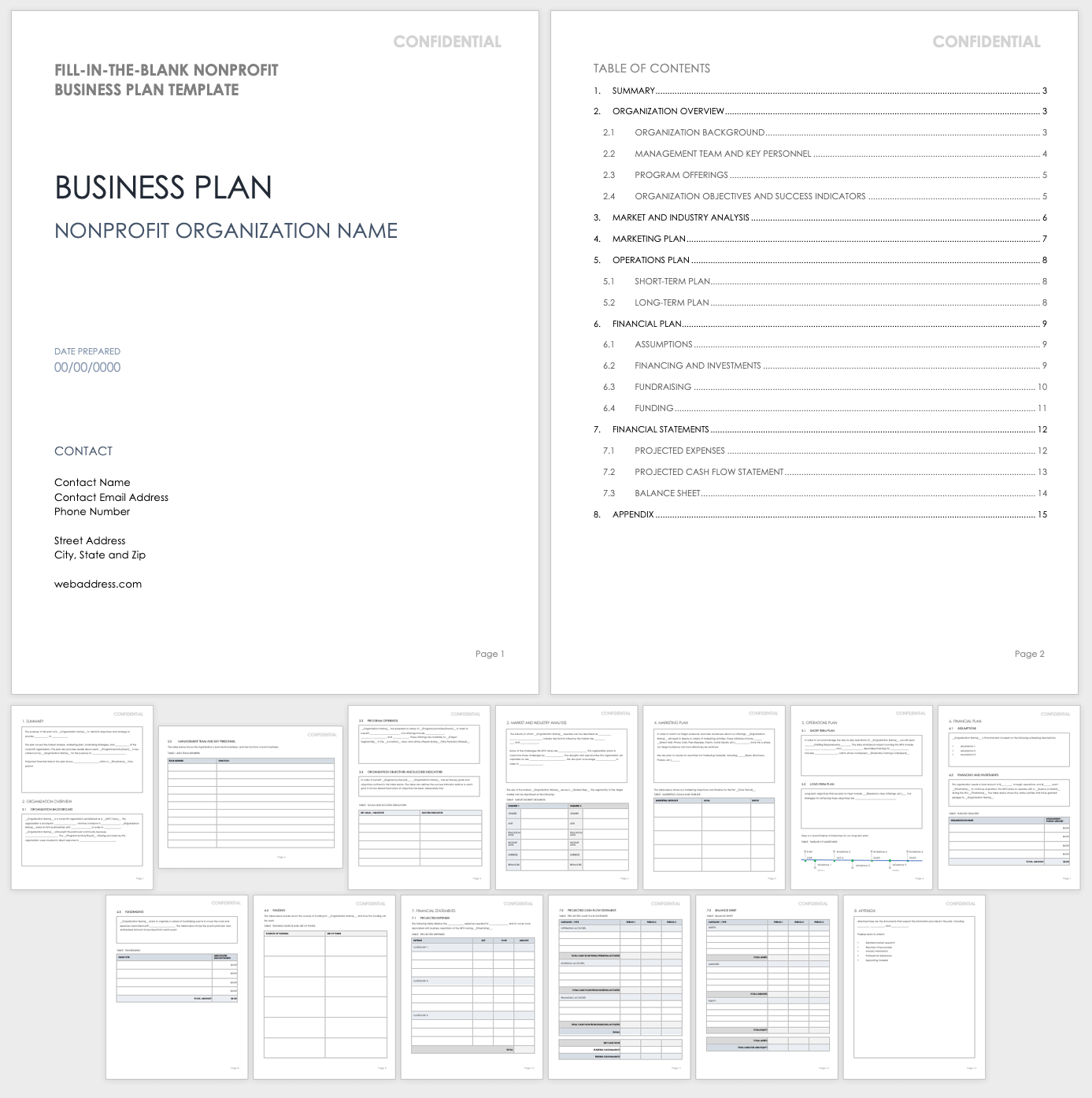

Fill-In-the-Blank Nonprofit Business Plan Template

Use this fill-in-the-blank template as the basis for building a thorough business plan for a nonprofit organization. This template includes space to describe your organization’s background, purpose, and main objectives, as well as key personnel, program and service offerings, market analysis, promotional activities, fundraising methods, and more.

Download Fill-In-the-Blank Nonprofit Business Plan Template

For additional resources that cater to a wide variety of organizations, visit “ Free Fill-In-the-Blank Business Plan Templates .”

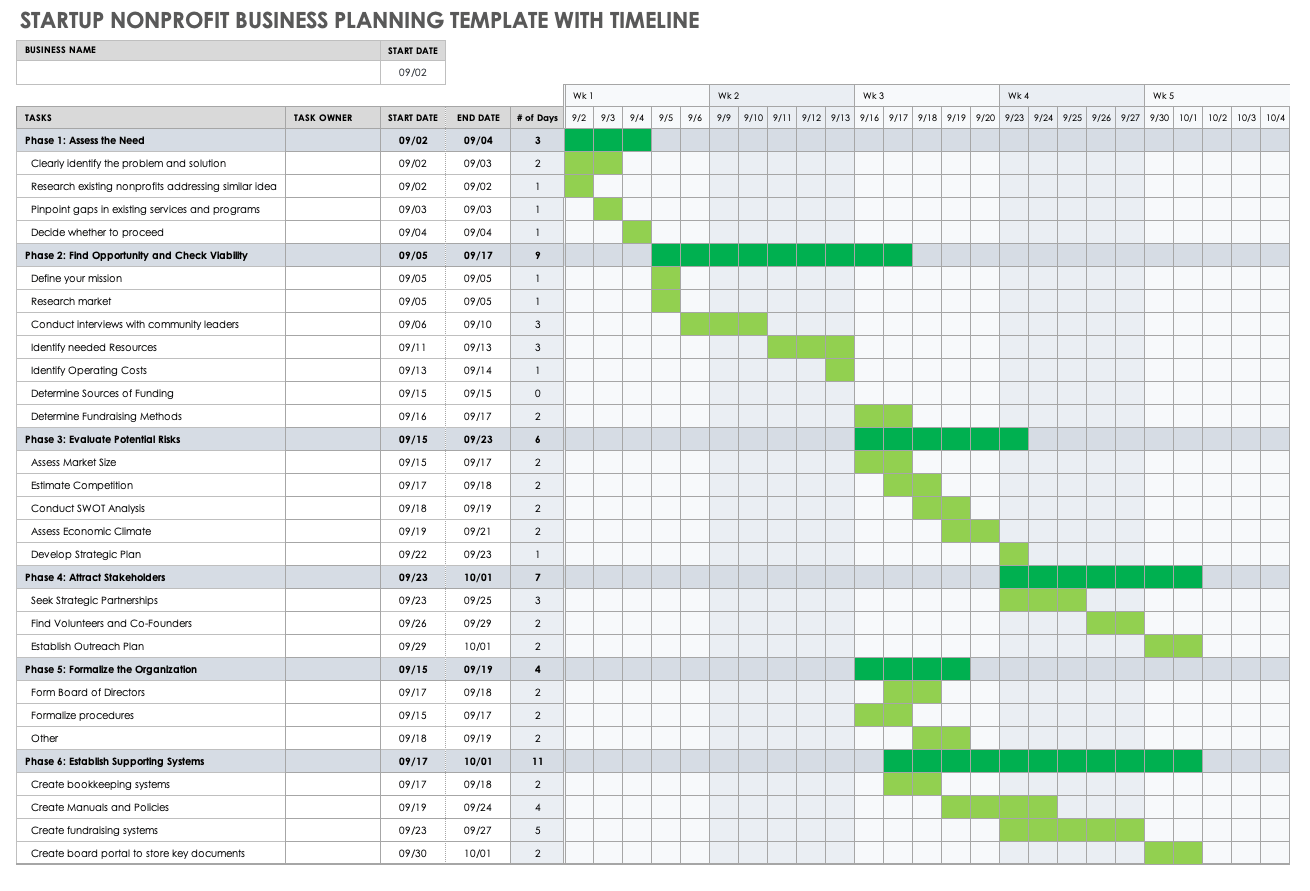

Startup Nonprofit Business Planning Template with Timeline

Use this business planning template to organize and schedule key activities for your business. Fill in the cells according to the due dates, and color-code the cells by phase, owner, or category to provide a visual timeline of progress.

Download Startup Nonprofit Business Planning Template with Timeline

Excel | Smartsheet

Nonprofit Business Plan Template for Youth Program

Use this template as a foundation for building a powerful and attractive nonprofit business plan for youth programs and services. This template has all the core components of a nonprofit business plan. It includes room to detail the organization’s background, management team key personnel, current and future youth program offerings, promotional activities, operations plan, financial statements, and much more.

Download Nonprofit Business Plan Template for Youth Program

Word | PDF | Google Doc

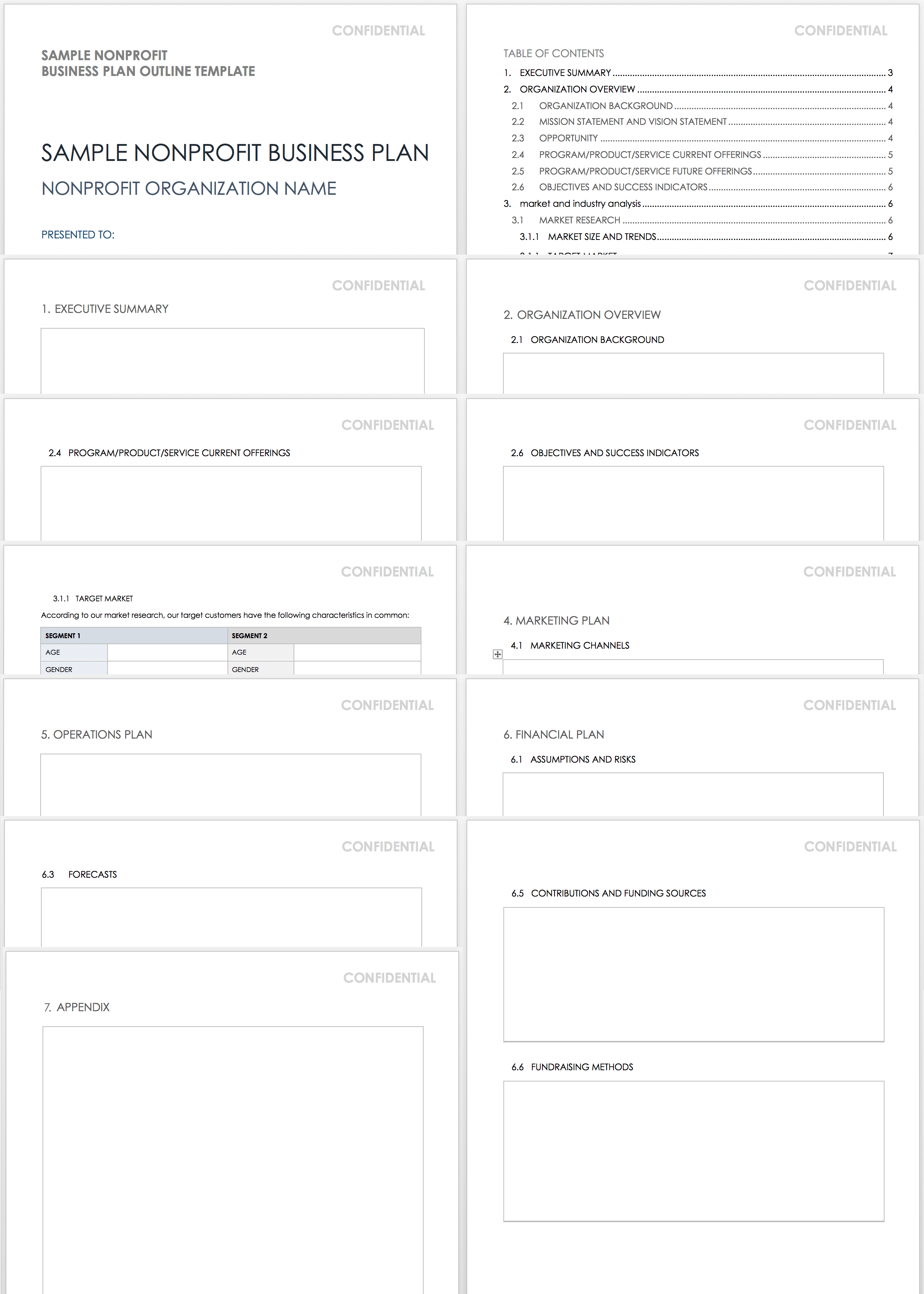

Sample Nonprofit Business Plan Outline Template

You can customize this sample nonprofit business plan outline to fit the specific needs of your organization. To ensure that you don’t miss any essential details, use this outline to help you prepare and organize the elements of your plan before filling in each section.

Download Sample Nonprofit Business Plan Outline Template

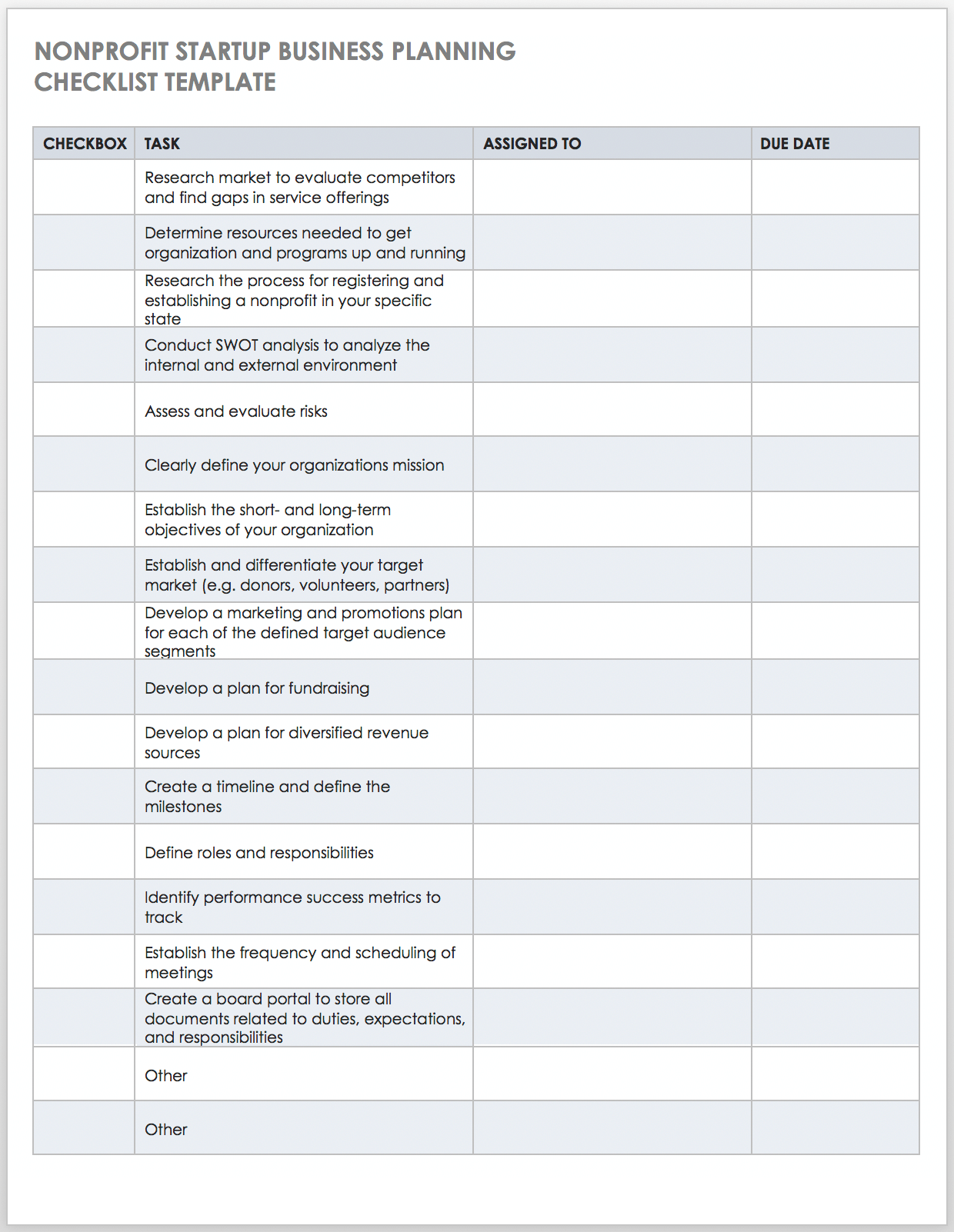

Nonprofit Startup Business Planning Checklist Template

Use this customizable business planning checklist as the basis for outlining the necessary steps to get your nonprofit organization up and running. You can customize this checklist to fit your individual needs. It includes essential steps, such as conducting a SWOT analysis , fulfilling the research requirements specific to your state, conducting a risk assessment , defining roles and responsibilities, creating a portal for board members, and other tasks to keep your plan on track.

Download Nonprofit Startup Business Planning Checklist Template

Tips to Create Your Nonprofit Business Plan

Your nonprofit business plan should provide your donors, volunteers, and other key stakeholders with a clear picture of your overarching mission and objectives. Below, we share our top tips for ensuring that your plan is attractive and thorough.

- Develop a Strategy First: You must aim before you fire if you want to be effective. In other words, develop a strategic plan for your nonprofit in order to provide your team with direction and a roadmap before you build your business plan.

- Save Time with a Template: No need to start from scratch when you can use a customizable nonprofit business plan template to get started. (Download one of the options above.)

- Start with What You Have: With the exception of completing the executive summary, which you must do last, you aren’t obligated to fill in each section of the plan in order. Use the information you have on hand to begin filling in the various parts of your business plan, then conduct additional research to fill in the gaps.

- Ensure Your Information Is Credible: Back up all the details in your plan with reputable sources that stakeholders can easily reference.

- Be Realistic: Use realistic assumptions and numbers in your financial statements and forecasts. Avoid the use of overly lofty or low-lying projections, so stakeholders feel more confident about your plan.

- Strive for Scannability: Keep each section clear and concise. Use bullet points where appropriate, and avoid large walls of text.

- Use Visuals: Add tables, charts, and other graphics to draw the eye and support key points in the plan.

- Be Consistent: Keep the voice and formatting (e.g., font style and size) consistent throughout the plan to maintain a sense of continuity.

- Stay True to Your Brand: Make sure that the tone, colors, and overall style of the business plan are a true reflection of your organization’s brand.

- Proofread Before Distribution: Prior to distributing the plan to stakeholders, have a colleague proofread the rough version to check for errors and ensure that the plan is polished.

- Don’t Set It and Forget It: You should treat your nonprofit business plan as a living document that you need to review and update on a regular basis — as objectives change and your organization grows.

- Use an Effective Collaboration Tool: Use an online tool to accomplish the following: collaborate with key personnel on all components of the business plan; enable version control for all documents; and keep resources in one accessible place.

Improve Your Nonprofit Business Planning Efforts with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Get started

- Project management

- CRM and Sales

- Work management

- Product development life cycle

- Comparisons

- Construction management

- monday.com updates

The best nonprofit business plan template

If you’re looking to start a new charity but don’t know where to start, a nonprofit business plan template can help. There are more than 1.5 million nonprofit organizations registered in the US. While it’s awesome that there are so many charitable orgs, unfortunately, many of them struggle to keep their doors open.

Like any other business, a nonprofit needs to prepare for the unexpected. Even without a global pandemic, strategic planning is crucial for a nonprofit to succeed.

In this article, we’ll look at why a business plan is important for nonprofit organizations and what details to include in your business plan. To get you started, our versatile nonprofit business plan template is ready for you to download to turn your nonprofit dreams into a reality.

Get the template

What is a nonprofit business plan template?

A nonprofit business plan template is not that different from a regular, profit-oriented business plan template. It can even focus on financial gain — as long as it specifies how to use that excess for the greater good.

A nonprofit business plan template includes fields that cover the foundational elements of a business plan, including:

- The overarching purpose of your nonprofit

- Its long and short-term goals

- An outline of how you’ll achieve these goals

The template also controls the general layout of the business plan, like recommended headings, sub-headings, and questions. But what’s the point? Let’s dive into the benefits a business plan template offers nonprofits.

Download Excel template

Why use a nonprofit business plan template?

To get your nonprofit business plans in motion, templates can:

Provide direction

If you’ve decided to start a nonprofit, you’re likely driven by passion and purpose. Although nonprofits are generally mission-driven, they’re still businesses. And that means you need to have a working business model. A template will give your ideas direction and encourage you to put your strategic thinking cap on.

Help you secure funding

One of the biggest reasons for writing a nonprofit business plan is to attract investment. After all, without enough funding , it’s nearly impossible to get your business off the ground. There’s simply no business without capital investment, and that’s even more true for nonprofits that rarely sell products.

Stakeholders and potential investors will need to assess the feasibility of your nonprofit business. You can encourage them to invest by presenting them with a well-written, well-thought-out business plan with all the necessary details — and a template lays the right foundation.

Facilitate clear messaging

One of the essential characteristics of any business plan — nonprofits included — is transparency around what you want to achieve and how you are going to achieve it. A nebulous statement with grandiose aspirations but no practical plan won’t inspire confidence.

Instead, you should create a clear and concise purpose statement that sums up your goals and planned action steps. A good template will help you maintain a strong purpose statement and use clear messaging throughout.

Of course, there are different types of nonprofit plan templates you can use, depending on the kind of business plan you want to draw up.

What are some examples of a nonprofit business plan template?

From summary nonprofit plans to all encompassing strategies, check out a few sample business plan templates for different nonprofit use cases.

Summary nonprofit business plan template

New nonprofit ventures in the early stages of development can use this business plan template. It’s created to put out feelers to see if investors are interested in your idea. For example, you may want to start an animal shelter in your community, but aren’t sure if it’s a viable option due to a lack of funds. You’d use a summary business plan template to gauge interest in your nonprofit.

Full nonprofit business plan template

In this scenario, you have already laid the foundations for your nonprofit. You’re now at a point where you need financing to get your nonprofit off the ground.

This template is much longer than a summary and includes all the sections of a nonprofit business plan including the:

Executive summary

- Nonprofit description

- Needs analysis

- Product/service

- Marketing strategy

- Management team & board

- Human resource needs

It also typically includes a variety of documents that back up your market research and financial situation.

Operational nonprofit business plan template

This type of business plan template is extremely detail-oriented and outlines your nonprofit’s daily operations. It acts as an in-depth guide for who does what, how they should do it, and when they should do it.

An operational nonprofit business plan is written for your internal team rather than external parties like investors or board members.

Convinced to give a business plan template a go? Lucky for you, our team has created the perfect option for nonprofits.

monday.com’s nonprofit business plan template

At monday.com, we understand that starting a nonprofit business can feel overwhelming — scrambling to line up investors, arranging fundraising events, filing federal forms, and more. Because we want you and your nonprofit to succeed, we’ve created a customizable template to get you started. It’s right inside our Work OS , a digital platform that helps you effectively manage every aspect of your work — from budgets and high-level plans to individual to-do lists.

Here’s what you can do on our template:

Access all your documents from one central location

Besides a business plan, starting a nonprofit requires a lot of other documentation. Supporting documents include a cash flow statement or a general financial statement, resumes of founders, and letters of support.

monday.com’s Work OS lets you store all these essential documents in one centralized location. That means you don’t need to open several tabs or run multiple programs to view your information. On monday.com, you can quickly and easily access documents and share them with potential investors and donors. Security features also help you control access to any board or document, only letting invited people or employees view or edit them. By keeping everything in one place, you save time on tracking down rogue files or statements and can focus on what really matters, such as running your nonprofit.

Turn your business plan into action

With monday.com’s nonprofit business plan template, you can seamlessly transform your plan into actionable tasks. After all, it’s going to take more than some sound strategic planning to bring your nonprofit to life.

Based on your business plan, you have the power to create interactive vision boards, calendars, timelines, cards, charts, and more. Because delegation is key, assign tasks to any of your team members from your main board. You can even set up notification automations so that everyone stays up to date with their responsibilities. Plus, to make sure the team stays on track, you can use the Progress Tracking Column that shows you the percent to completion of tasks based on the different status columns of your board.

Keep your finger on the pulse

From budgets to customer satisfaction, you need to maintain a high-level overview of your nonprofit’s key metrics.

monday.com keeps you well-informed on the status of your nonprofit’s progress, all on one platform. With customizable dashboards — for example, a real-time overview of donations received and projects completed — and visually appealing views, you can make confident decisions on how to take your nonprofit business forward.

Now that you have the template, let’s cover each section and how to fill it out correctly.

Essential sections of a nonprofit business plan template

So what exactly goes into a nonprofit business plan? Let’s take a look at the different sections you’ll find in most templates.

This is a concise summary of your business at the beginning of your plan. It should be both inspired and to the point. The executive summary is typically two pages long and dedicates about two sentences to each section of the plan.

Organization overview

This section gives some background on your company and summarizes the goal of your business. At the same time, it should touch on other important factors like your action plan for attracting potential external stakeholders. You can think of an organization overview as a mission statement and company description rolled into one.

Products, programs, and services

Any business exists to provide products, programs, and services — perhaps with a focus on the latter two for nonprofits. Your business plan should outline what you are bringing to your community. This will influence your target market , potential investors, and marketing strategies.

Marketing plan

An effective marketing strategy is the cornerstone of any successful business. Your marketing plan will identify your target audience and how you plan to reach them. It deals with pricing structures while also assessing customer engagement levels.

Operational plan

The operational plan describes the steps a company will take over a certain period. It focuses on the day-to-day aspects of the business, like what tasks need to be done and who is responsible for what. The operational section of a business plan works closely with strategic planning.

Competitive analysis

Even nonprofits face competition from other nonprofits with similar business profiles. A market analysis looks at the strengths and weaknesses of competing businesses and where you fit in. This section should include a strategy to overtake competitors in the market. There are many formats and templates you can use here, for example, a SWOT analysis .

Financial plan

Your financial plan should be a holistic image of your company’s financial status and financial goals. As well as your fundraising plan , make sure to include details like cash flow, investments, insurance, debt, and savings.

Before we wrap up, we’ll address some commonly asked questions about nonprofit business plan templates.

FAQs about nonprofit business plan templates

How do you write a business plan for a nonprofit.

The best way to write a nonprofit business plan is with a template so that you don’t leave anything out. Our template has all the sections ready for you to fill in, combined with features of a cutting-edge Work OS.

For some extra tips, take a look at our advice on how to write a business plan . We’ve detailed the various elements involved in business planning processes and how these should be structured.

How many pages should a nonprofit business plan be?

Business plans don’t have to be excessively long. Remember that concise communication is optimal. As a rule of thumb — and this will vary depending on the complexity and size of your business plan — a nonprofit business plan is typically between seven and thirty pages long.

What is a nonprofit business plan called?

A nonprofit business plan is called just that — a ‘nonprofit business plan.’ You may think that its nonprofit element makes it very different from a profit-oriented plan. But it is essentially the same type of document.

What is the best business structure for a nonprofit?

The consensus is that a corporation is the most appropriate and effective structure for a nonprofit business.

How do you start a nonprofit with no money?

Creating a business plan and approaching potential investors, aka donators, is the best way to start a nonprofit business if you don’t have the funds yourself.

Send this article to someone who’d like it.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

13 min. read

Updated May 10, 2024

Believe it or not, creating a business plan for a nonprofit organization is not that different from planning for a traditional business.

Nonprofits sometimes shy away from using the words “business planning,” preferring to use terms like “strategic plan” or “operating plan.” But, the fact is that preparing a plan for a for-profit business and a nonprofit organization are actually pretty similar processes. Both types of organizations need to create forecasts for revenue and plan how they’re going to spend the money they bring in. They also need to manage their cash and ensure that they can stay solvent to accomplish their goals.

In this guide, I’ll explain how to create a plan for your organization that will impress your board of directors, facilitate fundraising, and ensures that you deliver on your mission.

- Why does a nonprofit need a business plan?

Good business planning is about setting goals, getting everyone on the same page, tracking performance metrics, and improving over time. Even when your goal isn’t to increase profits, you still need to be able to run a fiscally healthy organization.

Business planning creates an opportunity to examine the heart of your mission , the financing you’ll need to bring that mission to fruition, and your plan to sustain your operations into the future.

Nonprofits are also responsible for meeting regularly with a board of directors and reporting on your organization’s finances is a critical part of that meeting. As part of your regular financial review with the board, you can compare your actual results to your financial forecast in your business plan. Are you meeting fundraising goals and keeping spending on track? Is the financial position of the organization where you wanted it to be?

In addition to internal use, a solid business plan can help you court major donors who will be interested in having a deeper understanding of how your organization works and your fiscal health and accountability. And you’ll definitely need a formal business plan if you intend to seek outside funding for capital expenses—it’s required by lenders.

Creating a business plan for your organization is a great way to get your management team or board to connect over your vision, goals, and trajectory. Even just going through the planning process with your colleagues will help you take a step back and get some high-level perspective .

- A nonprofit business plan outline

Keep in mind that developing a business plan is an ongoing process. It isn’t about just writing a physical document that is static, but a continually evolving strategy and action plan as your organization progresses over time. It’s essential that you run regular plan review meetings to track your progress against your plan. For most nonprofits, this will coincide with regular reports and meetings with the board of directors.

A nonprofit business plan will include many of the same sections of a standard business plan outline . If you’d like to start simple, you can download our free business plan template as a Word document, and adjust it according to the nonprofit plan outline below.

Executive summary

The executive summary of a nonprofit business plan is typically the first section of the plan to be read, but the last to be written. That’s because this section is a general overview of everything else in the business plan – the overall snapshot of what your vision is for the organization.

Write it as though you might share with a prospective donor, or someone unfamiliar with your organization: avoid internal jargon or acronyms, and write it so that someone who has never heard of you would understand what you’re doing.

Your executive summary should provide a very brief overview of your organization’s mission. It should describe who you serve, how you provide the services that you offer, and how you fundraise.

If you are putting together a plan to share with potential donors, you should include an overview of what you are asking for and how you intend to use the funds raised.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Opportunity

Start this section of your nonprofit plan by describing the problem that you are solving for your clients or your community at large. Then say how your organization solves the problem.

A great way to present your opportunity is with a positioning statement . Here’s a formula you can use to define your positioning:

For [target market description] who [target market need], [this product] [how it meets the need]. Unlike [key competition], it [most important distinguishing feature].

And here’s an example of a positioning statement using the formula:

For children, ages five to 12 (target market) who are struggling with reading (their need), Tutors Changing Lives (your organization or program name) helps them get up to grade-level reading through a once a week class (your solution).

Unlike the school district’s general after-school homework lab (your state-funded competition), our program specifically helps children learn to read within six months (how you’re different).

Your organization is special or you wouldn’t spend so much time devoted to it. Layout some of the nuts and bolts about what makes it great in this opening section of your business plan. Your nonprofit probably changes lives, changes your community, or maybe even changes the world. Explain how it does this.

This is where you really go into detail about the programs you’re offering. You’ll want to describe how many people you serve and how you serve them.

Target audience

In a for-profit business plan, this section would be used to define your target market . For nonprofit organizations, it’s basically the same thing but framed as who you’re serving with your organization. Who benefits from your services?

Not all organizations have clients that they serve directly, so you might exclude this section if that’s the case. For example, an environmental preservation organization might have a goal of acquiring land to preserve natural habitats. The organization isn’t directly serving individual groups of people and is instead trying to benefit the environment as a whole.

Similar organizations

Everyone has competition —nonprofits, too. You’re competing with other nonprofits for donor attention and support, and you’re competing with other organizations serving your target population. Even if your program is the only one in your area providing a specific service, you still have competition.

Think about what your prospective clients were doing about their problem (the one your organization is solving) before you came on this scene. If you’re running an after-school tutoring organization, you might be competing with after school sports programs for clients. Even though your organizations have fundamentally different missions.

For many nonprofit organizations, competing for funding is an important issue. You’ll want to use this section of your plan to explain who donors would choose your organization instead of similar organizations for their donations.

Future services and programs

If you’re running a regional nonprofit, do you want to be national in five years? If you’re currently serving children ages two to four, do you want to expand to ages five to 12? Use this section to talk about your long-term goals.

Just like a traditional business, you’ll benefit by laying out a long-term plan. Not only does it help guide your nonprofit, but it also provides a roadmap for the board as well as potential investors.

Promotion and outreach strategies

In a for-profit business plan, this section would be about marketing and sales strategies. For nonprofits, you’re going to talk about how you’re going to reach your target client population.

You’ll probably do some combination of:

- Advertising: print and direct mail, television, radio, and so on.

- Public relations: press releases, activities to promote brand awareness, and so on.

- Digital marketing: website, email, blog, social media, and so on.

Similar to the “target audience” section above, you may remove this section if you don’t promote your organization to clients and others who use your services.

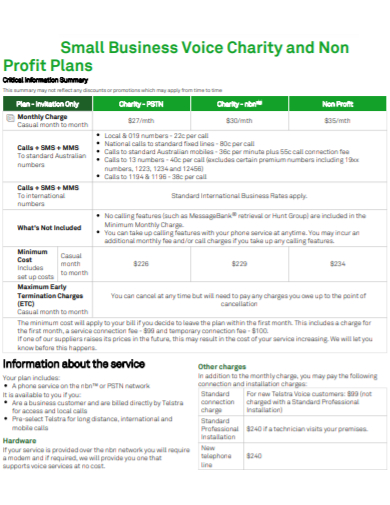

Costs and fees

Instead of including a pricing section, a nonprofit business plan should include a costs or fees section.

Talk about how your program is funded, and whether the costs your clients pay are the same for everyone, or based on income level, or something else. If your clients pay less for your service than it costs to run the program, how will you make up the difference?

If you don’t charge for your services and programs, you can state that here or remove this section.

Fundraising sources

Fundraising is critical for most nonprofit organizations. This portion of your business plan will detail who your key fundraising sources are.

Similar to understanding who your target audience for your services is, you’ll also want to know who your target market is for fundraising. Who are your supporters? What kind of person donates to your organization? Creating a “donor persona” could be a useful exercise to help you reflect on this subject and streamline your fundraising approach.

You’ll also want to define different tiers of prospective donors and how you plan on connecting with them. You’re probably going to include information about your annual giving program (usually lower-tier donors) and your major gifts program (folks who give larger amounts).

If you’re a private school, for example, you might think of your main target market as alumni who graduated during a certain year, at a certain income level. If you’re building a bequest program to build your endowment, your target market might be a specific population with interest in your cause who is at retirement age.

Do some research. The key here is not to report your target donors as everyone in a 3,000-mile radius with a wallet. The more specific you can be about your prospective donors —their demographics, income level, and interests, the more targeted (and less costly) your outreach can be.

Fundraising activities

How will you reach your donors with your message? Use this section of your business plan to explain how you will market your organization to potential donors and generate revenue.

You might use a combination of direct mail, advertising, and fundraising events. Detail the key activities and programs that you’ll use to reach your donors and raise money.

Strategic alliances and partnerships

Use this section to talk about how you’ll work with other organizations. Maybe you need to use a room in the local public library to run your program for the first year. Maybe your organization provides mental health counselors in local schools, so you partner with your school district.

In some instances, you might also be relying on public health programs like Medicaid to fund your program costs. Mention all those strategic partnerships here, especially if your program would have trouble existing without the partnership.

Milestones and metrics

Without milestones and metrics for your nonprofit, it will be more difficult to execute on your mission. Milestones and metrics are guideposts along the way that are indicators that your program is working and that your organization is healthy.

They might include elements of your fundraising goals—like monthly or quarterly donation goals, or it might be more about your participation metrics. Since most nonprofits working with foundations for grants do complex reporting on some of these, don’t feel like you have to re-write every single goal and metric for your organization here. Think about your bigger goals, and if you need to, include more information in your business plan’s appendix.

If you’re revisiting your plan on a monthly basis, and we recommend that you do, the items here might speak directly to the questions you know your board will ask in your monthly trustee meeting. The point is to avoid surprises by having eyes on your organization’s performance. Having these goals, and being able to change course if you’re not meeting them, will help your organization avoid falling into a budget deficit.

Key assumptions and risks

Your nonprofit exists to serve a particular population or cause. Before you designed your key programs or services, you probably did some research to validate that there’s a need for what you’re offering.

But you probably are also taking some calculated risks. In this section, talk about the unknowns for your organization. If you name them, you can address them.

For example, if you think there’s a need for a children’s literacy program, maybe you surveyed teachers or parents in your area to verify the need. But because you haven’t launched the program yet, one of your unknowns might be whether the kids will actually show up.

Management team and company

Who is going to be involved and what are their duties? What do these individuals bring to the table?

Include both the management team of the day-to-day aspects of your nonprofit as well as board members and mention those who may overlap between the two roles. Highlight their qualifications: titles, degrees, relevant past accomplishments, and designated responsibilities should be included in this section. It adds a personal touch to mention team members who are especially qualified because they’re close to the cause or have special first-hand experience with or knowledge of the population you’re serving.

There are probably some amazing, dedicated people with stellar qualifications on your team—this is the place to feature them (and don’t forget to include yourself!).

Financial plan