Home » Pros and Cons » 14 Pros and Cons of a Business Plan

14 Pros and Cons of a Business Plan

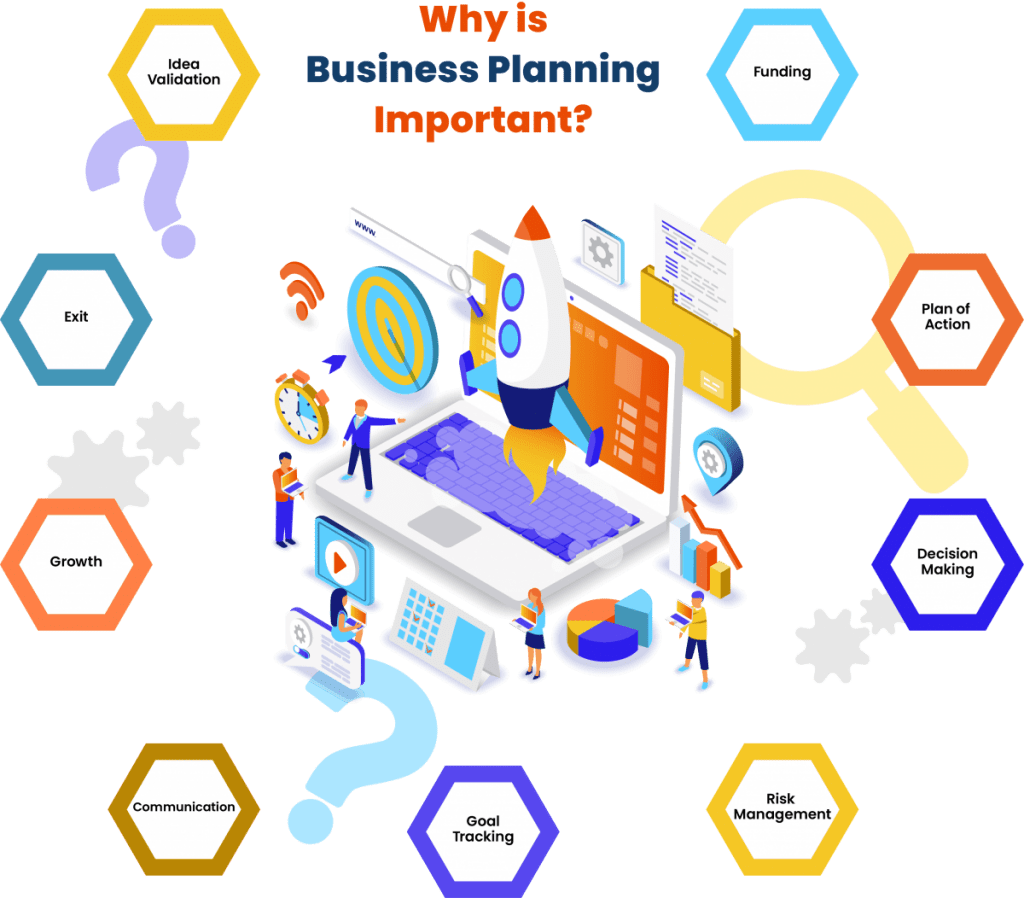

Should you create a business plan? Most people will say that you should have at least some sort of outline that helps you guide your business. Yet sometimes an opportunity is so great that you’ve just got to jump right in and grab it before it disappears. If you want funding or growth to be sustainable, however, there is a good chance that you’ll need to create a business plan of some sort in order to find success. Here are some of the pros and cons of a business plan to consider as you go about the process of creating and then running your business.

What Are the Pros of a Business Plan?

A business plan is a guide that you can use to make money. By understanding what your business is about and how it is likely to perform, you’ll be able to see how each result receive can impact your bottom line. With comprehensive plans in place, you’ll be prepared to take action no matter what happens over the course of any given day. Here are some more benefits to think about.

1. It gives you a glimpse of the future. A business plan helps you to forecast an idea to see if it has the potential to be successful. There’s no reason to proceed with the implementation of an idea if it is just going to cost you money, but that’s what you do if you go all-in without thinking about things. Even if the future seems uncertain, you’ll still get a glimpse of where your business should be.

2. You’ll know how to allocate your resources. How much inventory should you be holding right now? What kind of budget should you have? Some resources that your business needs to have are going to be scare. When you can see what your potential financial future is going to be, you can make adjustments to your journey so that you can avoid the obstacles that get in your way on the path toward success.

3. It is necessary to have a business plan for credit. In order for a financial institution to give you a line of credit, you’ll need to present them with your business plan. This plan gives the financial institution a chance to see how organized you happen to be so they can more accurately gauge their lending risks. Most institutions won’t even give you an appointment to discuss financing unless you have a formal business plan created and operational.

4. A business plan puts everyone onto the same page. When you’re working with multiple people, then you’re going to have multiple viewpoints as to what will bring about the most success. That’s not to say that the opinions of others are unimportant. If there isn’t any structure involved with a business, then people with a differing opinion tend to go rogue and just do their own thing. By making sure that everyone is on the same page with a business plan, you can funnel those creative energies into ideas that bring your company a greater chance of success.

5. It allows others to know that you’re taking this business seriously. It’s one thing to float an idea out to the internet to see if there is the potential of a business being formed from it. Creating a business plan for that idea means you’re taking the idea more seriously. It shows others that you have confidence in its value and that you’re willing to back it up. You are able to communicate your intentions more effectively, explain the value of your idea, and show how its growth can help others.

6. It’s an easy way to identify core demographics. No matter what business idea you have, you’re going to need customers in order for it to succeed. Whether you’re in the service industry or you’re selling products online, you’ll need to identify who your core prospects are going to be. Once that identification takes place, you can then clone those prospects in other demographics to continue a growth curve. Without plans in place that allow you to identify these people, you’re just guessing at who will want to do business with you and that’s about as reliable as throwing darts at a dartboard while blindfolded.

7. There is a marketing element included with a good business plan. This allows you to know how you’ll be able to reach future markets with your current products or services. You’ll also be able to hone your value proposition, giving your brand a more effective presence in each demographic.

What Are the Cons of a Business Plan?

A business plan takes time to create. Depending on the size of your business, it could be a time investment that takes away from your initial profits. Short-term losses might happen when you’re working on a plan, but the goal is to great long-term gains. For businesses operating on a shoestring budget, one short-term loss may be enough to cause that business to shut their doors. Here are some of the other disadvantages that should be considered.

1. A business plan can turn out to be inaccurate. It is important to involve the “right” people in the business planning process. These are the people who are going to be influencing the long-term vision of your business. Many small business owners feel like they can avoid this negative by just creating the business plan on their own, but that requires expertise in multiple fields for it to be successful. A broad range of opinions and input is usually necessary for the best possible business plan because otherwise the blind spots of inaccuracy can lead to many unintended consequences.

2. Too much time can be spent on analysis. Maybe you’ve heard the expression “paralysis by analysis.” It cute and catchy, but it also accurately describes the struggle that many have in the creation of a business plan. Focus on the essentials of your business and how it will grow. Sure – you’ll need to buy toilet paper for the bathroom and you’ll want a cleaning service twice per week, but is that more important than knowing how you can reach potential customers? Of course not.

3. There is often a lack of accountability. Because one person is generally responsible for the creation of a business plan, it is difficult to hold that person accountable to the process. The plans become their view of the company and the success they’d like to see. It also means the business plan gets created on their timetable instead of what is best for the business and since there isn’t anyone else involved, it can be difficult to hold their feet to the fire to get the job done.

4. A great business plan requires great implementation practices. Many businesses create a plan that just sits somewhere on a shelf or on a drive somewhere because it was made for one specific purpose: funding. When a solid business plan has assigned specific responsibilities to specific job positions and creates the foundation for information gathering and metric creation, it should become an integral part of the company. Unfortunately poor implementation has ruined many great business plans over the years.

5. It restricts the freedom you once had. Business plans dictate what you should do and how you should do it. A vibrant business sometimes needs its most creative people to have the freedom to develop innovative new ideas. Instead the average plan tends to create an environment where the executives of the company dictate the goals and the mission of everyone. The people who are on the front lines are often not given the chance to influence the implementation of the business plan, which ultimately puts a company at a disadvantage.

6. It creates an environment of false certainty. It is important to remember that a business plan is nothing more than a forecast based on plans and facts that are present today. We live in a changing world where nothing is 100% certain. If there is too much certainty in the business plan that has been created, then it can make a business be unable to adapt to the changes that the world is placing on it. Or worse – it can cause a business to miss an exciting new opportunity because they are so tunnel-visioned on what must be done to meet one specific goal.

7. There are no guarantees. Even with all of the best research, the best workers, and a comprehensive business plan all working on your behalf, failure is more likely to happen than success. In the next 5 years, 95 out of 100 companies that start-up today will be out of business and many of them will have created comprehensive business plans.

The pros and cons of a business plan show that it may be an essential component of good business, but a comprehensive plan may not be necessary in all circumstances. The goal of a business plan should be clear: to analyze the present so a best guess at future results can be obtained. You’re plotting out a journey for that company. If you can also plan for detours, then you’ll be able to increase your chances to experience success.

Related Posts:

- 25 Best Ways to Overcome the Fear of Failure

- 30 Best Student Action Plan Examples

- 100 Most Profitable Food Business Ideas

- 10 Amazon Pricing Strategies with Examples

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- Write Your Business Plan | Part 1 Overview Video

- The Basics of Writing a Business Plan

- How to Use Your Business Plan Most Effectively

12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 3 Key Things You Need to Know About Financing Your Business

- 12 Ways to Set Realistic Business Goals and Objectives

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- Write Your Business Plan | Part 2 Overview Video

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- Write Your Business Plan | Part 3 Overview Video

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- Write Your Business Plan | Part 4 Overview Video

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- Write Your Business Plan | Part 5 Overview Video

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

12 Reasons You Need a Business Plan Writing a business plan gives you a much better chance for success. But it does open you up to some risks.

By Eric Butow Edited by Dan Bova Oct 27, 2023

Opinions expressed by Entrepreneur contributors are their own.

This is part 4 / 12 of Write Your Business Plan: Section 1: The Foundation of a Business Plan series.

The only person who doesn't need a business plan is the one who's not going into business. You don't need a plan to start a hobby or something you do on the side for fun. But anybody beginning or extending a venture that will consume significant resources of money , energy, or time and that is expected to return a profit should take the time to draft some kind of plan.

Who Needs a Business Plan?

The classic business plan writer is an entrepreneur seeking funds to help start a new venture. Many great companies had their starts in the form of a plan that was used to convince investors to put up the capital necessary to get them underway.

However, it's a mistake to think that only startups need business plans. Companies and managers find plans useful at all stages of their existence, whether they're seeking financing or trying to figure out how to invest a surplus.

Established Firms Seeking Help

Many business plans are written by and for companies that are long past the startup stage but also well short of large-corporation status. These middle-stage enterprises may draft plans to help them find funding for growth just as the startups do, although the amounts they seek may be larger and the investors more willing because the company already has a track record. They may feel the need for a written plan to help manage an already rapidly growing business. A business plan may be seen as a valuable tool to convey the mission and prospects of the business to customers, suppliers, or other interested parties.

Just as the initial plan maps how to get from one leg of the journey to the next, an updated plan for additional funding adds another leg of your journey. It's not unlike traveling from the United States to Paris and then deciding to visit London or Barcelona or both along the way. You would then need to add to, or update, your plans. A business plan can, therefore, address the next stage in the life process of a business.

Related: How To Write A Business Plan

Business plans could be considered cheap insurance. Just as many people don't buy fire insurance on their homes and rely on good fortune to protect their investments, many successful business owners do not rely on written business plans but trust their own instincts. However, your business plan is more than insurance. It reflects your ideas , intuitions, instincts, and insights about your business and its future—and provides the cheap insurance of testing them out before you are committed to a course of action. There are so many reasons to create a business plan, and chances are that more than one of the following will apply to your business.

1. A plan helps you set specific objectives for managers.

Good management requires setting specific objectives and then tracking and following up. As your business grows, you want to organize, plan, and communicate your business priorities better to your team and to you. Writing a plan gets everything clear in your head before you talk about it with your team.

2. You can share your strategy, priorities, and plans with your spouse or partner.

People in your personal life intersect with your business life, so shouldn't they know what's supposed to be happening?

3. Use the plan to explain your displacement.

A short definition of displacement is, "Whatever you do is something else you don't do." Your plan will explain why you're doing what you've decided to do in your business.

4. A plan helps you figure out whether or not to rent or buy new space.

Do your growth prospects and plans justify taking on an increased fixed cost of new space?

Related: Do You Need To Write A Business Plan

5. You can explain your strategy for hiring new people.

How will new people help your business grow and prosper? What exactly are they going to do?

6. A plan helps you decide whether or not to bring on new assets.

How many new assets do you need, and will you buy or lease them? Use your business plan to help decide what's going to happen in the long term and how long important purchases, such as computer equipment, will last in your plan.

7. Share your plan with your team.

Explain the business objectives in your plan with your leadership team, employees, and new hires. What's more, make selected portions of your plan part of your new employee training.

8. Share parts of your plan with new allies to bring them aboard.

Use your plan to set targets for new alliances with complementary businesses and also disclose selected portions of your plan with those businesses as you negotiate an alliance.

9. Use your plan when you deal with professionals.

Share selected parts of your plan with your attorneys and accountants, as well as consultants if necessary.

10. Have all the information in your plan when you're ready to sell.

Sell your business when it's time to put it on the market so you can help buyers understand what you have, what it's worth, and why they want it.

Related: How To Build A Business Plan

11. A plan helps you set the valuation of the business.

Valuation means how much your business is worth, and it applies to formal transactions related to divorce, inheritance, estate planning, and tax issues. Usually, that takes a business plan as well as a professional with experience. The plan tells the valuation expert what your business is doing, when it's doing (or will do) certain things, why those things are being done, how much that work will cost, and the benefits that work will produce.

12. You can use information in the plan when you need cash.

Seek investment for a business no matter what stage of growth the business finds itself in. Investors need to see a business plan before they decide whether or not to invest. They'll expect the plan to cover all the main points.

Bonus: The Benefits for You

If you and/or someone on your team are still skeptical about the benefits of a business plan and how it will benefit you personally, consider some advantages that can help in your day-to-day management:

Your educated guesses will be better. Use your plan to refine your educated guesses about things like potential markets, sales drivers, lead processing, and business processes. Priorities will make more sense. Aside from the strategy, there are also priorities for other factors of your business including growth, management, and financial health. Use your plan to set a foundation for these, then you can revise them as the business evolves.

You'll understand interdependencies. Use a plan to keep track of what needs to happen and in what order. For example, if you have to time a product release to dovetail with your marketing efforts, your business plan can be invaluable in keeping you organized and on track.

You'll be better at delegating . The business plan must make clear who is responsible for what. Every important task should have one person in charge.

Managing team members and tracking results will be easy. The plan is a great format for putting responsibilities and expectations in writing. Then during team member reviews, you can look to your plan to spot the differences between expectations and results so that you can make course corrections.

You can better plan and manage cash flow. A cash flow plan within your overall business plan helps you and your leadership team make better-educated guesses about sales, costs, expenses, assets you need to buy, and debts you have to pay.

Related: How To Craft A Business Plan That Will Turn Investors' Heads

Business Planning Risks

There are risks associated with writing a business plan. That's right: While one of the main purposes of a business plan is to help you avoid risk, the act of creating one does create a few risks as well. These risks include:

The possible disclosure of confidential material. Although most of the people who see your plan will respect its confidentiality, a few may (either deliberately or by mistake) disclose proprietary information. For this reason, you may want to have a nondisclosure agreement, or NDA, signed before sending it to others.

Leading yourself astray. You may believe too strongly in the many forecasts and projects in your business plan.

Related: The Basics Of Writing A Business Plan

Ruining your reputation . . . or worse. If you purposely fill the plan with overly optimistic prognostication, exaggeration, or even falsehoods, you will do yourself a disservice. Some plans prepared for the purpose of seeking funds may run afoul of securities laws if they appear to be serving as prospectuses unblessed by the regulators.

Spending too much effort planning. You then may not have enough energy or time to actually run your business. Some call it "analysis paralysis." It's a syndrome that occurs when you spend so much time planning that you never do anything. For a lot of business people, this is a nonissue—they detest planning so much that there's no chance at all they'd forgo actually doing business and merely plan it.

Business planning can take on a life of its own. It's possible to spend so much time planning a startup that you miss your window of opportunity or to schedule such frequent updates of a plan for an established business that it becomes difficult to administer its other details. Big corporations have large staffs, which can be devoted to year-round planning. As a small business owner, you have to be more selective.

Your planning may be approaching the paralysis stage if you find yourself soothing your nerves about starting a business by delaying the startup date so you can plan more. If you notice yourself putting off crucial meetings so you can dig up more information for a plan update, suspect that planning has become overly important.

Related: What To Include And Not Include In A Business Plan

Diluting the effectiveness of your plan . If you put too much detail into your plan, you run the risk of overburdening anybody who reads it with irrelevant, obscuring details. A plan isn't supposed to be a potboiler, but it should tell a story—the story of your business.

Therefore, it should be as easy as possible to read. That means keeping technical jargon under control and making it readable in one sitting.

Explain any terms that may be unfamiliar to a reader who's not an expert on your industry. And never make the mistake of trying to overawe a reader with your expertise. There's a good chance someone reading your plan will know more than you do. If you come across as an overblown pretender, you can bet your plan will get short shrift.

It's easy to believe that a longer, more detailed plan is always better than a short, concise one. But financiers and others to whom you may send your plan are busy people. They do not have time to plow through an inches-thick plan and may be put off by its imposing appearance. Better to keep it to a couple of dozen pages and stick to the truly important material.

Expediting your plan . While some insist on endless planning, others try to speed up the process. In an effort to get a plan written quickly to show a potential investor, you may find yourself cutting corners or leaving out vital information. You don't want to take forever to prepare a business plan but using some of the business plan software programs can make it so easy that you find yourself letting the programs do more of the work. Remember, the tools are there to guide you and not the other way around. Give yourself enough time to make sure that:

- Each section says what you want it to say.

- All of your numbers add up and make sense.

- You have answers to anything readers could possibly ask you.

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

- How it Works

- Professional Advisors

- Companies & Individuals

- Advanced Knowledge Base

- Lite Knowledge Base

- Samples & Publications

- User Support

The Most Common Business Plan Pitfalls and How to Avoid Them

Recent Posts

- Why is Market Research Crucial?

- Tips for Small Businesses to Conquer Challenges of Remote Work

- Mastering the Art of Marketing: An Introduction to Marketing Plans

- How Can SMEs Leverage Artificial Intelligence (AI) to Drive Growth?

- 6 Cost-Effective Marketing Hacks

Every company benefits from an updated business plan. While it seems necessary for start-ups, it applies to established firms, too. An efficiently written business plan keeps the whole business on track in the process of execution of the company’s strategy and reaching its business goals. Business plan mistakes can result in anything ranging from small oversights to fatal errors for your business. It is even more important for the business who are at the funds raising stage, so the information they provide is accurate and none of your ideas are misleading and are in tune with the current market. To help you avoid your business plan from being discarded, here are some of the critical business plan mistakes to be careful with:

- Long and bulky Executive Summary The readers of business plan such as investors, bank institutions and key vendors start considering your business idea from reading the executive summary. Executive summary is a highlight of the most important items of your business plan in a concise but informative way. It should succinctly describe your compelling story on how a highly skilled team will deliver products or services to precisely defined target markets based on a consistent strategy. Besides, it should state the company’s value proposition on how their products or services will change the life of its customers for the better in a profitable way. In fact, many executive summaries are boring and state some business idea whose execution remains vague. Often, it is presented as just cut and paste of some sections from the introduction and some other parts of business plan. Therefore, there are high chances of the busy investor to move on to the next proposal, if executive summary does not provide a clear, convincing, and persuasive overview of the business.

- Attaching your value proposition to dated technology or dwindling markets When formulating in your business plan the opportunity you see for a product or service, you need to question it and can’t just assume that the idea has automatic demand in the real world. A professionally written business plan will assure you are setting up your business for success. This implies that you must develop a value proposition of your product or service that will change an emerging or existing market. Those markets that are shrinking or are being replaced by new industries will make it incredibly challenging for you to get funding. For instance, what would your reaction be if someone developed waterproof ink for typewriter ribbons? You wouldn’t necessarily be amazed, because the number of people looking to buy something like that is miniscule.

- Not knowing the target audience and segments A product or service that is everything to everyone does not exist. If that were so, we would all be using the same phone. In fact, your product or service is specific and advantageous to an ideal type of customer. Without defining your target market, you cannot reason how you will handle the fierce competition. There are competitors who are providing the same product and service. Investors trust their funds to companies that have completed and gained a complete knowledge of primary and secondary market. You must define your target market and outline how you will target this audience.

- Having unrealistic and aggressive growth projections Having read the executive summary, many investors jump straight to the financial section of the business plan. It is important that the assumptions and projections in this section to be realistic. Plans that show sales forecast, operating margin and revenues that are poorly reasoned, internally inconsistent or simply unrealistic significantly damage the credibility of the entire business plan. In opposite, sober, well-supported financial assumptions and projections communicate operational maturity and credibility. Benchmarking is an especially useful tool to use in your financial analysis. By comparing and basing your projections on the financial performance of public companies within your marketplace, you can prove that your assumptions and projections are achievable. Planium Pro makes your life easier in that regard. Finance section of the Planium Pro’s software provides an easy and quick benchmarking tool for a variety of industries so you can efficiently measure your projections and key ratios against your market averages.

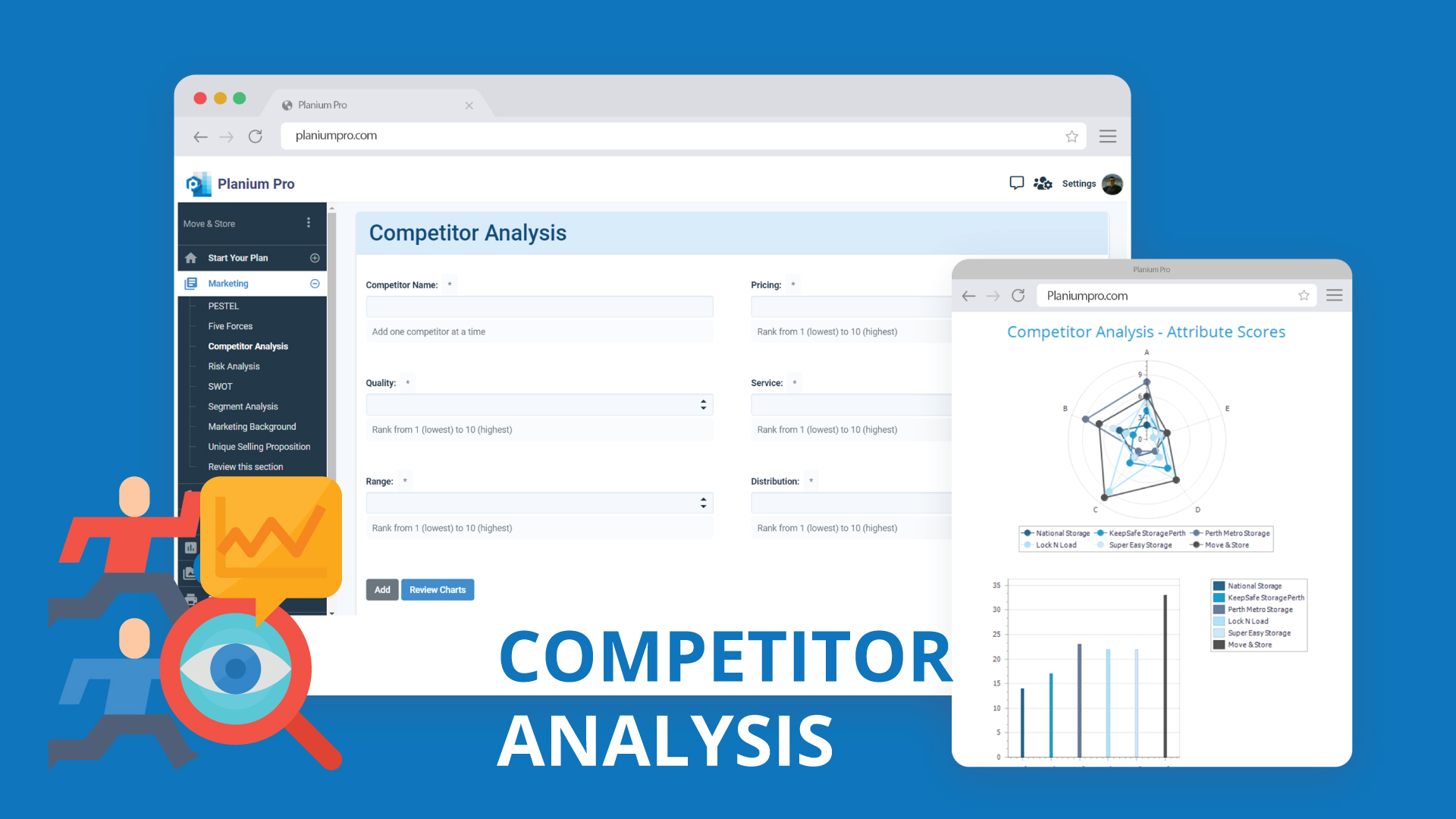

- Acknowledging your competitors, but not researching them Many new businesses are too much inward-focused. Being confident about your product or service is certainly a good attitude. But there is risk that this could twist your idea of how it correlates with products and services of competitors who have been in the market for some time. Besides, quite often entrepreneurs also miss or underestimate the possibility of new entrants who could increase competitive pressure. Our recommendation is to learn as much as you can about the people you’re going up against and perform Competitor Analysis, based on their pricing, quality, service and distribution channels. Knowing this information helps you prepare your own strategy to differentiate your business from theirs.

Next Steps • Keep these critical mistakes in mind when writing your business plan. • If you have already started writing your plan, use Planium Pro software to ease your preparation and streamline the process. Join our Planium Pro to see all the benefits yourself. Read More We would be interested to receive comments from small-business owners on what mistakes you have made in business plan writing and how you fixed them.

Leave a Reply Cancel Reply

Your email address will not be published.

Save my name, email, and website in this browser for the next time I comment.

Planium Pro

For professional & advanced users

Planium Pro Lite

For startup entrepreneur or small business users

Available at the following online bookstores:

Try for free

Business Plan

Who should write a business plan, pros and cons of a business plan, the anatomy of a business plan, .css-uphcpb{position:absolute;left:0;top:-87px;} what is a business plan, definition of a business plan.

A business plan is a strategic document which details the strategic objectives for a growing business or startup, and how it plans to achieve them.

In a nutshell, a business plan is a written expression of a business idea and will describe your business model, your product or service, how it will be priced, who will be your target market, and which tactics you plan to use to reach commercial success.

Whilst every enterprise should have a plan of some sort, a business plan is of particular importance during the investment process. Banks, venture capitalists, and angel investors alike will need to see a detailed plan in order to make sound investment decisions — think of your plan as a way of convincing them your idea is worth their resources.

Roadmapping From A to Z

Business plans can also be useful as a guide to keeping a new business on track, especially in the first few months or years when the road ahead isn’t too clear.

Starting a business isn’t an exact science. Some companies organically develop out of trial and error, while others are plotted out from start to finish.

So if you’re asking whether your company needs a lengthy business plan, the answer would be ‘no’. That said, there are definitely a few situations in which writing a plan makes sense and can help increase the chances of a business becoming successful:

In situations when the market is new and untested — or simply volatile — it can be very helpful to have a business plan to refer back to when the road ahead isn’t clear.

For those who have an exciting business idea but haven’t necessarily distilled it down into black-and-white. Writing a business plan is a great way to look at a concept from all angles and spot any potential pitfalls.

How to write a business plan?

The most important step in writing a business plan is to identify its purpose.

Who are you trying to attract with it, and why?

Here are a few key pointers for writing a business plan:

Are you looking to secure a bank loan, get funding from private investors, or to lure skilled professionals to join you?

Include a brief history of your business, the concept, and the products or services. Keep it professional and transparent.

Don’t exaggerate your experience or skills, and definitely don’t leave out information investors need to know. They’ll find out at some point, and if they discover you lied, they could break off their involvement. Trust is crucial.

Explain what the product or service your business offers in simplistic terms.

Watch out for complex language and do whatever you can to prevent readers from becoming confused.

Focus on the benefits the business offers, how it solves the core audience’s problem(s), and what evidence you have to prove that there is a space in the market for your idea. It’s important to touch on the market your business will operate in, and who your main competitors are.

Another essential aspect of writing an effective business plan is to keep it short and sweet. Just focus on delivering the crucial information the reader has to know in order to make a decision. They can always ask you to elaborate on certain points later.

Still, deciding whether or not a business plan will benefit you at this stage of your venture?

Let’s look at a few reasons why you might (or might not) want to write a business plan.

A business plan will help you to secure funding even when you have no trading history. At the seed stage, funding is all-important — especially for tech and SaaS companies. It’s here that a business plan can become an absolute lifesaver.

Your business plan will maintain a strategic focus as time goes on. If you’ve ever heard of “mission creep”, you’ll know how important an agreed can be — and your business plan serves exactly that purpose.

Having a plan down in black and white will help you get other people on board . Again, with no trading history, it can be hard to convince new partners that you know what you’re doing. A business plan elegantly solves this problem.

Your business plan can cause you to stop looking outward. Sometimes, especially in business, you need to be reactive to market conditions. If you focus too much on your original business plan, you might make mistakes that can be costly or miss golden opportunities because they weren’t in the plan.

A lot of time can be wasted analyzing performance. It’s easy to become too focused on the goals and objectives in your business plan — especially when you’re not achieving them. By spending too much time analyzing past performance and looking back, you may miss out on other ways to push the business forward.

A business plan is out of date as soon as it’s written. We all know how quickly market conditions change. And, unfortunately, certain elements in your business plan may have lost relevance by the time you’re ready to launch. But there is another way — by transferring your strategic plan into an actionable roadmap , you can get the best of both worlds. The business plan contains important detail that is less likely to change, such as your mission statement and target audience, and the roadmap clarifies a flexible, adaptable, route forward.

So, you’ve decided to write a business plan — a great choice!

But now comes the tricky task of actually writing it.

This part can be a little frustrating because there is no one-size-fits-all template appropriate for all business plans. The best approach, in fact, is to look at common ingredients of a business plan and pick out the ones that make sense for your venture.

The key elements of a great business plan include:

An overview of the business concept . This is sometimes referred to as an executive summary and it’s essentially the elevator pitch for your business.

A detailed description of the product or service. It’s here that you’ll describe exactly what your core offering will be — what’s your USP , and what value do you deliver?

An explanation of the target audience. You need a good understanding of who you’ll be selling your product or service to, backed up by recent market research.

Your sales and marketing strategy. Now that you know who you’re targeting, how do you plan to reach them? Here you can list primary tactics for finding and maintaining an engaged client base.

Your core team . This section is all about people: do you have a team behind you already? If not, how will you build this team and what will the timeline be? Why are you the right group of people to bring this idea to the market? This section is incredibly important when seeking external investment — in most cases, passion can get you much further than professional experience.

Financial forecasts . Some investors will skim the executive summary and skip straight to the finances — so expect your forecasts to be scrutinized in a lot of detail. Writing a business plan for your eyes only? That’s fine, but you should still take time to map out your financial requirements: how much money do you need to start? How do you plan to keep money coming in? How long will it take to break even ? Remember, cash is king. So you need a cash flow forecast that is realistic, achievable and keeps your business afloat, especially in the tricky first few years.

General FAQ

Glossary categories.

Feedback Management

Prioritization

Product Management

Product Strategy

Roadmapping

Build great roadmaps

Book a demo

Experience the new way of doing product management

ZenBusinessPlans

Home » Business Plan Tips

5 Types of Constraints That May Affect a Business Plan

In everyday language, “constraint” might simply mean any inconvenience, limitation, setback, restriction or fluctuation in capacity. Sometimes it seems like constraints are lurking everywhere. But in Dr. George’s Theory of Constraints, the word “constraint” refers to something very specific.

What is a Business Constraint?

According to Dr George Friedman, a business constraint is anything that interferes with the profitability of a company or business endeavour. Improving profitability requires the removal or reduction of business constraints. Common business constraints include time, financial concerns, management and regulations.

Indeed, every businessperson with a vision of where they are going, and specific strategies and goals to get there, will face challenges or barriers that limit them from achieving success. Most times, when confronted with solving problems or making improvements, business owners or managers feel overwhelmed. They lack the time, money, or resources to correct the problems they are experiencing. They often feel like their hands are tied, and they don’t know where to begin.

In other words, every business operation has something limiting it from reaching its full potential. Note that some of these conditions exist to limit sales or production output. This limit or constraint determines the maximum capacity of the system. Have it in mind that by removing or improving the single constraint, the system is elevated to a higher level of performance.

A business plan needs to be realistic so it is important to set out in detail the constraints that are likely to act as limitations to business activity. Business plans , according to Investopedia, are important documents used to attract investment before a company has established a proven track record. They are also a good way for companies to keep themselves on target going forward.

Even though they are very useful for new businesses, every company is expected to have a business plan . Normally, the plan is reviewed and updated periodically to see if goals have been met or have changed and evolved. Sometimes, a new business plan is created for an established business that has decided to move in a new direction.

There are several constraints that can affect how well a business plan is implemented. The constraints that may affect the implantation of a successful business plan include;

What are the Types of Constraints That May Affect a Business Plan?

Legal constraint.

Have it in mind that when a business is setting up a business plan, it is expected to abide by the laws to ensure that the business will not face any legal action against it. Legal changes tend to happen all the time over the course of a business’ running.

Legal changes can force the business to change the way it operates and also have an impact on how employees have to set up rules to ensure the safety of its employees. Also note that changes to tax laws and minimum wage can have a massive effect on the finance of a business.

The categories that legislation changes fall into are Health and safety. Health and safety can look at how the business is protected against fire and precautions that are taken for various dangers. Examples of laws that may affect these rules are food hygiene, environmental health – weights and measures. Employment laws also changes the way that businesses are allowed to handle employees and regulations that they are expected to follow to ensure that employees are chosen fairly.

Financial Constraint

Note that to implement a business plan with success, having enough money to back up the business plan is imperative. Ideally, there are many things that can be considered as collateral, assets such as your house and car can be used as the backup strength behind your loan.

Banks are more likely to offer loan services to someone who has a good credit history. Funding may not just come from external sources, funding could also come from your own savings and inheritance, this type of finance providing may be a lot safer than taking out a loan as you do not stand to lose personal assets , as you are not in debt to a bank.

Additionally, as part of a successful business plan, considering financial implications is very crucial. Looking at finance required for the startup cost will allow you to analyze how much money you are going to need for start up and running costs.

Technological Constraint

Many customers now opt to use the internet to buy products as it is an easier and more convenient way to shop, in many cases the internet is also cheaper. Businesses have adapted to this change by creating websites to visit and purchase items from. The younger generation prefers to use digital technology to shop online. Older people will perhaps stick to their traditional methods. You must also understand that these changing factors take a toll on businesses too.

Environmental Constraint

The implementation of a business plan can be constrained by a host of factors in the business environment. For instance, legal constraints determine how they produce (e.g. Health and Safety and Product Safety laws). Social constraints determine the tastes and buying patterns of consumers.

For instance, in recent years consumers have turned increasingly to healthy foods as an alternative to ones that are heavily saturated in fats and contain high levels of sugar. During the process of putting together a business plan, you will need to be constantly aware of these environmental constraints and how they alter over time.

You may need to take what is termed an anticipatory approach i.e. to anticipate changes that are likely to take place in the future in the business environment. By anticipating change, businesses are able to adjust the way they operate to be ahead of competitors.

Competitive Constraint

When building a business, it is very much unlikely that you are going to have a product or service that does not already exist. Note that when there are existing similar products to your own this is called competition. Competitors will always have an effect on how much profit your business makes.

Therefore, when marketing your product you must ensure that you are showing how it is better than competitors in the sense of value for money and quality. The strength of the competition is a key constraint on business plan success. Businesses need to position themselves in such a way as to limit the effect of the competition.

Studying business constraints are important to businesses that want to plan ahead. Businesses that take a reactive approach i.e. which only change when or after the environment alters, will be left behind. By anticipating change, businesses are able to adjust the way they operate to be ahead of competitors.

More on Business Plan Tips

How to Identify Strengths & Weaknesses in a Business Plan

- Small Business

- Business Planning & Strategy

- Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Corporate Strategy Tools

How to design an effective business plan, basic dimensions of a marketing plan.

- Measurement Tools for a Sales Plan

- How to Estimate Expected Profit

Writing a strong business plan is easier than you might think because most business plans follow the same basic format. If you are reviewing a plan you've already written or taking a look at one for a friend, knowing how to spot the strengths and weaknesses in the business plan helps you create the most accurate plan.

Look for a Comparative Analysis

When you analyze your competition in a business plan, you should include a comparative analysis, not just a competitive analysis. A competitive analysis looks at your direct competition, while a comparative analysis looks at the indirect competition.

This means a fitness center business plan should include a competitive analysis of other gyms and fitness centers. The plan should also include a comparative analysis of other fitness options people choose instead of going to the gym.

For example, some people don't go to gyms because they jog or play tennis for fitness. A gym business plan should address why people prefer to jog or play tennis (one is solitary, and one is social) and see if they can use those factors to get people to the gym.

Check for a Broad Marketing Approach

Marketing consists of product development, pricing strategies, places of sale and the promotion of a product or service. If a business plan focuses only on the Fourth P of the Four Ps—the marketing mix—it will be weak.

The plan mustn't confine marketing to social media campaigns, advertising, public relations and other promotions. A good business plan should contain separate sections on product development, pricing strategies, distribution channels and promotions.

Anticipate Marketplace Disruption

In addition to analyzing your marketplace as it stands today, your business plan should consider what might happen in the future. You must address new technologies, economic conditions, environmental factors, consumer-buying trends and other factors that might change.

For example, a business plan for a company that makes hard hats for coal miners should address the fact that more and more coal mining is done using machines, not miners, and that environmental laws are making it more difficult for utilities and factories to burn coal. What will that do to the demand for coal miner hard hats in five years?

Reflect Staffing Details

Investors and lenders look at a business plan to see who will be managing the business, according to the U.S. Small Business Administration . If you don't know who will be handling your marketing, IT, sales and other functions, you should at least know what positions your business will have.

A business plan should include an organizational chart that shows the chain of command, who will do what work and who will report to whom. If you can, include job descriptions for the positions you plan to fill.

Analyze Financial Projections

The more you can determine the costs to launch and run your business, the stronger your business plan will be. Budget projections should include not only the cost to make a product but also the expense to run the business and sell the product.

You need to anticipate the overhead you must apply to each unit you sell if you want to know how to price your products to reach specific profits at different sales levels. As sales increase, the overhead cost for each unit decreases, increasing your profit margin. Investors and lenders want to see profit projections using conservative and optimistic forecasts.

Don't forget to include your pre-launch expenses, which have to be paid off during the first year or several, advises Smarty Cents .

- U.S. Small Business Administration: Write Your Business Plan

- Smarty Cents: How to Write a Business Plan the Right Way

Steve Milano is a journalist and business executive/consultant. He has helped dozens of for-profit companies and nonprofits with their marketing and operations. Steve has written more than 8,000 articles during his career, focusing on small business, careers, personal finance and health and fitness. Steve also turned his tennis hobby into a career, coaching, writing, running nonprofits and conducting workshops around the globe.

Related Articles

Effects a sales volume increase or decrease will have on unit fixed cost, startup costs for a dog biscuit business, how to develop a marketing plan budget, how to start a cake & candy supply store, do all businesses need a production plan, how to determine overhead and labor rate, what does a beauty supply business plan consist of, how to start a fried dough business, five-year goals for businesses, most popular.

- 1 Effects a Sales Volume Increase or Decrease Will Have on Unit Fixed Cost

- 2 Startup Costs for a Dog Biscuit Business

- 3 How to Develop a Marketing Plan Budget

- 4 How to Start a Cake & Candy Supply Store

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

Disadvantages Of A Business Plan

- by Nmesoma Emmanuel

- August 3, 2023

Table of Contents Hide

#1. false confidence, #2. lack of liberty, #4. time and resources, who should write a business plan, how to write a business plan, advantages of a business plan, disadvantages of a business plan faq, what is the disadvantages of a business plan, what are the advantages of a business plan.

Effective business planning is comprehensive yet adaptable, cognizant of its constraints. By contrast, poor business planning is sloppy and overreaching, putting a small business on the wrong track. In this article, we will talk about both the advantages and disadvantages of a business plan.

A business plan is a strategic document that outlines the business’s or startup’s strategic objectives and how it intends to accomplish them.

In other words, a business plan is a written expression of a business idea. It will detail your business model, your product or service, how it will be priced, who your target market will be, and the strategies you intend to employ to achieve commercial success.

When done properly and effectively, business planning is a priceless tool for charting overall direction and anticipating changes. However, business planning is not a panacea and can occasionally result in the emergence of new problems such as:

Creating a detailed plan for business operations has the potential to instill an unwarranted sense of security. Plans and projections are based on a planner’s or manager’s best guess about how a business will evolve; however, unforeseen circumstances, such as the overall economic climate and the entry of new competitors, will always exist. A business that is rigidly committed to a plan runs the risk of being unable to adapt to new threats or opportunities.

Businesses that are vibrant thrive in part because employees have the freedom and opportunity to be creative. Business planning is typically a top-down process; managers articulate missions and objectives, and employees are tasked with achieving them. This process may not provide employees with sufficient freedom to influence the company’s long- or short-term objectives. This lack of freedom is detrimental to the business, as it deprives itself of exciting new ideas. It is also detrimental to employees, as they miss out on opportunities for engagement.

While effective business planning strives for objectivity in order to produce honest and accurate results, it is nearly impossible to be completely objective and dispassionate when envisioning your business’s future course. Even the most well-intentioned planners’ results may be skewed by wishful thinking. Additionally, a manager or owner with a vested interest in securing financing from a bank or investor may inflate projections intentionally or even subconsciously in order to portray future potential that is likely to attract capital.

Planning a business can be time-consuming and costly. It may necessitate the assistance of outside professionals, such as accountants, lawyers, and marketing experts, and it may divert time away from more immediate benefits, such as short-term problem-solving. Businesses that lack additional funds to spend on professional services or additional time to devote to collecting and interpreting data risk squandering valuable resources on an endeavor whose costs may outweigh its benefits.

Establishing a business is not a precise science. Some businesses grow organically through trial and error, while others are meticulously planned from start to finish.

Therefore, if you’re wondering whether your business requires a lengthy business plan, the answer is ‘no.’ That said, there are a few instances in which writing a plan makes sense and can help increase a business’s chances of success:

- A business plan can be an invaluable tool for securing long-term funding for technology startups with no trading history, such as SaaS companies.

- When entering a new and untested market — or when the market is simply volatile — it can be extremely beneficial to have a business plan to refer to when the road ahead is unclear.

- For those who have an exciting business idea but have not yet refined it to a black-and-white proposition. Writing a business plan is an excellent way to examine a concept holistically and identify potential pitfalls.

The first and most critical step in writing a business plan is determining its purpose. What audience are you attempting to reach with it, and why? The following are some critical points to remember when writing a business plan:

- Are you looking to obtain a bank loan, private investor funding, or to recruit skilled professionals?

- Include a synopsis of your business’s history, concept, and products or services. Maintain a professional and transparent demeanor.

- Exaggerate your experience or abilities, but most importantly, do not omit information that investors require. They’ll discover it eventually, and if they discover you lied, they may withdraw their involvement. It is critical to establish trust.

- Simplify how your business’s product or service works.

- Keep an eye out for convoluted language and do everything possible to keep readers from becoming confused.

- Concentrate on the benefits the business provides, how it solves the core audience’s problem(s), and the evidence you have to demonstrate that your idea has a market opportunity. It’s critical to discuss the market in which your business will operate and who your primary competitors are.

- Another critical component of writing an effective business plan is keeping it succinct. Concentrate solely on delivering the critical information that the reader requires in order to make a decision. They can always contact you later to clarify certain points.

Now let us take a look at the advantages and disadvantages of a business plan.

Advantages & Disadvantages Of A Business Plan

The advantages and disadvantages of a business plan demonstrate that while it is an essential component of a sound business, a comprehensive plan is not always necessary. The purpose of a business plan should be obvious: to analyze the present in order to make an educated guess about the future. You’re charting a course for that business.

A business plan is a road map for generating revenue. By gaining a thorough understanding of your business and its likely performance, you’ll be able to assess the impact of each result received on your bottom line. With comprehensive plans in place, you’ll be prepared to act regardless of what occurs during any given day. Consider the following additional benefits.

- #1. It provides a glimpse into the future.

A business plan enables you to forecast the potential success of an idea. There is no reason to proceed with the implementation of an idea if it is going to cost you money, but that is precisely what happens when you go all-in without considering the consequences. Even if the future appears uncertain, you’ll gain insight into the direction your business should take.

- #2. You’ll have a better idea of how to allocate your resources.

How much inventory should you have on hand at the moment? What budget should you set aside? Certain resources that your business requires will be scarce. When you have a clear picture of your potential financial future, you can adjust your journey to avoid the roadblocks that obstruct your path to success.

- #3. It is necessary to have a business plan for credit.

To obtain a line of credit from a financial institution, you must present them with your business plan. This plan enables the financial institution to assess your organization, allowing them to assess their lending risks. Most institutions will not even schedule an appointment to discuss financing unless you have developed and implemented a formal business plan.

- #4. A business plan brings all stakeholders together.

When you collaborate with multiple people, you’re going to have a variety of perspectives on what will result in the greatest success. That is not to say that others’ perspectives are irrelevant. When a business lacks structure, individuals with divergent viewpoints tend to go rogue and do their own thing. By ensuring that everyone understands the business plan, you can direct those creative energies toward ideas that increase your company’s chances of success.

- #5. It demonstrates to others that you are serious about this business.

It’s one thing to throw an idea out on the internet to see if it has the potential to become a business. By developing a business plan for that idea, you demonstrate that you are serious about it. It demonstrates to others that you believe in its worth and are willing to defend it. You can more effectively communicate your intentions, explain the value of your idea, and demonstrate how its growth can benefit others.

- #6. It’s a simple method for determining core populations.

Whatever business idea you have, it will require customers to succeed. Regardless of whether you’re in the service industry or selling products online, you’ll need to determine who your primary prospects are. After identifying those prospects, you can clone them in other demographics to maintain a growth curve. Without plans in place to identify these individuals, you’re left guessing about who will want to do business with you, which is about as reliable as blindfolded dart-throwing at a dartboard.

- #7. A sound business plan includes a marketing component.

This enables you to determine how your current products or services will be able to penetrate new markets. Additionally, you’ll be able to fine-tune your value proposition, ensuring that your brand has a stronger presence in each demographic.

A business plan is a lengthy process. Depending on the size of your business, this may require an investment of time that reduces your initial profits. While short-term losses may occur while developing a strategy, the ultimate goal is to achieve tremendous long-term gains. For small businesses operating on a shoestring budget, a single short-term loss may be sufficient to force them to close their doors. Here are a few additional disadvantages to consider.

#1. A business plan may prove to be unreliable.

It is critical to involve the “appropriate” individuals in the business planning process. These are the individuals who will have a long-term impact on your business’s vision. Many small business owners believe they can avoid this negative by developing the business plan independently, but this requires expertise in multiple fields. A diverse range of perspectives and input is typically required to create the best possible business plan, as blind spots of inaccuracy can result in a slew of unintended consequences.

#2. An excessive amount of time can be spent on analysis.

Perhaps you’ve heard the phrase “analysis paralysis.” It’s adorable and catchy, but it also accurately describes the struggle many entrepreneurs face when creating a business plan. Concentrate on the fundamentals of your business and how it will expand. True, you’ll need toilet paper for the bathroom and cleaning service twice a week, but isn’t knowing how to reach potential customers more important? Obviously not.

#3. Frequently, there is a lack of transparency.

Because a business plan is typically created by a single individual, it is difficult to hold that individual accountable for the process. The plans become their vision for the company and the level of success they desire. Additionally, it means the business plan is created on their schedule rather than the business’s, and because no one else is involved, it can be difficult to hold their feet to the fire to get the job done.

#4. A strong business plan necessitates strong execution practices.