10 Accounting Problem Solving Skills and How To Improve Them

Discover 10 Accounting Problem Solving skills along with some of the best tips to help you improve these abilities.

Accounting is an important skill for anyone who wants to be financially successful. Without a basic understanding of accounting, it can be difficult to make sound financial decisions. However, even if you have a strong understanding of accounting principles, you may still encounter occasional accounting problems.

When these problems arise, it is important to have strong problem solving skills in order to find a resolution. In this guide, we will discuss some tips for solving accounting problems. We will also provide an overview of some common accounting problems so that you can be prepared in the event that one arises.

Financial Statements

Regulatory filings, revenue projections, account reconciliation, general ledger, business knowledge, problem solving.

Financial statements are important because they provide a snapshot of a company’s financial health. They can be used to make decisions about whether or not to invest in a company, and they can also be used to track a company’s performance over time. Financial statements include the balance sheet, income statement, and cash flow statement.

Payroll is an important skill for accountants because it allows them to process and manage employee compensation and benefits. Payroll processing includes calculating gross wages, deductions, and net wages; preparing payroll tax returns; and managing benefits such as health insurance, retirement plans, and paid time off.

Accountants who can effectively manage payroll can help businesses save time and money. They can also help businesses comply with federal and state tax laws and regulations.

Regulatory filings are important because they are required by law. Companies must file certain documents with government agencies in order to operate. These filings include tax returns, annual reports, and shareholder communications. Failure to file these documents can result in penalties or even the closure of a company.

Regulatory filings are important because they provide transparency. By law, companies must file certain documents with government agencies. These filings are public, which means that anyone can access them. This transparency allows investors and other stakeholders to see how a company is operating.

Revenue projections are important for businesses because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Revenue projections are important because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Account reconciliation is the process of ensuring that all transactions in a company’s books are accurate. This process is important because it helps ensure that the company’s financial statements are accurate and can be relied upon by investors, creditors and other stakeholders.

Account reconciliation involves comparing the company’s books with the records kept by its banks, vendors and other parties with whom it does business. If there are any differences, they need to be investigated and resolved. This process can be time-consuming, but it is important to ensure that the company’s books are accurate.

Compliance is the process of ensuring that you are in compliance with the laws and regulations that apply to your business. It is important for businesses to be compliant because it helps to protect them from penalties and fines. Compliance also helps to build trust with customers and regulators.

To be compliant, businesses need to understand the laws and regulations that apply to them and then take the necessary steps to ensure that they are following the rules. For example, businesses that sell products to consumers need to be aware of the consumer protection laws that apply to them. Businesses that operate in certain industries, such as healthcare, need to be aware of the regulations that apply to them.

General ledger is an important accounting problem solving skill because it is used to track and report financial information for a business. The general ledger is a summary of all of the accounts that make up the financial statements, and it is used to keep track of the money coming in and going out of the business. The general ledger is also used to prepare financial statements, and it is important that the information in the general ledger is accurate and up to date.

Quickbooks is an important skill for anyone in the accounting field. Quickbooks is a software program that helps accountants and business owners keep track of their finances. Quickbooks can help you track invoices, manage payroll, and create financial reports. Quickbooks is a valuable skill because it can save you time and make your job easier.

Business knowledge is important for accounting problem solving because it helps accountants understand the context of the problem they are trying to solve. It also helps them identify the root cause of the problem and develop a solution that will be effective in the real world.

Accounting problem solving often involves looking at a company’s financial statements and trying to identify where the company is spending too much money or where it is making mistakes in its accounting practices. To do this, accountants need to understand the company’s business and the industry in which it operates. They also need to be familiar with the latest accounting standards and best practices.

Problem solving is an important skill for accountants because they often have to solve complex problems. Problem solving requires the ability to identify the problem, gather information, develop a plan and implement the plan. Accountants must be able to think critically and creatively to solve problems.

Problem solving often requires good communication skills. Accountants must be able to explain the problem, gather information and develop a plan with the client. They also need to be able to follow up to make sure the plan is working and to troubleshoot if there are any issues.

How to Improve Your Accounting Problem Solving Skills

1. Understand the basics of accounting If you want to improve your accounting problem solving skills, it is important to have a strong foundation in accounting principles. You should be able to read and understand financial statements, as well as have a working knowledge of payroll, regulatory filings, revenue projections and account reconciliation.

2. Be well-versed in accounting software In order to be an effective problem solver, you need to be well-versed in accounting software. This will allow you to quickly and efficiently find solutions to accounting problems.

3. Stay up-to-date on accounting news and changes It is also important to stay up-to-date on accounting news and changes. This will help you anticipate problems and find solutions more quickly.

4. Be proactive in solving problems When you encounter an accounting problem, it is important to be proactive in solving it. This means taking the time to understand the problem and researching potential solutions.

5. Communicate effectively with your team When you are working on a team, it is important to communicate effectively. This means being clear about what you need from your team members and keeping them updated on your progress.

6. Be organized and efficient When solving accounting problems, it is important to be organized and efficient. This means having a system in place for tracking your progress and keeping your work area tidy.

7. Practice problem solving One of the best ways to improve your accounting problem solving skills is to practice. This can be done by working on practice problems or by taking on small projects in your personal life.

8. Seek out feedback When you are working on solving accounting problems, it is important to seek out feedback. This can be done by asking for feedback from your team members or by seeking out feedback from a mentor.

10 Linguistic Skills and How To Improve Them

10 stakeholder management skills and how to improve them, you may also be interested in..., what does a head coach do, what does a turner construction project engineer do, what does a cracker barrel associate manager do, what does a saw operator do.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- CPA INSIDER

Top soft skills for accounting professionals

Soft skills are key to career advancement. one cpa at the forefront of recruitment and professional development shares tips for boosting these critical skills..

- Professional Development

Communication

- Career Development

As professionals advance in an accounting or finance career, soft skills become increasingly important. In a world that is becoming more digital, computerized, and automated, soft skills can be the differentiator between two employees competing for the same promotion or position.

In fact, in a recent survey reported by the Society for Human Resource Management, 97% of employers stated soft skills were either as important or more important than hard skills. Whether a professional is looking for a new job or seeking a promotion, focusing on and developing soft skills can help employees be more well-rounded and employable professionals.

What I am seeing, for my own team and firmwide working with hiring companies, is the importance placed on various soft skills for accounting and finance professionals, which can help take the company's work to the next level.

For professionals looking to improve their work and their employability, the four soft skills listed below are most prominent.

Time management

Time management is an essential skill for any accounting professional because of not only how deadline-focused the profession is, but also because of the time management discipline required by the large-scale shift to remote work. It can be challenging to avoid procrastination, and it is easier to get off track when working virtually.

Because of accounting's cyclical nature, employees have ample opportunities to hone time management skills. Most significant projects and deliverables will happen at the same time of year, depending on the organization. Here are a few tips I have found to help develop time management skills and stay organized.

Start with leveraging calendars and tasks. Using the organization's digital tools can help move projects along and keep them organized. For example, if working within a team setting, use a shared spreadsheet with colleagues to track each person's responsibilities for month-end close or whatever project the team has prioritized. For sole practitioners, diligently using a calendar can help with keeping on task and meeting deadlines.

Another way to develop time management skills is by talking to managers and colleagues. Ask how they keep their tasks aligned. They might be planning their days in a way that can work with other projects and tasks. CPAs who demonstrate good time management have a leg up both for new employment opportunities and for promotions within their organization.

Critical thinking

Various hiring managers we work with often request that candidates have "strong critical-thinking skills," but what does that mean for the accounting and finance profession? Critical thinking — analyzing problems and finding the causes and solutions to those problems — is a major facet of the accounting profession.

Organizations are constantly facing new financial challenges. Most recently, COVID-19 created a range of challenges for accounting and finance teams to solve. Reallocating funds and cash management, managing payroll changes, reacting to new legal changes to internal reporting practices, and other changes required employees to think critically and creatively to meet organizational needs.

While COVID-19 was unexpected, there are other challenges accounting teams can plan for. What we are seeing most employers ask for is accounting and finance professionals who not only look at the problems of the past and find solutions, but who also can predict problems before they occur. From first glance to final analysis, accounting professionals should look at all the information they have and be able to communicate why something happened and what can be done in the future to plan or account for it.

When working to develop critical thinking skills, I've found it extremely important to first question how and why processes are done the way they are and ask how they can be done better. This "professional skepticism" and general curiosity can help ensure accuracy across all tasks. Professional skepticism will make it easier to ask the right questions and find the "why" instead of just trusting information at face value.

Leveraging other successful accounting professionals' advice can hone critical thinking skills and make any accounting professional a stronger asset to their organization. Webinars, conferences, and networking with other accounting professionals can give insight into what other organizations are doing and offer vendor recommendations, process improvements, and more.

Our recruiters regularly see communication as a top skill for accounting and finance talent. Nearly every function of an organization interacts with the accounting and finance teams. Therefore, professionals need to have exceptional communication skills, both written and verbal. Important projects need to be communicated in an easy-to-understand way to executives and colleagues (especially if they are unfamiliar with accounting or finance terminology) to ensure proper completion.

If accounting and finance professionals have poor communication skills, making clear points, sharing their reports and creating action items from the findings can be difficult.

When working to develop strong communication skills, reach out to a manager for feedback. Have them review emails, reports, and other communication before sending out or sharing.

Ask them if the communication gets the point across and if they believe the end user will understand the report or the solution being communicated. It's important to recognize who your audience is and the best way to present the information.

Avoid using too much jargon and ensure that anyone can understand the information, not just accounting professionals. Along with asking a manager for help, do a self-review of any communication. For written work, read it out loud to catch errors. Hearing versus reading something has a different impact. For oral communication, practice in advance so that the meeting's goal or call is adequately communicated.

Collaboration

Collaboration with teammates and other employees is paramount for accounting professionals. Since accounting and finance teams touch every area of the business, they are expected to work cross-functionally and collaborate well with other employees. Projects that involve other employees — like budgets, cash flow projections, or strategic planning — can be complicated and require a high degree of collaboration.

While entry-level accountants might not lead these projects with other company leaders, they will eventually be expected to meet with teams across the organization, so developing this skill now is crucial for continued growth. Even for sole practitioners who work relatively independently, collaboration is absolutely key while working with clients and any other stakeholders in various projects.

One way I've found helpful in practicing to become a stronger collaborator is spending time before a meeting writing down questions and thoughts to bring to the conversation. Make speaking up in meetings and calls a regular habit, and eventually, it'll become muscle memory. Preparing questions and engaging with the topic will encourage other team members to do the same and create more dialogue and collaboration in the discussions.

— Ryan Chabus , CPA, MBA, is the controller at LaSalle Network, a staffing, recruiting, and culture firm based in the US. To comment on this article or to suggest an idea for another article, contact Drew Adamek, a JofA senior editor, at [email protected] .

Where to find August’s digital edition

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

4 questions to drive your audit technology strategy

Discover how AI can revolutionize the audit landscape. Our report tackles the biggest challenges in auditing and shows how AI's data-driven approach can provide solutions.

FEATURED ARTICLE

Single-owner firms: The thrill of flying solo

CPAs piloting their own accounting practices share their challenges, successes, and lessons learned.

This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Accountants as Problem Solvers

August 01, 2020

By: Linda McCann , DBA, CMA, CPA ; David Horn , CPA ; Jennifer Dosch , CMA

Managers often complain that accounting graduates aren’t prepared for today’s business environment. The complexity of our global economy and the increasing influence of, and reliance on, technology leads to practitioners and instructors questioning if undergraduate accounting programs focus on the right curriculum to prepare students for careers.

One soft skill that can help prepare accounting students for their careers is problem solving. Management accountants need to be able to work cross-functionally to solve problems and provide meaningful analyses. Many colleges, universities, and accrediting bodies in academia incorporate strategic goals requiring curriculum that facilitates problem-solving skills.

As instructors, we teach technical accounting skills by demonstrating and providing practice with accounting concepts and structured problems, which we assess via homework and exams. Teaching soft skills, such as unstructured problem solving, poses greater challenges that are more difficult to incorporate into the curriculum. How can students learn and approach unstructured problem solving?

A SLOW-THINKING APPROACH

Recent scientific discoveries into the brain reveal that humans employ fast and slow thinking to solve problems. The brain especially prefers making decisions and solving problems quickly based on recognized patterns, visual and verbal cues, prior knowledge, routines, familiar preferences, prejudices, and emotions.

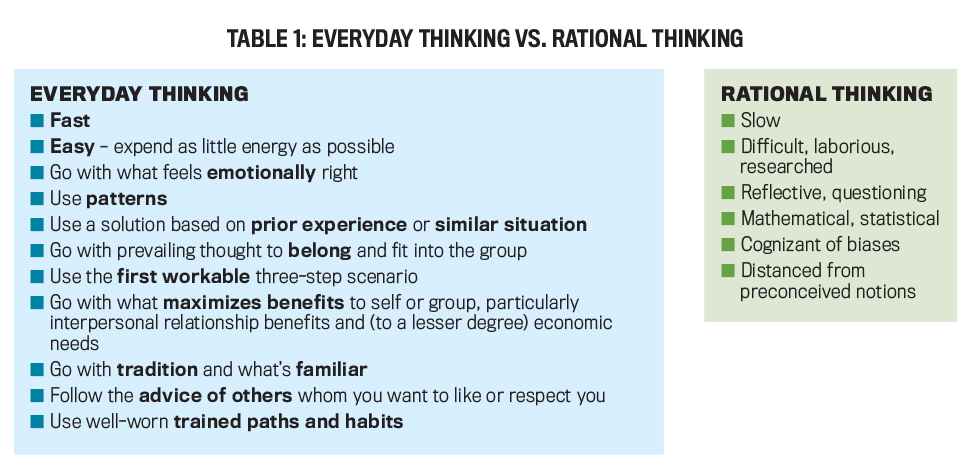

In contrast, decision making and problem solving often require slow thinking to digest new information, hypothesize alternatives, employ quantitative mathematical and statistical analysis, overtly recognize and break free from cognitive biases, challenge preconceived notions, synthesize ideas, and create new knowledge. To support this kind of slow, rational thinking, accountants can learn a methodical process for problem solving (see Table 1).

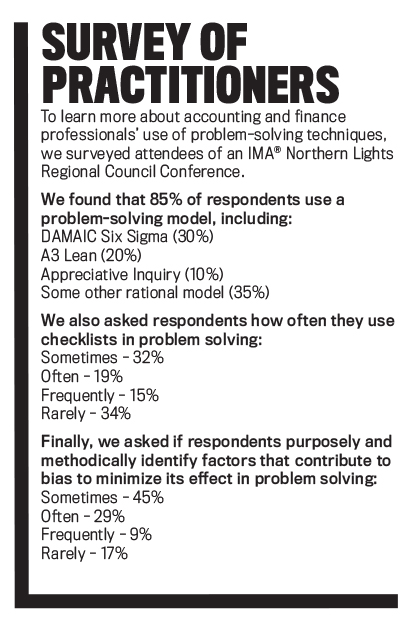

Many common business models—such as Six Sigma, A3 Lean, and Appreciative Inquiry—and the Association of American Colleges and Universities value problem solving, and critical-thinking grading rubrics describe specific steps for rational (i.e., slow thinking) problem solving. Business students, however, learn and apply these models in various courses, typically with no thread that ties them specifically to the accounting profession. Students learn bits and pieces of rational thinking throughout their undergraduate coursework, but instructors often don’t teach a common framework to apply these skills in a relevant and value-added way (see “Survey of Practitioners”).

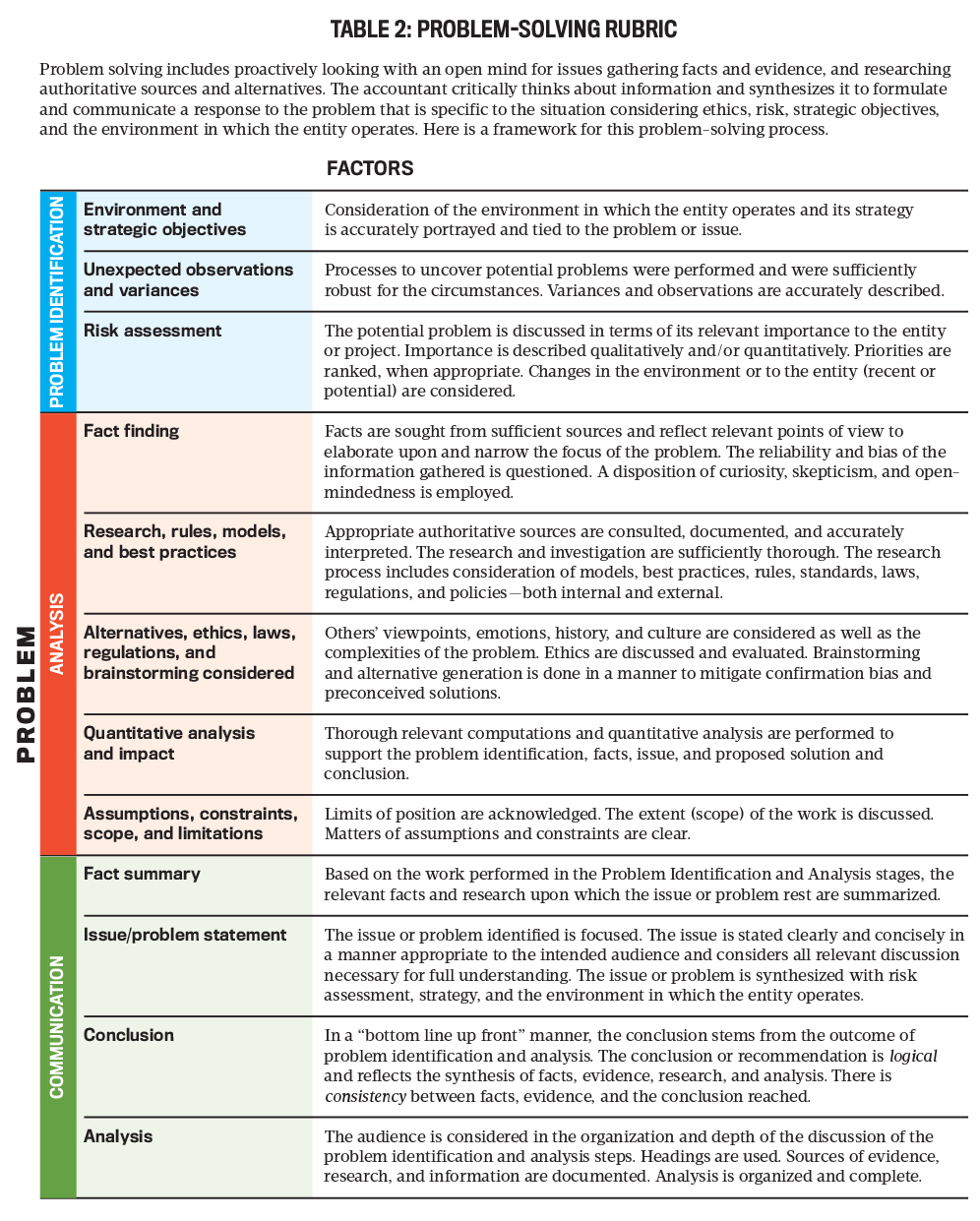

To help address this issue, we developed a problem-solving rubric for accounting students (see Table 2). The three of us are faculty members from Metropolitan State University in Minneapolis/St. Paul, Minn., and represent three different parts of the curriculum (auditing, business taxation, and management accounting), so it was important that it could be used across the entire accounting program.

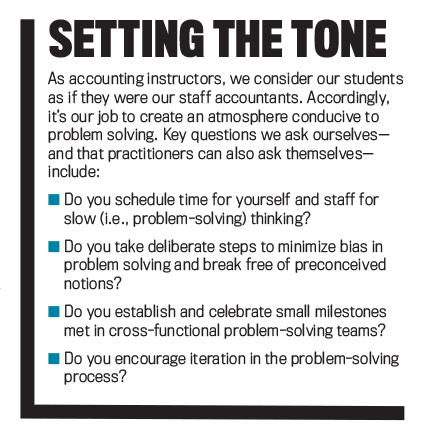

The rubric assesses learning in an organized way, providing a common framework (criteria) for students to consistently approach problem solving. The criteria include problem identification, analysis, and communication of results. It guides students through a series of problem-solving steps using terms and vocabulary specific to the accounting profession. The rubric also reminds us, as instructors, to create a learning environment where problem solving can occur (see “Setting the Tone”).

STEP 1: PROBLEM IDENTIFICATION

The iterative and looping nature of problem solving confounds inexperienced accountants. Where does one begin? Students tell us using a rubric provides a starting point.

To implement the rubric, we assign students projects with unclear goals, incomplete information, and more than one possible solution. Assignment topics vary. It could have students develop a cost-benefit analysis between adding employees or adopting Lean manufacturing techniques, analyze tax outcomes of business decisions, create a risk assessment and audit response for a fictitious client, or some other accounting-related issue.

Students begin by developing one or several hypotheses as to the nature of the problem. To generate ideas, we assist students in their brainstorming discussions. The rubric leads students to consider the environment, strategy, unexpected observations, overall importance, and risk assessment. At this stage, the identified problem may change, but the original hypothesized problem gives direction for next steps. Upon completing the assignment, we assess students on how they identified the problem.

Metropolitan State University’s business taxation course used the rubric in a case study that involves assessing the implication of the Wayfair v. South Dakota U.S. Supreme Court decision on a company’s sales tax collection. Prior to Wayfair , companies operated under a physical presence nexus established in Quill v. North Dakota . The Quill decision required companies to have a physical presence in a taxing jurisdiction in order to require collection and remittance of sales taxes on transactions.

In Wayfair , the U.S. Supreme Court overturned Quill in favor of an economic nexus standard, where companies only needed to have a certain level of economic activity. For example, in South Dakota, the threshold economic activity is 200 transactions or $100,000 in sales. The change from Quill to Wayfair was a major development in how companies operate and collect sales tax. It required companies to assess all jurisdictions in which they operate and evaluate how the change in the nexus standards impact its operations.

To apply this rubric to the change, students learn about a fictitious company that sells inventory to multiple states and collects and remits sales tax under the Quill physical presence nexus standard. We give students a subledger with all sales data for the given year. The rubric leads students to ask about implications of the Wayfair decision on the company, how the ruling impacts the company’s strategic objectives, and risks to the company because of the change in the law. Using the rubric, students are guided to discover the issue at hand, which is whether the company will have a significant number of new sales tax jurisdictions requiring collections and remittance from its customers.

Students tell us that without the rubric, they often feel like they have no road map at the beginning of a project or case study; identifying the problem seems too big and undefined to tackle. Many students initially resist engaging with unstructured problem-solving assignments because they differ from past assignments. Similar to what one might find in cross-functional teams opposed to change, students show their displeasure with crossed arms and distant body language.

Many college courses still rely on testing facts and use formulas and calculations, an approach that doesn’t put the student in the decision-making role but is familiar to them. With a rubric, students see smaller doable steps, where the assignment is heading, and how they can move forward and loop backward, when necessary. The rubric breaks down the initial intimidation students feel with unstructured problems.

STEP 2: ANALYSIS

Next, the rubric guides students through analyzing the problem using accounting-specific skills they’ve acquired in each course. For example, students consider tax laws, financial reporting and audit principles, or cost accounting techniques.

Continuing the sales and use tax example, at this stage, students apply the rubric to perform a complete analysis, enabling them to form a conclusion to communicate. What are the relevant facts to determine Wayfair ’s impact? What facts are irrelevant? What primary and secondary tax authority is needed to conduct research? Are there alternatives and exceptions to applying Wayfair ? Have all states adopted an economic nexus standard? Have all states adopted South Dakota’s transactional thresholds? What’s the quantitative impact to the company? Are there financial accounting implications to the Wayfair decision? What’s the scope of the necessary research, and are there limitations, constraints, and so on? Through the rubric, students formulate and answer questions and perform analysis to solve the problem at hand.

We assess students on their ability to gather and identify relevant facts, research any applicable rules and laws, assess alternatives, and perform any needed qualitative and quantitative analyses. At this stage, students apply theories and best practices learned in specific course fields, such as management accounting, taxation, and auditing.

To encourage elaboration, the rubric uses words such as curious, skeptical, model, assumption, authoritative, best practices, relevant, and sufficient sources. Like many accountants, students want to get their work done quickly, but problem solving takes time and slow thinking. Thanks to the rubric, more students turned in papers with greater depth, less “cut and paste,” and more relevant supporting details.

As in the real world, students often discover their original hypothesis or identified problem is incorrect, incomplete, or irrelevant. They confront the iterative nature of problem solving as they work through the analysis stage and build evidence to support their hypothesis. When evidence doesn’t support an identified problem, students go back and redefine their problem, gather new evidence, explore new alternative solutions, and build a case for their conclusion.

STEP 3: COMMUNICATION

Finally, students present their results in a memorandum to a hypothetical manager or audit partner. The memorandum mirrors common styles, such as IFRAC (issues, facts, rules, analysis, and conclusion) and BLUF (bottom line up front). Students state the problem and include the conclusion (i.e., solution) up front along with a summary of relevant facts and assumptions. Supporting documentation presents additional in-depth analysis.

This format familiarizes students with a presentation style that allows management to quickly understand conclusions while also providing more depth to support the up-front conclusion. We expect students to write and present findings in a clear and concise manner as if in a professional accounting setting. The rubric grading criteria helps students solve problems using rational thinking and delivering a memorandum that directly supports management decision making.

In the Wayfair case study, students draft a memorandum to management addressing the implications of the sales tax nexus precedence change. The facts section should discuss the company’s current sales and use tax policies. Students identify the issue as the change from physical presence nexus to economic nexus. The up-front conclusion should identify new jurisdictions from which the company needs to register and collect sales tax and quantify the volume of sales tax it expects to collect. Finally, the analysis provides an in-depth discussion of the change from Quill to Wayfair . Students should discuss how they determined new jurisdictions, limitations, and further required resources for the company.

PREPARING STUDENTS FOR THEIR CAREERS

We use the rubric format for projects or cases at different stages throughout the accounting curriculum. The problem-solving rubric measures student learning and reinforces rational thinking with each assignment. The projects that use the rubric vary in length, depth, and complexity as students move from management accounting to tax and then finally to audit. We find the rubric flexible enough to adapt to an instructor’s needs, yet it provides consistent core steps—identify the problem, analyze, and communicate—to solve problems.

The rubric helps students organize their communication through the memorandum. Setting up a memorandum so the problem and solution appear “up front” highlights mismatches between the problem, evidence, and conclusion. Further, it encourages students to decide—rather than ramble and include information that isn’t relevant. We find students often get to the communication stage and realize that their analysis doesn’t support their conclusion or identified problem. Fortunately, the rubric allows them to loop back and redefine and reanalyze.

By using the same grading criteria in multiple courses, we provide students with a familiar approach to problem solving that turns fast thinking to slow, rational thinking. The process and steps become routine and less daunting for the student. While each step still requires arduous thinking, the approach itself is a recognized pattern for students.

From our point of view as accounting instructors, the rubric helps provide consistent and fair grading. We provide separate points for milestones in problem identification, analysis, and communication, which further encourages students to go through each step of the process. Metropolitan State University plans to expand the use of this rubric in the accounting curriculum. This common framework provides students with a process to identify problems, research and investigate facts, conduct analyses, and communicate results across all accounting disciplines.

This process reinforces the problem-solving skills that students will need in their professional careers. These capabilities will help them perform their roles in today’s strategic, fast-paced business environment. Solving problems is critical for today’s management accountant. Through implementing the rubric, instructors can help students systematically apply a problem-solving process that they can take with them as they move from student to management accountant.

About the Authors

August 2020

- Strategy, Planning & Performance

- Decision Analysis

- Negotiation

- Metropolitan State University

Publication Highlights

Call for Ethics Papers: Sept. 1 Deadline

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Sign-up to our industry newsletter

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- ACCA Study Hub for learning providers

- Computer-Based Exam (CBE) centres

- ACCA Content Partners

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- The joys of problem solving

- Student e-magazine

Many accountants enjoy problem solving more than number crunching. So what typical problems can you look forward to cracking at work? Iwona Tokc-Wilde reports

Problem solving is something that accountants and finance professionals deal with virtually every working day. In fact, a recent survey by Robert Half shows it is this part of working in the profession that they like best: 41% of accountants say solving problems gives them the most job satisfaction, compared to just 22% who prefer working with numbers.

‘Accountants are usually excellent at dealing with detail and spotting patterns, which makes them good at – and enjoy – problem solving,’ comments Andi Lonnen, founder and director of Finance Training Academy.

If you are at the beginning of your journey into the profession and enjoy tackling problems, you have a head start. Problem solving is also a skill that is one of the 10 most sought-after trainee skills globally (see 'Related links').

Why problem-solving skills are so important

‘The role of accountancy and finance has shifted from a pure focus on fiscal control to one where it has an impact on the business,’ says Phil Sheridan, managing director at Robert Half.

‘The requirement for problem-solving skills is part of this transition as, by mining data and analysing trends, accountants are now translating numbers into actionable insights for the business and are increasingly being seen as strategic partners.’ By putting their data skills and their problem-solving skills to work together, they also help uncover potential areas for concern.

It is vital for accountants in practice to correctly identify, analyse and solve problems too.

‘As trusted advisers, it’s our role to look at everything in detail to pick-up anomalies, patterns and correlations in order to advise our clients on how to take things forward,’ says Shahzad Nawaz of AA Accountants. If they fail to pick up and analyse problems correctly, the accounts could be wrong.

‘This means the business owner would be relying on incorrect data, which could have a detrimental effect on the future of the business. And, of course, if external stakeholders are relying on the data, then we could potentially be misleading them too.’

Incorrect accounts could also have other serious knock-on effects.

‘If the accounting figures are incorrect, then the tax payments relating to the company will be incorrect too. Later on, the client could find themselves with additional tax to pay – with interest,’ says Tanya Addy of BHP Chartered Accountants.

‘Inaccurate accounting can also land businesses in serious commercial difficulties especially if, as a result, directors/owners have been taking more salary or dividends from the business than they were entitled to. In the worst case scenario, it could even lead to closure of the business.’

Problem solving at work

There are many areas where trainee and new accountants can practise solving problems, depending on the job you are doing.

‘If it’s accountancy, you’ll be looking at helping a business with cash flow, debtors and improving their record-keeping,’ says Nawaz.

At the nitty-gritty level, you will be reconciling control accounts, trying to understand why an account might not be balancing and investigating and clearing old items on reconciliations.

‘The work to balance an account involves finding out what the problem is and then resolving it, for example identifying and correcting transposition errors,’ says Lodden.

If you work in tax, you’ll be involved in advising a client on how much tax they will need to pay (and how much tax they can save) in a particular year.

‘This will require a review of the information provided by the client, such as bank statements and expenses, analysing which expenses incurred are allowable and disallowable for taxation, quantifying the results and communicating them to the client and to tax authorities,’ explains Carolyn Napier, senior ACCA tutor at London School of Business and Finance.

You will also be dealing with tax implications, and tax cost for both employer and employee, of providing benefits.

‘You will need to ascertain which benefits are taxable and which are tax-free, and then you’ll need to "solve the problem" of which tax or taxes are due and payable, and by what date,’ says Napier.

In industry, you may be given the opportunity to help analyse projects, and communicate your findings to various parts of the business.

‘This is where new and trainee accountants will need to be prepared to utilise their problem-solving skills – noting anomalies and seeking clarification on areas of uncertainly will ensure that a clearer picture can be obtained,’ says Sheridan.

Deborah Adigun-Hameed is an accountant and junior financial analyst at BlueBay Asset Management. By utilising her problem-solving aptitude and skills, she has been involved in major decisions that shape the company she works for.

‘I’ve contributed to key strategic discussions about which market and products are profitable, what we should be selling and how we compare with our competitors,’ says Adigun-Hameed.

‘I may be newly qualified, but my informed opinions and advice are really valued by the management.’

Both in practice and in industry, accountants are also increasingly called upon to help solve technology problems – for example, when a business intends to implement new business software solutions. They help with the evaluation and selection of a solution, and with planning and execution of the implementation process. They also assist in testing the new system and facilitate going live when the system is ready.

Hone your problem-solving skills

Problem solving is about using logic and your technical expertise to assess a situation and to come up with a workable solution. It is connected to other skills such as level-headedness and resilience, analytical skills and good teamworking skills.

It also requires creativity, which is best learnt through collaboration – brainstorming with others to clarify the problem, generate ideas and create as many potential solutions as possible. When putting forward ideas, be confident in your contributions.

‘Everyone, including those newly-qualified, has something to offer,’ says Adigun-Hameed. ‘Always think outside of the box, as cliché as that may sound. No new idea is insignificant. Innovation can be incremental; change can be small or radical.’

Improving your listening and communication skills will also make you a better problem solver.

‘Learning to communicate well is vital as you need to build rapport with clients. If you have a good rapport with someone, you are confident to ask questions, which is how you can pin down problems and find answers to those problems,’ says Nawaz.

Above all else, getting practical on-the-job experience is how you can get really good at problem solving.

‘The first control account a trainee tends to tackle and perfect is the bank control account; every trainee accountant has had to look for that 1p difference – as painful as that sounds, it certainly helps you learn,’ says Lauren Burt, client manager at EST Accountants and Tax Advisers.

"Everyone, including those newly-qualified, has something to offer. Always think outside of the box, as cliché as that may sound. No new idea is insignificant. Innovation can be incremental; change can be small or radical" Deborah Adigun-Hameed - BlueBay Asset Management

Related Links

- Top 10 global in-demand skills

- Student Accountant hub

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

Cookie policy

March 19, 2024

Five Essential Soft Skills for Accountants

The landscape of accounting is evolving, and with it, the skill set required for professionals within the field is also extending beyond the mastery of numbers and financial regulations. Today, the integration of accounting soft skills into the professional repertoire of an accountant is not just beneficial but essential for the success and growth of accounting firms. This article delves into five critical soft skills – adaptability, attention to detail, communication, teamwork, and problem-solving – that are paramount for modern accountants. We will explore the significance of these accounting soft skills and explain how to bridge the gap between accounting education and the dynamic demands of the industry.

The Five Essential Accounting Soft Skills

Before diving into the accountant skills that set apart successful accounting professionals today, it’s imperative to understand the landscape in which these skills reside. The accounting industry, marked by rapid technological advancements and shifting regulatory landscapes, demands more than just technical expertise.

The following five essential soft skills—adaptability, attention to detail, communication, teamwork, and problem-solving—represent the bridge connecting traditional accounting education with the dynamic needs of the modern market. These accounting soft skills complement an accountant’s technical abilities and enhance their capacity to navigate the complexities of the profession with finesse and resilience.

Adaptability

In an era where accounting standards, technologies, and client needs are constantly changing, adaptability emerges as a cornerstone skill. Accountants who can swiftly adjust to new software, regulations, and work environments position their firms for resilience and continued relevance. Encouraging a continuous learning and flexibility culture within your team can cultivate this adaptability. This involves regular training sessions, staying abreast of industry trends , and fostering an open mindset towards change.

Attention to Detail

The minutiae in accounting can often be the difference between compliance and costly errors. Attention to detail is, therefore, critical to ensuring accuracy and reliability in financial reporting and analysis. To enhance this skill, accounting firms can implement meticulous review processes, promote a culture of thoroughness, and utilise technology to automate routine checks, allowing accountants to focus on more complex tasks that require a keen eye.

Communication

The ability to articulate complex financial information in a clear, concise manner to clients, team members, and stakeholders is invaluable. Effective communication bridges the gap between technical accounting language and practical business application. Developing this skill involves formal professional communication training and practical experience, such as presenting reports or leading client meetings. Emphasising the importance of active listening is also crucial, as it ensures mutual understanding and fosters stronger relationships.

The collaborative nature of accounting work, from audit engagements to tax preparation, necessitates strong teamwork skills. Accountants must be able to work harmoniously within diverse and sometimes remote teams , contributing to a collective goal while respecting different perspectives and expertise. Building teamwork skills can be facilitated through team-building activities, cross-departmental projects, and emphasising a culture of respect and inclusion within the firm.

Problem-Solving

Accountants often face complex challenges that require innovative solutions. Whether it’s identifying tax savings opportunities, streamlining financial processes, or navigating new regulations, problem-solving skills are essential. Encouraging a problem-solving mindset involves fostering an environment where creativity is rewarded, challenges are viewed as opportunities for learning, and employees feel supported in taking calculated risks.

Further your Accounting Education with INAA

As the accounting profession continues to evolve, so must its practitioners’ skill set. The development of soft skills such as adaptability, attention to detail, communication, teamwork, and problem-solving is no longer optional but a necessity for firms aiming to thrive in a competitive and dynamic industry. By cultivating these skills, accounting firms can enhance their service delivery, strengthen client relationships, and secure a competitive edge in the market. The journey from traditional accountant skills to a more holistic professional capability is both challenging and rewarding, offering a path to greater success and fulfilment in the accounting profession.

Here at INAA , we aim to help professional accounting firms deliver best-in-class services worldwide. If you’re interested in learning more about the current trends within the accounting industry, be sure to look at what INAA can do for you. Apply for your membership today .

Share this post

- Career Management Skills

10 Accounting Skills You Need to Succeed on the Job

Search SkillsYouNeed:

Personal Skills:

- A - Z List of Personal Skills

- Personal Development

- Career Options for School Leavers

- Careers for Graduates

- Developing Your Super-Strengths

- Discovering Your Career Values

- Creating and Exploring Career Possibilities

- Improving Your Career Confidence

- Building A Personal Brand

- Job Crafting and Job Enrichment

- Choosing and Changing Jobs

- Negotiating Within Your Job

- Networking Skills

- Top Tips for Effective Networking

- Personal SWOT Analysis

- Continuing Professional Development

- Setting Up a ‘Side Hustle’

- Career Sectors

- Careers in Business

- Careers in Administration and Management

- Careers in Retail

- Careers in Hospitality and Personal Care

- Careers in Information Technology and Computing

- Careers in Construction

- Careers in Manufacturing

- Careers in Engineering

- Creative Careers: Arts, Crafts and Design

- Creative Careers: Media and Advertising

- Careers in Healthcare

- Careers in Social Work and Youth Work

- Careers in Life Sciences

- Careers in the Third Sector

- Careers Involving Animals, Farming and the Natural World

- Careers in Education

- Careers in Physical Sciences

- Careers in Financial Services, Insurance and Banking

- Careers in Law and Law Enforcement

- Careers in the Armed Forces, Security and Emergency Services

- Careers in Politics and Government

- Careers in Sports

Check out our eBook:

The Skills You Need Guide to Personal Development

- Creative Thinking Skills

- Personal Skills for the Mind

- Emotional Intelligence

- Stress and Stress Management

- Anger and Aggression

- Assertiveness

- Living Well, Living Ethically

- Understanding Sustainability

- Caring for Your Body

Subscribe to our FREE newsletter and start improving your life in just 5 minutes a day.

You'll get our 5 free 'One Minute Life Skills' and our weekly newsletter.

We'll never share your email address and you can unsubscribe at any time.

The accounting industry is expanding rapidly, with massive growth projected over the coming years. The Bureau of Labor Statistics forecast that 142,400 new accounting and auditing jobs will be available by 2024, a growth rate of 11%.

If you're an aspiring accountant, or someone currently working as an accountant, this article will equip you with the skills and knowledge you need to be a part of this rapidly evolving profession.

In recent times, the job of an accountant has evolved from just crunching numbers and hard skills to a career requiring soft skills such as strategic thinking and business acumen.

This article outlines the most valuable skills you should seek to develop to succeed as an accountant.

These ten skills are just a few foundational ones that all accountants should master. Make a note of these points and see which ones resonate with you the most.

1. Effective Communication

In the pathway of learning accounting hard skills, most accountants don’t focus much on soft skills such as effective communication. But having good communication skills can help you achieve far more in your accounting career.

Can you effectively communicate with your co-workers and clients? Are there any areas that need work to improve on this skill set? Effective communication is a vital accounting skill required for success. It can be as simple as the ability to use email tools to improve virtual collaboration.

Especially if you’re a startup , you might have to handle a lot of different aspects of your work along with accounting, and good communication skills will help you in more ways than you think.

The ability to communicate well both in person and in writing will help you get new clients, be better at your job, work well with your colleagues, and ultimately advance professionally.

Additionally, well-developed interpersonal skills are helpful for networking . The first impression is often the one that counts. If you can express yourself freely when meeting new people and establish valuable relationships, you have a great advantage.

Your body language and visual communication play an important role as well. As you grow in your career as an accountant, you will regularly face situations where efficient communication can help you leave a lasting impression and help you professionally.

2. Knowledge of Math and Important Software

How well do you perform in math? This is an accounting skill that not many people would think of, but it can be vital to the job. You need to combine mathematical thinking with good IT management skills to effectively make use of the evolving needs in accounting.

For those who are aiming to become senior-level accountants, it is necessary to be proficient in calculus, probability, statistics, and statistical analysis.

Accountants need to be skilled in dealing with numbers to examine and interpret figures. Even if they use a computer to do the more complex calculation, the skill of understanding the basic principles based on which these tools are operating will take you a long way.

Each business process today functions smoothly with the integration of the right tools. You need to be proficient with the software and tools your organization and industry are using.

Strong accounting skills are crucial to succeed in service charge accounting , ensuring accurate financial management and compliance.

For example, integrating inventory management software with the accounting system ensures that every order, purchase, and business activity is captured in the accounting system. It removes the risks of human errors, resulting in more accurate financial reports.

Some of the essential software and programs an accountant needs to be proficient with are:

Microsoft Excel - for the good old traditional accounting

QuickBooks or similar - for advanced and automated

QuickBooks is one of the top accounting software for small businesses. It is used to track expenses, payroll management, and other vital accounting processes.

It is pretty common to find a company using Quickbooks, and an accountant will probably end up working with it. You can compare QuickBooks Pro and premier to see the differences and how to use each version.

But, since many other alternatives to Quickbooks are surfacing very fast, it is necessary to adjust quickly or learn using more than one program. Your job might also require you to use invoice generator tools, so make sure you have a strong grasp of these as well.

3. Use Emotional Intelligence in Your Line of Work

Emotional intelligence is the ability to understand, use, and manage your own and others’ emotions and impact them positively. This particular ability can help an accountant to collaborate, influence, and build trust with colleagues and clients.

Emotional intelligence (EQ) is becoming an essential skill. In fact, one study found that emotional intelligence is responsible for 58% of job performance, and that 90% of top performers have a high EQ.

An accountant with emotional intelligence can stand out from the crowd and attract new opportunities in his/her career.

Emotional intelligence includes the following abilities:

Self-awareness : The ability to understand oneself, including behavior and emotions.

Self-management and self-regulation : The ability to control emotions and responses.

Self-motivation : The ability to keep oneself motivated, and continuously perform, act, and move toward goals.

Empathy : The ability to feel others’ feelings and relate with them effectively.

4. Learn Persuasion skills

Persuasion is often thought of as the ability to convince others to do what we want. For an accountant, this particular skill can be the ability to gain trust and build a relationship.

Accounting is a highly trust-intensive job and you need to persuade your clients/employer to trust your skills and expertise. It is about self-confidence and the ability to analyze a situation and come up with a plan that people have trust in.

Persuasion can help an accountant in the follows ways:

Control your reputation

Enlist support for controversial decisions

Ensure that accountability is located appropriately

Build alliances that can help you

Help others appreciate your levels of performance

5. Have Great Negotiation Skills

Negotiation skills are vital for accountants. Most people may carry the wrong perception that accountants have to deal only with papers and numbers. While in reality, good negotiation skills help you at each step of the career.

Especially if you’re just starting out, good negotiation skills will help you capture the opportunities you deserve. Whether it is an external negotiation with potential clients or internally with co-workers, negotiation skills determine how successful your interactions with others are.

If you think of it, an accountant is negotiating all the time, for example discussing budgets or dealing with banks and clients’ payments. Good use of negotiation skills can secure some of the best long-term relationships.

Here are some of the things that you can do with good negotiation skills:

- Increase the bottom line

- Build better relationships

- Resolve conflicts

- Enhance communication

6. Knowledge of Data Analysis and Interpretation Skills

Data analysis is the ability to read raw data and present it so that others can easily understand it. Using this, one can draw conclusions and make relevant business decisions.

Each business needs to make data-driven decisions, and it is where data analysis and interpretation skills come into play. Accountants need to work with data to make strategic business decisions and meet client’s demands.

Here are some essential things an accountant can do with data analysis:

Improve business performance : Accountants work in various industries, but each business needs to evaluate its performance and constantly improve it. Accountants can use data analysis to ensure a company is running well, meeting its targets, and constantly improving performance.

Manage risks : Accountants can read data to identify various risk points, and they can use predictive analysis to provide a company with a more clear future.

7. Critical Thinking and Problem-Solving Skills

You might face new challenges and unexpected errors in your accounting career. Playing with numbers is not so easy, after all. Additionally, an accounting practice may focus more on advisory services for clients. This is why a problem-solving attitude is necessary to perform such a job.

Today’s businesses are looking for problem solvers and not only number-crunchers. They want to have people who can analyze different situations and interpret solutions for them.

Critical thinking is the ability to solve problems, add value to data, interpret trends within a business, and overall take a broader commercial outlook that benefits a company. An accountant with this skill can evaluate complicated situations, consider different options, and reach logical conclusions.

Critical thinking can come naturally to people, or it can be developed over time. Here some tips for developing critical thinking:

Take inputs : Try to question how and why you do things the way you used to do.

Look for opportunities : How can you grow and improve? Consider alternative solutions to solve the problem you encounter in your line of work.

Communication : Talk through your reasoning and conclusions with colleagues each time you can.

Independent mindset : Think outside the box and challenge the current state of affairs. Make well-thought-out decisions. A critical thinker should be logical as well as creative.

Knowledge : Improve your knowledge by keeping an open mind for new things. There is always something new to learn that can help to solve problems.

8. Leadership, Management, and Supervisory Abilities

As much as these qualities are self-explanatory, there’s a need to have them ingrained in your work right from the start. Even if you’re just starting your career in accounting, good leadership skills will put you in a position to grow.

Leadership involves a series of skills and qualities, such as:

Organization skills : An accountant needs to manage many tasks and responsibilities and have excellent team management skills . One has to set deadlines, follow them, and, if necessary, use software to manage different tasks like handling transactions, creating reports, and more.

Time-management skill : You need to know the most important things to do for every task in hand, prioritize tasks, and work accordingly.

Adaptability: Industries and technologies are changing and evolving. You have to be able to adapt quickly. An accountant handles different types of clients and accounts, and adaptability helps you make specific decisions for each of them.

Initiative: Part of leadership is to take the initiative and be able to work without supervision while at the same time show you can supervise other people. An accountant has to be able to work with a team and guide them on the way forward.

You might handle the complete finance and accounting department of your organization going forward. Strong leadership skills will prepare you for the journey.

9. Teamwork or Interpersonal Communication Skills (Especially with Clients)

Being an accountant is not anymore just about reporting and working independently on sheets. With businesses becoming more complex, the need to communicate with other accounting departments or even interact with clients to explain accounting insights is rising.

Today, businesses want a strong involvement of the accountant in business processes and decision-making. In fact, they are required to analyze raw data and advise a business decision. As an accountant, you must develop a set of skills that help you in better team management and collaboration like clear communication skills, empathy, and problem-solving.

But, above all, it is vital to work and collaborate with other people within and outside your organization. You have to understand business situations, understand the other party’s needs, and deliver on them. It may involve working with other departments and collaborating with new people on each task.

What are the common challenges of working with other departments? It involves a set of skills to deal with departments with different priorities, people with different personalities, and maybe deal with conflicts between people.

Part of developing a successful skill teamwork to establish and maintain a credible and trusting partnership with colleagues in other departments so that everyone can work on common goals.

10. Attention to Detail

As an accountant, you have a huge financial responsibility on your shoulder. Strong attention to detail will help you avoid mistakes and errors.

It minimizes errors in accounting which could lead to audits and investigations by government agencies. Even a tiny mistake can multiply and lead to significant consequences.

When there are many tasks at hand that you need to work on and even delegate, consider using task management software to effectively track work for your team and for yourself.

Attention to detail is not a natural skill for everyone; yet it is one of the most crucial skills to your success in accounting. The key is to stay as organized as possible.

You could use a note-taking app to help you remember tasks, remove distractions, and do one task at a time. Improving focus can help becoming more detail-oriented and avoid mistakes.

An accountant needs many skills to be successful. It is not just about numbers and correct report formats anymore.

It is necessary to have interpersonal skills such as communication and working with other people, leadership, and attention to detail.

The above points are the most important to focus on for a successful accounting career. Use these and climb the ladder of success in your accounting journey. Good luck!

About the Author

Monica a self-driven person and loves to spend her leisure time reading interesting books that come her way. She is passionate about writing and collecting new books. She believes in hard work and it is her persistence that keeps her doing better. She is a perfectionist and doesn’t let go off things that don’t appear perfect to her. She loves traveling whenever she needs time off of her busy schedule. Her favorite holiday destination is Hawaii.

Continue to: Self-Motivation Writing a Business Case

See also: Managing Money: Budgeting Accounting Skills Every Person Should Know The Skills You Need to Build a Career in Finance

5 soft skills every modern accountant needs

One of your members of staff is a technically brilliant accountant who can crunch numbers and recall complex tax laws with their eyes closed. Yet for some reason, they are not achieving the results you expect. Does this sound familiar?

If it does, it's likely that they are lacking vital soft skills that are essential to perform well in a modern accounting firm.

An accountant can be as technically capable as anyone, but if they are unable to communicate effectively with clients, think on their feet, juggle tasks, or come up with a solution to a client’s complex problem, they will not have the same impact as a less technical, but more rounded accountant.

So what soft skills do you need your team to have?

Karbon surveyed more than 200 accountants from around the globe to find out what they believe the most important soft skills are for modern accountants to posses and master.

These are the top five (including how you can develop these skills across your team).

1. Problem solving

As accounting practices focus more on advisory services and your clients experience increasingly complex and unique problems, all accountants must be equipped to navigate unexpected challenges.

When something goes wrong, which staff members are the ones who complain and who are the ones that take action? The accountants who can think and act on their feet will be of most benefit to your clients, and will become indispensable to your firm.

Developing problem-solving skills amongst your staff

Whenever one of your staff members comes across a problem, make it a requirement that they always come to you with a potential solution, never just the problem on its own.

Even if their solution is ineffective and you don’t put it into action, making sure they come to you with how they'd address the problem will give them no choice but to think critically and on their feet.

2. Time management

Endless lists of tasks, strict deadlines, commitments with clients, and never enough time. This is just a normal day for an accountant, so if one of your staff members is unable to manage their time effectively, their output will be poor. It's that simple.

For an accountant, time management is about more than simply being on time. It refers to having the awareness of how long common processes will take, planning for this amongst your overall workload, and ensuring that no deadline will be missed and no task slips through the cracks.

Developing time management skills amongst your staff

Everyone is different when it comes to managing their time. This skill takes time to develop and each individual needs to find what works best for them.

For those members of your team who struggle most with managing their time, encourage them to:

List and prioritize their tasks each day

Itemize and set due dates for each granular action

Use reminders if they need to

Using a practice management tool with deep workflow management capabilities like Karbon will provide them with the structure to do this.

3. Written communication

The way you communicate sets the tone with how everyone around you perceives you. With email still being the most common way accountants speak with their clients , it should come as no surprise that written communication is seen as one of the most integral communication skills for accounting professionals.

Every member of your team must be able to clearly convey technical information in writing to their clients, in a way that:

Makes sense to the client (without being condescending)

Is friendly and personable, and makes the client feel valued

Developing written communication skills amongst your staff

There's no better way to improve writing skills than by practicing, so encourage your team to write as much as possible.

If your firm’s website has a blog, share the duty of drafting articles across your team. If you have visibility over your team’s emails , keep an eye on those who need to improve in this area and give them extra help or training.

4. Oral communication

Just like written communication, oral communication skills are critical to a successful accounting team.

Everyone on your team should be able to express information and ideas verbally. Mastering what to say and how to say it is one of the biggest steps an accountant can take toward ensuring their client relationships are successful.

Plus, teams that can effectively communicate together will always be more productive.

Developing oral communication skills amongst your staff

Again, practice makes perfect. Give every member of your team the chance to speak to their peers at internal meetings—if you hold staff meetings, rotate who chairs them, or who reports on the latest developments in their department.

You should also bring along junior staff to client meetings regularly, exposing them to important discussions and giving them the chance to voice their opinions.

5. Teamwork

An accounting firm’s success is rarely dependent on one team member doing something all by themselves.

Success is the result of your entire team working toward a common goal. Whether it's a process such as payroll that relies on input from multiple staff members, or increasing your monthly recurring revenue, which relies on each and every team member doing their part.

Accountants who are able to work well and collaborate with others, and help others when needed, are highly sought after. And that's before taking into account the positive effect team players have on your firm’s culture.

Developing teamwork amongst your staff

Do not let signs of great teamwork go unnoticed. If you see a member of staff lend a hand to a co-worker who is snowed under, remember to recognize them. It may sound obvious, but positive reinforcement still goes a long way—for accountants of all ages and levels of experience.

Hire and develop a well-rounded team

When you are recruiting for your next staff member, look for candidates who possess what you deem the most important of these soft skills—not just candidates who are great at the technical skills.

As for your firm’s existing staff, despite what many believe, soft skills can be learned. Just as your team once learned to read a financial statement or lodge a tax return, they can also learn these other skills that are critical if they, and your firm, are to grow.

So it’s important that you invest the time in developing soft skills as well as technical skills.

If you can build your team to include accountants who are well-versed in each of these areas, your accounting practice will grow from strength to strength.

Share this article

Accountant Skills

Learn about the skills that will be most essential for Accountants in 2024.

Getting Started as a Accountant

- What is a Accountant

- How To Become

- Certifications

- Tools & Software

- LinkedIn Guide

- Interview Questions

- Work-Life Balance

- Professional Goals

- Resume Examples

- Cover Letter Examples

What Skills Does a Accountant Need?

Find the important skills for any job.

Types of Skills for Accountants

Technical accounting proficiency, technological adaptability, analytical and critical thinking, regulatory and ethical standards, communication and interpersonal abilities, business acumen and strategic insight, top hard skills for accountants.

Equipping accountants with analytical prowess and technological fluency for precision in financial stewardship and strategic decision-making.

- Advanced Excel and Spreadsheet Proficiency

- Financial Reporting and GAAP Compliance

- Tax Preparation and Planning

- Auditing and Internal Controls

- Financial Forecasting and Analysis

- Accounting Software Proficiency (e.g., QuickBooks, SAP)

- Regulatory Compliance and Tax Law

- Cost Accounting and Inventory Management

- Business Intelligence and Data Analytics

- Blockchain Fundamentals and Cryptocurrency Accounting

Top Soft Skills for Accountants

Empowering accountants with the interpersonal finesse and critical acumen essential for dynamic financial stewardship and client trust.

- Communication and Interpersonal Skills

- Client Relationship Management

- Adaptability and Flexibility

- Problem-Solving and Critical Thinking

- Attention to Detail and Accuracy

- Time Management and Organization

- Integrity and Trustworthiness

- Teamwork and Collaboration

Continuous Learning and Professional Development

- Emotional Intelligence and Empathy

Most Important Accountant Skills in 2024

Advanced data analysis and interpretation, technological proficiency, regulatory compliance and risk management, strategic financial planning, effective communication and reporting, business acumen and industry knowledge, leadership and team collaboration.

Show the Right Skills in Every Application

Accountant skills by experience level, important skills for entry-level accountants, important skills for mid-level accountants, important skills for senior accountants, most underrated skills for accountants, 1. active listening, 2. critical thinking, 3. cultural competence, how to demonstrate your skills as a accountant in 2024, how you can upskill as a accountant.

- Master Advanced Data Analysis Tools: Develop proficiency in data analytics software and tools such as Power BI, Tableau, or advanced Excel features to interpret financial data more effectively and provide strategic insights.

- Stay Current with Regulatory Changes: Regularly update your knowledge of accounting standards, tax laws, and compliance regulations through webinars, courses, and professional publications.

- Expand Expertise in Financial Technologies: Familiarize yourself with the latest fintech innovations, including blockchain, cryptocurrencies, and digital payments, to understand their impact on accounting practices.

- Enhance IT Skills and Cybersecurity Awareness: Improve your understanding of information systems and cybersecurity to protect sensitive financial data and understand the IT controls within your organization or client businesses.

- Obtain Specialized Certifications: Pursue additional certifications such as CMA, CGMA, or CPA specializations to demonstrate advanced competencies and dedication to your field.

- Embrace Automation and AI: Learn how to work with accounting automation tools and artificial intelligence to streamline processes and focus on more strategic tasks.

- Develop Soft Skills: Strengthen communication, leadership, and problem-solving skills to better manage teams, lead projects, and consult with clients on complex financial matters.

- Participate in Professional Accounting Networks: Join accounting forums, associations, and online communities to exchange knowledge, stay informed about industry trends, and build a professional network.

- Focus on Sustainability Accounting: Gain expertise in environmental, social, and governance (ESG) reporting and sustainable finance to meet the growing demand for accountability in corporate sustainability.

- Practice Continuous Learning: Set aside regular time for self-study, reading industry literature, and attending training to ensure your skills remain sharp and relevant.

Skill FAQs for Accountants

What are the emerging skills for accountants today, how can accountants effectivley develop their soft skills, how important is technical expertise for accountants.

Accountant Education

More Skills for Related Roles

Driving financial success by overseeing accurate, efficient accounting operations

Ensuring financial accuracy and compliance, safeguarding business integrity and growth

Balancing financial accuracy with efficiency, ensuring fiscal health and transparency

Navigating complex tax landscapes, ensuring compliance while maximizing savings

Steering financial success with strategic oversight, ensuring fiscal integrity and growth

Driving financial strategies, analyzing market trends for business profitability

Start Your Accountant Career with Teal

- Business Partner

- Strategic Partner

- Problem Solving

- Communication

- Strategic Thinking

- Influencing

Problem Solving Skills For Accountants

Problem solving skills for accountants are so valuable because businesses are full of problems that need solving – and almost all business problems have some kind of financial impact.

Therefore accountants with problem solving skills are highly valuable.

As a technically proficient accountant you understand many technical solutions to finance problems and issues.

You know what complies with the rules, what is possible and what is not.

However there comes a time when you are faced with problems that are difficult, eiether because they aren’t well-formed, are ambiguous or complex.

Complex problems

These are problems where there is no right answer and the issues span multiple disciplines and departments.

Developing problem-solving skills will set you apart from your colleagues, as you will be able to help solve these complex problems.

For instance, you will be a vital resource for developing the finance function.

You’ll also become a valued partner to other non-financial managers.

You will be able to propose solutions that work for you and them.

You can also ensure that they work within the financial constraints that you understand well.

Understanding business problems

The first step is to understand the problem thoroughly. To examine it from every relevant angle and understand it in context.