How to Perform a Sales Analysis (Step-by-Step): Methods & Metrics

Want to achieve your sales goals? Then you have to kiss guesswork and intuition goodbye. Instead, get cozy with regular sales analysis to generate cold, hard data for your team.

Of course, wanting to go steady with data and actually making it happen are two different things. To make it a reality, you have to know what sales analysis is, why it's so beneficial to sales teams like yours, and how to analyze sales metrics and KPIs for your sales strategy .

Keep reading to learn everything you need to know about sales data analysis. That way, you can boost performance —for you and your team—and capture that elusive jena se qua that will turn your competitors green with envy. Let's do this!

What is Sales Analysis?

It's pretty simple: sales analysis is what happens when sales professionals monitor sales data in order to evaluate sales team performance. Doing so can uncover insights about:

- Top-performing products/services

- Underperforming products/services

- Customer behavior and retention

- New sales and market opportunities

- The future outlook of your sales team

When done right, sales analysis can help you run a more efficient and effective sales department now and in the future .

Curious about the total contract value ? Hey there, our article holds the answers.

How Often Should You Perform a Sales Analysis?

Worried you'll come off too strong? You don't want to look desperate. How much is too much? Luckily, the quickest way to sales analysis heart is to spend quality time with it.

In other words, check in regularly. How regularly depends on the sales metrics you need to track, your overall performance, and the type of sales reports you're analyzing.

Your sales goals can also impact how often you should perform sales analysis.

In general, expect to track overarching metrics like net sales and/or deal size on a monthly basis . More specific metrics, like calls or emails sent, should be tracked on a shorter-term basis. Remember to monitor seasonal changes and YoY metrics, whatever your cadence.

What is Included in a Sales Analysis?

Better said: what isn't included in a sales analysis?

Ultimately, what you decide to include in your sales analysis report will depend on your goals. Here are some ideas:

- Sales activity volume

- The ratio of new leads to qualified leads

- Information about your pricing structure

- Data on your social media campaigns

- Current sales trends

- Revenue and costs for a specific period

Along with these things, a clear sales data analytics report will show you what to do with the information. Specific action steps are a vital piece of sales analysis, meaning you can do more with the information you've gathered. Moreover, explore Google Sheets alternatives that may better suit your sales analytics needs, providing enhanced functionalities for improved data management.

What is Sales Analysis Useful For? 4 Irresistible Benefits

Why should sales managers get serious about sales analysis? Two words: the benefits!

Seriously, if you want to see how your team performs against its sales goals—throughout the entire sales cycle—you need to monitor the specific metrics that pertain to them.

They may have unmet demands that will streamline your business processes and benefit you in the long run, including outsourcing needs that cover 3PL warehouse management , manufacturing, offshore or onshore, etc. This is one of the reasons why those metrics must be monitored.

Once you do, you can make better decisions, understand market trends, boost company profits, and improve customer satisfaction. Let's take a closer look:

- Make better decisions: Sales analysis will reveal the real-time success of your sales plan . You can use this information to build a better, data-driven approach.

- Understand market trends: It doesn't matter what you're doing—launching a new product, planning inventory , etc. A sales analysis report will help you uncover hot market opportunities and must-know trends to maximize your efforts.

- Boost company profits: Top sales reps spend more time talking to high-quality leads. Sales analysis will help you identify the best prospects so your team can close more deals. It will also reveal information regarding your non-customers, which can be used to sharpen your sales pitch and personalize future marketing strategies .

- Improve customer satisfaction: Sales analysis will help you understand what customers want and why they buy. These details can be used to forge deeper bonds with your target audience, leading to more upsell and cross-sell opportunities.

Does the idea of sales analysis have you hot and bothered? Great! Now, I'll show you a proven, four-step process you can use to analyze the metrics and KPIs that matter to you.

How to Perform Sales Analysis: A 4-Step Process

You're ready to take the plunge and generate your sales analysis report—but how? Follow this four-step process, and you'll have sales analysis wrapped around your finger quickly!

Step 1: Choose the Right Sales Analysis Method

Different sales analysis methods will allow you to generate various kinds of reports. So, before you do anything else, choose a method that aligns with your sales goals.

Here are seven specific sales analysis reports you need to know about:

- Sales trend analysis: This type of sales analysis looks for patterns in sales data. Use it to track your team's progress toward its goals while understanding sales patterns in specific products, customers, and/or geographies.

- Sales performance analysis: Sales performance analysis is crucial for effective sales performance management . This type of analysis will help you gauge your sales team's performance and evaluate the overall effectiveness of your sales strategy. Utilize it to compare actual results to expected outcomes and make necessary adjustments. Implementing these changes can lead to faster closing times, increased win rates, and a significant boost in revenue growth. (Dive into the world of CRM and its pivotal role in driving revenue growth .)

- Predictive sales analysis: This type of sales analysis is designed to help you predict future risks and opportunities. Use it to create accurate sales forecasts.

- Sales pipeline analysis: This type of sales analysis will help you discover common sales activities prospects go through before they convert. As such, it will give your sales team the context to shorten sales cycles and close more deals.

- Product sales analysis: This type of analysis is perfect for large companies and/or companies with extensive product offerings. It helps them determine which products actually affect their bottom lines. Use it to understand your company's demographics better, pinpoint popular products, and the like.

- Prescriptive analysis: This type of sales analysis will empower your sales reps with knowledge, helping them determine which opportunities to pursue and which to dump like radioactive waste. Use it to increase rep success and team-wide win rates.

- Market research: This type of sales analysis may seem old-fashioned, but it's never gone out of style. To use this technique, survey your customers, research your competitors through web scraping (a technique that automates the process of extracting data from a website ) using curl proxy for greater efficiency and reliability, and read general sales statistics. Once you do, you'll better understand your customer's needs , thereby improving your sales effectiveness.

Step 2: Identify the Specific Information You Need

You've chosen the perfect sales analysis method. It just seems to get you and the sales goals you want to achieve. Congratulations! But your work is far from over…

Now, you need to identify the specific bits of information you need. For example, you might want to measure the impact of your sales training efforts. Or find the top-selling product from a recent marketing campaign. Or determine similarities between repeat customers.

When you know what information you need, you can choose metrics and KPIs to help you acquire, track, and measure it. We'll discuss this a bit more in the next section.

Before we get there, though, we need to talk about timing. What time frames should you collect data for? The answer to that question will depend on the metrics you're tracking, but weekly, monthly, quarterly, and yearly periods are common.

Remember that consistency is essential, regardless of which metrics you monitor. With that in mind, we plan to conduct an analysis more frequently during special promotions.

Step 3: Choose a Sales Analysis Tool and Analyze Your Data

Your sales analysis efforts are going strong! To keep them that way, invest in an analytics tool to help you get the most out of every metric you decide to track. Here are a few ideas:

- Spreadsheets: You gotta love the classics. A spreadsheet tool like Microsoft Excel can help you analyze and interpret your sales data. Just ensure you have sufficient quantity and quality of data before you start. If you don't, you won't be able to make informed decisions that propel your company forward. (Note: sidle up on these report templates to make spreadsheet reporting easier!)

- CRM software: Every sales organization needs a CRM. How else will you store contact information, automate email sequences, and view sales pipelines from one dashboard? Newsflash: your CRM tool can also be used for sales analysis. If you use Close , for example, you can quickly generate reports for any metric or KPI, including detailed pipeline and funnel reports, which will help you with sales forecasting .

- Sales analytics apps: Some tools are entirely dedicated to sales analysis. Chorus.ai , for example, will help you analyze sales calls and pinpoint areas of improvement. Gong.io will help you report on customer interactions and forecast future sales. And Seismic will help you calculate the effect of your sales enablement efforts.

At the end of the day, choose the sales analysis tool to help you accomplish your goals. Look for substance, not style. We all know you'll make better business decisions with the right data analytics tools in your toolbox.

Step 4: Share Your Results with Relevant Stakeholders

Last but not least, you need to present your sales data analysis to key stakeholders.

Unless you’re asked to share the process by which you arrived at your results, only show the main findings. You can use graphs and visuals to help your audience interpret the data. Additionally, employing tools like the revenue growth calculator can be instrumental in visualizing and comprehending complex sales data effectively.

For example, if you lead a sales team and want to share information regarding team performance with your CEO, you might want to include charts around your sales goals, your best-selling products, and your team's revenue and expenses.

Overall, your sales analysis presentations should share actionable insights and be easily understood. They should also end with recommendations to help accomplish this goal.

Seeking sales excellence? Discover the power of challenger selling strategies .

Choosing the Sales Analysis Metrics and KPIs That Matter

At this point, you know exactly how to perform an in-depth sales analysis—follow the four-step process above. Now, you need to choose a few KPIs to monitor.

Here are ten metrics you'll probably end up tracking at some point. This is not an exhaustive list of KPIs. If you want that, check out this article when you're done with it.

1. Monthly Sales Growth

This metric will give you the juicy details on your overall sales revenue. Is it going up, going down, or holding steady? Knowing this will help you better optimize your sales processes.

How to calculate it: (Current month’s performance - Previous month’s performance) / 100

2. Sales Opportunities

This KPI will tell you about the opportunities your sales reps create. It can be used to determine good and bad-fit prospects, which makes it useful for sales prospecting.

How to calculate it: Count the total number of opportunities your sales team creates within a specified period, such as one month, one quarter, or one year.

3. Lead Conversion Rate

This metric will help you understand why and how leads are converted . You can then use this information to design a foolproof customer acquisition plan for your company.

How to calculate it: (Number of leads that converted into opportunity in a given period) / (Number of leads created in this period)

4. Average Conversion Time

This KPI is all about productivity. Track it to determine how long leads can convert into paying customers. You can combine it with other metrics, like lead conversion rate and total sales opportunities, for a handy bird’s eye view of your company's sales pipeline.

How to calculate it: (The sum of all lead conversion times within a specified period) / (Number of lead conversion times included in that period)

5. Monthly Onboarding and Demo Calls Booked

This metric will help you understand the health of your sales funnel. Prospects who make it to the demo and/or onboarding stages of your funnel are likely to convert.

How to calculate it: Count the number of onboarding and demo calls booked in a time period

6. Pipeline Value

This KPI will tell you the revenue you can expect to generate from the sales opportunities in your department's pipeline within a specific time frame.

How to calculate it: (Value of projected sale) x (Percentage of confidence they will close.)

7. Sales Targets

This metric will share historical data regarding team performance. Want to know the amount of revenue generated or the number of product subscriptions sold? This metric will help.

8. Customer Lifetime Value (CLV)

This is an extremely popular KPI —with good reason. Track it to learn how much revenue the average customer generates for your company during their lifetime based on the average deal size and how long your customers stay with you. Then, use it to predict future revenue, make informed decisions about customer acquisition , etc.

How to calculate it: (Average revenue per user) x (Average customer lifetime)

9. Calls and Emails Per Rep

This metric tells you how many calls and emails your sales team makes daily, weekly, and monthly. It can be used to evaluate productivity and identify broken sales funnels.

How to calculate it: Tally up the total number of calls/emails your sales team makes within a specified period of time.

Want to amplify your sales results? Dive into our comprehensive guide on the best sales productivity tools available.

10. New and Expansion Monthly Recurring Revenue (MRR)

These are essential metrics for SaaS companies because they tell them how much revenue they generated this month compared to last month. Brands can then use this information to determine the effectiveness of their sales and marketing teams and help minimize churn.

How to calculate these two metrics:

New MRR = (New customers) x (MRR per new customer)

Expansion MRR = [(Expansion MRR at the end of the month – Expansion MRR at the beginning of the month) / Expansion MRR at the beginning of the month] x 100

Fall in Love with Sales Analysis

Sales analysis reports create accountability, reveal insights about one's customer base , the specific traits top-performing sales reps have… Honestly, they have the power to revolutionize your entire sales and decision-making processes, which is why they deserve your unending love and devotion.

The question is, which tool will you use to generate said reports? Here's my advice: choose Close. Our top-rated CRM platform has all the tools you need to create custom reports and monitor specific KPIs. Even better, you can try it with this 14-day free trial before buying it.

That's right, I'm not asking you to put a ring on our hand just yet. Take us out on a date, see what we offer, and then decide if you want to spend the rest of your life with us. (Or at least the rest of your sales career .) Something tells me we're a match made in heaven!

I want to try Close for free for 14 days . (Say YES!!!)

START YOUR FREE 14-DAY TRIAL

More articles from The Close Blog

Discover our latest free sales tools powered by AI

Learn from the sales pros with our free sales guides.

Sales Analysis: Learn To Zoom In & Master the Pipeline [+Types, Importance]

All companies rely on sales figures to see how they are performing. That said, looking at the revenue generated cannot help pinpoint what’s working (or not).

Without metrics to guide you, it’s hard to make educated and data-driven decisions that will benefit your company now and in the future. This is where sales analysis comes in.

In this blog post, we show you the importance of sales analysis, its types, and how to implement it into your workflows.

We’ll also show you how to ‘read between the lines’ of sales analysis reports and help you draw powerful conclusions and insights.

Table of Contents

What Is Sales Analysis?

Sales analysis assesses, analyzes, and monitors a business’s sales efforts. Sales analysis may include capturing, filtering, and analyzing sales data to evaluate past sales performance and predict future sales figures. Sales analysis aids in making strategic business decisions and developing effective sales tactics and strategies.

Sales analysis often includes the following:

- Sales trend analysis: Sales trend analysis is the process of studying sales data of a business over a specified period to determine and identify patterns, fluctuations, and trends. Trend analysis also involves the analysis of seasonal sales trends, market trend analysis, growth rates, sales forecast analysis, and performance comparisons with previous periods.

- Product performance: This sales analysis reveals the products/services that are performing well and the products/services that are not – and helps focus or redirect efforts more effectively.

- Customer behavior : This analysis helps understand your customers better, including their purchasing behavior, and helps businesses tailor their offerings to suit the customers’ needs.

- Sales channel performance: Channel analysis evaluates how effective various sales channels are – this may include direct, online, physical retail, or even social media.

- Sales force performance: Sales force analysis evaluates the performance of sales teams, regions, departments, and even individuals.

- Market comparison: This involves comparing a business’s sales performance and figures with competitors and industry benchmarks and can provide valuable insights.

Sales analysis leverages various analytical and marketing tools to help visualize complex data and monitor a business’s sales performance. This can then be used to formulate a plan of action. AI and machine learning have revolutionized sales analysis, including advanced sales forecasting, predictive analytics, and more.

It is important to note that sales analysis shouldn’t be dull numbers or dry paragraphs. You can visualize it in the form of bar graphs and charts.

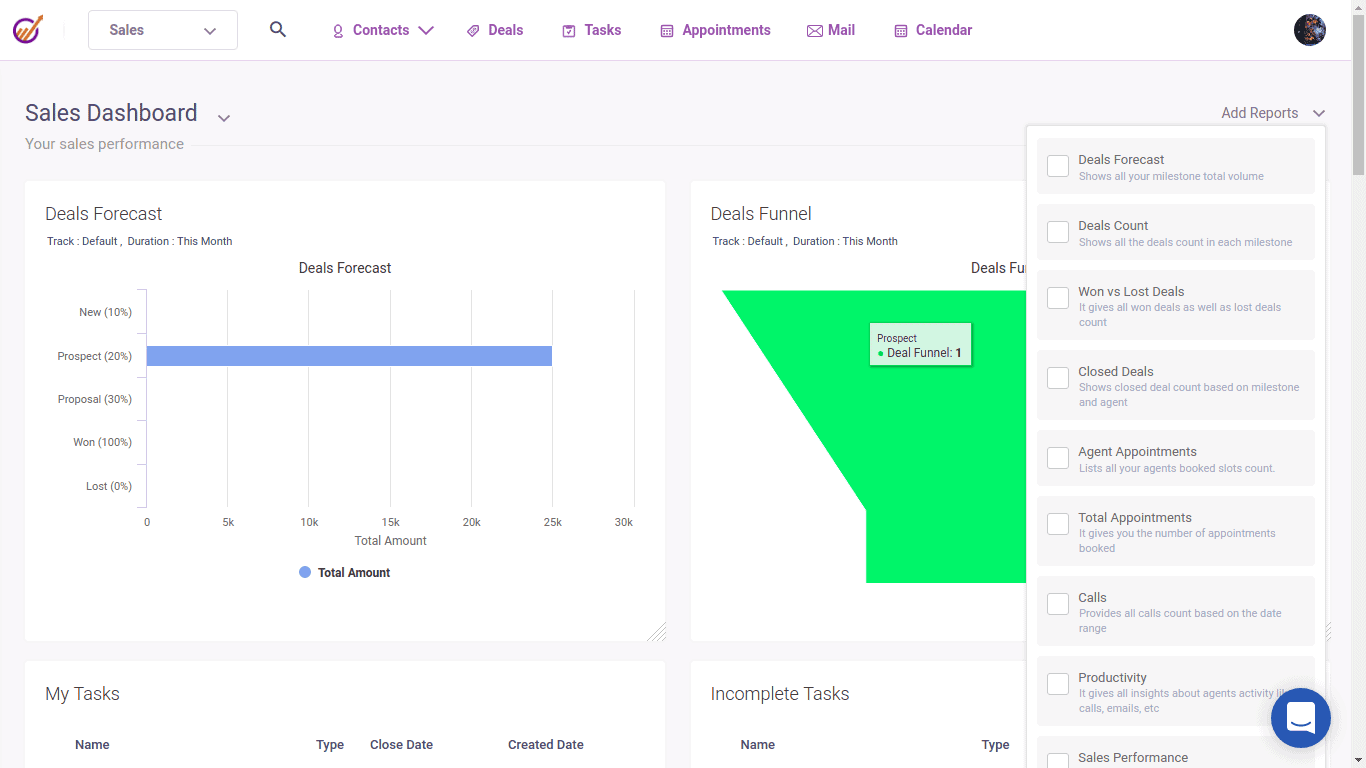

Take a look at this example to see what a sample report might look like:

The above sample sales report shows a handful of metrics your company may begin tracking for your sales reps and sales team going forward.

Here are some other KPIs you need to consider:

- Regional sales

- Average purchase value

- Sales per rep

- Quote-to-close

- Cannibalization rate

- Sell-through rate

- Lead conversion rate

- Product performance

- Sales to date

- Sales opportunities

- Sales targets

- Sales growth

Read Also: 10 Top Sales Analysis Software for Small Business Owners

What Are The Different Types of Sales Analysis?

Now that you have a clearer understanding of sales analytics, let’s talk more about the different types of analysis you can perform to get valuable insight metrics.

Market Research

The first type of sales analysis we’re discussing is quite important.

It’s known as market research or market analysis , where sales professionals and sales managers survey leads and potential customers to gain insights about their behavior and affinity towards your products.

You can do this in person or through online surveys — depending on your business type.

👉Get inspired by the best sales page examples to create high-converting pages – explore our comprehensive guide now! 🌟

Prescriptive Analysis

With prescriptive analytics, you use predictive information to learn more about your potential customers.

This tells you which deals are worth chasing and which are better left behind. Also, for the deals your sales team or sales manager does decide to pursue, they’ll have a good approach ready to make the lead or prospect more receptive to the sale.

Diagnostic Analytics

Using diagnostic analytics, you can better review your company’s current and past sales data to understand less-than-stellar emerging issues.

For example, maybe your new product didn’t sell as well because it came out right before the pandemic. This sales data analysis can help you ideate better ways to reach customers and prospects.

👉Winning at sales isn’t just about closing deals. It’s about managing your leads effectively. Discover how in our comprehensive guide on sales lead management .

Sales Effectiveness Analytics

Who are your most effective sales representatives? S ales data analysis can help you pinpoint your best sales rep/sales reps (and those struggling), and can give valuable information during sales coaching.

As this dictates your company’s ability to win deals, you can use this sales data to optimize your workforce and key tasks.

Read more: Sales Blitz Definition, Example, and Sales Strategy

Product Sales Analytics

The success of your products depends on the actionable insights you gain through product sales analysis. You must conduct sales analyses for all the products you sell regularly.

If certain products have gone beyond their useful life and have underperformed for a while, you might use sales metrics here to decide whether or not to continue the said product.

Sales Pipeline Analytics

If you only had one choice, you’d have to choose this one. That’s how important sales pipeline analytics is.

By studying analytics related to your sales pipeline, you can see how many leads convert to customers, how long they remain customers, who your most qualified leads are, what their money-making potential is, and which sales team member is assigned to work with them.

Use a sales analytics software like EngageBay to streamline your sales pipelines.

Read also: 12 Powerful Sales Growth Strategies (+ Calculations)

Predictive Sales Analytics

If you’re not entirely pleased with the accuracy of your sales pipeline analysis , you may want to supplement the information with predictive sales.

These sales data analytics are automated, so your sales forecasting can give you an accurate glimpse into the future. It’s almost like having a crystal ball!

Predictive sales pipeline analysis is super helpful for companies of any size, from small businesses to Fortune 500s and anything in between.

Read also: Sales Report Template — How and Why to Create One

The Importance of Sales Analysis

Let’s look at what all good sales analysis can do for your business.

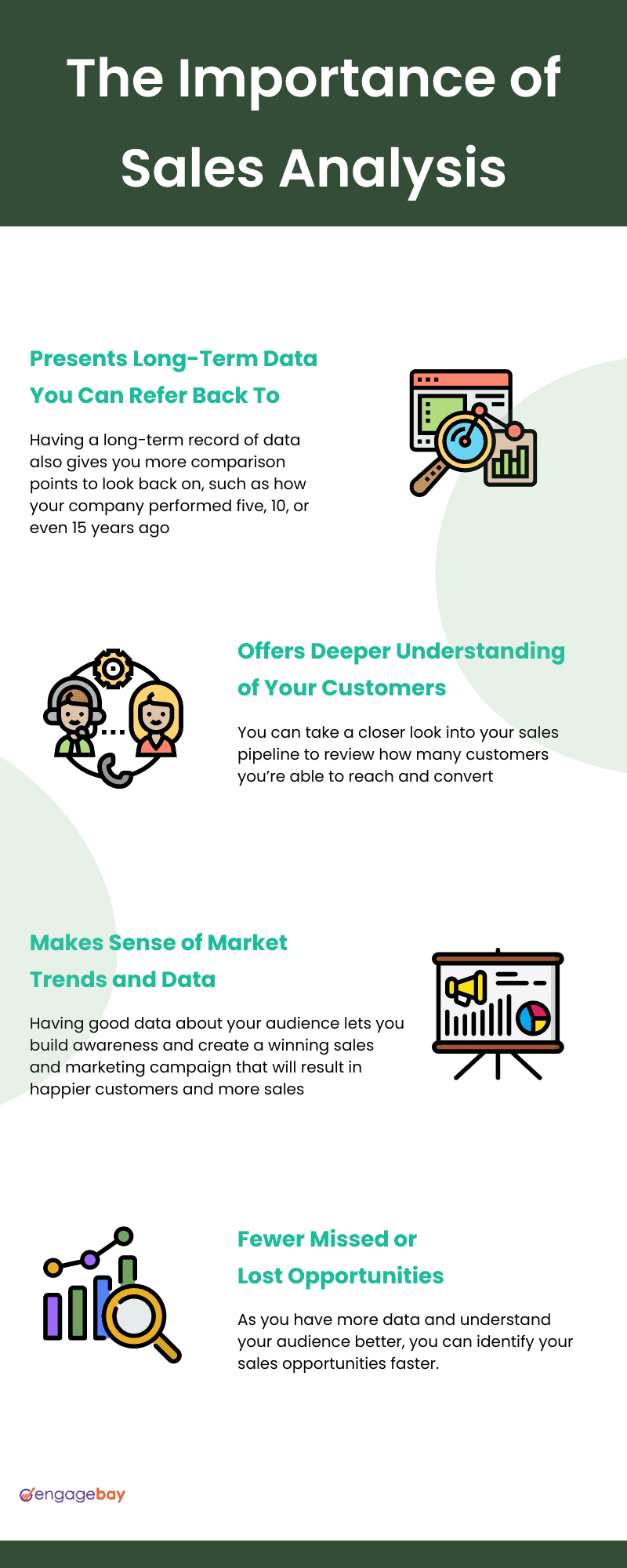

Presents Long-Term Data You Can Refer Back To

For new businesses, sales analytics is indispensable.

As you begin to experience growth in the years ahead, you can express it in specifics — with numbers and stats to back you up — instead of using general terms.

Even if your company has been around for a few years, it’s never too late to start tracking your sales analytics. Having a long-term sales data record also gives you more comparison points to consider, such as how your company performed five, 10, or even 15 years ago.

Related blog: How to Build the Perfect Sales Enablement Strategy?

Offers Deeper Understanding of Your Customers

Does sales data analysis sound too dry to you? Well, what if we refer to it as ‘Customer Analytics?’

You can see which products and services your customers like, as these will be the ones that sell the best. You can also take a closer look into your sales pipeline to review how many prospects and customers you can reach and convert.

Having a pulse on what makes your prospects and customers tick is one of the greatest tasks of any company. If you understand your audience inside and out, you’ll have more conversions and greater sales — and you can retain customers better .

Read also: Breaking the Rules — The Art of Guerrilla Marketing and Why It Works

Makes Sense of Market Trends and Data

In the last section, we mentioned market research as one of the top sales trend analysis methods.

Having good data about your audience lets you craft sales deals that become useful for your company in many ways. For example, before unveiling a new product or service, you can refer to your sales target market data to gauge receptiveness.

This lets you build awareness and create a winning sales and marketing campaign that will result in happier customers and more sales.

Fewer Missed or Lost Opportunities

Why take shots in the dark when you have sales analysis?

Without sales performance analysis, we can guarantee you’re missing out on opportunities — even if your sales team works tirelessly.

As the saying goes: ‘’Work smarter, not harder.’’ Each lost or missed opportunity is money your company loses.

Market research is crucial in reclaiming these lost opportunities. When you know your audience better, you can identify sales opportunities that weren’t otherwise apparent.

Read also: The Sales Analyst Job Description at 25 Top Companies

How to Perform a Sales Analysis Using CRM Tools

To understand your customers, continue selling goods they care about, and predict future market trends, analyze sales forecasts, your company must begin gathering sales data .

Using a customer relationship management (CRM) software like EngageBay, you can perform sales analysis without needing an expensive sales force software.

The sales process involves three simple steps:

Step 1: Determine Which Sales Data Will Go into the Report and Gather the Data

Using the metrics and types of sales analyses covered in this article, determine which sales data is most important to your company at this stage — a crucial stage of the sales process. Metrics can be anything from competitive analysis, net sales, product sale data, revenue, and even Google Analytics data to help you make informed decisions.

Ask yourself some questions during this early yet critical stage of formulating your own sales analysis report based on sales activity:

- Which of your products sells the most?

- Does one product have anything in common with the other? If so, what, and can you replicate it?

- Who are your repeat customers?

- What characteristics or traits do they have in common?

- How much time do you put into your company’s sales training?

Yes, those are a lot of questions you need to answer, but you must take the time to go through them one by one and come up with accurate, data-driven responses.

You don’t necessarily have to do this by yourself, so involve other key stakeholders in your company and your sales and marketing teams .

Once you can answer those all-important questions, you need to determine what your most relevant variables are to meet your sales goals.

Read also: What Is Sales Volume? 8 Strategies to Boost Your Revenue

Step 2: Use a CRM Tool for Evaluating Your Sales Data

Whether your CRM software requires you to manually input your information or import it over, get all the sales data loaded into the program.

You can then draw up an overview of your company’s sales (present and past sales).

Step 3: Send the Report to People Who Matter

Once you get the reports, you can let your marketing, sales, and customer service teams take a look. This can help them tremendously as it offers a roadmap to improve their sales processes.

Read also: 10 Data-driven Marketing Trends You Can’t Ignore

How Do You Analyze Sales Reports?

How do you analyze a sales report ? Here are some tips for making sense of all the information in front of you.

Determine a Relevant Range

Keep the time range in mind when creating your analysis report, so you’re not left to scale a seemingly endless mountain of numbers. Depending on what you need, you can look at quarterly data, or sales data from a year or two back to compare with current benchmarks.

Even if you went overboard in your sales reporting, you can clip the sales data range and present only the dates you want displayed, as this is most relevant to what’s happening in your company now.

👉Want to take your sales game to the next level? Understand the real meaning of strategic selling from our comprehensive guide .

Focus on Certain Sales Metrics

With a dozen or so sales metrics you can track to determine the success of your sales team, it’s easy to feel a little overwhelmed.

Again, there’s no need to present every single sales metric if your stakeholders are only interested in lead conversions or product cannibalization info.

Cherry-picking metrics is all well and good and sometimes even preferable. However, ensure you don’t fall into the trap of only pulling the sales metrics that make your company look great and sweeping the bad metrics under the rug — successful sales leaders warn against doing this.

Failing to paint the whole picture of a poor sales period can cause you to lose business partners, which is almost as bad as losing customers. It’s certainly just as costly.

Read also: Why are Startups Losing Money (& What to Do About It)?

Now that you know the importance of sales analysis for your business, it’s time to implement it.

A sales analysis tool shows both sides of the coin: On the one hand, you get to know the best-performing sales agents, segment hot leads, set up your sales goal, and identify the campaigns that bring in customers in hordes.

On the other hand, you can weed out cold leads, train struggling agents, and tweak or improve failed products or campaigns.

There are a few great CRM software in the market today. For small businesses that need a comprehensive yet affordable sales analysis software, EngageBay is an excellent choice.

Watch this testimonial from Lauraine M., a small business owner:

It’s more than a sales analysis tool, though.

You get hundreds of marketing, sales, and customer service features — all packed into affordable plans. You get all your reports in neatly organized dashboards. Oh, and you can create custom ones, too.

Sign up now, or book a 30-minute demo with our experts — we are here to help you grow your business.

About The Author

Nicole Malczan

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

RESOURCE CENTRE

What is sales analysis, what is sales analysis.

Sales analysis is the art of transforming sales data into actionable insights that help boost profitability, enhance customer satisfaction, and inform data-driven decisions. An efficient sales analysis scrutinises sales data, identifies patterns, trends, and opportunities, and uses this information to streamline operations, improve sales strategies, and ultimately achieve measurable sales results too.

Sales analysis helps you identify:

- Peak sales periods

- Bestselling products

Armed with this information, you can optimise your inventory and streamline your operations for maximum efficiency.

The importance of sales analysis

Sales analysis is your strategic shield against uncertainties like market fluctuations and changing consumer preferences. Deciphering and analysing sales data uncovers vital insights. It transforms numbers into actionable strategies, serving as your GPS in the sales labyrinth, guiding you to the most profitable routes.

Elevating sales reps to peak performance

By delving into sales data, you can identify your top performers, understand their strategies, and replicate their success across the board. You will uncover areas for improvement, enabling you to provide targeted training and support. With this data-driven approach, you will turn your sales team into a powerhouse of revenue generation.

Quick tips:

- Implement a robust Customer Relationship Management (CRM) system to collect, store, and review sales data.

- Utilise analytics tools to identify top performers and understand their strategies.

- Encourage collaboration and knowledge-sharing among team members. Cross-functional alignment is the #1 tactic for driving growth and 81% of sales representatives say team selling helps them close deals ( Salesforce State of Sales Report )

- Conduct regular training sessions to share successful strategies with the entire sales team.

Boosting morale to create a culture of success

By identifying and rewarding top performers, you create a culture of healthy competition and motivation. Digging into sales analysis can help set realistic goals, giving your team a clear path to success. When your reps notice their efforts directly translating into results, job satisfaction and morale shoot through the roof. This translates into better customer interactions and, ultimately, more sales.

- Establish a formal recognition program that highlights and rewards top-performing sales reps based on key metrics such as revenue generated, conversion rates, or customer satisfaction scores.

- Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals with each sales rep. Analyse past performance data to establish realistic targets that motivate and challenge the team.

- Clearly communicate expectations and milestones to ensure a shared understanding of success.

- Use sales analytics to provide transparent and objective performance feedback; review and adjust goals based on performance and market dynamics.

Accelerating business growth with quick decisions

In today's fast-paced business world, quick decisions are often the difference between success and stagnation. Sales analysis offers you the gift of agility. You can rapidly respond to changing market conditions, identify trends, and pivot your strategies accordingly. No more waiting for the quarterly report – with real-time data at your fingertips, you are always a step ahead. This nimbleness helps you capitalise on opportunities and mitigate risks swiftly.

- Invest in a data analytics platform that offers real-time insights into sales performance.

- Train teams on the effective use of analytics tools to make informed, swift decisions.

- Regularly review and refine decision-making processes based on feedback and outcomes.

- Implement tools for continuous monitoring of market trends and competitor activities e.g. tools for monitoring social media, web analytics, customer feedback and review platforms, surveys and polls, etc.

Types of sales analysis

1. sales forecasting.

Sales forecasting is the practice of using historical sales data and market analysis to predict future sales accurately. This information prepares you for seasonal peaks so you can optimise inventory and ensure your business sails smoothly through market volatility.

Harness the full potential of sales forecasting with:

- Time series analysis: Use specialised forecasting software to gauge historical sales data and identify patterns and trends over time. This could involve monthly, quarterly, or yearly sales figures.

- Predictive analytics: Employ predictive modelling techniques to forecast future sales based on factors like seasonality, economic indicators, and market trends. Machine learning algorithms can be used to build predictive models for more accurate forecasts.

- Ensure that your historical data is accurate and comprehensive for meaningful forecasting.

- Work with marketing, finance, and operations teams to gather relevant data that might impact sales.

- Markets evolve, so regularly review and update your forecasting models to reflect changing conditions.

- Prepare for different scenarios by running simulations based on various market conditions.

2. Sales management

Sales management is the process of overseeing and optimising the performance of a sales team to achieve revenue goals and maximise profitability. Sales analysis in this context involves monitoring individual and team performance, identifying areas for improvement, and providing the right tools and training.

Optimise sales management using dashboards that provide real-time insights into individual and team performance, visualising key sales metrics like conversion rates, deal pipelines, and revenue generated.

3. Sales reporting

Sales reporting offers insights into what's happening within your sales department, resembling your daily news source but with data instead of headlines. It is the process of transforming sales data into comprehensible insights that guide informed business decisions.

By regularly generating and reviewing sales reports, you can track your progress, identify areas of success, and pinpoint weaknesses. This leads to informed decision-making, whether it is adjusting marketing strategies, optimising sales channels, or fine-tuning product offerings.

- Automate reporting processes to save time and ensure regular, timely updates.

- Tailor reports to focus on the most critical metrics for your business goals.

- Gather feedback on the usefulness of reports and iterate to continuously improve the reporting process.

How to use sales analysis data

Customer segmentation: tailoring the experience.

92% of companies are using data effectively to understand customer behaviour (Salesforce State of Commerce Report).

Sales analysis data allows you to categorise your customers based on demographics, purchase history, and behaviour. By understanding the unique needs and preferences of different customer segments, you can tailor your marketing strategies, product offerings, and customer service to create a personalised experience that drives loyalty and repeat-business.

Market expansion: Identifying growth opportunities

Companies wielding powerful customer analytics are 1.5 times more likely to achieve rapid sales growth, with a sales cycle capable of driving a 15–25% boost in earnings, thereby fuelling market expansion. (McKinsey Research- Future of B2B Sales)

Sales analysis data is your compass for market expansion. By identifying underperforming regions or segments with growth potential, you decide where to focus your marketing and sales efforts. Whether it is targeting new geographies or entering new customer segments, this data empowers you to expand strategically.

Pricing strategies: Maximising profit margins

Price management initiatives can increase a company’s margins by 2%- 7% in 12 months—yielding an ROI between 200%- 350% . (Deloitte’s Three-Minute Guide to Pricing Analytics)

Pricing is a critical factor in profitability. With sales analysis data, you can evaluate the performance of different price points, discounts, and promotions. You can identify the sweet spot where your products or services are competitively priced while maximising profit margins. This data-driven approach helps you make strategic pricing decisions that boost your bottom line.

Inventory optimisation: Minimising waste

Product development: meeting market needs.

Your product or service portfolio should evolve to meet changing market demands. Sales analysis data sheds light on which products are thriving and which ones need improvement or retirement. It guides you in developing new products or enhancing existing ones to stay competitive and satisfy your customers' evolving needs.

Follow these steps before you get your raw sales data ready for mining:

Top sales analysis metrics & KPIs

Your data is a gold mine, but it speaks in the language of metrics and KPIs (Key Performance Indicators). Understanding these metrics and indicators is vital to making the most out of your sales analysis data.

Here's a comprehensive list:

Revenue is the ultimate metric that reveals the financial health of your business. Tracking your total income over time helps you assess the impact of your sales strategies and marketing efforts. The goal is to ensure consistent growth and stability.

Discover: How to optimise your revenue lifecycle management

Net profit margin

Gross profit margin, customer lifetime value (ltv).

Sales do not stop at the checkout. Customer LTV measures the total revenue a customer generates throughout their relationship with your business. By understanding LTV, you can tailor your marketing strategies to retain and maximise the value of each customer.

Churn rate reveals how many customers you lose over a specific period. High churn rates can erode your revenue and profitability. By tracking and addressing churn, you can implement strategies to retain customers and boost long-term success.

Retention rate

Retaining customers is often more cost-effective than acquiring new ones. Retention rate reflects the percentage of customers who continue to do business with you over time. High retention rates are a testament to your customer-centric approach and can significantly impact your bottom line.

80% of sales reps emphasise the growing significance of post-close customer relationships. Top performers enhance customer retention through value-based communication, accountability, and proactive feedback-seeking after a sale.

How sales analysis reports help

Sales analysis reports offer a comprehensive snapshot of crucial sales data and metrics, streamlining the process of optimising your sales strategies by swiftly pinpointing strengths and weaknesses.

A typical sales analysis report has five to seven components. Here’s how each of them empowers your business.

|

|

The overview: A bird's-eye view of your sales pipeline performance | This section gives you an immediate sense of how well your business is performing and areas that need attention. |

Performance metrics | Performance metrics allow you to assess the effectiveness of your sales and marketing efforts. By comparing actual performance with goals, you can identify areas for improvement and fine-tune your operations for better results. |

Market analysis | Market analysis helps you understand customer preferences, market trends, and competitive landscapes. Armed with this knowledge, you can adjust your strategies to remain competitive and capture opportunities as they arise. |

Customer insights | Customer insights help you identify your most loyal customers, track their buying patterns, and tailor your services to meet their needs. This customer-centric approach enhances satisfaction, fosters loyalty, and translates into long-term profitability. |

Product evaluation | Product evaluation helps you identify your best-sellers and slow movers, enabling you to optimise your product mix. This section also provides valuable insights into inventory management and turnover rates. |

Sales channel breakdown | A sales channel breakdown dissects your sales sources, from online to offline, different regions, and more. By understanding where your actual sales originate, you can allocate resources efficiently to the most effective channels. It guides you in making informed decisions regarding sales and marketing strategies. |

Budget optimisation | Budget allocation examines how you are spending your resources, including marketing, advertising, and promotional expenses. It enables you to assess the efficiency of your resource allocation and helps identify areas where you can optimise costs. By ensuring resources are allocated effectively, you can improve the overall profitability of your business. |

Sales analysis tools and CRM (Customer Relationship Management)

Sales analysis tools are software or applications that empower businesses to collect, analyse, and interpret sales data and key performance metrics, enabling data-driven decisions and strategic improvements in sales and marketing strategies. Examples of sales analysis tools include business intelligence platforms, forecasting software, sales automation and management software, reporting engines to monitor sales activities, and solutions for email productivity and sales acceleration. CRM systems, on the other hand, focus on nurturing customer relationships, enhancing customer experience, and boosting loyalty.

Sales analysis tools and CRM are the dynamic duo that empowers businesses to thrive. These tools offer deep insights into sales data, helping you make data-driven decisions.

Choosing the right sales analysis tools

Scalability: Consider your business's current size and potential for growth. Ensure the tools can scale with your business.

Integration: Look for tools that can seamlessly integrate with your existing systems and software to avoid data silos.

Ease of use: User-friendliness is key. Opt for tools that your team can quickly adopt without extensive training.

Data security: Protecting customer and sales data is non-negotiable. Ensure the tools adhere to robust security standards.

Charting the course to success with Salesforce

Sales analysis tools have become indispensable for organisations seeking to enhance their sales strategies and boost overall business performance. Salesforce, a market leader in customer relationship management , offers a powerful suite of tools that can transform your sales analysis process. By leveraging Salesforce, you can gain valuable insights into your sales data, track key performance metrics, and make data-driven decisions to enhance customer engagement and satisfaction.

Unsure where to begin? Explore our free demo to kickstart your journey towards optimising your sales strategies, identifying pivotal moments of truth, and crafting a more engaging and rewarding customer experience.

Discover how Salesforce can be your trusted partner in understanding customer journeys, enhancing sales performance, and building lasting customer relationships.

Trends in Sales Operations

What Is a Sales Pipeline and How Do You Build One? A Complete Guide

More resources.

Research and Report

Trends in Generative AI for Sales

Your Sales Tech Stack Is About to Get a Whole Lot Smaller

What Is a Sales Pipeline and How Do You Build One?

Get monthly updates and fresh ideas delivered to your inbox.

- Sales CRM Software

- Application Portals

- Call Center CRM

- Mobile CRM App

- Omnichannel Communication CONVERSE

- Reporting Dashboard SIERA

- Lead Management System

- Opportunity Management

- Sales Process Automation

- Sales Tracking

- Door-to-Door Sales

- Remote Team Management

- Field Sales CRM

- Merchant Onboarding App

- App UI/UX Customizer CASA

- Outside Sales CRM

- Field Force Automation

- Collections Management

- Field Force Tracking

- Event Campaign Management

- Bancassurance Management

- Marketing Automation

- Chatbot - Website

- Chatbot - WhatsApp

- Landing Pages

- Email Campaigns

- Lead Capture Automation

- Lead Engagement

- BTL Marketing Automation

- Advanced Marketing Analytics

- Hospitals and Clinics

- Hospice and Palliative Care

- Fertility Clinics

- Dental Care

- Diagnostics Labs

- ACQUISITION

- Patient Intake Automation

- Patient Appointment Scheduling

- Healthcare Call Center Solution

- Patient Experience Management

- Self-serve Patient Portals

- EHR Integration

- Physician Empanelment

- Security and Compliance

- Patient Engagement

- Higher Education

- Pre-schools and K12

- Training Institutions

- Overseas Education

- Student Recruitment Software

- Admission Portal

- Teacher Onboarding

- Publisher Portal

- Admission Software

- Credit Unions

- Securities and Trading

- Lending CRM

- Loan Origination System

- WhatsApp Lending Bot

- Debt Recovery Automation

- Bancassurance Solution

- PAPERLESS ONBOARDING

- e-KYC Solution

- Video KYC Solution

- Merchant Onboarding

- Merchant Lifecycle Management

- Travel and Hospitality

- Agriculture

- Home Improvement

- View by Industries

- What is Sales Analytics? [Benefits, Types, and Metrics to Track]

Analytics has become an integral part of life, from finding the shortest route to work to forecasting stock market trends.

Analyzing previous trends ensures that businesses always make the right decision. And as the scale of the decision and its impact magnifies, more robust analytics need to take over. The gut feeling cannot cut it anymore.

According to McKinsey, businesses that rely on data to make decisions are 19 times more likely to be profitable. It’s no surprise that sales, a number-driven aspect of business, benefits from the right analytics. If your goal is fast and sustainable growth, your sales team must make quick and accurate decisions to improve its performance.

Sales analytics isn’t a new term. Businesses have been using it for years to optimize various steps of the sales cycle . But most of them are just at the tip of the iceberg when it comes to intelligent sales analytics.

This article aims to help you identify appropriate sales analytics to resolve business challenges.

What is Sales Analytics?

Sales analytics refers to the use of technology to collect and use sales data to derive actionable insights. It is used to identify, optimize, and forecast sales. It uses different metrics and KPIs to plan an efficient sales model that generates higher revenue for the business. Here’s how Prashant Ahlawat, Vice President – Analytics and Transformation, at LeadSquared, defines sales analytics:

“Sales analytics is a compass for your sales teams. It guides you towards growth using tools that track past data and current performance against goals. The analytics reports then help you plan targets in the future.”

Sales involves many stages with their own set of metrics. There’s always an abundance of data to track, but it’s hard to make sense of it every time.

While you may want to use data to find gaps in your sales processes, it’s next to impossible without the right tools.

One such tool is sales analytics. It can help you identify gaps and improve your sales processes.

Let’s take a closer look at it.

Benefits of Sales Analytics

1. Boost sales productivity

Sales reps need to always be on their toes to achieve results. Sales processes are often complex. You’ll find several hurdles between lead gen to closing a sale .

Data analytics in sales help managers decrease the sales cycle length by identifying the areas of improvement. Along with an average 20% increase in sales productivity , analytics also helps salespeople decrease leakages in the sales pipeline .

2. Identify new sales opportunities

As a business grows, products evolve, new sales opportunities emerge. Tracking sales data helps enterprises understand the product fitment across industries and regions. The historical data allows salespeople to define their customer base and introduce opportunities to upsell and cross-sell .

3. Plan effective sales targets

Sales data—deals closed, qualified opportunities, length of sales cycles—captured over a year or even a quarter, can significantly improve the way businesses strategize their sales targets .

Predictive analysis helps forecast sales revenues and set individual targets based on your sales team’s performance.

4. Improve customer acquisition

Personalized customer journeys are hard to build without insights into customer behavior. The customer’s journey has multiple touchpoints , which can be improved by tracking factors like time on a certain website, tone during the call, and response rate. Customer analytics help salespeople make relevant recommendations, and over 44% of businesses use it to acquire new customers.

5. Incentivise sales teams

Incentives are the biggest motivator for sales teams. But you can’t reward their performance without accurate records.

Recording sales activities and their outcomes help businesses incentivize their sales teams fairly. Analytics simplify payroll management and help managers choose an appropriate sales commission structure .

6. Increase customer retention

Every business aims to improve their Customer Lifetime Value because acquiring a new customer is 5X more expensive than retaining one. And that’s precisely what sales analytics help you achieve! Diagnosing the possible drop-off stages and taking preventive measures brings down the number of churned accounts.

So, now you know the benefits of sales analytics. And the first step to achieve them is to use the right type of sales analytics that align with your sales goals .

7 Types of Sales Analytics [+ Metrics to Track!]

The scope of sales analysis is vast.

But it all boils down to choosing the right analytics and metrics that help you achieve your business goals.

Business analytics fall under four broad categories:

- Descriptive

- Diagnostic

- Predictive

- Prescriptive

However, sales analytics are more specific to a business’ sales process. Let’s look at the 7 essential sales analytics and relevant metrics under each type.

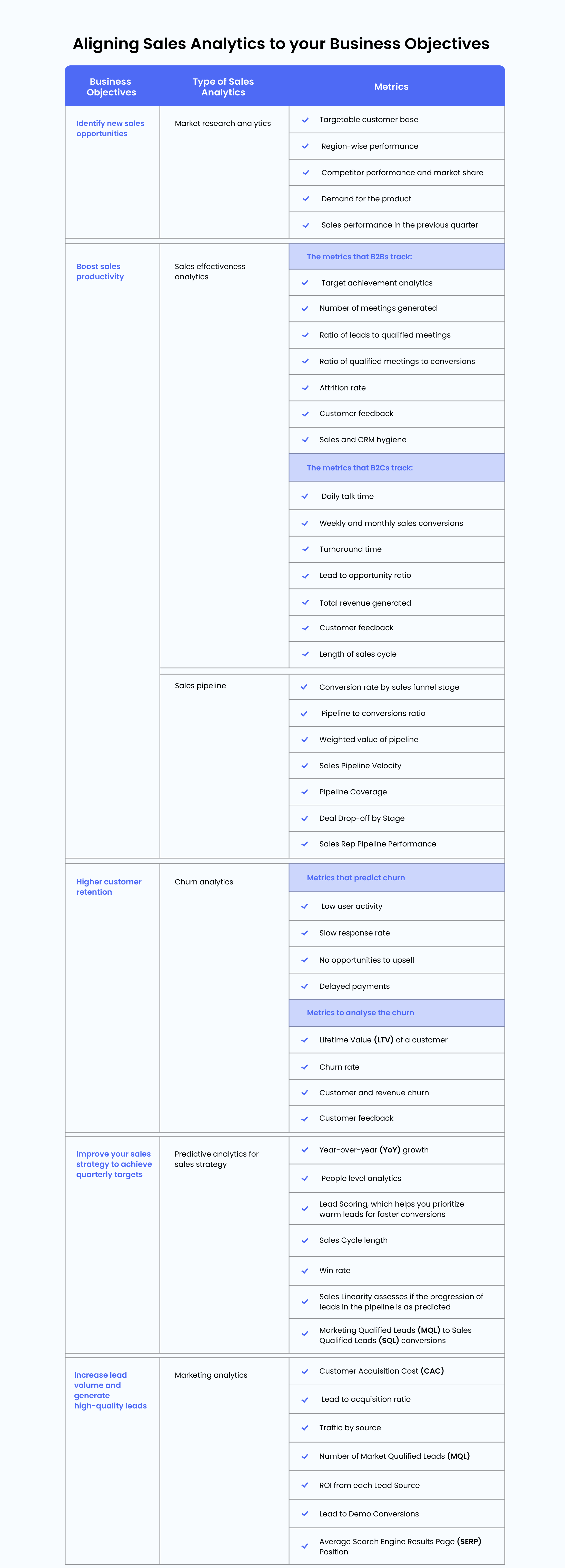

1. Market Research Analytics

Marketing research involves deriving data related to target customers, well-performing regions, and untapped markets. It is vital to launch a new product and begin sales in new geos.

The metrics to track are:

- Targetable customer base

- Region-wise sales

- Competitor performance and market share

- Demand for the product

- Sales performance in the previous quarter (Especially if you’re looking to ramp up sales in a certain region)

2. Product Sales Analytics

Product Sales Analytics can be highly effective for businesses with multiple or seasonal product offerings. It considers the performance of every product or service that the company offers. It helps the sales team identify the products to focus on based on the revenue and sales targets . The analytics can be tracked for a certain timeframe and demographic.

- Net Promoter Score (NPS) for the product/service (NPS score= %promoters – %detractors, where promoters rate your product 8-10 and detractors rate it 0-7 out of 10)

- The number of active users over a daily and monthly timeframe.

- Monthly recurring revenue (MRR = Average revenue per account x Total number of accounts)

- % Sales volume ((Units of individual product sold x 100) ÷ Total units of all products sold)

- Repeat buys per product (Repeat Purchase Rate = (Repeat customers x 100) ÷ Total customers)

- Minimum, maximum, and average selling price per product

Comparing these metrics across different products/services helps you ramp up sales or drop certain products.

3. Sales Effectiveness Analytics

Almost every business would want to track its sales effectiveness. The extent and type of analytics used to monitor teams vary across different industries and businesses.

Tracking productivity and sales effectiveness on a daily, monthly, and quarterly basis help in identifying your team’s scope of improvement.

The metrics to track differ as per the targets that the business has set and its sales workflow. B2Cs usually have a higher sales velocity and shorter sales cycles than B2Bs. But in general, here are a few metrics that B2Bs and B2Cs rely on.

Sales effectiveness metrics for B2B businesses

- Target achievement analytics (Your targets can be conversions or revenue dependent. For revenue dependent targets, % Achievement = (Revenue generated x 100) ÷ Target revenue). And for conversion dependent targets, % Achievement = (Number of deals closed x 100) ÷ Target conversions.))

- Number of meetings generated

- Ratio of leads to qualified meetings

- Ratio of qualified meetings to conversions

- Attrition rate (Usually calculated for team managers, Attrition Rate = (No. Of employees who left the team x 100) ÷ Average no. of team members)

- Customer feedback

- Sales and CRM hygiene

Sales effectiveness metrics for B2C businesses

- Daily talk time

- Weekly and monthly sales conversions (Conversion Rate = (Conversions x 100) ÷ Total opportunities)

- Turnaround time

- Lead to opportunity ratio

- Total revenue generated (Total Revenue = Number of products sold X Cost per unit)

- Customer feedback

- Length of the sales cycle

- Sales and CRM hygiene

4. Sales Pipeline Analytics

The journey from a qualified prospect to a customer is mapped in the sales pipeline . But each stage in the sales pipeline can turn into a drop-off point if it isn’t properly tracked and analyzed. Sales pipeline analytics help you determine what slows down the conversions and what you can do to speed it up.

The metrics to track are:

- Conversion rate by sales funnel stage

- Pipeline to conversions ratio

- Weighted value of pipeline (Weighted value = Probability of Closing x Deal Value, where the probability depends on the stage of the pipeline, such as 50% for the negotiation stage)

- Sales Pipeline Velocity (Sales Pipeline velocity= (Number of deals in pipeline x Average deal size) ÷ Average sales cycle length)

- Pipeline Coverage (Number of opportunities in pipeline for given period ÷ quota period)

- Deal Drop-off by Stage

- Sales Rep Pipeline Performance

(Also read: 32 Sales KPIs Every Manager Should Measure to learn more about the different sales performance metrics in detail)

6. Predictive Analytics for Sales Strategy

Every business aims to grow faster, witness higher conversions, and create an unmatched revenue stream. Hours of planning, strategizing, and forecasting go into realizing these goals, but there’s no guarantee they’ll be met. Creating a sales strategy using analytics can’t assure the desired results, but the chances that you will meet them shoot up. Forecasting growth while keeping all the variables in mind is highly complicated. Sales data from the past acts as a benchmark and every year the stakes are increased to ensure business growth.

Here are some of the metrics that help you set suitable targets for your teams:

- Year-over-year (YoY) growth ([(Current Year’s Revenue – Previous Year’s Revenue) x 100] ÷ Previous Year’s Revenue)

- People level analytics to assess team’s performance

- Lead Scoring , which helps you prioritize warm leads for faster conversions

- Sales Cycle length (Sum of the Number of days it took to close each deal ÷ Total Number of deals)

- Win rate (Deals closed ÷ Total Number of deals)

- Sales Linearity assesses if the progression of leads in the pipeline is as predicted

- Marketing Qualified Leads (MQL) to Sales Qualified Leads (SQL) conversion rate

7. Churn Analytics

Churned accounts can be discouraging for your sales teams. Also, it brings a steep drop in your annual revenue.

Churn analytics help you identify touchpoints with a higher drop-off rate and the accounts with a high churn probability. A lot of the churn metrics are qualitative or based on customer behavior. With this information, your salespeople can intervene to prevent churn.

The churn analytics can be divided into two categories, predictive and post-mortem. The metrics to track are interdependent for both these categories.

Metrics that predict churn:

- Low user activity

- Slow response rate

- No opportunities to upsell

- Delayed payments

Once the account is churned, it is important to evaluate the factors that caused the churn to avoid them for other accounts. It is also known as the post-mortem of the churn.

Metrics to analyze the churn:

- Lifetime Value (LTV) of a customer (LTV = Lifetime Value = Average Value of Sale × Number of Transactions × Retention Time Period)

- Churn rate ((Lost Customers ÷ Total Customers at the Start of Time Period) x 100)

- Customer and revenue churn (% Change in number of customers and annual revenue because of the churn)

8. Marketing analytics

Marketing Qualified Leads (MQLs) have high intent and can be easily converted into a customer by the sales team. Employing the right marketing analytics ensure that leads keep flowing into the sales funnel .

Usually, many campaigns and marketing activities run in parallel. Figuring out which strategy generates the highest ROI and brings in the greatest number of leads is extremely important. So, analyzing your lead sources and the effectiveness of each campaign helps the marketing team restructure their budgets to improve the volume of quality leads.

- Customer Acquisition Cost (CAC) (Customer Acquisition Cost = Cost of sales and marketing ÷ number of new customers acquired)

- Lead to acquisition ratio (Lifetime Value (LTV) ÷ Customer Acquisition Cost (CAC))

- Traffic by source

- Number of Market Qualified Leads

- ROI from each Lead Source

- Lead to Demo Conversions

- Average Search Engine Results Page (SERP) Position

Now that we’ve discussed all the types of sales analysis methods, mapping them to your business analytics becomes extremely easy. This table sums it all up.

You can bookmark this page or download this Sales Analytics Guide to share with your team. Sales analytics carry the power to transform your business However, the general notion is analytics is a high-end and complicated matter that’ll take up a lot of investment.

But this isn’t true; you just need to identify what works for your business.

Getting Started with Sales Analytics

“Any business with a sales team needs sales analytics, irrespective of the industry or the complexity of your product. All KPIs that you set for your teams should be tracked and analyzed, even if you use the most basic reports.” Murali Krishna, Vice President – Sales, LeadSquared

The biggest deterrents to using advanced sales analytics tools are the cost and the need for a well-defined sales process. However, sales analysis doesn’t always need a tool.

For businesses with small teams or a short and simple sales process, people-level analytics and sales effectiveness metrics should suffice. The business can effortlessly record and analyze this data on Excel sheets.

As the size of your sales team increases, Excel sheets begin to break. The amount of data increases exponentially and only a good sales analytics software can meet the requirements.

A sales analytics software is also essential if you have multiple product offerings that need to be mapped to customers.

“While a few industries can make do without a sales analytics software, it’s a basic requirement for others such as edtech, real estate, banking and insurance, manufacturing, and e-commerce.” Pritika Khorana, Regional Sales Manager, LeadSquared

If you’re just getting started with sales analytics, the following courses and books could help!

Sales Analytics Courses:

1. LinkedIn’s Business Analytics: Sales Data 2. Sales Analytics Beginner Complete Course by Udemy 3. Wharton’s Business Analytics

Sales Analytics Books:

1. The Power of Sales Analytics by A. Zoltners, P. Sinha, and S. Lorimer 2. Predictive Analytics: The Power to Predict Who Will Click, Buy, Lie, or Die by E. Siegel 3. Business Analytics: Data Analysis & Decision Making by S. Christian Albright and Wayne L. Winston

The right sales analytics can be a game-changer for your business. That’s exactly how Tricoci University of Beauty Culture, a Chicago-based cosmetology school, increased their process efficiency by 75%.

Here’s a little peek into their sales analysis journey with LeadSquared.

How Tricoci University Increased Process Efficiency by 75%

Tricoci University has 16 campuses spread across Illinois, Wisconsin, and Indiana. The school takes pride on its people-centric approach to preparing the leading beauty professionals of tomorrow.

An absence of sales and marketing analytics made it hard for them to improve their enrolment process quickly. Here’s when they chose LeadSquared as their CRM tool to meet their enrolment goals.

| Introduce touchpoints to regularly track and store data | Digital student enrolment journeys with a detailed view of the admissions pipeline. | Real-time tracking of the lead stage, intent, and activities. |

| Generate impactful insights from sales data to improve the enrolment process. | Ability to enrolment workflows using sales and marketing data. | Improved process efficiency by |

| Improve the productivity of their enrolments team. | with various performance metrics to evaluate the team. | Highly productive sales teams. Improved remote team management. |

The sales analytics journey will be impactful only when the data trends are visualized and reported. There are a few ways to go about this. You can either integrate your sales data with a visualization and reporting tool—like Tableau, Microsoft Power BI, or Qlikview— or you can opt for a CRM with reporting tools.

Both these options work great for businesses, but a CRM with sales reporting abilities is more convenient and financially feasible. LeadSquared CRM , with its advanced reporting tools, is a one-stop solution to track and visualize sales data.

Watch our Masterclass on LeadSquared Reports & Analytics to understand the different types of reports that you can generate on the LeadSquared platform.

Every business intends to use its sales analytics software for different purposes. And there are many that you can choose from.

Key Features of a Sales Analytics Tool

A sales analytics tool tracks and analyzes sales data to make actionable improvements. But choosing the right tool for sales analysis is imperative. Here’s a checklist of the features that you should evaluate before you purchase a new sales analytics software.

1. Visualization Capabilities

The tool should be able to visualize your sales data in every way possible–charts, tables, graphs, or tables. It’s important to note that the visualization must be real-time and easy to generate and access.

2. Scalability

Can the tool handle the data when your team and the number of leads increase by 10X or 15X? If you aim to grow rapidly, it’s important for the tool to scale along with your business.

3. Platform Security

Loss of data, whether it is process-related or sensitive lead information, can affect your business negatively. The platform should be secure enough to prevent data leaks and the loss of important information.

4. Uptime of the system

Sales data is generated by the minute. So, your sales analytics software must always stay operational. The core engine should be robust enough to carry out all the calculations and handle reports even when lead volume peaks.

5. Short term and long-term data insights

The insights must help you make decisions both on a short and long term. For instance, on a daily/weekly and on a monthly/quarterly/yearly basis. So, the software must consistently record and update the data.

I hope this article helps you streamline your sales analytics strategy to resolve any business challenges you may face. To sum it up, sales analysis is all about putting your data to work to improve sales outcomes. With the right tool, sales analytics can completely transform your business.

A CRM is one such tool to track sales data, record it, and derive insights from it. If you’re looking for a CRM with advanced monitoring and reporting capabilities, you should give LeadSquared a shot!

Book a demo to know more about LeadSquared’s Sales CRM.

Sales analytics is used to identify, optimize, and forecast sales. It uses different metrics and KPIs to strategize a sales model that is efficient and generates high revenue for a business.

Sales data that is tracked on a CRM can be used to generate insightful reports. These reports help you boost sales productivity, increase customer retention , improve sales strategy and generate a high lead volume. The CRM analytics also highlight the products and markets that your sales team must focus on.

Business analytics fall under four broad categories—descriptive, diagnostic, predictive, and prescriptive. They take both qualitative and quantitative factors into account and help your business achieve rapid growth.

Kritika is a content writer at LeadSquared. She loves reading and is trying to learn more about sales. Through her writing, she wants to make sales easier for everyone. You can connect with her on LinkedIn or write to her at [email protected].

Table of Contents

- Share on Facebook

- Share on WhatsApp

- Share on LinkedIn

Want to see LeadSquared in action?

- Customer Portal

- Performance Management

- Dev Platform LAPPS

- Help Portal

- Pricing SALES

- Pricing MARKETING

- Education CRM

- Healthcare CRM

- Insurance CRM

- Banking CRM

- Real Estate

- Marketplace CRM

- Manufacturing CRM

- What is CRM

- What is lead management

- What is vendor management

- What is sales management

- Case Studies

- Guides & Blogs

- Compare CRM

- CRM Glossary

- Sales Glossary

- Media & News

GET IN TOUCH

(+1) 732-385-3546 (US)

081-48549748 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

- Legal & Compliance

Attain 100% lead capture, 75% increase in sales efficiency and 2x engagement.

What should you look for in a CRM software?

10 Important Sales Analysis Reports [+ 4 Sales Report Templates]

Published: October 28, 2022

Are you finding it difficult to hit your sales goals , unclog your sales funnel , and increase your sales velocity ? Sales reports can help.

Sales reports allow you to improve your sales process, fill knowledge gaps, and hit your quotas consistently. As a sales manager, creating a sales report also allows you to gather hard data for your colleagues or C-suite to make informed decisions quickly.

In this post, you’ll learn what sales reports are, their benefits, and how to use sales report templates.

What is a sales report?

- Benefits of Sales Reporting

How to Write a Sales Report

Types of sales analysis reports, sales report templates.

A sales report or sales analysis report is a document that shows trends impacting your sales operations within a specific period. While the content of sales reports may vary depending on your goal, they include metrics like revenue, accounts won, leads, and more. Insights from these reports help you identify the strengths and weaknesses of your sales strategy.

.png)

Free Sales Metrics Calculator

A free, interactive template to calculate your sales KPIs.

- Average Deal Size

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

The Benefits of Sales Reporting

Reporting data in a standardized way is crucial to the success of your business. Here are the common benefits of developing a sales reporting cadence.

Improving Team and Reps Performance

Sales reports provide data-driven insights about the sales performance of individual reps and your entire team. This allows you to know if underperforming reps need coaching. You can also identify who would benefit from regular one-on-one meetings to level up and hit their quotas.

The same applies to your team. If your team isn’t hitting the company’s revenue goals, you can use sales reports to find gaps to improve your sales process .

Assisting Fast Decision-making

Making informed and timely decisions is vital to the success of any sales strategy . This is where sales reporting shines.

With regular sales reporting, your C-suite or managers can quickly iterate on what drives the company's growth. You can also track and adjust sales tactics that are performing below par.

Boosting the Morale of Your Sales Team.

Creating daily sales reports may be time-consuming. But whether you do this daily, weekly, or monthly, these reports can take team morale to new heights.

Monitoring and showing the sales performance of each team member motivates them to do more. Gamifying performance results can challenge other team members to quit settling for average performance. Put another way, sales reporting can create healthy competition and push your sales team to aim for the “best” outcomes.

The goal of every sales report is to pass actionable and detailed sales information to your team. To do this, you need to know the purpose and audience of your sales report. You’ll also need to use the right data, decide on a reporting timeframe, and create engaging slides.

Here’s a breakdown of how to write an engaging sales report.

1. Know the purpose of your sales report.

Identifying your goal is the first step toward creating a winning sales report. With your goal in mind, you can easily determine the best data to include and decide on a reporting timeframe.

2. Tailor your sales report to your audience.

Metrics that interest your sales reps may not interest your CEO. Those that interest your CEO may not interest your director or VP of marketing. These folks are in the same organization as you, but they have different interests.

Sales reps may want granular details on their sales performance. Your marketing lead may only be interested in the sales reports from marketing campaigns. And your busy CEO may only want the overall results of your marketing and sales activities without the specifics of how you reached your goals. See, different strokes for different people. Tailor your sales report accordingly.

3. Determine your sales reporting timeframe.

Your reporting timeframe depends on your sales objectives and how frequently you need to update your team or management. You can do this in three ways.

Daily Sales Reporting

A daily sales report tracks the sales activities of each business day. This report increases your rep’s accountability, encourages productivity, and includes sales performance metrics like:

- Duration of each outbound call.

- Number of sales opportunities.

- Number of outbound calls.

- Number of proposals sent.

- Number of emails sent.

Weekly Sales Reporting

A weekly sales report measures the weekly sales performance of individual reps and your entire sales team. This report allows sales leaders to know which reps are on track to hit their KPIs. Weekly sales reports track metrics like:

- Call/contact volume.

- Lead-to-opportunity ratio.

- Lead conversion ratio.

- Number of appointments set.

- Number of closed deals.

- Sales volume by channel.

- Total sales by region.

Monthly Sales Reporting

A monthly sales report summarizes your sales performance for the month. This report helps you determine the effectiveness of your sales strategy so you can tweak it if necessary. Monthly sales reports track metrics like:

- Number of deals at each stage of the pipeline.

- Number of scheduled meetings.

- Length of the sales cycle.

- Average close rate.

- Average deal size.

- Sales volume.

4. Get your sales data.

Collecting and analyzing your sales data is a lot easier when you’re using a CRM. With a CRM, you can use filters to remove duplicate records and pull specific information. That’s more fun than relying on clunky spreadsheets, right? Here’s a quick video on how you can gather sales data for your reports.

You can also create custom reports if you regularly use certain sales data. Here’s how:

5. Explain key insights from your sales data.

You need to make sense of your sales data by explaining the “why” of each one.

- If there was a dip in the close rate, why?

- If there was a high lead conversion ratio, why?

- If there are more won deals in a specific region, why?

Just as the questions are endless, so are the insights you can gain by evaluating your sales data. For instance, more won deals could have resulted from a new tactic your team tried, a new channel they started using, a partner ecosystem they joined, and much more.

When you state why there’s an upward or downward trend in your data, you provide a roadmap for what your team can improve and what they can continue doing to achieve the best sales results.

Note: If possible attribute which changes to your sales data were caused by team tactics and which are attributed to the larger macro-economic environment. A spike or dip in sales may be the result of factors beyond your control. You’ll want to distinguish those factors where possible.

6. Use visuals to show vital sales trends and metrics.

Remember the popular saying, “A picture is worth a thousand words?”

It’s true, especially with sales reporting. When you create attractive visuals, your audience won’t have to wade through spreadsheets with lots of numbers. This saves their time and allows you to quickly communicate the insights in your report.