- REALTOR® Store

Resources and updates on NAR’s settlement agreement related to broker commissions.

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- The Advocacy Scoop

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today The Advocacy Scoop Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

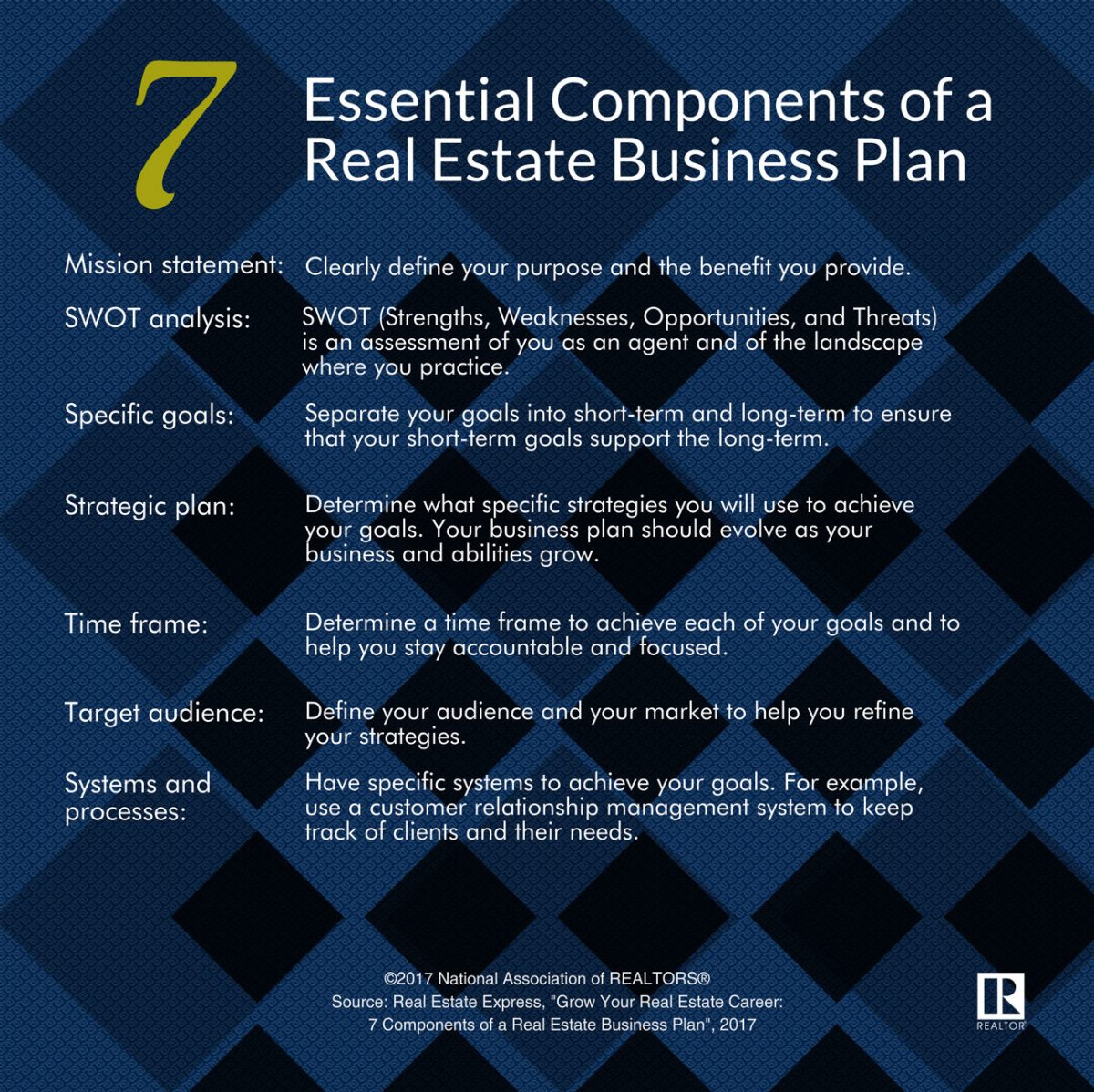

- Writing a Business Plan

Writing a business plan may seem a daunting task as there are so many moving parts and concepts to address. Take it one step at a time and be sure to schedule regular review (quarterly, semi-annually, or annually) of your plan to be sure you on are track to meet your goals.

Why Write a Business Plan?

Making a business plan creates the foundation for your business. It provides an easy-to-understand framework and allows you to navigate the unexpected.

Quick Takeaways

- A good business plan not only creates a road map for your business, but helps you work through your goals and get them on paper

- Business plans come in many formats and contain many sections, but even the most basic should include a mission and vision statement, marketing plans, and a proposed management structure

- Business plans can help you get investors and new business partners

Source: Write Your Business Plan: United States Small Business Association

Writing a business plan is imperative to getting your business of the ground. While every plan is different – and most likely depends on the type and size of your business – there are some basic elements you don’t want to ignore.

Latest on this topic

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

Defining Your Mission & Vision

Writing a business plan begins by defining your business’s mission and vision statement. Though creating such a statement may seem like fluff, it is an important exercise. The mission and vision statement sets the foundation upon which to launch your business. It is difficult to move forward successfully without first defining your business and the ideals under which your business operates. A company description should be included as a part of the mission and vision statement. Some questions you should ask yourself include:

- What type of real estate do you sell?

- Where is your business located?

- Who founded your business?

- What sets your business apart from your competitors?

What is a Vision Statement ( Business News Daily , Jan. 16, 2024)

How to Write a Mission Statement ( The Balance , Jan. 2, 2020)

How to Write a Mission Statement ( Janel M. Radtke , 1998)

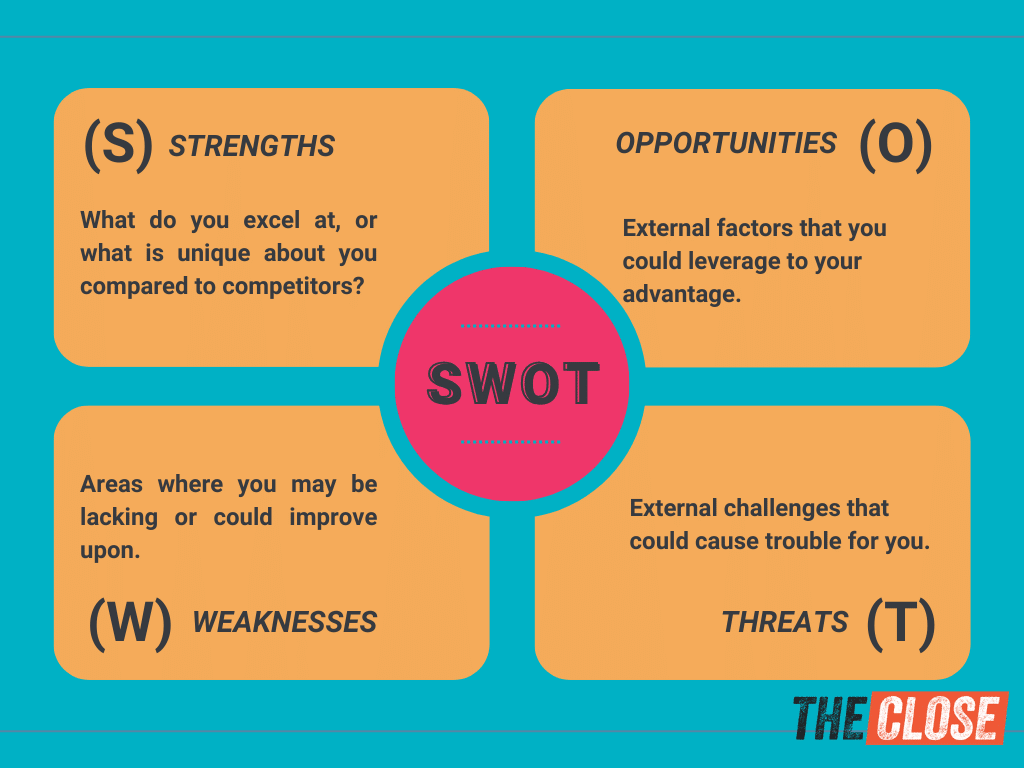

Using a SWOT Analysis to Structure Your Business Plan

Once you’ve created a mission and vision statement, the next step is to develop a SWOT analysis. SWOT stands for “Strengths, Weaknesses, Opportunities, and Threats.” It is difficult to set goals for your business without first enumerating your business’s strengths and weaknesses, and the strengths and weaknesses of your competitors. Evaluate by using the following questions:

- Do you offer superior customer service as compared with your competitors?

- Do you specialize in a niche market? What experiences do you have that set you apart from your competitors?

- What are your competitors’ strengths?

- Where do you see the market already saturated, and where are there opportunities for expansion and growth?

Strength, Weakness, Opportunity, and Threat (SWOT) ( Investopedia , Oct. 30, 2023)

How to Conduct a SWOT Analysis for Your Small Business ( SCORE , Apr. 28, 2022)

SWOT Analysis Toolbox ( University of Washington )

Setting Business Goals

Next, translate your mission and vision into tangible goals. For instance, if your mission statement is to make every client feel like your most important client, think about the following:

- How specifically will you implement this?

- Do you want to grow your business?

- Is this growth measured by gross revenue, profit, personnel, or physical office space?

- How much growth do you aim for annually?

- What specific targets will you strive to hit annually in the next few years?

Setting Business Goals & Objectives: 4 Considerations ( Harvard Business School , Oct. 31, 2023)

What are Business Goals? Definition, How To Set Business Goals and Examples ( Indeed , Jul. 31, 2023)

Establishing a Format

Most businesses either follow a traditional business plan format or a lean startup plan.

Traditional Business Plan

A traditional business plan is detailed and comprehensive. Writing this business plan takes more time. A traditional business plan typically contains the following elements:

- Executive Summary

- Company description

- Market analysis

- Organization and management

- Service or product line

- Marketing and sales

- Funding request

- Financial projections

Lean Startup Plan

A lean startup plan requires high-level focus but is easier to write, with an emphasis on key elements. A lean startup plan typically contains the following elements:

- Key partnerships

- Key activities

- Key resources

- Value proposition

- Customer relationships

- Customer segments

- Cost structure

- Revenue stream

Creating a Marketing Plan

You may wish to create a marketing plan as either a section of your business plan or as an addendum. The Marketing Mix concerns product , price , place and promotion .

- What is your product?

- How does your price distinguish you from your competitors—is it industry average, upper quartile, or lower quartile?

- How does your pricing strategy benefit your clients?

- How and where will you promote your services?

- What types of promotions will you advertise?

- Will you ask clients for referrals or use coupons?

- Which channels will you use to place your marketing message?

Your Guide to Creating a Small Business Marketing Plan ( Business.com , Feb. 2, 2024)

10 Questions You Need to Answer to Create a Powerful Marketing Plan ( The Balance , Jan. 16, 2020)

Developing a Marketing Plan ( Federal Deposit Insurance Corporation )

Forming a Team

Ensuring the cooperation of all colleagues, supervisors, and supervisees involved in your plan is another important element to consider. Some questions to consider are:

- Is your business plan’s success contingent upon the cooperation of your colleagues?

- If so, what specifically do you need them to do?

- How will you evaluate their participation?

- Are they on-board with the role you have assigned them?

- How will you get “buy in” from these individuals?

How to Build a Real Estate Team + 7 Critical Mistakes to Avoid ( The Close , May 17, 2023)

Don’t Start a Real Estate Team Without Asking Yourself These 8 Questions ( Homelight , Jan. 21, 2020)

Implementing a Business Plan and Reviewing Regularly

Implementation and follow-up are frequently overlooked aspects to the business plan, yet vital to the success of the plan. Set dates (annually, semi-annually, quarterly, or monthly) to review your business plans goals. Consider the following while reviewing:

- Are you on track?

- Are the goals reasonable to achieve, impossible, or too easy?

- How do you measure success—is it by revenue, profit, or number of transactions?

And lastly, think about overall goals.

- How do you plan to implement your business plan’s goals?

- When will you review and refine your business plan goals?

- What process will you use to review your goals?

- What types of quantitative and qualitative data will you collect and use to measure your success?

These items are only a few sections of a business plan. Depending on your business, you may want to include additional sections in your plan such as a:

- Cover letter stating the reasoning behind developing a business plan

- Non-disclosure statement

- Table of contents

How To Write a Business Proposal Letter (With Examples) ( Indeed , Jul. 18, 2023)

How To Implement Your Business Plan Objectives ( The Balance , Aug. 19, 2022)

The Bottom Line

Creating a business plan may seem daunting, but by understanding your business and market fully, you can create a plan that generates success (however you choose to define it).

Real Estate Business Plans – Samples, Instructional Guides, and Templates

9 Steps to Writing a Real Estate Business Plan + Templates ( The Close , Apr. 3, 2024)

How to Write a Real Estate Business Plan (+Free Template) ( Fit Small Business , Jun. 30, 2023)

The Ultimate Guide to Creating a Real Estate Business Plan + Free Template ( Placester )

Write Your Business Plan ( U.S. Small Business Administration )

General Business Plans – Samples, Instructional Guides, and Templates

Business Plan Template for a Startup Business ( SCORE , Apr. 23, 2024)

Guide to Creating a Business Plan with Template (Business News Daily, Mar. 28, 2024)

Nine Lessons These Entrepreneurs Wish They Knew Before Writing Their First Business Plans ( Forbes , Jul. 25, 2021)

How to Write a Business Plan 101 ( Entrepreneur , Feb. 22, 2021)

Books, eBooks & Other Resources

Ebooks & other resources.

The following eBooks and digital audiobooks are available to NAR members:

The Straightforward Business Plan (eBook)

Business Plan Checklist (eBook)

The SWOT Analysis (eBook)

The Business Plan Workbook (eBook)

Start-Up! A Beginner's Guide to Planning a 21st Century Business (eBook)

Complete Book of Business Plans (eBook)

How to Write a Business Plan (eBook)

The Easy Step by Step Guide to Writing a Business Plan and Making it Work (eBook)

Business Planning: 25 Keys to a Sound Business Plan (Audiobook)

Your First Business Plan, 5 th Edition (eBook)

Anatomy of a Business Plan (eBook)

Writing a Business Plan and Making it Work (Audiobook)

The Social Network Business Plan (eBook)

Books, Videos, Research Reports & More

As a member benefit, the following resources and more are available for loan through the NAR Library. Items will be mailed directly to you or made available for pickup at the REALTOR® Building in Chicago.

Writing an Effective Business Plan (Deloitte and Touche, 1999) HD 1375 D37w

Have an idea for a real estate topic? Send us your suggestions .

The inclusion of links on this page does not imply endorsement by the National Association of REALTORS®. NAR makes no representations about whether the content of any external sites which may be linked in this page complies with state or federal laws or regulations or with applicable NAR policies. These links are provided for your convenience only and you rely on them at your own risk.

Real Estate Business Planning for 2024: Your Path to Success

As we step into the promising landscape of 2024, real estate professionals are gearing up to set their business goals and strategies for the year ahead. Whether you’re an experienced agent or just starting in the industry, effective business planning is key to navigating the ever-evolving real estate market. In this blog post, we’ll explore essential tips to help you create a robust business plan for a successful 2024.

1. Reflect and Analyze Your 2023 Performance

Before you set your sights on 2024, take a moment to look back at 2023. What were your biggest sources of leads? How effective was your marketing strategy? What worked well, and what needs adjustments? Reflecting on the past year’s performance can provide valuable insights into areas where you excelled and areas that may require improvement.

For newer agents, finding leads may be a primary focus. Building relationships within your existing network can be a powerful way to generate leads. Consider connecting with people you naturally engage with, such as those from your place of worship, former colleagues, fellow parents from your kids’ sports teams, or even your social media contacts.

2. Set Clear and Measurable Goals

One of the fundamental components of your business plan is goal-setting. Start by writing down your goals for 2024, making them visible in your workspace. Prioritize your personal life, ensuring that you allocate time for your family. It’s essential not to put your loved ones last on your list.

Next, create a comprehensive business plan that outlines the specific targets you aim to achieve throughout the year. Consider factors like how many contacts, listings, and sales you’ll need to meet your monthly, quarterly, and annual financial goals. Having clear, measurable objectives will provide you with a roadmap to track your progress and stay motivated.

3. Craft a Strategic Work Schedule

Your daily and weekly work schedule plays a crucial role in supporting your goals. Assign priority to activities that directly contribute to your income. These income-producing activities may include lead generation, client follow-up, contract writing, roleplaying, and skill development. Prioritize these activities in your schedule to maximize your earning potential.

4. Develop a Targeted Marketing Plan

In today’s real estate landscape, a well-thought-out marketing plan is essential. Identify the primary sources of business that work best for you. These sources could include social media marketing, geographic farming, targeting expired listings, or focusing on new-home construction. Create tailored marketing plans for each of these sources to maximize your reach and effectiveness.

5. Balance Professional and Personal Growth

Achieving success in real estate is not solely about professional growth; it’s also about maintaining a balanced personal life. Outline both professional and personal growth plans in your business strategy.

Professional growth goals may encompass activities such as reading regularly, enrolling in relevant courses, obtaining professional designations, or attending industry-related seminars and conferences. These pursuits enhance your skills and knowledge, positioning you as a more valuable asset to your clients.

On the personal front, it’s crucial to set goals that prioritize your well-being and happiness. Dedicate quality time to your loved ones, pursue hobbies or interests, and establish a savings plan to secure your financial future.

As you embark on your journey in real estate for 2024, remember that effective business planning is the foundation of your success. By reflecting on past performance, setting clear goals, crafting a strategic work schedule, developing targeted marketing plans, and balancing personal and professional growth, you can create a robust business plan that guides you towards achieving your aspirations. Here’s to a prosperous and fulfilling year ahead in the world of real estate!

Recent Posts

Understanding commission advances: how they work and why you need one, how does international real estate work, exploring the “work, play, live” concept in real estate.

- What to Expect as the Real Estate Market Heats Up for Summer 2024

- Money Management for Real Estate Professionals

- Advanced Commissions

- Current Trends

- Identity Theft

- Landscaping

- Miscellaneous

- Personal Growth

- Press Release

- Professional Development

- Real Estate

Previous Post 2024 Real Estate Forecast: What Homebuyers and Sellers Need to Know

Next post how do real estate agents get paid, recommended for you.

Your real estate business plan is your greatest predictor of success…

…because when done correctly, it serves as your guide for the entire year. Let me show you how to bring more certainty to what you can achieve.

Our industry is going through a monumental shift, leaving much uncertainty in the air. However, with a powerful real estate business plan in hand, you can navigate these turbulent waters with confidence. No matter which direction the market takes, your finely tuned real estate business plan will keep you on track and unfazed. Let it be your guiding light that illuminates the way forward, ensuring unwavering certainty in your journey.

That’s why I hosted a webinar called “ Make It or Break It: Business Planning for a Turbulent Year and Beyond ,” which is dedicated to helping you create a real estate business plan for success.

In this blog, I’m giving you a sneak peek inside, sharing seven fundamental elements that make up a truly effective real estate business plan. Take some time to think about each of them before you listen to the webinar!

I can’t stress how important it is that you begin thinking about this stuff NOW and do it in the correct way. So with that said, let’s dive right in…

Real Estate Business Plan Fundamentals

No. 1: purpose.

Begin with your “What?” It is a fundamental principle that the universe cannot give you what you want if you don’t even know what you want.

So what do you want? But more than that, what does it look like? In ten years, what do you hope to build? “Selling some houses to make some money” is not a mission; it’s just a thing you want to do, and it won’t fuel you to achieve anything truly special.

If you haven’t already realized what your purpose is, you can discover it by listing out what you value, because your mission statement should reflect the physical manifestation of your values. And if you need help here, in the webinar I’ll show you what my top five values are in order to give you an example to work off of.

No. 2: Motivation

Now that you know what you want, WHY do you want it?

The fact of the matter is that you will get tired and there will be times when you feel like getting complacent or not following through. In order to have a guaranteed way of refueling yourself and staying on track, you need to be very honest about what motivates you.

Fear of letting down my family, those who work for me, and the agents I serve is what honestly motivates me. These answers sound like what you’d hear from a LOT of people, but the truth is, sometimes people deceive themselves about what actually motivates them. This requires deep introspection. If money, lots of vacations, or status are what really inspire you to work at your best, you need to know that.

Once you know what or who you’re doing it for, it’s time to put an accountability plan in place, because no one can stay self-motivated all the time – that’s just not how people work. And unless your spouse is a professional business coach who can look at your numbers and hold you truly accountable, they don’t exactly count.

No 3: Units & Goals

What if I told you that you could bring increased predictability to your business , even with uncertain market conditions? That’s the power of tracking and measuring , and in next week’s webinar, I’ll help you dig into all the most important metrics to know.

It’s about getting very specific about what’s possible and breaking it down into an equation you can follow for success. When you set overly ambitious goals without reason or a guide to reaching them, then those aren’t real goals – they’re hopes and wishes.

No. 4: Marketing & Lead Gen

Identifying how you’ll attract new business and committing to your plan is one of the most crucial steps toward making the new year a successful one:

- What marketing are you currently running?

- What marketing are you planning to run?

- And most importantly, what marketing can you afford to run?

Your marketing budget and action plan are vital to a successful real estate business plan, but they must have a thoughtful strategy behind them. Look through what’s showing you the best results and what lead-generation pillars can complement or integrate with what you’re already doing.

Maybe there are areas where you spent too much money or ones where you would have benefited from investing significantly more. We need to get your budget dialed in and then align it with the action items you need to be hitting yearly, quarterly, monthly, weekly, and daily. Join me for the webinar and we’ll give you the template to figure all of this out.

No. 5: Operations

Just because someone is running a business doesn’t mean that they always understand how it works. If you keep doing the same procedure over and over and have inconsistent results with it, there is something wrong with the procedure.

Our goal in this section is to prepare you and your team (if you have one or are planning to build one) with all the tools, resources, and SYSTEMS you need to get more done with less effort. If your SOPs aren’t already completely locked down, you want to pay extra attention to this section of your business plan.

No. 6: Finances

Isn’t it interesting how people who don’t budget their money always seem to struggle with it, no matter how much they make? Well, you’re not going to be that person.

Your real estate business plan should have an exact breakdown of what happens with every commission check, covering your taxes, expenses, and every other aspect of your financial plan. You’ll want to work on paying off debts, making wise investments, and having money set away in case you need it (REMEMBER THAT SHIFTING MARKET?).

No. 7: An Important Exercise

I’m going to hold back here because we covered this exercise at length during our “Make It or Break It: Business Planning” webinar , and broke it down step by step. Get access to this important business planning webinar , and be sure to take notes because this is an exercise that should be done annually for every business plan you craft.

How About Access to a Business Planning Webinar?

As a real estate professional, solving problems for a profit is what it’s all about. And with the inevitable challenges that the next 12 months will bring, it’s more crucial than ever to be equipped and prepared. That’s why our recent business planning webinar , “Make It or Break It: Business Planning for a Turbulent Year and Beyond,” was a massive hit.

With access to this on-demand business plan webinar, you’ll gain immediate access to our acclaimed seven-point business plan template, essential tips on fostering the right mindset to conquer today’s volatile market, engaging Q&A sessions, and more insights from Tom Ferry.

Don’t miss this chance to arm yourself with the knowledge and tools to thrive. Unlock your access to the full video, business plan, and more.

Related Articles

Would you like to generate and convert more leads in less time.

- Free consultation

- Leadership Coaching

- One2One Coaching

- Group Coaching

- Success Stories

- The Curious CEO

- Our System Explained

- Referral Maker PRO

- Referral Maker CRM

- REALStrengths

- Buffini Referral Network

- Buffini Groups

- Do It N.O.W.

- Become a Certified Full-Service Professional

- 100 Days to Greatness

- The Pathway to Mastery—Essentials

- The Pathway to Mastery—Advanced

- Peak Producers

- Ultimate Recruiting Solution

- Buffini Certification – Start Here!

- Master Class

- The Peak Experience

- MasterMind Summit

- Leadership Conference

- Virtual Events

- Meet Our Speakers

- Free Resources

- Buffini Bonus Content

- Free Tips and Training

- It's a Good Life podcast

- Free Business Consultation

- 25th Year Anniversary

- Press Releases

- Submit a Referral

- Brian Buffini

- The Emigrant Edge

- Take a Course About Buffini & Company Training Buffini & Company real estate training programs maximize agent productivity and profitability for all skill levels, while taking you to the next level of your career. Available Courses 100 Days to Greatness In just 100 days, this real estate training course will guide you through proven systems to launch or jumpstart your real estate career. NAR Member Special --> The Pathway to Mastery - Essentials In just eight weeks, master the fundamentals of Working by Referral, lead generation, working with buyers and sellers, negotiation and building a world-class business plan. The Pathway to Mastery - Advanced This next-level training course contains eight modules taking a deep dive into objection handling, pricing presentations and the entire buying and selling process start to finish. Peak Producers Learn to generate leads every day, professionally serve all clients and produce at a consistently high level when Working by Referral in this 12-week course. --> Ultimate Recruiting Solutions Watch eight videos facilitated by Buffini & Company trainers providing insights, strategies and best practices that will transform you into the Ultimate Recruiter.

- Lead a Course About Buffini & Company Training Get Buffini Certified to facilitate real estate training courses for agents on every step of the real estate career path, from licensee to seasoned pro. Available Courses 100 Days to Greatness In 100 days, help your agents establish systems to launch their real estate career that include lead generation, closing deals and leveraging time, energy and money. NAR Member Special --> The Pathway to Mastery - Essentials Increase your agents’ bottom lines by facilitating this eight-week program diving deep into lead generation, working with buyers and sellers, negotiation and business planning. The Pathway to Mastery - Advanced Strengthen agents’ Work by Referral foundations with this eight-module, next-level training course focused on creating a more professional buyer/seller experience. . Peak Producers In 12 weeks, help your agents get the skills to build a rock-solid real estate business and overcome the peaks and valleys in income and referrals. -->

- Buffini & Company Magazine

Search Buffini & Company

Buffini & company blog, 9 steps to creating a strategic real estate business plan for 2024.

- Posted on Work by Referral

Catch all the groundbreaking insights of Brian Buffini’s Mid-Year Bold Predictions 2024 , now available on-demand. Has there ever been a more complex time in the real estate industry? Brian gives you the inside scoop on what’s taking place behind the numbers. Watch now.

Creating a comprehensive business plan is essential for real estate agents who want to stay organized, maximize productivity and win market share. Here are 9 steps an agent should take to design a dynamic strategic plan.

1. Define Your Mission Statement

Take some time to reflect on why you are in this business. What are your primary reasons? What benefits will you provide to your potential clients? What do you hope to accomplish by taking on this responsibility?

2. Define Your Target Audience or Niche Think about what types of clients you want to work with. It could be a category of people (such as new homeowners) or a specific niche (such as retirement communities). Will extra resources or measures be needed to reach them?

3. Evaluate Your Resources

Will you be working by yourself? Determine if it would make sense to hire an assistant or another agent to help manage lead generation. If you have a team, create a flow chart with each member’s responsibilities. That will help you to see who is doing what and identify any gaps to fill.

4. Set Clear Goals

A great model to follow is SMART goals : specific, measurable, achievable, relevant.

Include both short- and long-term objectives, such as annual income targets and the number of transactions you aim to complete.

5. Establish Budget and Financial Projections

Create a detailed budget that accounts for business expenses, such as licensing fees, marketing and advertising, office space and transportation.

Lead generation is your most important priority. A comprehensive, well-designed, multi-faceted marketing campaign is crucial for your business to succeed. As part of your budgeting step, be sure to include this important category and analyze if it makes sense to do in-house or to off source.

6. Create Strategic Action Steps

A great customer relationship management (CRM) system will help you run your business with maximum productivity.

- It allows you to organize all your contacts and their detailed information in one place. It also lets you rank contacts by importance and informs you when and how those clients and leads should be contacted.

- It has functionality that creates detailed reports so you can track your transactions and expenses. It should also be able to generate reports, so you know if you are on target to meet your financial goals and what to do to reach them.

- It helps you stay aligned with your goals, to-do lists and calendars. A CRM can also create action steps based on your goals and current progress and can generate your priority list.

7. Create a Plan for Evaluation and Review

Regularly review your progress and adjust your business plan as needed. Use key performance indicators (KPIs) to see if you are hitting your benchmarks and if you need to adjust your plan.

8. Consider Support and Accountability

Consider working with a real estate coach to help you strategize and implement measures so you can reach your goals. A coach will also help you deal with issues head on to keep you accountable and on task.

9. Commit to Continuous Learning

Commit to ongoing professional development by attending training seminars and staying updated on industry trends.

Buffini & Company – We’ve Got You!

Buffini & Company’s coaches have already been working to establish systems and resources in place to help get their clients ready and positioned for a strong 2024 selling season. To learn more about how a coach can help you take full advantage of the extraordinary year to come, schedule a free Business Consultation .

Share this:

Leave a reply.

Your email address will not be published. Required fields are marked *

Related Posts

August 19, 2024

Real estate business plan – what you need to build, maintain, and grow your business.

Are you prepared to make this your best year ever? Begin [...]

August 8, 2024

Re/max co-founder shares tips to excel.

When it comes to real estate, there are leaders — and then there [...]

August 2, 2024

Certified full-service professional (cfsp) real estate training | buffini.

The real estate industry is at a crossroads amid legal [...]

July 31, 2024

Prepare to thrive in 2025 with brian’s bold predictions | buffini.

The real estate industry has seen many changes over the last years [...]

July 26, 2024

Real estate lead generation – challenges, strategies, and how to stand out.

Real estate lead generation is the process of identifying and [...]

July 9, 2024

Watch brian buffini’s bold predictions: mid-year 2024 real estate market outlook july 22.

Brian Buffini, the chairman and founder of Buffini & Company, will [...]

See how we help top agents create and grow their own companies — without the burdens of operating a brokerage.

Explore Benefits

Success Stories

See how our partners are breaking production records and surpassing growth benchmarks.

See the Results

Discover who we are, how we work, and what we’re doing to change the real estate industry for good.

Learn About Side

Browse videos, blogs, events and news — compiled to help you work smarter and stay in the know.

View Resources

Side Mobile Menu

- Top-Producing Agents

- Top-Producing Agents with Teams

- Top-Producing Independent Brokers

- High-Potential Agents

- Productivity

- RealTrends Rankings

- States and Managing Brokers

- Partner News

- Own It Podcast

- Market Updates

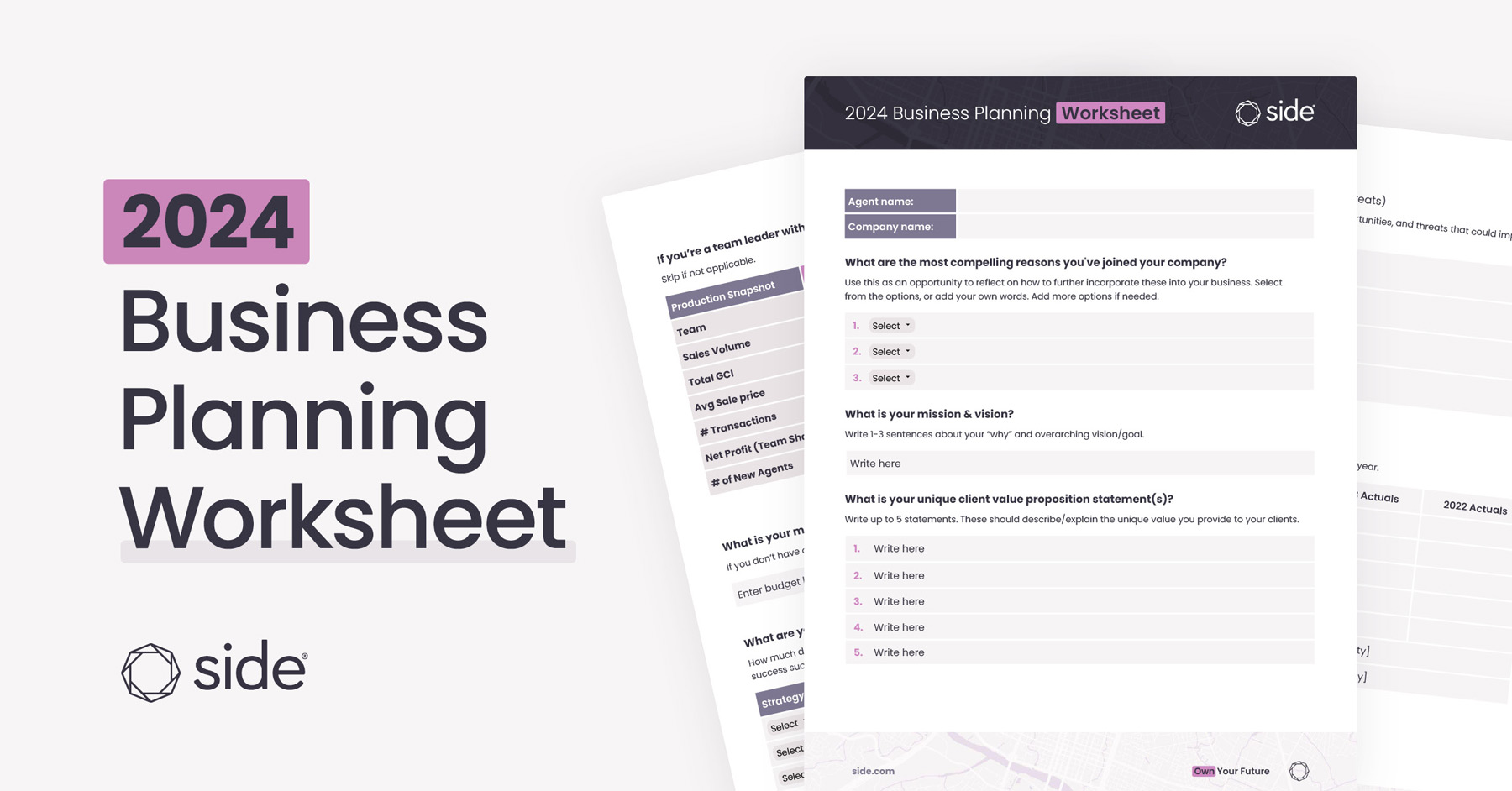

Download Your 2024 Real Estate Business Planning Worksheet

- Share on Facebook

- Share on X Profile

- Share on LinkedIn Page

- Share via Email

To achieve your goals, you have to have the right plan in place. So we’ve created a 2024 Business Planning Worksheet that will help you consider (and capture):

- ✅ What you need or value most in your business

- 🤓 Your overarching career vision and mission

- 🌟 The unique value you provide to your clients

- 💪 Your strengths, weaknesses, opportunities, and threats

- 📊 Your business and financial goals

You’ll come away with a clearer understanding of what you’d like to accomplish, the key areas you should focus on, and the tactics you should use to make 2024 your best year yet.

Partner with Side

Start the conversation.

Please use a different email address to ensure our team can reach you.

- Buyer Agent 101

- Listing Agent 101

- Getting Your License

- Open Houses

- Stats + Trends

- Realtor Safety

- Social Media

- Website Marketing

- Referral Marketing

- Property Marketing

- Branding + PR

- Marketing Companies

- Purchasing Leads

- Prospecting

- Paid Advertising

- Generate Listings

- Generate Buyer Leads

- Apps + Software

- Lead Gen Companies

- Website Builders

- Predictive Analytics

- Brokerage Tech

- Building a Brokerage

- Recruiting Agents

- Lead Generation

- Tech Reviews

- Write for Us

All products mentioned at The Close are in the best interest of real estate professionals. We are editorially independent and may earn commissions from partner links.

7 Steps to Writing a Real Estate Business Plan (+ Template)

As a licensed real estate agent in Florida, Jodie built a successful real estate business by combining her real estate knowledge, copywriting, and digital marketing expertise. See full bio

- Do Agents Really Need a Business Plan?

- Write a Real Estate Business Plan in 7 Easy Steps

- Identify Who You Are as a Real Estate Agent

- Analyze Your Real Estate Market

- Identify Your Ideal Client

- Conduct a SWOT Analysis

- Establish Your SMART Goals

- Create Your Financial Plan

- Track Your Progress & Adjust as Needed

- Bringing It All Together

Are you ready to take your business to the next level? I’ve got just the thing to help you— a foolproof real estate business plan. But before you start thinking, “Ugh, not a boring business plan for real estate,” hear me out. I’ve got a template that’ll make the process a breeze. Plus, I’ll walk you through seven easy steps to craft a plan to put you ahead of the game and have you achieve your wildest real estate dreams in no time. Your success story starts now.

Key Takeaways:

- A well-crafted business plan is your roadmap to success. It guides your decisions and keeps you focused on your goals.

- Create a solid plan by defining your mission, vision, and values, analyzing your market and ideal client, conducting a SWOT analysis, setting SMART goals, and creating a financial plan.

- Regularly track your progress, review your key performance indicators (KPIs), stay flexible, and seek accountability to ensure long-term success.

- Remember, your Realtor business plan should evolve with your business. Embrace change and stay focused on your goals to make your real estate dreams a reality.

Do Agents Really Need a Real Estate Business Plan?

Absolutely. Your real estate agent business plan is your roadmap to success. Without it, you risk losing direction and focus in your real estate career.

A well-crafted business plan helps you:

- Understand your current position in the market

- Set clear and achievable goals

- Create a roadmap for success

- Track your progress and performance

- Make informed decisions and adjustments

Think of your real estate business planning as your GPS, guiding you from your current situation to your desired destination. It serves as your North Star, keeping you focused and on track, even in challenging times. Invest the time to create a solid business plan, and you’ll be well-positioned to succeed in your market and achieve your goals. Your future self will appreciate the effort you put in now.

Before we dive into this section, get our real estate business plan template ( click here to go back up to grab it ) and work through it as I explain each section. I’ll give you some direction on each element to help you craft your own business plan.

1. Identify Who You Are as a Real Estate Agent

Let’s start with your “why.” Understanding your purpose for choosing real estate is crucial because it is the foundation for your business plan and guides your decision-making process. Defining your mission, vision, and values will help you stay focused and motivated as you navigate your real estate career.

Mission: Your mission statement defines your purpose for choosing real estate. It clearly states what you’re trying to do, the problem you want to solve, and the difference you want to make.

Ex: Wanda Sellfast’s mission is to empower first-time homebuyers in Sunnyvale, California, to achieve their dream of homeownership and build long-term wealth through real estate.

Vision: Your vision statement focuses on the ultimate outcome you want to achieve for your clients and community.

Ex: Wanda Sellfast’s vision is a Sunnyvale, where everyone has the opportunity to own a home and build a stable, secure future, creating a more inclusive and prosperous community for all.

Values: Your core values are the guiding principles that shape your behavior, decisions, and interactions with clients and colleagues.

Ex: Wanda Sellfast’s core values include:

- Integrity: Being honest, transparent, and ethical in all dealings.

- Dedication: Being devoted to clients’ success and going the extra mile.

- Community: Building strong, vibrant communities and giving back.

Clearly defining your mission, vision, and values lays the foundation for a strong and purposeful real estate business that will help you positively impact your clients’ lives and your community.

2. Analyze Your Real Estate Market

As a real estate pro, you must deeply understand your local market. This knowledge includes knowing key metrics such as average days on market, average price points, common home styles and sizes, and demographic trends. When someone asks about the market, you should be able to confidently roll those numbers off your tongue without hesitation.

To quickly become the local expert, choosing specific farm areas to focus on is crucial. Concentrate your marketing efforts and build your local knowledge in a handful of communities and neighborhoods.

Some places to do research include:

- Your local MLS: Check your hot sheet daily

- Zillow: Check out the Premier Agents who show up in your neighborhood

- Social media: Who is targeting their posts to your area?

- Direct mail: Check your mailbox for flyers and postcards

- Drive by: Drive through your farm areas to see who has signs in yards

Once you’ve identified your target areas, start conducting comparative market analyses (CMAs) to familiarize yourself with the properties and trends in those neighborhoods. That way, you’ll provide accurate insights to your clients and make informed decisions in your business.

Remember to research your competition. Understand what other agents working in the same area are doing, who they’re targeting, and identify any gaps in their services. This understanding will help you differentiate yourself from your competition and better serve your clients’ needs. In our real estate business planning template, I ask you to examine and record:

- Trends: Track key metrics, such as days on market and average sold prices, to stay informed about your specific market.

- Market opportunities: Identify situations where there are more buyers and sellers (or vice versa) in the marketplace so you can better advise your clients and find opportunities for them and your business.

- Market saturation: Recognize areas where there may be an oversupply of certain property types or price points, allowing you to adjust your strategy accordingly.

- Local competition: Analyze your competitors’ strengths, weaknesses, and gaps in their services to identify opportunities for differentiation and possibilities to create a more meaningful impact.

Remember, real estate is hyper-local. While national and state news can provide some context, your primary focus should be on specific needs and trends within your target areas and the clients you want to serve. By thoroughly analyzing your local real estate market, you’ll be well-equipped to make informed decisions, provide valuable insights to your clients, and ultimately build a successful and thriving business.

3. Identify Your Ideal Client

When creating your real estate business plan, it’s crucial to identify your ideal client. You can’t be everything to everyone, no matter how much you think you should. And trust me, you certainly don’t want to work with every single person who needs real estate advice. By focusing on your ideal client, you’ll create a targeted marketing message that effectively attracts the right people to your business—those you want to work with.

Think of your target market as a broad group of people who might be interested in your services, while your ideal client is a specific person you are best suited to work with within that group. To create a detailed profile of your ideal client, ask yourself questions like:

- What age range do they fall into?

- What’s their family situation?

- What’s their income level and profession?

- What are their hobbies and interests?

- What motivates them to buy or sell a home?

- What are their biggest fears or concerns about the real estate process?

Answering these questions will help you create a clear picture of your ideal client, making it easier to tailor your marketing messages and services to meet their needs. Consider using this ideal client worksheet , which guides you through the process of creating a detailed client avatar. This will ensure you don’t miss any important aspects of their profile, and you can refer back to it as you develop your marketing plan .

By incorporating your ideal client into your overall business plan, you’ll be better equipped to make informed decisions about your marketing efforts, service offerings, and growth strategies. This clarity will help you build stronger relationships with your clients, stand out from the competition, and ultimately achieve your real estate business goals.

4. Conduct a SWOT Analysis

If you want to crush it in this business, you’ve got to think like an entrepreneur. One of the best tools in your arsenal is a SWOT analysis. It sounds ominous, but don’t worry, it’s actually pretty simple. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It’s all about taking a good, hard look at yourself and your business.

| What do you slay at? Maybe you're a master negotiator or have a knack for finding hidden gem properties. Whatever it is, own it and make it the backbone of your strategy. | What's happening in your market that you can use to your advantage? Is there an untapped niche or a new technology that could help you streamline your business? |

| We all have weaknesses, so don't be afraid to admit yours. You may not be the best at staying organized or struggle with marketing. The key is to be honest with yourself and either work on improving those areas or hire someone to help you. | There's competition out there, but don't let that keep you up at night. Instead of obsessing over what other agents are doing, focus on your game plan and stick to it. Identifying threats means recognizing things outside your control that could hinder your success, like the slowing real estate market or limited inventory. |

By conducting a SWOT analysis as part of your real estate business plan, you’ll have a clear picture of your current situation and your future goals. And don’t just do it once and forget about it—review and update it regularly to stay on top of your game.

5. Establish Your SMART Goals

If you want to make it big in real estate, setting goals is an absolute must . But not just any goals— I’m talking about SMART goals . SMART stands for Specific , Measurable , Achievable, Relevant , and Time-bound . It’s like a recipe for success, ensuring your goals are clear, realistic, and have a deadline.

Your SMART goals are an integral part of your overall business plan for real estate. They should be stepping stones to help you achieve your long-term vision and mission. So, analyze your SWOT analysis, ideal client, and market, and craft goals that will help you dominate your niche.

Example Smart Goal: Close 10 transactions in the next quarter.

Make sure to provide as many details as possible behind your goals. Don’t just say, “I want to sell more houses.” That’s too vague. In the example above, the goal is specific: “close 10 transactions.”

If you can’t measure your progress, how will you know if you’re crushing it or falling behind? Ensure your goals have numbers attached to track your success or see where you need to focus more energy. “Close 10 transactions” has a specific number, so you have a way to measure your progress.

I know you’ve got big dreams for your real estate business , but Rome wasn’t built in a day. Set goals that stretch you beyond your comfort zone but are still achievable. This way, you’ll gain confidence, build momentum, and push yourself to new heights. Closing 10 transactions in a quarter is a lofty goal, but it’s still achievable. Your goals should stretch you but still be within your reach.

Relevant goals are the ones that actually move the needle for your business. Sure, becoming the next TikTok sensation might be a lot of fun, but unless TikTok generates most of your clients, it won’t help you close more deals. Your goals should be laser-focused on the activities and milestones that will help you grow your real estate career. In the example above, the goal is specifically related to real estate.

Deadlines are your friend. Without a timeline, your goals are just wishes. Give yourself a precise end date and work backward to create a plan of action. In the example, the deadline for achieving the goal is the end of the current quarter. If you don’t achieve the goal, you can evaluate where the shortfall was and reset for the next quarter.

“Setting goals is the first step in turning the invisible into the visible.”

Tony Robbins

Remember, just like your SWOT analysis, your goals aren’t set in stone. Review and adjust them regularly to stay on track and adapt to business and market changes.

6. Create Your Financial Plan

Financial planning might not be your idea of a good time, but this is where your real estate business plan really comes together. Thanks to all the research and strategizing you’ve done, most of the heavy lifting is already done. Now, it’s just a matter of plugging in the numbers and ensuring everything adds up.

In this real estate business plan template section, you’ll want to account for all your operating expenses. That means everything from your marketing budget to your lead generation costs. Don’t forget about the little things (like printer ink, file folders, thank you cards, etc.)—they might seem small, but they can add up quickly. Some typical expenses to consider include:

- Marketing and advertising (business cards, website , social media ads )

- Lead generation ( online leads , referral fees, networking events )

- Office supplies and equipment (computer, printer, software subscriptions )

- Transportation (gas, car maintenance, parking)

- Professional development (training, courses, conferences )

- Dues and memberships (MLS fees, association dues)

- Insurance (errors and omissions, general liability)

- Taxes and licenses (business licenses, self-employment taxes)

Once you’ve figured out your expenses, it’s time to reverse-engineer the numbers and determine how many deals you need to close each month to cover your costs. If you’re just starting out and don’t have a track record to go off of, no worries! This planning period allows you to set a budget and create a roadmap for success.

Pro tip: Keep your personal and business finances separate. Never dip into your personal cash for business expenses. Not only will it make tax time a nightmare, but it’s way too easy to blow your budget without even realizing it.

If you’re evaluating your starting assets and realizing they don’t quite match your startup costs, don’t panic. This new insight is just a sign that you must return to the drawing board and tweak your strategy until the numbers line up. It might take some trial and error, but getting your financial plan right from the start is worth it.

7. Track Your Progress & Adjust as Needed

You’ve worked hard and created a killer real estate business plan, and you’re ready to take on the world. But remember, your business plan isn’t a one-and-done deal. It’s a living, breathing document that needs to evolve as your business grows and changes. That’s why it’s so important to track your progress and make adjustments along the way.

Here are a few key things to keep in mind:

- Set regular check-ins: Schedule dedicated time to review your progress and see how you’re doing against your goals, whether weekly, monthly, or quarterly.

- Keep an eye on your KPIs: Your key performance indicators (KPIs) are the metrics that matter most to your business. Things like lead generation, conversion rates, and average sales price can give you a clear picture of your performance.

- Celebrate your wins: When you hit a milestone or crush a goal, take a moment to celebrate. Acknowledging your successes will keep you motivated and energized.

- Don’t be afraid to pivot: If something isn’t working, change course. Your real estate business plan should be flexible enough to accommodate new opportunities and shifting market conditions.

- Stay accountable: Find an accountability partner, join a mastermind group, or work with a coach to help you stay on track and overcome obstacles.

“It’s the small wins on the long journey that we need in order to keep our confidence, joy, and motivation alive.”

Brendon Burchard

Remember, your real estate business plan is your roadmap to success. But even the best-laid plans need to be adjusted from time to time. By tracking your progress, staying flexible, and keeping your eye on the prize, you’ll be well on your way to building the real estate business of your dreams.

How do I start a real estate business plan?

Use this step-by-step guide and the downloadable real estate business plan template to map your business goals, finances, and mission. Identify your ideal client so you can target your marketing strategy. Once you’ve completed all the business plan elements, put them into action and watch your real estate business grow.

Is starting a real estate business profitable?

In the most simple terms, absolutely yes! Real estate can be an extremely profitable business if it’s run properly. But you need to have a roadmap to follow to keep track of your spending vs income. It’s easy to lose track of expenses and overextend yourself when you don’t have a set plan.

How do I jump-start my real estate business?

One of the easiest ways to jump-start any business is to set clear goals for yourself. Use this guide and the downloadable template to ensure you have clear, concise, trackable goals to keep you on track.

How do I organize my real estate business?

Start by setting some SMART goals to give yourself a concrete idea of what you see as success. Then, make sure you’re using the right tools—customer relationship manager (CRM), website, digital document signing, digital forms, etc., and make sure you have them easily accessible. Try keeping most of your business running from inside your CRM. It’s much easier to keep everything organized if everything is in one place.

Now, you have a step-by-step guide to creating a real estate business plan that will take your career to the next level. Taking the extra time to map your path to success is an essential step in helping you achieve your goals. Spend the extra time—it’s worth it. Now, it’s time to do the work and make it happen. You’ve got this!

Have you created your real estate business plan? Did I miss any crucial steps? Let me know in the comments!

As a licensed real estate agent in Florida, Jodie built a successful real estate business by combining her real estate knowledge, copywriting, and digital marketing expertise.

51 Comments

Add comment cancel reply.

Your email address will not be published. Required fields are marked *

Related articles

The best & worst time to sell a house going into 2025.

According to statistics, the best months to sell a home are from spring through late summer (April to October), while the worst time to sell a house is from fall to winter (November to March).

Real Estate Buyer Questionnaire to Build Rapport & Trust (+ PDF)

Are house hunters ghosting you? The trick to turning prospects into buyer clients is taking the time to listen to their hopes, dreams, and needs. Here's the questionnaire that will help you do just that.

The #1 Open House Checklist Top Agents Use to Get Amazing Results

Want to crush your next open house? We've got a checklist and plenty of pro tips that will give you everything you need to host your most successful listing promotions event yet.

Success! You've been subscribed.

Help us get to know you better.

Your 2024 Real Estate Business Plan Checklist

November 10, 2023

Real Estate Business Planning, Real Estate CRM

We’ve all been there – we put the work in to build out a business plan for your real estate team for the new year, only for it to fall apart come March. All of that time spent business planning in the trash. And here we are again, nearing the end of the year and we’re starting to look ahead to 2024. Instead of going through the same motions in anticipation that your business plan will, again, meet its demise, try changing your approach. See how you can build a real estate business plan that’s flexible, can change as the market does and better yet – be used and employed.

Start by taking a look at your business to see where you can make improvements to generate more money, while also saving money. This is especially relevant if your market is down by 40% or more, which is the case in some areas. A helpful tip you can use to better understand what’s going on in your market is to leverage MLS to look at the units closed last year compared to this year. Identifying realistic growth levers for your business will help set your real estate team up for success. We cover this and more in our latest webinar with our partners, Sisu and Spring B, team leader of the #1 team in Utah and a Sierra Interactive power user. You can watch it here .

Forty percent is a pretty intimidating number, and we know it’s not realistic to try and cut 40% of expenses. So that brings us to the question – how do we bring in more revenue? Using a revenue waterfall methodology to examine your business and identify growth levers will help get you there. There are four main levers that real estate teams can pull to increase revenue:

- Increase per-agent productivity

- Increase price point

- Increase agent count

- Manage expenses

Increase Per-Agent Productivity

When looking at ways to increase revenue outside of ancillaries, you can start by focusing on increasing per-agent productivity. Start by making sure you have standard operating procedures for speed to lead, number of attempted contacts and types of attempted contacts. Accountability here is key, so it’s good to get in the habit of auditing your database weekly to ensure agents are following through on your expectations. If not, pull them off lead flow until rectified. Additionally, setting up action plans with automation to streamline processes and automate messaging, touchpoints and tasks will make it easier for agents to get more done with less. This allows them to focus on the most high-intent, transaction-ready leads while the CRM nurtures the others until they’re ready . Setting up lead ponds is another tool that agents, including new hires, can use to self-source leads and create opportunities. Over everything, the biggest takeaway is that if it’s not in the CRM, it doesn’t exist, or it didn’t happen. Building adoption of the CRM across your entire real estate team is critical to increasing per-agent productivity.

Increase Price Point

The concept of increasing your price point may seem simple, however, it’s easier said than done. It’s far from an easy button, rather a lever you really need to put some sweat equity into. It isn’t even possible in every market. With that said, where do you start? First, ensure that you have content pages set up and optimized on your website targeted to the neighborhoods, cities and areas that have your ideal price point. You should also consider running paid ad campaigns for those areas to increase your brand awareness in your target neighborhoods. The focus here is to farm your target areas and plant seeds through direct mailers, blog posts with a local focus, or a neighborhood website. This begins establishing a presence where you want your increased price point to grow.

Increase Agent Count

The first rule of increasing your agent count? Recruit. The second rule of increasing your agent count? Recruit. Cue Brad Pitt. For many real estate team leaders, this may be the answer and the biggest growth lever you have if expenses are in line, price points are firm and agent productivity is in check. When increasing your agent count, set your new agents up for success with the following:

- A bootcamp to get them ramped and productive quickly

- Train on systems, processes and expectations included in your real estate business plan

- Have new agents shadow veteran agents

- Provide them with a pond or specific lead sources to work. This will get them on the phones early to gauge if they’re going to do the work and fit the profile

- Set benchmarks for performance and clear expectations, meeting frequently to coach on these

Having a good CRM in place that’s simple and intuitive will make the onboarding process much smoother and reduce friction when introducing new agents.

Managing Expenses

The final growth lever is to make sure you understand your expenses and profit margins. The benchmark for real estate profit margin is 30%, and 40% for COGs. It is decidedly difficult to cut much of your expenses, but significantly easier to trim the fat. You can do this by simply looking at your tech stack and identifying what’s working for you and what’s not. Steer clear of shiny object syndrome (as hard as this is), and focus on the technology that your team will actually use. This includes your website, CRM, reporting and action management tools. In addition, look at your paid lead sources – which ones are working, which ones are not? Find the ROI of each to help determine this. When you have this, turn off the lead sources that aren’t working for you and double down on the ones that are. Another option is to partner with a lender to share expenses.

Build Your Real Estate Business Plan

With these four growth levers in mind, which includes increasing per-agent productivity, increasing price point, increasing agent count, and managing expenses, you can build a more informed real estate business plan with realistic goals and clear areas of improvement. Sierra Interactive’s real estate CRM software will help you thread the needle through efficient lead management, smart lead follow-up and nurturing. See how Sierra Interactive can help put some rocket fuel into your 2024 real estate business plan – schedule a demo with us today.

Kelly Sanchez is the Content Marketing Manager at Sierra Interactive.

Schedule a Demo

Thoughtfully designed features, intuitive workflows and stunning UX. You’re about to find out why top-performing real estate teams pick Sierra.

Previous Post

Video: Thriving in the Current Real Estate Market: Strategies for Success

Video: success through others: how to build a productive, long-lasting and legacy real estate team, related posts.

Real Estate Business Planning

Turn Your Database Into a Growth Engine with...

Lead Generation

Generating Real Estate Seller Leads Online

Unearthing Hidden Leads in Your Real Estate Lead...

Lead Nurturing

The Secret to Real Estate Lead Nurturing Through...

We Hustle, So You Don’t Have To

Explore solutions that free your mind and your wallet.

- Get started

How to Write a Solid Real Estate Business Plan in 2024

March 13, 2024

If you want to grow your real estate business , then you’ll need to get clear on where you want to go and how you can get there.

Research from the Harvard Business Review indicates that entrepreneurs who create formal business plans are 16% more likely to achieve viability than those who don’t. Further studies also demonstrate that business planning can accelerate a firm’s growth by 30% , and the time invested in writing a business plan can significantly enhance the likelihood of success .

In this article, we’ll guide you through the critical elements of a strong real estate business plan, helping you create a unique strategy aligned with your company goals.

Find It Fast

Why every agent and broker should have a real estate business plan

A real estate business plan acts as a strategic blueprint for an agent, team, or brokerage, mapping out key facets, critical milestones, company goals, and the business’s overall financial health. A plan needs a clear vision and roadmap for how the company will achieve its goals and grow within its specific market.

Additionally, general business plans are pivotal in securing capital and compelling potential investors or partners. A great business plan can attract skilled employees and top-level talent, leading to further expansion and growth.

For an agent or a broker, a real estate business plan is essential for determining your identity in the luxury market and what you can offer clients. It helps you hone in on your ideal customer and allows you to assess the financial viability of your business easily.

Your real estate business plan is a guide to your goals and a clear-cut strategy for how you can stand out from the competition, grow your business, and fulfill your overarching mission.

Real estate business plans: the basics

When constructing your real estate business plan, it’s best to keep things simple, manageable, and achievable. Focus on where you are now, where you want to go, and how you can reasonably get there.

Here are six critical elements of a straightforward real estate business plan:

- Executive summary: The executive summary serves as a brief overview of who you are, your purpose, and your goals.

- Overview and objectives: The overview and objectives section can vary somewhat based on your individual needs, but they should include your mission statement, your history, and your objectives.

- Market opportunities and competitive analysis: Your business plan should outline where market conditions are ideal for the rapid growth of a business and what your competition is already doing in that space.

- SWOT analysis: SWOT stands for Strengths, Weaknesses, Opportunities, and Threats and is a useful analytical tool for determining your strategic position.

- Marketing plan: The marketing plan identifies and details how you will reach and attract your target audience.

- Financial plan: A financial plan is a fairly straightforward snapshot of the economic health of your business.

Most business plans adhere to a timeframe of three to five years, though some are as short as one year, others as long as seven. Although everything in this article provides recommendations for a three to five-year plan, it’s worth looking beyond five years for future growth opportunities.

Creating your own real estate business plan

Now that you know the main sections of your real estate business plan, let’s dive into exactly what goes into each element.

Executive summary

A good summary is typically one to two pages (although one is optimal) and should include the following:

- Description of services

- Summary of objectives

- Brief market and competition snapshot (you’ll dive deeper into this later in your business plan)

- Capital or partnership requirements, if applicable

Your executive summary is the one part of your business plan you can recite from memory. There’s no fluff. Consider this your elevator pitch to sell your vision and convince others to join you on your mission.

Overview and objectives

Mission statement.

Your mission statement is why you do what you do—the guiding principles for your business.

For example, here are two excellent real estate company mission statements:

- Compass : Our mission is to help everyone find their place in the world. Compass is building the first modern real estate platform, pairing the industry’s top talent with technology to make the search and sell experience intelligent and seamless.

- Sotheby’s Realty : Built on centuries of tradition and dedicated to innovation, the Sotheby’s International Realty brand artfully unites connoisseurs of life with their aspirations through a deeply connected global network of exceptional people.

Your history is just that—when you started, location, leadership, milestones, and notable services or specializations.

Objectives are your primary goals. A common technique for establishing your goals is through the “SMART” method, ensuring your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

Objectives that might cover the course of a five-year plan include:

- Rebrand the company website in 30 days.

- Establish a social media presence in 90 days.

- Close five transactions per month in year one and double transaction volume by year three.

- Double the size of the firm by year five.

Ensure your goals are targeted and realistic within your set time frame.

More likely than not, your business will have multiple objectives simultaneously. Group them based on category and designate a team member who will be responsible for managing achievements, setting milestones, and assessing progress.

Market opportunities and competitive analysis

Understanding your market and your competition involves taking stock of the landscape’s size, demographics, demands, and trends.

Market opportunities

When determining your market opportunities in your business plan, consider the following questions:

- What is the size and stability of the market?

- Is the market currently on an upward or downward trajectory?

- What are the current demographics of the market?

- What segment of the market do I want to target?

- Is there a demand for a particular type of housing?

- Are there more sellers than buyers, or vice versa?

Also, pinpoint specific market circumstances that could significantly impact your business, like interest rate trends or local economic development. Be sure to document these insights in your plan as well.

Competitive analysis

In many business plans, competitive analysis is worthy of its own standalone section. Regardless of how you present it, devote some space to your competition and thoroughly research what they currently do in the real estate market.

Include both immediate and secondary competitors, and note if the market is primed for new competitors in the future. Also, identify the risks and opportunities when comparing your niche market and services versus others vying for similar business.

Remember to ask yourself:

- What do I offer clients that the competition does not?

- Can I stand out in this market and generate revenue?

- How can I advertise myself to showcase these differences?

SWOT analysis