- Data Enrichment

- Chrome Extension

- Email Verification

- Technographics

- Email Finder

- Intent Data

- Case Studies

- Affiliate Program

- Help Center

How to Create a Sales Forecast (Examples & Templates)

Every business needs management tools to maximize performance and keep everything running smoothly. A sales forecast is a critical tool that businesses use to measure their progress and check everything is going to plan. Here’s a closer look at why sales forecasts are important and how to create them. We have some great templates for you, too.

What Is a Sales Forecast – And Which Factors Impact It?

Sales forecasts are data-backed predictions about the sales volume a business will experience over a specific period.

A sales forecast is very important because it provides the foundation for almost all other planning activities. Businesses will rely on accurate sales forecasting to better understand how they should plan financially and execute their game plan .

This means that sales forecasts have the potential to make or break a business.

As with anything in life, though, nothing is certain. Sales forecasts can be affected by a range of factors. This means that businesses have to prepare for any and all eventualities.

Here’s a look at some of the factors that can affect sales forecasting:

A lack of sales history

Sales forecasts are often built using historical data. Businesses analyze previous results to extrapolate and create predictions. If a business starts and lacks a good body of historical sales data, it will struggle to create an accurate sales forecast.

The type of business

Each industry has its series of unique challenges and quirks. Those factors are sometimes unpredictable and could affect a business’s revenues. The ad tech industry, for instance, is often rocked by new data privacy regulations.

Outside factors

Some businesses find that everything is moving according to plan before blindsiding by an unpredictable event they cannot control. Consumer earnings may plummet, for instance, and cause people to restrict their spending.

Inside factors

Some businesses are forced to change their pricing or payment structures. This new dynamic can often have unpredictable effects and cause a business to veer off course from what its sales forecast predicted.

Why Should You Establish Sales Forecasts?

Sales forecasting is essential for every business. Here are some of the key reasons.

Perform accurate financial planning

Sales forecasts help the CFO and financial team understand how much cash is going to be coming into a business. This gives businesses a better understanding of how they can use that capital and makes it possible to calculate what profit they can expect over a given period .

Plan sales activities

A sales forecast can help executives with sales planning. Those executives will understand how many salespeople to employ, for instance, and which quotas and targets to attribute to each of those salespeople. This means that an accurate sales forecast can help salespeople to understand and hit their objectives.

Coordinate marketing

A sales forecast will have a big impact on marketing. For instance, the sales forecast might show that sales are waning, and a bigger investment needs to be placed within marketing. It might also show that a particular product or service fails to deliver appropriate amounts of value.

Control inventory

A sales forecast gives businesses a good understanding of how much inventory they will need to purchase and retain. This is an important factor; it helps businesses balance overstocking and running out of materials. This is also true for SaaS businesses needing customer support and success.

Avoid fluctuations in price

An accurate sales forecast helps businesses maintain consistent product and service pricing. A poor sales forecast might mean a business is forced to adjust its pricing unpredictably. This tactic is often the result of panic; without the proper strategy, it jeopardizes a business’s profitability.

How to Forecast Sales – The Best Sales Forecasting Methods

Businesses around the world use a range of sales forecasting techniques. Here’s a closer look at some key methods you could use.

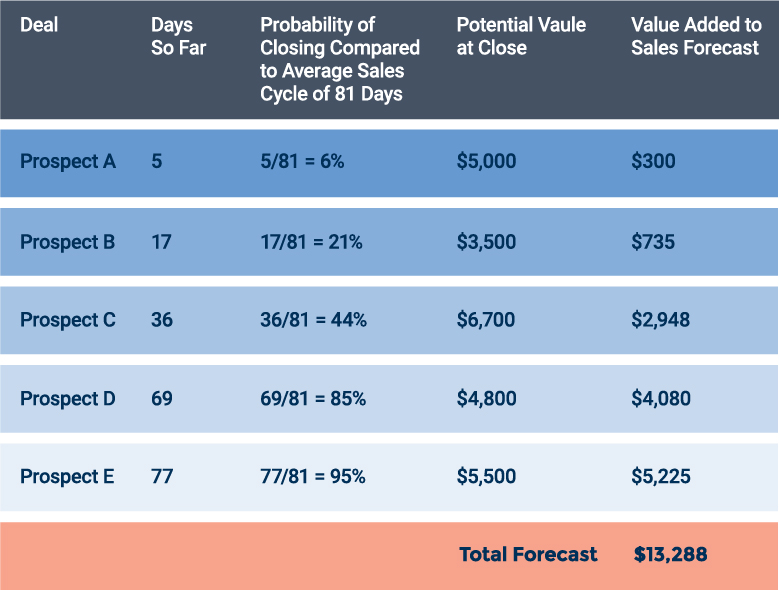

Opportunity Stage Forecasting

What is it?

This sales forecasting technique calculates the likelihood of deals closing throughout a pipeline.

Most businesses use a sales pipeline divided into a series of sections. The likelihood of converting a prospect increases the deeper the prospect moves into the sales process. To get the most from this technique, the team must dig into the current performance of the sales team.

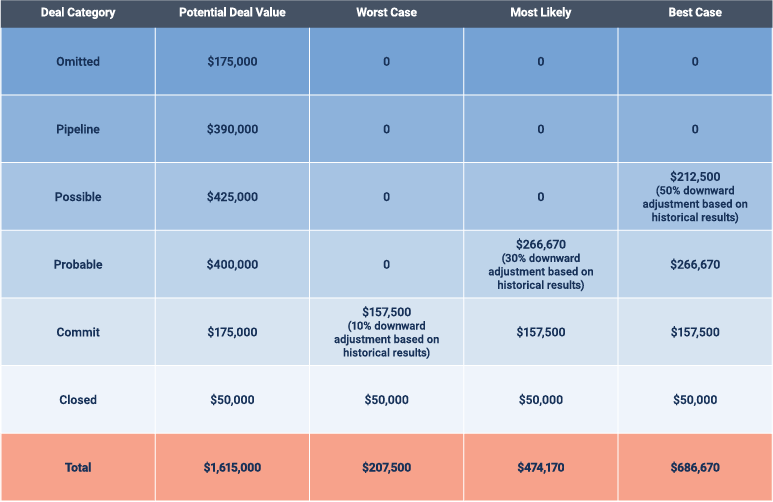

After that analysis, the probabilities might look something like this:

- Sales Accepted lead : 10% probability of closing

- Sales Qualified Lead : 25% probability of closing

- Proposal sent : 40% probability of closing

- Negotiating : 60% probability of closing

- Contract sent : 90% probability of closing

Using these probabilities, you can extrapolate an opportunity stage sales forecast. You’ll want to take the deal’s potential value and multiply that by the win likelihood.

Who should use it

This is a great sales forecasting method if you have access to historical data, lots of leads in your pipeline, and you need a quick estimate. It’s important to understand that this isn’t the most accurate option, given that many random factors affect those probabilities.

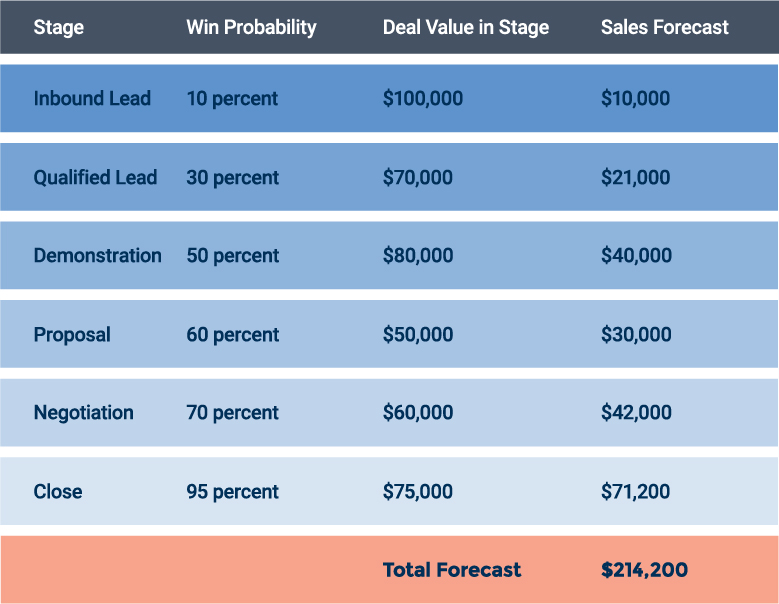

Length of Sales Cycle Forecasting

This sales forecasting method finds the average length of your sales cycle. This helps you predict when your deals will likely close and reveal opportunities for your sales team to expedite the sales cycle.

This method is simple. You can find the length of your average sales cycle using the following basic formula:

Total # of days to close deals / # of closed deals

Let’s imagine, for instance, that you find the following:

- Deal 1: 28 days

- Deal 2: 15 days

- Deal 3: 50 days

- Deal 4: 38 days

We closed four deals, and it took 131 days to close them all together. This means that the average length of our sales cycle is 33 days.

Equipped with that information, we can look at our pipeline and estimate how likely we are to close deals based on how old they are. The closer a deal moves toward the average sales cycle length, the more likely it will be closed.

This is a great sales forecasting method for sales managers who want to learn more about the deals spread across their pipeline. For instance, they can use this method to differentiate between different types of groups.

Sales managers might find that the average sales cycle length is much shorter for web leads, for example, when compared to email leads.

Historical Forecasting

Historical forecasting is a very quick and simple sales forecasting technique. The process involves looking back at your previous performance within a certain timeframe and assuming that your future performance will be superior or at least equal.

This is a useful reference because it helps you to get to grips with seasonality and the outside factors that affect your sales. You might find, for instance, that the holidays are a particularly slow time for your business, and looking at historical data can help you to prepare.

With that said, historical forecasting has its issues. It assumes that buyer demand will be constant, which is no longer a given. This could mean you overestimate your sales statistics and use an accurate sales forecast.

This forecasting method is ideal for a business that needs a quick and easy way to project how much it will sell over a given period. That said, historical data should be used as a benchmark instead of the foundation of a sales forecast.

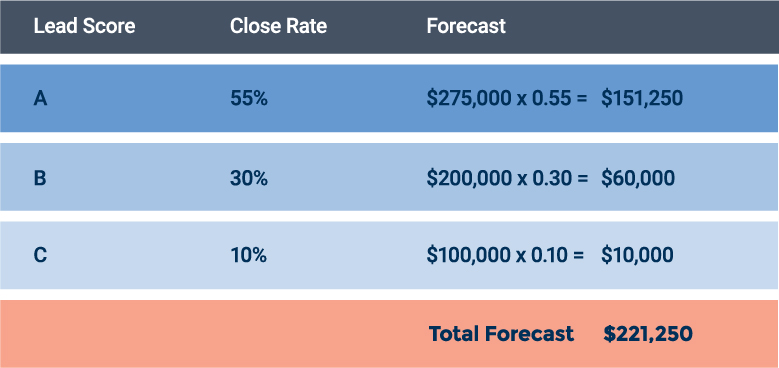

Lead Pipeline Forecasting

This time-consuming sales forecasting method involves reviewing each lead within your pipeline and determining how likely the deal will be closed. That likelihood is determined by exploring factors like the value of the opportunity, the performance of your salespeople, seasonality, and more.

This is a time-consuming method, and it often makes sense for businesses with fewer high-value leads – it wouldn’t necessarily be efficient or make much sense for a SaaS business, for instance.

The big benefit of this method is its accuracy. If you have reliable and rigid data to base your analysis on, you will find that this method can give you a deeper insight into each lead.

This method makes sense for those businesses that have a lower number of leads. Inside salespeople, for instance, will want to get a clearer picture of every lead within their pipeline. This method isn’t appropriate for SaaS businesses that operate according to volume.

Test Market Analysis Forecasting

Businesses often launch exciting new products and services. But it can be difficult to get accurate sales forecasts without historical data . Test Market Analysis forecasting is the process of developing a product or service and introducing it to a test market to forecast sales and get an approximation of future sales.

This limited rollout allows businesses to track the performance of the new offering and monitor things like consumer awareness, repeat purchase patterns, and more. This is a data-gathering exercise, and it feeds businesses with the information they need to create accurate sales forecasts.

This approach is perfect for those businesses that need to perform real-world experiments to gather useful information. A new business can use sales forecasting to use its sales data to predict where future sales can come from. This can limit the cost since it’s an effective way of having a busy sales pipeline. The limited rollout of the product is also useful from a product perspective, given that adjustments can be made according to feedback.

A big issue with this form of forecasting is that one test market may not be like the others. Your data might not reflect the wider reality, so you must make prudent choices that provide you with accurate information.

Multivariable Analysis

As the name suggests, this method calls upon analyzing a range of variables to get the clearest picture possible. This means that if the method is performed well, it can often provide the most accurate forecast.

If you use this technique, you will want to bring together factors like the average length of your sales cycle, the performance of your salespeople, historical forecasting, and more.

The success of this method hinges upon two key factors within your business:

- the accuracy of your salespeople and their reporting

- the quality of the forecasting tools that you use.

Both of these factors must be in place to make sure this forecasting method has the best chance of success.

Multivariable forecasting is most appropriate for larger and well-organized businesses, as it uses the data and tools necessary to blend various forecasting methods into one. This could be it if you need the most accurate forecast method possible.

Intuitive Forecasting

Your salespeople are on the front; their experience is very valuable. They often have a good idea of how likely they are to close a particular deal and can use educated guesses to assess the situation.

Experienced salespeople can take emotion out of the equation and rely on their experience and knowledge to make accurate predictions. Some businesses decide to incorporate those gut instincts into the way that they forecast a particular sale.

Some businesses, for instance, will add a score to the conversion probability of their various prospects according to the gut feeling of their salespeople.

This intuitive forecasting method is particularly useful for businesses that lack historical data. Without the quantifiable data to provide the basis for your sales forecasting, you might have to turn to more qualitative assessments from your salespeople.

The downside of this sales forecasting method is clear, though. These assessments are highly subjective, and you might find that your salespeople are often more optimistic in their projections. This means those projections should be taken with a pinch of salt, but they are better than nothing.

Sales Forecast Examples

We know the theory, but how about the practice? In these awesome examples, let’s take a closer look at what those sales forecast methods look like.

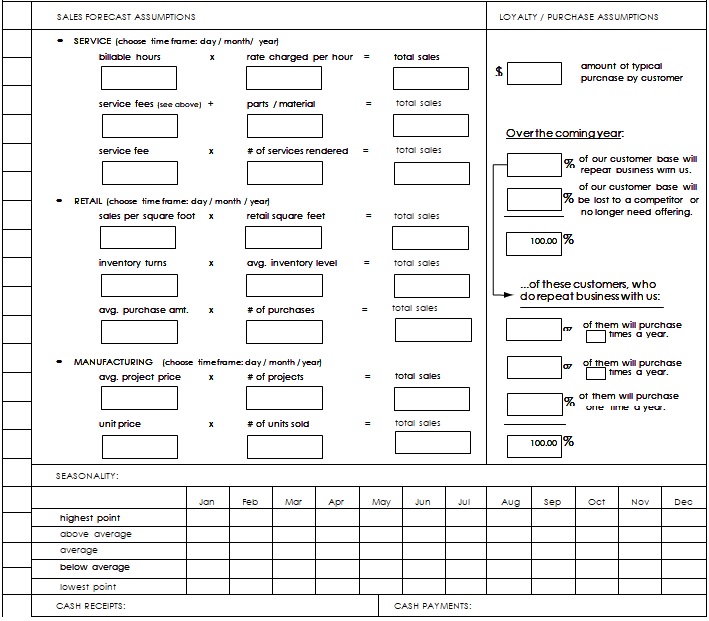

Standard Business Plan Financials

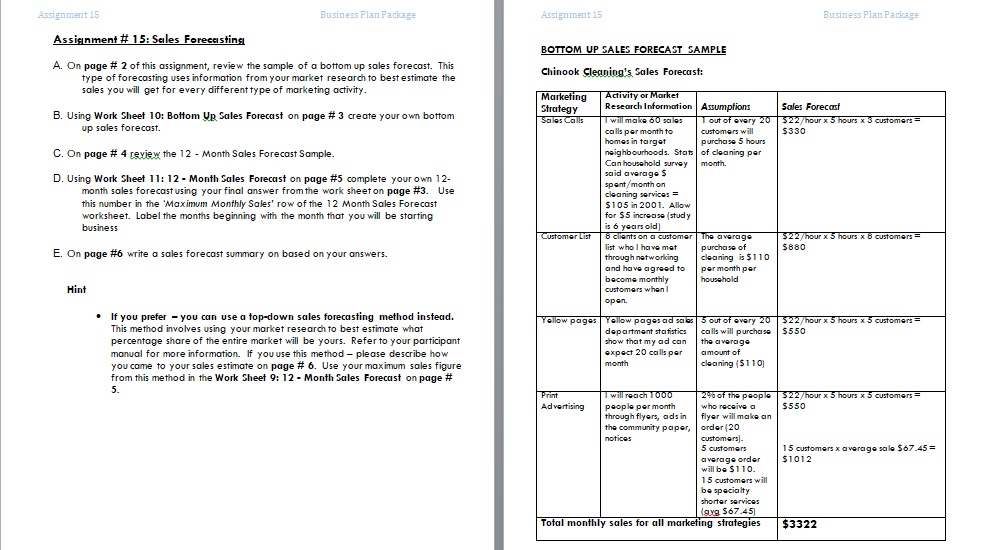

This example from Tim Berry (chairman and founder of Palo Alto Software) looks at what a startup sales forecast might look like .

Tim sets the scene and describes Magda’s situation – she wants to open a small café in an office park.

He goes on to show how Magda would establish a base case, estimate her monthly capacity, and what type of sales she could expect. To wrap up, she goes through her month-by-month estimates for her first year and estimates her direct cost.

This is a great exercise and unmissable reading for new entrepreneurs dreaming up a new venture.

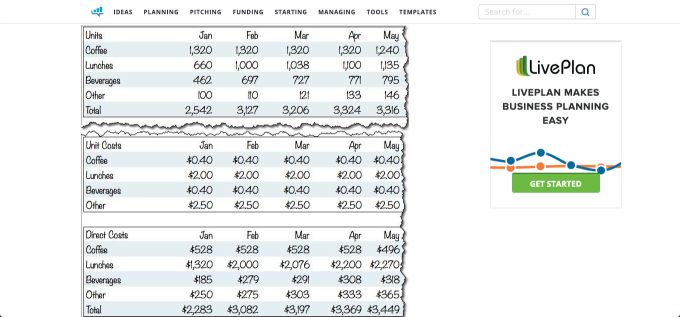

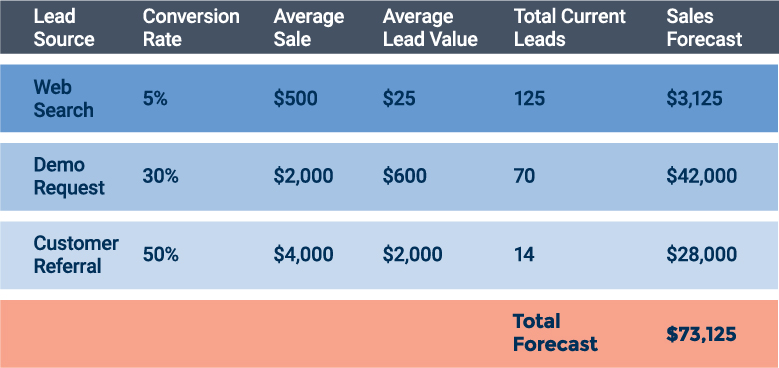

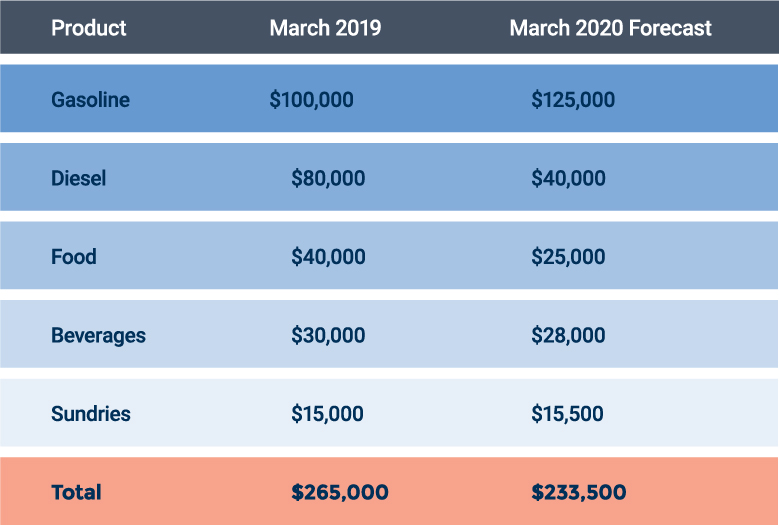

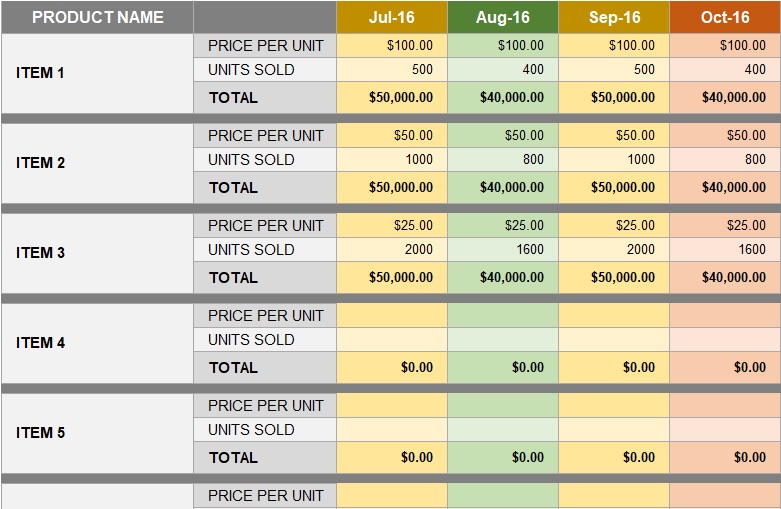

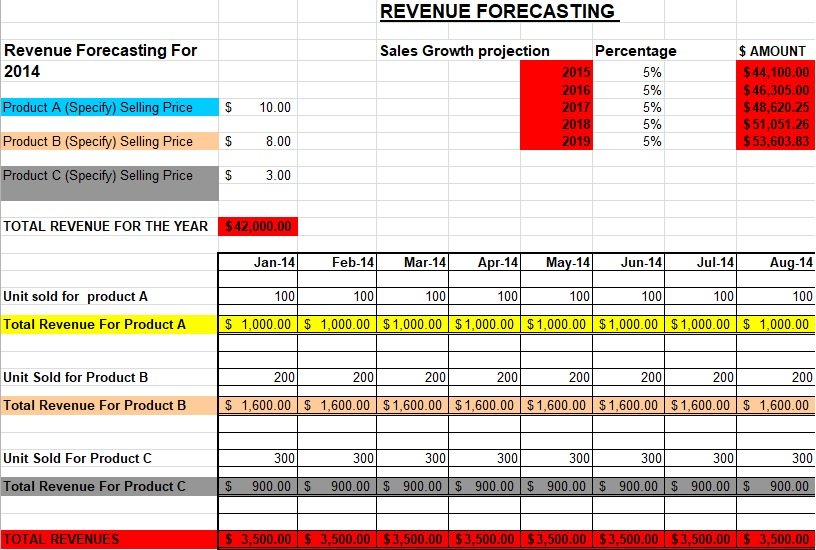

Sales Forecast Guide by Toptal Research

This simple sales forecasting guide from Toptal Research also includes a simple example that forms the basis of the guide. These simple visuals and data will give you a good idea of how you can put your sales forecasting efforts together and what it will look like.

This example also shows that you can attractively forecast sales and inform the sales teams. Sales forecasting doesn’t have to be boring columns of data, but you can bring your sales forecast to life with colorful visuals.

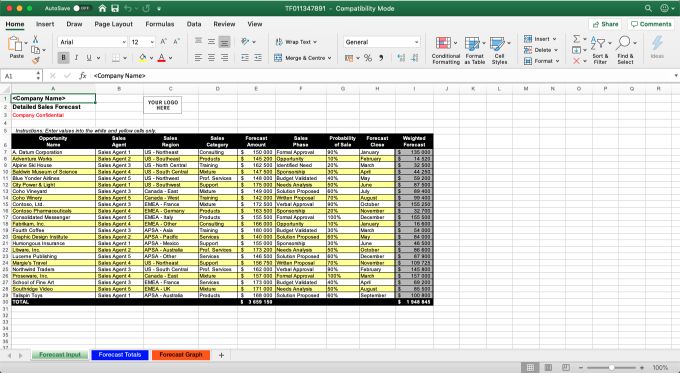

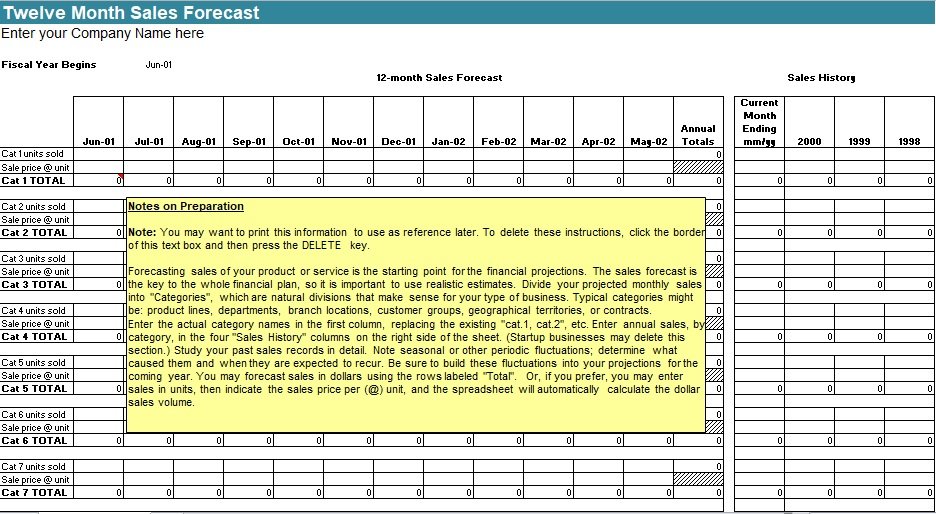

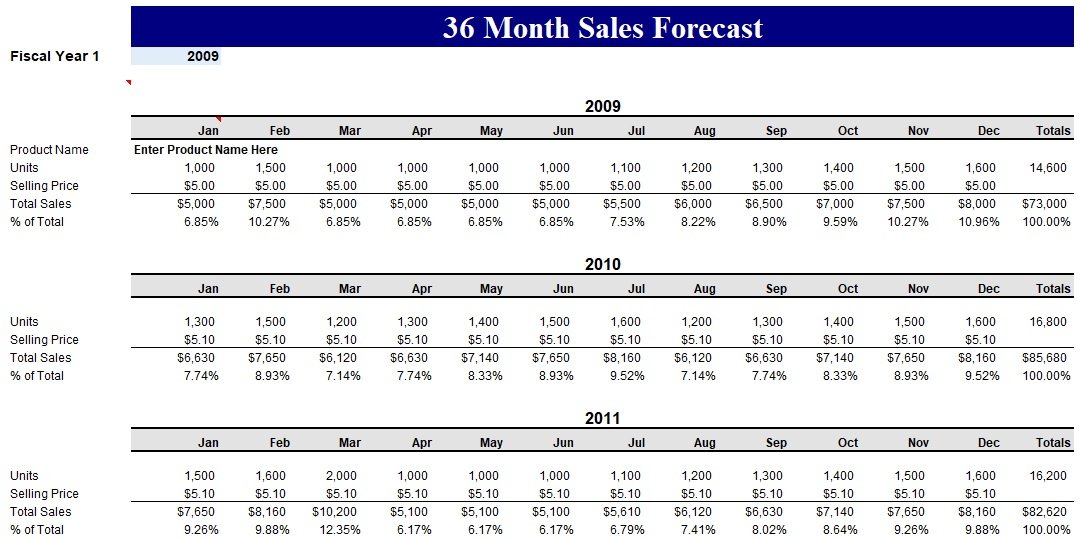

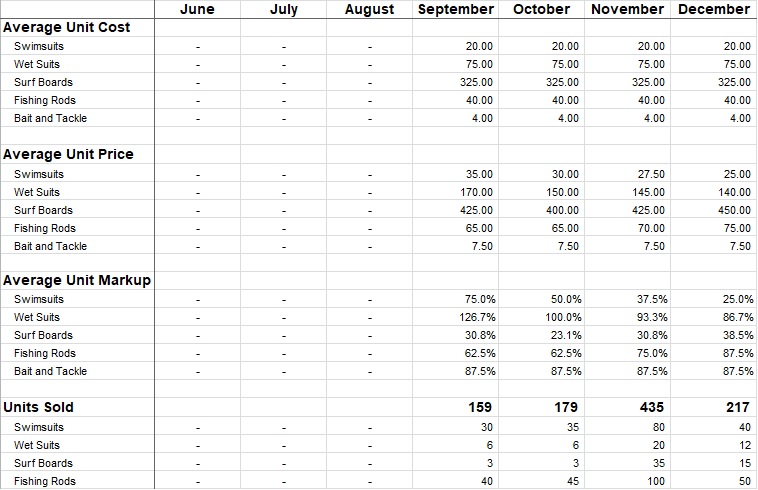

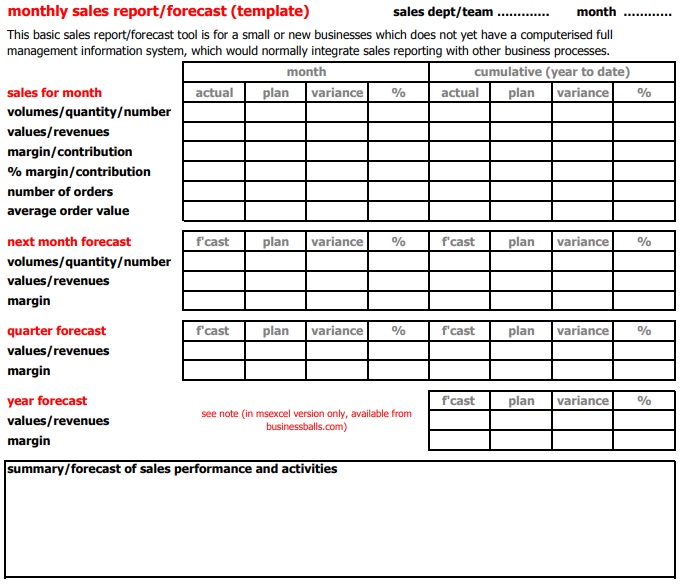

Detailed Sales Forecast by Microsoft

This detailed sales forecast template from Microsoft makes it simple for you to estimate your monthly sales projections.

The formula comes with pre-built formulas and worksheet features that result in an attractive and clear template. The template also relies on a weighted sales forecasting method based on the probability of closing each opportunity.

Even if you do not use this exact template, it’s a great file to use. It can give you a great idea of the information you need to include and how it might come together in a spreadsheet format.

Sales Forecast Templates

Looking for your own sales forecast templates to get a running start? Here’s a look at some of the most practical and useful templates.

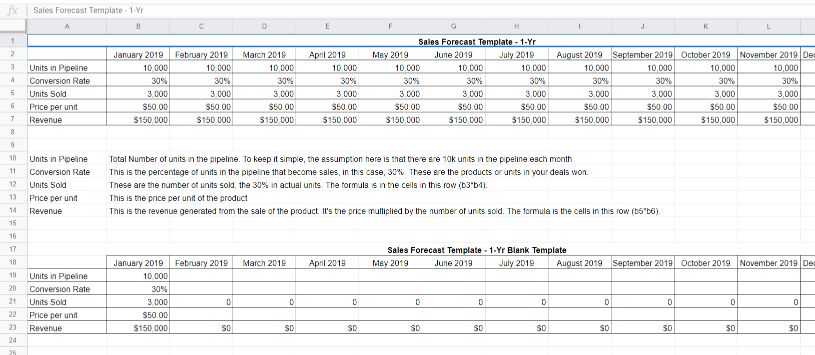

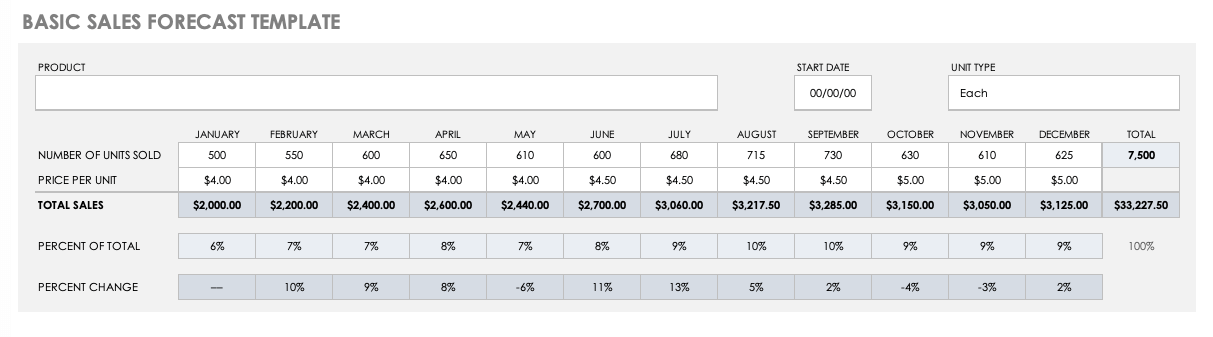

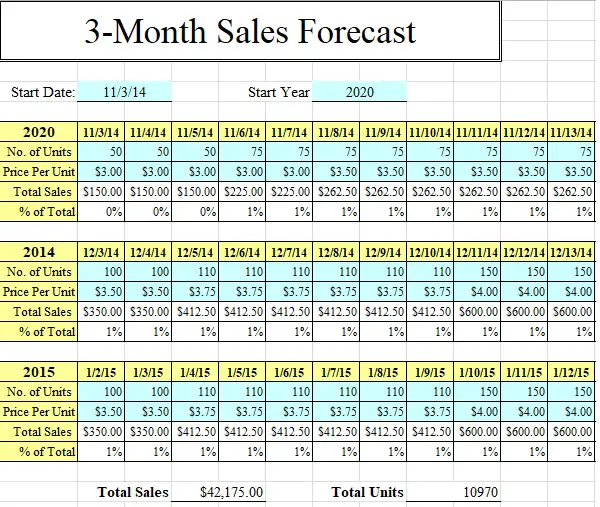

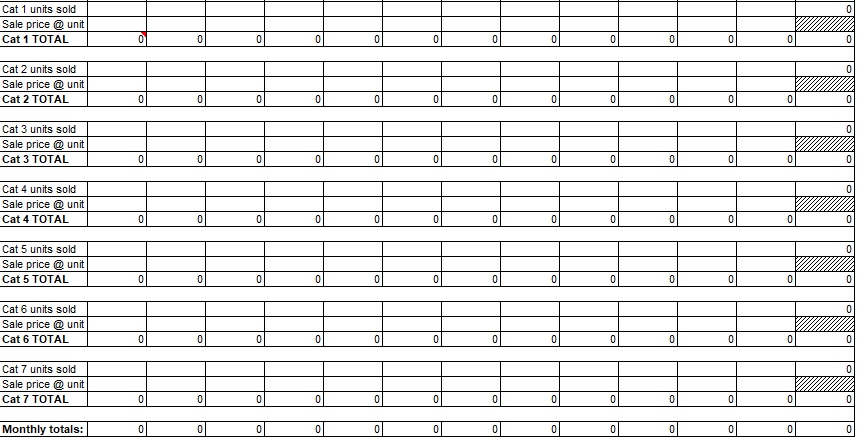

Sales Forecast Template for Excel by Vertex42

This free sales forecast template helps you keep a handle on key information like unit sales, growth rate, profit margins, and gross profit.

The template is already set up to help you compare and analyze a range of products and services on a monthly basis. The chart also includes a range of sample charts that can be used to effectively and accurately communicate the contents of your sales forecast.

The same worksheet can be used to create monthly and yearly forecasts. You can play with the template to find your desired view and information.

Sales Forecast Template by Freshworks

This simple forecasting template helps you to put together an effective sales forecast. This finished product can then be used to grow your revenues and hit your quotas.

This template is particularly effective for small businesses and startups that need to project sales and prioritize deals at the early stages of their business. Freshworks also explains that the template can help businesses achieve a higher rate of on-time delivery and accurate hiring projections.

The free sales forecast template is very intuitive to use. Again, it’s great to flick through the spreadsheet to understand what you need in a sales forecast and how it can be put together.

Free Sales Forecast Template by Fit Small Business

This sales forecast template is perfect if your CRM doesn’t currently offer built-in sales forecasting. This template can help you create a forecast from scratch that is adjusted to your own particular needs much quicker.

The template is available in various formats, including PDF, Excel, and Google Sheets. This is great news if you create your small business on your own terms and have limited software access .

Again, this template is clear and simple to use. All of the fields are explained within the spreadsheet – you don’t have to worry about going elsewhere to find definitions.

Sales Forecasting Tools

Looking for sales forecasting tools to take your activities to the next level? Here’s a look at some of the standout options.

Pipedrive is a sales CRM that is designed for salespeople by salespeople. It is a robust CRM that includes all of the features a sales team needs to achieve sales success and grow their business.

The tool also includes a forecasting tool. This tool acts as a personal sales manager that helps salespeople to choose the right deals and activities at the right time. This helps salespeople to become better closers.

By all accounts, this function is very useful for salespeople and managers alike. The forecasting tool can also be customized to match the specific needs of salespeople.

Smart Demand Planner

Smart Demand Planner is a consensus demand planning and statistical forecasting solution that understands how accurate critical forecasts are to a business.

The tool was built on the premise that forecasts are often inaccurate and can cause various issues. Moreover, the traditional sales forecast often resides within a complex spreadsheet that is difficult to use, share, and scale.

The tool aims to fix those issues by aligning strategic business forecasting at all levels of your hierarchy. Smart Demand Planner offers a statistically sound objective foundation for your sales activities.

amoCRM is an easy and smart sales solution that focuses on the world of messenger-based sales. The platform understands the popularity and potential of messenger apps, so it offers a whole new way of using the channel to create valuable relationships.

The tool also includes visual, real-time reports that give salespeople and managers powerful insights. These analytics can be used to set targets and also forecast future sales. What’s more, they can measure performance and identify target areas.

The visual look and feel of the platform make this a very intuitive option. It can drive value through accurate forecasting in businesses where messenger-based selling is critical.

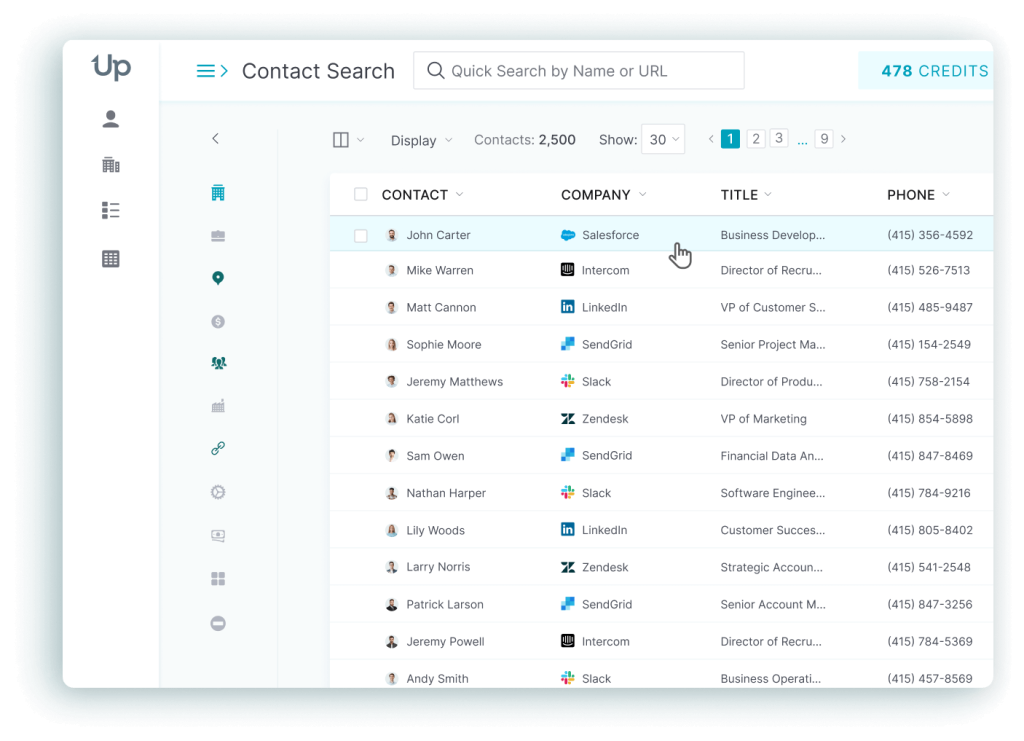

As we have seen, forecasts are critical to the success of your business. They can be cost-effective for a new business, keep sales teams and reps informed, and more. However, every business also needs the leads to make those forecasts a reality. Learn more about UpLead today and how our platform can help you to find, connect, and engage with qualified prospects.

Hunter.io Review for 2024: Key Features, Plans, & a Final Verdict

What is Lusha? A Comprehensive Beginner’s Guide (2024)

Apollo.io Integrations: Information to Personalize Your Tech Stack

see uplead in action

Start your free trial today!

Try UpLead free for 7 days.

- Platform Overview

- Buyer Intent

- Knowledge Base

- Search By Industry

- Code Red Safety

- Staffing Future

- Complete Merchant Solutions

- TBM Consulting Group

- Request a Demo

Copyright © 2024 UpLead | All Rights Reserved

- Terms & Conditions

- Privacy Policy

- Cookie Notice

- Do Not Sell or Share My Personal Information

How to Create a Sales Forecast

11 min. read

Updated October 27, 2023

Business owners are often afraid to forecast sales. But, you shouldn’t be. Because you can successfully forecast your own business’s sales.

You don’t have to be an MBA or CPA. It’s not about some magic right answer that you don’t know. It’s not about training you don’t have. It doesn’t take spreadsheet modeling (much less econometric modeling) to estimate units and price per unit for future sales. You just have to know your own business.

Forecasting isn’t about seeing into the future

Sales forecasting is much easier than you think and much more useful than you imagine.

I was a vice president of a market research firm for several years, doing expensive forecasts, and I saw many times that there’s nothing better than the educated guess of somebody who knows the business well. All those sophisticated techniques depend on data from the past — and the past, by itself, isn’t the best predictor of the future. You are.

It’s not about guessing the future correctly. We’re human; we don’t do that well. Instead, it’s about setting down assumptions, expectations, drivers, tracking, and management. It’s about doing your job, not having precognitive powers.

- Successful forecasting is driven by regular reviews

What really matters is that you review and revise your forecast regularly. Spending should be tied to sales, so the forecast helps you budget and manage. You measure the value of a sales forecast like you do anything in business, by its measurable business results.

That also means you should not back off from forecasting because you have a new product, or new business, without past data. Lay out the sales drivers and interdependencies, to connect the dots, so that as you review plan-versus-actual results every month, you can easily make course corrections.

If you think sales forecasting is hard, try running a business without a forecast. That’s much harder.

Your sales forecast is also the backbone of your business plan . People measure a business and its growth by sales, and your sales forecast sets the standard for expenses , profits, and growth. The sales forecast is almost always going to be the first set of numbers you’ll track for plan versus actual use, even if you do no other numbers.

If nothing else, just forecast your sales, track plan-versus-actual results, and make corrections — that process alone, just the sales forecast and tracking is in itself already business planning. To get started on building your forecast follow these steps.

And if you run a subscription-based business, we have a guide dedicated to building a sales forecast for that business model.

- Step 1: Set up your lines of sales

Most forecasts show several distinct lines of sales. Ideally, your sales lines match your accounting, but not necessarily in the same level of detail.

For example, a restaurant ought not to forecast sales for each item on the menu. Instead, it forecasts breakfasts, lunches, dinners, and drinks, summarized. And a bookstore ought not to forecast sales by book, and not even by topic or author, but rather by lines of sales such as hardcover, softcover, magazines, and maybe categories (such as fiction, non-fiction, travel, etc.) if that works.

Always try to set your streams to match your accounting, so you can look at the difference between the forecast and actual sales later. This is excellent for real business planning. It makes the heart of the process, the regular review, and revision, much easier. The point is better management.

For instance, in a bicycle retail store business plan, the owner works with five lines of sales, as shown in the illustration here.

In this sample case, the revenue includes new bikes, repair, clothing, accessories, and a service contract. The bookkeeping for this retail store tracks sales in those same five categories.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Step 2: Forecast line by line

There are many ways to forecast a line of sales.

The method for each row depends on the business model

Among the main methods are:.

- Unit sales : My personal favorite. Sales = units times price. You set an average price and forecast the units. And of course, you can change projected pricing over time. This is my favorite for most businesses because it gives you two factors to act on with course corrections: unit sales, or price.

- Service units : Even though services don’t sell physical units, most sell billable units, such as billable hours for lawyers and accountants, or trips for transportations services, engagements for consultants, and so forth.

- Recurring charges : Subscriptions. For each month or year, it has to forecast new signups, existing monthly charges, and cancellations. Estimates depend on both new signups and cancellations, which is often called “churn.”

- Revenue only : For those who prefer to forecast revenue by the stream as just the money, without the extra information of breaking it into units and prices.

Most sales forecast rows are simple math

For a business plan, I recommend you make your sales forecast a detailed look at the next 12 months and then broadly cover two years after that. Here’s how to approach each method of line-by-line forecasting.

Start with units if you can

For unit sales, start by forecasting units month by month, as shown here below for the new bike’s line of sales in the bicycle shop plan:

I recommend looking at the visual as you forecast the units because most of us can see trends easier when we look at the line, as shown in the illustration, rather than just the numbers. You can also see the numbers in the forecast near the bottom. The first year, fiscal 2021 in this forecast, is the sum of those months.

Estimate price assumptions

With a simple revenue-only assumption, you do one row of units as shown in the above illustration, and you are done. The units are dollars, or whatever other currency you are using in your forecast. In this example, the new bicycle product will be sold for an average of $550.00.

That’s a simplifying assumption, taking the average price, not the detailed price for each brand or line. Garrett, the shop owner, uses his past results to determine his actual average price for the most recent year. Then he rounds that estimate and adds his own judgment and educated guess on how that will change.

Multiply price times units

Multiplying units times the revenue per unit generates the sales forecast for this row. So for example the $18,150 shown for October of 2020 is the product of 33 units times $550 each. And the $21,450 shown for the next month is the product of 39 units times $550 each.

Subscription models are more complicated

Lately, a lot of businesses offer their buyers subscriptions, such as monthly packages, traditional or online newspapers, software, and even streaming services. All of these give a business recurring revenues, which is a big advantage.

For subscriptions, you normally estimate new subscriptions per month and canceled subscriptions per month, and leave a calculation for the actual subscriptions charged. That’s a more complicated method, which demands more details.

For that, you can refer to detailed discussions on subscription forecasting in How to Forecast Sales for a Subscription Business .

- But how do you know what numbers to put into your sales forecast?

The math may be simple, yes, but this is predicting the future, and humans don’t do that well. So, don’t try to guess the future accurately for months in advance.

Instead, aim for making clear assumptions and understanding what drives your sales, such as web traffic and conversions, in one example, or the direct sales pipeline and leads, in another. Review results every month, and revise your forecast. Your educated guesses become more accurate over time.

Experience in the field is a huge advantage

In a normal ongoing business, the business owner has ample experience with past sales. They may not know accounting or technical forecasting, but they know their business. They are aware of changes in the market, their own business’s promotions, and other factors that business owners should know. They are comfortable making educated guesses.

If you don’t personally have the experience, try to find information and make guesses based on the experience of an employee, your mentor , or others you’ve spoken within your field.

Use past results as a guide

Use results from the recent past if your business has them. Start a forecast by putting last year’s numbers into next year’s forecast, and then focus on what might be different this year from next.

Do you have new opportunities that will make sales grow? New marketing activities, promotions? Then increase the forecast. New competition, and new problems? Nobody wants to forecast decreasing sales, but if that’s likely, you need to deal with it by cutting costs or changing your focus.

Look for drivers

To forecast sales for a new restaurant, first, draw a map of tables and chairs and then estimate how many meals per mealtime at capacity, and in the beginning. It’s not a random number; it’s a matter of how many people come in.

To forecast sales for a new mobile app, you might get data from the Apple and Android mobile app stores about average downloads for different apps. A good web search might also reveal some anecdotal evidence, blog posts, and news stories, about the ramp-up of existing apps that were successful.

Get those numbers and think about how your case might be different. Maybe you drive downloads with a website, so you can predict traffic from past experience and then assume a percentage of web visitors who will download the app.

- Estimate direct costs

Direct costs are also called the cost of goods sold (COGS) and per-unit costs. Direct costs are important because they help calculate gross margin, which is used as a basis for comparison in financial benchmarks, and are an instant measure (sales less direct costs) of your underlying profitability.

For example, I know from benchmarks that an average sporting goods store makes a 34 percent gross margin. That means that they spend $66 on average to buy the goods they sell for $100.

Not all businesses have direct costs. Service businesses supposedly don’t have direct costs, so they have a gross margin of 100 percent. That may be true for some professionals like accountants and lawyers, but a lot of services do have direct costs. For example, taxis have gasoline and maintenance. So do airlines.

A normal sales forecast includes units, price per unit, sales, direct cost per unit, and direct costs. The math is simple, with the direct costs per unit related to total direct costs the same way price per unit relates to total sales.

Multiply the units projected for any time period by the unit direct costs, and that gives you total direct costs. And here too, assume this view is just a cut-out, it flows to the right. In this example, Garrett the shop owner projected the direct costs of new bikes based on the assumption of 49 percent of sales.

Given the unit forecast estimate, the calculation of units times direct costs produces the forecast shown in the illustration below for direct costs for that product. So therefore the projected direct costs for new bikes in October is $8,894, which is 49% of the projected sales for that month, $18,150.

- Never forecast in a vacuum

Never think of your sales forecast in a vacuum. It flows from the strategic action plans with their assumptions, milestones , and metrics. Your marketing milestones affect your sales. Your business offering milestones affect your sales.

When you change milestones—and you will, because all business plans change—you should change your sales forecast to match.

- Timing matters

Your sales are supposed to refer to when the ownership changes hands (for products) or when the service is performed (for services). It isn’t a sale when it’s ordered, or promised, or even when it’s contracted.

With proper accrual accounting , it is a sale even if it hasn’t been paid for. With so-called cash-based accounting, by the way, it isn’t a sale until it’s paid for. Accrual is better because it gives you a more accurate picture, unless you’re very small and do all your business, both buying and selling, with cash only.

I know that seems simple, but it’s surprising how many people decide to do something different. The penalty for doing things differently is that then you don’t match the standard, and the bankers, analysts, and investors can’t tell what you meant.

This goes for direct costs, too. The direct costs in your monthly profit and loss statement are supposed to be just the costs associated with that month’s sales. Please notice how, in the examples above, the direct costs for the sample bicycle store are linked to the actual unit sales.

- Live with your assumptions

Sales forecasting is not about accurately guessing the future. It’s about laying out your assumptions so you can manage changes effectively as sales and direct costs come out different from what you expected. Use this to adjust your sales forecast and improve your business by making course corrections to deal with what is working and what isn’t.

I believe that even if you do nothing else, by the time you use a sales forecast and review plan versus actual results every month, you are already managing with a business plan . You can’t review actual results without looking at what happened, why, and what to do next.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Forecasting isn’t about seeing into the future

Related Articles

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

3 Min. Read

What Is a Break-Even Analysis?

9 Min. Read

How to Create a Cash Flow Forecast

4 Min. Read

How to Create an Expense Budget

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Product overview

- All features

- Latest feature release

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Capacity planning

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana AI

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Content calendars

- Marketing strategic planning

- Resource planning

- Project intake

- Product launches

- Employee onboarding

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Business strategy |

- Sales forecasting: How to create a sale ...

Sales forecasting: How to create a sales forecast template (with examples)

A strong sales team is the key to success for most companies. They say a good salesperson can sell sand at the beach, but whether you’re selling products in the Caribbean or Antarctica, it all comes down to strategy. When you’re unsure if your current strategy is working, a sales forecast can help.

What is a sales forecast?

A sales forecast predicts future sales revenue using past business data. Your sales forecast can predict a number of different things, including the number of new sales for an existing product, the new customers you’ll gain, or the memberships you’ll sell in a given time period. These forecasts are then used during project planning to determine how much you should allocate towards new products and services.

Why is sales forecasting important?

Sales forecasting helps you keep a finger on your business’s pulse. It sets the ground rules for a variety of business operations, including your sales strategy and project planning. Once you calculate your sales projections, you can use the results to assess your business health, predict cash flow, and adjust your plans accordingly.

![business plan sales forecast [inline illustration] the importance of sales forecasting (infographic)](https://assets.asana.biz/transform/9c03e89a-1145-44c3-be52-f0f8e9d6785c/inline-business-strategy-sales-forecast-template-3-2x?io=transform:fill,width:2560&format=webp)

An effective sales forecasting plan:

Predicts demand: When you have an idea of how many units you may sell, you can get a head start on production.

Helps you make smart investments: If you have future goals of expanding your business with new locations or products, knowing when you’ll have the income to do so is important.

Contributes to goal setting: Your sales forecast can help you set goals outside of investments as well, like outshining competitors or hiring new team members.

Guides spending: Your sales forecast may be the wake-up call you need to set a budget and use cost control to reduce expenses.

Improves the sales process: You can change your current sales process based on the sales projections you’re unhappy with.

Highlights financial problems: Your sales forecast template will open your eyes to problem areas you may not have noticed otherwise.

Helps with resource management: Do you have the resources you need to fill orders if it’s an accurate sales forecast? Your sales forecast can guide how you allocate and manage resources to hit targets.

When you have an accurate prediction of your future sales, you can use your projections to adjust your current sales process. Leveraging inventory management software can help you implement these adjustments more effectively by providing up-to-date data on stock levels and supply chain performance.

Sales forecasting methods

Sales forecasting is an important part of strategic business planning because it enables sales managers and teams to predict future sales and make informed decisions. But why are there multiple sales forecasting methods? Simply put, businesses vary in size, industry, and market dynamics, so no single methodology suits all.

Choosing the right sales forecasting method is more of an art than a science. It involves:

Analyzing your business size and industry

Assessing the available data and tools

Understanding your sales cycle's complexity

A few telltale signs that you've picked the correct approach include:

Improved accuracy in sales target predictions

Enhanced understanding of market trends

Better alignment with your business goals

Opportunity stage forecasting

Opportunity stage forecasting is a dynamic approach ideal for businesses using CRM systems like Salesforce. It assesses the likelihood of sales closing based on the stages of the sales pipeline. This method is particularly beneficial for sales organizations with a clearly defined sales process.

For example, a software company might use this method to forecast sales by examining the number of prospects in each stage of their funnel, from initial contact to final negotiation.

Pipeline forecasting method

The pipeline forecasting method is similar to opportunity stage forecasting but focuses more on the volume and quality of leads at each pipeline stage. It's particularly useful for businesses that rely heavily on sales forecasting tools and dashboards for decision-making.

A real estate agency could use it by examining the number of properties listed, the stage of negotiations, and the number of closings forecasted in the pipeline.

Length of sales cycle forecasting

Small businesses often prefer the length of sales cycle forecasting. It's straightforward and involves analyzing the duration of past sales cycles to predict future ones. This method is effective for businesses with consistent sales cycle lengths.

A furniture manufacturer, for instance, might use this method by analyzing the average time taken from initial customer contact to closing a sale in the past year.

Intuitive forecasting

Intuitive forecasting relies on the expertise and intuition of sales managers and their teams. It's less about spreadsheets and more about market research and understanding customer behavior. This method is often used with other, more data-driven approaches.

A boutique fashion store, for example, might use this method, relying on the owner's deep understanding of fashion trends and customer preferences.

Historical forecasting

Historical forecasting uses past performance data to predict future sales. This method is advantageous for businesses with ample historical sales data. It's less effective for new markets or rapidly changing industries.

An established book retailer could use historical data from previous years, considering seasonal trends and past marketing campaigns, to forecast next quarter's sales.

Multivariable analysis forecasting

Multivariable analysis forecasting is a more sophisticated method that's ideal for larger sales organizations. It analyzes factors like market trends, economic conditions, and marketing efforts to provide a holistic view of potential sales outcomes.

An automotive company, for example, could analyze factors like economic conditions, competitor activity, and past sales data to forecast future car sales.

How to calculate sales forecast

Sales forecasts determine how much you expect to do in sales for a given time frame. For example, let’s say you expect to sell 100 units in Q1 of fiscal year 2024. To calculate sales forecasts, you’ll use past data to predict future trends.

When you’re first creating a forecast, it’s important to establish benchmarks that determine how much you normally sell of any given product to how many people. Compare historical sales data against sales quotas—i.e., how much you sold vs. how much you expected to sell. This type of analysis can help you set a baseline for what you expect to achieve every week, month, quarter, and so on.

For many companies, this means establishing a formula. The exact inputs will vary based on your products or services, but generally, you can use the following:

Sales forecast = Number of products you expect to sell x The value of each product

For example, if you sell SaaS products, your sales forecast might look something like this:

SaaS FY24 Sales forecast = Number of expected subscribers x Subscription price

Ultimately, the sales forecasting process is a guess—but it’s an educated one. You’ll use the information you already have to create a data-driven forecasting model. How accurate your forecast is depends on your sales team. The sales team uses facts such as their prospects, current market conditions, and their sales pipeline. But they will also use their experience in the field to decide on final numbers for what they think will sell. Because of this, sales leaders are more likely to have better forecasting accuracy than new members of the sales team.

Sales forecast vs. sales goal

Your sales forecast is based on historical data and current market conditions. While you always hope your sales goals are attainable—and you can use data to estimate what your team is capable of—your goals might not line up directly with your forecast. This can be for a number of reasons, including wanting to create stretch goals that push your sales team beyond what they’ve done in the past or big, pie-in-the-sky goals that boost investor confidence.

How to create a sales forecast

There are different sales forecasting methods, and some are simpler than others. With the steps below, you’ll have a basic understanding of how to create a sales forecast template that you can customize to the method of your choice.

![business plan sales forecast [inline illustration] 5 steps to make a sales forecast template (infographic)](https://assets.asana.biz/transform/35de7f09-d37d-4c5e-bf88-86af25016c28/inline-business-strategy-sales-forecast-template-1-2x?io=transform:fill,width:2560&format=webp)

1. Track your business data

Without details from your past sales, you won’t have anything to base your predictions on. If you don’t have past sales data, you can begin tracking sales now to create a sales forecast in the future. The data you’ll need to track includes:

Number of units sold per month

Revenue of each product by month

Number of units returned or canceled (so you can get an accurate sales calculation)

Other items you can track to make your predictions more accurate include:

Growth percentage

Number of sales representatives

Average sales cycle length

There are different ways to use these data points when forecasting sales. If you want to calculate your sales run rate, which is your projected revenue for the next year, use your revenue from the past month and multiply it by 12. Then, adjust this number based on other relevant data points, like seasonality.

Tip: The best way to track historical data is to use customer relationship management (CRM) software. When you have a CRM strategy in place, you can easily pull data into your sales forecast template and make quick projections.

2. Set your metrics

Before you perform the calculations in your sales forecast template, you need to decide what you’re measuring. The basic questions you should ask are:

What is the product or service you’re selling and forecasting for? Answering this question helps you decide what exactly you’re evaluating. For example, you can investigate future trends for a long-standing product to decide whether it’s worth continuing, or you can predict future sales for a new product.

How far in the future do you want to make projections? You can decide to make projections for as little as six months or as much as five years in the future. The complexity of your sales forecast is up to you.

How much will you sell each product for, and how do you measure your products? Set your product’s metrics, whether they be units, hours, memberships, or something else. That way, you can calculate revenue on a price-per-unit basis.

How long is your sales cycle? Your sales cycle—also called a sales funnel—is how long it takes for you to make the average sale from beginning to end. Sales cycles are often monthly, quarterly, or yearly. Depending on the product you’re selling, your sales cycle may be unique. Steps in the sales cycle typically include:

Lead generation

Lead qualification

Initial contact

Making an offer

Negotiation

Closing the deal

Tip: You can still project customer growth versus revenue even if your company is in its early phases. If you don’t have enough historical data to use for your sales forecast template, you can use data from a company similar to yours in the market.

3. Choose a forecasting method

While there are many forecasting methods to choose from, we’ll concentrate on two straightforward approaches to provide a clear understanding of how sales forecasting can be implemented efficiently. The top-down method starts with the total size of the market and works down, while the bottom-up method starts with your business and expands out.

Top-down method: To use the top-down method, start with the total size of the market—or total addressable market (TAM). Then, estimate how much of the market you think your business can capture. For example, if you’re in a large, oversaturated market, you may only capture 3% of the TAM. If the total addressable market is $1 billion, your projected annual sales would be $30 million.

Bottom-up method: With the bottom-up method, you’ll estimate the total units your company will sell in a sales cycle, then multiply that number by your average cost per unit. You can expand out by adding other variables, like the number of sales reps, department expenses, or website views. The bottom-up forecasting method uses company data to project more specific results.

You’ll need to choose one method to fill in your sales forecast template, but you can also try both methods to compare results.

Tip: The best forecasting method for you may depend on what type of business you’re running. If your company experiences little fluctuation in revenue, then the top-down forecasting method should work well. The top-down model can also work for new businesses that have little business data to work with. Bottom-up forecasting may be better for seasonal businesses or startups looking to make future budget and staffing decisions.

4. Calculate your sales forecast

You’ve already learned a basic way to calculate revenue using the top-down method. Below, you’ll see another way to estimate your projected sales revenue on an annual scale.

Divide your sales revenue for the year so far by the number of months so far to calculate your average monthly sales rate.

Multiply your average monthly sales rate by the number of months left in the year to calculate your projected sales revenue for the rest of the year.

Add your total sales revenue so far to your projected sales revenue for the rest of the year to calculate your annual sales forecast.

A more generalized way to estimate your future sales revenue for the year is to multiply your total sales revenue from the previous year.

Example: Let’s say your company sells a software application for $300 per unit and you sold 500 units from January to March. Your sales revenue so far is $150,000 ($300 per unit x 500 units sold). You’re three months into the calendar year, so your average monthly sales rate is $50,000 ($150,000 / 3 months). That means your projected sales revenue for the rest of the year is $450,000 ($50,000 x 9 months).

5. Adjust for external factors

A sales forecast predicts future revenue by making assumptions about your growth rate based on past success. But your past success is only one component of your growth rate. There are external factors outside of your control that can affect sales growth—and you should consider them if you want to make accurate projections.

Some external factors you can adjust your calculations around include:

Inflation rate: Inflation is how much prices increase over a specific time period, and it usually fluctuates based on a country’s overall economic state. You can take your annual sales forecast and factor in inflation rate to ensure you’re not projecting a higher or lower number of sales than the economy will permit.

The competition: Is your market becoming more competitive as time goes on? For example, are you selling software during a tech boom? If so, assess whether your market share will shrink because of rising competition in the coming year(s).

Market changes: The market can shift as people change their behavior. Your audience may spend an average of six hours per day on their phones in one year. In the next year, mental health awareness may cause phone usage to drop. These changes are hard to predict, so you must stay on top of market news.

Industry changes: Industry changes happen when new products and technologies come on the market and make other products obsolete. One instance of this is the invention of AI technology.

Legislation: Although not as common, changes in legislation can affect the way companies sell their products. For example, vaping was a multi-million dollar industry until laws banned the sale of vape products to people under the age of 21.

Seasonality: Many industries experience seasonality based on how human behavior and human needs change with the seasons. For example, people spend more time inside during the winter, so they may be on their computers more. Retail stores may also experience a jump in sales around Christmas time.

Tip: You can create a comprehensive sales plan to set goals for team members. Aside from revenue targets and training milestones, consider assigning each of these external factors to your team members so they can keep track of essential information. That way, you’ll have your bases covered on anything that may affect future sales growth.

Sales forecast template

Below you’ll see an example of a software company’s six-month sales forecast template for two products. Product one is a software application, and product two is a software accessory.

In this sales forecast template, the company used past sales data to fill in each month. They projected their sales would increase by 10% each month because of a 5% increase in inflation and because they gained 5% more of the market. They kept their price per unit the same as the previous year.

Putting both products in the same chart can help the company see that their lower-cost product—the software accessory—brings in more revenue than their higher-cost product. The company can then use this insight to create more low-cost products in the future.

Sales forecast examples

Sales forecasting is not a one-size-fits-all process. It varies significantly across industries and business sizes. Understanding this through practical examples can help businesses identify the most suitable forecasting method for their unique needs.

![business plan sales forecast [inline illustration] 6 month sales forecast (example)](https://assets.asana.biz/transform/1ea5d5bf-2c96-428a-9097-40a76a798573/inline-business-strategy-sales-forecast-template-2-2x?io=transform:fill,width:2560&format=webp)

Sales forecasting example 1: E-commerce

In the e-commerce sector, where trends can shift rapidly, intuitive forecasting is often useful for making quick, informed decisions.

Scenario: An e-commerce retailer specializing in fashion accessories is planning for the upcoming festive season.

Trend analysis phase: The team spends the first week analyzing customer feedback and current fashion trends on social media, using intuitive forecasting to predict which products will be popular.

Inventory planning phase: Based on these insights, the next three weeks are dedicated to selecting and ordering inventory, focusing on products predicted to be in high demand.

Sales monitoring and adjustment: As the holiday season approaches, the team closely monitors early sales data, ready to adjust their inventory and marketing strategies based on real-time sales performance.

This approach allows the e-commerce retailer to stay agile , adapting quickly to market trends and customer preferences.

Sales forecasting example 2: Software development

For a software development company, especially one working with B2B clients, opportunity stage forecasting can help predict sales and manage the sales pipeline effectively.

Scenario: A software development company is launching a new project management tool.

Lead generation and qualification phase: In the initial month, the sales team focuses on generating leads, qualifying them, and categorizing potential clients based on their progress through the sales pipeline.

Proposal and negotiation phase: For the next two months, the team works on creating tailored proposals for high-potential leads and enters negotiation stages, using opportunity stage forecasting to predict the likelihood of deal closures.

Closure and review: In the final phase, the team aims to close deals, review the accuracy of their initial forecasts, and refine their approach based on the outcomes.

Opportunity stage forecasting enables the software company to efficiently manage its sales pipeline , focusing resources on the most promising leads and improving their chances of successful deal closures.

Pair your sales forecast with a strong sales process

A sales forecast is only one part of the larger sales picture. As your team members acquire leads and close deals, you can track them through the sales pipeline. A solid sales plan is the foundation of future success.

Related resources

15 creative elevator pitch examples for every scenario

How Asana streamlines strategic planning with work management

How to create a CRM strategy: 6 steps (with examples)

What is management by objectives (MBO)?

Flash Sale Savings ⚡

up to 60% off LivePlan Premium. Save Now

0 results have been found for “”

Return to blog home

How to Do a Sales Forecast for Your Business the Right Way

Posted june 8, 2021 by noah parsons.

New entrepreneurs frequently ask me for advice about forecasting their sales . These entrepreneurs are always optimistic about the future of their new company. However, when it comes to the details, most aren’t sure how to predict future sales and how much money they’re going to make.

It’s an intimidating task, looking into the future. The good thing is, none of us are fortune tellers and none of us know any more about your new business than you do. (If you do happen to be able to see into the future, please just skip the whole startup thing and go play the stock market. It’ll be much easier and make you richer!)

So, my advice is always to just take a deep breath and relax. You’re as well equipped as everyone else to put together a credible, reasonably accurate forecast. Let’s dive right in and figure it out.

What is sales forecasting?

Sales forecasting is the process of estimating future sales with the goal of better informing your decisions. A sales forecast is typically based on any combination of past sales data, industry benchmarks, or economic trends. It’s a method designed to help you better manage your workforce, ash flow, and any other resources that may affect revenue and sales

It’s typically easier for established businesses to create more accurate sales forecasts based on previous sales data. Newer businesses, on the other hand, will have to rely on market research, competitive benchmarks, and other forms of interest to establish a baseline for sales numbers.

Check out our detailed guide on creating a full financial forecast without historical data for more.

Why is sales forecasting important?

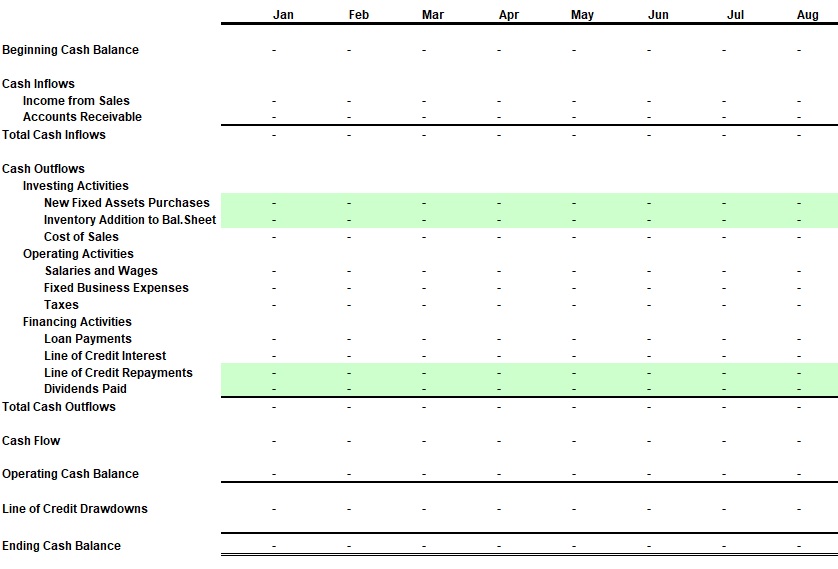

Your sales forecast is the foundation of the financial story that you are creating for your business. Once you have your sales forecast complete, you’ll be able to easily create your profit and loss statement , cash flow statement , and balance sheet.

Sales forecasts help you set goals

But beyond just setting the stage for a complete financial forecast, your sales forecast is really all about setting goals for your company . You’re looking to answer questions like:

- What do you hope to achieve in the next month? Year? 5-years?

- How many customers do you hope to have next month and next year?

- How much will each customer hopefully spend with your company?

Your sales forecast will help you answer all of these questions and potentially any others that involve the future of your business.

Sales forecasts inform investors

Having a solid sales forecast also provides a picture of your performance and performance milestones for potential investors. Like you, they want to be sure you have established goals and a firm trajectory for your business laid out. The more detailed, organized, and up-to-date your forecast is, the better you explain the position of your business to third parties and even employees.

How to use your sales forecast for budgeting

Your sales forecast is also your guide to how much you should be spending. Assuming you want to run a profitable business, you’ll use your sales forecast to guide what you should be spending on marketing to acquire new customers and how much you should be spending on operations and administration.

Now, you don’t always need to be profitable, especially if you are trying to expand aggressively. But, you’ll eventually need your expenses to be less than your sales in order to turn a profit.

How detailed should your forecast be?

When you’re forecasting your sales , the first thing you should do is figure out what you should create a forecast for. You don’t want want to be too generic and just forecast sales for your entire company. On the other hand, you don’t want to create a forecast for every individual product or service that you sell.

For example, if you’re starting a restaurant, you don’t want to create forecasts for each item on the menu. Instead, you should focus on broader categories like lunch, dinner, and drinks. If you’re starting a clothing shop, forecast the key categories of clothing that you sell, like outerwear, casual wear, and so on.

You’ll probably want between three to ten categories covering the types of sales that you do. More than ten is going to be a lot of work to forecast and fewer than three probably means that you haven’t divided things up quite enough.

You really can’t get this wrong. After all, it’s just forecasting and you can always come back and adjust your categories later. Just pick a few to get started and move on.

Which forecasting model is best? Top-down or bottom-up?

Before they have much historical sales data, lots of startups make this mistake—and it’s a big one. They forecast “from the top down.” What that means is that they figure out the total size of the market (TAM, or total addressable market) and then decide that they will capture a small percentage of that total market.

For example, in 2015, more than 1.4 billion smartphones were sold worldwide. It’s pretty tempting for a startup to say that they’re going to get 1 percent of that total market. After all, 1 percent is such a tiny little number, it’s got to be believable, right?

The problem is that this kind of guessing is not based on any kind of reality. Sure, it looks like it might be credible on the surface, but you have to dig deeper. What’s driving those sales? How are people finding out about this new smartphone company? Of the people that find out about the new company, how many are going to buy?

So, instead of forecasting “from the top-down,” do a “bottom-up” forecast. Just like the name suggests, bottom-up forecasting is more of an educated guess, starting at the bottom and working up to a forecast.

Start by thinking about how many potential customers you might be able to make contact with; this could be through advertising, sales calls, or other marketing methods. This is your SOM (your “share of the market”), the subset of your 1 percent of the market that you will realistically reach—particularly in the first few years of your business. This is your target market .

Of the people you can reach, how many do you think you’ll be able to bring in the door or get onto your website? And finally, of the people that come in the door, get on the phone, or visit your site, how many will buy?

Here’s an example:

- 10,000 people see my company’s ad online

- 1,000 people click from the ad to my website

- 100 people end up making a purchase

Obviously, these are all nice round numbers, but it should give you an idea of how bottom-up forecasting works.

The last step of the bottom-up forecasting method is to think about the average amount that each of those 100 people in our example ends up spending. On average, do they spend $20? $100? It’s O.K. to guess here, and the best way to refine your guess is to go out and talk to your potential customers and interview them. You’ll be surprised how accurate a number you can get with a few simple interviews.

How to create a sales forecast

Keep in mind that your sales forecast is an estimate of the number of goods and services you believe you can sell over a period of time. This will also include the cost to produce and sell those goods and services, as well as the estimated profit you’ll come away with.

We’ll dive into specific methods, assumptions, and questions you’ll need to ask in order to build a viable sales forecast. But to start, here are the general steps you’ll need to take to create a sales forecast:

- List out the goods and services you sell

- Estimate how much of each you expect to sell

- Define the unit price or dollar value of each good or service sold

- Multiply the number sold by the price

- Determine how much it will cost to produce and sell each good or service

- Multiply this cost by the estimated sales volume

- Subtract the total cost from the total sales

This is a super basic rundown of what is included in your sales forecast to give you an idea of what to expect. For example, you may find the need to aggregate similar items into unified categories, if you sell a large variety of items. And if at all possible, try to keep your forecasted items grouped similarly to how they appear on your accounting statements to make updates easier.

Check out this video for a quick overview of how to forecast sales:

Now let’s dive into some specific elements of your forecast you’ll need to define ahead of time.

Should you forecast in units or dollars?

Let’s start by talking about “unit” sales.

A “unit” is simply a stand-in for whatever it is that you are selling. A single lunch at a restaurant would be a unit. An hour of consulting work is also a unit. The word “unit” is just a generic way to talk about whatever it is that you are selling.

Now that’s out of the way, let’s talk about why you should forecast by units.

Units help you think about the number of products, hours, meals, and so on, that you are selling. It’s easier to think about sales this way rather than to think just in dollars (or yen, or pounds, or rand, etc.).

With a dollar-based forecast, you are only thinking about the total amount of money that you’ll make in a given month, rather than the details of the number of units that you are selling and the average price you are selling each unit for.

To forecast by units, you predict how many units you’re going to sell each month—using the bottom-up method of course. Then, you figure out what the average price is going to be for each unit. Multiply those two numbers together and you have the total sales you plan on making each month.

For example, if you plan on selling 1,000 units at $20 each, you’ll make $20,000.

When you forecast by units, you have a couple of different variables to play with: What if I’m able to sell more units? What if I raise or lower my prices?

Also, there’s another benefit: At the end of a month of sales, I can look back at my forecast and see how I did compared to the forecast in greater detail. Did I meet my goals because I sold more units? Or did I sell for a higher price than I thought I would? This level of detail helps you guide your business and grow it moving forward.

Sales forecast assumptions

One thing to remember is that your sales forecast is built on assumptions. You’re not predicting the future, but aggregating information to help define your future outlook. These assumptions are always changing, meaning that you’ll need to have a pulse on the following:

Market conditions

Having a general understanding of the macro effects on your business can help you better predict overall growth. A growing or shrinking market can either provide a low or high ceiling for potential sales increases. So, you need to understand how your business can react to any changes.

What does the broader market look like? Is the economy slowing or growing? Is the industry you operate in seeing an influx of competition? Maybe there’s a labor or material shortage? Are there new customers you now have access to?

Products and services

You may find yourself making regular changes to your products and services. This can be sales factors that impact the customer, or production factors that impact the overall cost.

Are you making any changes or updates to current offerings? Are you launching a new product or service that compliments or disrupts your existing sales? Are you adjusting prices or sales channels? Are you able to decrease the cost of production? Or are expenses rising due to material, labor, or other production costs?

Seasonality

Depending on what you’re selling, you may find dips or increases in sales at specific times during the year. This seasonality may have to do with the weather, holidays, product/feature releases, or a number of other predictable factors.

If you have been operating for a while, you can likely look at your accounting data to identify any trends. If you’re a new business look to your competitors to see how they act during specific times of the year to help you identify these trends earlier on.

Marketing efforts

How much you spend on marketing, and even your messaging may have an impact on your overall sales. Make sure that you connect any performance changes to marketing efforts that may affect your performance.

Are you launching a new marketing campaign? Are you spending more or less on advertising? Are you adjusting your targeting for digital ads? Are you branching out or removing specific marketing channels from your overall strategy?

Regulatory changes

You may find that specific laws or regulations directly impact your industry. It’s difficult to anticipate what legislation will provide a negative or positive impact, and just how often this type of regulatory change may occur. The best thing you can do is keep your ear to the ground, and be ready to adjust expenses or sales when any changes appear to make traction.

How far forward should you forecast?

I recommend that you forecast monthly for 12 months into the future and then just develop an annual sales forecast for another three to five years.

The further your forecast into the future, the less you’re going to know and the less benefit it’s going to have for you. After all, the world is going to change, your business is going to change, and you’ll be updating your forecast to reflect those changes.

12 months from now is far enough into the future to guess. You’ll have to update your forecasts regularly with actual performance to help keep them accurate.

And don’t forget, all forecasts are wrong—and that’s O.K. Your forecast is just your best guess at what’s going to happen. As you learn more about your business and your customers, you can change and adjust your forecast. It’s not set in stone.

Why using visuals will make forecasting easier

My final word of advice is to make sure that you graph your monthly sales with a chart.

A chart will make it easy to see how your sales might dip during a slow period of the year and then grow again during your peak season. A chart will also highlight potentially unreasonable guesses at your sales growth. If for example, you show a big jump in sales from one month to the next, you should be able to back this up with a strategy that’s going to deliver those sales.

Adjust your forecasts based on actual results

Your sales forecast isn’t done when you start sharing it with lenders and investors. Instead, smart businesses use their sales forecast to measure their progress and ensure that they’re on the right track. Their sales forecast becomes a live forecast . An up-to-date management tool that helps them run their business better.

The easiest way to convert your sales forecast into a management tool is to have a monthly financial review meeting where you look at your business’s finances. You shouldn’t just look at your accounting system, though. You should compare the numbers from your accounting software to your forecast and see if you’re on track.

Are you exceeding your goals? Or maybe you’re falling a little bit short. Either way, knowing if you’re meeting your goals or not will help you determine if you need to make some shifts in strategy. This way, your business numbers drive your strategy.

Forecasting is easier with LivePlan

Sales forecasting tools like LivePlan can help with this. LivePlan uses a smart dashboard to automatically compare your forecast to your numbers from your accounting system—no cutting and pasting or complicated spreadsheets required. And with LivePlan’s LiveForecast feature , you can update the forecasts within your Profit and Loss Statement, with the push of a button.

This allows you to spend less time updating and more time analyzing performance to make better decisions. In fact, the LiveForecast feature allows you to expand the details of your performance and identify the variance in performance within your statements. You’ll know your current cash position and the impact on projected year-end totals at a glance. It provides you with enough information to then explore the dashboard with questions and potential steps in mind.

Sales forecasting isn’t as difficult as you think

Just remember that sales forecasting doesn’t have to be hard. Anyone can do it and you, as an entrepreneur, are the most qualified to do it for your business. You know your customers, and you know your market, so you can forecast your sales.

Like this post? Share with a friend!

Noah Parsons

Posted in financials, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

The Last Guide to Sales Forecasting You’ll Ever Need: How-To Guides and Examples

By Kate Eby | January 26, 2020 (updated August 26, 2024)

- Share on Facebook

- Share on LinkedIn

Link copied

Sales forecasts are a critical part of your business planning. In this comprehensive guide, you’ll learn how to do them correctly, including explanations of different forecasting methods, step-by-step tutorials, and advice from experienced finance and sales leaders.

Included on this page, you'll find details on more than 20 sales forecasting techniques , information regarding how to forecast sales for new businesses and products , a step-by-step guide on how to forecast sales , and a free sales forecast template .

What Is Sales Forecasting?

When you produce a sales forecast , you are predicting what your sales or revenue will be in the future. An accurate sales forecast helps your firm make better decisions and is arguably the most important piece of your business plan.

A sales forecast contrasts with a sales goal . The former is the realistic representation of what you believe will occur, while the latter is what you want to occur. Forecasts are never perfectly accurate, but you should be as objective as possible when creating a sales forecast. Goals, on the other hand, can be based on optimistic or motivational targets.

Because the sales forecast is critical to business planning, many different stakeholders in a company (beyond sales managers and representatives) rely on these estimates, including human resources planners, finance directors, and C-level executives.

In this article, you’ll learn about different sales forecasting methods with varying levels of sophistication. The most basic method is called naive forecasting , which uses the prior period’s actual sales for the new period’s forecast and does not apply any adjustments for growth or inflation. Naive forecasts are used as comparative figures for more robust methods.

What Is Sales Planning?

A sales plan describes the goals, strategies, target customers, and likely hurdles for your sales effort. The sales plan defines your sales strategy and the method of execution you will use to achieve the numbers in your sales forecast.

Overview of Sales Forecasting Steps

Your sales forecasting model can ultimately become very sophisticated, but to grasp the basics, you should first gain a high-level understanding of what is involved. There are three primary steps to getting started:

- Decide which forecasting method or technique you will use. Also, determine the time period for your forecast. Later in this guide, we will review different methods of forecasting sales, including how to know which is best for your business.

- Gather the data to plug into your forecast model. The data points will vary by method, but will almost always include your actual past sales and current growth rate.

- Pick a tool to support your forecasting effort. For learning purposes, you can start with pencil and paper, but soon after, you’ll want to take advantage of digital solutions. Common tools include spreadsheets, accounting software, and customer relationship management (CRM) or sales management solutions.

As you get going, remember not to be overly focused on complex formulas. Do regular reality checks to make sure your sales forecasts accord with common sense. Bounce forecasts off sales reps to get realistic feedback, and revise.

You will likely achieve greater accuracy if you build your forecasts based on unit sales wherever possible, because pricing can move independently from unit sales. Use data if you have it.

Benefits and Importance of Sales Forecasting